Stochastic Oscillator

Description

We continue the review of binary options oscillators for our readers. Why are we doing this? Proper understanding and use of indicators will help you achieve good trading results. Today we will talk about one of the most popular technical indicators among traders – the Stochastic Oscillator, you will learn about its features, how to use it and how to make the options trading process more efficient. You can also familiarize yourself with indicators in the forex market: https://eto-razvod.ru/forex-indicators/.

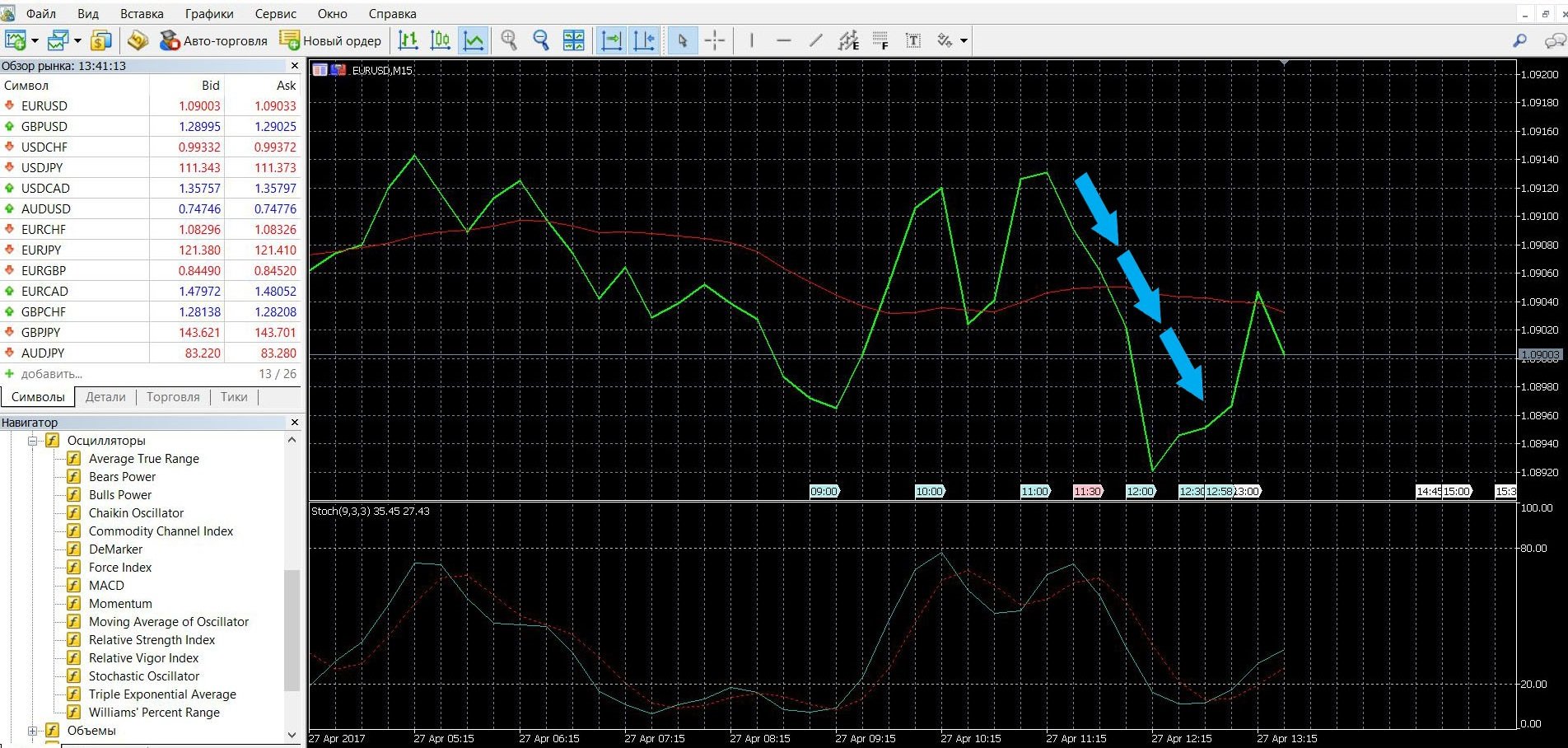

Stochastic is a technical indicator that gives market participants an understanding of at what point the price dynamics will change and when it is possible to purchase options at a profit. This is a leading oscillator, its advantage is that you will be able to see the market trend in advance. The indicator is widely used in trading stocks, futures, forex, etc. You can see how the indicator looks on the MetaTrader 4 (MT4) platform in the image below. You can also download the MetaTrader 4 platform and work with the oscillator.

Stochastic was developed in the 1950s by financier George Lane, thanks to his work it became widespread as a qualitative tool in the analysis of financial markets. The advantage of the indicator: it measures and shows the “momentum” – the difference between the price at the moment and the price that was a certain number of periods earlier. Or in another way, it shows how much the price of an asset changes, which gives you an excellent opportunity for your trading. Having understood the principle of operation of the indicator, you will understand the key states of the market:

- Signals of rise and fall in prices.

- Signals of an excessively high-low price level.

- Divergence signals.

What is the principle of operation of the Stochastic oscillator

This indicator has become so popular due to its simple and intuitive operation, it is used in options trading by both professional traders and beginners. If you are just starting out in trading, Stochastic is the tool that will make it easier for you to make decisions about buying options.

The indicator consists of two lines, denoted as %K and %D. The %K line is the main, dynamic and fast, reacts even to minimal price fluctuations. The line is calculated according to the formula:

%K = (C(i) – L(n)) / (H(n) – L(n)) * 100, where:

- C (i) is the closing price of one trading period (candlestick),

- L(n) is the minimum value of the value for the last n candles,

- H(n) is the maximum value of the value for the last n candles,

- n in the formula is the calculation period.

The standard value of the trading period is 5. So, when analyzing the hourly chart, the last 5 hours will be taken into account, when analyzing the data of the daily chart, the last 5 days will be taken into account.

The main difference between the %D line is that it is auxiliary and slow, showing a moving average from the main line. Its purpose is to smooth out unnecessary noise of the main line so that the bidder sees the maximum net value and makes the right decision based on the data. The line is calculated in most cases using the following formula:

%D = MA(%K, m), where:

- MA is a moving average, which can be used as its simple, weighted or

- Exponential shape depending on how the indicator is set up.

- m is the smoothing period of the moving average.

And yet, more often than not, smoothing cannot give good results, and both lines begin to react strongly to price changes, which leads to a large number of false signals. In this case, in order to smooth the curves more and make them slower, the method is used when, after plotting, the %D line is considered the %K line, the %K formula is used in the calculation of the %D line.

Trading signals:

- If the indicator chart line (%K or %D) first falls below the 20% level and then rises above it, then you can buy.

- If the indicator chart line first rises above the 80% level and then falls below it, then you can sell.

- If the %K line rises above the %D line, then you can buy.

- If the %K line falls below the %D line, then you can sell.

- If you see discrepancies and expect the beginning of a trend towards falling prices, then you can sell.

Info taken from Wikipedia.

Do I need to install Stochastic in your platform?

The oscillator is integrated into most platforms for traders, including the MetaTrader 4 platform, and is widely used by trading participants who prefer an automated trading process. If your platform doesn’t have Stochastic, you can download it here. Professionals know that the correct adjustment of the oscillator will increase income. You can read more about setting up the indicator here.

Application of the indicator for binary options

- The importance of Stochastic for binary options, as a leading indicator, can hardly be overestimated. To give you an idea of how this indicator works in binary options, you can give an example:

If for several periods of time the price of an asset moves rapidly in one direction (for example, up or down), and then its speed slows down, Stochastic, unlike other indicators, reacts to this immediately and shows you a slowdown as a signal for a possible change in trends in the market.

- The use of indicators in trading is necessary, so you will know the market trends. In binary options, several such charts are used, but set for several different periods. So, many strategies have appeared, especially the “Two Stochastics” strategy.

- 3. Oscillators help to see and even predict the movement of stocks, make the right decision and make money on it. During trading, it is important to know the full situation of the market in a certain period, to see its dynamics and opportunities. This is what will help you reach a qualitatively new level of work with options.

Rules for concluding transactions (screenshots)

Trading with a signal for a rise – a decrease in prices

In this case, the indicator will help to understand the price dynamics in advance. Using the signals correctly, you will make a deal with a positive outcome. In the images below, you can see what the upward trend of the market looks like on the MetaTrader 4 platform:

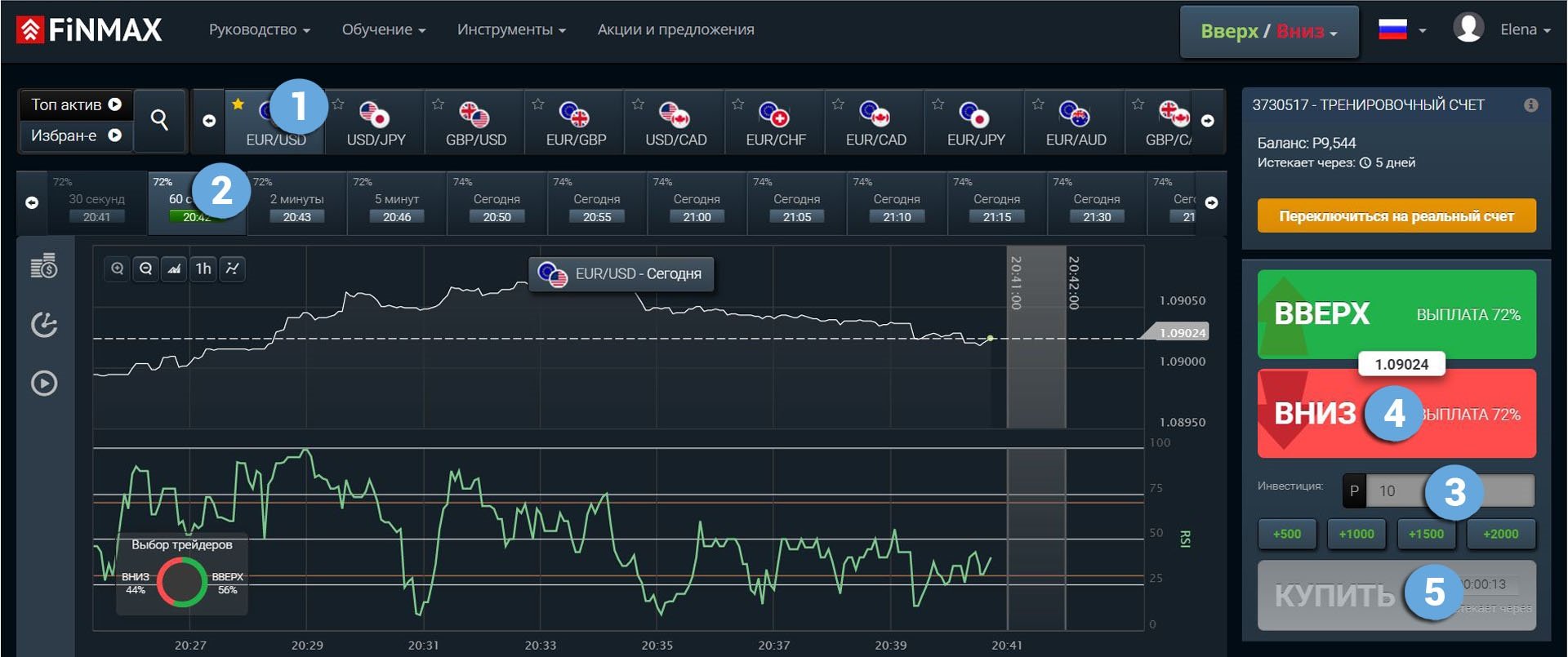

You can take advantage of the uptrend opportunities in price and place a CALL (up) rate with the Finmax broker. To do this, you need to go to the broker’s website finmaxbo.com and take the following steps:

Prepare the option data, for this we indicate:

- Type of trading asset.

- Expiration of the option.

- The size of the bet.

- Forecast for the movement of the quote: UP.

- Click the “buy” button and monitor the results of the movement of currencies on the chart.

In the image below, you can see what the downward trend of the market looks like on the MetaTrader 4 platform:

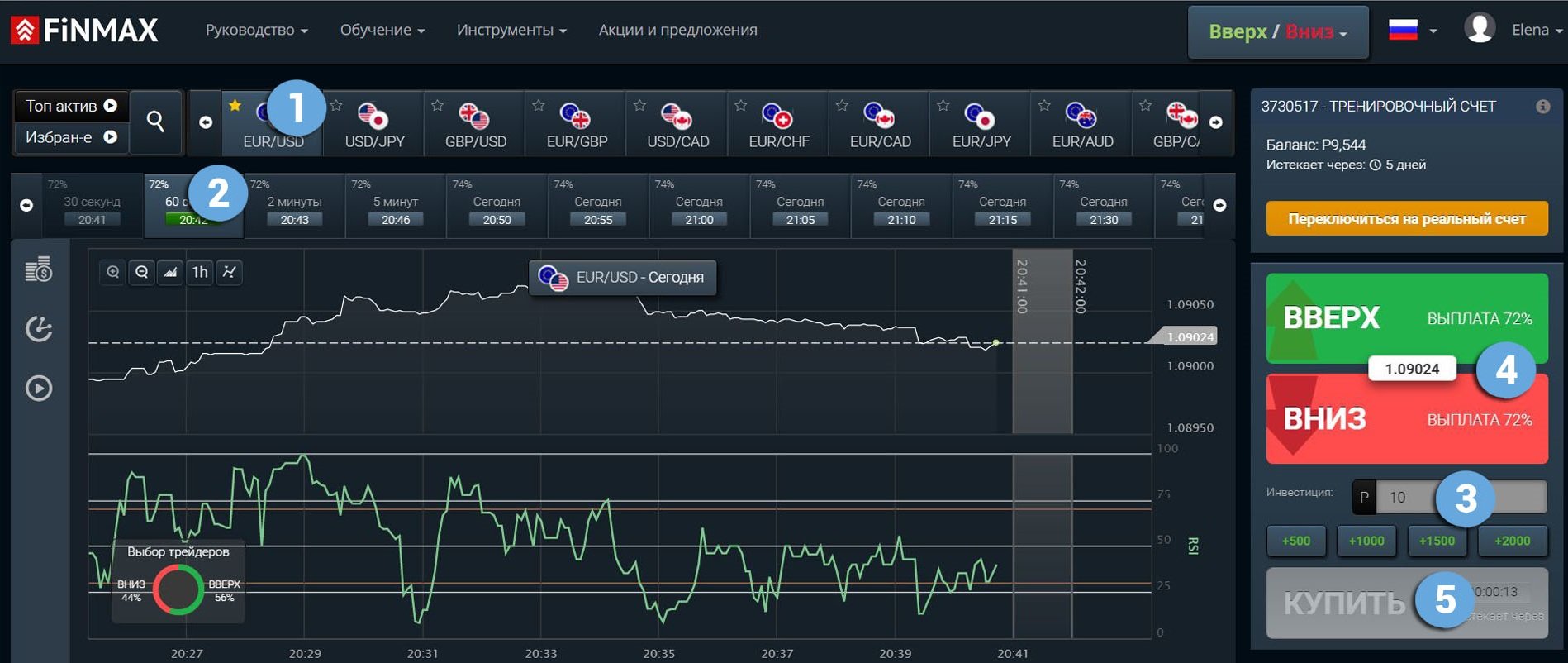

You can take advantage of the downward trend in price and place a PUT (down) rate with the Finmax broker. To do this, you need to go to the broker’s website finmaxbo.com and take the following steps: Prepare the option data, for this we indicate:

1. Type of trading asset.

2. Validity of the option.

3. The size of the bet.

4. Forecast for the movement of the quote: DOWN.

5. Click the “buy” button and monitor the results of the movement of currencies on the chart.

Trading in divergence

The study of divergences, that is, the discrepancy between the indicator readings and the price, is one of the most effective Stochastic signals. This is a reliable buy signal, using which you will get the most out of trading. When the price goes in one direction, and the %D or %K lines of Stochastic go in the other, this is a signal that the price movement will soon change. The illustrations below illustrate this information well:

Price Down – Indicator Up:

Price up – the indicator tends to go down:

The maximum price is the tendency of the oscillator to a minimum:

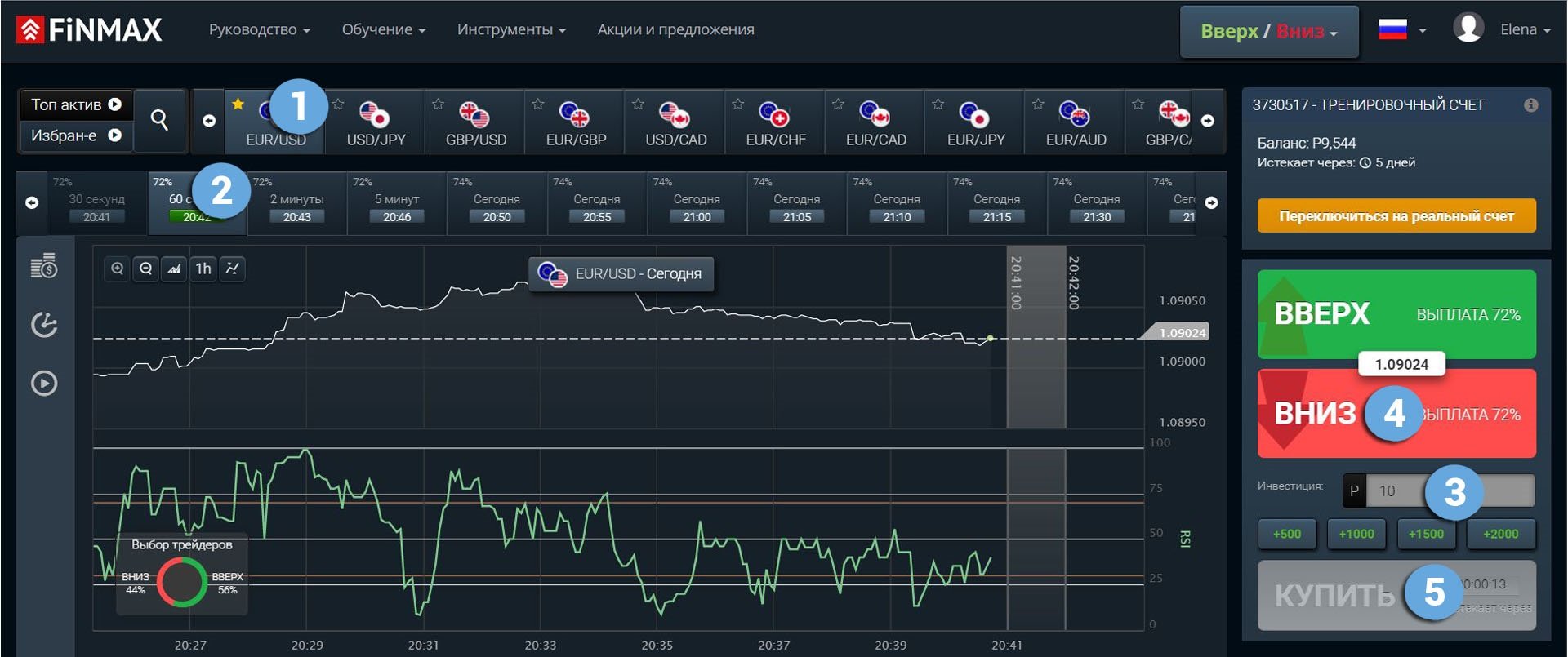

The images are taken from the binguru.net website. You can take advantage of price divergence opportunities and place a bet with the Finmax broker. To do this, you need to go to the broker’s website finmaxbo.com and take the following steps:

Prepare the option data, for this we indicate:

- Type of trading asset.

- Expiration of the option.

- The size of the bet.

- Forecast for the movement of the quote.

- Click the “buy” button and monitor the results of the movement of currencies on the chart.

Trading with an overbought-oversold signal

We also recommend using Stochastic to buy binary options in cases where its lines fall into the overbought-oversold zones (below 20 or above 80):

If both indicator lines are above the 80 mark, the blue one crosses the orange one from top to bottom, and then both lines move into the range between 20 and 80, this is a signal to buy a put option:

You can take advantage of the downward trend in price and place a PUT (down) rate with the Finmax broker. To do this, you need to go to the broker’s website finmaxbo.com and take the following steps:

Prepare the option data, for this we indicate:

- Type of trading asset.

- Expiration of the option.

- The size of the bet.

- Forecast for the movement of the quote: DOWN.

- Click the “buy” button and monitor the results of the movement of currencies on the chart.

To buy a call option , the signal is mirrored opposite (blue crosses orange from below and up in the zone below 20, then moves to the range of 20-80):

You can take advantage of the uptrend opportunities in price and place a CALL (up) rate with the Finmax broker. To do this, you need to go to the broker’s website finmaxbo.com and take the following steps:

Prepare the option data, for this we indicate:

- Type of trading asset.

- Expiration of the option.

- The size of the bet.

- Forecast for the movement of the quote: UP.

- Click the “buy” button and monitor the results of the movement of currencies on the chart.

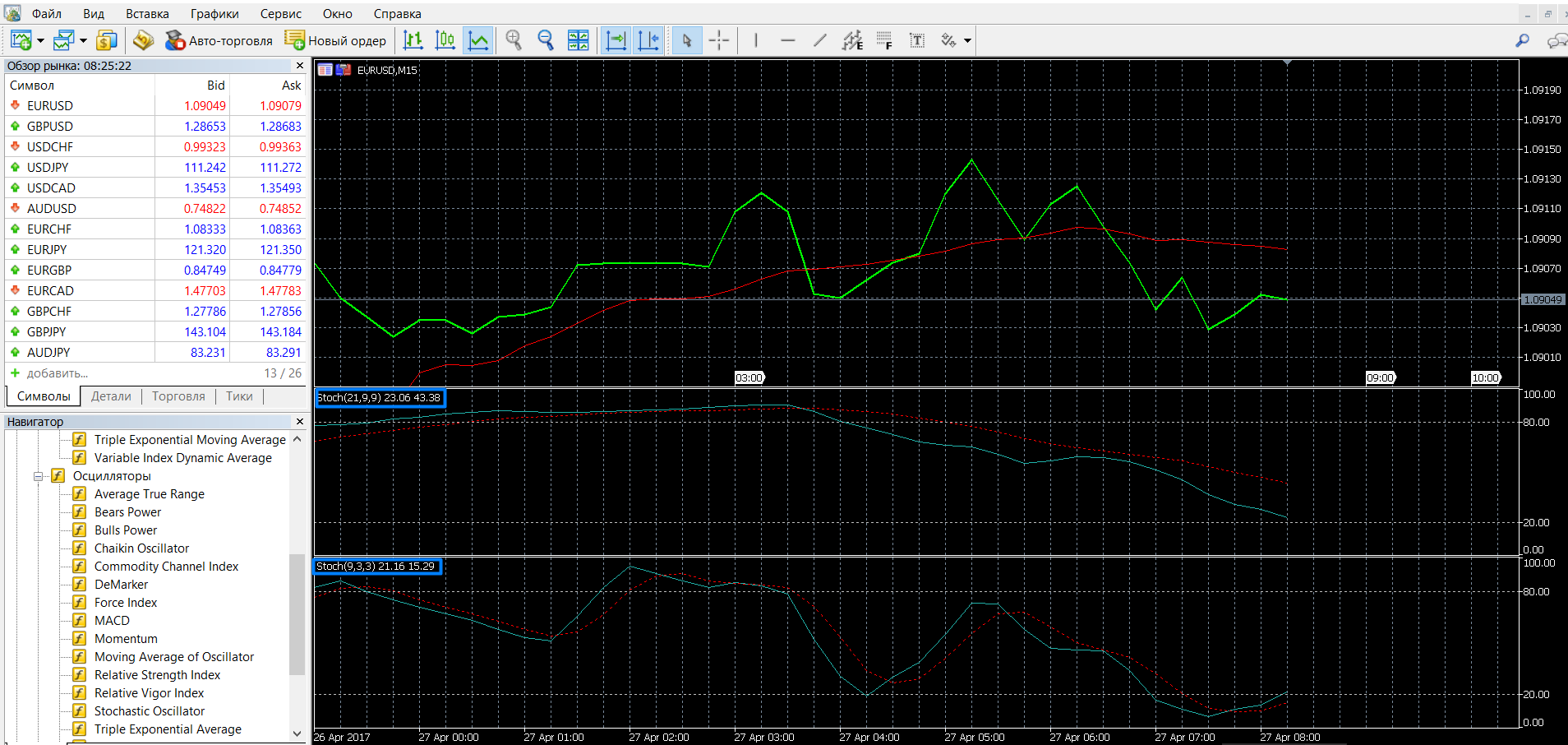

Trading according to the “Two Stochastics” strategy

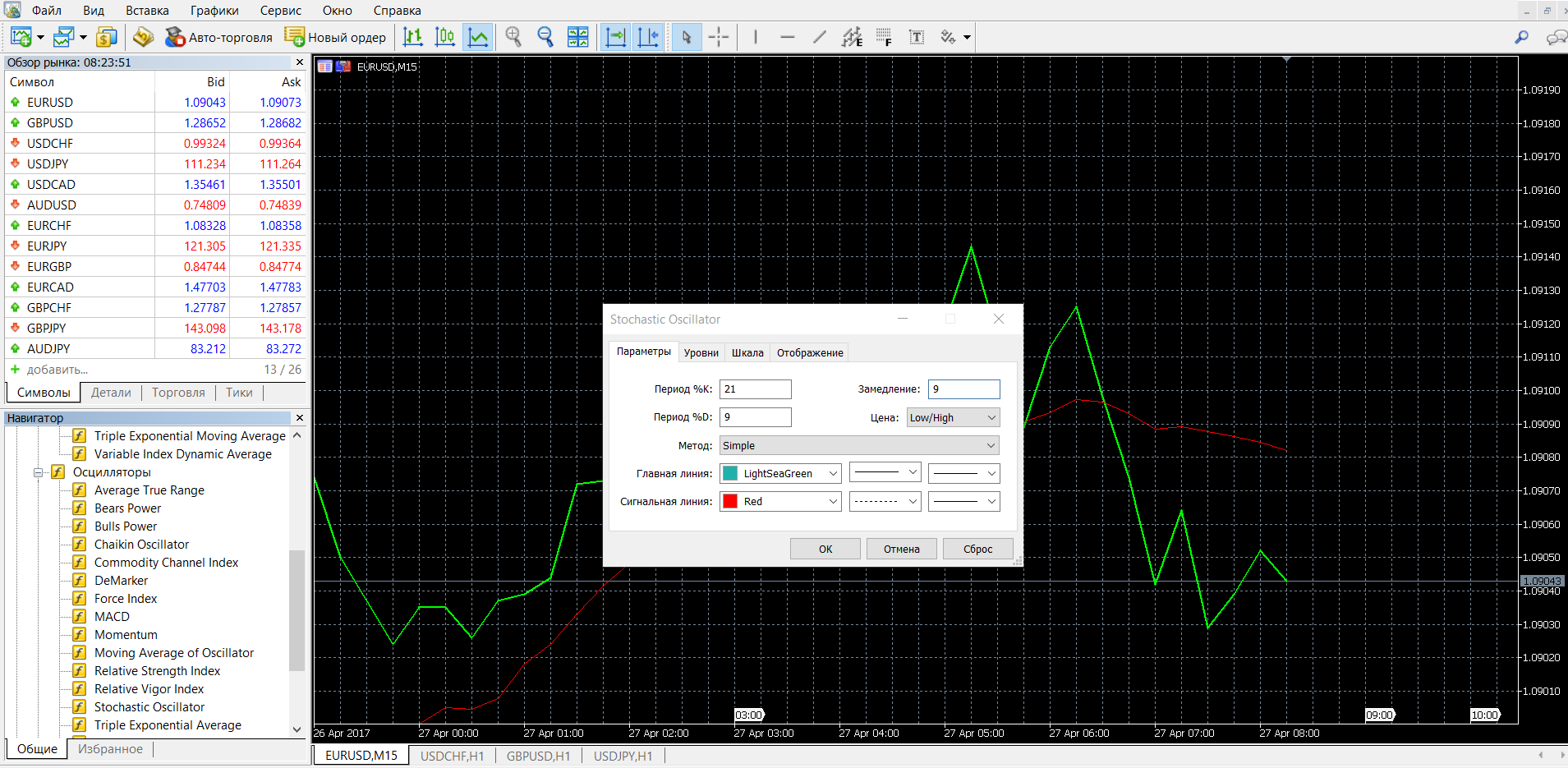

For a full analysis of the market situation, it is customary to analyze the indicators of two Stochastics, but with different parameters. So, the strategy will allow you to determine the direction of the market accurately and make the right decision. In order to use the “Two Stochastics” strategy on the MetaTrader 4 platform, you need to follow these steps:

1. Add the first oscillator chart

As you can see in the image below, when adding, a window always opens in which you need to change the parameters:

- Period %K = 21.

- Period %D = 9.

- Deceleration = 9.

This is the main, main indicator, it identifies the trend. Its peculiarity: it is slow, gives a signal with a delay, there are few signals.

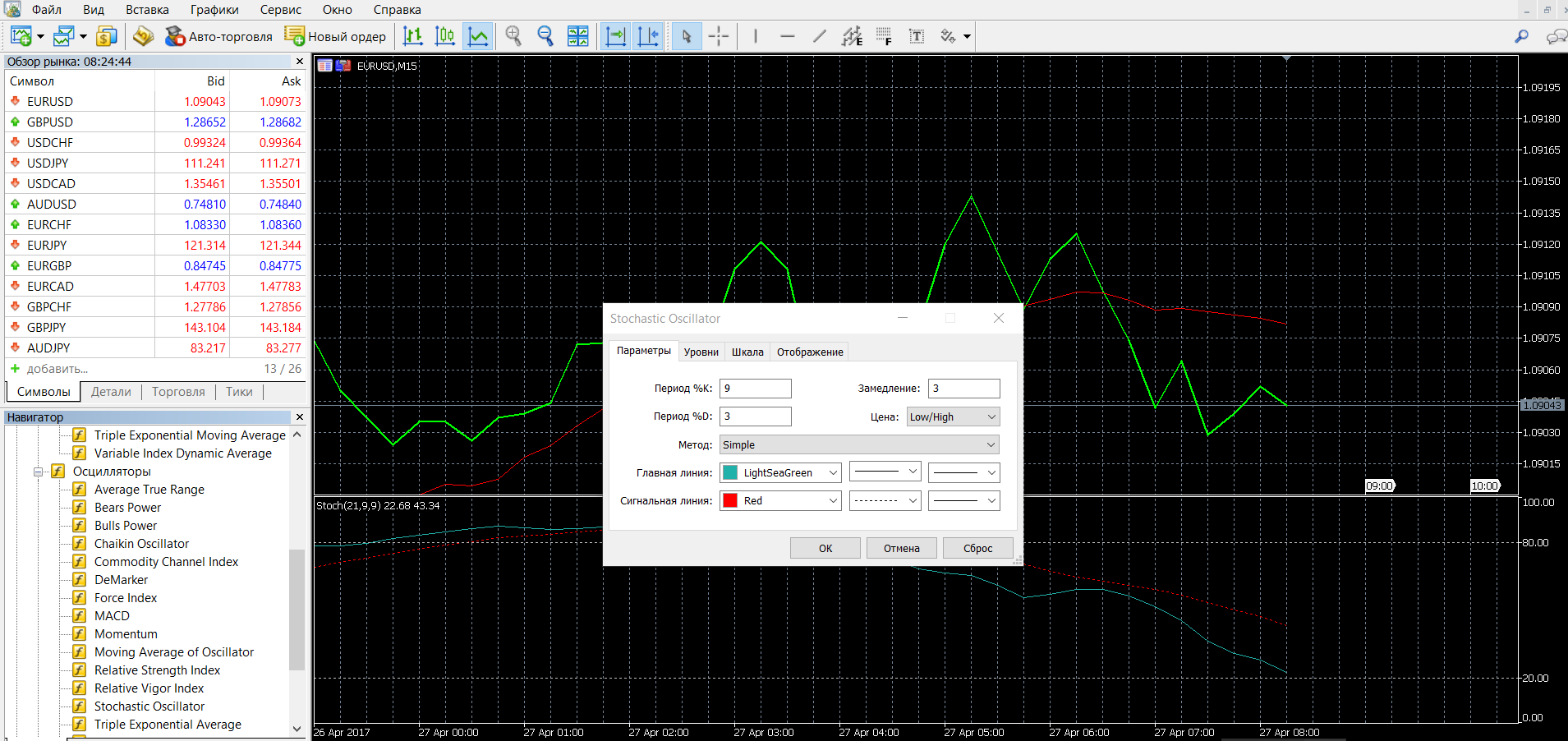

2. Add a second oscillator chart

Specify the following data in the window that opens:

- Period %K = 9.

- Period %D = 3.

- Deceleration = 3.

This Stochastic plays a supporting role, determines the optimal moment to place a bet. It gives a lot of signals, it is necessary to remember that some of them are false. As you can see in the image below, both indicators differ in charts, it is the combination of two or more oscillators that is an effective way to get the necessary information:

After you have set up the charts in the MetaTrader 4 platform, you can check the “Two Stochastics” strategy in operation and place a bet with the Finmax broker. To do this, you need to go to the broker’s website finmaxbo.com and take the following steps:

Prepare the option data, for this we indicate:

- Type of trading asset.

- Expiration of the option.

- The size of the bet.

- Forecast for the movement of the quote.

- Click the “buy” button and monitor the results of the movement of currencies on the chart.

Money management

Stochastic is one of the most informative indicators in binary options trading, it indicates market changes faster than other tools. This makes it indispensable for achieving maximum performance. And yet, adhere to the basic rules of money management, that is, money management, this will be the key to successful, profitable and safe trading:

The minimum amount for trading. Minimum deposit amount

Don’t risk all the money. Put up a minimum of funds for participation in the auction. To avoid a major loss and loss of a large amount of money, deposit the minimum amount to participate in the auction. So, if the outcome of the auction is unsuccessful, there will be more money on your account to continue working. Often beginners make a mistake when they deposit into the account and place a bet on the entire amount of money, respectively, if the outcome of the auction is unsuccessful, in this case you will be left without money and in order to continue working, you will have to deposit funds again.

Bargaining in one transaction is not more than 5%

Allocate money wisely. Trading in one transaction should not exceed 5% of the deposit and no more than 15% of the deposit of all your transactions at the same time. So, in case of loss, you will have more money in your account in order to continue trading.

A reasonable amount of assets

Optimize your work. Do not take a lot of assets for trading at once: you will not have time to understand their dynamics and there is a high risk of being left without funds. It is optimal to use three assets: it can be stocks, indices, commodities. With increasing experience, you can expand your investment portfolio and develop new assets (look at the possibilities of futures, metals, for example).

The Rule of Three

Keep the situation under control. According to statistics, three failed trades and a novice player loses control, panics, tries to recoup and return losses. Conversely, three successful trades, and the trader is inspired by success, continues trading without stopping, while losing attention and concentration. Take the rule of three for work and teach yourself to stop after three consecutive transactions. It doesn’t matter if your work was successful or not, keep it under control and save money.

Expiration

The importance of choosing the expiration time cannot be underestimated, because the result of the transaction depends on it. Expiration dates affect the profitability and risks of trading.

What is expiration?

In binary options, the term means the expiration date of the transaction. If you want to buy an option, you need to choose the time after which you want to close the transaction, that is, the expiration time. It can be any time – from 30 seconds to several months. Your trade will close at the time of your choice. In trading, different expiration periods are offered: ultra-short (from 60 seconds) and long terms, a month or more. Different expiration always means different profits and investment risks, so remember the expiration rules.

Expiration rules:

- If you are in doubt about choosing the end time of the transaction, choose a long term. So, you will see the full picture of what is happening in the market, you will be able to observe the trends.

- If you like to take risks, try intraday (a few hours a day) or short-term (minutes) trading. This type of trading is characterized by increased risks. It is also chosen by beginners, as you can increase income in just a minute, but the risk here is great and more unpredictable.

- Short-term trading is largely a coincidence, a game of roulette. Macroeconomic indicators will not help here, it is not for nothing that many brokers prohibit such trading during the release of important news. There is a lot of noise on small timings, the situation is often unpredictable.

Is it possible to change the expiration?

It is possible, in the following cases:

- If in the process of participating in the auction you realize that you will not achieve the desired result, the broker may allow you to close the transaction ahead of schedule.

- If you are not sure about the term of the option, it can be extended by paying the required amount to the broker.