Varieties of the Moving Average are often found on the charts of binary options traders today. The fact is that a skillful combination of these indicators will allow you to receive accurate signals for entering the market, will filter out potentially unprofitable ones.

Today you will get acquainted with the “3 moving averages” strategy, which is based on the work of three MAs. This interesting system combines different types of moving averages: two of them (EMA) act as dynamic levels, and the moving average with the longest period (SMA) determines the direction of the transaction and filters out false signals. In order to make this technique more effective, we recommend adding candlestick analysis patterns to the chart.

The advantage of the system is that it is simple, shows excellent efficiency, despite its apparent lightness. In addition, it is universal, suitable for all assets: currency pairs, stocks, indices, metals, etc. Here you can also choose the timeframe that is convenient for the user, but it is worth remembering that with prolonged trading, the accuracy of the signals increases. On minute charts, additional data filtering will be required.

Indicator settings

Trading according to this strategy is carried out using three Moving Averages, two of which are exponential, having short periods; The third line is the “heavy” moving average with the highest value of the period:

- EMA 8;

- EMA 21;

- SMA 100.

These settings of the indicator are best suited to different market conditions. It is recommended to hone the work on the strategy with such data. Further, having gained sufficient experience in trading using this technique, you can test different periods depending on the state of the market.

Setting up a trading platform

In the strategy, we use only 3 lines of the MA indicator, which will allow us to work with the free version of the “live chart”. On most broker platforms, this indicator is also available.

How to trade a strategy in TradingView?

Once you’re on the TradingView website, select an asset. Next, add moving averages to the chart. To do this, search for MA and EMA tools. After that, adjust the periods for the indicators: 100, 21 and 8. It is recommended to choose contrasting colors to display the lines on the chart – this will save you time when analyzing the market:

In our example in the image above, the “slow” MA is highlighted in black, the exponential moving averages are highlighted in green and red. Setting up a strategy will only take you a couple of minutes of time. After the indicators are added to the chart, you can start trading.

Strategy signals

On the chart, a “slow” moving average indicates the direction of the trade. Its line should be above or below the price. The angle of its inclination allows you to objectively assess the strength of the trend. Exponential moving averages act as dynamic support and resistance levels. Their advantage over standard moving averages is automatic data drawing; These lines follow the trend.

For example, consider the chart of the binary options broker Olympus Trade. The platform makes it easy to use all three tools necessary for strategy trading at once. The indicators are set up in the same way as on the “live chart”, it takes only 2-3 minutes of time.

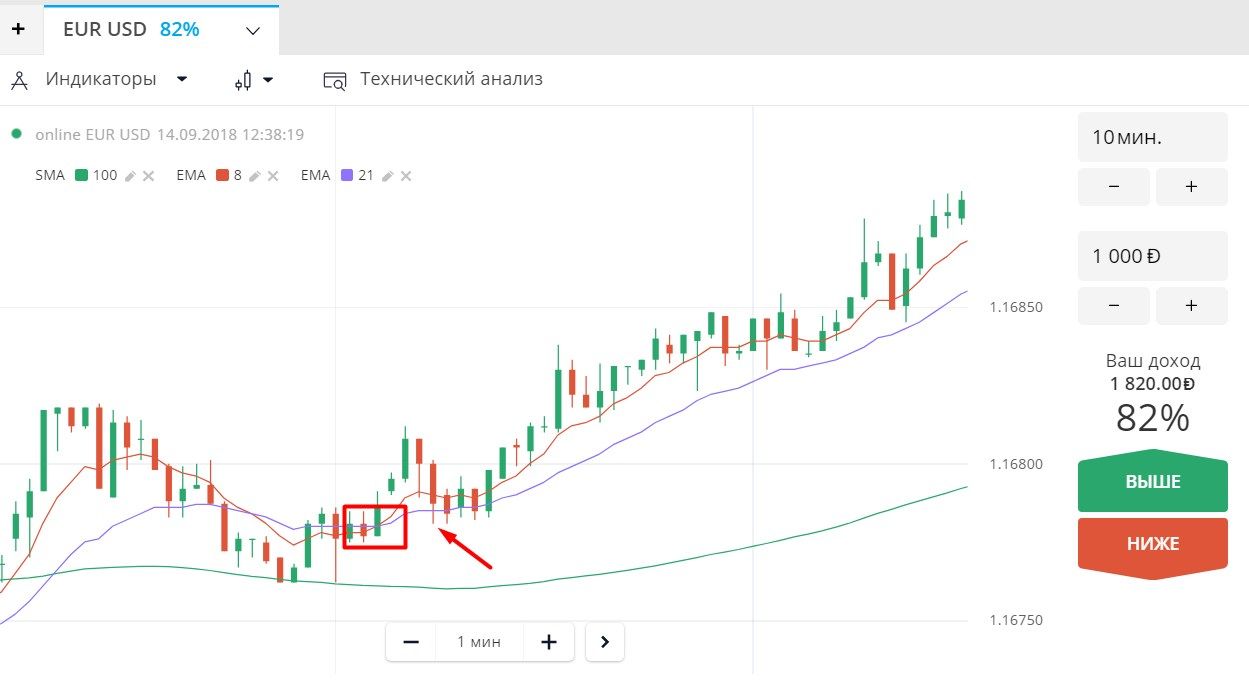

Buying a “HIGHER” option

To buy a “HIGHER” option, you need to wait for the moment when the following signals appear on the chart:

- Price should be below the SMA 100.

- EMA8 and 21 crossed, then there was a pullback against the trend.

- At the same time, the overall impulse of the asset’s dynamics should be directed upwards. On the chart, it looks like this:

The arrow indicates the point of purchase of the option “UP”. The rectangle highlights the intersection of the moving tracks. For example, there are also other signals, we have marked only the “ideal” option for trading. The entry point to the market in this case is additionally confirmed by the Pin Bar pattern.

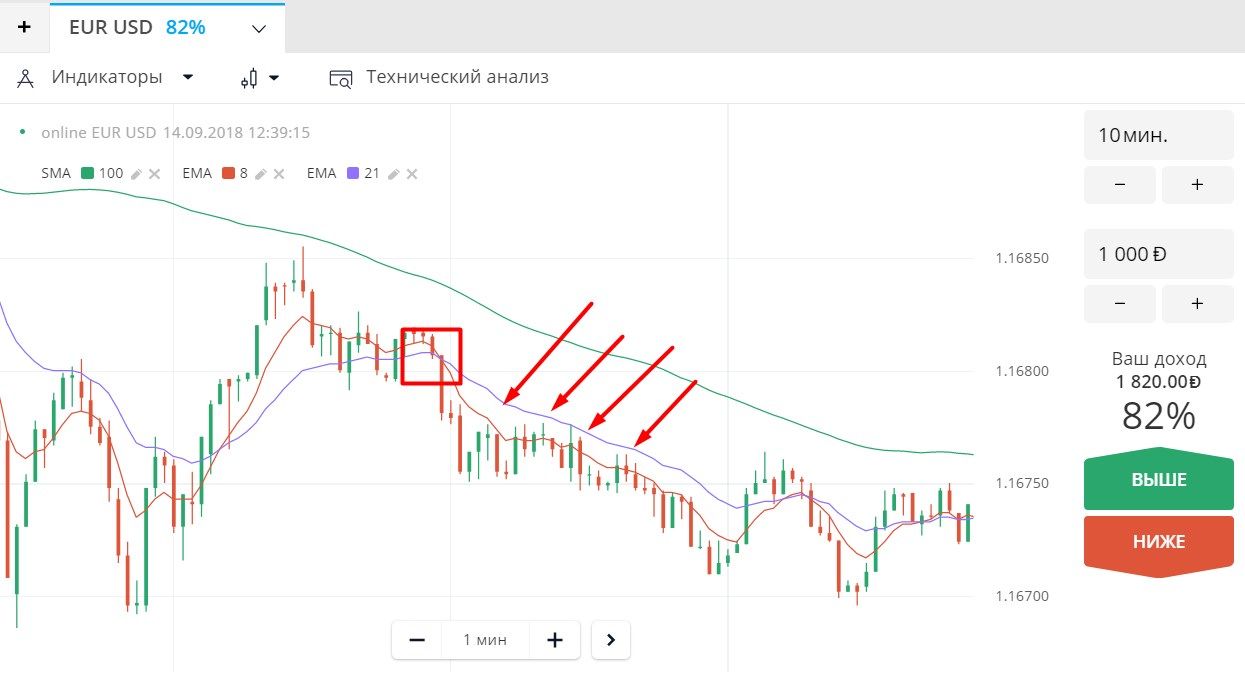

Buying an option “BELOW”

To buy the option “BELOW”, the opposite situation should occur on the terminal chart:

- The price line should be below the “slow” moving average.

- At the same time, fast MAs crossed and the price returned to them again:

Here are 4 signals, each of which will bring profit. Despite the absence of candlestick patterns, we can get a profit in each of these trades. And although the intersection of fast MAs is behind the “higher” moving average, this does not prevent us from working.

Expiration

The “3 moving averages” strategy involves trading binary options with the trend, so it is quite difficult to make a mistake with the term of the transaction. It is recommended to set values from 5 to 10 candles. On the minute chart – 5 minutes-10 minutes. Beginners should choose an average value, such as 7.

Often traders trade short-term options, setting a timeframe of 1-5 minutes – here you should be more careful, because With such high-speed operation, there is a lot of market noise. We recommend using a timeframe of 15 minutes or more, at which the efficiency of transactions will increase significantly.

Management:

The rules of money management are standard here. The risk in each of the transactions should not exceed 5% of the deposit amount. Beginners are advised to limit the amount of traded options to two or three percent of the account size. This approach will save the budget and help you work correctly with signals.

Rules

Most strategies involve refusing to make deals during the publication of important news, because The market becomes unpredictable during such periods. As you know, any trend fades in the market over time. For additional filtering of signals, you can use candlestick patterns , support and resistance lines, indicators, etc.

Conclusion

The “3 moving averages” strategy allows the trader to get a stable profit with minimal effort. Every market player, even a beginner, can learn how to work correctly with three moving averages. When trading using this methodology, it should be remembered that the market is entered in the direction of the general impulse of price dynamics. Regardless of the strength of the trend, it will stop over time, however, a large number of signals allows you to compensate for unsuccessful entries into transactions and increase earnings on the deposit.

The key advantages of the strategy are simplicity, versatility and efficiency. There is only one drawback: moving averages are often late with signals. This problem can be solved quite well by gaining experience in trading in the market, including this strategy.

Before trading binary options on a real account, we recommend practicing on a demo broker account. One of the best platforms for this is Olympus Trade. The broker’s website allows you to practice on a demo account for an unlimited time, using all the tools that are available to the client and on a real account.