Alligator indicator

Description

By publishing a series of detailed reviews of binary options oscillators for users of the INVESTMAGNATES.COM portal, we try to make your training in the basics of trading accessible. Every beginner in options starts working in trading with the study of materials about technical indicators, profitable strategies and other tools. Collecting useful information on our resource, we do everything to make your acquaintance with trading productive. In today’s article, we will talk about the Alligator indicator.

Alligator is a popular technical trend indicator developed by a trader, author of many training materials, Bill Williams. This is a unique tool that will appeal to both beginners and professionals of binary options. If you carefully study its features, learn how to work with it correctly, it is able to bring a decent income in trading.

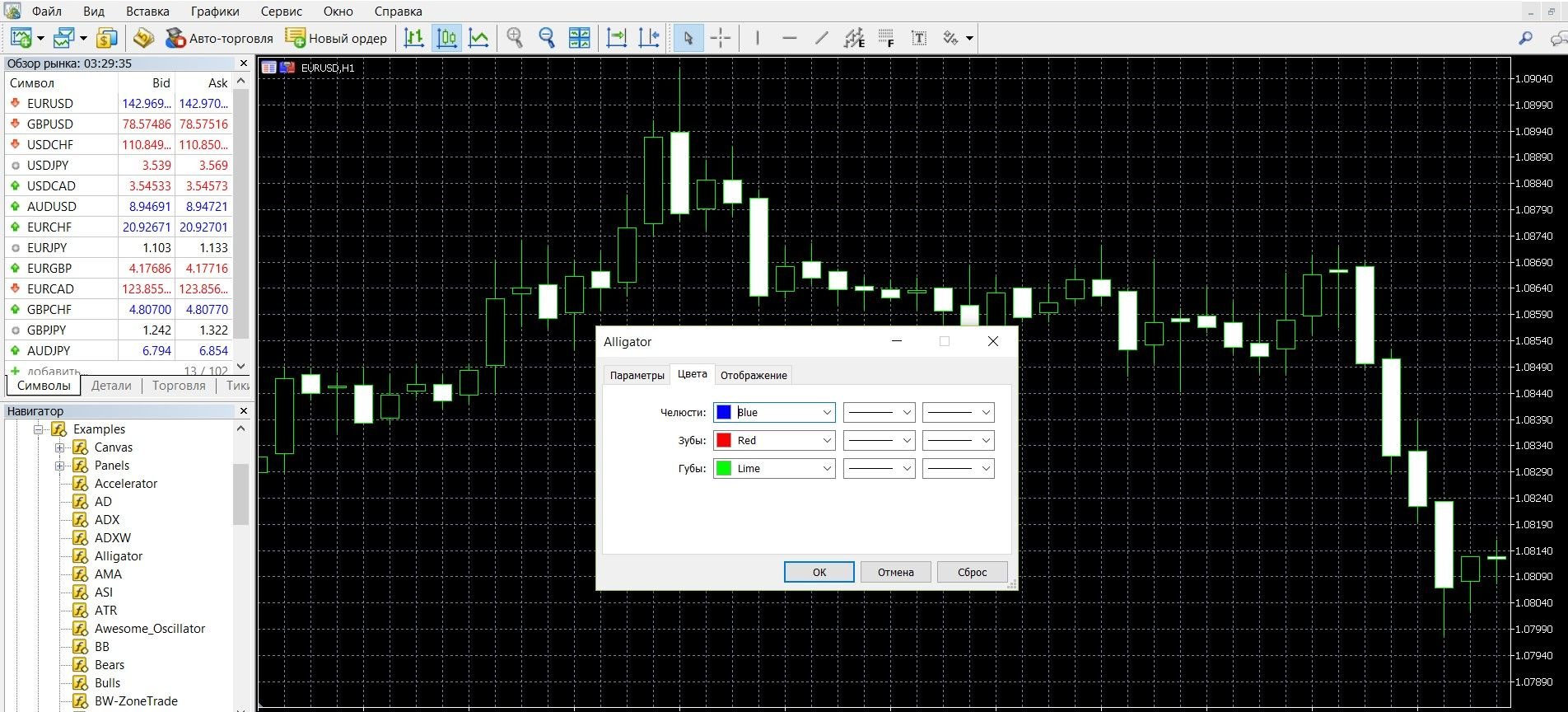

The advantage of the Alligator is that it accurately identifies the tipping points when the price leaves a calm state. So, witnessing the emergence of a trend, a trader can make money by opening positions. The indicator consists of three moving averages that are superimposed on the price chart. These moving averages have their own periods and displacements, they are displayed in different colors and each of them was given a name by Bill Williams: Alligator’s Jaw – blue MA; Alligator’s teeth – red MA; The lips of the alligator are green MA. The position of these moving averages relative to the price chart gives qualitative signals of market dynamics and determines the phases of the emergence of the trend.

The author of the indicator described the peculiarity of the tool as follows:

when all the lines are intertwined, the Alligator is resting, there are no signals for both buys and sells in the flat market; the longer the Alligator rests, the hungrier it will be, i.e. The stronger the trend movement is expected.

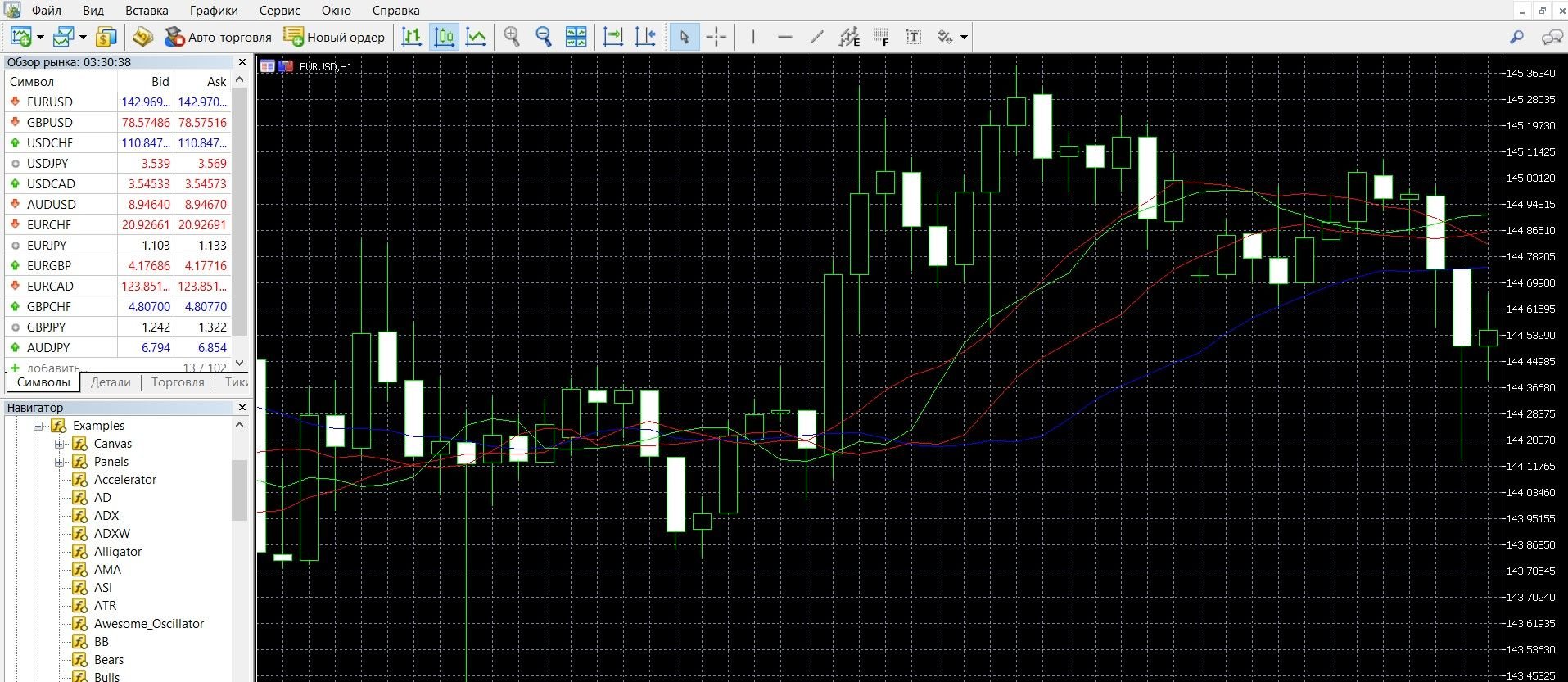

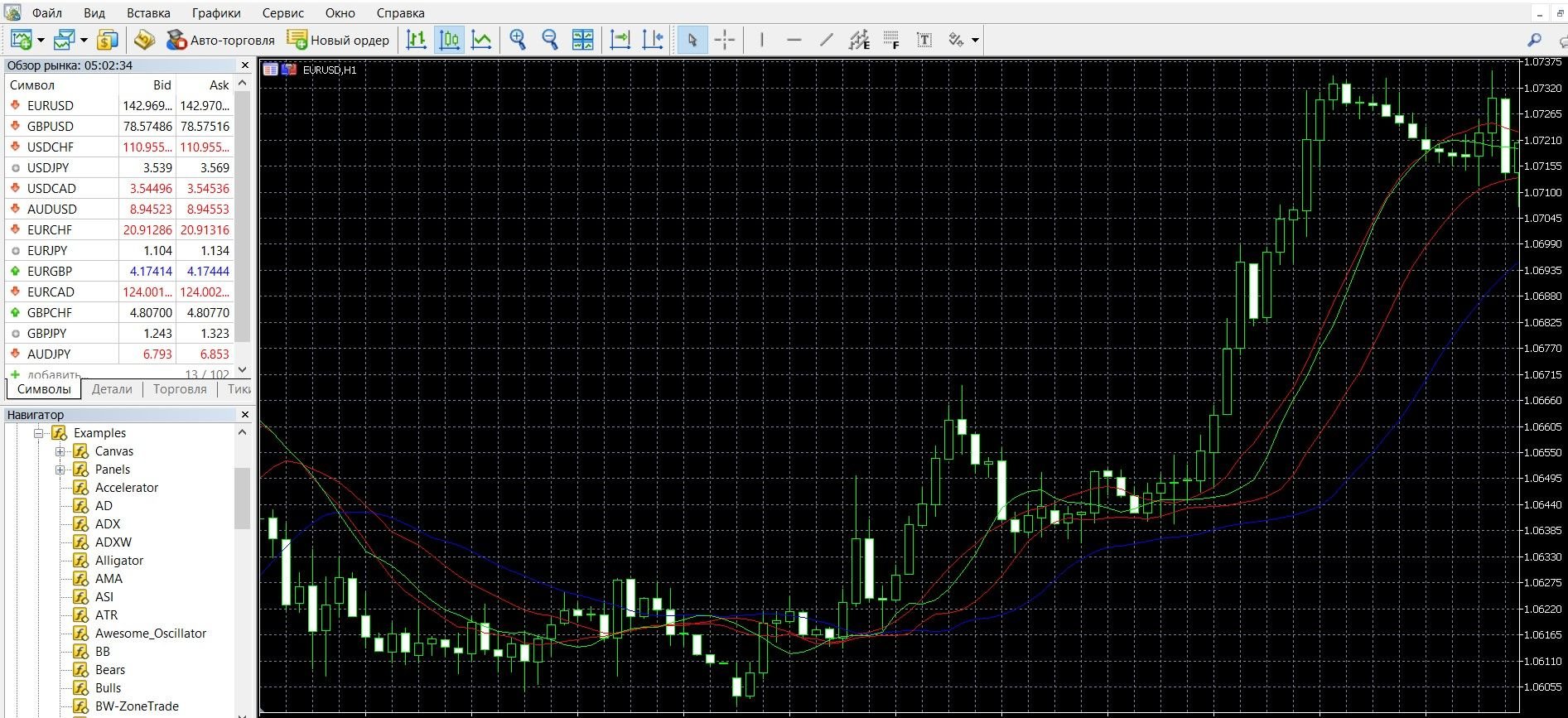

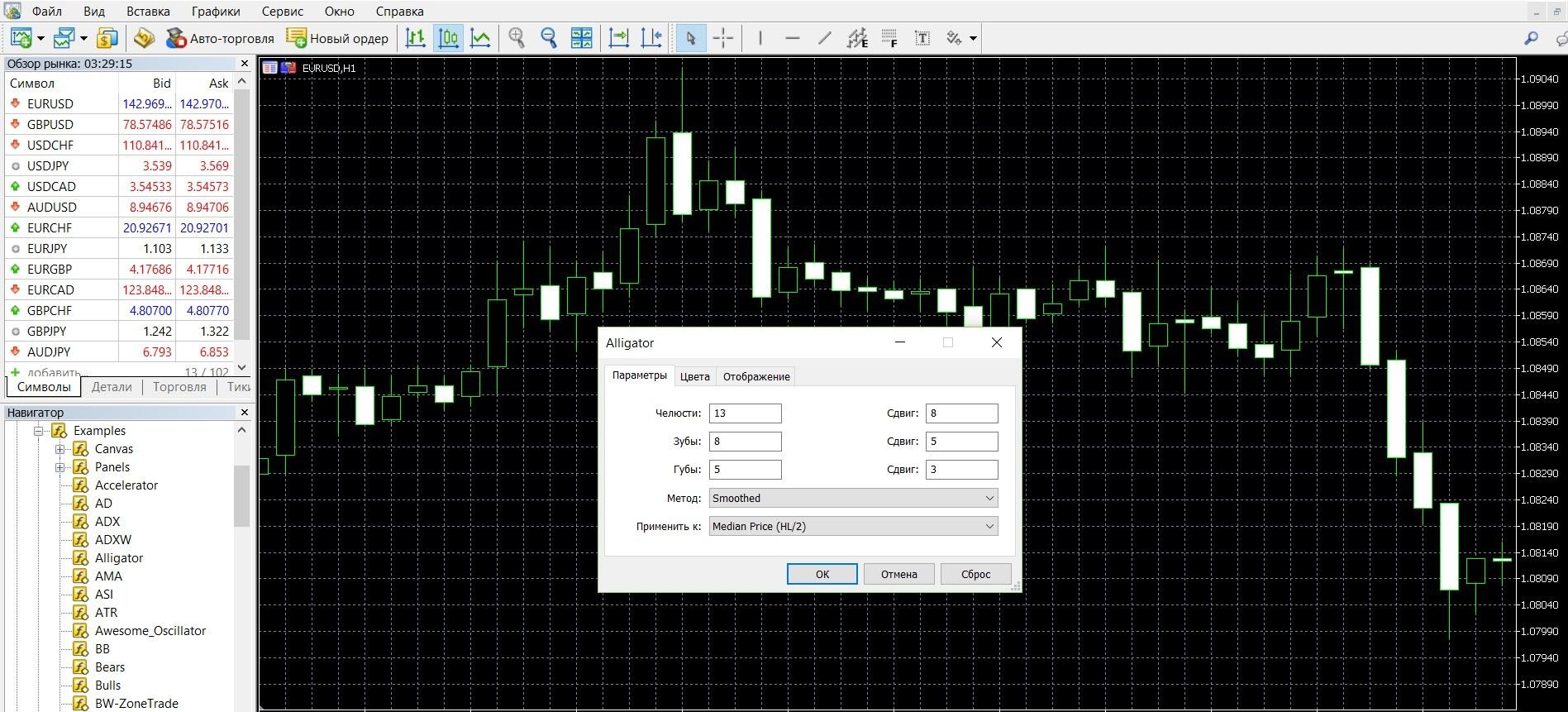

You can see how the Alligator visually looks on the MetaTrader 4 (MT4) platform in the image below. You can also download the MetaTrader 4 platform and get acquainted with this tool in more detail.

What is the working principle of the Alligator indicator?

Most of the time, the market is in a calm state, and only at 15-30% strong movements begin, taking advantage of which, traders make big profits. Therefore, it is important to work in such periods when prices have a strong momentum movement. It is the finding of such impulses that is the goal of the Alligator.

Alligator is a simple and straightforward tool that will make it easy to identify trend precursors and high-yield entry points for opening positions. His work is based on the readings of three moving average lines (MA), which have their own time periods and bias coefficients. The special arrangement of these curves and the moments of their interweaving act as high-quality signals to buy an option:

- The curved line in blue is the Alligator’s jaw. This is a long moving average with a period of 13, the data of which is shifted by 8 candles into the future.

- The curved line in red is Alligator’s teeth. This is a moving average with a period of 8, the data of which is shifted by 5 candles into the future.

- The curved line of green color is the Alligator Lip. This is a short moving average with a period of 5, the data of which is shifted by 2 candles into the future.

Interacting with each other, these three elements signal the connections of different time periods. To determine the entry points to the market, it is necessary to assess the position of the prices moving relative to the chart and determine the convergences and divergences of the Alligator’s Jaws, Teeth and Lips. The indicator displays the following states (phases) of the market:

- When the lines are intertwined with each other, refuse to trade, we have a signal of market consolidation, its flat or sleep (Alligator’s dream). The longer the sleep passes, the hungrier the awakened Alligator will be, the stronger the trend will be.

- When the Alligator wakes up, its mouth opens, the gliding diverges, primarily the Jaws (blue line). At the same time, the green line crosses the other two lines, which is considered a good signal for action.

- Then the Alligator feels the so-called “food” – these are buyers and sellers who are in the market at the moment (bullish or bearish trend), there is an even greater divergence of lines, the jaws are opened as much as possible. The prey begins to run away from the Alligator, we see the direction of the trend: if the price is below the mouth of the Alligator, the trend is downward, above it, the trend is upward.

- As soon as the Alligator has received enough food, he falls asleep again, the lines converge together again, there is a flat market.

Alligator calculation formula:

MEDIAN PRICE = (HIGH + LOW)/2

ALLIGATORS JAW = SMMA (MEDIAN PRICE, 13, 8)

ALLIGATORS TEETH = SMMA (MEDIAN PRICE, 8, 5)

ALLIGATORS LIPS = SMMA (MEDIAN PRICE, 5, 3), where:

MEDIAN PRICE — median price;

HIGH — the maximum price of the bar;

LOW — the minimum price of the bar;

SMMA (A, B, C) is a smoothed moving average.

Parameter A is the data to be smoothed, B is the smoothing period, C is the shift to the future.

ALLIGATORS JAW — Alligator’s jaws (blue line);

ALLIGATORS TEETH — Alligator teeth (red line);

ALLIGATORS LIPS — Alligator lips (green line).

Info taken from www.mql5.com website

Indicator signals:

Signals of the presence of a trend or flat market:

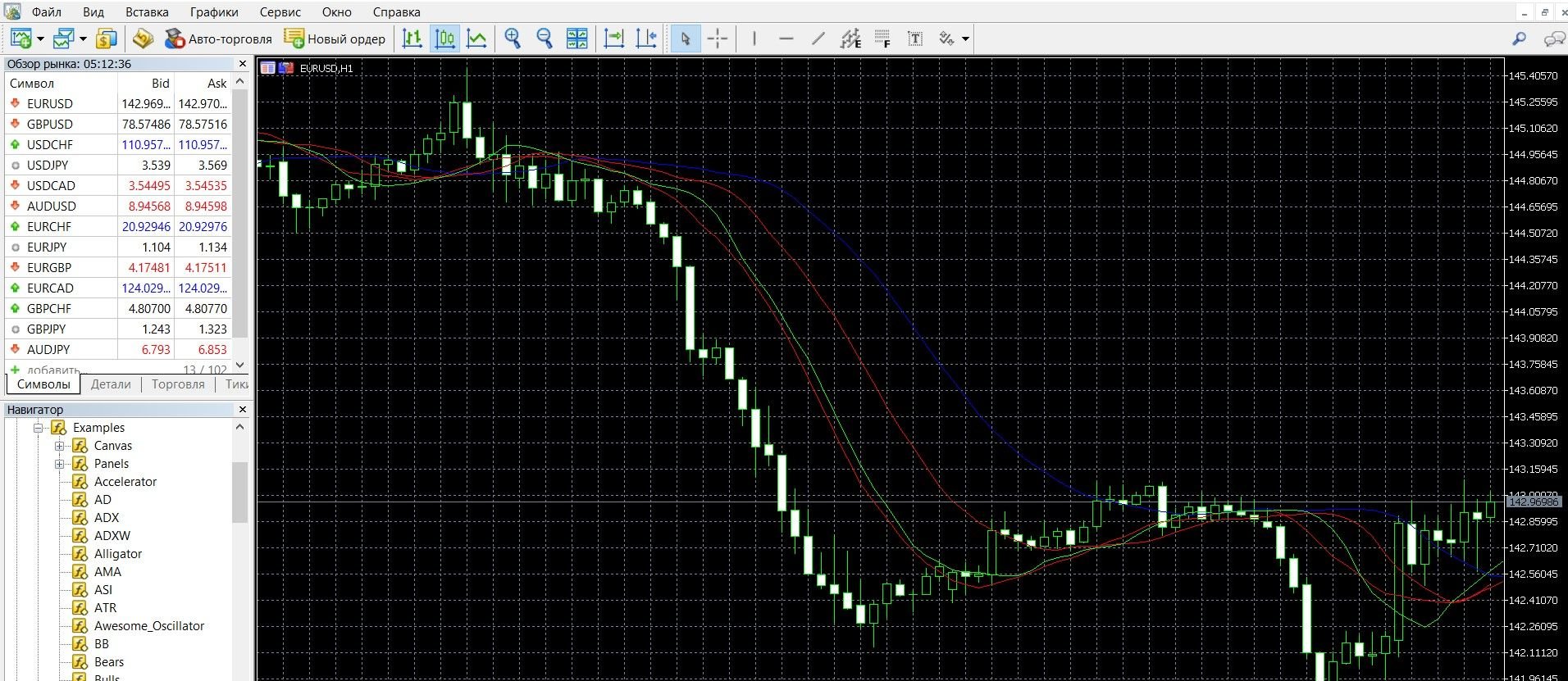

A flat situation occurs when the indicator lines are intertwined, in this case there is no trend and it is better not to trade:

When the lines are divorced and directed in one direction, there is a trend in the market:

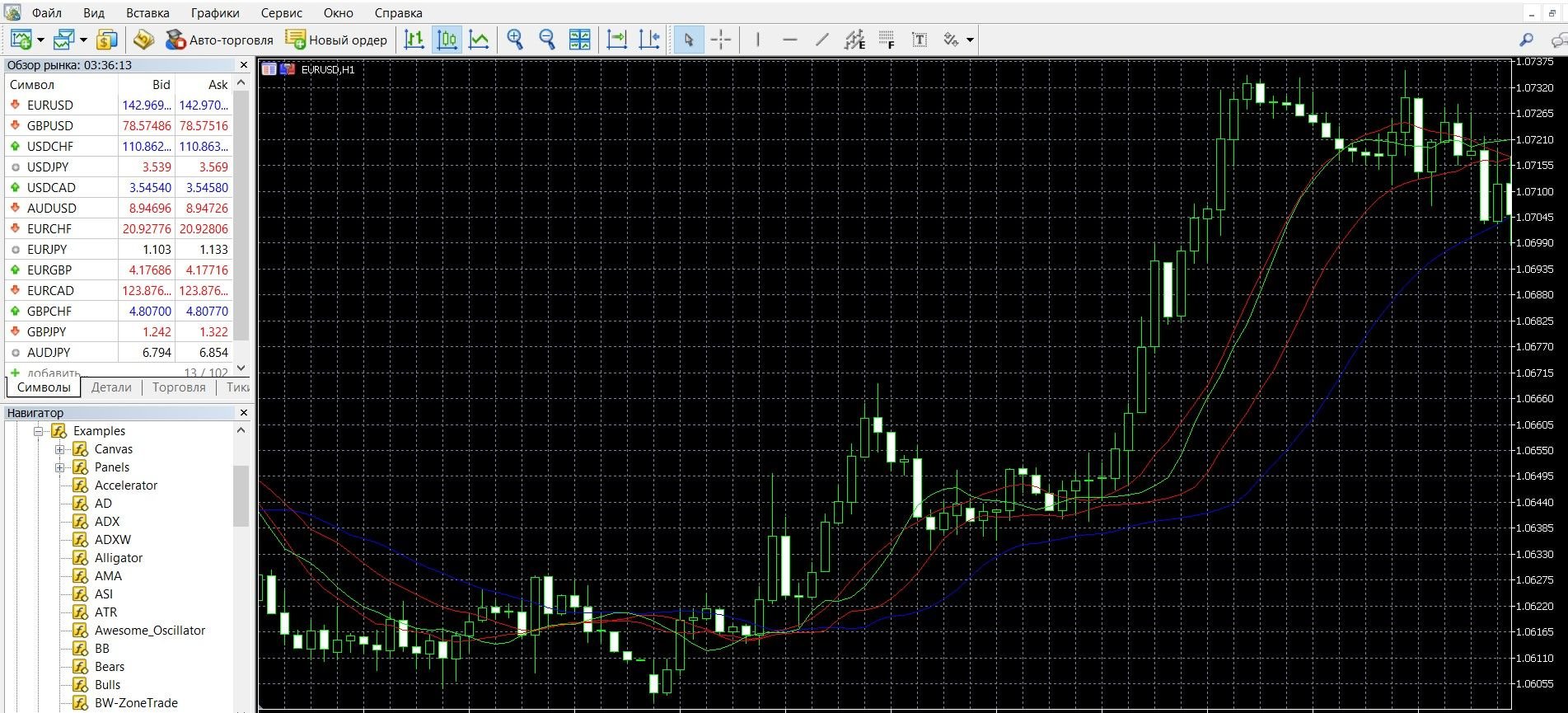

- If the price line is above all the indicator lines, we have an uptrend. When the Alligator is oriented upwards and indicates the existence of an upper trend in the market, it is worth buying a CALL option (up):

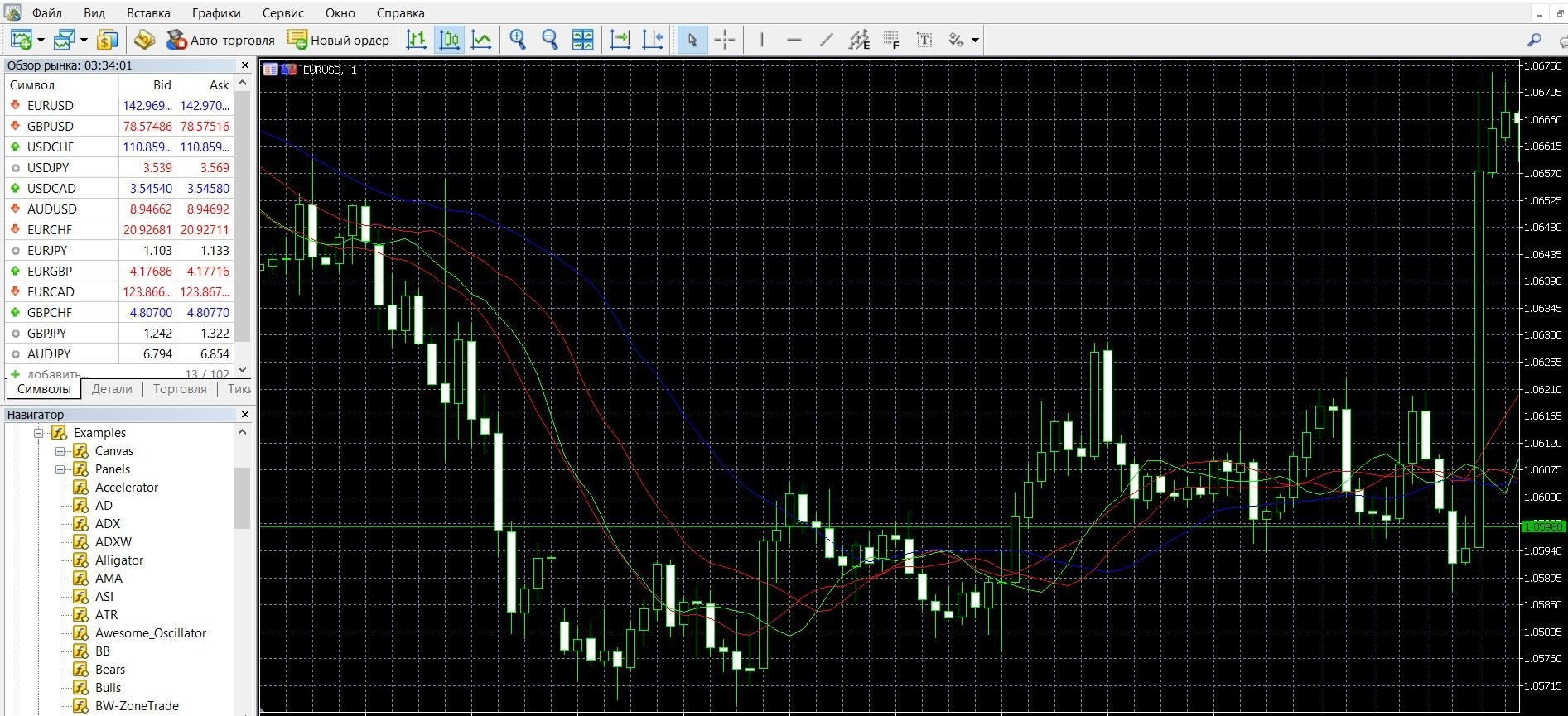

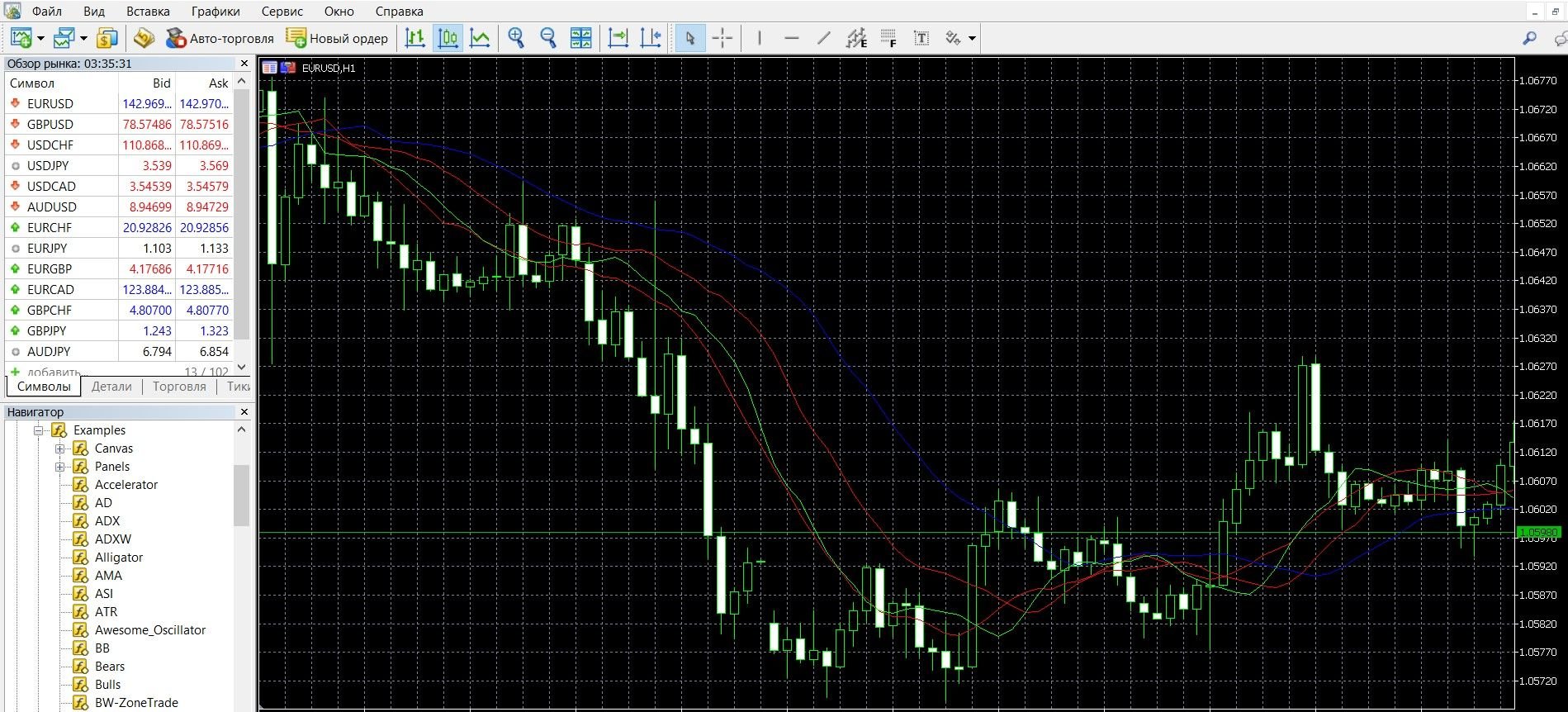

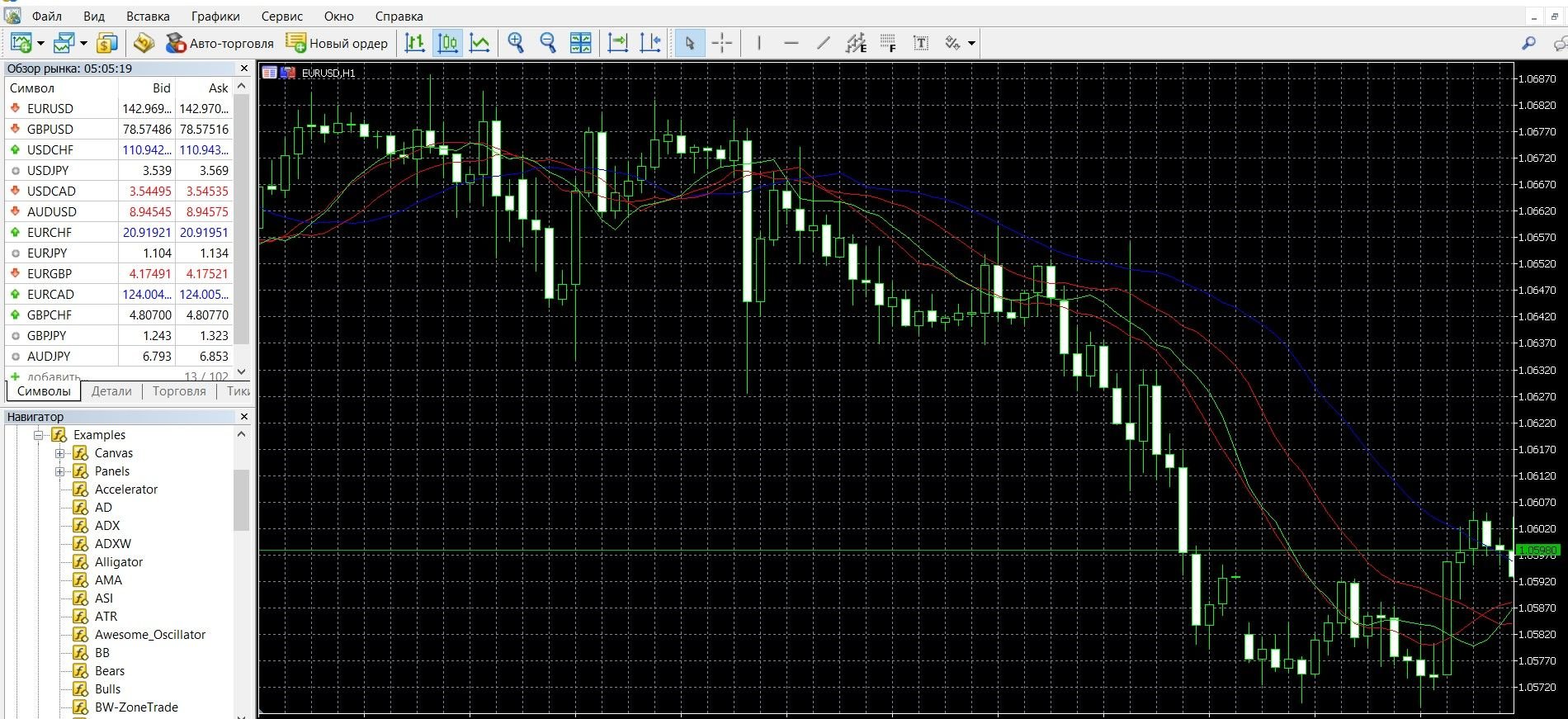

- If it is lower, there is a downtrend. The more lines are separated, the stronger the trend. When the Alligator is oriented downwards and indicates the presence of a downtrend in the market, it is worth buying a PAT option (down):

Signal of a change in price dynamics:

- There is a price correction, the green line goes down under the blue line, a reversal begins and a new crossing of the blue line upwards, it is worth buying a CALL option:

- There is a price correction, the green line goes above the blue line up, a reversal begins and a new intersection of the blue line downwards, it is worth buying a put option:

Signal for determining the strength of the subsequent trend:

This signal is determined by the time during which the moving averages are in a chaotic intertwined state: the longer this happens, the stronger the trend will be.

The image below shows the situation of the end of the flat market, after which the Alligator “woke up and wanted to eat”, the trend is gaining momentum. Tk. the green line goes down under the blue line, there is a reversal and a new intersection of the blue line upwards, it is worth buying a CALL option:

The image below shows the situation of the end of the flat market, after which the Alligator “woke up and wanted to eat”, the trend takes on a new form. Tk. the green line goes above the blue line up, there is a reversal and a new intersection of the blue line down, it is worth buying a put option:

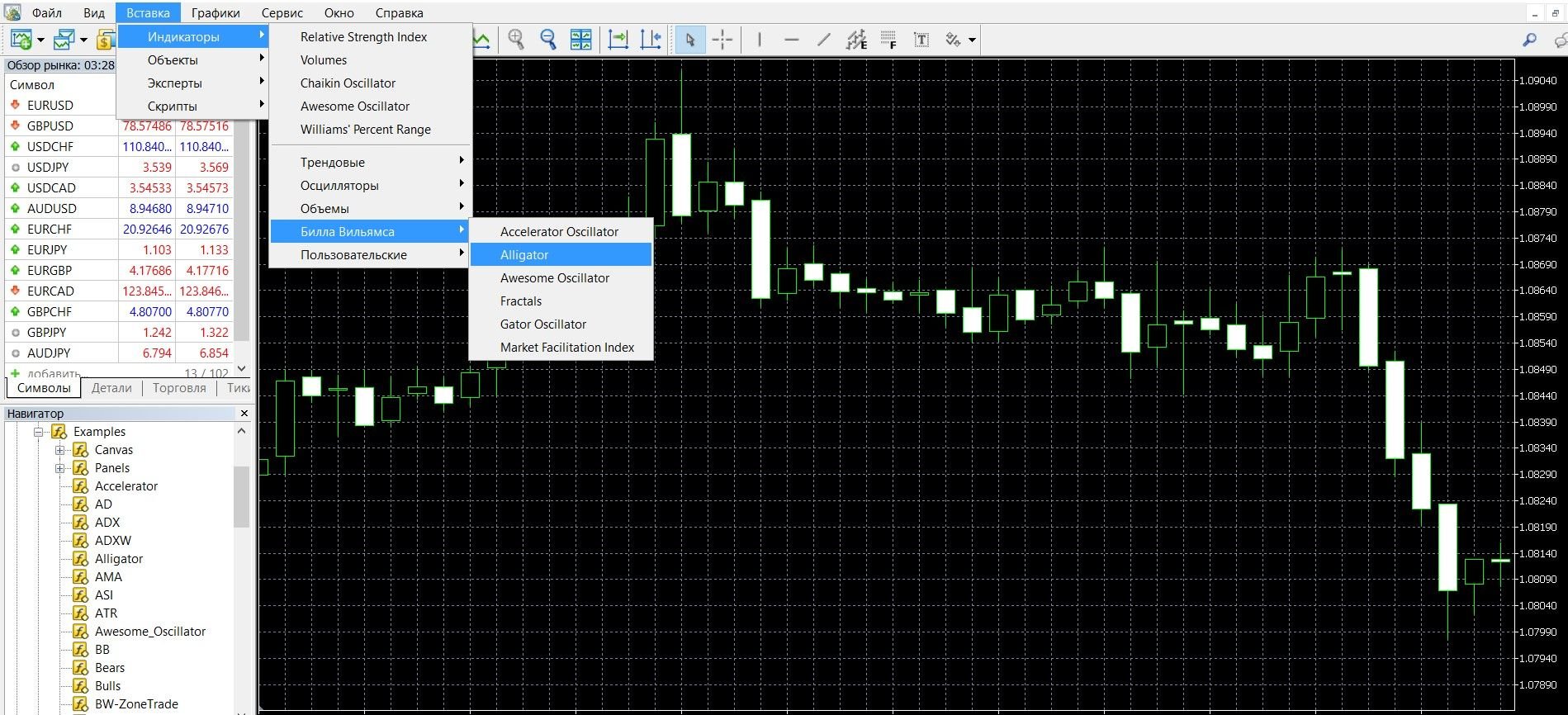

Do I need to install Alligator on your platform?

Alligator is a classic tool for technical analysis of the market situation, it is integrated into almost all modern trading terminals, and it is also available in MetaTrader 4.

To add an oscillator to the price chart, take the following steps:

- Click the “Insert” tab in the top menu of the platform

- Select the tab “Indicators” – “Bill Williams”

- In the drop-down menu that opens, select “Alligator”. The indicator has been added to the chart, you can start working with it.

When adding an indicator to a price chart, you can experiment with its settings, change the periods and shifts of moving averages.

If your platform doesn’t have an indicator, download it here.

Application of the indicator for binary options

Alligator is another useful invention of the popular trader and author of many analysis tutorials, Bill Williams. Studying the stock and commodity markets, he concluded that the largest percentage of the time (70-80%) the market is in a state when the price moves between certain levels, without going beyond their borders. And only for a short time, the price moves with a certain direction up or down, which is called a trend movement.

The goal of the Alligator is to accurately determine the initial stages, as well as signal the continuation of the trend price movement. The indicator was created in order to successfully analyze the strength of market dynamics, protect the trader’s funds from losses during those periods when the price movement is in a limited range, and determine the beginning of trading that occurs during a trend movement.

The use of the indicator in options trading will help to identify the following information:

- about the duration of the trend,

- about the strength of the upcoming trend,

- about the presence of a flat or trend situation in the market.

Like most technical indicators, the Alligator can give false signals. It is recommended to use it in combination with oscillators. Often, for a more accurate determination of entry points, the Alligator is used in tandem with another Bill Williams indicator – the Fractal. In addition, you can reduce the number of false signals using the settings.

Best of all, the indicator manifests itself on a chart with a long period of time, it is recommended to use it on daily timeframes. On short periods, there are many false signals.

Rules for concluding transactions (screenshots)

Trading when there is a trend signal

When the price line is above all the indicator lines, we have an uptrend. The alligator is oriented upwards and indicates the existence of an upper trend in the market, it is worth buying a CALL option (up). In the image below, you can observe the upward trend of the market on the MetaTrader 4 platform:

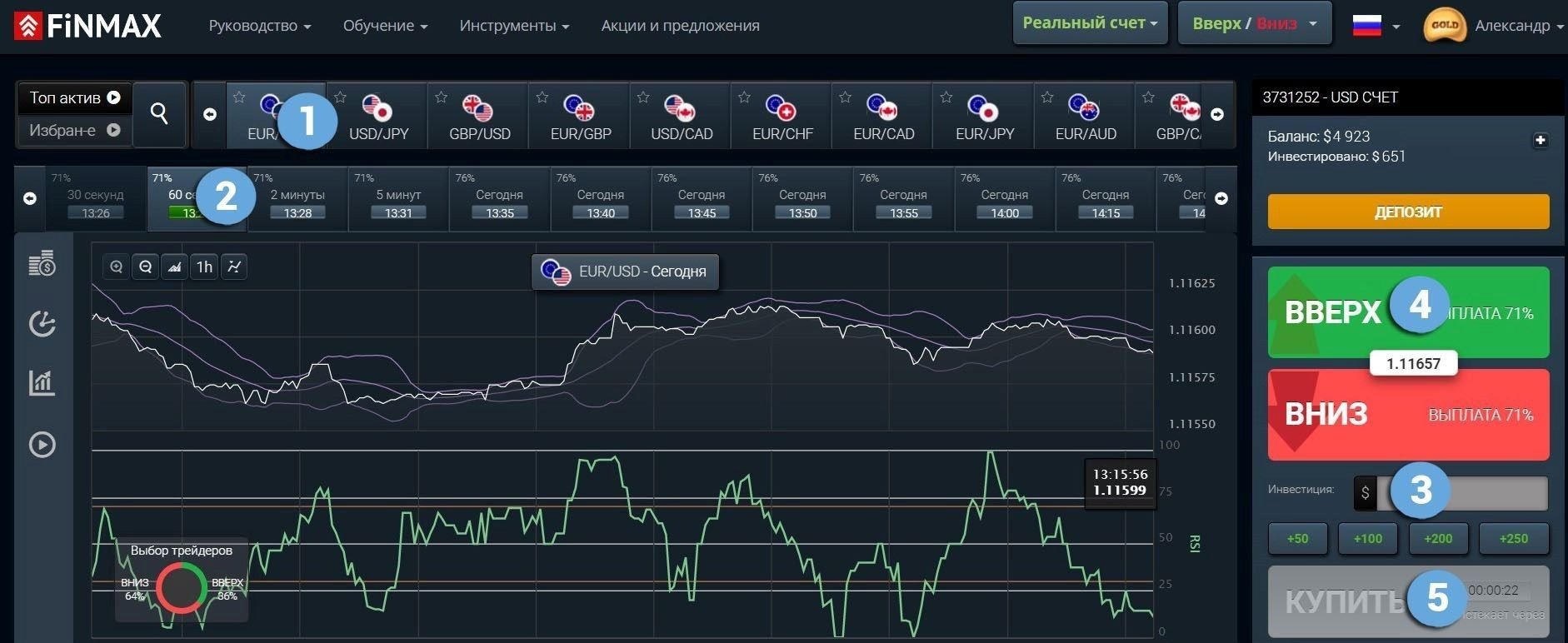

Take advantage of the uptrend opportunities of the price and make a CALL ( up) rate with a reliable broker Finmax. To do this, go to the broker’s website finmaxbo.com and prepare the parameters of the option, indicating:

- Option

- Expiration

- Bet amount

- Movement forecast: UP

- Click the “buy” button and wait for the results.

If the price line is below all the indicator lines, we have a downtrend. The more lines are separated, the stronger the trend. When the Alligator is oriented downwards and indicates the presence of a downtrend in the market, it is worth buying a PCI option (down). In the image below, you can observe the downward trend of the market on the MetaTrader 4 platform:

Take advantage of the downtrend opportunities of the price and make a PUT rate (down) with a reliable broker Finmax. To do this, go to the broker’s website finmaxbo.com and prepare the parameters of the option, indicating:

- Option

- Expiration

- Bet amount

- Movement forecast: DOWN

- Click the “buy” button and wait for the results.

Trading with signals of a change in price dynamics

When the green Alligator line goes under the blue down, there is a trend reversal and a new upward crossing of the blue line, it is worth buying a CALL option. The image below shows an uptrend signal on the MetaTrader 4 platform (you can buy a CALL option on the finmaxbo.com broker’s website, the instructions are listed above):

When the green line of the Alligator goes above the blue line upwards, there is a reversal and a new crossing of the blue line downwards, it is worth buying a put option. The image below shows a downtrend signal on the MetaTrader 4 platform (you can buy a PUT option on the broker’s website finmaxbo.com, the instructions are listed above):

Trading with a signal to determine the strength of the trend

The image below shows the situation of the flat market, after which the Alligator “woke up and wanted to eat”, the trend is gaining momentum. Tk. the green line goes down under the blue line, there is a reversal and a new intersection of the blue line upwards, it is worth buying a CALL option (you can buy a CALL option on the broker’s website finmaxbo.com, the instructions are indicated above):

The image below shows the situation of the flat market, after which the Alligator “woke up and wanted to eat”, the trend takes on a new form. Tk. the green line goes above the blue line up, there is a reversal and a new intersection of the blue line down, it is worth buying a PCI option (you can buy a PCI option on the broker’s website finmaxbo.com, the instructions are indicated above):

Money management

Despite the fact that trading professionals are interested in the basics of money management, for whom a stable income is important, beginners are also advised to get acquainted with it. The sooner you discover the principles of money management, the better the performance of your trading will be. Money management is an effectively built strategy for managing funds in an account, which solves issues such as conscious work with a deposit, how to save and increase its funds. Following the basic rules of money management will make trading profitable:

Trade with a minimum of funds: try to spend a minimum of funds on trading; it is worth betting on an option of about 5% of your deposit; trade options that are worth less than your funds; Work with a broker that guarantees you good profits. By following these guidelines, you will save your deposit.

Transfer a minimum of funds to a deposit: try to work with a minimum of funds in the account; you should not put the entire deposit on the auction of one option; remember that the funds may still be useful to recoup; Organize work with the deposit practically: allocate a free cash limit that is permissible to implement in trading and then try not to go beyond it. By following these guidelines, you will save your capital.

Trade with a minimum of assets: try to gradually complicate your work in trading; Start with the minimum – with 2-3 assets and then, when you feel more confident and experienced, increase the number of tradable assets. By following these recommendations, you will organize effective work from the very first steps in trading.

Trade without emotions: try to keep the right attitude when starting to trade options; Remember, the mood decides a lot – both the success of trading and your attitude to trading. Excessive emotions always make it difficult to concentrate and make correct predictions. By following these recommendations, you can easily build a conscious attitude to trading.

Expiration

Like the basics of money management, this is also the main concept of trading. Expiration (from the English Expiration, “expiration, expiration”) is the moment when the option expires and bidders find out the results of forecasts and understand whether the funds on the deposit will be replenished. The concept of expiration affects the results of your trading. If you need a stable income, consciously choose expiration to your strategy.

Types of options:

- Ultra-short options (express) – 60 seconds – 5 minutes.

- Short-term options – 15 minutes – several hours.

- Medium-term options – from 6 hours – a day.

- Long-term options – a day – several months.

Is it possible to extend the expiration of options?

You can extend the expiration if during trading you realize that you have chosen the wrong quote forecast. Not every broker allows you to extend the expiration, remember this.

Expiration rules:

- If you are new to binary options, you should first use a long expiration, which will reduce the risks of this expiration.

- If you are a professional in trading, who has good trading experience behind him, you should use the expiration that is convenient for you. Work with a broker that allows you to increase expiration during trading, which will reduce the loss of funds in case of an incorrect forecast.

- If you want to make quick money, you should use a short-term (a minute – a few hours) expiration, which can give you money in a minute. Remember that express expiration is unpredictable.

- If you want to receive a stable income from trading, you should use a long-term expiration, which can bring you a decent income.

Expiration in Alligator strategies

Trading when there is a trend signal

Short-term trading: not recommended when working with Alligator; because. You can confuse signals with false data.

Medium-term expiration: from 1 hour to several hours; Allowed; it will be easier to catch Alligator signals on long time intervals, in this case you can take the analysis of other indicators as a basis.

Long-term expiration: allowed; It will allow you to see high-quality signals to enter a trade and achieve a good profit.

Trading with signals of a change in price dynamics

Short-term trading: not recommended for working with the Alligator; At short time intervals, it is more difficult to see high-quality signals to enter a trade.

Medium-term expiration: from 1 hour to several hours; Allowed; it will be easier to catch Alligator signals on long time intervals, in this case you can take the analysis of other indicators as a basis.

Long-term expiration: allowed; In this case, it is easier and more efficient to search for signals to enter the market using the Alligator, you will be able to see high-quality signals and make decent money.

Trading with a signal to determine the strength of the trend

Short-term trading: not recommended for working with the Alligator; because. You can confuse signals with false data.

Medium-term expiration: from 1 hour to several hours; Allowed; it will be easier to catch Alligator signals on long time intervals, in this case you can take the analysis of other indicators as a basis.

Long-term expiration: allowed; will help you see high-quality signals to enter the market with the help of the Alligator.

RSI + Alligator Strategy

This strategy will be effective and will allow you to filter out erroneous Alligator signals. The strategy will need RSI and Alligator. The RSI will act as a filter for false signals. The signal to enter the market will be: the movement of the three Alligator lines downwards, there is a large distance between the lines, the Alligator jaws (blue line) are far from the price chart; The RSI is not in the oversold zone.

Short-term trading: not recommended for working with the Alligator; At these time intervals, it is more difficult for you to see good signals to enter a trade.

Medium-term expiration: from 1 hour to several hours; Allowed; it is easier to catch Alligator signals on long time intervals, in this case you can work with RSI data.

Long-term expiration: allowed; It is more difficult to search for signals to enter the market with the help of Alligator, you will be able to see high-quality signals and get a good income.

Strategy “Fractals + Alligator”

A simple but profitable strategy (approximately 75% of successful trades), which uses the indicators of B. Williams Alligator and Fractals. Designed to work with long-term expirations, signals will not be so frequent: 1-3 per week). Buy signal: Alligator in a consolidation position (intertwined lines); after interlacing the Alligator lines, wait for confirmation from the fractal: the candlestick on the Fractal is located above the Alligator and does not touch its lines. At the maximum of the Fractal, you need to draw a horizontal line and as soon as the price touches this line, open a long position.

Short-term trading: not allowed, in this case it is difficult to track the dynamics of the market; Expiration is risky.

Medium-term expiration: from 1 hour to several hours; is not allowed; catching Alligator signals on these time intervals will be more difficult.

Long-term expiration: recommended in this strategy; It will allow you to get high-quality market entry signals that will bring you a good income.

To study the possibilities of expiration in practice, work on the convenient platform of a trusted broker Finmax. To do this, you just need to go to the finmaxbo.com website. Advantages of the terminal: a modern platform that meets modern trading trends, great opportunities for using expiration (from 30 seconds to six months), comfortable work in your personal account, a set of tools for a trader.

Downloads

MetaTrader 4 (MT4) platform – download.

Alligator indicator for the MT4 platform – download.

Tagged with: Binary Options Indicator