Williams Accumulation/Distribution Indicator (WAD)

Description

Getting acquainted with trading, you learn binary options oscillators, profitable strategies and other tools, thanks to which you plan to achieve the best results in trading. In order to ensure that the material is always available for your training, we publish detailed reviews of indicators on the INVESTMAGNATES.COM portal. Here you will always find complete information about the necessary instrument, its features and trading rules. In today’s article, we will tell you about the Accumulation / Williams Distribution indicator.

The Williams Accumulation /Distribution index (WAD) is a dynamic volume indicator that aims to correlate changes in market volume and price. At the heart of this oscillator is the idea that the importance of market dynamics, and hence signals, increases with an increase in the volume accompanying it. This is another of the options trading tools authored by the famous trader Larry Williams.

This tool should be considered the so-called cumulative sum of the values of each day: WAD = current WAD value + yesterday’s WAD value. At the same time, the initial and absolute values of the indicator do not play a role; The shape of the cumulative curve, which is shown in a separate chart window above or below the price window, is important.

The daily changes in the Accumulation/Distribution indicator are in many ways similar to the data of Japanese candlesticks: both of these instruments display information about the direction in which (positive or negative) the confrontation between sellers and buyers ended.

Initially, the volume indicator was developed for the stock market, but gained great popularity in the foreign exchange markets and binary options. Today, the tool is quite popular with traders when analyzing price changes and increasing market volumes. L. Williams himself recommended using WAD to determine market divergences.

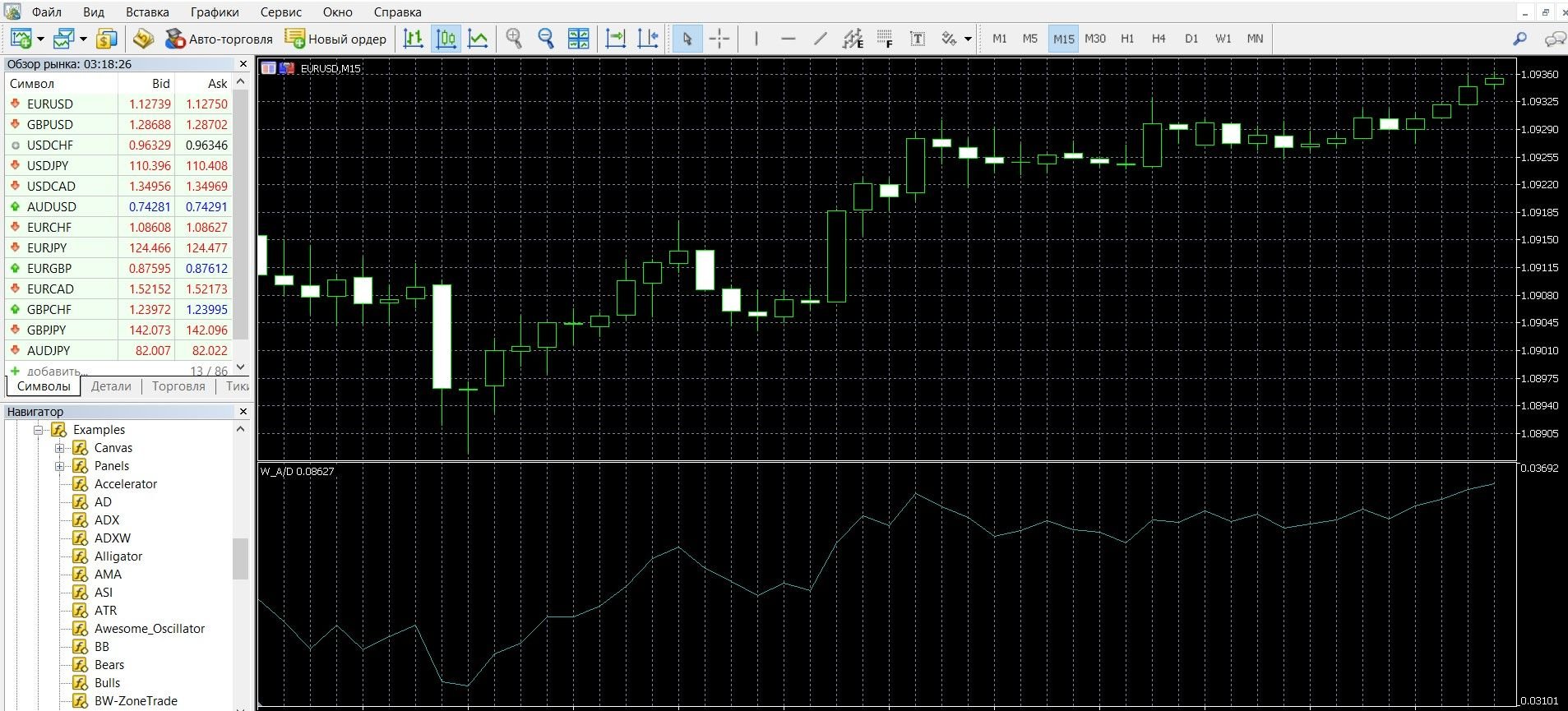

You can see what WAD looks like on the popular MetaTrader 4 (MT4) trading platform in the image below. You can also download the MetaTrader 4 platform and get acquainted with the capabilities of the tool in practice.

How does the WAD indicator work?

The indicator is based on the assumption that with the growing price dynamics, most of the closing prices will fall on the edge of the upper extremes. As we know, after identifying a trend, its movement will always be stimulated by the addition of a mass of participants. So, volume control comes to the fore in the analysis. The Accumulation/Distribution indicator is the accumulated sum of positive and negative (cumulative and distributive) price movements:

- accumulation – means the state of the market, which is controlled by buyers,

- Distribution is the state of the market controlled by sellers.

If the current closing price is higher than the previous data, the WAD reading will increase due to the difference between the current closing price and the true low. If the current closing price is less than the previous data, the WAD readings will decrease due to the difference between the current closing price and the true high.

The readings of the indicator line follow the movements of the price chart, with the update of the indicator lows, the price lows change, a powerful downtrend appears in front of us, and vice versa, when updating the maximum readings of the price chart and the indicator, an uptrend occurs.

The formula for calculating the indicator:

WA/D(i) = A/D(i) + WA/D(i – 1), where:

TRH (i) is the maximum of the true range;

TRL (i) is the minimum of the true range;

MIN – minimum value;

MAX – maximum value;

|| – logical OR;

LOW (i) – the minimum price of the current bar;

HIGH (i) – the maximum price of the current bar;

CLOSE (i) – closing price of the current bar;

CLOSE (i – 1) – closing price of the previous bar;

A/D (i) is the current value of accumulation/distribution;

WA/D (i) – the current value of the Williams’ Accumulation/Distribution indicator;

WA/D (i – 1) – the value of the Williams’ Accumulation/Distribution indicator on the previous bar.

Info taken from www.mql5.com website

WAD indicator signals :

Divergence and convergence signals:

- Divergence is a discrepancy between the readings of the price chart and WAD in an uptrend; signal to buy a CALL option (up),

- Convergence – discrepancy between the readings of the price chart and WAD in a downtrend; signal to buy a put option (down).

Uptrend-downtrend signals:

- If the WAD curve, repeating the movement of the chart, shows a strong downtrend, this is a signal to buy a PUT option,

- If the WAD curve, repeating the movements of the chart, shows a strong uptrend, this is a signal to buy a call option.

Do I need to install a WAD indicator in your platform?

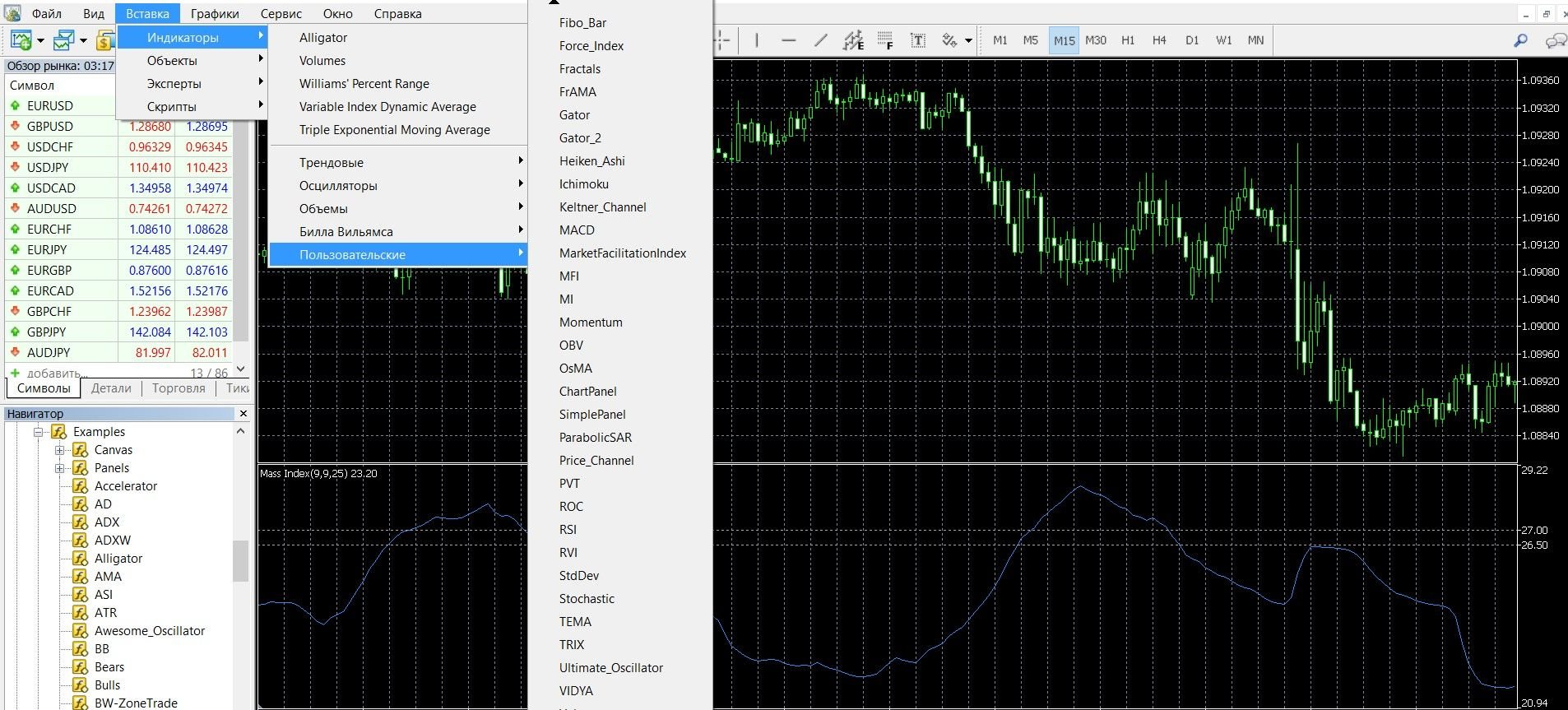

WAD is not a classic options trading tool, it is not in the main set of indicators of the MetaTrader 4 platform. You can install it in MT4 by downloading it for free here.

You can find out how to easily install the downloaded file in MetaTrader 4 here.

After installing the indicator, add it to the price chart, take the following steps:

- Click the “Insert” tab in the top menu of the platform

- Select the tab “Indicators” – “Custom” – “WAD”. The indicator is added to the main chart, you can work.

Application of the indicator for binary options

The indicator is especially valuable in binary options, it allows you to analyze the price dynamics. In addition, it is necessary and will be able to show itself perfectly when working with market volumes. In the event of an increase in these prices, the bulk of the closing prices are located at the edge of the upper extremes; If these prices fall, the bulk of the closing prices will be in the lows zone. Appearing on the market, a new trend is gaining momentum due to the fact that new participants join the trade. So, volumes begin to grow in the market.

With an increase in sales and a change in market dynamics, the indicator readings change: reaching the maximum by the price chart can be explained by volume, so the indicator readings increase. Volumes close to extremes are very heavy. When the price readings decrease, the volume moves away from the indicator; Proximity to extremes will determine the weight of the indicators.

As one of the important indications of the state of the market, volume clearly signals the dominant forces at a particular moment. The indicator line follows the movements of the price chart:

- When the WAD lows are updated, the price lows also change. This is a signal that there is a strong downtrend in the market, buying PUT options.

- When updating the highs of the price and the indicator, an uptrend signal occurs, you should buy CALL options.

WAD is one of the simple and understandable tools of a trader, in order to determine signals, it is enough to track the curve readings and price behavior. Still, it is worth using it together with other indicators to search for high-quality signals. With divergence and convergence, it is important to wait for the price to turn in the direction of this signal and only then make a decision to enter the market.

Rules for concluding transactions (screenshots)

Trading with uptrend-downtrend signals

When the WAD curve, repeating the movements of the chart, shows a strong uptrend, this is a signal to buy a call option. In the image below, you can see the signal of the upward trend of the market on the MetaTrader 4 platform:

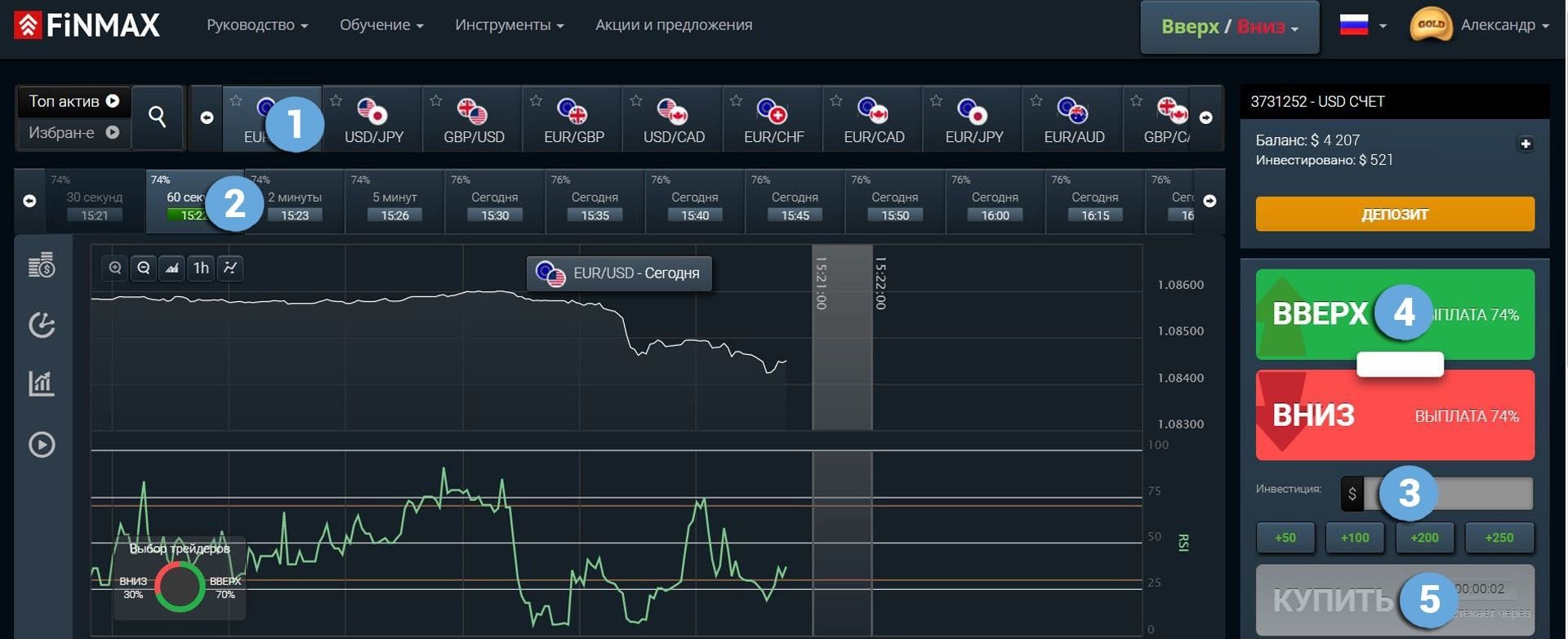

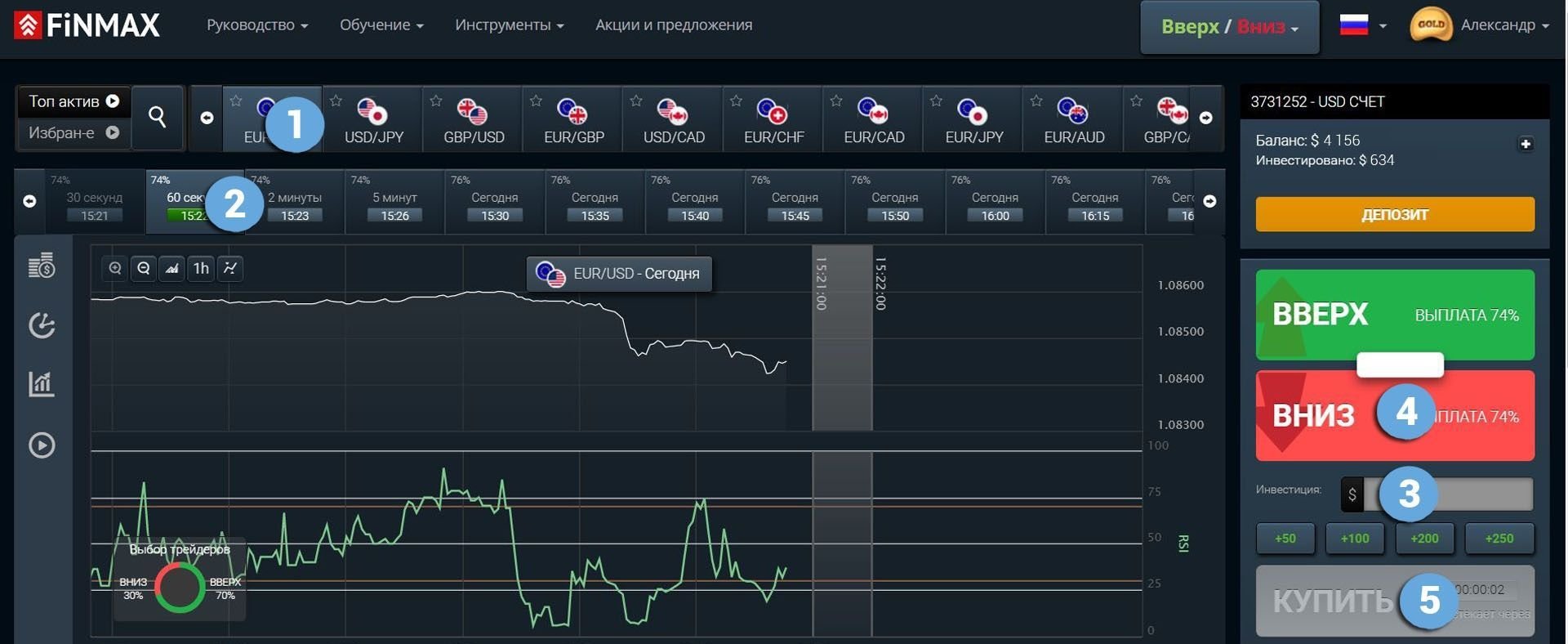

Take advantage of the uptrend opportunities and place a CALL (up) rate with the Finmax broker. To do this, go to the broker’s website finmaxbo.com and prepare an option, indicating:

- Option

- Expiration

- Bet amount

- Movement forecast: UP

- Click the “buy” button and wait for the results.

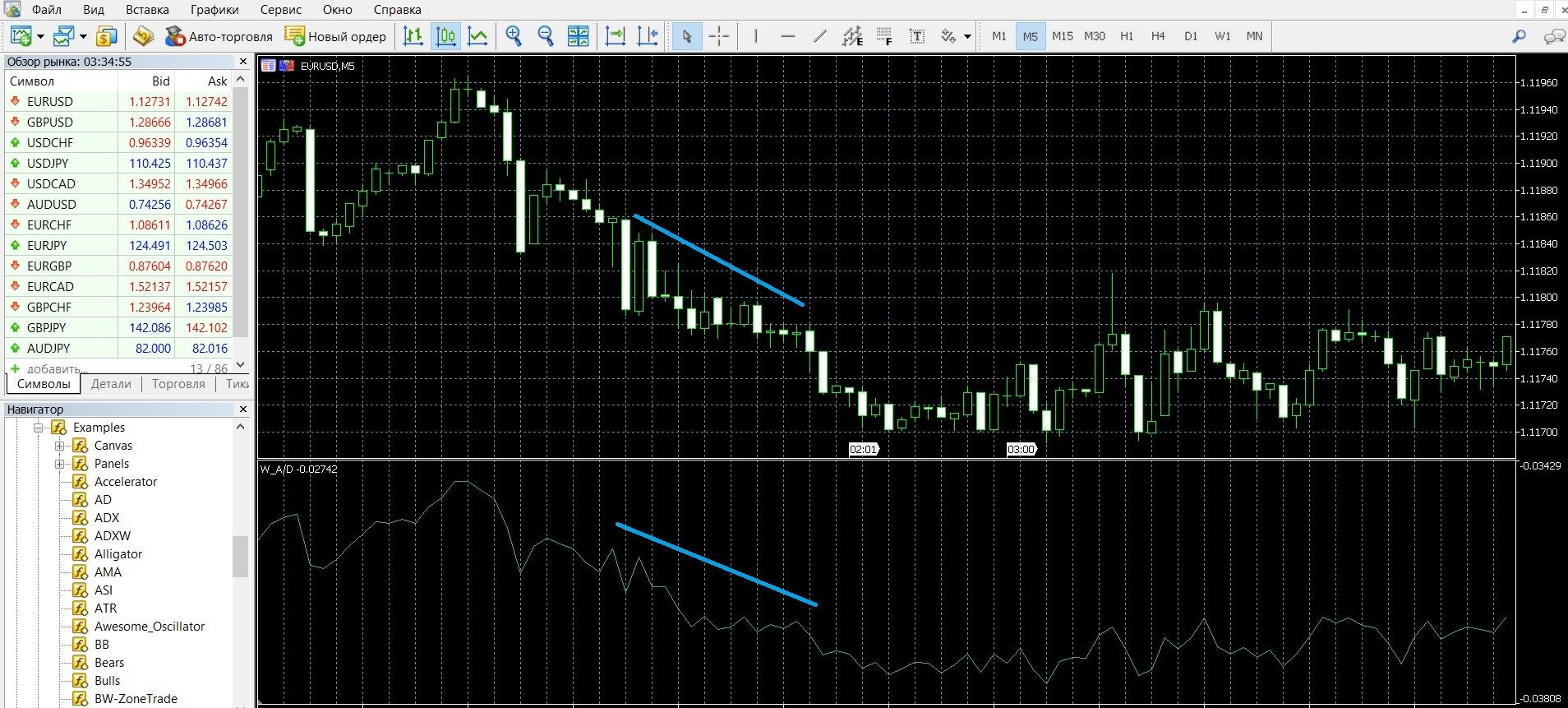

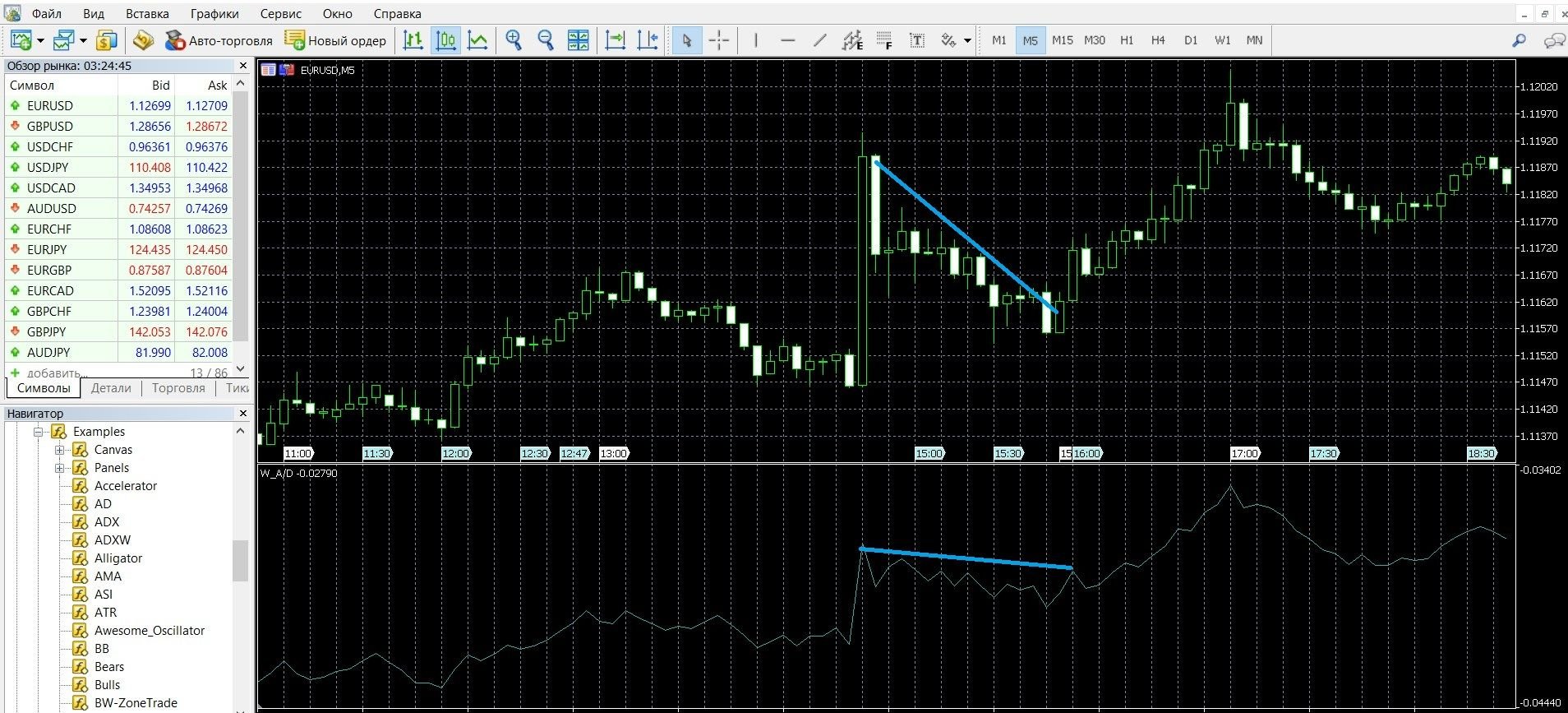

When the WAD curve, repeating the movements of the chart, shows a strong downtrend, this is a signal to buy a put option. In the image below, you can see the signal of the downward trend of the market on the MetaTrader 4 platform:

Take advantage of the downtrend opportunities of the price and place a PUT (down) rate with the Finmax broker. To do this, go to the broker’s website finmaxbo.com and prepare an option, indicating:

- Option

- Expiration

- Bet amount

- Movement forecast: UP

- Click the “buy” button and wait for the results.

Trading with a divergence signal

Divergence WAD appears on an uptrend, when the price chart goes in one direction, and the WAD data in the other, this is a signal of an imminent trend change. The image below shows a divergence signal on the MetaTrader 4 platform (you can buy a CALL option on the finmaxbo.com broker’s website, the instructions are listed above):

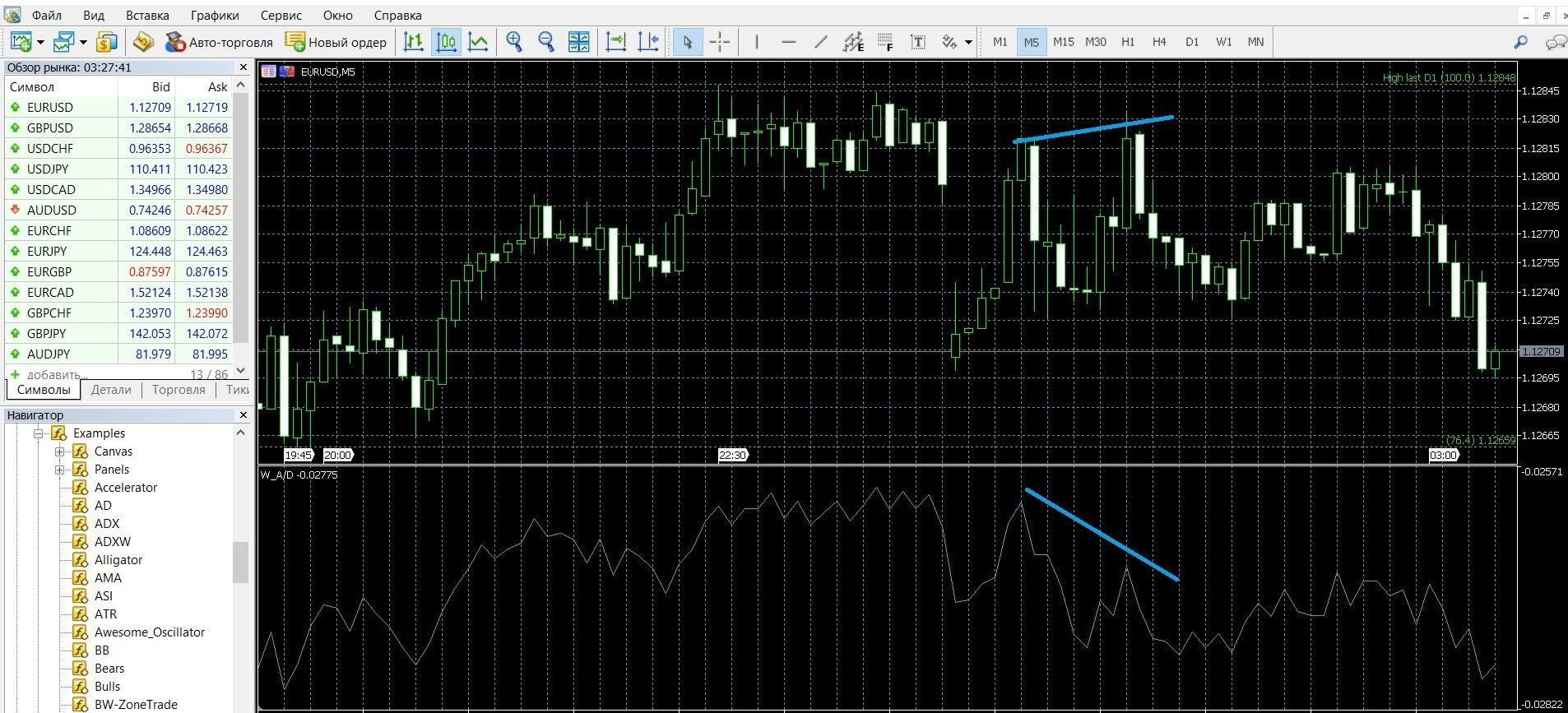

Trading with a convergence signal

Convergence WAD appears on a downtrend when the price on the chart goes in one direction, and the WAD lines in the other, this is a signal of an imminent trend change. The image below shows the convergence signal on the MetaTrader 4 platform (you can buy a PCI option on the finmaxbo.com broker’s website, the instructions are listed above):

Money management

Most often, professional options players begin to put into practice the basics of money management. They have extensive experience in trading and are thinking about how to get a stable profit. Then the rules of money management come to the rescue – this is a conscious strategy for managing funds on a deposit, which is able to answer, for example, questions such as: proper work with capital, economical spending of funds, measures to increase income. If you plan to make options trading the main source of income, apply the rules of money management in your work:

Trading with a minimum of money: it is worth spending a minimum of your funds on options trading; bet on bets no more than 5% of the deposit; take part in those assets whose price is less than the funds in the account; work with an effective broker. Follow these rules and you will save your capital.

Trading with a minimum deposit: it is worth trading with the minimum possible deposit; save capital and not spend the entire amount at once on one option; When working with a deposit, determine for yourself a strict limit that is allowed to trade and not go beyond it. Follow these rules and you will save your deposit.

Trading with a minimum number of assets: it is worthwhile, when starting to trade, to gradually complicate your work; It is recommended to start the first trades with 2-3 assets, and then gradually increase the amount of work. Follow these rules and you will make your work productive.

Trading without emotions: it is worthwhile, working in trading, to build the right attitude; When trading options, it is important to remove unnecessary emotions that will interfere with focusing on the process. Follow these rules and you will achieve the maximum in trading.

Expiration

Expiration time, as well as the rules of money management, is the leading concept in trading. The effectiveness of your options trading depends on these two concepts.

Expiration is the moment of expiration of the option (that is, the expiration time), when market participants see the results of their forecasts and understand whether their account will be replenished with funds. If a stable income is important to you, consciously choose the expiration of the option every time.

Types of options:

- Ultra-short options – 60 seconds – 5 minutes.

- Short-term options – 15 minutes – several hours

- Medium-term options – from 6 hours – a day

- Long-term options – a day – several months.

Is it possible to extend the expiration of options?

It is possible, not every broker is allowed to do this. Choose a broker that allows you to extend the expiration, which will minimize your losses and save capital.

Expiration rules:

- It is better for option beginners to work with a long expiration, this will help reduce the risk of losing funds.

- It is better for options professionals to choose an expiration at the pace of which they are more comfortable working. Choose those brokers who allow an increase in expiration during trading, this will help reduce risks.

- If you want to get quick money, it is better to choose a short-term (minute – several hours) expiration, which will give income in a minute. At the same time, you need to remember the unpredictability of such express expirations.

- If you want to learn a stable income from options, it is better to choose a long-term expiration that will bring a decent income and minimize losses.

Expiration in WAD Strategies

Strategy for oversold-overbought signals

Short-term trading: allowed, can bring a good income if the signals are used correctly; risky, reminiscent of playing the lottery.

Recommended expiration: from 30 minutes to several hours; During this time period, you will analyze the market situation, see the dynamics of the behavior of sellers and buyers, and use the indicator data correctly.

Long-term expiration: also allowed; It will help to better understand the dynamics of prices, to study the influence of other factors on the market, if you make the right decision, you will get a good income.

Strategy for divergence and convergence

Short-term trading: allowed; You should be more careful when studying the signals, refer to the data of additional indicators.

Recommended expiration: from 5 minutes to several hours; You will better understand the dynamics of the trend and the mood of the market, study the signals of oscillators, and be able to make an informed decision.

Long-term expiration: also allowed; It will allow you to better prepare for decision-making: you will have time to study the signals of strategies, the external situation that affects the dynamics of the market: news, economy.

WAD +

RSI

This strategy is based on the use of WAD and RSI indicators. It will allow you to get high-quality signals to enter the market. The RSI will act as a trend confirmation; WAD record the current state of market volumes.

Short-term trading: allowed; Be careful when studying the signals, refer to the signals of the confirmation indicator.

Recommended expiration: from 15 minutes to several hours; You will see the dynamics of the trend, the mood of market participants, study the signals of oscillators.

Long-term expiration: also allowed; It will allow you to better prepare for decision-making: to study signals, the external situation that affects the dynamics of the market: news, economy.

WAD +

MACD

This strategy is based on the use of WAD and MACD indicators. It will allow you to get high-quality signals to enter the market. The MACD will act as a trend confirmation; WAD record the current state of market volumes.

Short-term trading: allowed; Be careful when studying the signals, refer to the signals of the confirmation indicator.

Recommended expiration: from 15 minutes to several hours; You will be able to observe the current forces of the market, see the dynamics of the trend, study the signals of oscillators.

Long-term expiration: also allowed; It will allow you to better prepare for decision-making: to study signals, the external situation that affects the dynamics of the market: news, economy.

We recommend that you try all possible types of expiration in practice and choose the one that will be convenient for you. To do this, use the platform of the reliable broker Finmax by going to the finmaxbo.com website. The advantages of this site: convenience and simplicity, wide expiration options (from 30 seconds to six months), the availability of the necessary set of tools for work.

Downloads

MetaTrader 4 (MT4) platform – download.

WAD indicator for the MT4 platform – download.

Tagged with: Binary Options Indicator