Money Flow Index (MFI) indicator

By publishing detailed reviews of binary options oscillators for readers of the INVESTMAGNATES.COM portal, we make your trading training available. Every options beginner begins his first steps in trading by studying materials about technical indicators, reliable strategies and other tools. By collecting useful information on our portal, we do everything to make your trading training productive. Today’s article is devoted to the MFI indicator.

The Money Flow Index (MFI) is a technical indicator of the speed of price movement, which is similar to the Relative Strength Index (RSI). Its difference from RSI is that the volume indicator is taken into account in the calculations. The author of the indicator is trader Bill Williams, he described his new tool in the book “Trading Chaos”. Creating the oscillator, he spoke of tick volume as an important indicator of market expectations, interconnected with price movement.

The volume indicator is orders that have recently arrived on the market that change the pace of movement. Or in another way, new players enter the market, increasing the number of transactions, which shows a change in tick volume. This is how the existing dynamics are strengthened or decreased.

The main advantage of MFI (https://eto-razvod.ru/forex-indicators/mfi/) is a sustainable tool that provides reliable readings for measuring the strength of cash flows invested in an asset (for example, in a currency or security). The Money Flow Index compares positive and negative cash flows, obtaining an indicator that, in comparison with price data, determines the strength of the trend. Like RSI, MFI takes values from 0 to 100, calculated using 14 candles. You can see how the MFI indicator visually looks on the MetaTrader 4 (MT4) platform in the image below. In addition, you can download the MetaTrader 4 platform and get acquainted with the oscillator in practice.

How does the MFI indicator work?

MFI works on the principle of comparing the indicators of positive and negative cash flows of the market. In the event that the price indicator for a specific period is higher, this indicates a positive inflow of funds into the asset. If the price indicator for the period is less, this indicates that investors are withdrawing funds from this asset.

By tracking the price dynamics of an asset and showing information about whether the trading volume is rising or falling, MFI signals the strength of the trend in order to justify trading with it, determine the beginning of a new trend or when it is better to avoid trading. This is especially valuable in options trading, because allows you to make high-quality forecasts of market entries. The indicator is an indicator of the intensity of investments in financial instruments. It analyzes the price dynamics based on positive and negative money flows, and, after comparing with the price, takes a value from 0 to 100, which reflects the strength of a particular trend.

When working with the Money Flow Index, you need to consider:

- Data on the discrepancy between the indicator and the price movement. If prices rise and the value of the Money Flow Index falls (or vice versa), a price reversal is possible.

- Money Flow Index readings above 80 and below 20 indicate a potential top and bottom of the market.

- MFI works well on all timeframes – from five-minute to weekly charts.

MFI calculation formula:

MFI = 100 – (100 / (1 + MR), where:

- HIGH — the maximum price of the current bar;

- LOW — the minimum price of the current bar;

- CLOSE — closing price of the current bar;

- VOLUME — volume of the current bar.

Info taken from www.metatrader5.com website

MFI indicator signals:

Divergences/Convergences

Divergence and convergence are the phenomena of divergence of the directions of movement of the price chart and the movement of the indicator. They warn market participants about an imminent market reversal. Divergences and convergences between the price of an asset and MFI are used as buy or sell signals. Like other oscillators (e.g., MACD, Momentum, Stochastically , etc.), close reversal points of the current trend are often shown.

- If there is a divergence signal, which manifests itself on an uptrend, you should buy call options.

- when there is a convergence signal, which manifests itself on a downtrend, you should buy put options.

Overbought-oversold

MFI is used to identify overbought-oversold zones.

- The asset was overbought when the MFI reached the value of 80 and exceeded it. There is a signal to sell the put option.

- The oversold level is below the level of 20 points. There is a signal to buy a CALL option.

When oversold levels are reached, there is a possibility that the market may reverse.

Do you need to install MFI on your platform?

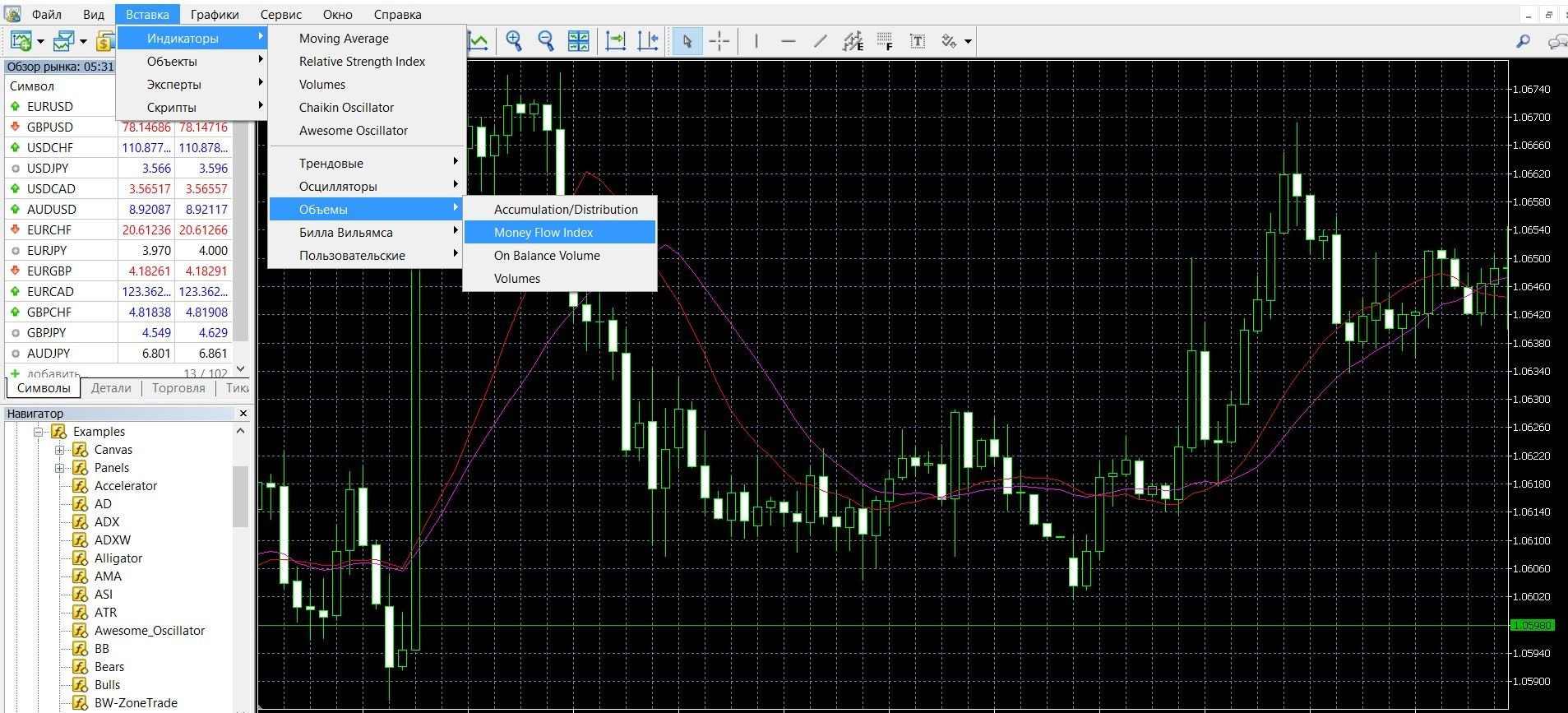

MFI is a classic tool for analyzing the market situation, it is presented in almost all modern trading terminals, and it is also available in MetaTrader 4. To add an oscillator to the price chart, take the following steps:

- Click on the “Insert” tab in the top menu of the platform.

- Select the tab “Indicators” – “Volume”.

- In the drop-down menu that opens, select “Money Flow Index”. The indicator is added to the chart, you can work.

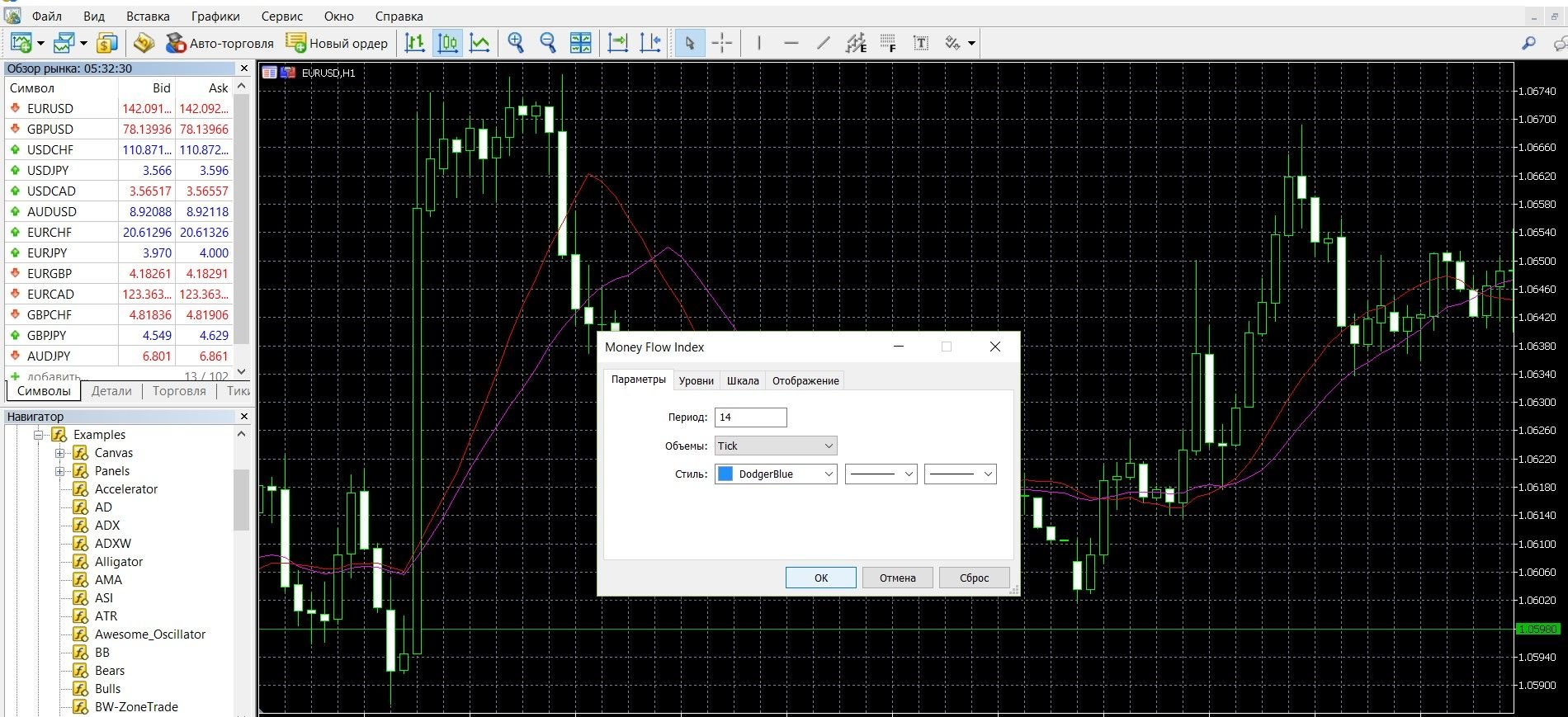

When installing the Money Flow Index, you can use the setting of the “period” value, which is 14 by default. The trader chooses this value for himself, depending on the strategy of work. If the period of the Money Flow Index is reduced, the volatility of the indicator will increase. If your platform doesn’t have an indicator, download it here.

Application of the indicator for binary options

The Bill Williams Money Flow Index is a very interesting indicator that can be adopted in options trading. First of all, it deserves attention, because it is built in volume. It is often considered a more serious and useful instrument in options than RSI. Financial markets work as follows: price dynamics are related to the flow of funds. The larger this flow, the stronger the dynamics. And yet, in reality, everything is more complicated and it is not easy to determine the dynamics. This task has been simplified with the advent of the Cash Flow Index, which is able to determine the direction of money movement. It is worth remembering that MFI works with tick volumes, since it is unlikely to determine the real operating volumes on options.

Among the advantages of the indicator: it is similar to the RSI, but, in addition to the price indicator, it also takes into account trading activity (tick volume), which improves the quality of signals. It is easy to set up (just set the period parameter); The graph data is consistent, you can see the statistics of the data and assess the risks. The indicator is widely used in binary options trading. Like the RSI, it gives qualitative divergence and convergence signals, as well as overbought-oversold signals. It is worth remembering that the divergence between the price indicator and MFI can be observed for quite a long time and the market may not turn around. Therefore, carefully study the behavior of the indicator. One of the main advantages of MFI is stability and stability. Like other indicators, it is recommended to be used in conjunction with other technical analysis tools to confirm data.

Rules for concluding transactions (screenshots)

Trading with an overbought-oversold signal

MFI signals overbought-oversold zones. The asset was overbought when the MFI reached the value of 80 and exceeded it. You can place a PUT (down) bet. In the image below, you can observe the upward trend of the market on the MetaTrader 4 platform. This upward trend signals an imminent market reversal:

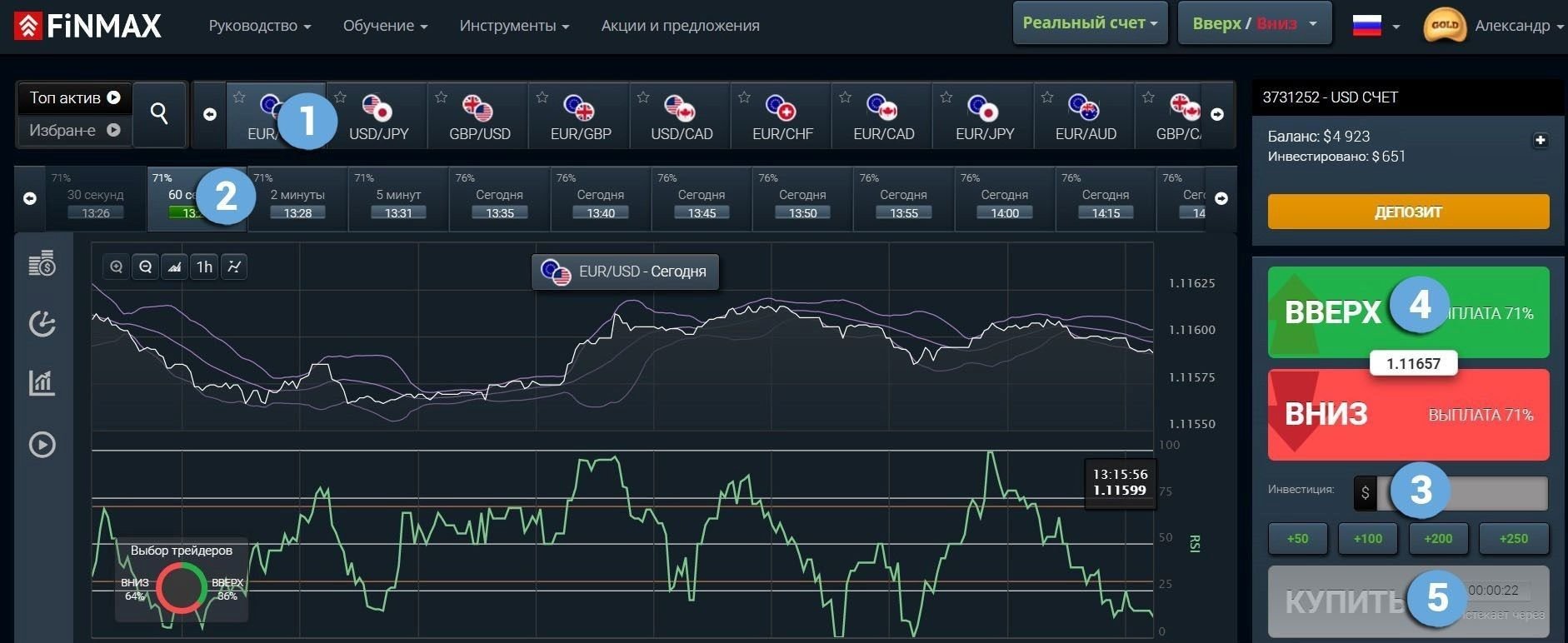

Take advantage of the uptrend opportunities of the price and place a PUT (down) rate with the reliable broker Finmax. To do this, go to the broker’s website finmaxbo.com and prepare the parameters of the option, indicating:

- Option.

- Expiration.

- The amount of the bet.

- Movement forecast: DOWN.

- Click the “buy” button and wait for the results.

When MFI’s oversold level is below the 20 pip level, you can buy a CALL option (up). In the image below, you can observe the downward trend of the market on the MetaTrader 4 platform. This downward trend signals an imminent reversal of the market in the other direction:

Take advantage of the opportunities of the downtrend of the price and make a CALL rate (up) with a reliable broker Finmax. To do this, go to the broker’s website finmaxbo.com and prepare the parameters of the option, indicating:

- Option.

- Expiration.

- The amount of the bet.

- Movement forecast: UP.

- Click the “buy” button and wait for the results.

Trading with a divergence signal

Divergence occurs in an uptrend, when the price goes in one direction, and the indicator lines in the other, which will signal an imminent trend change. The image below shows the divergence signal on the MetaTrader 4 platform (you can buy a CALL option on the Finmax broker’s website, the instructions are listed above):

Convergence trading

Convergence occurs in a downtrend when the price on the chart sets new peaks, but the indicator does not, which will signal a trend change. The image below shows the convergence signal on the MetaTrader 4 platform (you can buy a PCI option on the Finmax broker’s website, the instructions are listed above):

Money management

Professional market players think more about money management and consciously use its principles in their work, who began to think about getting a stable income. Still, if you are new to options, this does not mean that it is too early for you to think about money management, and even on the contrary, the sooner you put into practice its principles, the better your results will be. Money management is an effective strategy for managing an account and personal finances, which is able to solve such issues as the correct work with a personal account, how to save and increase funds on it.

- Trade with a minimum of funds: it is recommended to spend a minimum of funds on trading; bet on the option about 5% of the amount of your deposit; work with options, the price of which is less than the funds on the deposit; Work with a reliable broker who will guarantee you the best results and profits. Follow these guidelines and you’ll save your funds on your deposit.

- Transfer a minimum of funds to a deposit: it is recommended to work with a minimum of funds in the account; do not put the entire deposit on the option, because the money may still be useful in order to recoup; It is worth organizing work with the deposit more practically: allocate a free limit that you can freely implement and then do not go beyond it. Follow these guidelines and you will easily save your capital.

- Trade with a minimum of assets: it is recommended, when working with options, to gradually complicate your work; Start trading with 2-3 assets and then, as soon as you feel more confident, you can increase the number of assets traded. With this approach, you will be able to keep the situation under control, track the status of the account. Follow these recommendations, and you will be able to easily organize effective work from the very first steps in trading.

- Trade without emotions: it is recommended, when starting to work in options, to learn how to properly tune in to work. Remember that the mood here decides a lot – and the success of trading. Excessive emotions will interfere with concentration and draw the right conclusions. When trading, tune in to serious work, because at this moment you need analytics and informed decisions for a positive outcome. Follow these recommendations, and you can easily build a conscious attitude to trading.

Expiration

Like the principles of money management, this is one of the leading concepts in trading. Expiration is the moment of expiration of the option, when bidders find out the results of their forecasts and understand whether the funds on the deposit will be replenished. Expiration directly affects the performance of your trading. If you want trading to bring you a stable income, consciously work with expiration.

Types of options:

- Ultra-short options (express) – 60 seconds – 5 minutes.

- Short-term options – 15 minutes – several hours.

- Medium-term options – from 6 hours – a day.

- Long-term options – a day – several months.

Is it possible to extend the expiration of options?

You can extend the expiration if you realize during trading that you have chosen the wrong predictions. Not every broker allows you to extend the expiration, remember this.

Expiration rules:

- If you are new to binary options, first use a long expiration, which minimizes the risks of this expiration.

- If you are a professional in trading, who has good trading experience behind you, use the expiration that is convenient for you. Choose brokers that will allow you to increase expiration during trading, which minimizes the loss of funds in case of an incorrect forecast.

- If you want to get a quick income, use a short-term (a minute – a few hours) expiration, which will give you quick earnings in a minute. Remember that express expiration is always unpredictable.

- If you want to get a stable income, take advantage of the opportunities of long-term expiration, which will bring you a decent stable income.

Expiration in strategies with MFI

Strategy for oversold-overbought signals

- Short-term trading: allowed, difficult to understand market dynamics; Expiration is characterized by riskiness and unpredictability.

- Recommended expiration: from 1 hour to several hours; You will be able to analyze the market situation, determine the forces at work, see the development of the trend and market entry signals.

- Long-term expiration: also recommended; It will allow you to get high-quality market entry signals that will bring you a good income.

Strategy for divergence and convergence signals

- Short-term trading: it is allowed, due to the high degree of risks it can lead to losses, so be careful when making a decision.

- Recommended expiration: from 1 hour to several hours; It will allow not only to obtain data on the dynamics of the trend, but also to analyze the situation on the market, determine the forces at work, and see high-quality signals of entering the market.

- Expiration of more than an hour: also recommended, will allow you to analyze the dynamics of the market, predict the outcome of trading based on macroeconomic analysis (news, economics, etc.).

Expiration in the scalping strategy “Bollinger bands

+ MFI”

An interesting scalping strategy that can bring you a good income. To work, you will need the Bollinger bands indicators (as the main signal to enter the market) and MFI (as an additional signal). Buy signal: When the price touches or breaks through the lower Bollinger band and the MFI is in the oversold zone (below level 20), it is necessary to wait for a bullish candle to form. We enter the market at the opening of the next candle (after the bullish one). Sell signal: When the price touches or breaks through the upper Bollinger Band and the MFI is in the overbought zone (above level 80), it is necessary to wait for a bearish candle to form. We enter the market at the opening of the next candle (after the bearish one).

- Short-term trading: recommended, because this is a scalping strategy, then the work takes place with this expiration; allows you to get high-quality signals, participate in a large number of transactions and get a decent income.

- Day expiration: not recommended; Before us is a scalping strategy, which is focused on express expiration, long terms in this case will not bring a good result.

- Long-term expiration: also not recommended; Before us is a scalping strategy that is focused on express expirations, long-term expirations will not bring good results, it is difficult to follow the signal for, for example, a week.

Expiration in the scalping strategy “MA + MFI”

Another interesting scalping strategy that is characterized by high profitability. To work, you will need indicators: a simple moving average (3 SMA) and MFI. Working on such a strategy is simple: we enter the market when the MFI crosses the moving average. Buy signal: MFI crosses from bottom to top (below 30) moving average 3 (SMA). The market is entered at the opening of the next candle. Sell signal: MFI crosses the moving average 3 (SMA) from top to bottom (above 70). We enter the market at the opening of the next candle.

- Short-term trading: recommended, because this is a scalping strategy, then the work takes place with this expiration; allows you to get high-quality signals, participate in a large number of transactions and get a decent income.

- Day expiration: not recommended; Before us is a scalping strategy, which is focused on express expiration, long terms in this case will not bring a good result.

- Long-term expiration: also not recommended; Before us is a scalping strategy that is focused on express expirations, long-term expirations will not bring good results, it is difficult to follow the signal for, for example, a week.

Expiration in the scalping strategy “MA + Volume + MFI”

In this strategy, you will be able to take advantage of SMA signals, as well as see the money supply and price volume. A simple moving average (SMA) is one of the most effective technical analysis tools that determine the direction of the trend and entry points to the market. To work, you will need indicators: 2 SMA indicators with periods 5 and 14; Money Flow Index; Volume. Buy signal: the downward trend changes to an upward trend, the 5 SMA crosses the 14 SMA from bottom to top; at the moment of crossing the SMA, the MFI is above level 50, or crosses it from bottom to top; Volume signals an increase in tick volume compared to the previous candle. Sell signal: the uptrend changes to a downtrend, the 5 SMA crosses the 14 SMA from top to bottom; at the moment of crossing the SMA, the MFI is above level 50 or crosses it from top to bottom; Volume signals an increase in tick volume compared to the previous candle.

- Short-term trading: not recommended, due to the high degree of risks it can lead to losses.

- Recommended expiration: from 1 hour to several hours; day trading will be distinguished by more favorable conditions; Less market noise will allow you to see high-quality trend signals.

- Long-term expiration: also not recommended, because. It is difficult to observe the development of the trend and track high-quality signals.

To test in practice all the possibilities of expiration, use the convenient platform of a trusted broker Finmax. To do this, you need to go to the finmaxbo.com website. Among the advantages of the terminal: a modern platform that meets all modern trading trends, the ability to choose an expiration from 30 seconds to six months, the comfort of working on the site and in your personal account, an expanded set of tools for a trader.

Downloads

Tagged with: Binary Options Indicator