Chaikin Oscillator (CHO)

Description

We bring to your attention reviews of binary options oscillators on the INVESTMAGNATES.COM portal, which will help make your trading training productive. Thanks to our detailed materials, you will learn a lot of useful things about technical indicators – the main trading tools, their application and how to get a stable profit with them. Today’s post will tell you about the Chaikin oscillator.

The Chaikin Oscillator (CHO) is one of the most popular and effective volume indicators, the author of which is the well-known trader and analyst Mark Chaikin, who also created analysis tools such as the volatility indicator and the Money Flow oscillator. He was inspired to create CHO by the work of Joe Granville and Larry Williams.

The Chaikin indicator is, first of all, a convenient technical analysis tool that displays the features of accelerating the price movement. In many ways, this unique hybrid tool resembles the MACD, which is why it is often referred to as the regular MACD indicator, but applied to the Accumulation/Distribution indicator.

Unlike MACD, it includes an A/D script, has a different appearance. We can say that CHO is the difference between the three-day and ten-day simple moving averages of the Accumulation/Distribution indicator. As you remember, A/D is used to estimate total cash flow. So, working with CHO, the trader analyzes not the acceleration of the nature of the price chart, but changes in the A/D readings. This makes it possible to obtain data earlier than using the accumulation/distribution indicator alone.

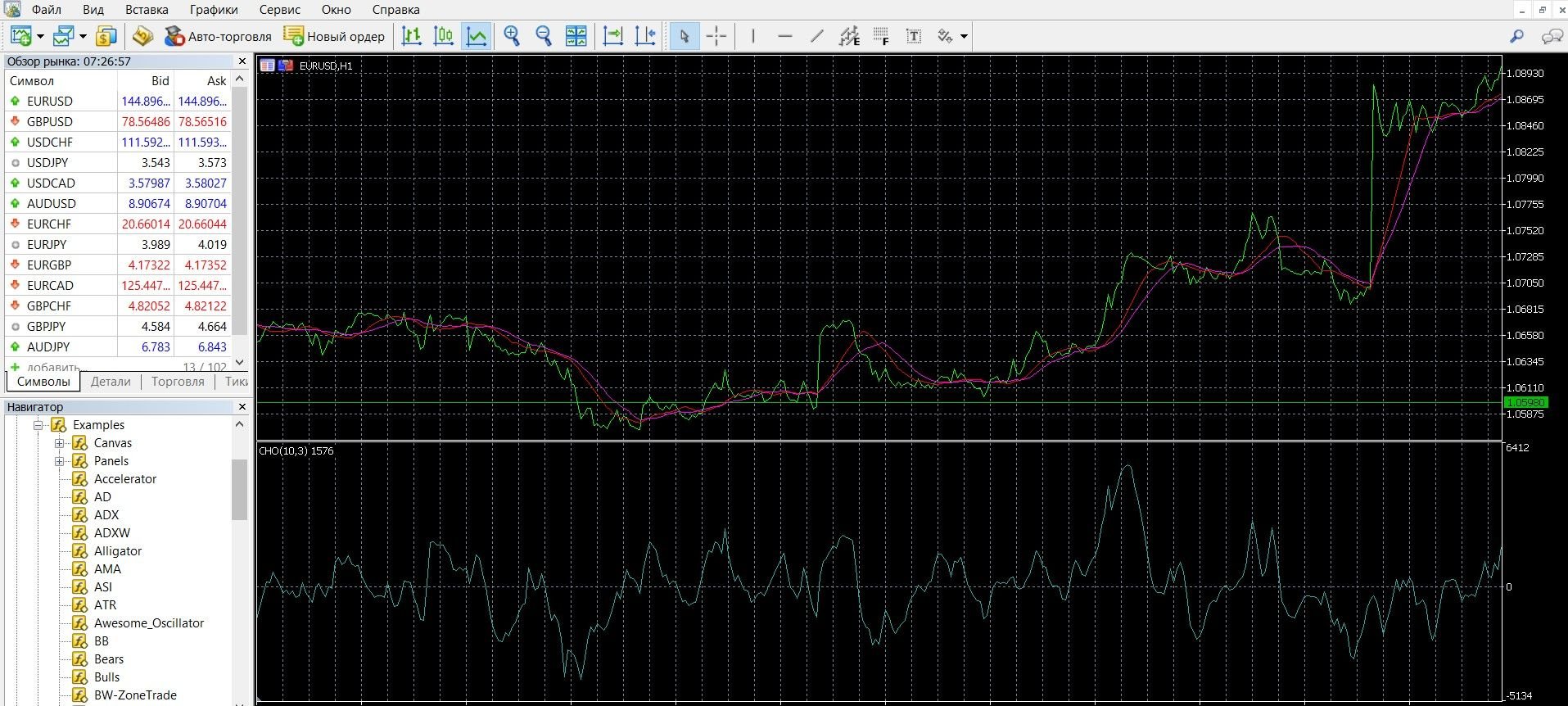

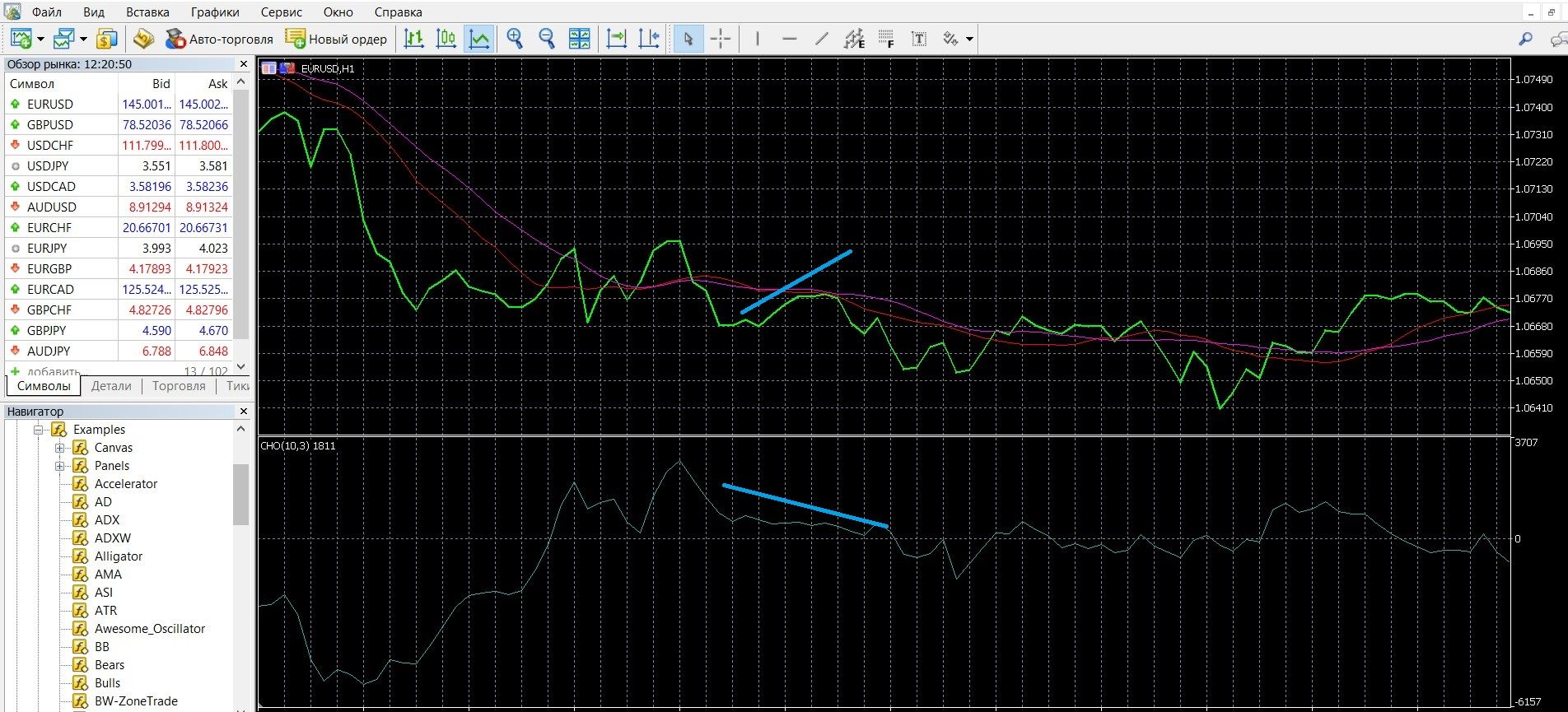

The Chaikin indicator is successfully used in a variety of financial markets, including options. It is common among traders, becoming an indispensable assistant in technical analysis. You can see what CHO looks like on the MetaTrader 4 (MT4) platform in the image below. In addition, you can download the MetaTrader 4 platform and get acquainted with the oscillator in detail.

What is the working principle of the CHO indicator?

The oscillator uses the principle of accumulation/distribution, which allows you to determine the trend strength of buyers and sellers when using the closing prices of previous periods. This effective technical tool was created to help the trader in determining the strength of the market movement: in the event that the closing of the period is closer to the highs, buyers dominate the market (we are talking about an uptrend), if closer to the lows – a qualitative signal about the dominance of sellers (this is a downtrend).

It is the AD indicator that acts as the material that is smoothed out by moving averages; then, after smoothing, one average is subtracted from the other and we get the Chaikin oscillator. The value of the indicator is that it contains information about volumes, as well as information about prices and their ranges during a specific time interval.

The advantage of the tool is that you do not need to use two indicators on the same chart, such work increases the efficiency and convenience of data collection, and also makes it possible to identify false signals. In order to obtain a trend characteristic, several indicators are used at once:

- The Accumulation/Distribution line, which shows the direction of the main trend in a specific time interval.

- The bars of the Chaikin indicator, the length of which increases when the trend intensifies, and vice versa, shortens when the trend reverses. The color also changes: green indicates movement in the direction of the trend, red indicates a correction.

- The zero line, which becomes a reference point to help determine how great the possibility of a reversal is. In this case, it is recommended to open positions when the price is just starting to move away from this line.

Chaikin Oscillator is an excellent tool for working with any strategy that works in the direction of the trend, its use makes trading more effective and safe.

Chaikin indicator signals

Like the MACD, the Chaikin indicator gives two types of standard signals that can be used to work effectively in the binary options market:

Crossovers with the signal line:

- If the histogram crosses from bottom to top, this is a bearish trend, it is worth buying a CALL option.

- If the histogram crosses from top to bottom and is a bullish trend, it is worth buying a put option.

Discrepancies with the price chart:

Divergence/convergence is a signal of divergence and convergence of the indicator line with the information of the price chart, which often indicates a weak trend that will be corrected, or it is worth waiting for a reversal:

Divergence occurs if the high price is not confirmed by CHO data; it is worth buying a CALL option.

Convergence occurs if the low price is not confirmed by CHO data; it is worth buying a PCI option.

The formula for calculating CHO is:

CHO = EMA (A/D, 3) – EMA (A/D, 10), where:

EMA — Exponential Moving Average;

A/D is the value of the Accumulation/Distribution indicator.

Info taken from www.metatrader5.com website

Do you need to install CHO on your platform?

The CHO indicator is not included in the standard tools of the MetaTrader platform, in order to work with it, you need to install it in the trading platform. You can download the oscillator for the MetaTrader 4 platform here. You can read how to easily and quickly install the downloaded file in MetaTrader 4 here.

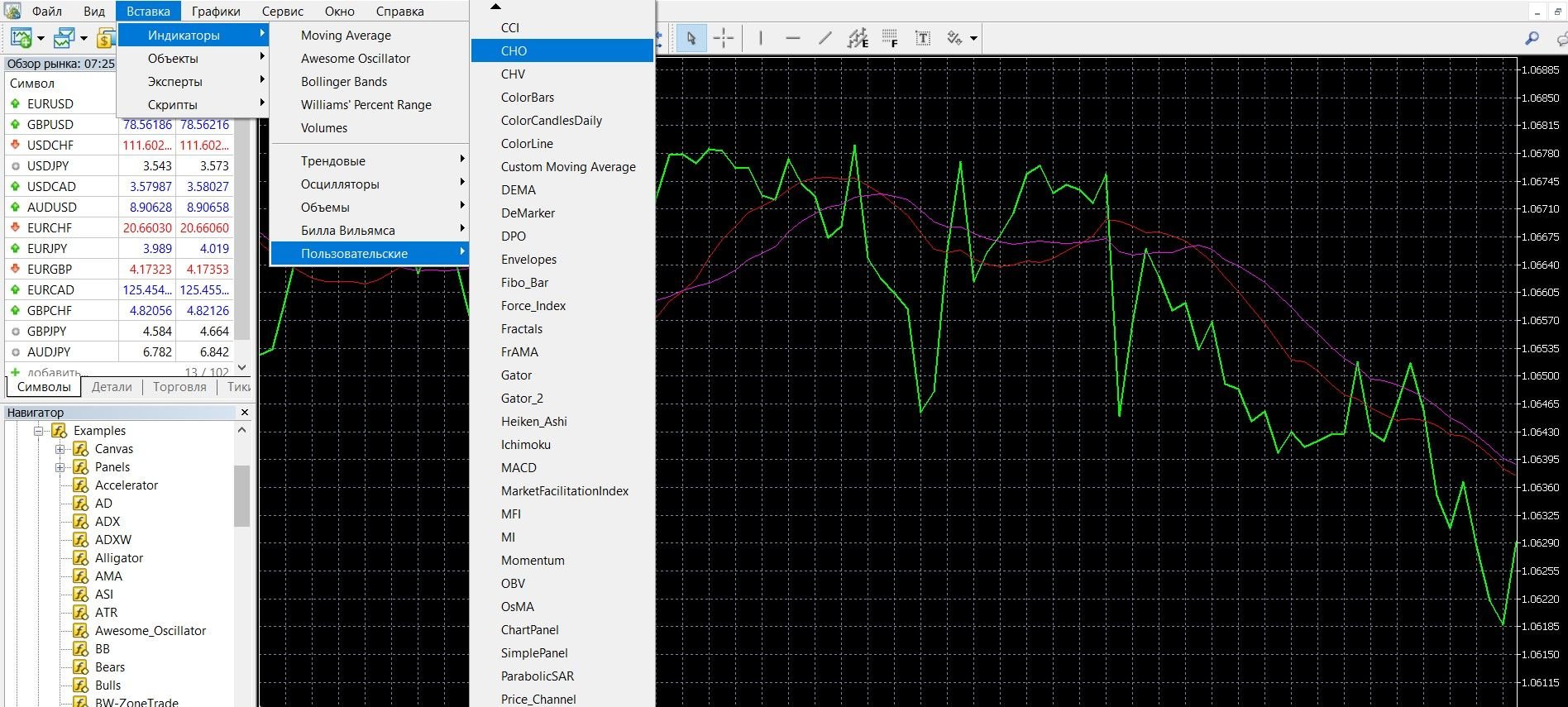

Next, after installing the CHO, you can add it to the main price chart, to do this, do the following:

1. Click the “Insert” tab in the top menu of the platform

2. Select the “Indicators” tab

3. In the drop-down menu that opens, select the “Custom” tab

4. In the drop-down menu that opens, select “CHO”. The indicator is added to the chart, you can work.

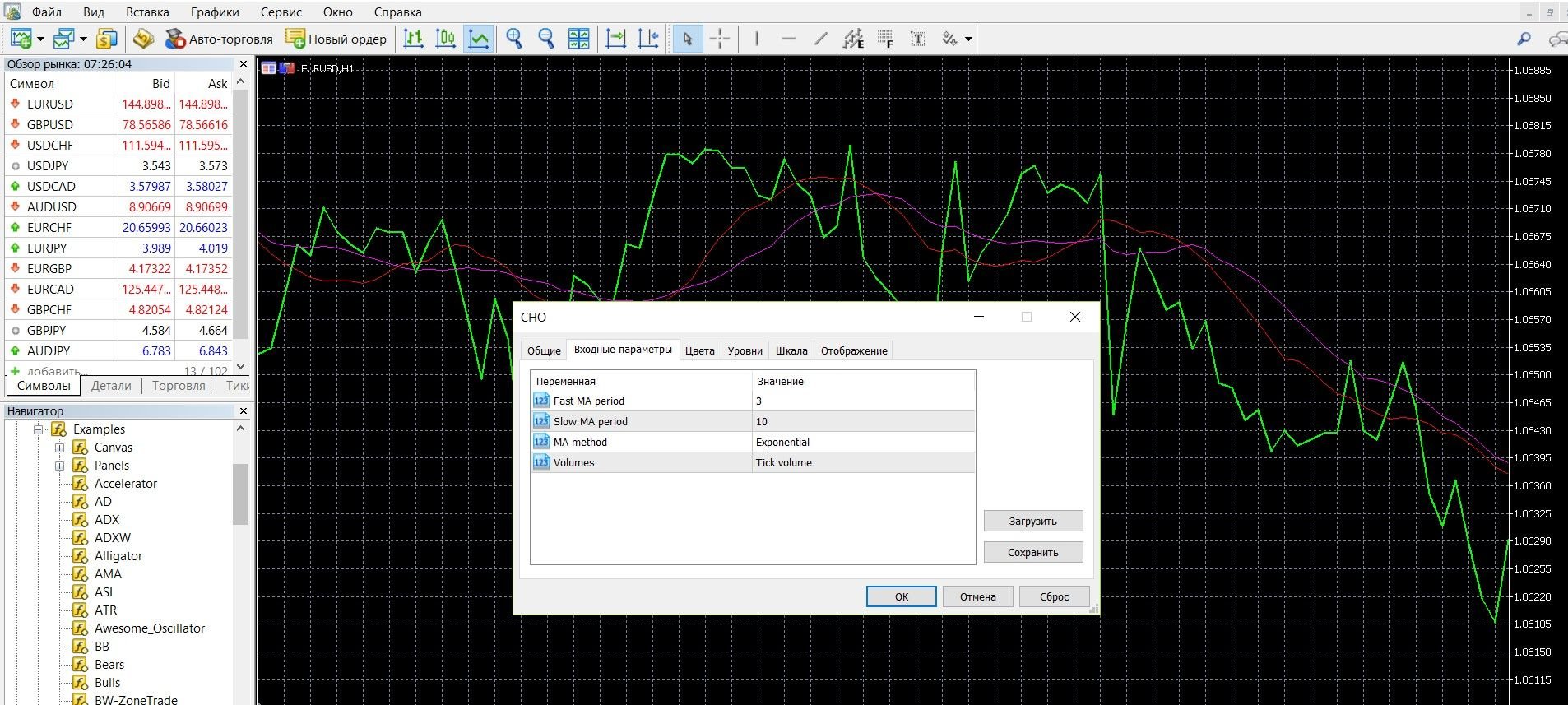

There are 3 parameters in the indicator settings that you can customize:

- SlowPeriod – responsible for the period of the slow moving average.

- FastPeriod – is responsible for the period of the fast moving average.

- TypeSmooth – responsible for selecting the type of moving average.

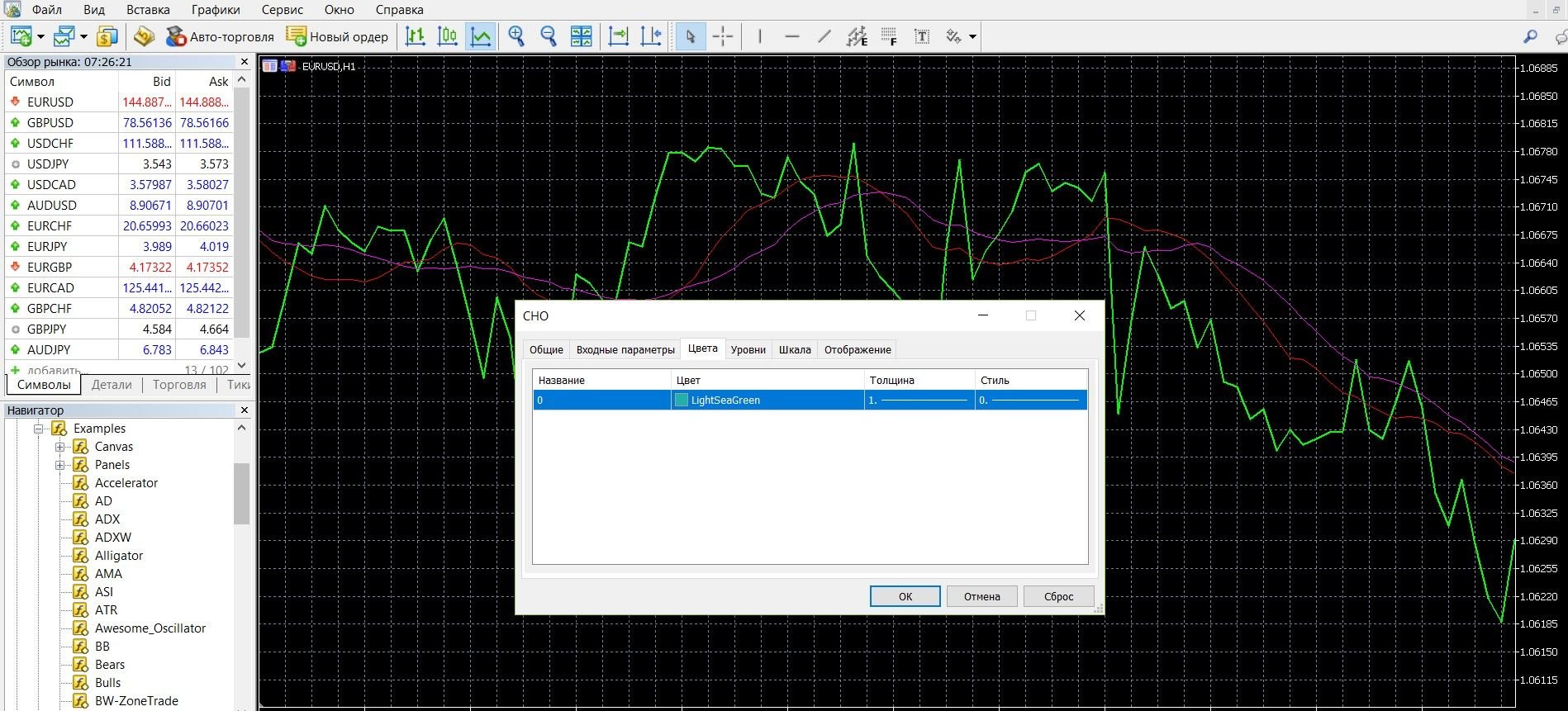

If you increase the numerical values of SlowPeriod and FastPeriod, the number of CHO signals will decrease; If these indicators are reduced, the number of signals will increase. Also, you can change the color of the CHO line.

If your platform doesn’t have an indicator, download it here.

Application of the indicator for binary options

The indicator is based on the principle of accumulation/distribution, which helps it to determine the dominant forces of the market. These data are based on the closing prices of previous periods: if the close was closer to the highs, then the market is dominated by buyers (upward trend), if to the lows – sellers (downtrend).

The main application of CHO is to find trends in positive or negative zones: when the curve is in a position of more than +/-10 for a long time, we have a strong trend in front of us; When it is near the +/-25 level and holds here, it is also a strong trend.

In addition, it is a harbinger of an imminent change in the direction of market dynamics, which will be signaled by the intersection of the curve of the central line: if the curve crosses line 0 from top to bottom, we have the opportunity to buy a PUT option, if the curve crosses line 0 from bottom to top – the possibility of buying a call option. The indicator also shows qualitative convergence and divergence signals.

Despite the fact that CHO is a very well-known trend indicator, it is not recommended to use it on its own, because it is not recommended to use it on its own. It is very sensitive to changes and the percentage of false signals is high. It is used in combination with other technical analysis tools.

CHO shows quite high-quality results in combination with stochastic oscillators (RSI, Stochastic), this is an effective trading system that you can consider working. If the reversal and intersection of the fast Stochastic lines coincides with the reversal of the Chaikin oscillator, which is confirmed by the slow Stochastic, we have a high-quality trend reversal signal. CHO is often combined with Keltner Channels and Bollinger Bands, in this case, the Chaikin indicator acts as a support for confirming the strength of the trend.

Rules for concluding transactions (screenshots)

Trading when crossing the signal line

If the signal line crosses the histogram from bottom to top on the CHO chart, it is worth buying a CALL option. In the image below, you can see what the upward trend of the market looks like on the MetaTrader 4 platform:

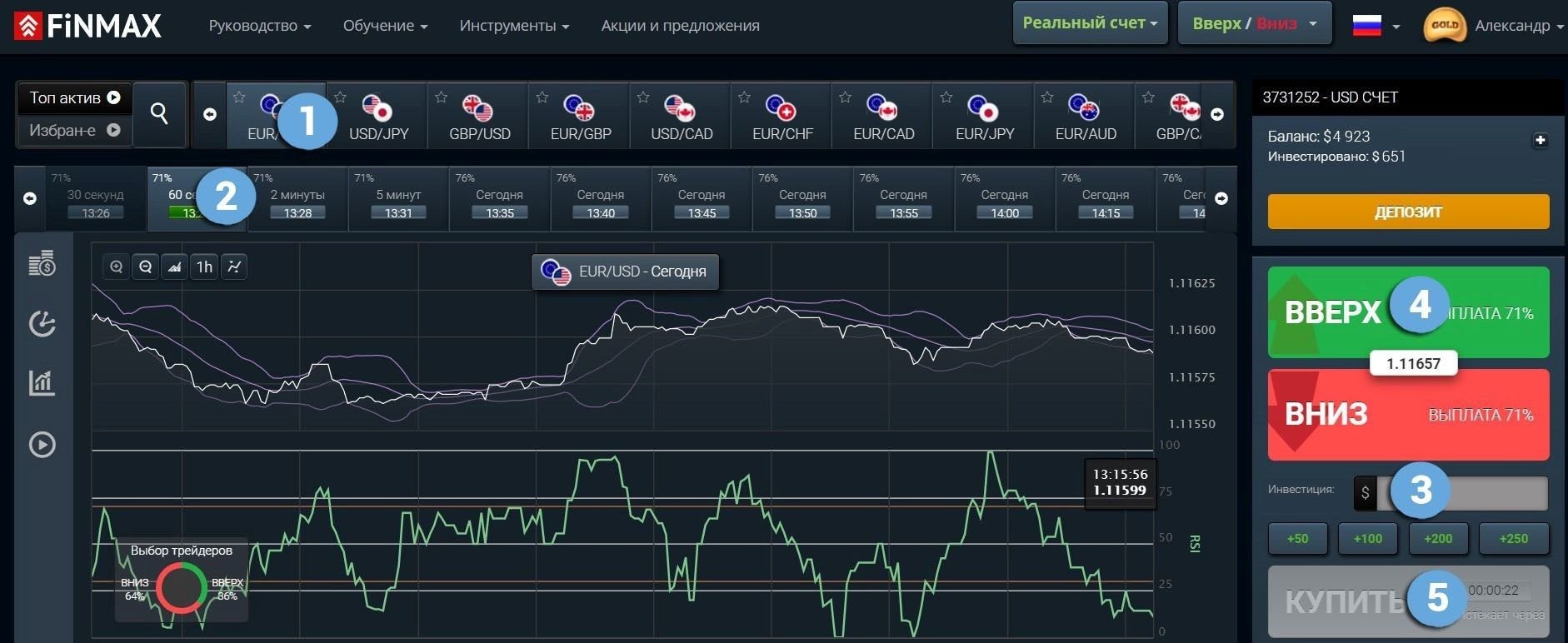

You can place a CALL ( up) bet with the Finmax broker. To do this, you must go to the broker’s website finmaxbo.com and prepare an option, indicating:

1. Asset

2. Expiration

3. Bet size

4. Movement forecast: UP

5. Click the “buy” button and wait for the results.

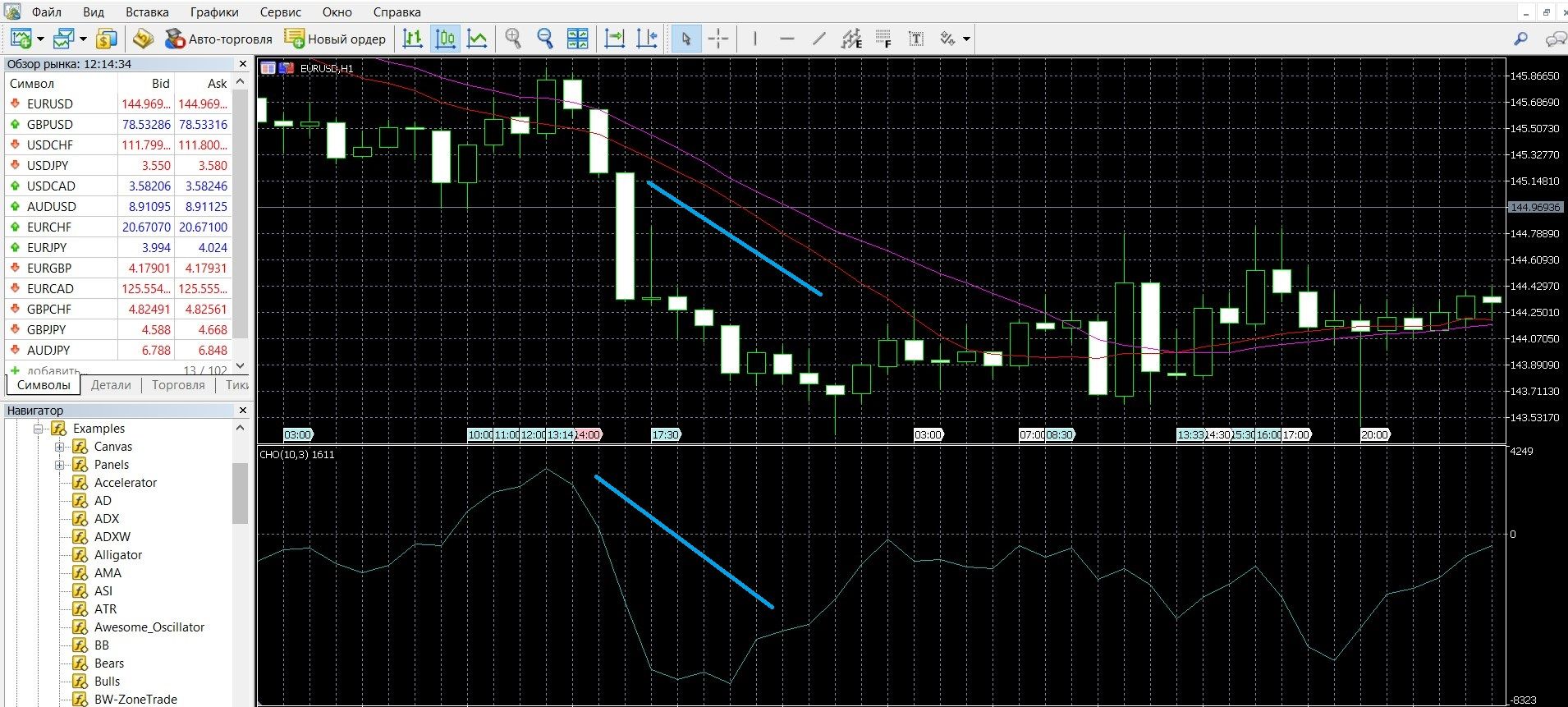

If the signal line crosses the histogram from top to bottom on the CHO chart, it is worth buying a PCI option. In the image below, you can see what the downward trend of the market looks like on the MetaTrader 4 platform:

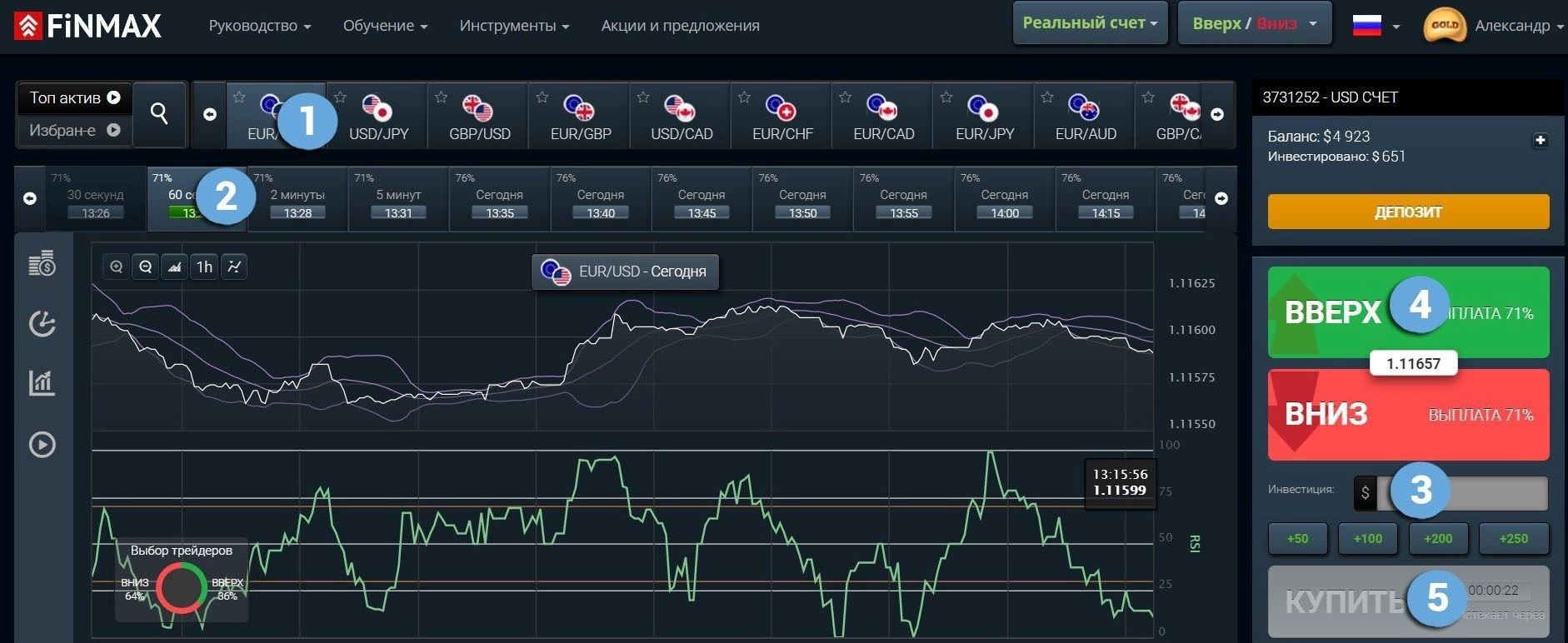

You can place a PUT (down) bet with a Finmax broker. To do this, you must go to the broker’s website finmaxbo.com and prepare an option, indicating:

1. Asset

2. Expiration

3. Bet size

4. Movement forecast: UP

5. Click the “buy” button and wait for the results.

Trading in divergence

In the image below, you can see the divergence of the market on the MetaTrader 4 platform:

Take advantage of the divergence and place a CALL ( up) bet with the Finmax broker. To do this, go to the broker’s website finmaxbo.com and prepare an option, indicating:

1. Asset

2. Expiration

3. Bet size

4. Movement forecast: UP

5. Click the “buy” button and wait for the results.

Convergence trading

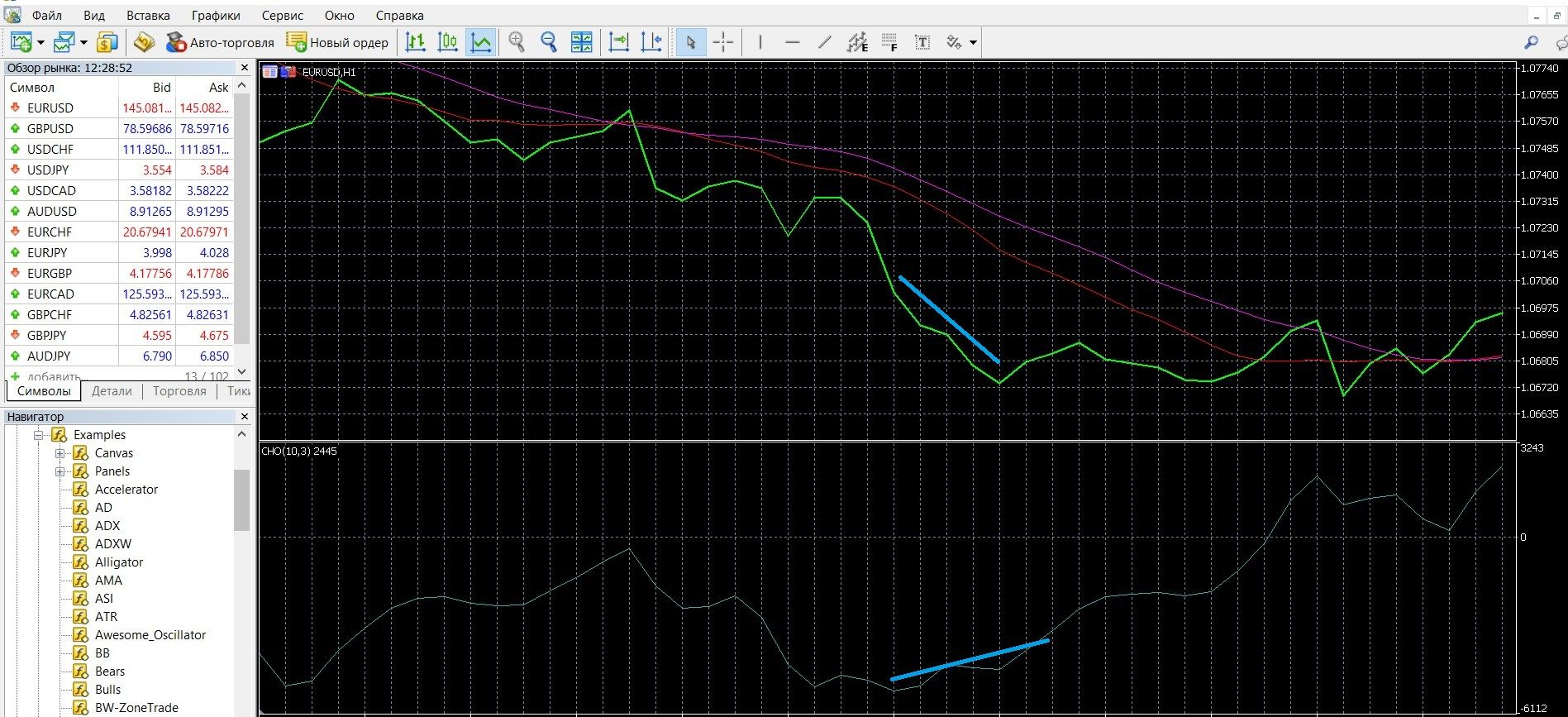

In the image below, you can see the convergence of the market on the MetaTrader 4 platform:

Take advantage of convergence and place a PUT (down) rate with the Finmax broker. To do this, go to the broker’s website finmaxbo.com and prepare an option, indicating:

1. Asset

2. Expiration

3. Bet size

4. Movement forecast: DOWN

5. Click the “buy” button and wait for the results.

Money management

Despite the fact that the concept of money management is better known to professional traders who are thinking about obtaining a stable income, beginners of options are also recommended to use its basics as early as possible. Money management is an effective strategy for managing a personal account, which helps to solve such important issues as competent work with a deposit, saving and increasing funds on it, and a strategy for reducing losses on the account. The basic rules of money management will make trading effective and, importantly, profitable:

Trade with a minimum of funds: spend a minimum of money on trading; bet on the option about 5% of the amount on the account; participate in lots, the value of which is less than the amount of funds in the account; Choose a broker that guarantees the best result. These provisions will help you keep your funds on deposit.

Transfer a minimum of funds to a deposit: work with minimum amounts; do not bet all the capital on the option; Determine for yourself the amount of free limit that you can spend on trading and do not go beyond it. These provisions will help save your capital.

Trade with a minimum of assets: start trading with 2-3 assets; only when you get comfortable with the system, increase the number of assets; The more assets you use, the greater the load on the deposit, the more difficult it is to track the status of the deposit. These provisions will help to organize work efficiently and get a good profit.

Trade without emotions: in trading, the most important thing is the attitude; any excessive emotions interfere with concentration, which will affect the result of trading; treat trading as a serious job, where you will need analytics, informed decisions; Always be aware of the risks. These provisions will teach you how to build a conscious attitude to trading.

Expiration

Like money management, this is one of the main concepts in trading. Expiration (from the English Expiration, “expiration, end”) – the timing of the end of the transaction, when bidders find out the results of forecasts, and, accordingly, funds will come to their account. By working correctly with expiration, you will be able to improve your performance several times. Conversely, inattention to it will reduce your chances of productive work. In order for your options trading to bring a stable income, consciously work with expiration.

Types of options:

- Ultra-short options (express) – 60 seconds – 5 minutes.

- Short-term options – 15 minutes – several hours.

- Medium-term options – from 6 hours – a day.

- Long-term options – a day – several months.

Is it possible to extend the expiration of options?

You can extend the expiration if you suddenly realize during the auction that your forecast turned out to be incorrect. Remember that this is not allowed by all brokers.

Expiration rules:

1. If you are just starting out in binary options, we recommend using long terms of transactions. Such expiration will allow you to minimize the risks of express expiration.

2. If you are thinking about reducing risks, choose a broker carefully. We recommend working in a terminal where an increase in the expiration period is allowed. This will prevent the loss of funds in the event that you realize that you have made the wrong forecast of market dynamics.

3. If you are thinking about how to get a quick income, we recommend using a short-term (a minute – a few hours) expiration. Such an expiration can give you earnings in just a minute, but remember that express expiration with the unpredictability of the outcome resembles a lottery.

4. If you are thinking about how to get a stable profit, we recommend using long-term expiration. Such a choice will help you take a high-quality approach to forecasting transactions and get a decent income.

Expiration in strategies with CHO

Strategy at the intersection with the signal line

Short-term trading: allowed; Because of the unpredictable results, it resembles a lottery.

Recommended expiration: from 30 minutes to several hours; During this time, you will be able to analyze market opportunities, see indicator signals and place a bet.

Long-term expiration: also recommended; You will be able to use not only technical analysis, but also connect macroeconomic data (news, economics, politics) to your work.

Strategy for divergence and convergence

Short-term trading: allowed; When using additional indicators, it will bring a good income.

Recommended expiration: from 5 minutes to 30 minutes; You will have time to observe the dynamics of the trend and the mood of the market, study the signals of oscillators.

Long-term expiration: also recommended; You will be able to use advanced opportunities to make the right decision: strategies, oscillators, the external situation that affects the dynamics of the market: news, economy.

Strategy “CHO + Stochastic“

A simple strategy, the signals of which, thanks to Stochastic, are high-quality and profitable. For the strategy, you need the Stochastic and the Chaikin indicator. A trend reversal signal would be a reversal and crossover of the fast Stochastic lines that coincide with the CHO reversal, which should also be confirmed by the slow Stochastic.

Short-term trading: not recommended; reminiscent of a lottery, so be careful when making decisions.

Recommended expiration: from 1 hour to several hours; So, you will be able to understand the dynamics of the market, use technical analysis, study the behavior of oscillators.

Long-term expiration: recommended; In this case, you will be able to get high-quality signals and confirm them from oscillators, connect all your experience and be able to make good money.

CHO + Bollinger Bands Strategy

The Chaikin indicator is usually used with other trading instruments. This strategy, which requires CHO oscillators and Bollinger Bands, will allow you to get high-quality trend confirmation signals. The main source of decision-making is the Bollinger Bands, CHO serves as support for confirming the strength of the trend.

Short-term trading: not recommended; Reminiscent of lottery results, be careful when making decisions.

Recommended expiration: from 1 hour to several hours; So, you will be able to understand the dynamics of the market, use technical analysis, study the signals and behavior of oscillators.

Long-term expiration: recommended; In this case, you will receive high-quality signals and confirmation of them from oscillators, you will be able to connect all your experience for the right solution and earn money.

You can get acquainted with all the expiration options, for this we recommend using the platform of a trusted broker Finmax by going to the finmaxbo.com website. The advantage of the platform is that you have a choice of expiration from 30 seconds to six months. The platform is convenient and understandable, here you can get the most out of options trading.

Downloads

MetaTrader 4 (MT4) platform – download.

CHO Oscillator for MT4 platform – download.