By learning the basics of trading, you get acquainted with binary options oscillators, profitable strategies and other tools thanks to which you want to achieve the maximum in trading. To ensure that the necessary material is always available to you, we publish a series of detailed reviews of indicators on the INVESTMAGNATES.COM portal. Here you can always find out full information about the instrument, the rules of trading with it and a lot of useful information. In today’s article, we will tell you about the Mass Index indicator.

The Mass Index (MI) is a technical range indicator that was developed by the well-known analyst Donald Dorsey to identify signals of a reversal of market trends and breaking through important levels. The main idea of the oscillator is that if the range between the price high and low changes, there will be a high probability of a trend reversal. The larger this range is, the greater the volatility will be, with the narrowing of indicators, on the contrary, the volatility readings will decrease. In this way, the Mass Index (https://eto-razvod.ru/forex-indicators/mass-index/) resembles the Bollinger Bands.

The advantage of the indicator is that it defines a clear picture of a possible change in market trends, which gives profitable opening and closing trades. Introducing the Mass Index for market analysis, D. Dorsey said that the essence of this indicator is to track changes in the price range. Unlike other oscillators, the Mass Index is not needed to determine the trend, but to determine the points at which the direction of the trend changes.

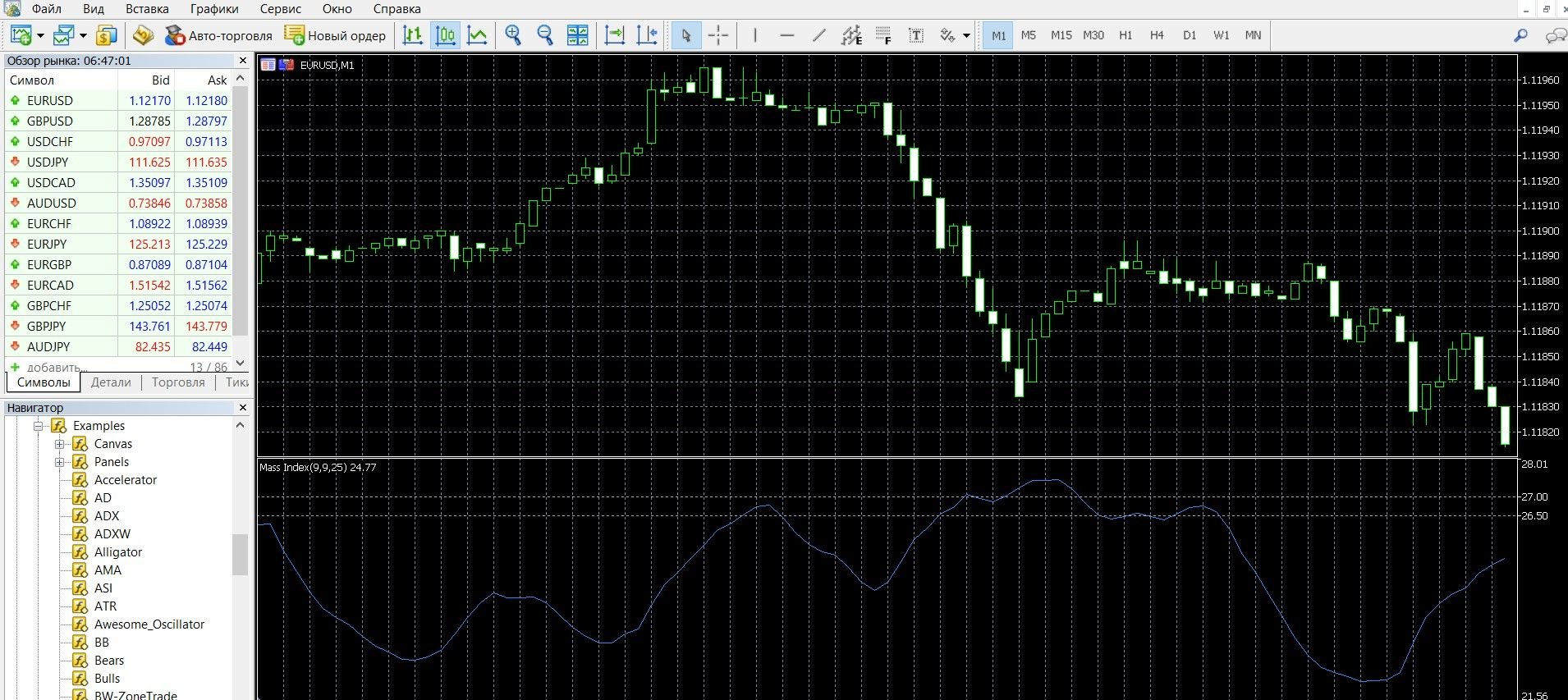

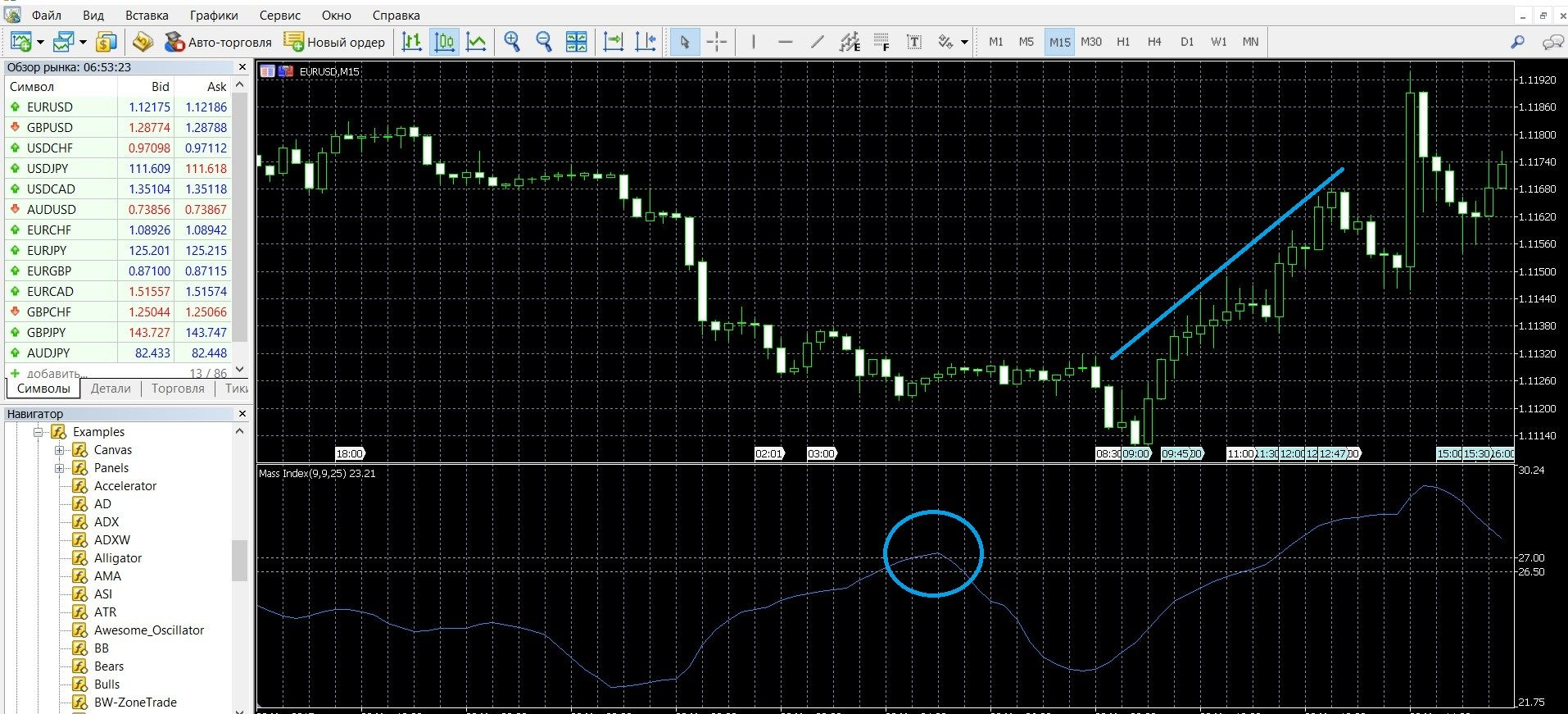

One of the main signals of the instrument, according to its author, is the “reversal hump”, which is formed when the decline index rises first to the level of 27, then when it falls below the indicator of 26.5. Such a picture indicates a likely change in trend. You can see what the Mass Index looks like on the MetaTrader 4 (MT4) platform in the image below. You can also download the MetaTrader 4 platform and get acquainted with the tool in practice.

What is the principle of operation of the Mass Index indicator?

The Mass Index is used to predict trend changes. This is important data, because allow you to close current options and open new ones in the opposite direction when there are clear signals of a trend change. The oscillator is based on the principle of changing the width of the range at the maximum and minimum prices. If the range between these prices has changed, it indicates a trend reversal. Thus, the Mass Index increases with the expansion of the range and, conversely, decreases with the narrowing of the readings.

The oscillator measures the compression and stretching, as well as the average spread between the maximum and minimum velocity of price dynamics. On the chart, it is represented as a curve that moves up or down. To receive signals, levels 27 and 26.5 are required, which are set by default. It is these parameters that allow you to observe the dynamics of the market and receive high-quality signals. The tool is based on moving averages, but it is worth remembering that the Mass Index does not determine the direction of the trend, but gives information about the points of a possible reversal of movement. Most often, the instrument is combined to confirm signals along with other indicators, for example, the Exponential Moving Average (EMA).

The formula for calculating the indicator:

MI = SUM (EMA (high – low, 9) / EMA (EMA (high – low, 9), n), where

SUM — sum;

high — the maximum of the current candle;

low — low of the current candle;

EMA – Exponential Moving Average;

n is the time interval of the indicator.

Signals of the Mass Index indicator:

Reversal signals of the “reversal hump”

The type of trading signals, for buying or selling, after the appearance of a “reversal hump”, is determined by the direction of the 9 EMA indicator:

- The EMA and the “reversal hump” are directed downwards – a signal to buy a CALL option (up)

- The EMA and the “hump” are directed upwards – a signal to buy a put option (down).

Divergence and convergence

- Divergence – that is, a discrepancy between the readings of the price chart and the Mass Index on an uptrend – a signal to buy a CALL option (up)

- Convergence signals – that is, a mismatch between the readings of the price chart and the Mass Index in a downtrend – a signal to buy a put option (down)

Do I need to install the Mass Index indicator in your platform?

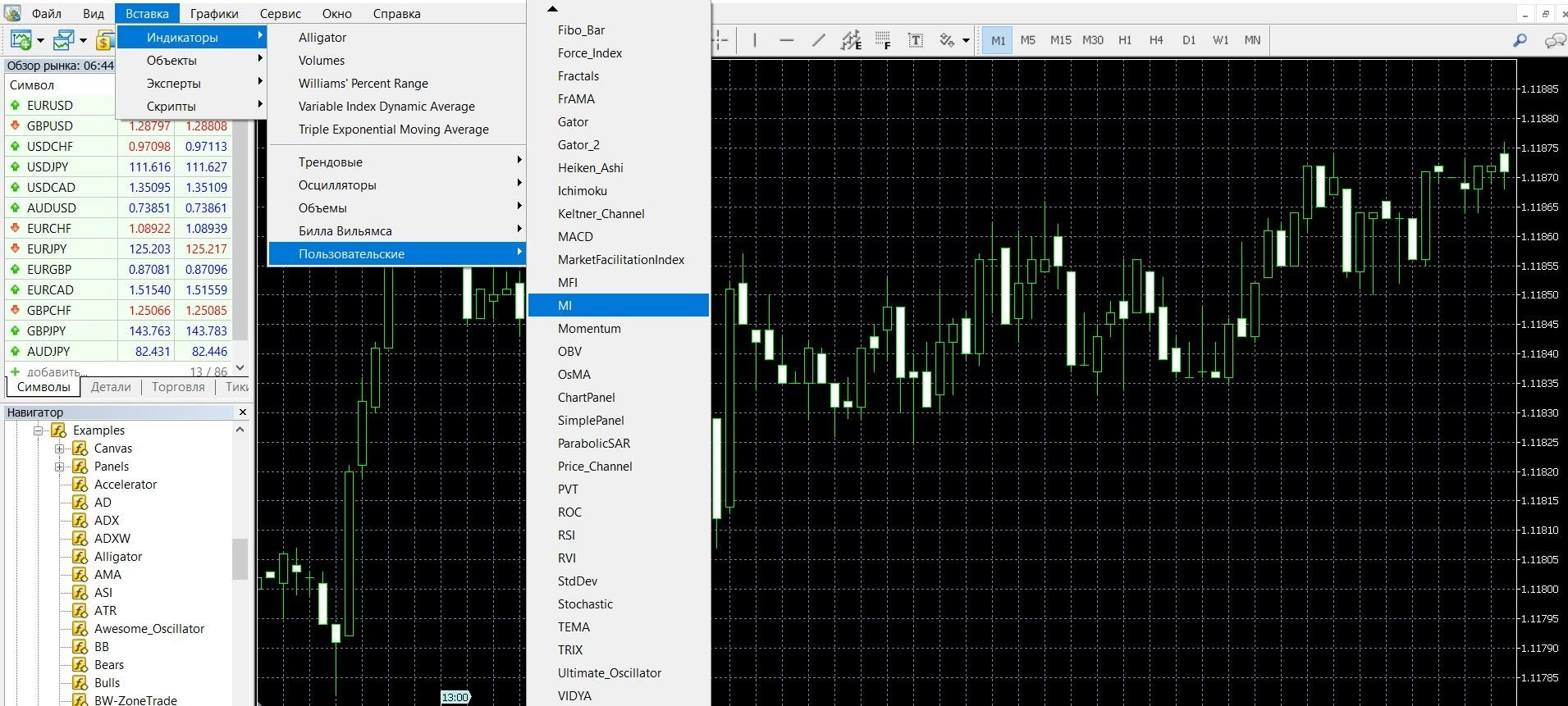

The Mass Index is a non-classical tool in options trading, it is not in the main set of tools of the MetaTrader 4 platform. You can easily install it in MT4 by downloading it here. You can read how to install the downloaded file in MetaTrader 4 here. After installing the indicator, add it to the price chart, take the following steps:

- Click on the “Insert” tab in the top menu of the platform.

- Select the tab “Indicators” – “Custom” – “MI”. The indicator is added to the main chart, you can work.

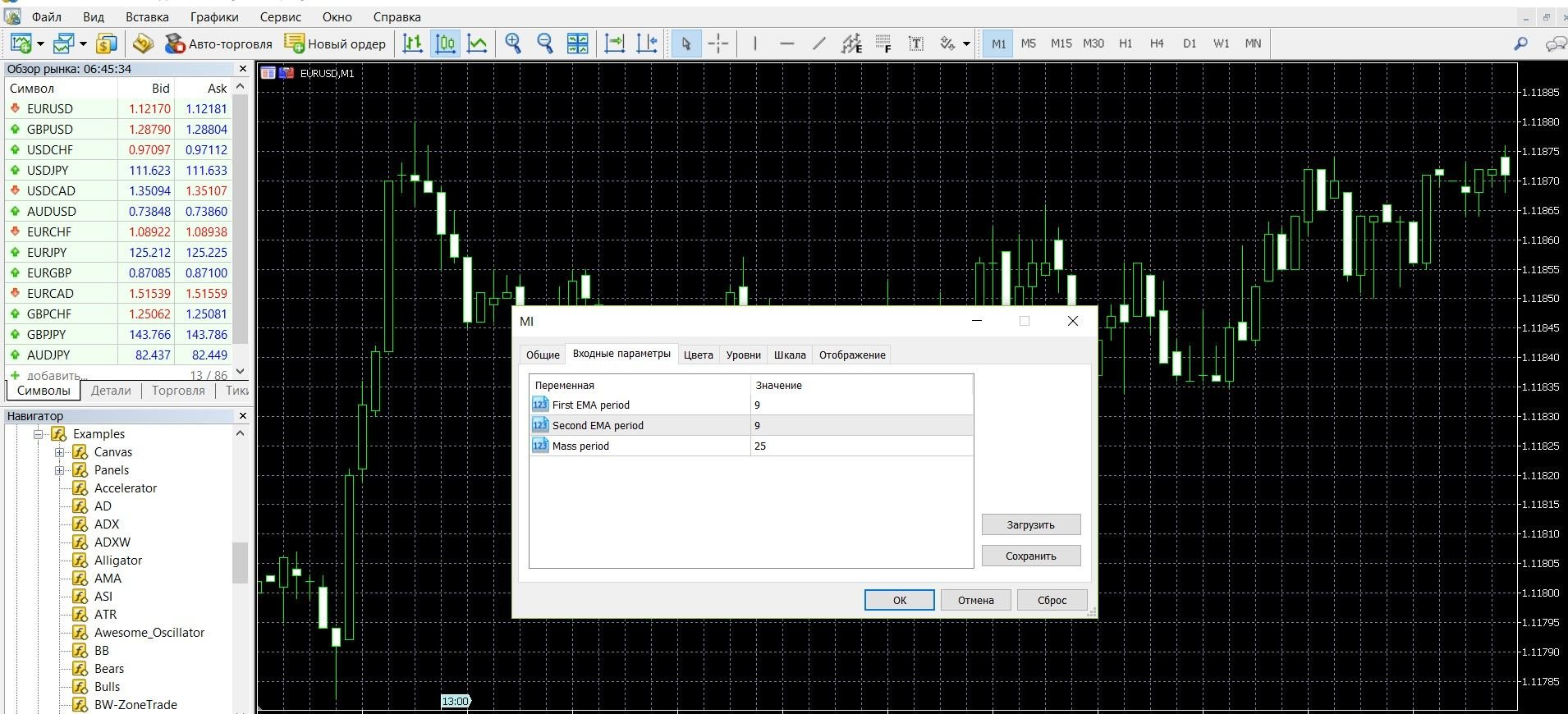

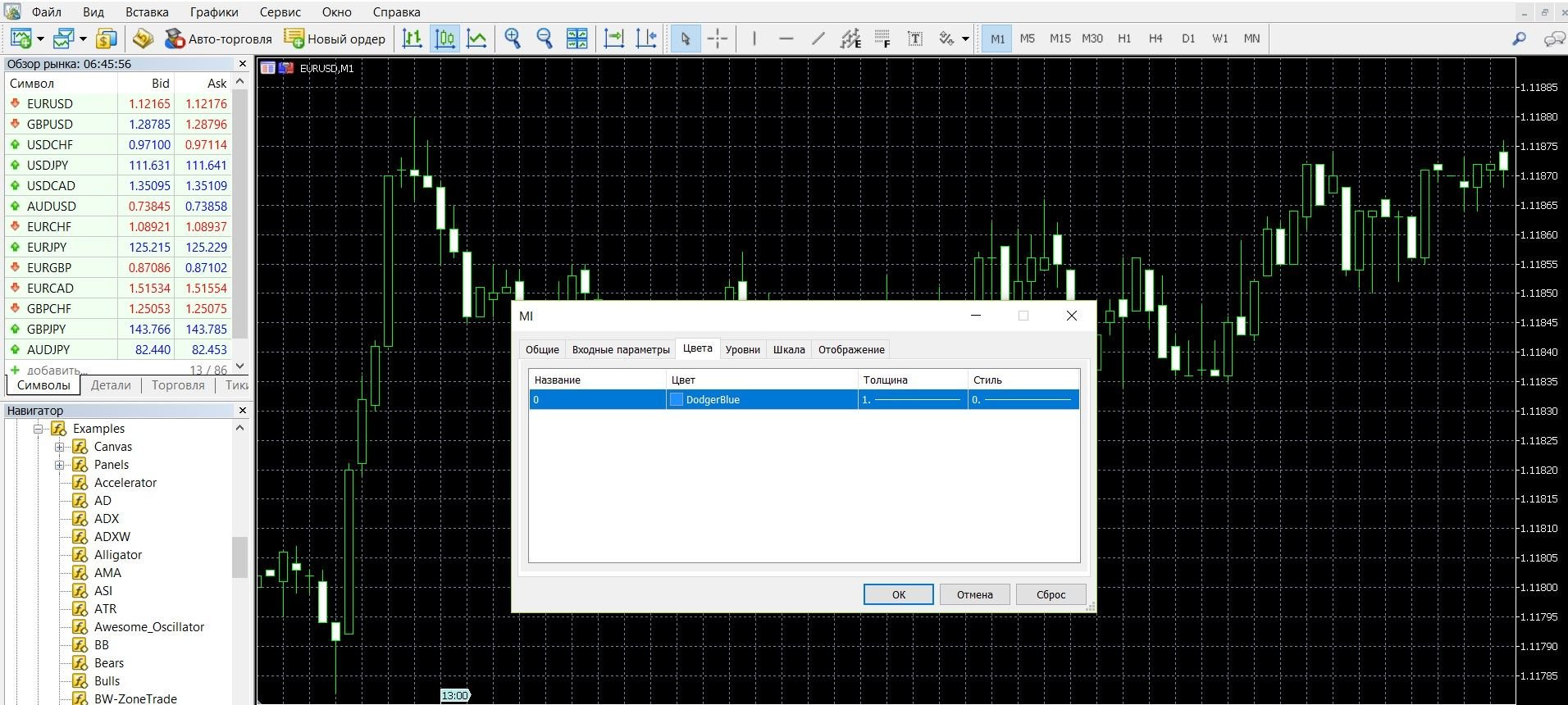

The following indicator settings are available to you:

In the “Levels” tab, you can adjust the levels of the “reversal hump” signal.

- First EMA period – the number of periods of the indicator EMA.

- Second EMA period – the period for calculating the second moving average.

- Mass period – the maximum number of periods when calculating the indicator.

When changing the standard parameters, remember that a decrease in the period indicator will lead to increased volatility and the appearance of false signals; With an increase in the indicator of periods, on the contrary, the indicator will be less mobile and will begin to miss signals. You can adjust the period for your strategy, select the color parameters of the indicator. Still, it is recommended to use its standard settings: First EMA period – 9, Second EMA period – 9, Mass Period – 25. 14.

Application of the indicator for binary options

The indicator is based on moving averages, in contrast to which the instrument does not show the direction of the trend. It was developed only to find pivot points. That is, its rise or fall does not mean that price readings will rise or fall with it. The purpose of the indicator for a binary options trader is to inform that the market is about to reverse. In order to determine exactly in which direction this reversal will be, additional technical analysis tools are needed.

According to D. Dorsey, an important signal of the Mass Index is a special model called the “reversal hump”. This pattern is formed when the 25-period indicator rises first above 27, and then when it decreases below 26.5. In such a situation, a price reversal is likely, and this will not depend on the general price trend. This indicator signal is almost one hundred percent correct, but its only disadvantage is that it is quite rare. The indicator deserves special attention from traders because it is able to determine the expansion and narrowing of the range of price fluctuations in the market. If there is an expansion of the corridor of changes, the curve shows growth, if the range narrows, the curve will rush down.

The Mass indicator will work great when analyzing currency pairs, metals, stocks, and indices. It can be used at any expiration, but it will show the best performance in segments H1, H4 and D1. At small time intervals, false signals usually interfere. Tk. The signals of the Masses indicator do not always mean the appearance of pivot points, it is important to use it only in combination with other oscillators. For example, in combination with moving averages, it will be an excellent binary options trading strategy.

Rules for concluding transactions (screenshots)

Trading on a reversal signal

When the EMA and the “reversal hump” are directed downwards – this is a signal of an imminent market reversal, it is worth buying a CALL option (up). In the image below, you can observe a signal of an imminent upward trend in the market on the MetaTrader 4 platform:

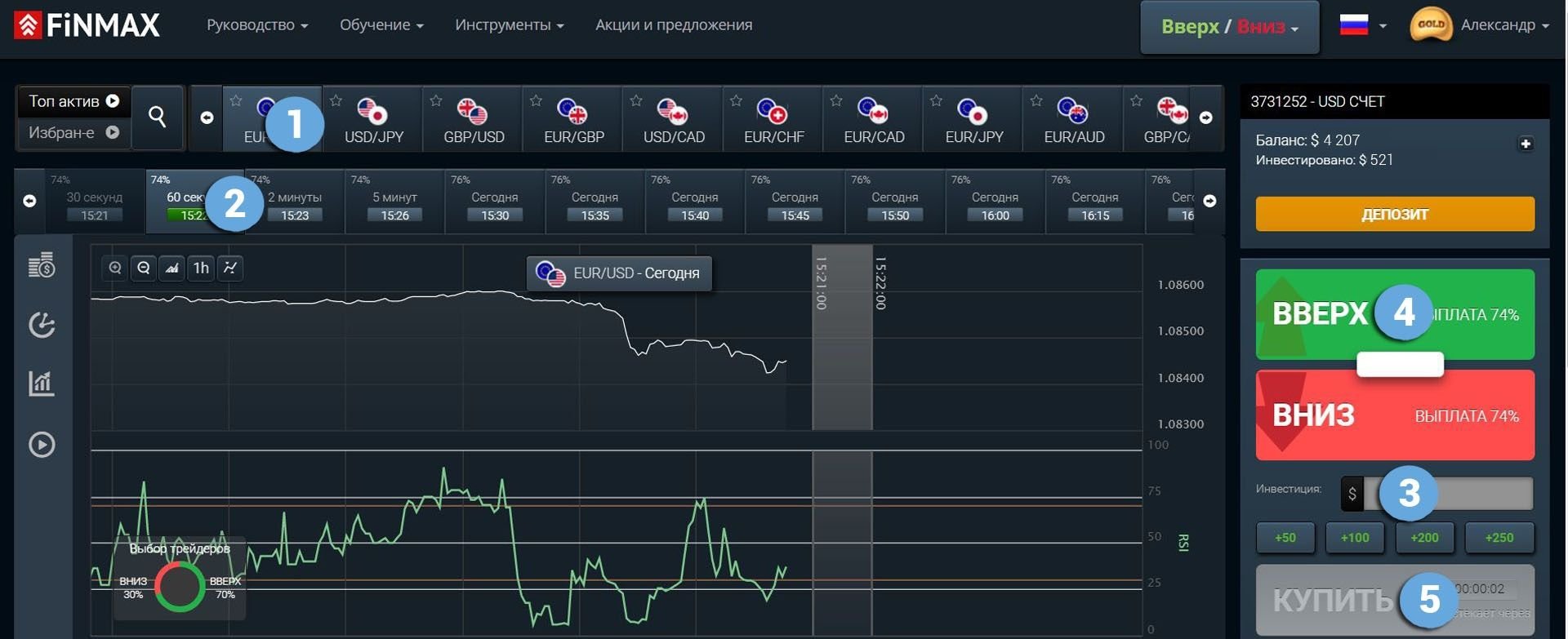

Take advantage of the uptrend opportunities and place a CALL (up) rate with the Finmax broker. To do this, go to the broker’s website finmaxbo.com and prepare an option, indicating:

- Option.

- Expiration.

- The amount of the bet.

- Movement forecast: UP.

- Click the “buy” button and wait for the results.

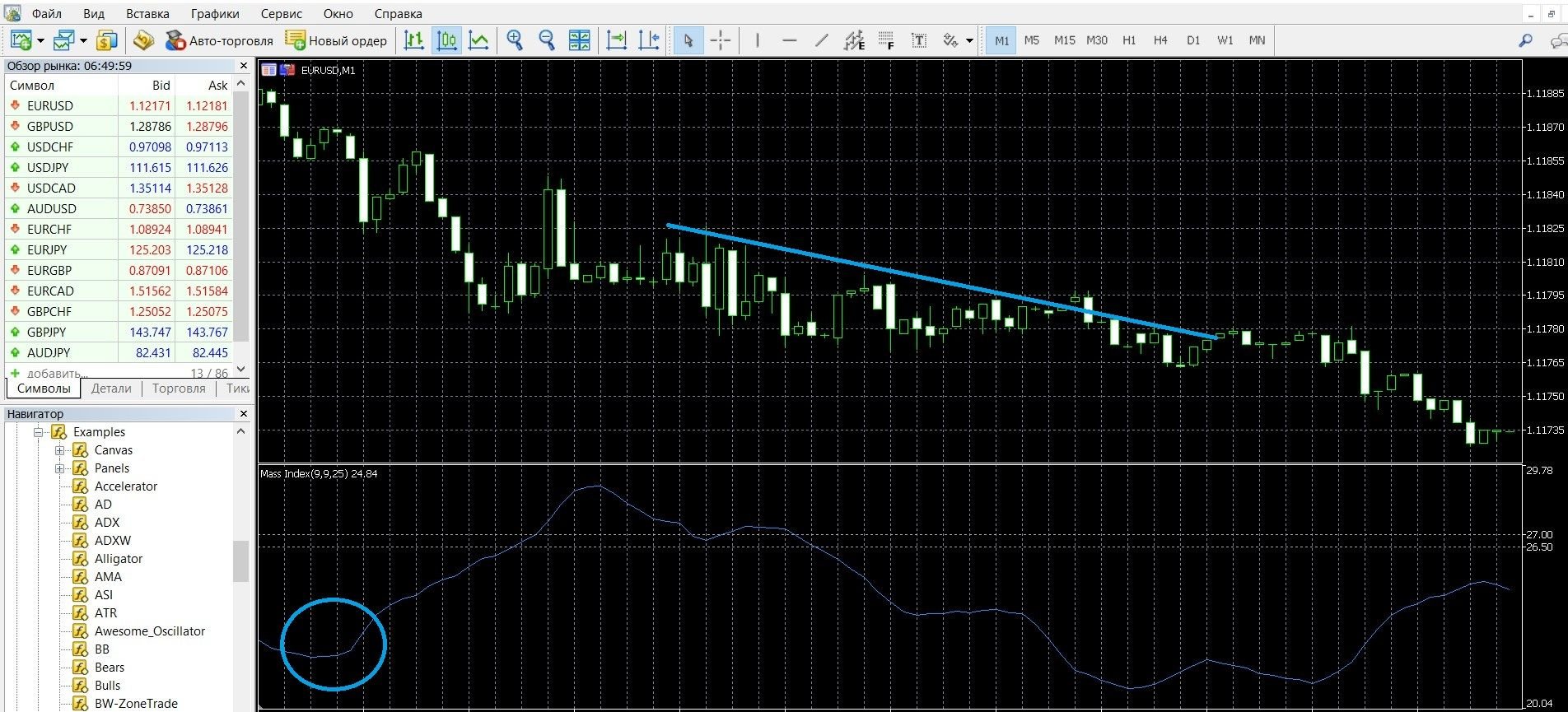

When the EMA and the “reversal hump” are directed upwards – this is a signal of an imminent market reversal, it is worth buying a put option (down). In the image below, you can observe the signal of an imminent downward trend of the market on the MetaTrader 4 platform:

Take advantage of the downtrend opportunities of the price and place a PUT (down) rate with the Finmax broker. To do this, go to the broker’s website finmaxbo.com and prepare an option, indicating:

- Option.

- Expiration.

- The amount of the bet.

- Movement forecast: UP.

- Click the “buy” button and wait for the results.

Trading with a divergence signal

Divergence appears on an uptrend when the price goes in one direction, and the indicator data goes in the other, this is a signal of an imminent trend change. The image below shows a divergence signal on the MetaTrader 4 platform (you can buy a CALL option on the finmaxbo.com broker’s website, the instructions are listed above):

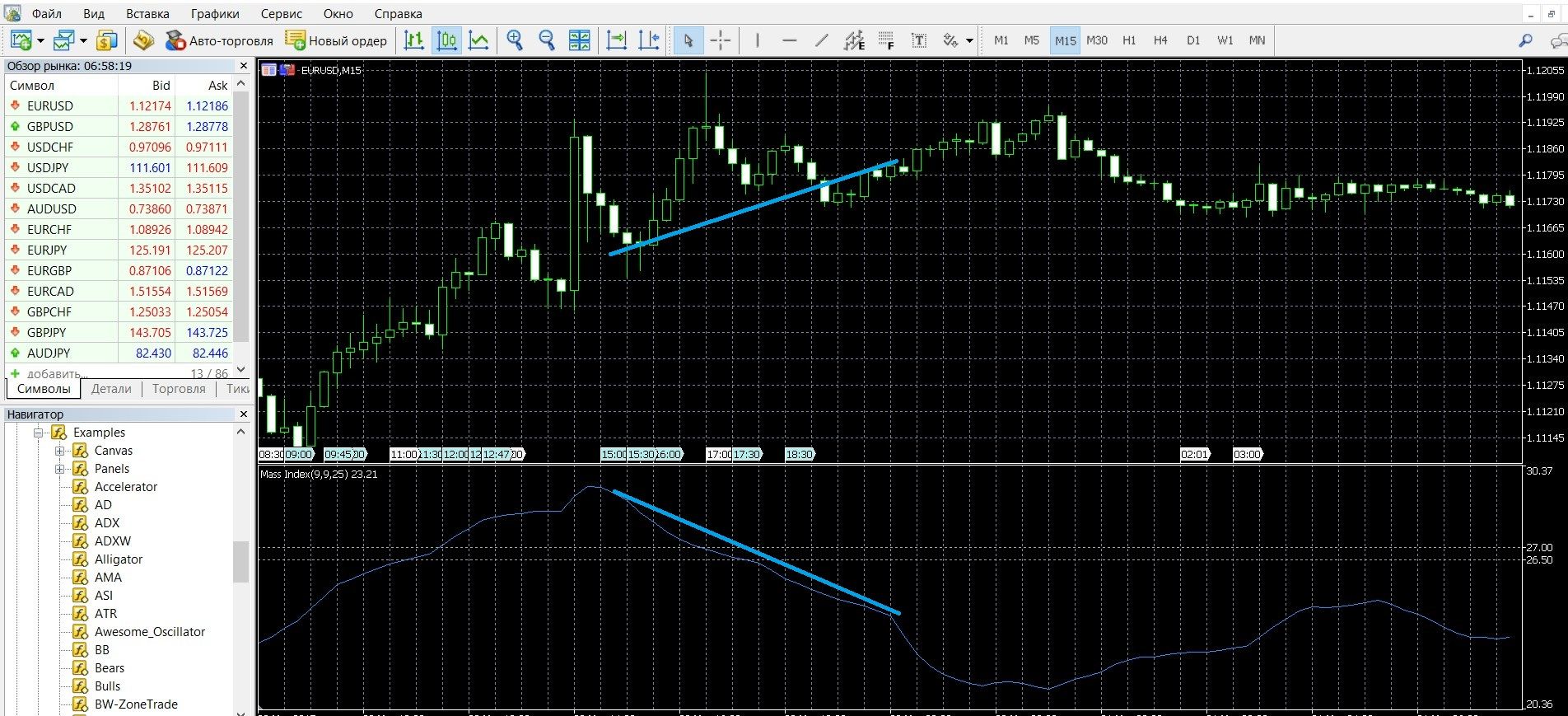

Convergence trading

Convergence appears on a downtrend, when the price on the chart goes in one direction, and the indicator lines in the other, this is a signal of an imminent trend change. The image below shows the convergence signal on the MetaTrader 4 platform (you can buy a PCI option on the finmaxbo.com broker’s website, the instructions are listed above):

Money management

It is believed that professional traders come to apply the basics of money management. They already have a positive experience in options trading and, in order to get a stable profit from trading, they introduce the principles of money management into their work. If you are just starting the first steps in options, get acquainted with these principles and try to put them into practice as early as possible, and then your work will become more effective.

Money management is a consciously and thoughtfully built money management strategy that answers such important questions as how to work with a deposit correctly, how to spend it economically and receive income, how to make sure that there are always funds on the deposit. If trading is the main way to generate income for you, apply the rules of money management in your work:

- Trading with a minimum of money: it is recommended to spend a minimum of funds on options trading; bet on options no more than 5% of the deposit; participate in options whose price is less than your funds; work with such a trusted broker that guarantees you performance. By following these principles, you will preserve your capital.

- Trading with a minimum deposit: it is recommended to trade with a minimum deposit in the account; do not put all the capital on the auction of one option; Work with the deposit thoughtfully, allocate a certain limit of funds that are allowed to trade and not go beyond it. By following these principles, you will save your capital.

- Trading with a minimum number of assets: it is recommended to gradually try your hand at options trading; trade starting with 2-3 assets, and then gradually complicate the amount of work. By following these principles, you organize productive work.

- Trading without emotions: it is recommended to work in the market only with the right working attitude; remove unnecessary emotions that can interfere with concentration and make the right decision. By following these principles, you will get the most out of your trading.

Expiration

Like the principles of money management, expiration time is the leading concept of trading, which directly affects the effectiveness and profitability of your options trading. Expiration (from the English Expiration, “expiration, expiration”) is the moment of expiration of the option (that is, the expiration time), when the results of their forecasts become clear to market participants. If the trader has made a correct forecast of the price dynamics (up or down), he receives money on deposit. So, thinking about getting a stable income, each time consciously choose the expiration of the option.

Types of options:

- Ultra-short options – 60 seconds – 5 minutes.

- Short-term options – 15 minutes – several hours

- Medium-term options – from 6 hours – a day

- Long-term options – a day – several months.

Is it possible to extend the expiration of options?

It is possible, but not every broker is allowed to do so.

Expiration rules:

- Option beginners are advised to work with a long expiration, which will reduce the risk of losing funds.

- Options professionals, when choosing an expiration, are advised to rely on effective strategies, as well as choose an expiration that they are comfortable working with. It is worth working with those brokers who allow an increase in expiration during trading, which will reduce losses in case of an incorrect forecast.

- If you need quick money, take advantage of a short-term (a minute – a few hours) expiration, which will give you income in a minute. At the same time, it is worth remembering the unpredictability of express expirations.

- If you need a stable income, take advantage of long-term expiration, which will bring you good profits and minimize losses.

Expiration in Mass Index Strategies

Expiration at a reversal signal

Short-term trading: it is allowed, it has a high degree of risk, there are also many false signals in such a time period, be careful when predicting rates.

Recommended expiration: from 1 hour to several hours; It will allow you to take advantage of high-quality market entry signals and get a good income.

Long-term expiration: it is also recommended, you will be able to analyze the dynamics of the market, predict the outcome of trading based on macroeconomic data that affect the change in trends (news, economy, etc.).

Expiration with divergence and convergence signals

Short-term trading: allowed, characterized by a high degree of risk, be careful when predicting rates.

Recommended expiration: from 1 hour to several hours; will allow you to take advantage of high-quality market entry signals.

Long-term expiration: it is also recommended, it will allow you to analyze the dynamics of the market, predict the outcome of trades based on macroeconomic analysis (news, economics, etc.).

Expiration in the “Snakes” strategy

An interesting strategy that gives good performance thanks to the tools used: DMI, TSI, Trix Indicator (Triple Exponential Moving Average) and Mass Index.

Features of indicators: The Trix indicator is a unique mixture of single, double and triple exponential moving averages, which gives a lower delay of signals than each line individually. Unlike traditional moving averages, this indicator is a faster version that eliminates the lags inherent in the traditional EMA;

DMI (Directional Movement Index) – an indicator of directional movement, which determines the existence of a trend in the market and its strength; TSI is a true strength index that identifies overbought-oversold zones; The Mass Index in the strategy acts as a forecast of a trend reversal; It does not show the direction of movement, it only determines the moment of reversal.

Trade entry signal: trade entry along the trend (moving); DMI shows a pronounced trend with volatility; The TSI crosses the Mass index from top to bottom or from bottom to top depending on the position.

Short-term trading: allowed, characterized by a high degree of risk, be careful when predicting rates.

Recommended expiration: from 180 seconds to 1 hour; It will allow you to get high-quality signals to enter the market, confirm them with the data of all indicators.

Long-term expiration: also allowed, but it will be more difficult to work and predict results is also more difficult with such a serious set of indicators.

Expiration with the “MA + Mass Index” strategy

Effective strategy using MA and Mass Index indicators. As you know, MA is effective in a clear uptrend and downtrend, it helps to identify changes in trend dynamics. The Mass Index here will act as a forecast of a trend reversal. So, you will get quality signals (of a bullish or bearish trend) confirmed by the MA.

Short-term trading: it is allowed, it has a high degree of risk, there are many false signals in such a time period, you should be more careful when predicting rates.

Recommended expiration: from 1 hour to several hours; It will allow you to take advantage of high-quality market entry signals and get a good income.

Long-term expiration: it is also recommended, you will be able to analyze the dynamics of the market, predict the outcome of trading based on macroeconomic data that affect the change in trends (news, economy, etc.).

Try all possible expirations in practice and choose the one that is convenient for you. To do this, we recommend using the platform of a trusted broker Finmax by going to the finmaxbo.com website. Among the advantages of the trading platform: convenience and simplicity, wide expiration options (from 30 seconds to six months), the availability of the necessary set of tools for work.

Downloads

Tagged with: Binary Options Indicator