Binary options are one of the most interesting and profitable financial instruments that the securities market offers us. By trading an option, you can earn faster than on forex and with less risk, this explains the popularity of this tool.

Let’s figure out what a binary option is

A binary option (digital option, all-or-nothing option, or fixed-profit option) is an option that, depending on the fulfillment of a specified condition at a specified time, either provides a fixed amount of income or does not bring anything.

Usually, we are talking about whether the exchange price of the underlying asset will be higher (or lower) than a certain level. A fixed payout is made if the option is won, regardless of the degree of price change (how much higher or lower it is).

There are several types of binary options:

Types of Binary Options

CLASSIC BINARY OPTION

The classic binary option is also known as an all-or-nothing binary option.

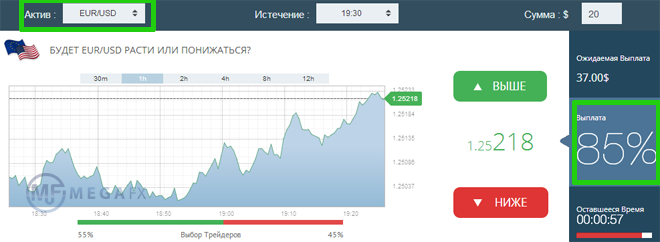

It is also called a digital option or a fixed-profit option. In this case, you need to guess the vector of price movement and play either up or down (“call” or “put”). Based on the prediction made, click the “CALL” sector if the price of the selected asset is expected to rise, or “PUT” if the price of it, in your opinion, will fall. Everything is simple and clear, as you can see.

The profit of the classic option is 80% and higher, some binary options brokers reach 96%.

If you made a mistake in the forecast, then many brokers have provided for a partial return of the invested amount. Such a payment, with an incorrect forecast, can be up to 10-15 percent. A trifle, but nice.

So, what you need to do to open a deal on a classic binary option:

1. Select the asset you want to trade.

2. Choose the time during which your option will last, its pros call the expiration date of the option.

3. Enter the amount of your investment in the pop-up window.

4. Before clicking the main button – “Apply”, carefully check all the conditions of the option you have chosen.

As a rule, many brokers give you a couple more seconds so that you have the opportunity to cancel the transaction if you notice an error at the very last moment.

OPTION “CONSTRUCTOR”

The fundamental difference between the “Constructor” and the classic option is the absence of a fixed profit, here you set it yourself. You determine the ratio of return and risk, as well as other parameters of the transaction that seem preferable to you and are more suitable for your style of play. As a rule, there are clear time limits. Most often, a deal can be opened for at least 30 minutes, and for a maximum of 4 – 5 hours.

What you need to do to open a deal on the binary option “Constructor”:

1. Select the asset you want to trade.

2. Select the expiration time of the option.

3. Enter the desired reward and payout parameters for you, in case of an unsuccessful transaction, in the new “Profit Control Risk” window that opens. It will be two digits, the first is the percentage of profitability, the second is the percentage of payment).

4. In a new window, enter the investment amount.

5. Carefully check all the selected transaction parameters and click “APPLY”.

6. Guided by your forecast of the price movement of the asset, click ”

CALL”

if you foresee growth, or ”

PUT”

if the price, in your opinion, will fall.

OPTION ONE TOUCH – “ONE TOUCH”

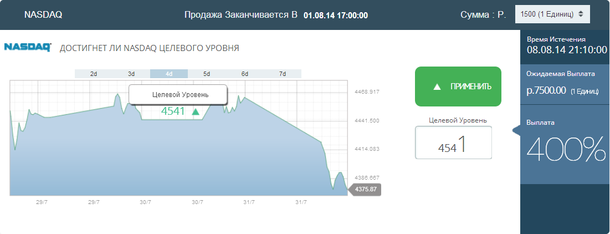

The One Touch option is considered highly profitable and preferable if you risk small amounts, and intend to win quickly and a lot. And this, most importantly, is quite possible. “One touch” allows you to earn 300 and 600 percent of the amount invested in the game for one option. The condition for making a profit when playing with one touch is the very touch or overcoming the set price level of the selected asset. Hence its name.

The feature of the One-touch option is a fixed price, which is called the stop price. For example, at 14.00 on October 5, 2013, the market value of a share is 150 rubles. The terms of the option stipulate that you will win if the price rises to 155 rubles during those hours. Further development of trading is not taken into account. It remains for you to agree or not with the proposed version of the event. This is if in a simplified form, in real life, brokers offer players more complex and multivariate, but ready-made options for purchase, in which everything is predetermined – the target rate of the asset value, the type of asset and the expiration date.

The main thing that makes One touch different from classic option operations is a strictly defined start and end time for the game. You can purchase assets only during the hours set by brokers, and not whenever you please. This introduces certain inconveniences and complicates trading, but all these disadvantages are compensated with more than high profitability of transactions. Often, you can buy a Onetouch option only on Saturday and Sunday, when all exchanges are resting. The sale of assets starts at 00:00 on Saturday and ends at 19:00 on Sunday. And you can close the deal only in a week, usually on Friday 19:30.

There are two options for forecasts – in the direction of increasing or decreasing the value of the asset, in relation to the existing level, for the term of the option. The amount of profit often depends on what kind of barrier you set for the growth or fall in the value of the asset. Thus, you yourself regulate your risks and the amount of possible profit. The broker can independently set these parameters, in the latter case, the profitability of trading will have a fixed size.

One-touch options trading can be available every day, including weekends, but during strictly specified hours, for example, from 06:00 to 13:00. But it is preferable to start the game on the weekend, as you have a better chance of winning. In order to get the profit, it is necessary that the price of the asset you have chosen reaches, that is, touches the base rate agreed ahead of time on any of the trading days from Monday to Friday. So, if you started on the weekend, you have five days of play ahead of you, and this is as many as five attempts to achieve what you want.

NO-TOUCH OPTION

The No-touch option is not as popular as its opposite One-touch or “One Touch”, but some brokers still offer such a game. Its essence is obvious from the name. In this binary option, you will be left with a profit if a certain price level is not reached within a specified period of time.

If you delve into the topic of tangents, then you can also call binary options such as “double one touch” – Double-one-touch and Double-no-touch.

OPTION “60 SECONDS”

Trading on the option “60 seconds” – for the most impatient and gambling. This is a unique tool for quick trades and instant winnings. The whole point of the game is that you can start and end it every 60 seconds. Opening and closing trades at such a speed is interesting and addictive.

We open a deal on the “60 seconds” option. To do this:

1. Choose the asset you want to trade.

2. Guided by the forecast of price movement, click “CALL” if we hope for growth, or “PUT” if we are pessimistic about the fall.

3. Enter the investment amount in the pop-up window.

4. Check all the parameters of the transaction and click the “Start” button.

It should be borne in mind that during the release of important financial news, many brokers block access to the “60 seconds” option. This is usually 15-20 minutes before the news is released and the same amount after.

American, European, Bermuda types of binary options

Academically speaking, binary options are divided into three main types:

- American

- European

- Bermuda or Mid-Atlantic.

The American-type option is in the greatest swing. Its advantage is that the player, upon reaching the desired indicators, can fix his profit without waiting for the end of trading.

Accordingly, he can immediately buy a new option and make a profit an infinite number of times per calendar day.

But the European binary option is conservative, it has a fixed expiration date, and the investor is forced to wait for a strike – the maturity date – in any development of events.

Bermuda or Mid-Atlantic options are good for the so-called “windows”, which are pre-spelled out in its regulations. The buyer has the right not to wait for the end of the auction, but can complete the game, remaining in the black, on one of the “window” dates.