Binary options are becoming more and more popular, and with popularity, the number of scammers and scammers is growing. Today, each country issues a license to conduct brokerage activities, there are about 30 licenses in the world. Many traders mistakenly think that a broker’s license protects the interests of the trader, but this is not always the case.

In this article, we will deal with the questions: How to protect yourself and what to look for when choosing a broker for options trading? What are the advantages of certification and licensing for a broker and trader?

Licensed binary options brokers – who needs them.

If you have ever thought about trying your hand at binary options, or just know at least something about this industry, then you have heard about brokers.

In fact, binary options brokers are far from the last component in the scheme of your success if you decide to make money on trading. After all, they are your intermediaries between you and the binary options market.

This is what the brokers themselves manage your investments and the money you earn, under your guidance, it goes without saying. Therefore, it is important to choose a broker who would not pocket your hard-earned money, but work with you honestly. With the right choice, only YOU will influence the result of your trades.

And here lies the main problem – the problem of choosing an honest binary options broker. There are so many companies on the market for conducting financial trading that it is difficult to remember at least half. If you have chosen an unfair boxer, you simply will not be able to withdraw your money, or your transactions will work out regardless of the real movement of the asset price. Therefore, licensed brokers are NEEDED BY YOU, THE TRADER!

How to choose a binary options broker.

It is necessary to choose a broker for trading binary options according to the scheme: LICENSE>REVIEWS>TERMS AND CONDITIONS

Choosing the broker you could and would like to work with is even more difficult. After reading the reviews on our website, you can see that even large companies for financial trading with licenses are not always loyal and honest to the trader. Therefore, it is very important to check the intermediary broker before making a deposit and making a final decision.

So, briefly about what to look for when choosing a broker? How to make sure that the broker you choose is honest with clients and will be your partner, not your enemy? How to insure your funds, or at least get at least some guarantees that the broker will not pocket them?

Read also: The broker does not return money – What to do?

For you, we have developed several criteria on the basis of which you can make your choice.

The main criteria when choosing a broker for options trading

By following these rules when choosing a binary options broker, you will be able to avoid scammers. If you opened an account with a fraudulent broker, you will not be withdrawn and will simply be deceived.

So, to choose the right broker, you need to make sure that:

- The broker has registration and all the necessary permits and licenses of financial regulators to work – more on this later in the article.

- The broker offers deposit and withdrawal methods that are available to you. Otherwise, you simply will not be able to make a deposit or use the money earned.

- The broker has no claims of any kind in the history of its activities. If there were such claims, it means that some traders have already faced the unfair attitude of this company. Don’t want to repeat their story? – Do not mess with these brokers.

- Pay attention to how many years the broker has been providing its services. The longer a broker has been on the market, the more reliable it is. But fly-by-night companies should beware. After all, no one yet knows what they breathe and how conscientious they are.

- The arbitration must be conducted by a third party. Not by the broker or his representative. Needless to say, in the second case, you have no chance of winning the dispute.

- guarantee of the safety of investments. Usually, such a guarantee is provided by a compensation fund. The bottom line is that the regulator freezes a certain part of the trader’s funds in case he cannot or does not want to pay his obligations.

- licensing. The broker must have all the licenses and permits in order to do, in fact, what he does. If the broker works illegally, then the responsibility for the lost funds is solely your fault.

ALL OF THESE RULES ARE THE PERFECT FORM OF BROKER VERIFICATION. AT THE SAME TIME, EVEN RUSSIAN BROKERS ARE REGISTERED IN OTHER COUNTRIES. THEREFORE, IF YOUR DEPOSIT IS MORE THAN $ 10,000, CAREFULLY READ THE TERMS OF THE COMPANY.

Is the license a confirmation of the broker’s reliability?

Check the broker’s license number and be sure to read traders’ reviews on the site. The best reviews are complaints with specific information.

Of course. That is, simply put, if an option broker has been issued a certificate, then this in itself is a confirmation of its reliability, a kind of mandate that gives the trader confidence that it is possible to work with this broker. Only not always having a license from a broker can protect you from fraud.

It is widely believed that licensed brokers are HONEST. And traders began to prefer certified brokers so actively that brokers themselves began to do everything about obtaining a license from the regulator for financial markets. The number of certified brokers began to grow like mushrooms, and with them began to grow the number of clone companies (scammers who show fake licenses) that pretend to be certified brokers, use their brand, take customers’ money and disappear like fly-by-night companies.

Read also: Binary options news to keep abreast of events

How can you tell if a clone company is communicating with you?

In order not to get hooked by such a clone, you need to carefully study all the documents that the company must provide you. As a rule, if the documents are genuine, then the company will provide them with pleasure – after all, it is the most profitable for the broker. But if the broker starts looking for excuses, reasons, excuses, then, most likely, a clone company is communicating with you, and you need to stay away from it.

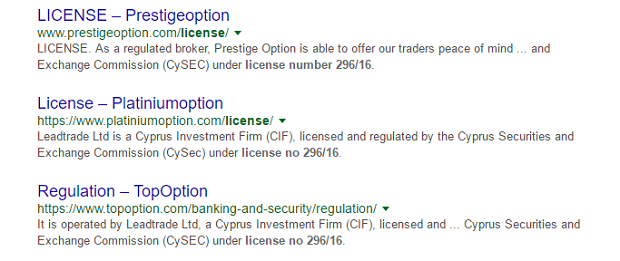

Please note that these brokers use the same license. This is due to the fact that the license is issued by SYSEC to the company that sells its rights. Thus, the regulator itself does not control the broker, but the company with the main license.

Please note that these brokers use the same license. This is due to the fact that the license is issued by SYSEC to the company that sells its rights. Thus, the regulator itself does not control the broker, but the company with the main license.

Moreover, the license number can be checked in the regulator’s database – so you will definitely not be deceived. Well, if you decide to work with a company that has neither a license nor documents, then blame yourself if this same company takes your money into its hands.

However, many fraudulent companies claim that they are registered in some other country, in Cyprus, for example, or in the Virgin Islands, and that their activities are regulated by the authorities there. You can believe it, but it’s better to check.

What a trader should pay attention to when choosing a binary options broker:

- Registration data of the company on the regulator’s website;

- For what type of activity the license was issued;

- Is the license still valid?

In this way, you can avoid scammers and protect your investments.

So, certified brokers:

- They do not affect the outcome of trades, the result depends solely on the trader;

- Do not mislead the trader about the state of his account.

What authorities are brokers licensed by?

Binary options brokers obtain licenses for various types of activities:

- To conduct brokerage activities;

- To conduct dealer activities;

- For the management of securities in the stock market.

In fact, each country has its own financial regulator. However, there are the most common regulators.

Major Securities Commissions for Binary Brokers

- CySEC – Cyprus Securities and Exchange Commission

- FSA – Financial Services Authority (UK Financial Conduct Authority )

- NFA — National Futures Association

- MiFID – The Markets in Financial Instruments Directive

- FCA – The Financial Conduct Authority (Служба финансовой деятельности Великобритании)

- Center for Regulation of Relations in the Financial Markets of Russia

- KROUFR – Commission for Regulation of Relations of Financial Market Participants

- Central Bank of the Russian Federation – Central Bank of the Russian Federation

- CRFIN – Self-regulatory organization Center for Regulation of OTC Financial Instruments and Technologies

There are more than 30 financial regulators. Each of which sets the conditions for the broker to obtain a license.

It is this regulator that is especially popular with brokers from different countries. This is due to the loyalty of this regulator to companies providing trading services, as well as the policy of Cyprus aimed at attracting investment.

However, in order to carry out activities on the territory of Russia, this license is not enough. In order to work legally, you need certification from the Center for Regulation of Relations in Financial Markets.

The regulator itself is subordinate to such organizations as the Central Bank of the Russian Federation, the antimonopoly organization, the Ministry of Finance, and the Bank of Russia Financial Markets Service. In short, if the broker has already received a certificate from the FMRC, then you can definitely work with him.

A certificate is issued for a period of 1 year, and after the expiration of the period, you need to go through the certification process again.

In this video, an indication of what to do if the broker does not withdraw your money

Read the entire article:The broker does not return money – What to do?

Who is protected by a license from a binary options broker?

This is the main question that should concern us. As previously stated, there are numerous companies with a license, however, reviews show that the behavior of these brokers is, to put it mildly, fraudulent. They do not withdraw money, they are rude, they have a lot of technical problems. Just look at the reviews and the blacklist of brokers on our website.

Let’s try to figure out what gives you, traders, a license.

- The tasks of the regulator are:

- Maintenance of the legislative framework

- Regulation of the work of market participants

- Issuance of licenses

- Defending the interests of investors.

But can a regulator in America or England defend the interests of a trader from Russia? The answer cannot be unequivocal. After all, if you think that the broker deceived you, you need to write a letter with a full description of the problem. However, it is very difficult to prove the problem and the claim. After all, if a trader was advised to open a deal, and a pseudo analyst advised, and the trader lost money, the trader is to blame. Why? Because you were given an opinion without a guarantee, and it was you who performed the action yourself.

In conclusion, a license from a broker can help defend your rights, but does not promise a 100% solution to the issue. If the broker has a license from Russian regulators, it can help citizens of Russia, but not Ukraine.

Results.

Working with a certified broker can be the key to the safety of your funds and, in many ways, the success of the trading itself. Nowadays, it is possible to check whether a broker is a scammer even without super-knowledge. Cooperation with brokers who have a license is more honest than with brokers without. You can’t rely only on the license and the regulator. After all, you must understand the reality of the situation.

One broker told me that the account is insured up to $ 20,000 in the event of a bankrupt company, but I had a deposit of only $ 1000. And how does this insurance affect the fact that I did not withdraw money?

It is enough to have common sense, be able to use the Internet and not be seduced by offers to earn millions per second, only a couple of rubles are invested.

Be sure to read and leave reviews from other traders.

START WORKING ONLY WITH TRUSTED BROKERS

Tagged with: Regulation