One promising investment project, Cashbery (their website: https://cashbery.com) has suspended payments to depositors indefinitely. An investigation conducted by the Russian Central Bank (more details on the website of the Central Bank of the Russian Federation) showed that the company, which attracted customers with assurances of colossal profits from microcredit operations and short-term loans to small and medium-sized businesses, did not even have a license to engage in financial activities.

In such situations, the victims, as a rule, are people who believe the convincing persuasion of professional fraudsters. And there were a lot of them, according to some estimates, up to three hundred thousand people. The reaction of the Central Bank and the Prosecutor General’s Office was belated, by the time Cashbery was convicted of creating a financial pyramid, payments on deposits had not been made for several months.

This allows you to dispute the transaction and achieve a chargeback

There is no patented tool that guarantees that everyone can return the funds transferred to the disposal of Cashbery and similar firms, and cannot exist. As a rule, when a financial pyramid collapses, it turns out that there was practically nothing behind the impressive shell of the soap bubble, so there will be nothing special to return. However, some cash savings still remain, and it is worth trying to return your own , fortunately, protective mechanisms for this have long existed and are successfully applied.

Payment systems around the world support the so-called chargeback procedure (full instructions on the eto-razvod.ru website), which allows you to reasonably dispute the transaction and achieve a chargeback. It is not resorted to too often, because the existing rules of payment systems qualify the chargeback as the last resort launched when the owner of the bank card failed to return his transfer in all other ways. Therefore, the period after the transaction, allotted for the initiation of the procedure, is long and reaches almost one and a half years.

We recommend the article: The broker does not return money: what to do?

Payment systems are obliged to the banks that have joined them (referred to in such cases as issuers) to respond to requests from persons using plastic payment cards issued by them. If the owner of the bank card wishes to dispute the transaction, the issuer undertakes to verify the validity of such a request and, recognizing the arguments as indisputable, initiate the procedure.

What to contact the issuer and what obstacles may arise

It is not enough to send a request to challenge the transaction, you need to thoroughly prepare for it, and record negotiations with the issuer, seeking answers in writing. Since the chargeback procedure is considered as the last resort to solve the problem, the financial institution will need to prove that attempts to influence the counterparty, like Cashbery, have been made repeatedly. The proof will be:

- recordings of Skype and phone conversations (audio, video, screenshots);

- screenshots of e-mail correspondence.

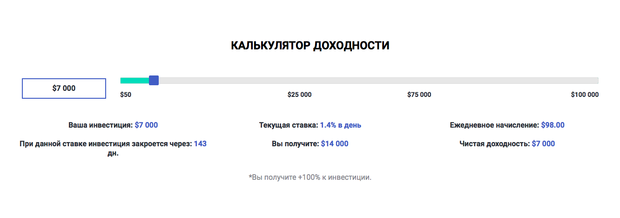

When justifying the violation by the counterparty of its obligations, it is appropriate not only to indicate which specific points and how they were violated, but also to provide a link to the site where these documents are posted. For example, on such a page https://cashberytrading.com/, which contains a promise to provide incredible profitability:

It should be borne in mind that the issuer may not fulfill the obligations imposed on it by the payment system in relation to the owner of the payment card. This is inherent in some of the leading Russian banks. The reason may be some kind of hitch, and lack of competence (or simply negligence) of a bank employee. As a result, the time allotted for initiating the procedure may be lost. In this case, the courtroom may become a battlefield for the return of deposits, and the issuing bank will turn into a defendant.

Participants in the procedure and its progress

By submitting a reasonable request to the issuing bank, the owner of the payment card turns out to be an interested, but outside observer, waiting for when and how the investigation will end. In the procedure, active roles are assigned to:

- the issuer who initiates it and further protects the interests of the client;

- to the acquiring bank that performed the transaction, to which the issuer electronically sends a request for a chargeback. It is the acquirer who will withdraw the funds received by the addressee from the owner of the bank card;

- the organization to which the funds were received under the disputed transaction. It can prove to the acquirer that the claims are unfounded;

- arbitration instance formed by the payment system. Here, consideration of the validity of the cancellation of the transaction will occur if the issuer and acquirer do not reach an agreement. The decision made at the level of arbitration should be made as final. (The peculiarities of the procedure within the framework of the international payment system MasterCard allow banks to appeal if they have any arguments that were not previously taken into account).

What do companies specializing in the transaction dispute procedure offer?

With the increase in the number of persons disputing payments, the number of firms offering their services in such cases also increases. Among the advantages of using the service:

- the opportunity to free up time for your own affairs;

- avoidance of mistakes arising from lack of experience in the procedure. The devil is in the details that ruin the case. Such a detail, which reduces the probability of success to zero, may be, for example, the wrong choice of the code used by the payment system as grounds to dispute the transaction in certain situations.

You have to pay for the work of professionals, even if they recommend abandoning the venture as hopeless, because unreasonable. The fee will be a certain proportion of the amount involved in the transaction.