Gator Oscillator Indicator

Description

We continue detailed reviews of binary options oscillators for regular users of our portal. Why do you need this information? For your convenience, we collect detailed useful material on the resource that will help you achieve more in trading.

In order for binary options trading to be successful, you need to know about the tools and be able to use them. By understanding how the market works, how brokers work, and how trends arise, you will be able to make the right betting predictions and make money on it. Today we will tell you about one of the main technical indicators – the Gator oscillator, its capabilities and benefits for your successful trading in the market.

The Gator Oscillator originated thanks to trader Bill Williams, who developed the Alligator indicator. Gator Oscillator is an indicator-addition to the “Alligator”, its improved version, which uses the data of the “Alligator” moving averages to make its own chart.

The peculiarity of the Gator Oscillator is that it separates the periods of the trending state of the market from the non-trending one and then displays this information in a clear form. As explained by the value of the oscillator its creator, this indicator distinguishes the moments of sleep of the “Alligator” (the so-called non-trending market, the Balance Lines of the “Alligator” at this moment are intertwined) from the moment of wakefulness (trend market, the Balance Lines of the “Alligator” are built sequentially one by one behind the price chart).

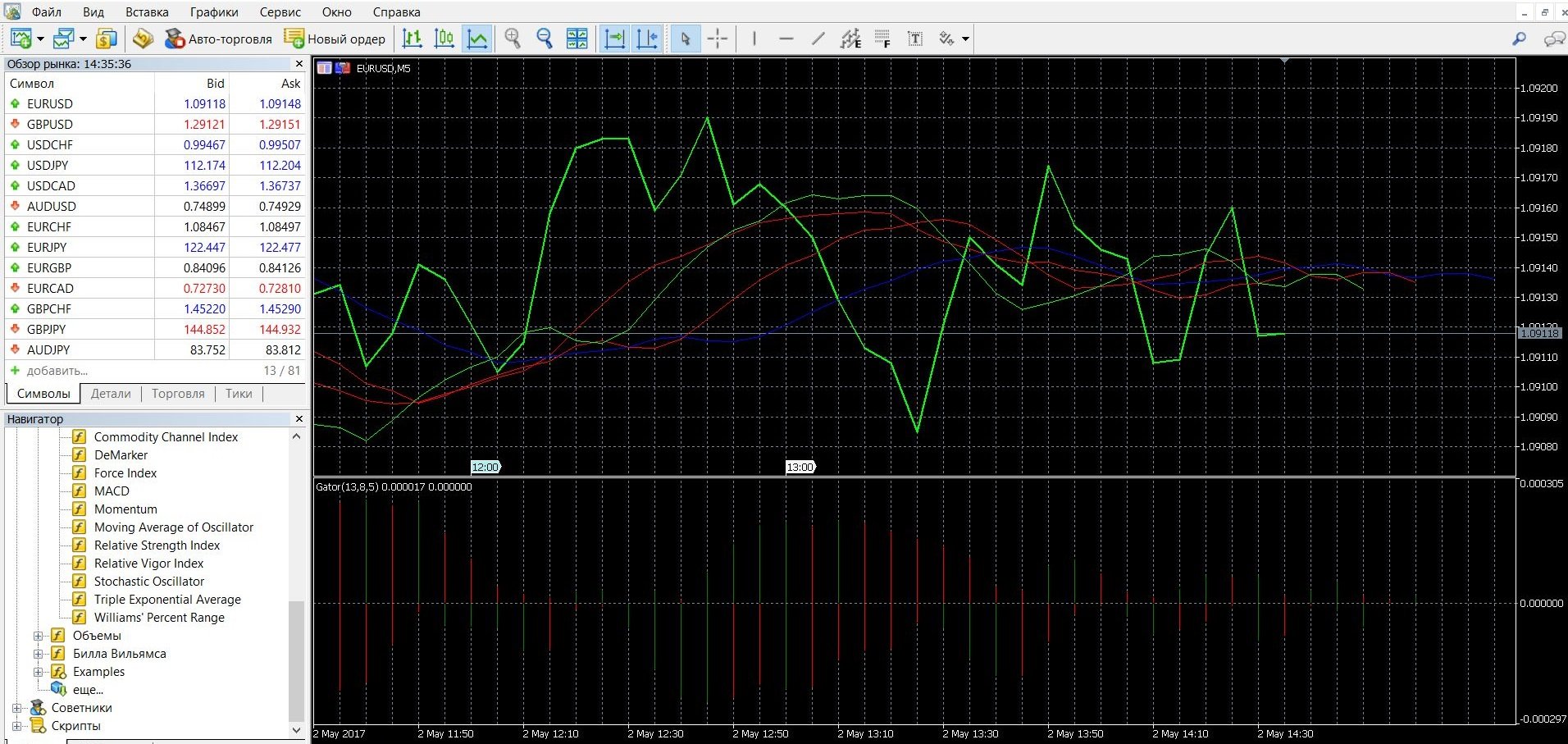

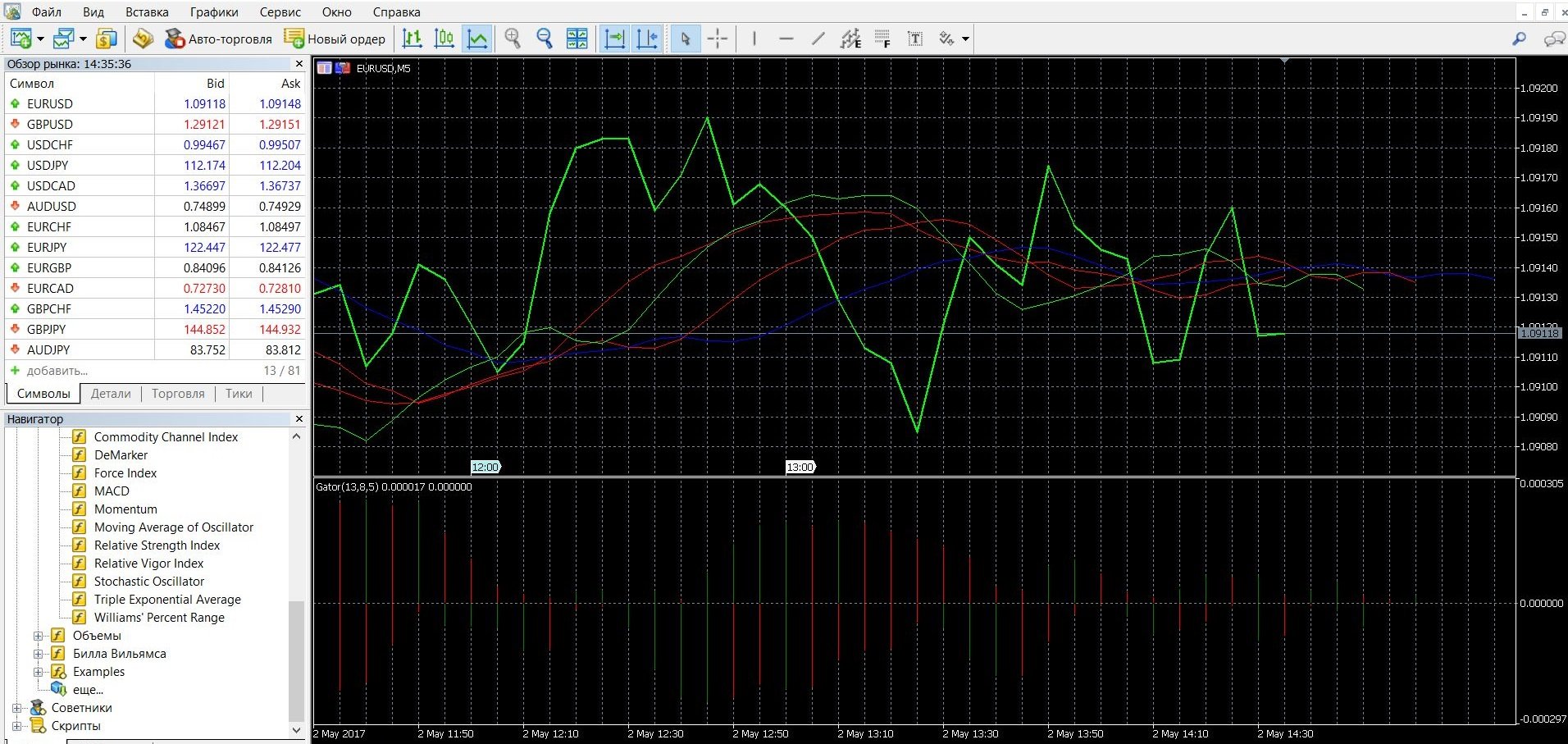

On the chart, the Gator Oscillator indicator shows information using two histograms: 1 – located above the zero level and shows the difference in the values of the jaw and teeth of the “Alligator”, 2 – located below the zero level and demonstrates the difference between the lips and teeth of the “Alligator”.

You can see how the Gator Oscillator looks on the MetaTrader 4 (MT4) platform in the image below. You can also download the MetaTrader 4 platform and work with this indicator.

How does the Gator Oscillator work?

The Gator indicator is located in a separate window and consists of two interconnected histograms. The columns are colored red and green, which corresponds to the ratio of the current and previous values. The green stripes indicate an intensification of the trend, the red color indicates a weakening. When the current value is less than the previous one, the bar is colored red; When the current value is greater than the value of the previous value, the bar is colored green.

The Gator oscillator is generally similar to the Alligator, the only difference is that the Alligator is based on the use of a moving average line, and the Gator has a histogram. The Gator Oscillator gives an understanding of the trend as living in certain phases:

1. Awakening – the trend is forming. The phase begins with a change in the color of one of the stripes from red to green. The graph shows the bars of each color, in this case it does not matter which bar is above and below zero.

2. Nutrition – the trend is intensifying. On the chart, both bars turned green.

3. Saturation – the momentum of the trend decreases. The phase begins from the moment when one of the green bars turns red. At the same time, as long as both stripes are painted in different colors, it does not matter which one is located above or below the axis.

4. Sleep – the trend has exhausted itself. On the chart, both bars are red.

Trend phases of the Gator Oscillator:

So, by correctly determining the phases of the trend, you can start trading from the moment the trend forms and finish it before its end. The highs shown by the Gator Oscillator fully correspond to the highs, that is, the periods of the largest divergence of the smoothed moving averages (blue and red Balance Lines) at the Alligator.

Also, the lows shown by the Gator Oscillator fully correspond to the difference in the values of the moving averages (red and green Balance Lines) of the Alligator, but with a minus, since the graph is shown under the zero axis. Both the high and low indicate the presence of a strong trend in the market. If the Gator Oscillator fluctuates around the zero mark, it suggests that there is no trend.

Gator Oscillator formula:

Histogram1 = Abs (Smma (Median Price, 13, 8) – Smma (Median Price, 8, 5))

Histogram2 = (-1) * Abs (Smma (Median Price, 8, 5) – Smma (Median Price, 5, 3))

Smma i = (Sum 1 – Smma i-1 + Median Price i ) / N

Where is:

Smma i — smoothed moving average of the current bar (except for the first one);

Sum 1 — the sum of Median Price prices for N periods, counted from the previous bar;

Smma i-1 — smoothed moving average of the previous bar;

Median Pricei — median price of the current bar;

N is the period.

Multiplying by “-1” is necessary for the second histogram to be displayed on the indicator chart below the zero mark.

The material is taken from the site enc.fxeuroclub.ru

Do I need to install the Gator Oscillator on my platform?

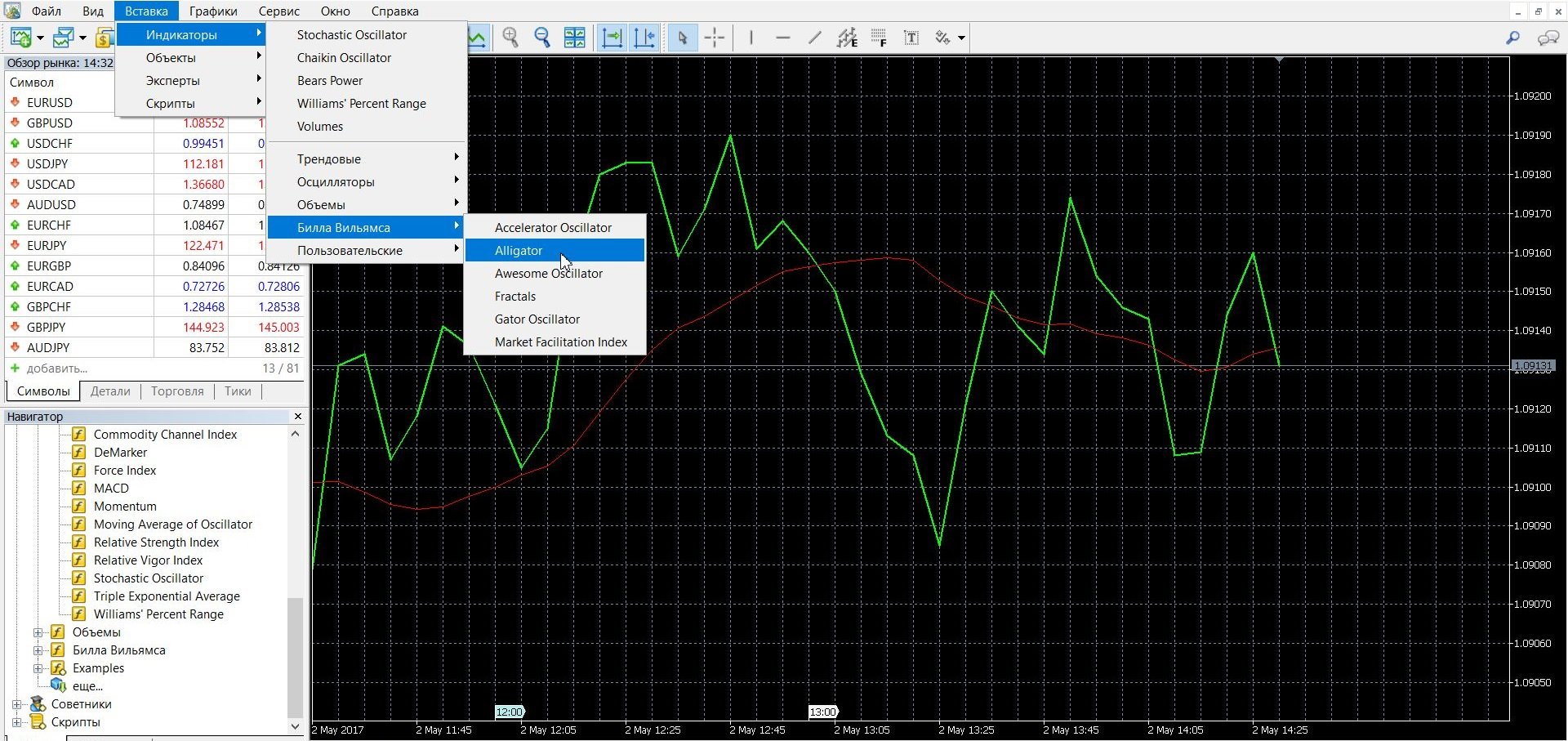

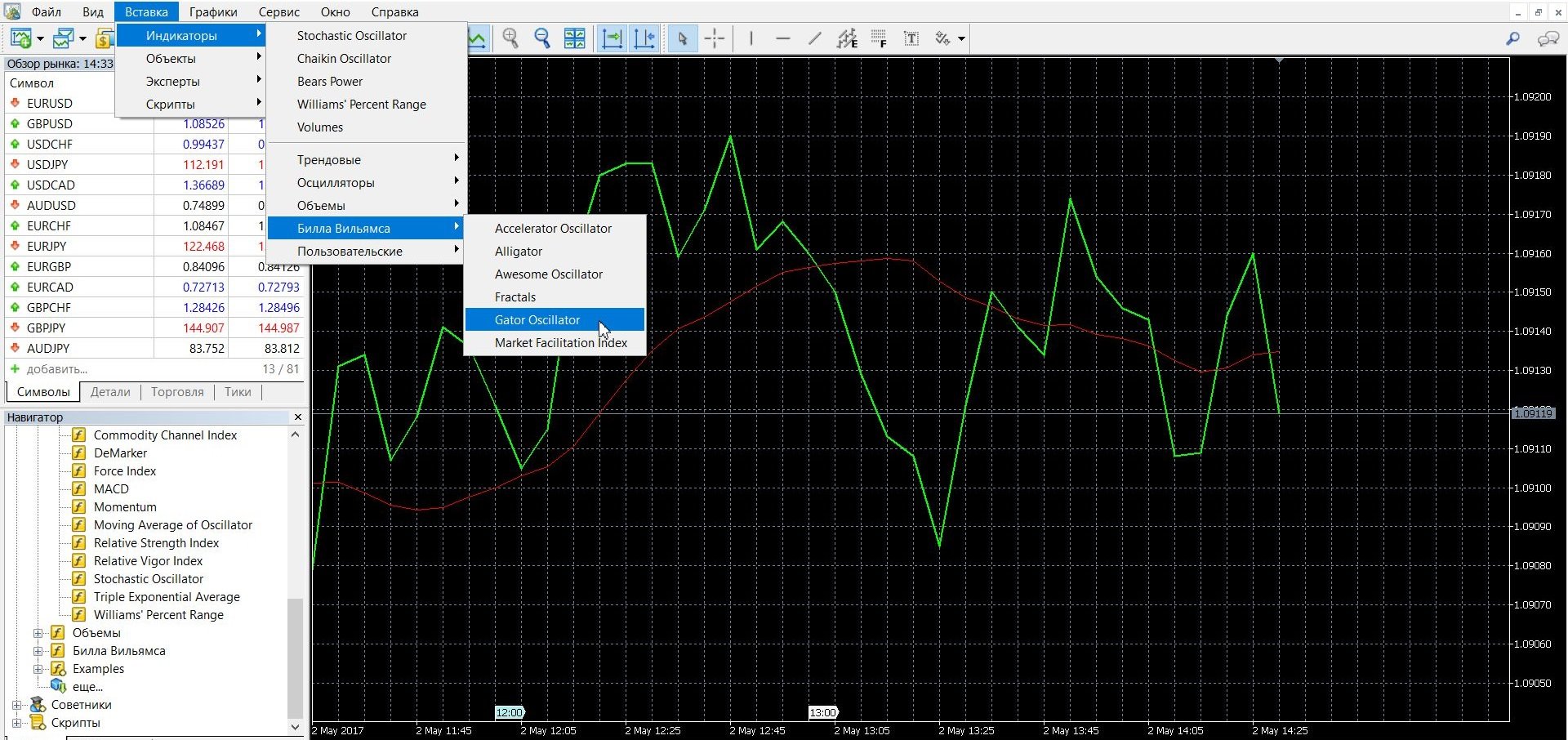

This oscillator is available in almost all trading platforms, including the MetaTrader 4 platform. To add the Gator Oscillator to the price chart on the MetaTrader 4 platform, follow these steps:

1. Click the “Insert” tab in the top menu of the platform

2. Select the “Indicators” tab

3. In the drop-down menu that opens, select the “Bill Williams” tab

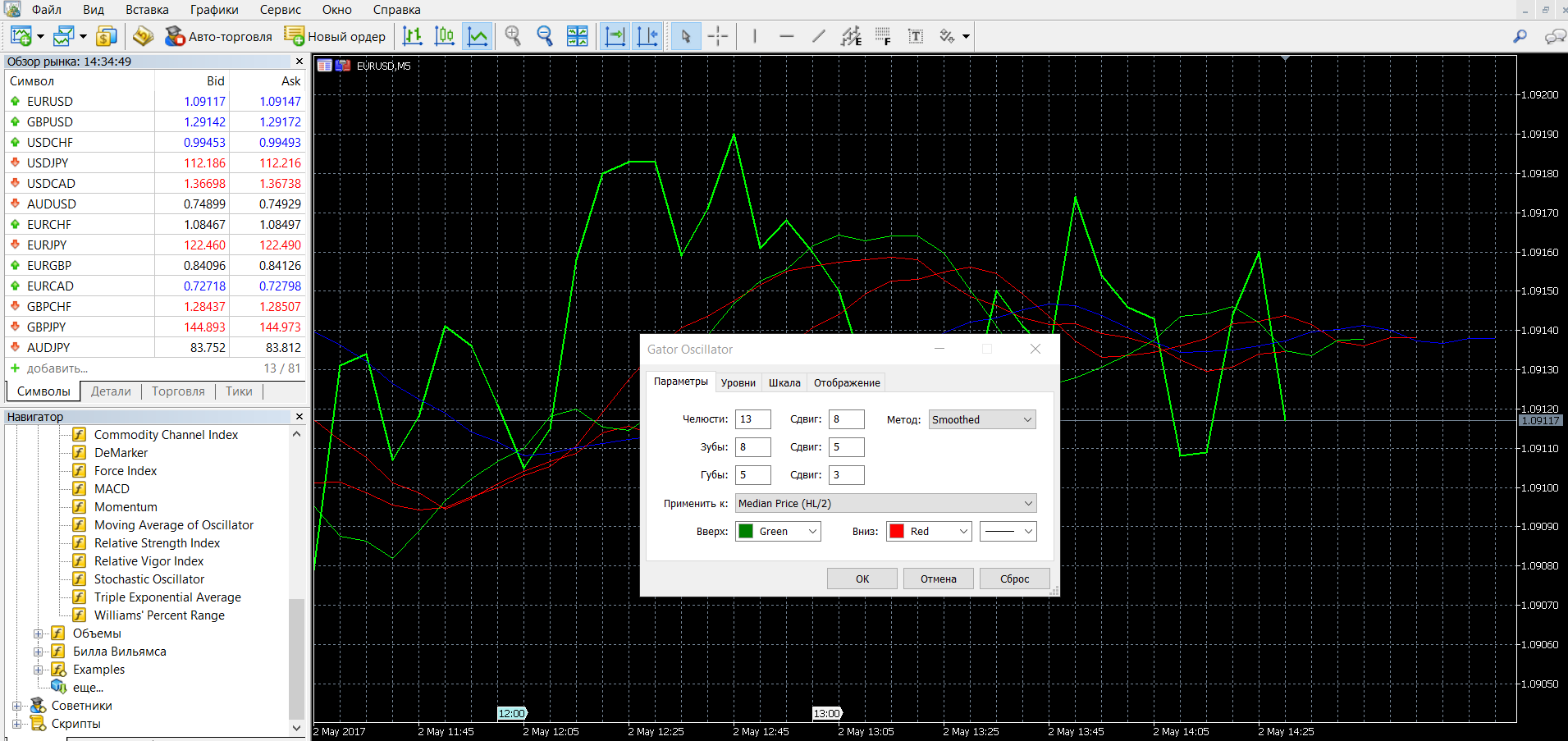

4. In the drop-down menu that opens, select Alligator first, then Gator Oscillator

5. When adding a Gator Oscillator to the chart, an active window will open in which you do not need to change the parameters.

6. So, the graphs are formed, you can work with the material.

If your platform doesn’t have a Gator Oscillator, you can download it here.

Application of the indicator for binary options

1. The Gator indicator clearly shows the periods of market dynamics, which means that it clearly demonstrates the development of trends: a state of rest, a rise / fall of the market.

2. Gator only gives information about how strong/weak the trend is and does not show data on price dynamics. Since the Gator Oscillator does not have its own signals, it is not recommended to use only its data during trading. This is an excellent additional oscillator, which is used to predict the capabilities of the Alligator, is quite visual when predicting the moments of intersection of the Alligator balance lines.

3. Using the indicator, you will be able to react in time to the state of the market and benefit from it. It is worth making a trade at the moment when Gator wakes up and closing it during the saturation period, when the trend is almost exhausted.

4. Gator’s capabilities are usually used on large and medium timings, using it on small timeframes is risky.

5. The importance of oscillators for options trading is great, predicting market trends, they allow you to direct you to the right decision in advance. In trading, it is important not only to be in control of the situation and correctly interpret the main tools, but also to be able to draw the right conclusions in time.

Rules for concluding transactions (screenshots)

Gator Oscillator in trading with a signal for a rise and fall in prices

When using the Gator Oscillator, you should know that it can be used with the Alligator indicator, as well as with other oscillators (Stochastic, RSI, DPO, for example). Gator Oscillator does not give a specific signal, but thanks to its capabilities, you will know about the origin of the trend, about the dynamics of the market.

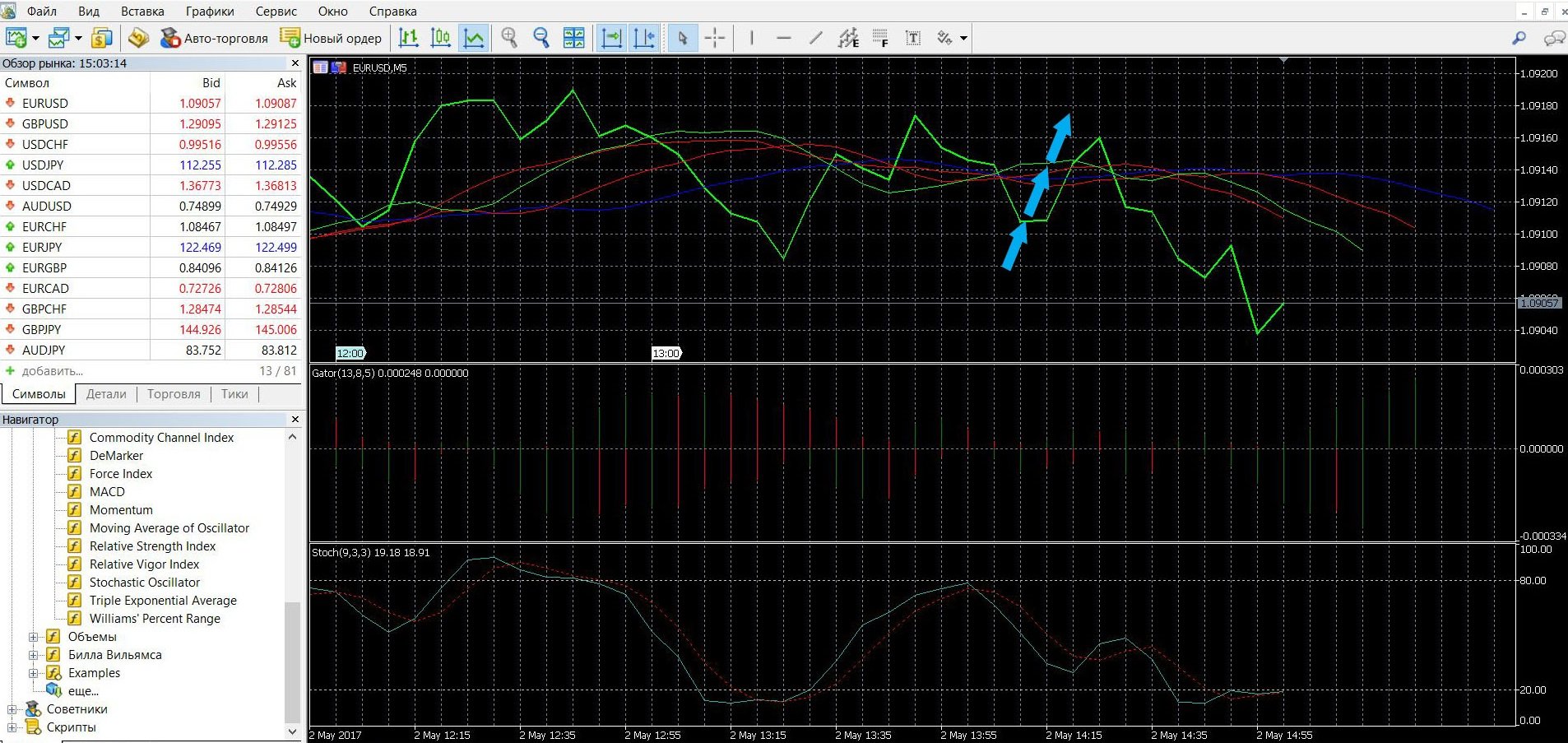

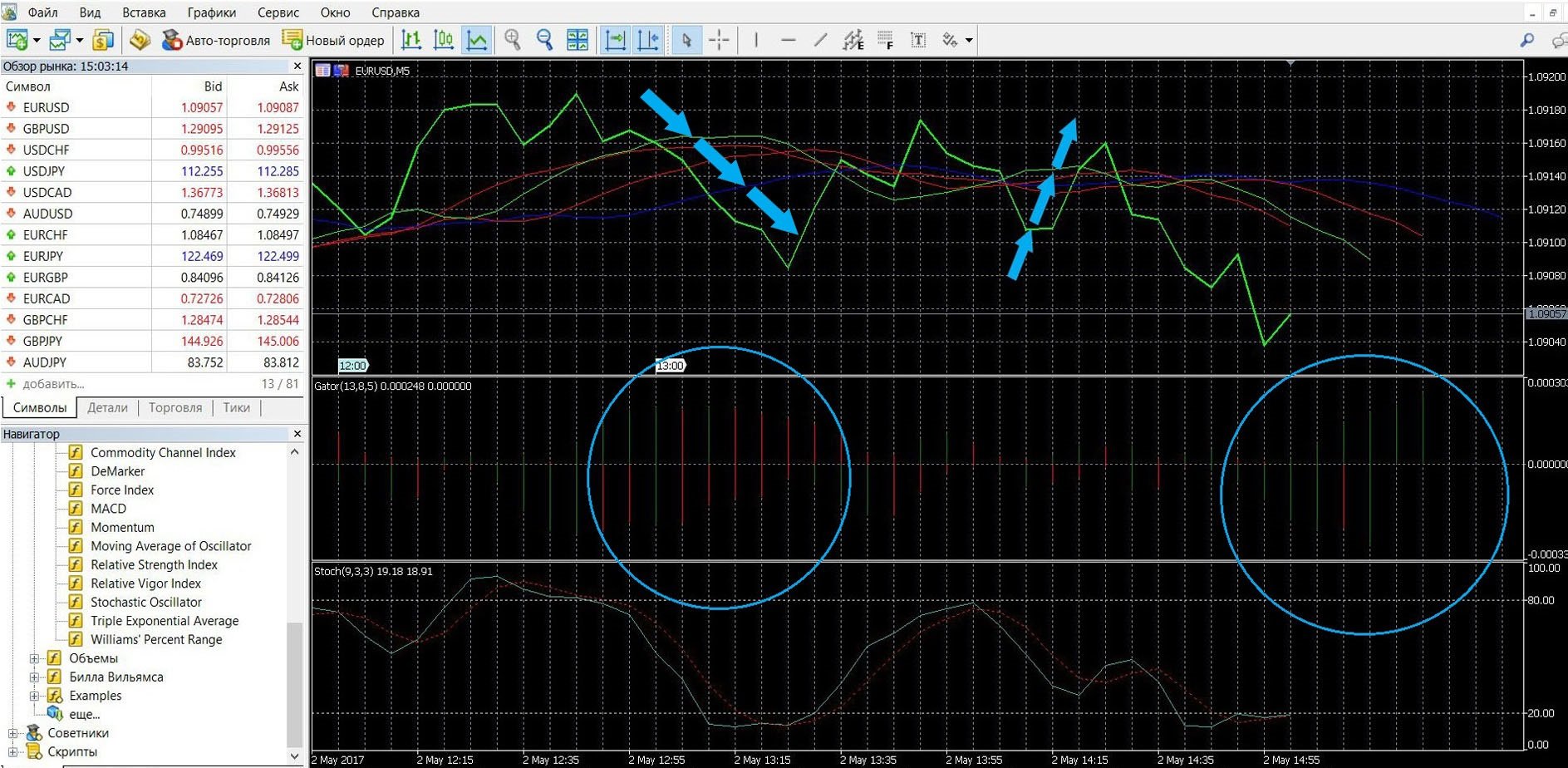

Let’s demonstrate the logic in which you can use the Gator Oscillator in conjunction with other indicators. In the images below, you can see what the upward trend of the market looks like on the MetaTrader 4 platform. This trend is shown not only in the “Alligator” and the Gator Oscillator, but Stochastic also speaks about it. So, having received information from the oscillators, you can place a CALL bet (up):

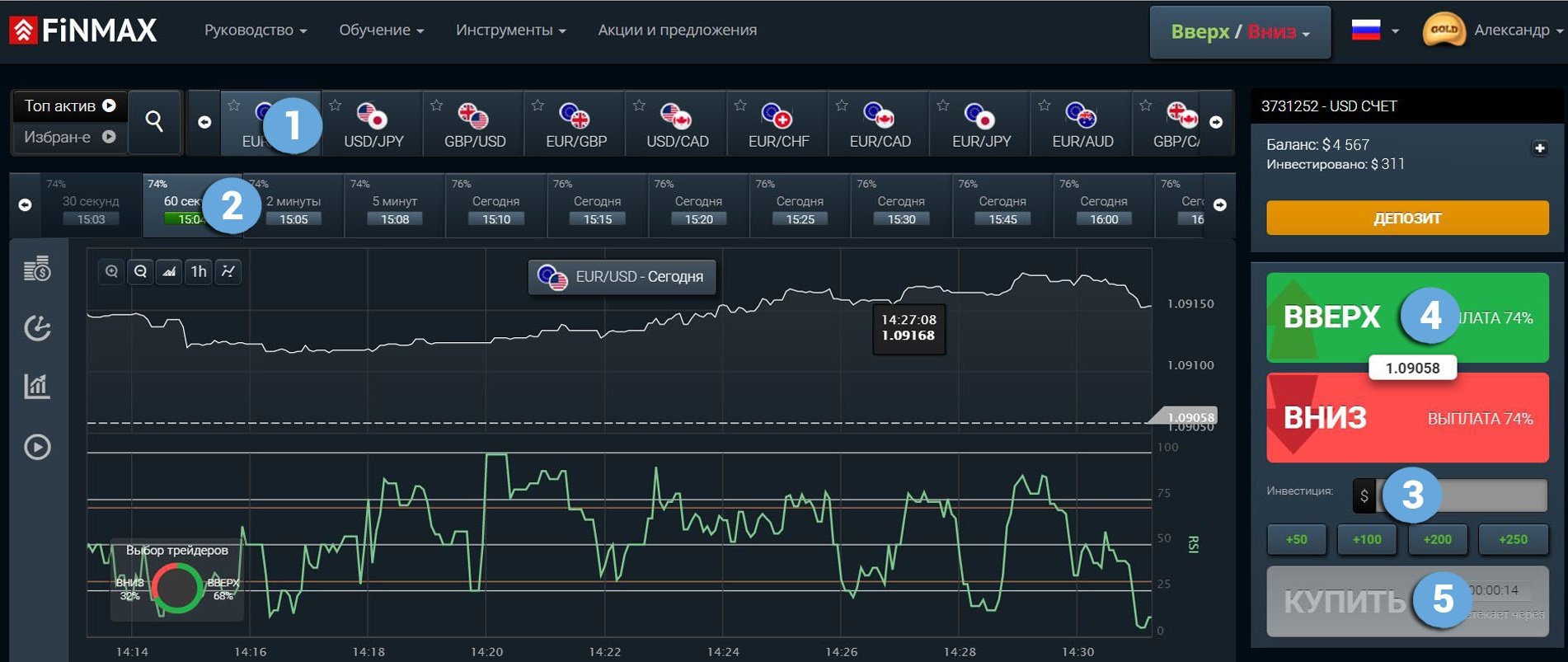

The CALL rate (up) can be made at the Finmax broker. To do this, you need to go to the broker’s website finmaxbo.com and take the following steps:

Prepare the option data, for this we indicate:

1. Type of asset

2. Validity of the option

3. Bet size

4. Forecast for the movement of the quote: UP

5. Click the “buy” button and monitor the results of the movement of currencies on the chart

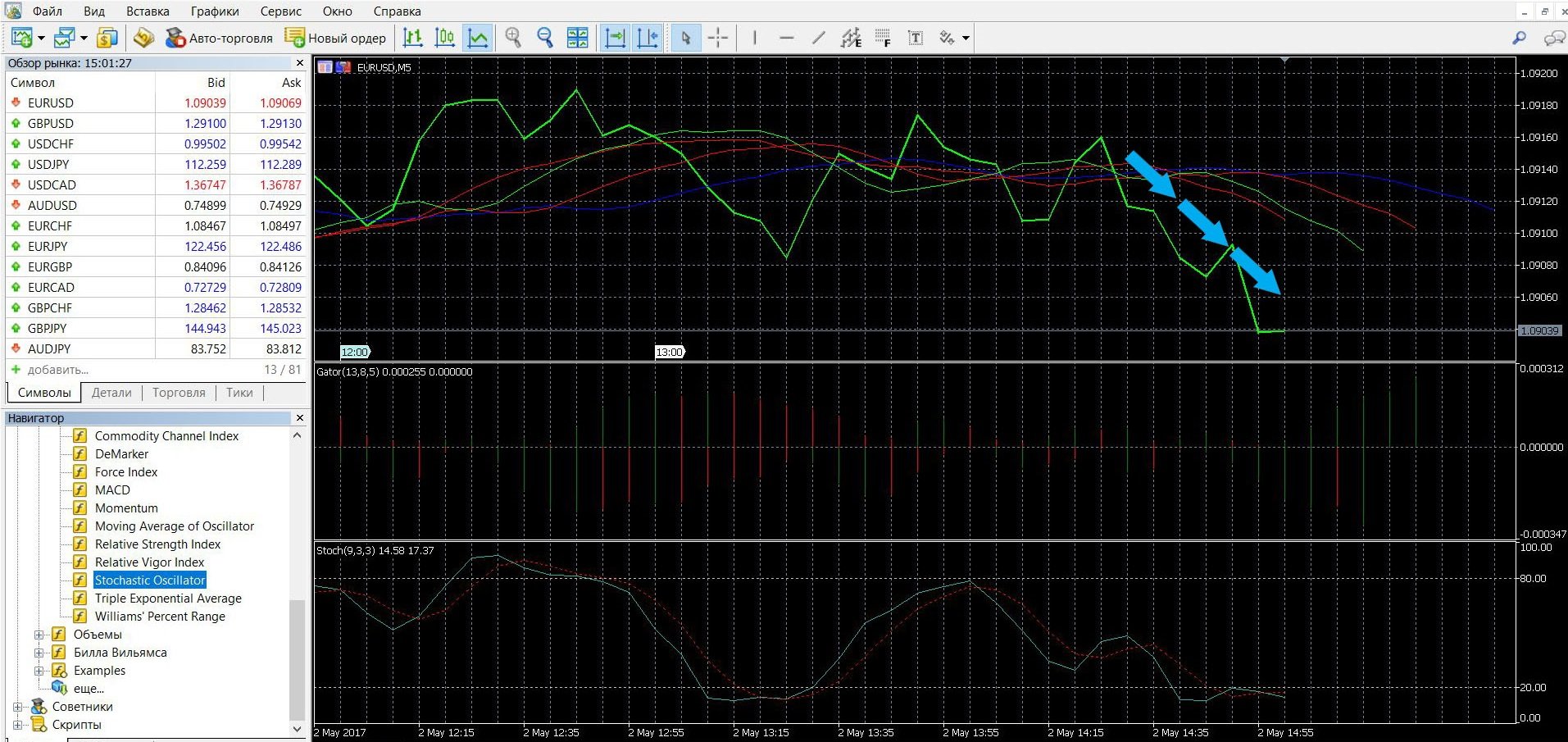

In the images below, you can see what the downward trend of the market looks like on the MetaTrader 4 platform. This trend is demonstrated not only in the Alligator and the Gator Oscillator, but also in the Stochastic. So, having received information from the oscillators, you can make a PUT bet (down):

You can place a PUT (down) bet with the Finmax broker. To do this, you need to go to the broker’s website finmaxbo.com and take the following steps:

Prepare the option data, for this we indicate:

1. Type of asset

2. Validity of the option

3. Bet size

4. Forecast for the movement of the quote: DOWN

5. Click the “buy” button and monitor the results of the movement of currencies on the chart

Gator Oscillator in trading with an overbought-oversold signal

In this case, the Gator Oscillator will also act as an assistant to other indicators. Thanks to the capabilities of the Alligator, Gator Oscillator and other indicators, you can track a clear overbought-overserved signal.

A reliable sign of entry into the market at the Gator Oscillator is the green color of a strongly elongated histogram column, which confirms the presence of a strong trend in the market, and vice versa, the red color of a strongly elongated bar confirms the minimum of the trend.

Let’s demonstrate the logic in which you can use the Gator Oscillator in conjunction with other tools. In the images below, you can see what the upward and downward trends of the market look like on the MetaTrader 4 platform. This trend is shown not only in the “Alligator” and the Gator Oscillator, it is also signaled by the Stochastic chart. So, having received the necessary information from the oscillators, you can place a CALL (up) or PUT (down) bet:

To place a CALL (up) or PUT (down) bet with a Finmax broker, you must go to the finmaxbo.com broker’s website and take the following steps:

Prepare the option data, for this we indicate:

1. Type of asset

2. Validity of the option

3. Bet size

4. Forecast for the movement of the quote: DOWN/UP

5. Click the “buy” button and monitor the results of the movement of currencies on the chart

When working with the Gator Oscillator, give preference to the Alligator data, and you should also use other indicators. So you will be sure of the information and make the right conclusion.

Money management

Success in trading is when you stop losing your money, and come, at least, to stability. Most often, unreasonably high risks, lack of a strategy in the circulation of own funds lead to unsuccessful trading. If you do not know how to properly manage your capital, you will not be able to get a stable income. So that at some point you do not lose the entire deposit, remember and put into practice the basic rules of money management.

Bet the minimum

When participating in the auction, do not risk all your funds: bet the minimum amount. The same applies to your account – you should not deposit a large amount at once. So, in case of failure, you will have free money and, accordingly, the opportunity to recoup.

Trade wisely

Manage your funds wisely: do not put your money in a transaction, do not put more than 5% of the deposit in one transaction. Remember that your prediction may not come true and then you may need funds to recoup.

Streamline your work

Gradually get involved in the work: at the initial stages, you should not participate in trading all possible assets. Start with two or three, get comfortable with the system and gradually expand your investment portfolio. So, you will get the basic concepts of what the market is and will be able to correctly apply knowledge in practice.

Take control of yourself

During trading, keep the situation under control, remember the rule of three and stop trading after three trades. According to statistics, there are only three failed trades and the trader panics and loses control, trying to return the loss. The rule of three will teach you self-control and discipline, regardless of whether your transaction was successful or not. You will save money and become more confident.

Expiration

The expiration of binary options is the onset of the end of a fixed-term contract, when obligations are fulfilled. This is one of the key concepts in options trading, your income depends on what the expiration period will be.

The peculiarity of the expiration of options is that in this case the execution depends on the investor’s forecast. Options have become popular due to the opportunity to get quick money. Here, the deadline is more often less than a month, or even a few hours.

Depending on the expiration date, options are:

Short-term – that is, the execution period is often less than one hour (“60 seconds” options are popular, when you need to guess how the price will behave in the next minute). Trading such options attracts many traders, including inexperienced ones. They are also distinguished by a high degree of risk.

Long-term – that is, with a longer execution period: a week, a month, etc. The possibilities of such options attract professional market players who are on the stock exchange for the sake of full-fledged earnings. To place a bet, you need to analyze the behavior of the asset, its dynamics, and more extensive knowledge is needed.

Extension of binary options expiration

Often, brokers allow traders to change the expiration dates, this is allowed and only upwards. To do this, you will need to deposit funds – about 40% of the bet.

Expiration rules:

1. Are you new to trading and have doubts about choosing the end time of the transaction? Then you should choose a long period to see a detailed picture of the market.

2. To minimize risks, choose a broker that allows you to increase the terms of bets.

3. Do you like to take risks? Try intraday (a few hours) or short-term (minutes) trading. Advantage: you can quickly increase your income, but remember about the great risk that characterizes such bets.

4. Do you want more from trading? Professionals are more likely to determine the duration of the transaction based on the trading strategy, trading conditions (economy, news). Here, the terms of bets are different, and the profitability is higher.

Expiration and financial losses

It is worth remembering that expiration is a loss and you need to be prepared for this. It is almost impossible to predict the course of events and the situation on the market, it is influenced by too much. Therefore, always have an additional reserve of funds, which will become your freedom and your opportunity to recoup and return the funds to yourself.

Downloads

MetaTrader 4 (MT4) platform – download

Gator Oscillator for MT4 platform – download