Moving Averages in Binary Options Indicator

The Moving Averages indicator is one of the most common trader’s tools that shows the average price value for a specific period of time. If the price chart is lower, it is a downtrend, if it is higher, it is an uptrend. Moving averages appeared on the market a long time ago and were able to successfully gain popularity among traders around the world, are present in most profitable trading strategies . The main reason for this popularity is the simple use of indicators, the ability to qualitatively predict asset prices.

The mechanism of the indicator is simple and will be understandable even for a beginner in options. This is an automated program that calculates the average price of an asset for a specific time period, as well as showing the deviations of the value from the average value. The indicator determines short-term and global changes in market trends, which will allow you to conclude transactions based on correct forecasts and make a profit.

There are 4 types of moving averages:

- Simple Moving Average (SMA) is a simple moving average.

- The Exponential Moving Average (EMA) is an exponential moving average.

- Smoothed Moving Average (SMA) is a smoothed moving average.

- Linear Weighted Moving Average (LWMA) is a linear weighted moving average.

Let’s analyze each of them separately.

Simple Moving Average

The Moving Average (MA) is a standard indicator, the main purpose of which is to measure the average price over a time period. This moving average is the most popular among traders who trade on higher timeframes. The indicator shows the average price, but the peculiarity of the SMA is that when calculating it, an equal value is given to all prices.

SMA is used to smooth out minute price fluctuations and identify overall market dynamics. More often, this trend analyzer is used with other oscillators to exclude false signals.

You can read more about opportunities and trading with MA in a detailed review here.

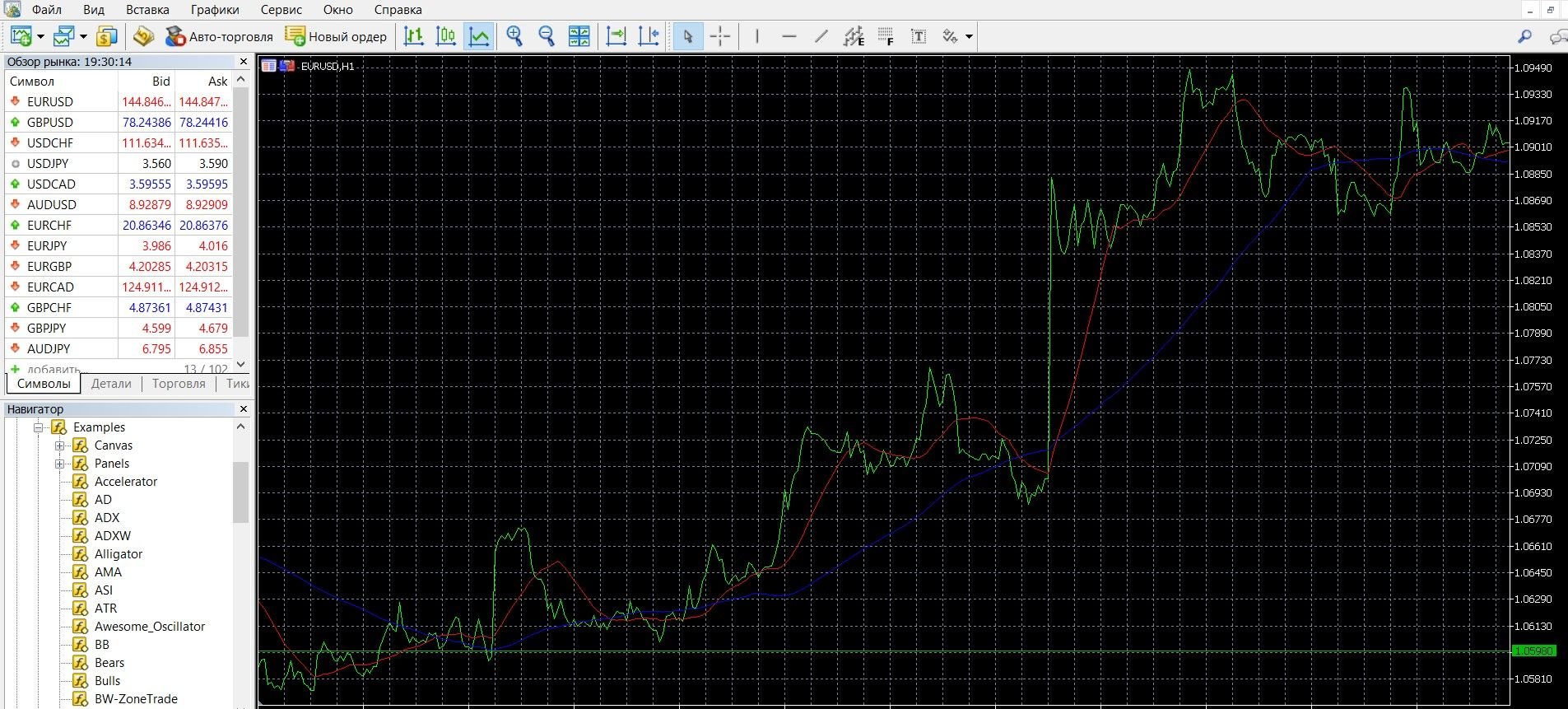

In the image below, you can see the behavior of the MA indicator (periods 20 (red line) and 80 (blue line) on the price chart on the MetaTrader 4 platform:

Exponential Moving Average

SMA has a drawback, signal lag, so there is an EMA that reduces this delay. This is done by giving the new price more weight than the old ones. The EMA, first of all, looks at the closing of the price at this time. At the same time, the shorter the time interval, the greater the “weight” of the new price. EMA is more sensitive, more susceptible to market dynamics, reacts quickly to price changes, so it is common among those traders who trade intraday. It is in many ways similar to a weighted moving average.

The use of an exponential curve will allow you to avoid false signals, accurately assess the situation of market changes due to greater sensitivity.

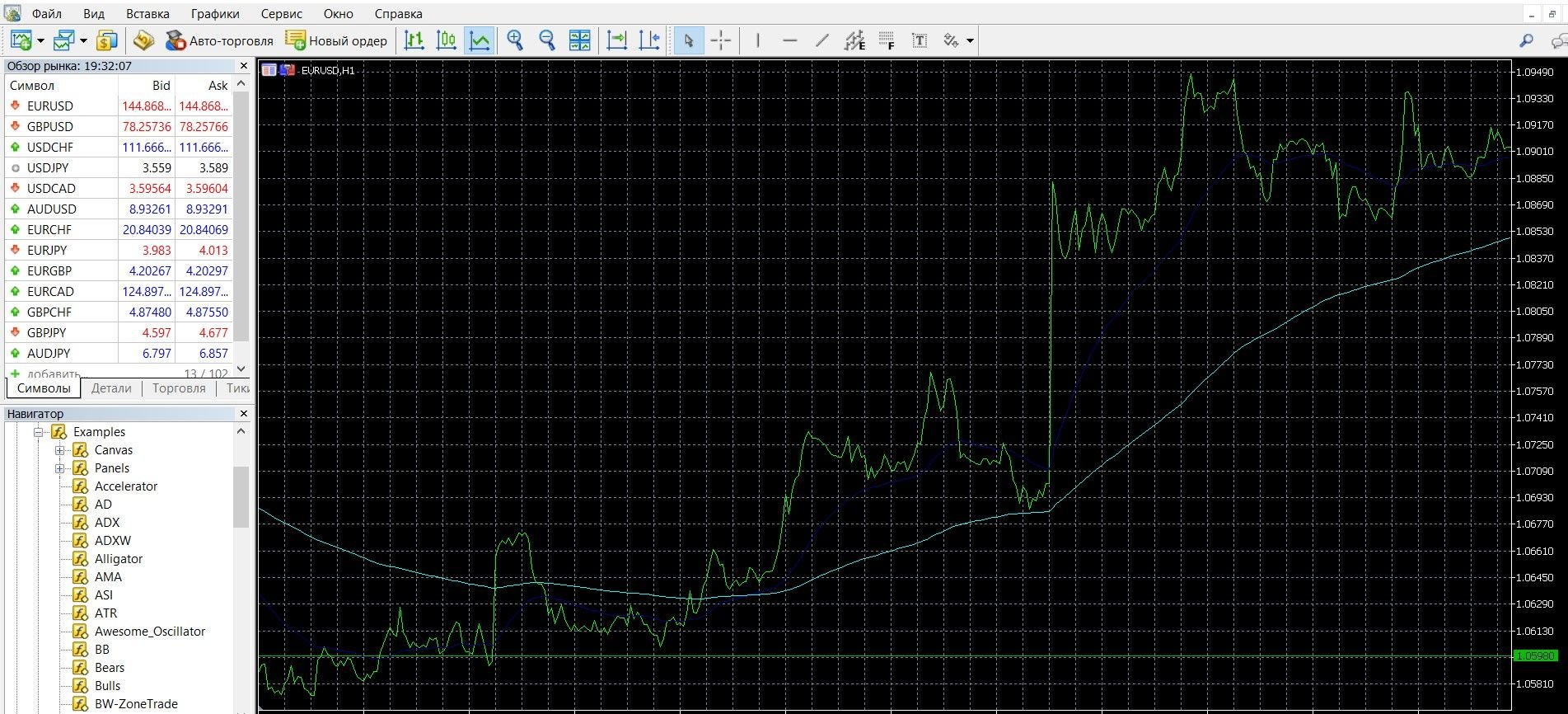

In the image below, you can see the EMA indicator (periods 20 (dark red line) and 80 (light pink line) on the price chart on the MetaTrader 4 platform:

Smoothed Moving Average

The Smoothed Moving Average (SMA) is a very interesting indicator that pays special attention to a large time frame. Here, the oscillations of the line are small, because it is called smoothed. Such a line does not give clear data, but it is less sensitive to market fluctuations and gives fewer false signals. For the line to change, there must be a significant fluctuation in the market. And yet, few traders use this moving average because of the specifics of its construction.

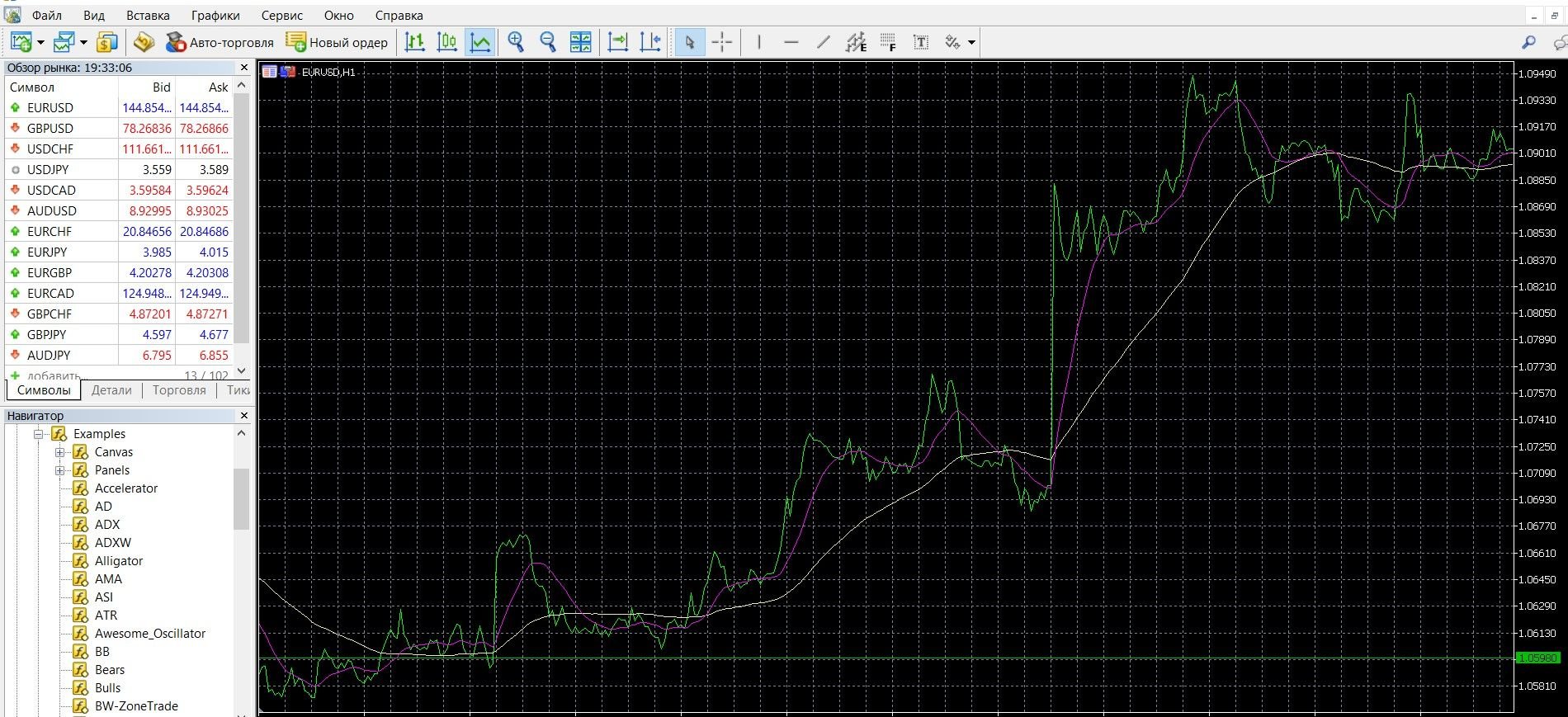

It is worth using a smoothed moving average for long-term trading, because. It works well with long periods of time. In the image below, you can see the SMMA indicator (periods 20 (dark blue) and 80 (light blue) on the price chart on the MetaTrader 4 platform:

Weighted Moving Average

This moving average also gives a lot of importance to new information compared to old data, but makes it simpler and more pronounced. Weighted moving averages show the average value of the price for a specific time interval, each period is multiplied by a weighting factor. As a result, earlier values have less weight, and new values have more weight, which affects the sensitivity of the indicator to recent price changes. It is important to monitor its performance, because It gives a lot of false signals.

This indicator will help to eliminate a significant disadvantage of simple moving averages, which pay attention to prices regardless of the distance from the current cost. A weighted moving average pays more attention to prices closer to the current option price. Working with it is simple: when the curve is directed downwards, it is a signal to buy a PUT option, if it is up, it is a signal to buy a call option.

In the image below, you can see the behavior of the WMA indicator (periods 20 (pink) and 80 (light pink) on the price chart on the MetaTrader 4 platform:

Please note: MA and exponential moving averages are especially popular in trading today, if the first moving average is more “lazy”, then the second one is the most dynamic. And yet, what exactly to use in trading, each market participant decides individually and on the basis of his strategy. For short segments, it is better to use the exponential average, for long segments – a simple MA. Remember that all moving averages have undeniable advantages, it is not for nothing that they are included in a large number of effective strategies.

How to add Moving Averages to MetaTrader 4

The MA indicator is a classic tool that is available in most modern trading terminals. It is also installed on the MetaTrader 4 platform. If you don’t have MetaTrader 4, you can download it here.

To add an oscillator to the main price chart in the MetaTrader 4 platform, you need to take the following steps:

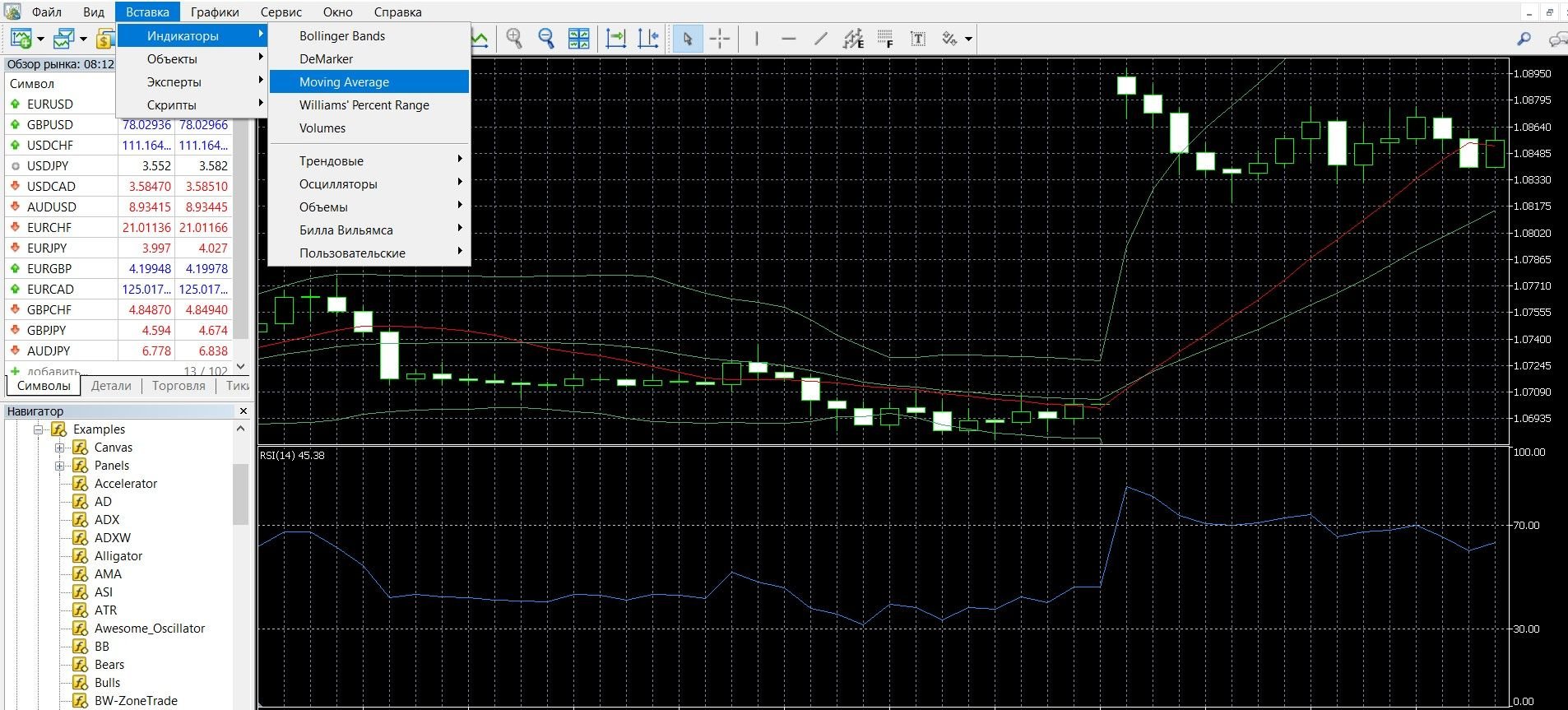

1. Click the “Insert” tab in the top menu of the platform

2. Select the “Indicators” tab

3. In the drop-down menu that opens, select the “Trending” tab

4. In the drop-down menu that opens, select Moving Average

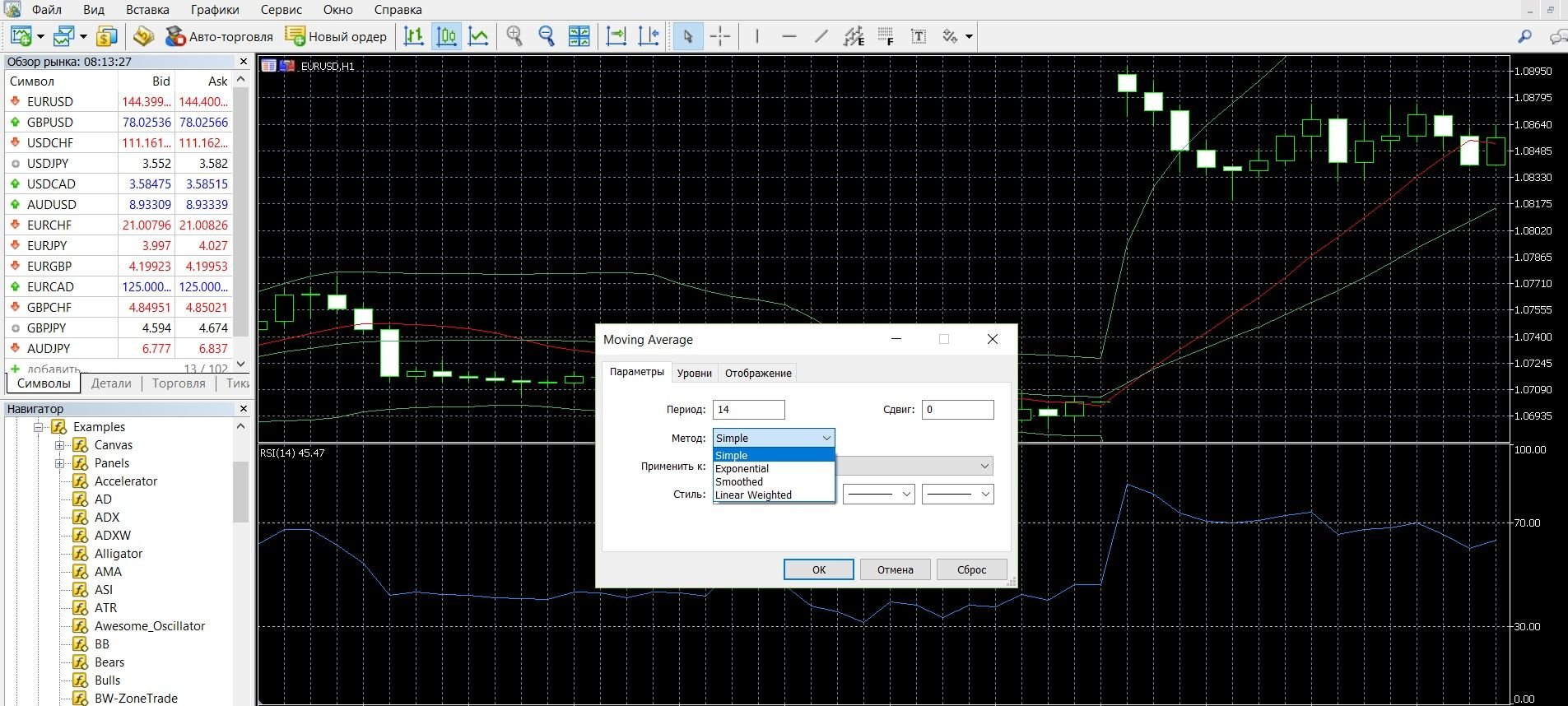

5. In the active window that opens, leave the Period parameter in the standard position: 14. Further, you can change the value of the period in any direction and analyze the data obtained. Also in the MT4 terminal (section “MA Method”) you can add several types of averages to the main chart: exponential, smoothed, weighted.

6. The schedule is formed, you can work with the information:

If your platform doesn’t have a Moving Average, you can download it here. You can see the instructions for installing indicators in MetaTrader 4 here.

Trading in Finmax based on Moving Averages

For productive trading with the Moving Averages indicator, we recommend choosing a reliable broker Finmax. It is simple and comfortable to work here, you have access to a choice of oscillators (including Simple Moving Average), a convenient personal account. You can see what the terminal workspace looks like by going to the finmaxbo.com website:

Also, for effective forecasting of signals on the market, we recommend working with the popular MetaTrader 4 terminal, where you can set any Moving Averages to the main price chart.

Take advantage of the MetaTrader 4 platform and, based on the information of the Moving Averages, as well as other indicators, place bets in the Finmax terminal. In the image below, you can see the upward trend on the MetaTrader 4 platform:

To buy an express CALL option in the Finmax trading terminal, you need to do the following:

1. Go to the broker’s website finmaxbo.com and prepare an option, indicating:

2. Type of asset

3. Expiration

4. Bet size

5. Forecast of quote movement: UP

6. Click the “buy” button and follow the results.

In the image below, you can see the downward trend on the MetaTrader 4 platform:

To buy an express PCI option in the Finmax trading terminal, you need to do the following:

1. Go to the broker’s website finmaxbo.com and prepare an option, indicating:

2. Type of asset

3. Expiration

4. Bet size

5. Forecast of quote movement: DOWN

6. Click the “buy” button and follow the results.