DMI (Directional Movement Index) indicator

Description

Binary options trading attracts an increasing number of those who would like to make money on the Internet. Trading can be safely considered almost the only way to quickly get real money in unlimited quantities, no matter what you prefer, express trading or long-term options. All earnings can be withdrawn in any convenient way and spent as you want.

And yet, most market participants are beginning to wonder how to get the most out of trading. To do this, you need to take into account the peculiarities of the market in your work, use oscillators, try strategies, consciously choose a trading terminal, and be aware of broker ratings. All this useful material for your work is presented on our portal, where you can always familiarize yourself with it. Today we will talk about the DMI trend indicator.

The Directional Movement Index (DMI) is a technical indicator created in 1978 by financier Wells Wilder to assess the vector and strength of market trends. The concept of DMI is described in the work “New Concepts in Technical Trading Systems”. This interesting tool includes the ADX indicator and is an important part of it, both tools are identical in operation.

DMI is able to identify powerful dynamics at the earliest stages, especially effective during long-term trading. In this case, to study the current forces of the market, the alignment of forces of sellers and buyers is taken as a basis. By analyzing the data, the indicator determines the total amount of price movements for a specific interval.

As a standard for a trader who works with trend instruments, entering a trade is entering at the beginning of a new dynamic, but this is sometimes difficult to do. It is important to see not only the emergence of a new trend, but also to understand how strong it is in order to implement a new trend. There are many tools in options that measure momentum, but most often they generate false signals. The exception is indicators that detect new impulses by measuring the strength of buyers and sellers. DMI is such an effective and reliable tool.

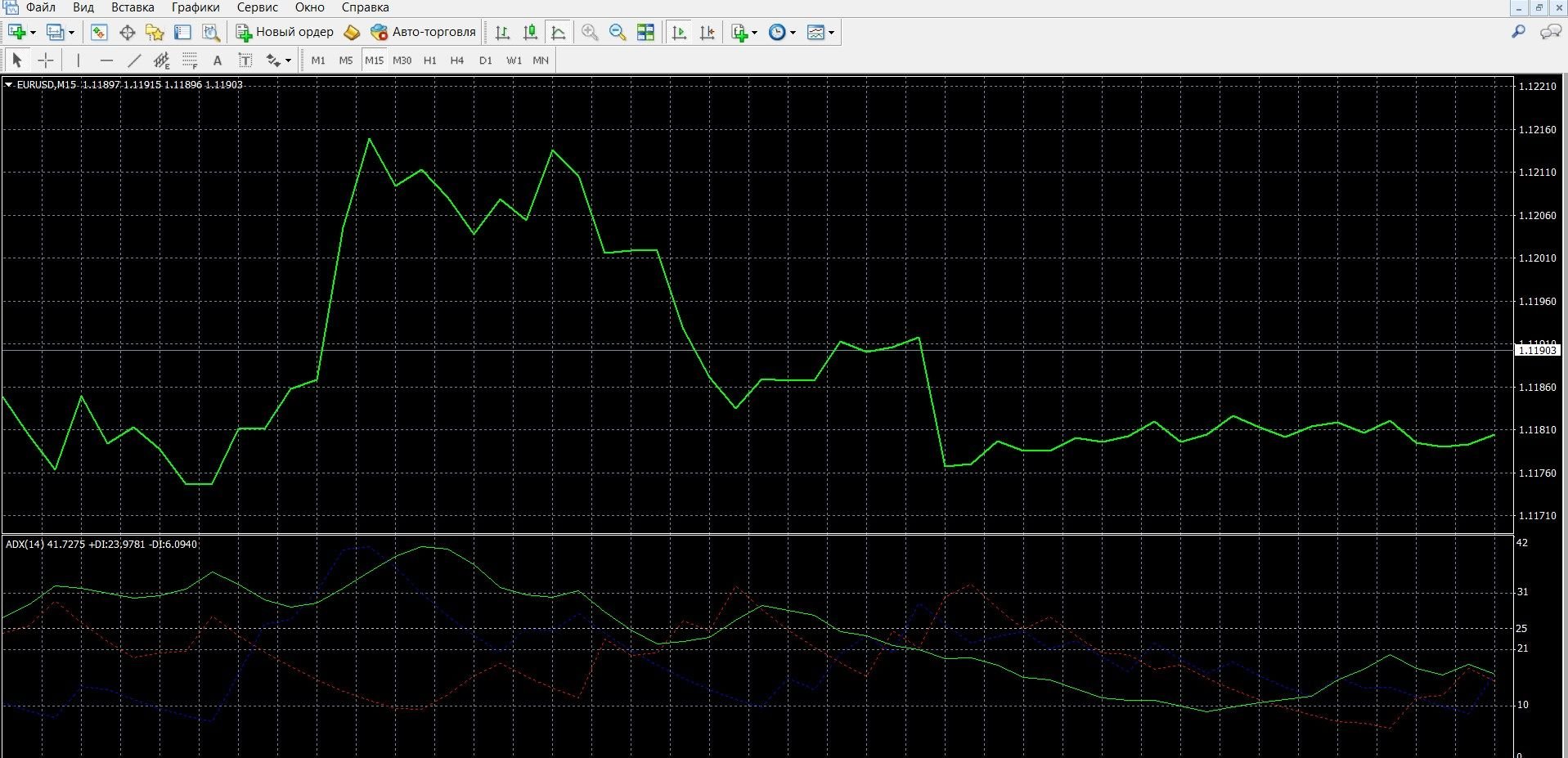

You can see what the DMI looks like on the MetaTrader 4 (MT4) platform in the image below. You can also download the MetaTrader 4 platform and get acquainted with the oscillator in operation.

In the presented image, the indicator consists of three lines, which are indicated:

- directional indicator + DI – blue line,

- directional indicator –DI – red line,

- ADX is a green line.

What is the working principle of the DMI indicator?

DMI is a productive and accurate technology for determining the movement of trends, the difference of which is in the analysis of price lows and highs. Collecting data for display, the DMI examines both sides of the market, sellers and buyers, then determines the total sum of trend directions: with a positive result, bulls dominate the market, with a negative result, bears.

Working on the new indicator, the author believed that the market is in a state of trend only 30% of the time, the rest of the time is spent on a sideways state, the formation of a trend. To minimize losses in between the trend, a DMI has emerged, which not only determines the current trend, but also studies the strength of the market movement. The indicator is based on:

- DMI+, showing a bullish trend,

- DMI-, showing a bearish trend,

- ADX, which displays the average index of directional movement.

The first line is positive, the second is negatively directed. Together, these lines generate a signal, which is then given to the trader to carry out PUT and CALL trading. So, in order to add the indicator to the main price chart, you just need to add the standard ADX indicator. The indicator values are located within the range from 0 to 100, the higher the indicator, the stronger the dynamics. So, if the curves are located above 25, there is a strong unidirectional trend in the market.

A curve with a negative value is a component of the ADX, which is used to fix a bearish trend: if it grows, this is the probability of a continuation of the downtrend.

A curve with a positive value usually moves in the same direction as the price, when prices rise, it will rise, when the price decreases, it will fall. In the event of a sharp increase, the chances of continuing the upward trend increase. The values of this curve are always the opposite of those of the curve with a negative value. This line is considered a key line in the calculation of the ADX index.

DMI indicator signals:

+D L and –D L intersection signals:

- If +DL moves upwards, crossing -DL from bottom to top, this indicates a reversal towards an uptrend, you can buy call options;

- If the -DL line, moving upwards, crosses +DI from bottom to top, this indicates a reversal in the direction of the downtrend, you can buy put options.

Almost all signals of the indicator are focused on breaking through the level of 25, which is a reliable confirmation of the situation.

Divergence signals:

A more reliable signal is the divergence of +DMI and –DMI and the price chart:

- If the price chart forms an extremum, and the DMI shows the opposite situation, we have a divergence, a signal of an imminent market reversal, you can buy call options.

ADX signals:

ADX, filtering signals, shows whether there is a trend in the market or not:

- If the ADX line is growing, and the +DI line is above -DI, this is an uptrend, you can buy call options,

- If the ADX line rises and +DI falls below -DI, this is a downtrend, you can buy put options.

Do I need to install the indicator in your platform?

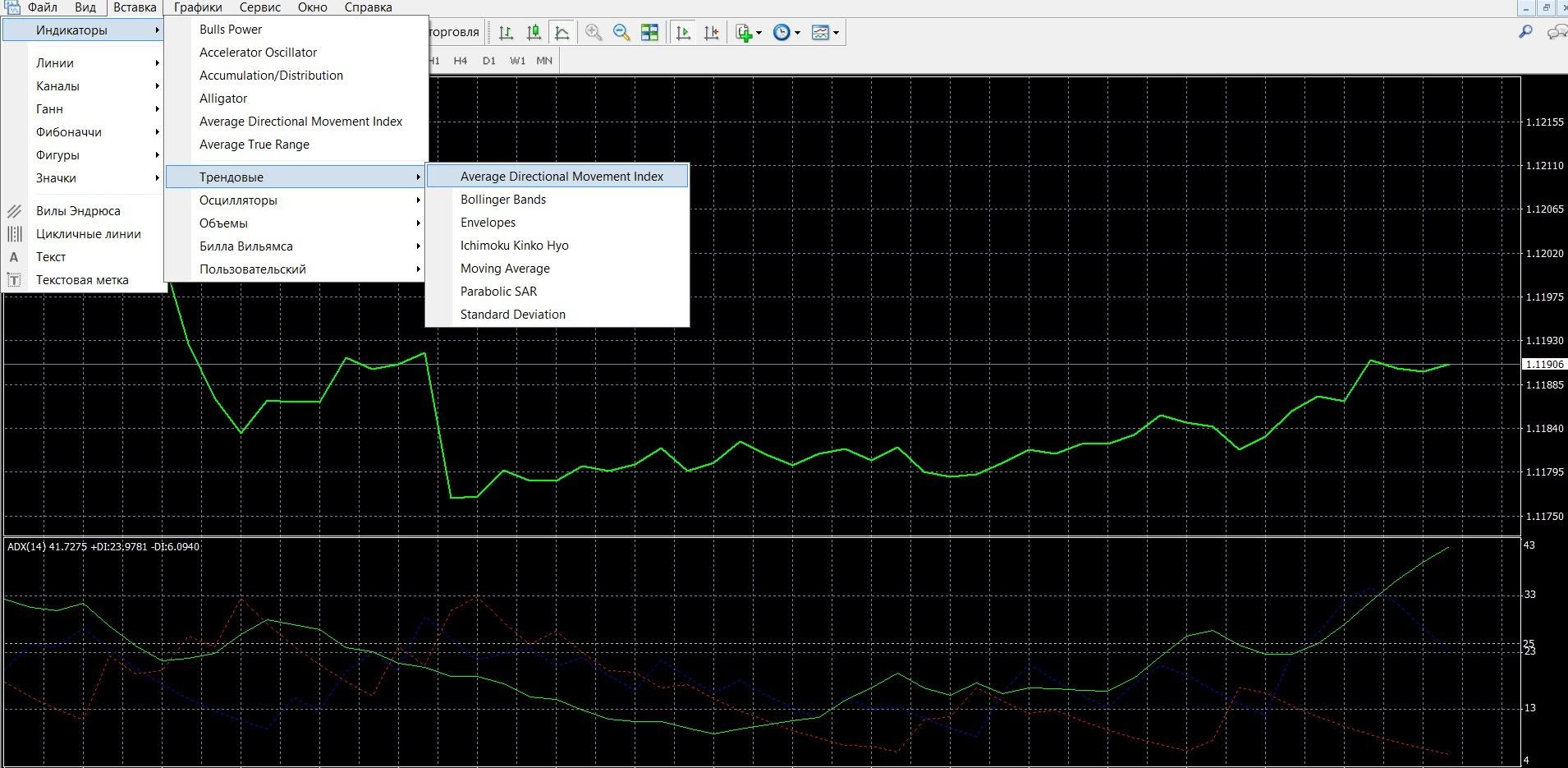

DMI is part of the ADX indicator, which is in the MetaTrader 4 platform, so you can add it to the price chart by following these steps:

- Click the “Insert” tab in the top menu of the platform

- Select the tab “Indicators” – “Custom”

- In the drop-down menu, select “ADX”. The indicator has been added to the chart, you can work with its data.

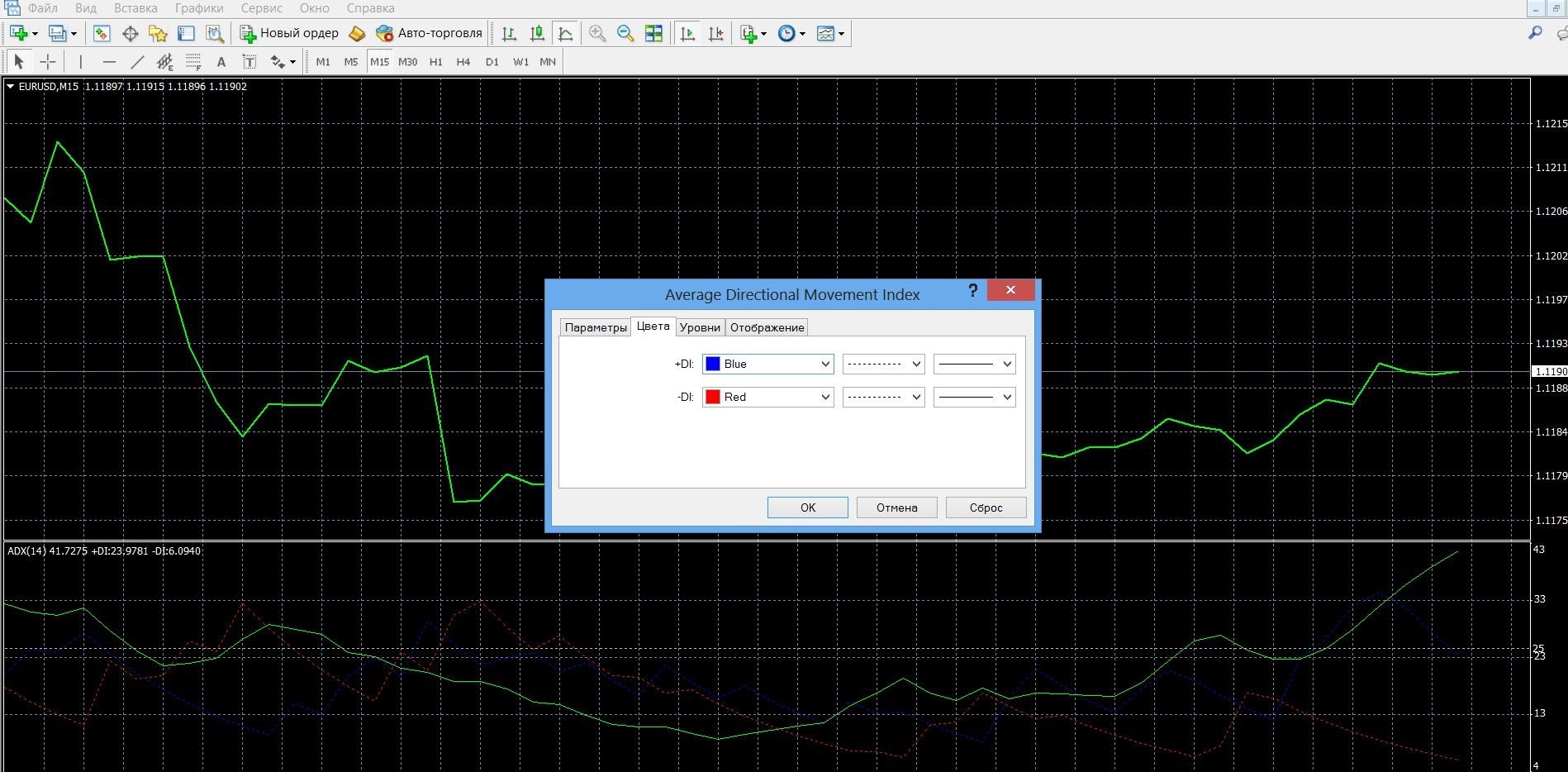

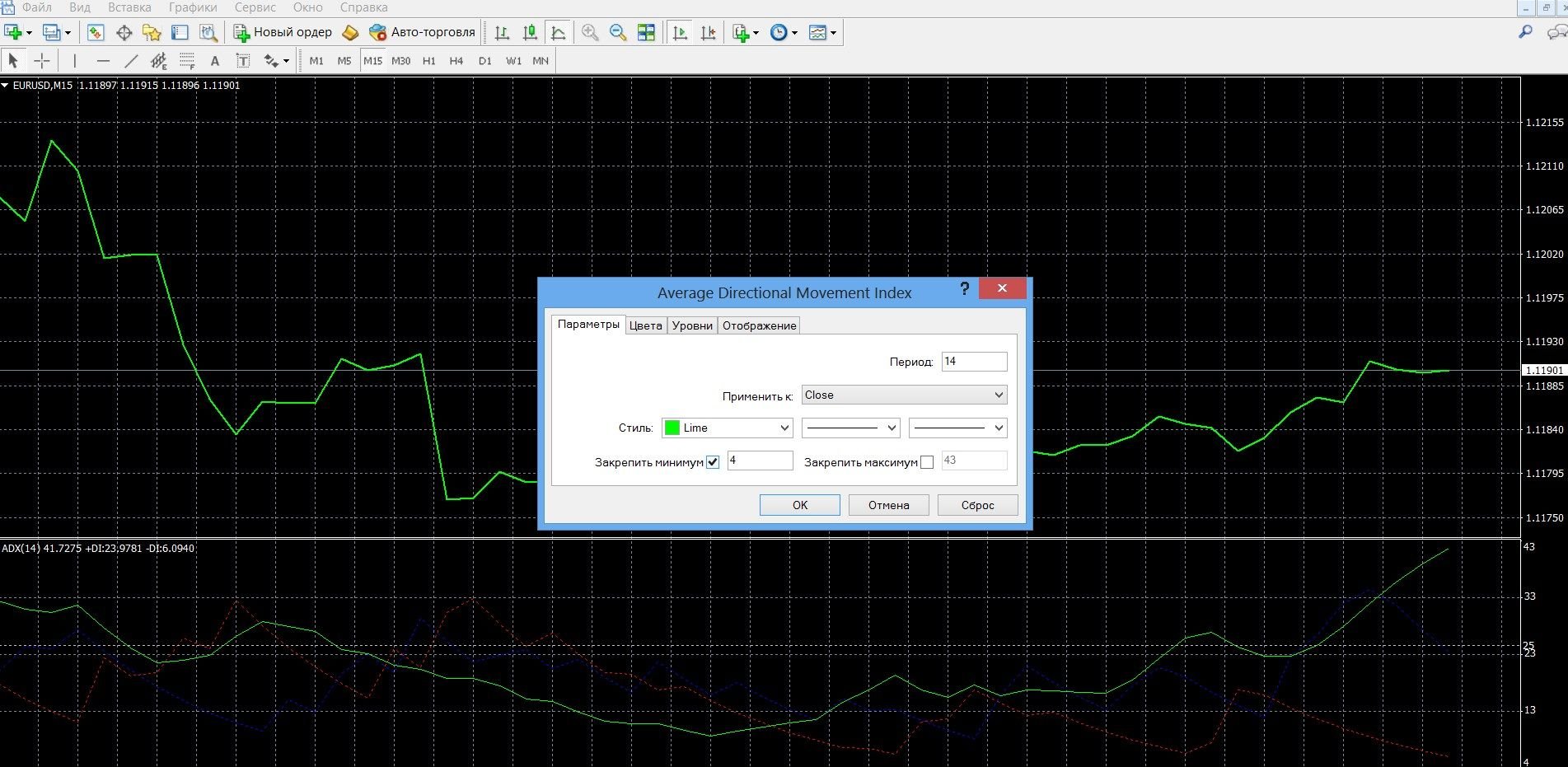

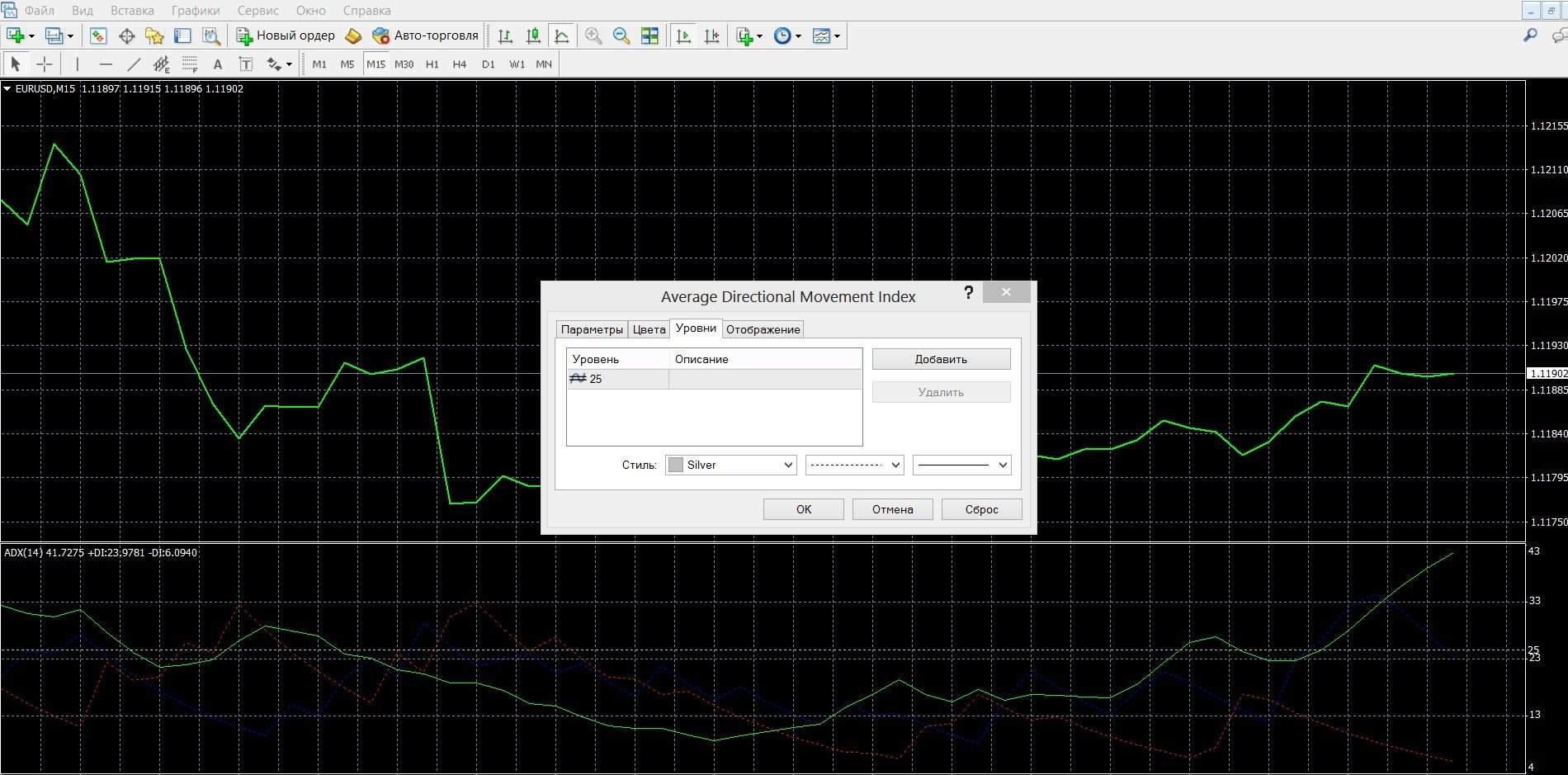

To work, you can use the standard settings or change them according to the strategy. When adding the ADX indicator, you need to connect a level – a line with an indicator of 25, on the basis of which the indicator readings are built.

If you don’t have the DMI indicator, you can download it here.

Application of the indicator for binary options

DMI is one of the most effective tools for a trader, which will help not only to identify a powerful trend, but also to study the strength of the market at a particular moment. Often, for effective trading, it is important to understand the strength of the trend, which allows you to make an indicator that measures the strength of sellers and buyers.

In addition to determining the strength of the emerging trend, this tool signals the divergence of the market. It is better to use it for these signals, because. in such a case, the DMI provides a large potential profit.

Working perfectly in the formation of a trend, the tool is ineffective when the market is flat. The behavior of the +DMI and –DMI lines determines the volatility of the market:

- the more they diverge from each other, the higher the volatility;

- If the distance between them is lower, there are also frequent intersections – this is a sideways state of the market, it is worth waiting it out.

With low market volatility, the DMI gives a lot of false signals, in this case it is recommended to use it as an auxiliary tool to avoid a large number of false signals. On the contrary, in the case of increased market volatility, its signals are accurate.

For effective trading, you should use the following rules:

- If the -DL line rises and crosses the 25 mark, it is a bearish trend.

- If the +DL line rises and crosses the 25 mark, it is a bullish trend.

- If the lines are intertwined with each other, they move below the 25 mark, the market is flat.

The “25” mark is an important level and its breakout indicates a strong momentum of price movement.

DMI can be perfectly used as the main or additional tool in your own profitable strategy. It behaves perfectly in any timeframe, on any assets. One drawback of the indicator is that in case of low market volatility, it is not effective and gives false signals, so it is recommended to combine it with other instruments.

DMI is a powerful tool, perhaps one of the best, which helps to make a profit at the very beginning of trend formation. With it, you can build many profitable trading systems.

Rules for concluding transactions (screenshots)

Trading at the +DL and –DL crossover signal

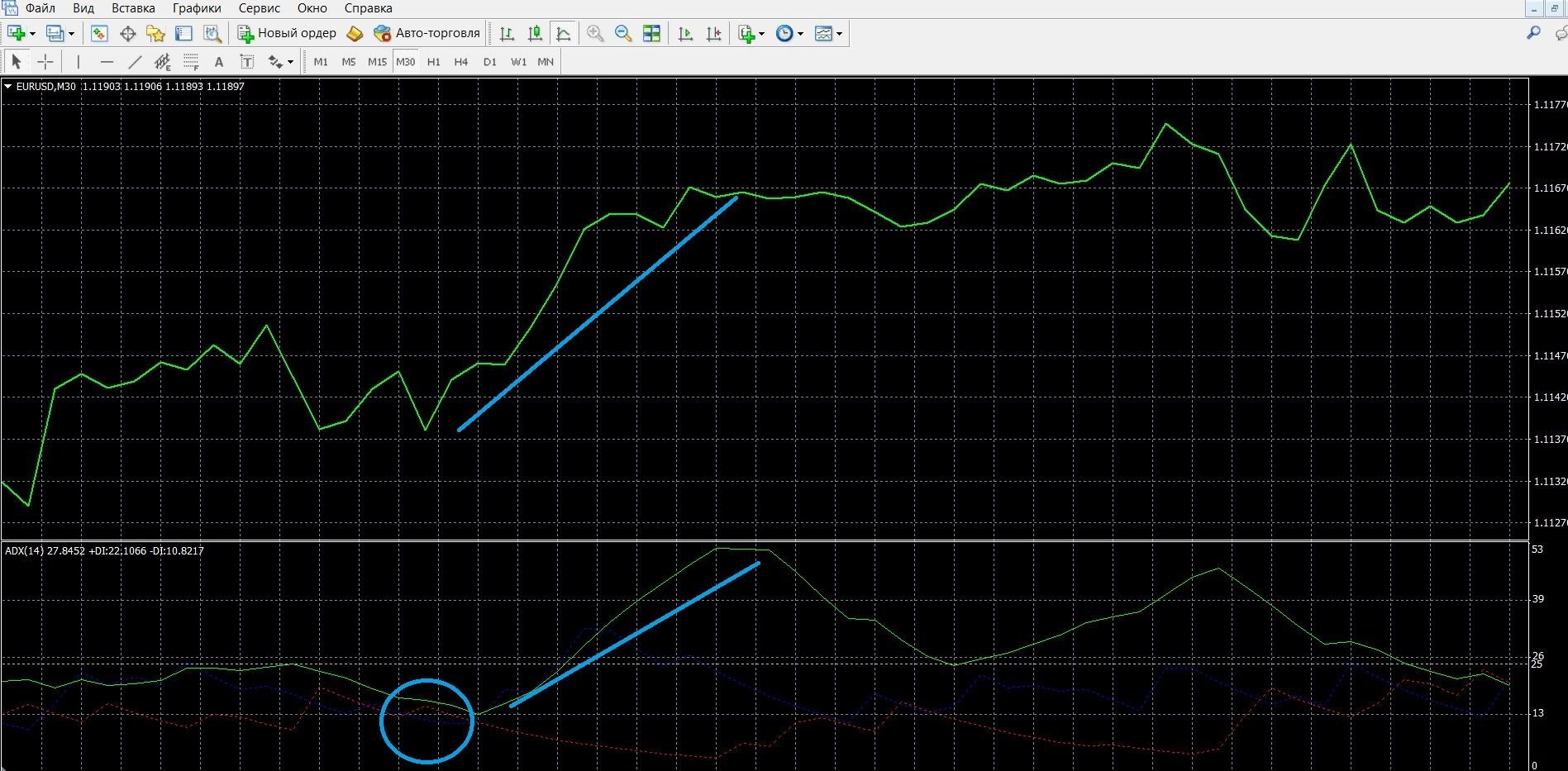

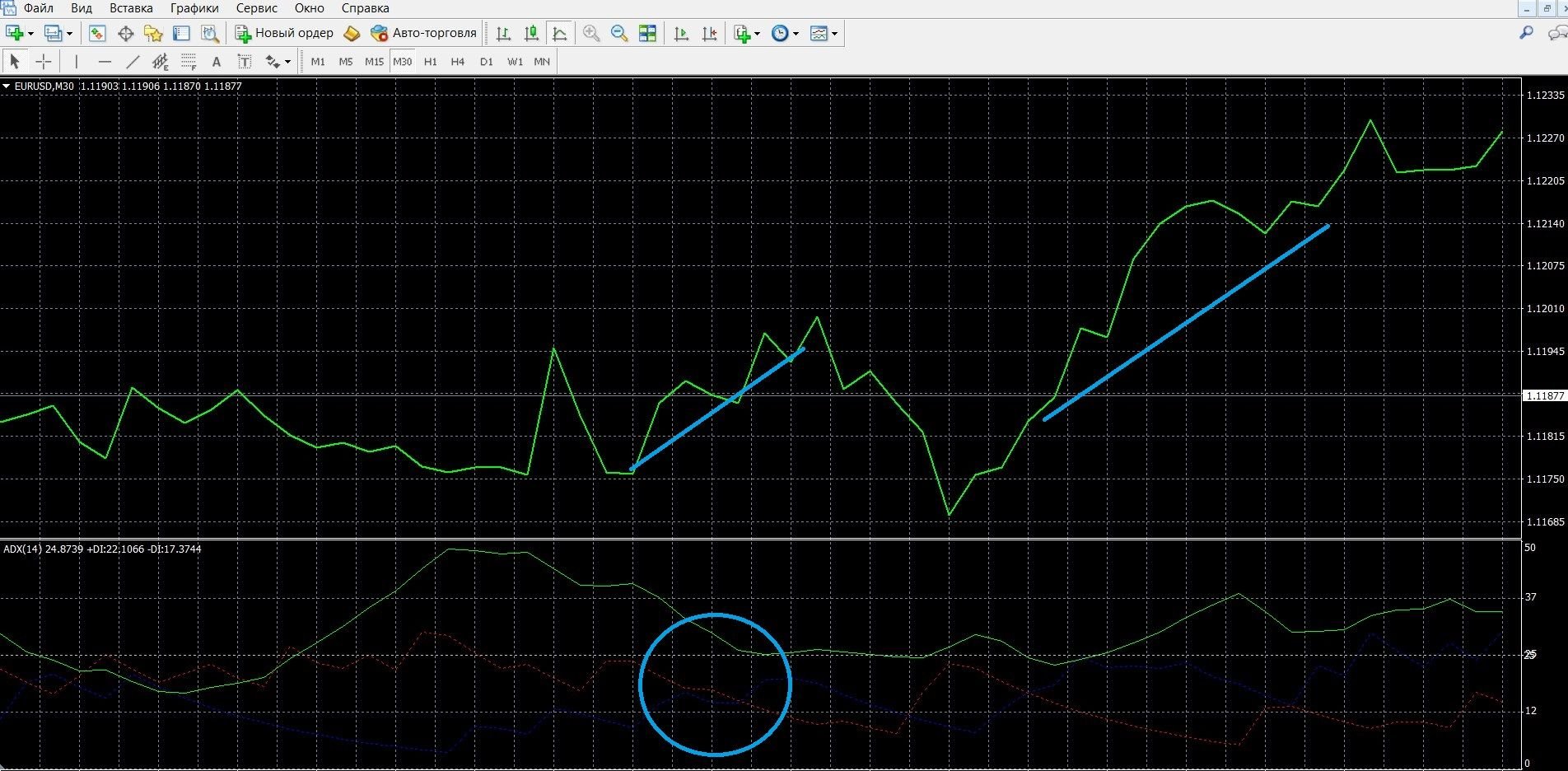

If +DL moves upwards, crossing -DL from bottom to top, this indicates a reversal towards an uptrend, you can buy a call option. In the image, you can observe an upward trend on the MetaTrader 4 platform:

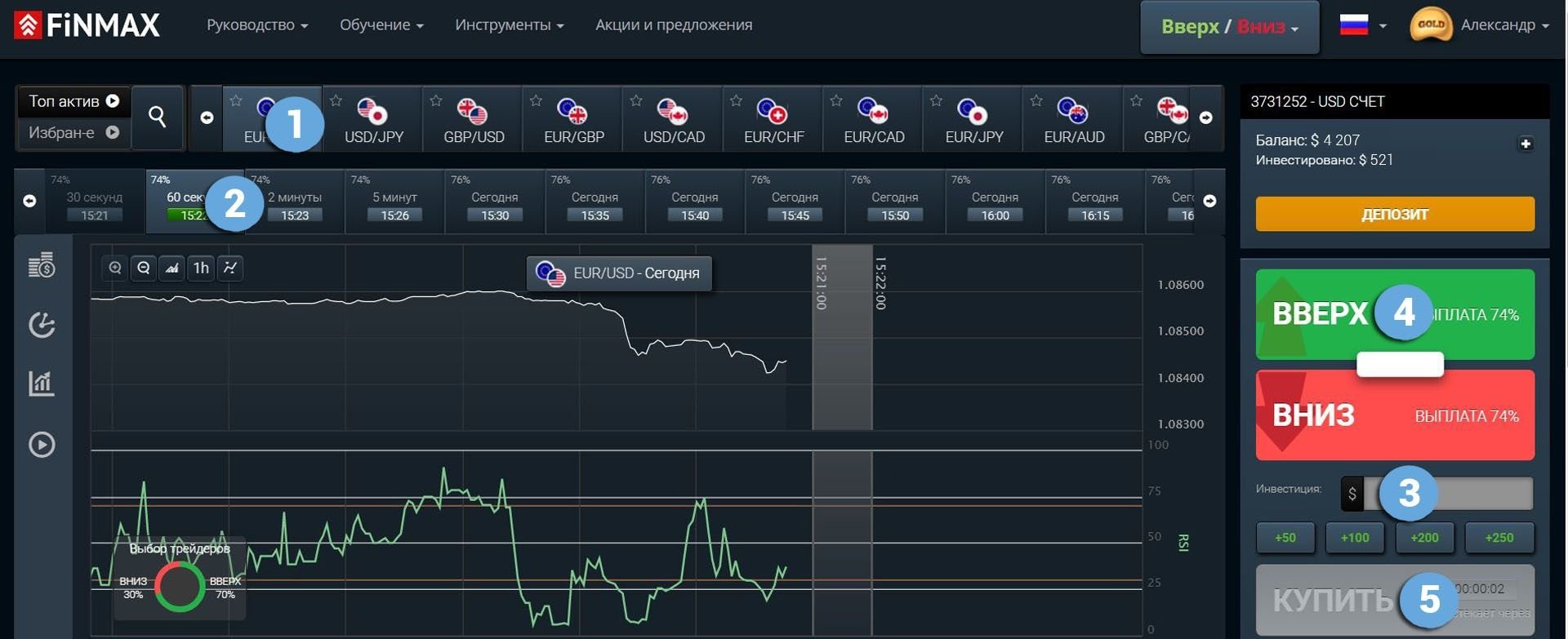

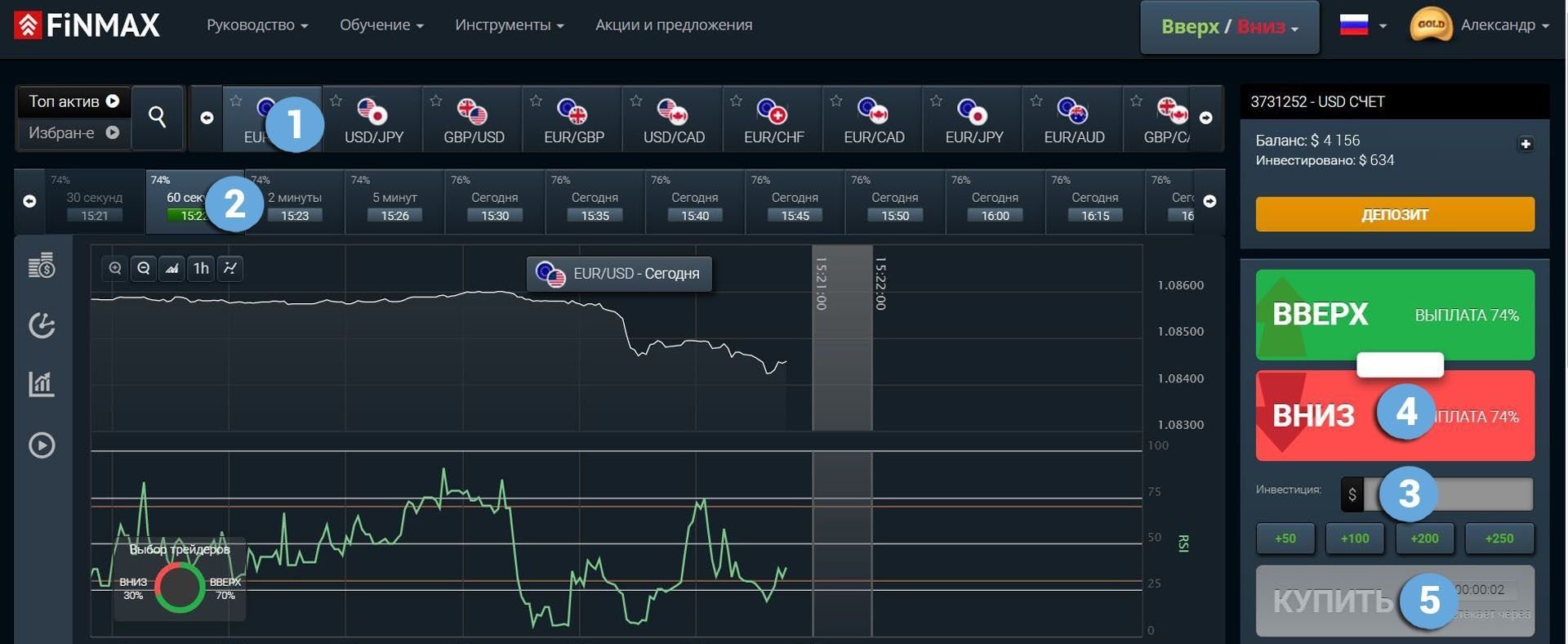

Using the signal, make a profitable CALL bet with the Finmax broker by going to the finmaxbo.com website and preparing an option, indicating:

- Option

- Expiration

- Amount

- Prediction: up

- Next, it remains only to click on the “buy” button and wait for the results:

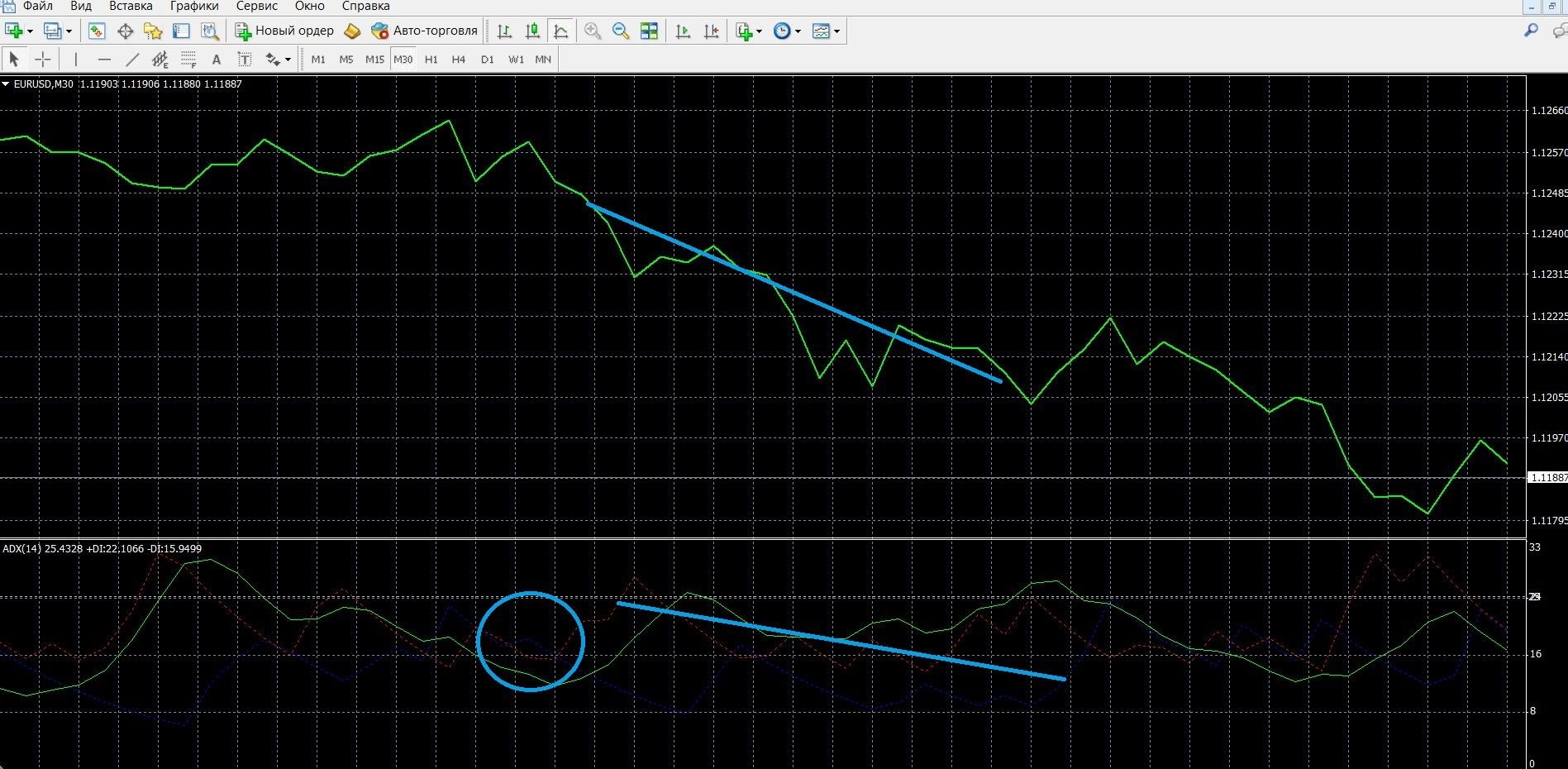

If the -DL line, moving upwards, crosses +DI from bottom to top, this indicates a reversal in the direction of the downtrend, you can buy put options. In the image, you can observe a downward trend on the MetaTrader 4 platform:

Using the signal, make a profitable PCI bet with the Finmax broker by going to the finmaxbo.com website and preparing an option, indicating:

- Option

- Expiration

- Amount

- Prediction: down

- Next, it remains only to click on the “buy” button and wait for the results:

Trading with a DMI divergence signal

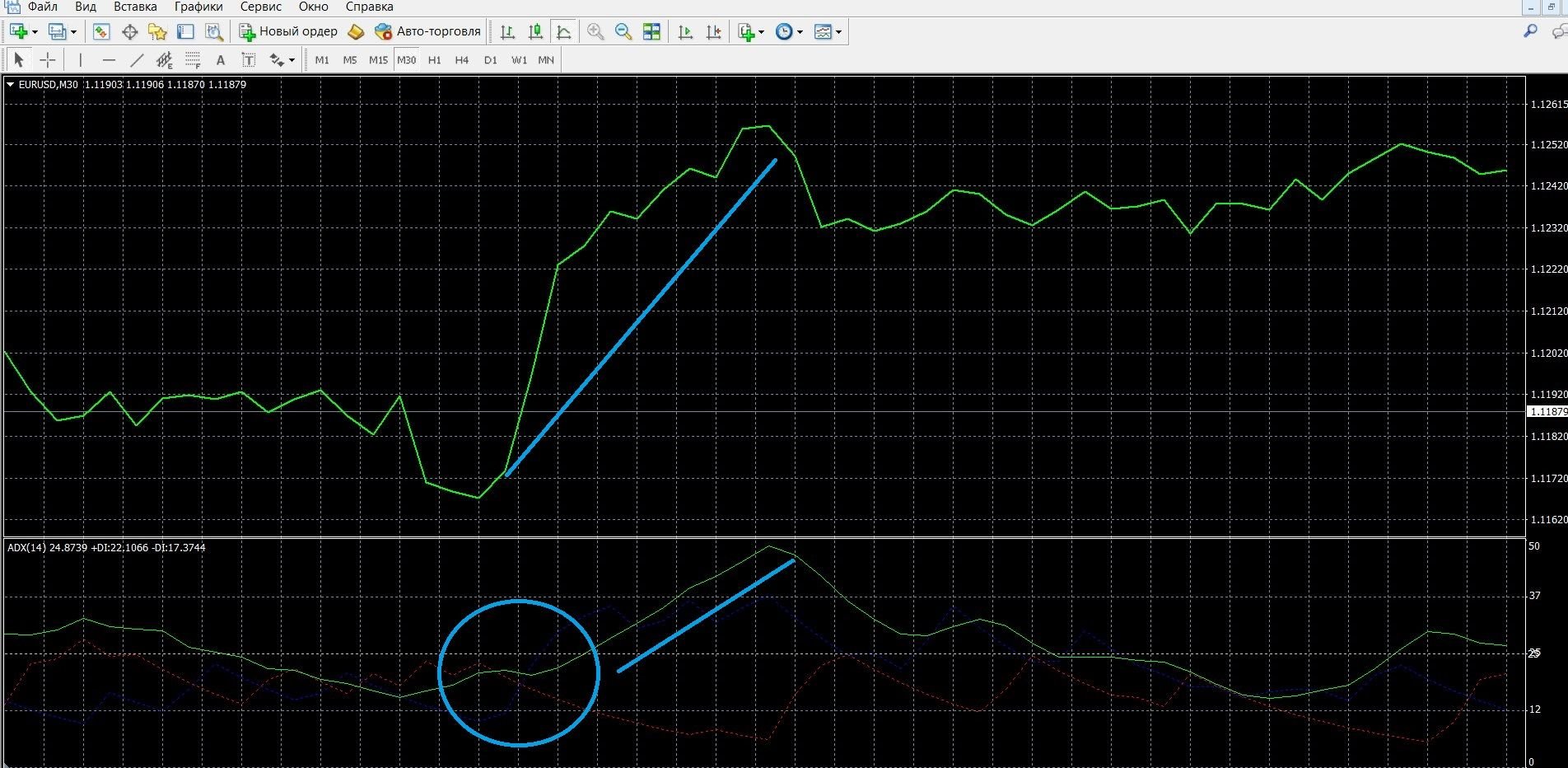

If the price chart forms an extremum, and the DMI shows the opposite situation, we have a divergence in front of us, you can buy call options. In the image below, you can see an uptrend on the MetaTrader 4 platform (take advantage of the moment and place a CALL bet on the finmaxbo.com broker’s website, instructions are presented above):

Trading with ADX signals

If the ADX line is growing, and the +DI line is above -DI, this is an uptrend, you can buy call options. In the image below, you can see an uptrend on the MetaTrader 4 platform (take advantage of the moment and place a CALL bet on the finmaxbo.com broker’s website, instructions are presented above):

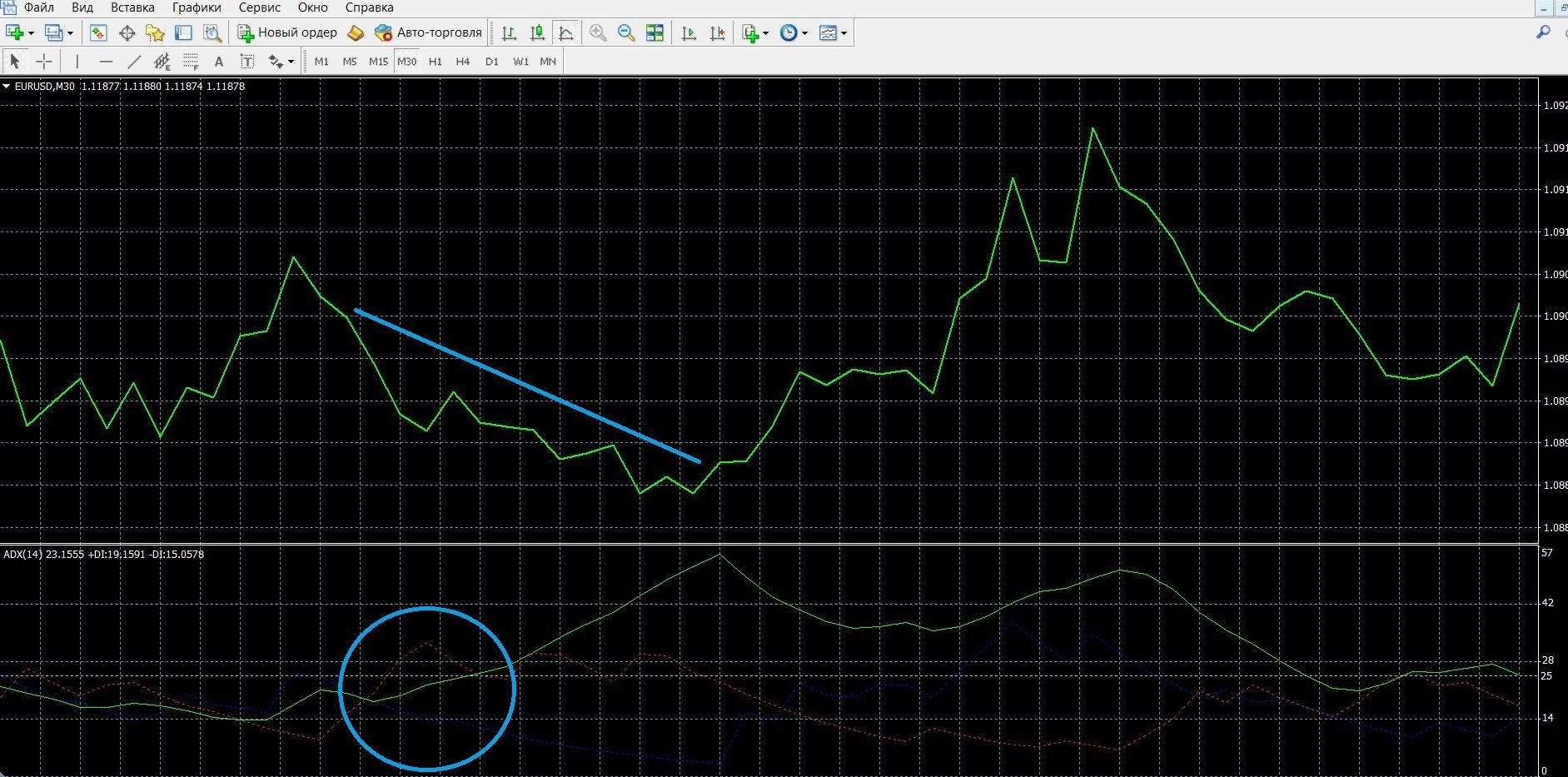

If the ADX line rises and +DI falls below -DI, this is a downtrend, you can buy put options. In the image below, you can see the downtrend on the MetaTrader 4 platform (take advantage of the moment and place a PUT bet on the finmaxbo.com broker’s website, instructions are presented above):

Money management

Applying the rules of money management is the key to your successful options trading. Especially if you are going to reach a stable income from trading, the basics of money management are what you should start working with right now.

At the same time, it doesn’t matter if you are a professional or a beginner, paying attention to money management, you will be able to build effective money management: you will learn how to spend account funds economically, how to use them in trading so that they are always on deposit, giving you the opportunity to earn further money. Money management will help solve these and many other important issues:

Minimum money: it is recommended to use the minimum possible amount for the transaction; allocate no more than 5% of the deposit for trading; participate in those transactions whose prices are less than your account. Using these simple basics in trading, you can save your capital for a long time.

Minimum deposit: it is recommended to use a minimum deposit; do not bet the entire amount on participation in one transaction; always know that your funds will still be useful for work; Consciously work with the personal capital of the deposit: after you have transferred the amount to the account, it is better to immediately allocate a free limit that can be traded and go beyond its limits. Using these simple basics in trading, you can save your deposit.

Minimum assets: it is recommended to participate, especially for novice traders, in with 2-3 assets; When you have mastered the peculiarities of working in the market and feel confident, increase the amount of investment by trading several transactions. Using these simple basics in trading, you can make your work productive.

Minimum emotions: it is recommended, when participating in the auction, to immediately tune in to serious work; always remember that your mood affects the effectiveness of trading; It has long been proven that excessive emotionality interferes with productive work, does not allow you to concentrate and correctly analyze the situation. Using these simple basics in trading, you can achieve more in options.

Expiration

As well as money management, the correct use of expiration in trading will be one hundred percent key to success in options. Expiration (from the English Expiration, “end”) is the moment when the trading of assets has ended, the participants are informed about the results of the work and whether the accounts will be replenished with funds in the event of a positive outlook. In many ways, a well-thought-out expiration is your profitable strategy that will bring you a stable profit.

Types of options:

- Ultra-short options – 30 seconds – 5 minutes.

- Short-term options – 10 minutes – several hours.

- Medium-term options – a day – a few weeks.

- Long-term options – a month – six months.

Is it allowed to extend the expiration?

It is allowed, but not on all trading platforms. If during trading you realize that your forecast is wrong, you can safely extend the expiration by reducing your losses.

Expiration rules:

- For traders who are only taking their first steps in options, it is better to initially work with long-term expiration, the big advantage of which is stable trading with minimal risks to your funds.

- For traders who already have extensive experience in options, it is better, when choosing expiration, to be based on a more comfortable trading style. In addition, when choosing a broker, find out if there will be an opportunity to increase expiration during trading, which will minimize your losses in case of an incorrect outcome.

- Market participants who want to get instant money from trading, it is better to work for this with a short-term (minute – several hours) expiration, which will bring the first money in 30 seconds. In this case, always keep in mind the risks of turbo trading.

- Market participants who want to receive stable money are better off working with long-term expiration, which has a more relaxed trading style, it is predictable and less risky.

Expiration in strategies with DMI

Expiration at the intersection signal +D L and –D L

Short-term trading: allowed; is characterized by increased risks; It is worth using additional indicators in order to avoid false signals and get a good income.

Medium-term expiration: allowed; With such trading, you can observe the strength of the market more, use indicators and make the right forecast.

Long-term expiration: also allowed; With such trading, you can use all the accumulated experience: functional and technical analysis, indicators and trading strategies, all this will allow you to achieve good performance.

Expiration at DMI divergence signal

Short-term trading: allowed; Despite the fact that express trading is characterized by increased risks, if you build the work correctly, you will get more than one productive deal.

Medium-term expiration: allowed; With such trading, you can more calmly observe the strength of the market, use indicators and make the correct forecast.

Long-term expiration: also allowed; With such trading, you can use all the accumulated experience: functional and technical analysis, indicators and trading strategies, all this will allow you to achieve good performance.

Expiration at ADX trend signals

Short-term trading: allowed; Despite the fact that turbo trading is, first of all, increased risks, if you build your work correctly, you will get more than one productive deal.

Medium-term expiration: allowed; With such trading, you can more calmly observe the strength of the market, see the results of these indicators and make the correct forecast.

Long-term expiration: also allowed; With such trading, you can use all the accumulated trading experience: functional and technical analysis, indicators and trading strategies, all this will make it possible to make the right forecast and get a good profit.

Expiration in the “DMI+Stochastic

“ strategy

We present to your attention a simple but productive trading strategy that uses the DMI and Stochastic indicators, combining the capabilities of a trend indicator and an oversold-overbought oscillator. The DMI will show entry points, while Stochastic will show oversold and overbought.

Short-term trading: allowed in such a profitable trading strategy, it will allow you to get high-quality signals and earn a decent income.

Medium-term expiration: allowed; Such an expiration in a calmer trade, using two reliable instruments, will allow you to get a good income.

Long-term expiration: also allowed; such trading, in addition to the opportunity to take advantage of reliable Stochastic and DMI signals, will allow you to apply knowledge in the field of fundamental and technical analysis, which will give you a decent income.

More and more immersed in trading, do not forget to pay attention to the study of the features of using expiration in order to determine a comfortable trading style for you. To do this, use the convenient terminal of our recommended broker Finmax. Among its advantages: a simple functional platform, a convenient personal account, the possibility of a large selection of options and expiration (from 30 seconds to six months), etc. Start implementing your profitable strategy now and go to the broker’s website finmaxbo.com.

Downloads

MetaTrader 4 (MT4) platform – download.

DMI indicator for the MT4 platform – download.