MACD indicator

Description

By publishing in-depth reviews of binary options oscillators on the INVESTMAGNATES.COM portal, we help make your trading training more productive and effective. The materials will tell you about the features of the tools and their settings, how to get a stable profit. Today you will get acquainted with the MACD technical indicator, which is very common among modern market players.

MACD or “ Moving Average Convergence/Divergence” is one of the most popular technical analysis indicators used to predict price dynamics, its work is based on the method of convergence / divergence of the average movement of the exchange rate. Or in another way, MACD allows you to see the direction of current market trends, shows reversal points.

The abbreviation of the oscillator stands for as follows:

MA stands for moving average,

C – convergence (convergence),

D – divergence (divergence).

MACD was created by American trader and analyst Gerald Appel and remains one of the most used in trading to this day. It is used to determine the trend in the market – downward or upward. To plot the indicator, you need two exponential moving averages (EMAs): fast (period – 12) and slow (period – 26). Curves are not plotted on the price chart, but the calculated difference between them is the MACD.

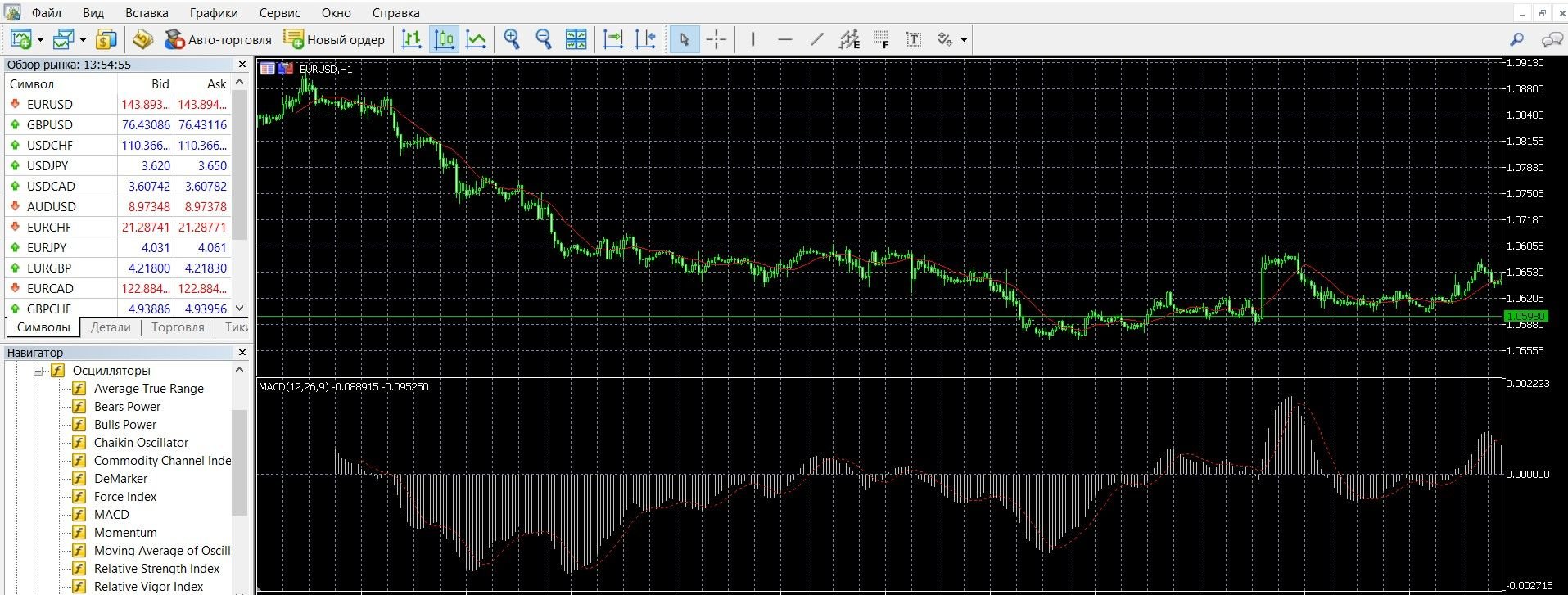

You can see what the MACD looks like on the MetaTrader 4 (MT4) platform in the image below. In addition, you can download the MetaTrader 4 platform and get acquainted with the oscillator in more detail.

What is the working principle of the MACD indicator?

MACD is easy to use, and, even more valuable, combines the capabilities of a trend indicator and a torque oscillator. In most cases, it is used as a trend indicator and to determine convergence and divergence. This tool helps to see in which direction the price will go, that is, its potential strength, to indicate probable reversals.

The indicator is based on the ratio of two moving averages of prices with periods of 12 and 26. Since both moving averages have different speeds, the fast one reacts to price changes faster than the slow one. When a new trend is formed, the fast average approaches the slow one and then crosses it. In order for traders to see the right moments to buy and sell options, there is a signal line on the chart – the indicator’s 9-period moving average.

Interestingly, the MACD allows you to enter a trade at the beginning of a trend and exit before it ends. Its difference from other oscillators is in the absence of upper and lower boundaries on the chart, so it cannot determine the overbought-oversold zones.

Like all technical indicators based on the use of moving averages, the MACD gives lagging signals. And yet, the oscillator qualitatively shows market trends, and trading according to its data can bring a good income.

Setting the main parameter of the instrument – moving periods, will affect the quality of the signal: the smaller the moving parameters, the more false signals; The larger the parameters, the more missed signals there will be. Usually, traders independently look for a suitable combination depending on the strategy.

Indicator signals:

Intersections:

Trading with MACD is based on the intersection of the indicator and its signal line:

- If the histogram crosses from bottom to top, it is worth buying a CALL option,

- If the histogram crosses the signal line from top to bottom, it is worth buying a put option.

Discrepancies:

The concepts of divergence and convergence are signals of divergence and convergence of the indicator line with the data of the main price chart. Such signals often indicate a weak trend that will be corrected, or it is worth waiting for a reversal:

- Divergence, or bullish divergence, occurs if the high price is not confirmed by the MACD data.

- Convergence, or bearish convergence, occurs if the price low is not confirmed by the MACD data.

The formula for calculating the indicator:

MACD = EMA(CLOSE, 12) – EMA(CLOSE, 26)

SIGNAL = SMA(MACD, 9), where:

EMA – Exponential Moving Average;

SMA is a simple moving average;

SIGNAL is the signal line of the indicator.

Info taken from www.metatrader5.com website

Do you need to install MACD in your platform?

MACD is a classic options trading tool, it is presented in most modern trading platforms. It is also available in MetaTrader 4.

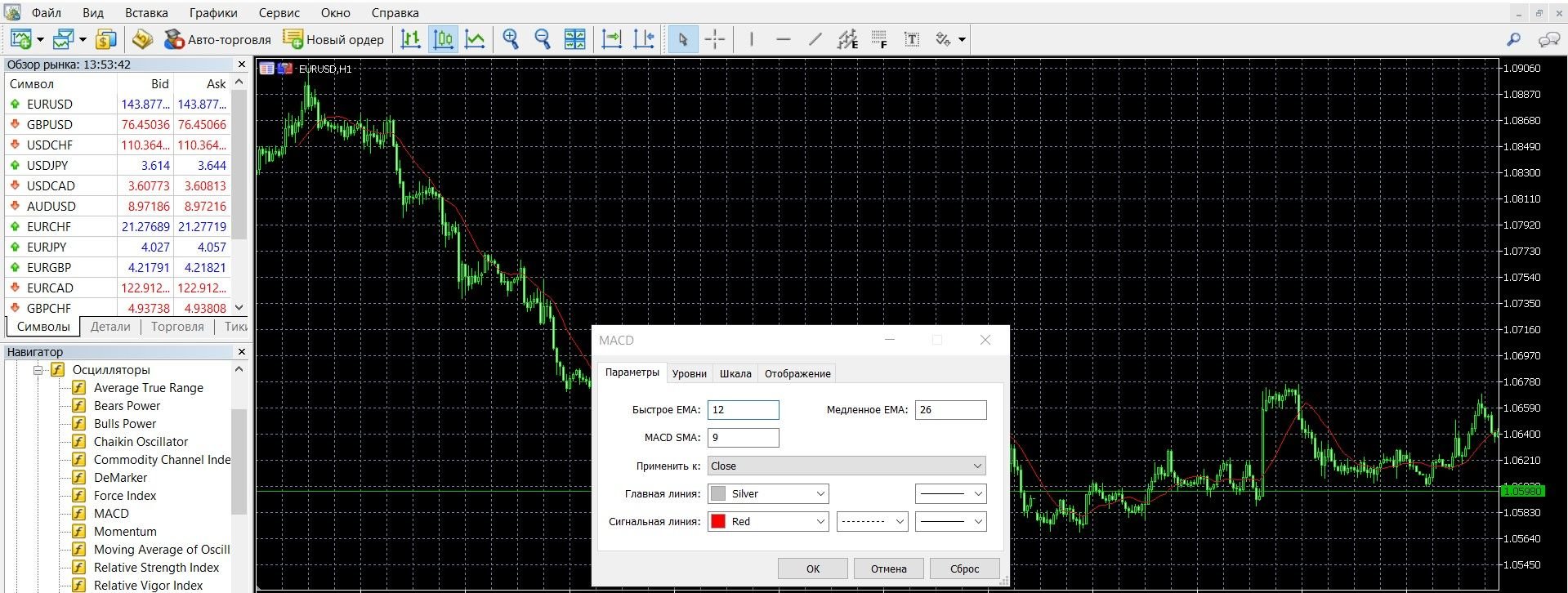

In the settings, you can work with the following indicators:

- the number of periods of the slower average,

- the number of periods of the faster average,

- mean period (the difference between the slow and fast average data).

If you set lower values for periods, the oscillator will record a lot of false signals. If you set large values, the oscillator will miss high-quality signals. It is recommended to use the standard numerical indicators: 12.26 and 9-day EMAs.

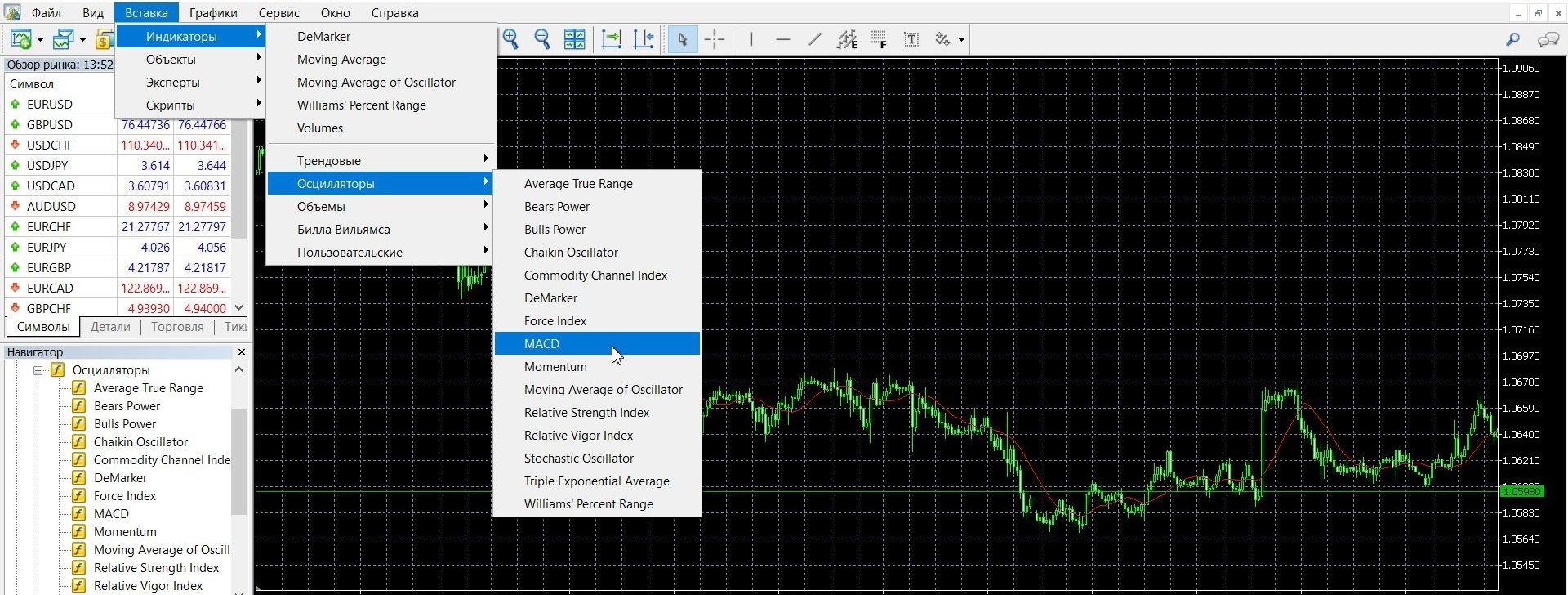

To add MACD to the main price chart on the MetaTrader 4 platform, you need to follow these steps:

1. Click the “Insert” tab in the top menu of the platform

2. Select the “Indicators” tab

3. In the drop-down menu that opens, select the “Oscillators” tab

4. In the drop-down menu that opens, select MACD. The indicator is added to the chart, you can work.

If your platform doesn’t have an indicator, download it here.

Application of the indicator for binary options

MACD, as mentioned above, is one of the most common instruments in options. It is especially effective at times of market fluctuations with a large amplitude in the trading corridor.

First of all, it is used to search for trends. Trading is based on the intersection of the indicator with its signal line: when the MACD is below the signal line, you can sell, when it is higher, you can buy.

One of the qualitative signals for action: the MACD crossing the zero line up and down. In addition, the indicator will help you make a decision to buy or sell an asset, allowing you to enter trading at the beginning of the trend and exit with its completion, which is convenient for market participants.

The indicator includes three indicators that are displayed in a separate chart:

- The black MACD line is a moving average that tracks the price of an asset.

- The red signal line is a moving average relative to the indicator. It smoothes the MACD data, interacts with it to receive signals.

- Histogram – shows the difference between the two above lines, shows the strength of the price momentum.

Rules for concluding transactions (screenshots)

Trading when crossing the signal line

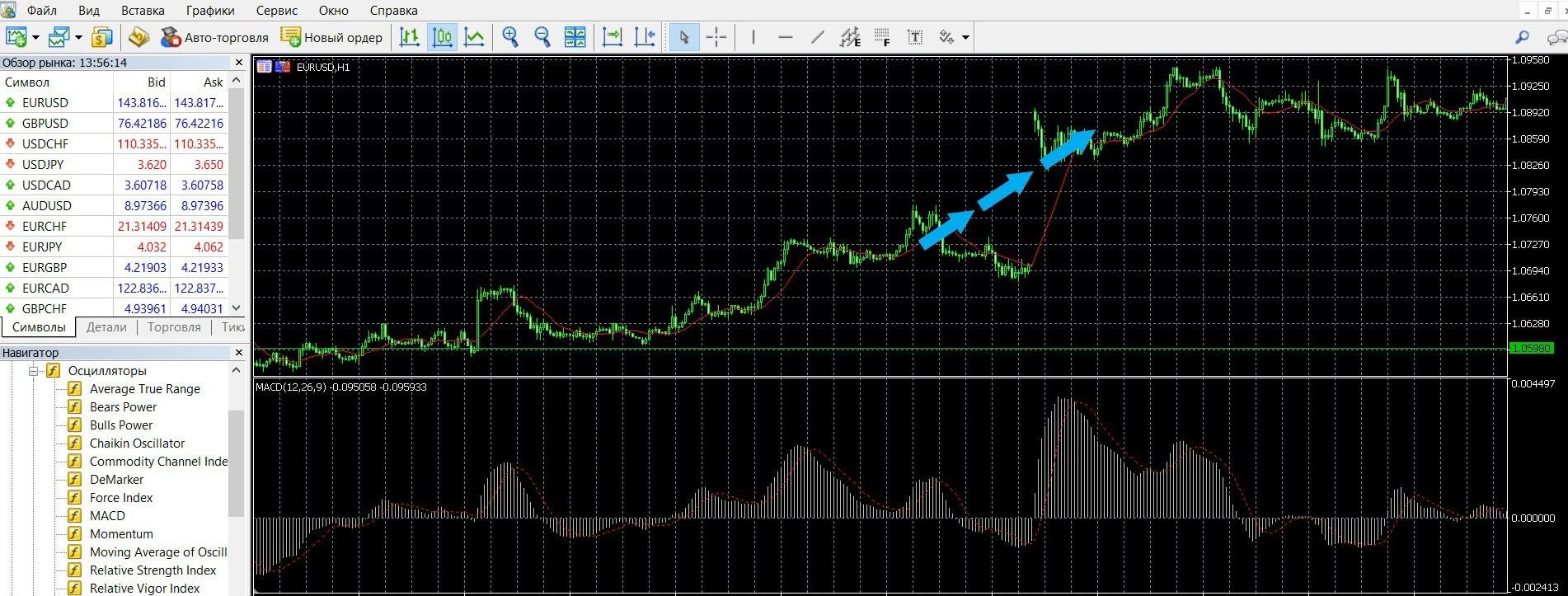

If the signal line crosses the histogram from bottom to top on the MACD chart, it is worth buying a CALL option. In the image below, you can see what the upward trend of the market looks like on the MetaTrader 4 platform:

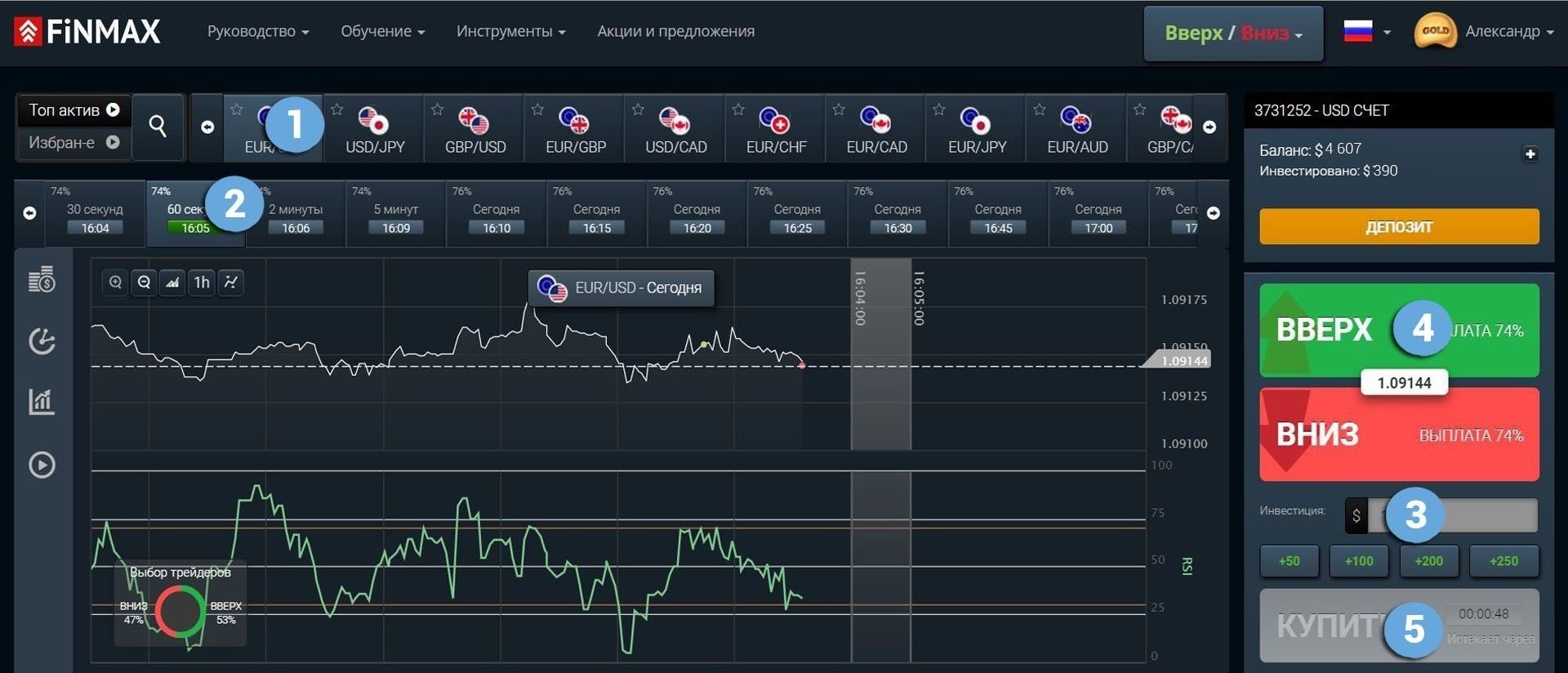

You can place a CALL ( up) bet with the Finmax broker. To do this, you must go to the broker’s website finmaxbo.com and prepare an option, specifying the data:

1. Asset

2. Expiration

3. Bet size

4. Movement forecast: UP

5. Next, click the “buy” button and wait for the results.

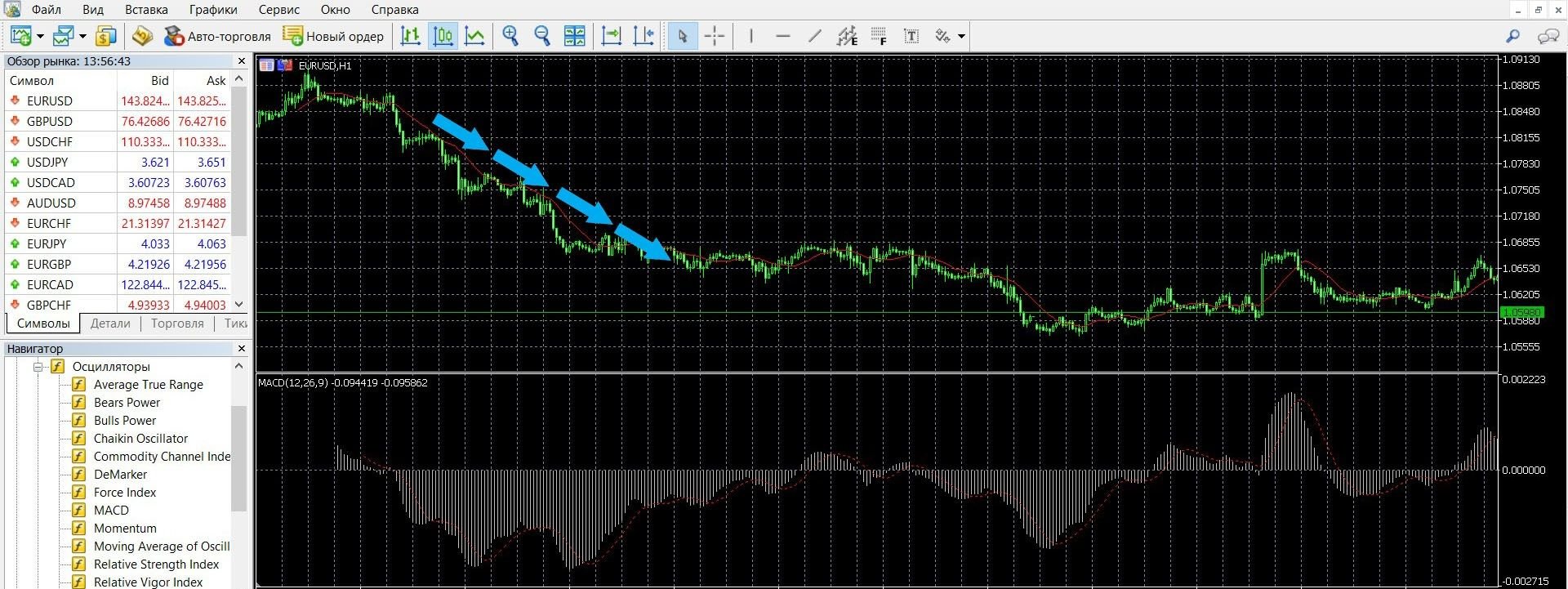

If the signal line crosses the histogram from top to bottom on the MACD chart, it is worth buying a put option. In the image below, you can see what the downward trend of the market looks like on the MetaTrader 4 platform:

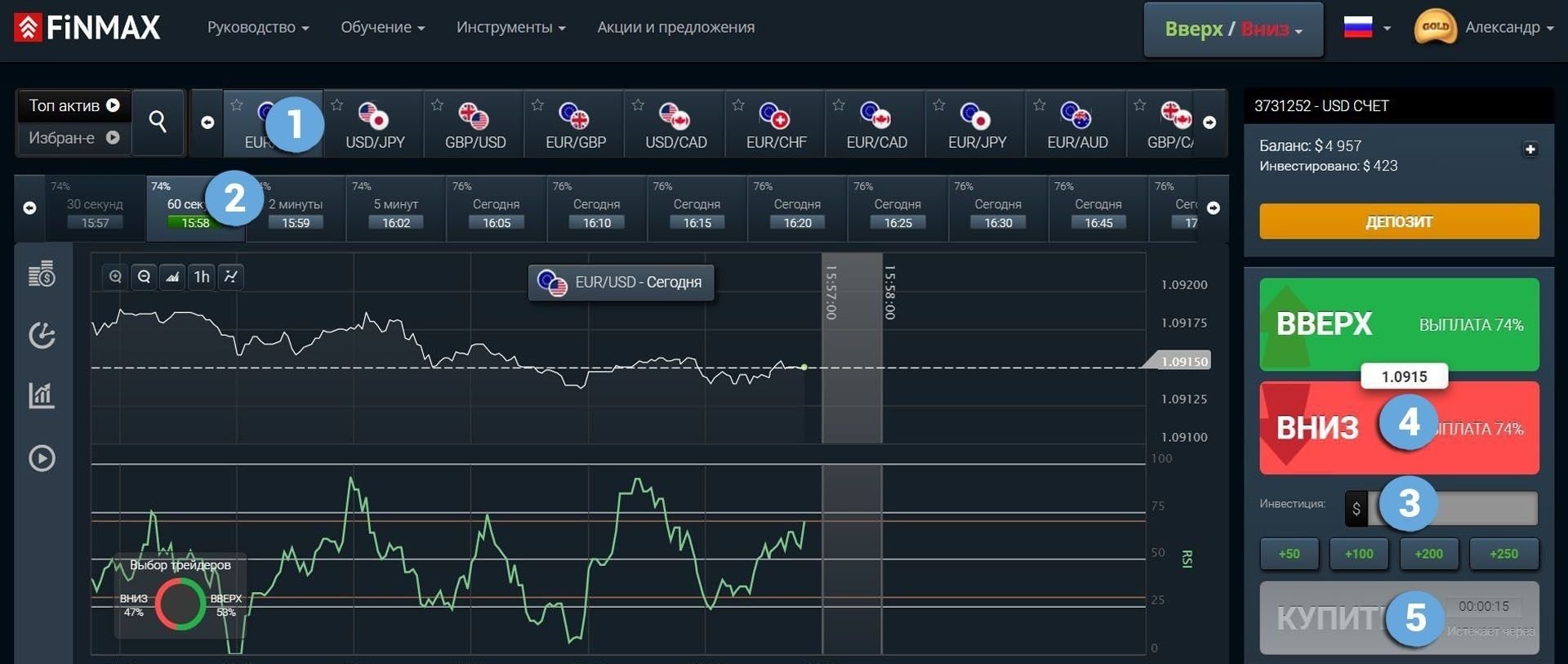

You can place a PUT (down) bet with a Finmax broker. To do this, you must go to the broker’s website finmaxbo.com and prepare an option, specifying the data:

1. Asset

2. Expiration

3. Bet size

4. Movement forecast: UP

5. Next, click the “buy” button and wait for the results.

Trading in divergence

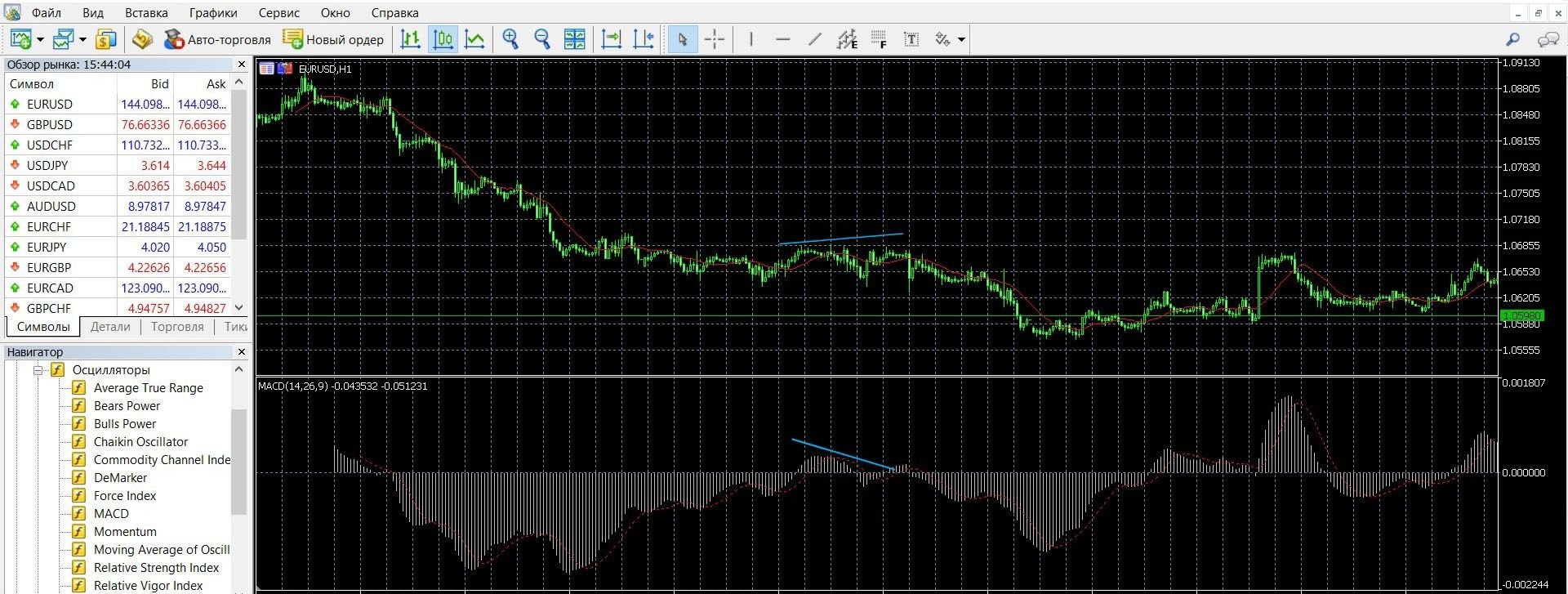

In the image you can see the divergence of the market on the MetaTrader 4 platform:

Take advantage of the divergence and place a bet with the Finmax broker. To do this, go to the broker’s website finmaxbo.com and prepare an option by entering the data:

1. Asset

2. Expiration

3. Bet size

4. Movement forecast: UP

5. Next, click the “buy” button and wait for the results.

Convergence trading

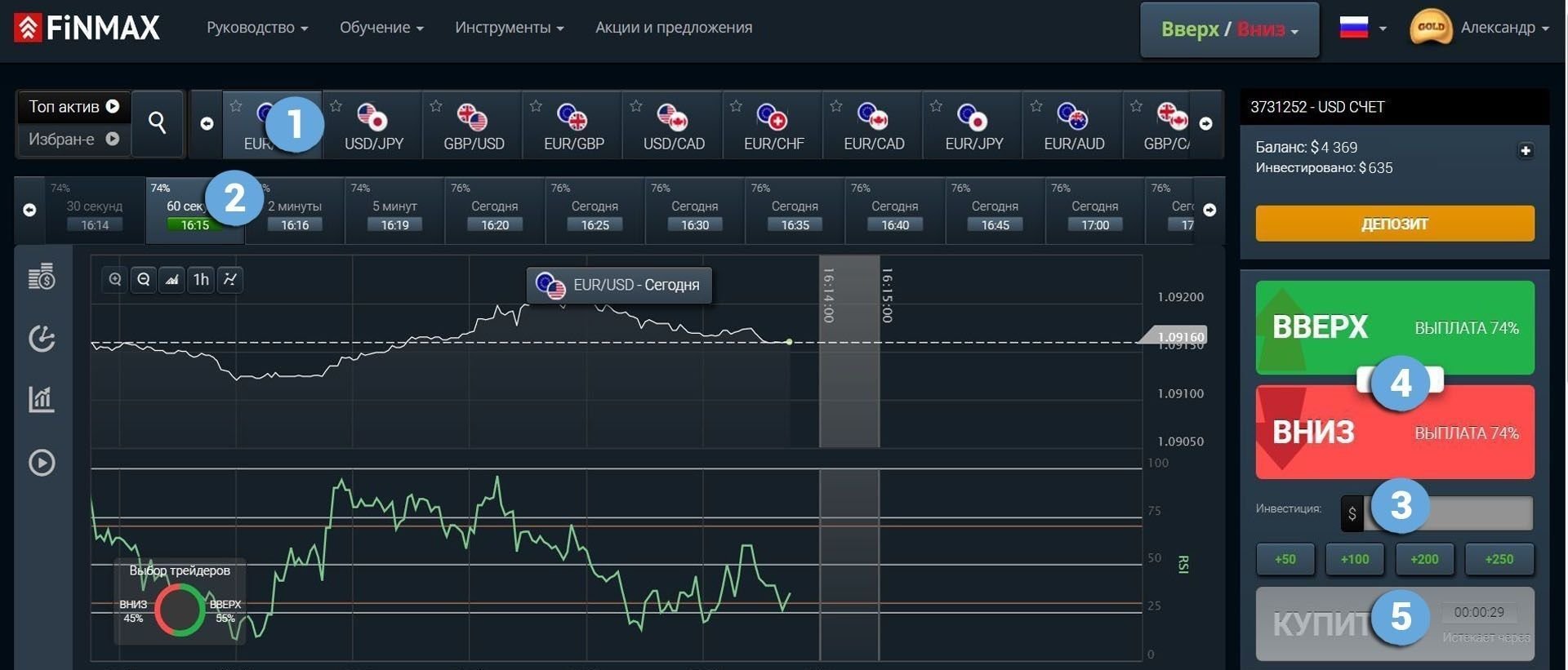

In the image you can see the convergence of the market on the MetaTrader 4 platform:

Take advantage of convergence and place a bet with the Finmax broker. To do this, go to the broker’s website finmaxbo.com and prepare an option by entering the data:

1. Asset

2. Expiration

3. Bet size

4. Movement forecast: DOWN

5. Next, click the “buy” button and wait for the results.

Money management

Mastering binary options trading, professional traders begin to seriously think about how to make the work not only profitable, but bringing a stable income. Even with high risks, experienced players always have funds in their account in any case. And yet, how to build work with capital in such a way that there are fewer losses, and the funds on the deposit do not end. These important questions are answered by money management – an effective strategy for managing personal capital. If you are new to trading, you should learn the rules of money management so that your work reaches a new level:

Minimum bets. Minimum funds

It is recommended to start trading with a minimum of funds. Bet no more than 5% of the deposit amount on a specific option. Participate in lots, the price of which is lower than the funds in your account. Work on the site of such a broker that will guarantee the best result. Follow these rules and you will always have capital on your deposit that will allow you to continue trading.

Minimum deposit

It is recommended to start trading with the minimum on the account. Transfer a minimum of funds to your account. You should not put all your capital at auction. Determine the amount of free cash limit that can be spent on trading and do not go beyond it. Follow these rules, and you can easily save funds in your account.

Minimum assets

It is recommended to start trading with a minimum of assets.

Trade 2-3 assets, starting your acquaintance with the market, and only after you understand the system, you can increase the number of assets. Remember that the more assets you have taken for trading, the greater the load on your account and the greater the risk of not noticing the state of the deposit in time. Follow these rules, and from the very first steps in trading, organize your work in such a way that it brings you a good result.

Minimum emotions

It is recommended to trade only with a working and serious attitude. Trading is distinguished by analytics, the need to make informed decisions, keeping in mind the risks. So, excessive emotions (both positive and negative) will interfere with concentration, which will affect your capital. Follow these rules, and build a serious attitude to trading.

Expiration

Another important concept for organizing successful work in trading, which affects the state of your deposit. With inattention to the peculiarities of expiration, the chances of productive work are reduced several times. Expiration is the expiration date of the option, when bidders can find out the results of their forecasts, and, accordingly, whether their deposit will be replenished. In order for options trading to bring a stable income, always remember about expiration.

Types of options:

- Ultra-short options (express) – 60 seconds.-5 minutes.

- Short-term options – 15 minutes to a few hours.

- Medium-term options – from 6 hours a day.

- Long-term options – a day or a few months.

Is it possible to extend the expiration of options?

It is possible, not allowed by all brokers.

Expiration rules:

1. If you are just starting out in options trading, it is recommended to choose long terms of transactions. So, you will be able to minimize the risks and unpredictability of express expiration several times.

2. If you are thinking about how to reduce risks, choose a broker carefully. Working on a site where it is possible to increase the expiration period, you can prevent the loss of funds if you see that you made the wrong prediction.

3. If you want to get a quick income, we recommend choosing a short-term (minute – several hours) expiration. Remember that express expiration with its unpredictability resembles a lottery or roulette.

4. If you want to get a stable income, we recommend choosing a long-term expiration, which will allow you to better approach forecasting and bring a good income.

Expiration in MACD strategies

Strategy at the intersection with the signal line

Short-term trading: allowed; Unpredictable results are reminiscent of a lottery.

Recommended expiration: from 30 minutes to several hours; You will be able to analyze market opportunities, look at indicator signals, and place a bet based on this data.

Long-term expiration: also recommended; You will be able to use not only technical analysis, but also connect macroeconomic data (news, economics, politics) to your work.

Strategy for divergence and convergence

Short-term trading: allowed; can bring a good result; because. Reminiscent of the lottery, you need to be careful when making decisions.

Recommended expiration: from 5 minutes to 30 minutes; You will have time to observe the dynamics of the trend and the mood of the market, study the behavior of oscillators.

Expiration of more than an hour: also recommended; It will allow you to connect all the possibilities for a more effective result: strategies, oscillators, the external situation that affects the dynamics of the market: news, economy.

“Parabolic SAR + MACD” strategy

This strategy gives good results in trending areas of the market. Required indicators: Parabolic SAR; MACD.

Parabolic SAR will give a signal about a change in the direction of the trend. The MACD acts as a confirmation of signals, shows the strength of the trend, in this case, divergence signals are especially indicative. Buying an option to increase: Parabolic SAR symbolizes a change in downward to upward trends; The MACD is located above the 0 mark, in the positive zone.

Short-term trading: not recommended, because The Parabolic SAR, the main tool of the strategy, will give false signals.

Intraday expiration: not recommended, this is also due to the peculiarities of the Parabolic SAR, the main strategy tool that will give false signals.

Long-term expiration: recommended; in this case, you will be able to get a high-quality signal from the oscillators and its confirmation from the MACD.

Scalping strategy “EMA + RSI + Bollinger Bands + MACD”

This strategy gives good results, showing high-quality signals for entering the market. Required indicators: EMA; RSI; Bollinger Bands; MACD.

Conditions for entering a long position: EMA crossed the center line of the Bollinger Bands from bottom to top; RSI crosses the zero line from bottom to top; The MACD signal line has crossed the bar line from top to bottom. Short position entry conditions: EMA crossed the center line of the Bollinger Bands from top to bottom; SI crossed the zero line from top to bottom; The MACD signal line crosses the bar line from bottom to top.

Short-term trading: recommended; It gives good results, like all scalping strategies.

Intraday expiration: not recommended; It will be very difficult to follow the appearance of a signal for several hours, while the profitability is minimal.

Long-term expiration: also not recommended; In addition to the fact that it is difficult to monitor the appearance of a signal, and this will have to be done for a large amount of time (more than a day), it is also ineffective, there is a high risk of losing money and time in vain.

Strategy “EMA + RSI + Fibonacci retracements + MASD”

A productive strategy that allows you to easily determine the presence of a trend and see high-quality signals for a trade. Required indicators: 3 moving averages: EMA 21, EMA 55, EMA 200; RSI; MACD; Fibonacci levels.

Moving averages show the presence and direction of the trend; RSI will indicate divergence signals, oversold-overbought moments, zones for making deals; The MACD will indicate the presence of divergences and determine the zones for making deals; Fibonacci retracements will determine profit targets.

Short-term trading: not recommended; Reminiscent of the lottery, you need to be careful when making decisions.

Recommended expiration: from 1 hour to several hours; You will have time to observe the development of the trend, the state of the market, study the behavior of oscillators.

Long-term expiration: recommended; In this case, you will be able to get high-quality signals and confirmation of them from oscillators, you will be able to connect all your experience for the right solution and earn decent money.

You can see all possible expiration options in action, for this we recommend using the platform of a reliable broker Finmax by going to the finmaxbo.com website. The advantage of the platform is that you have a choice of expiration from 30 seconds to six months. The platform is very user-friendly, simple and straightforward, here you can get the most out of options trading.

Downloads

MetaTrader 4 (MT4) platform – download.

MACD Oscillator for MT4 platform – download.