Williams Percentage Range Oscillator (Williams%R)

Description

We present to the readers of our portal another review of binary options oscillators . Read our materials, practice trading and reach new heights in financial trading. Today we will tell you about the Williams Percentage Range (Williams%R) indicator. You will learn about the benefits, your new trading opportunities with this tool and you will be able to work with it correctly.

The Williams Percentage Range Oscillator (Williams %R) is a technical indicator that shows information about the overbought-oversold asset zones on which you can make money. The oscillator is a simple but effective tool. It was created, described and popularized in the 1970s by trader Larry Williams. Interestingly, the tool was intended for the Forex market, but its capabilities were appreciated by trading players. So, thanks to the accurate prediction of signals, as well as the simple principle of operation, Williams %R has become popular with traders.

The oscillator is similar to the Stochastic Oscillator, but its difference is that the data is not smoothed out by the moving average, it has an inverted scale so that the overbought (CALL, up) and oversold (PUT, down) signals are accurately shown.

The advantage of the oscillator is in its dynamics, the information can be used in technical analysis of different timeframes (intraday, daily, weekly and monthly intervals). In addition, the oscillator shows data ahead of time, which will allow you to see trends in advance and draw the right conclusions.

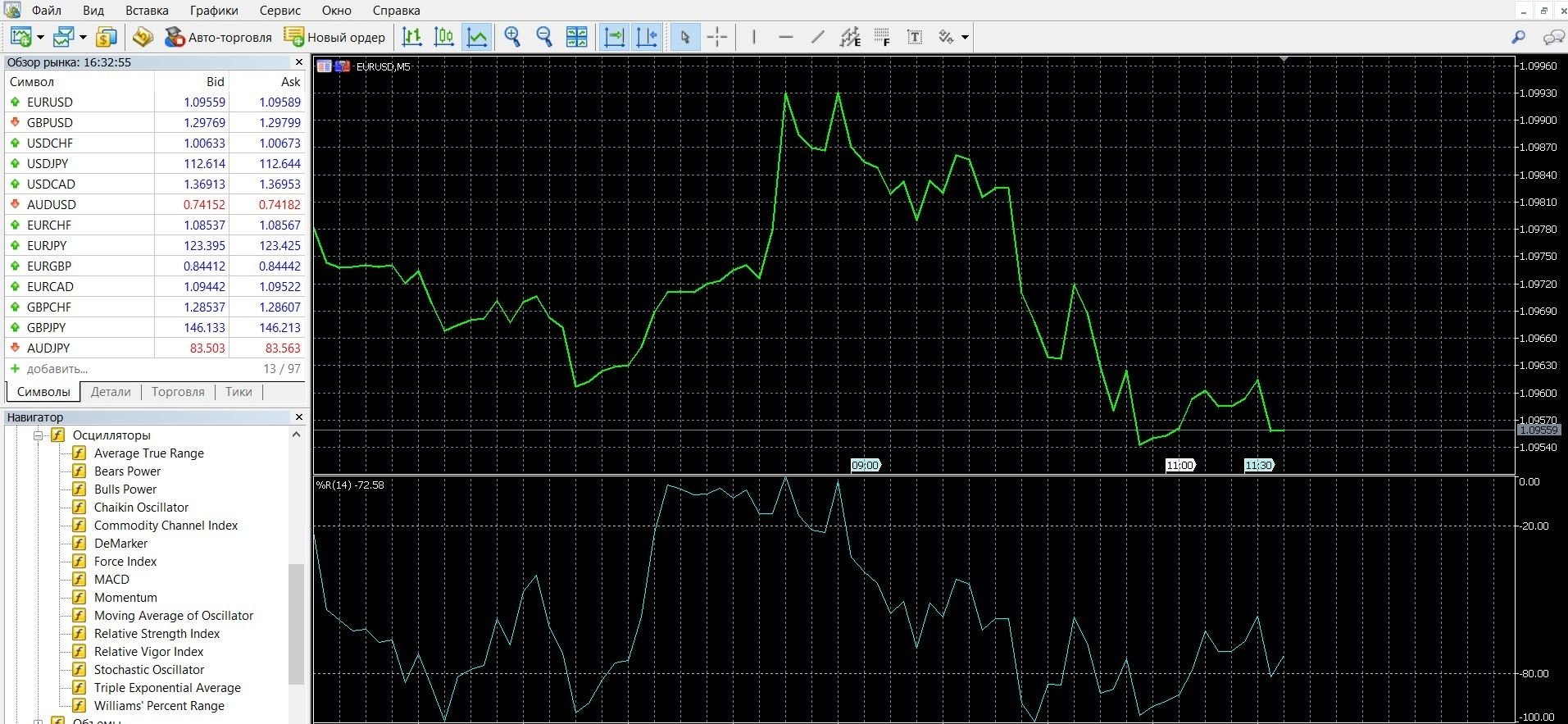

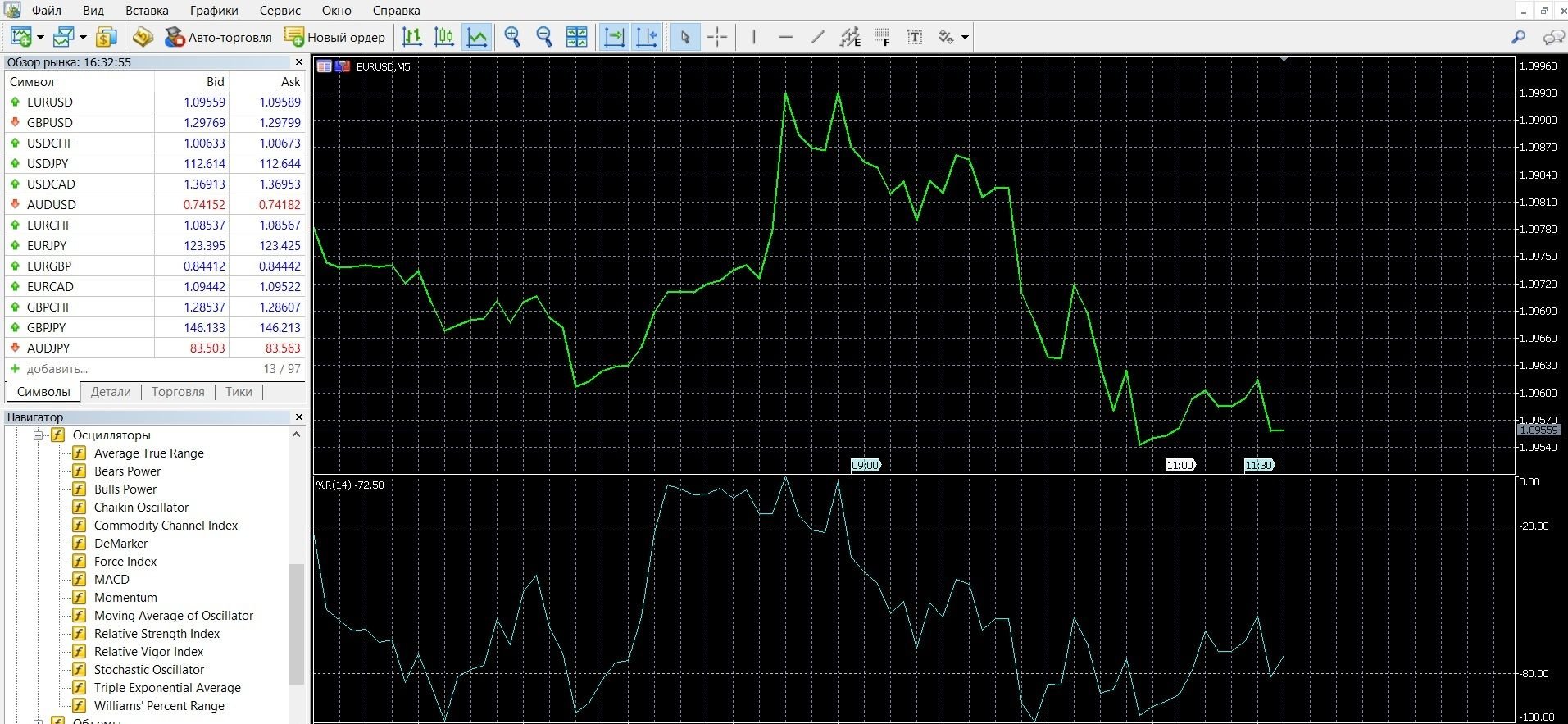

You can see what Williams %R looks like on the MetaTrader 4 (MT4) platform in the image below. You can also download the MetaTrader 4 platform, add the indicator to the main chart and work with it.

How does the Williams %R indicator work?

The data of the Williams %R indicator is based on the ratio of closing prices to the extremes of the price range and shows the position of the price at the moment relative to the maximum and minimum values for the previous period. It works within different time intervals, which is convenient for options players because the tool makes it easy to switch from short-term to medium-term trading or to long-term trading.

Williams %R is displayed as a line that moves in the range from 0 to 100 depending on market dynamics. The oscillator reacts quickly to changing trends, showing the direction of the line. One of the significant advantages of Williams %R is that it can be used at all time intervals. According to statistics, it is advantageous to use the indicator on large timeframes, because. At short-term intervals, price readings are unpredictable, which leads to errors.

Indicator signals:

The indicator displays the following signals for action:

Overbought/oversold assets:

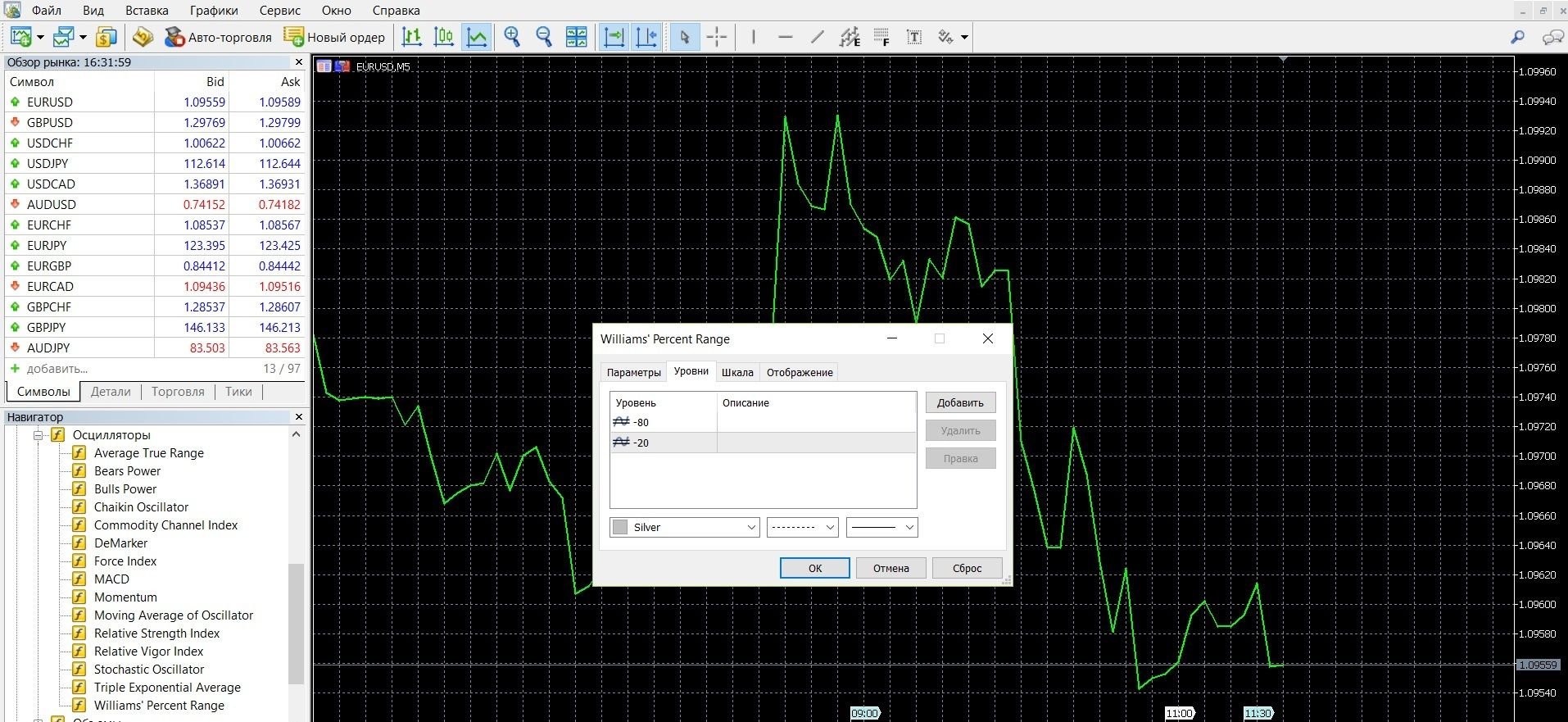

– from 0 to -20 – overbought zone. If the oscillator line breaks through the -20 mark from top to bottom, you can open a PUT option.

– from -80 to -100 – oversold zone. If the oscillator line breaks through the -80 mark from the bottom up, you can open a CALL option.

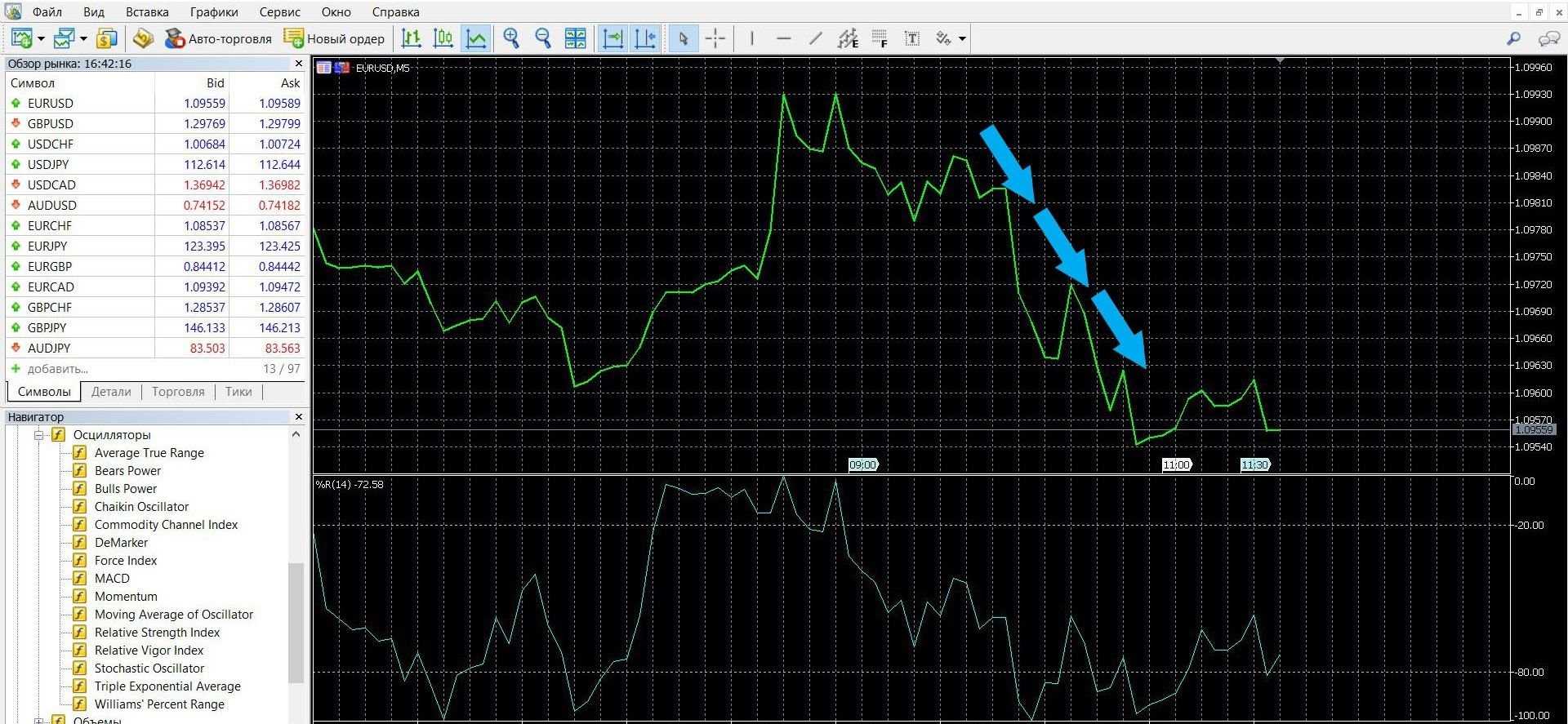

Divergence is a signal of an imminent change in the direction of the trend that occurs in an uptrend, this is an interesting phenomenon in trading when the price of an asset moves up, and the oscillator curve begins, on the contrary, to fall. This is a signal of an early trend change.

Convergence is also a signal of an imminent change in the direction of the trend, but in a downtrend, when the price on the chart sets new peaks, but the indicator does not, and warns of its completion.

The formula for calculating the indicator:

The formula is similar to Stochastic’s:

%R = -(MAX (HIGH (i – n)) – CLOSE (i)) / (MAX (HIGH (i – n)) – MIN (LOW (i – n))) * 100, where:

CLOSE (i) — today’s closing price;

MAX (HIGH (i – n)) — the highest maximum for n previous periods;

MIN (LOW (i – n)) is the lowest minimum for n previous periods.

Do I need to install Williams %R on my platform?

This indicator is a classic tool in binary options trading, it is integrated into almost all trading platforms, users of the MetaTrader 4 platform can use it without installation.

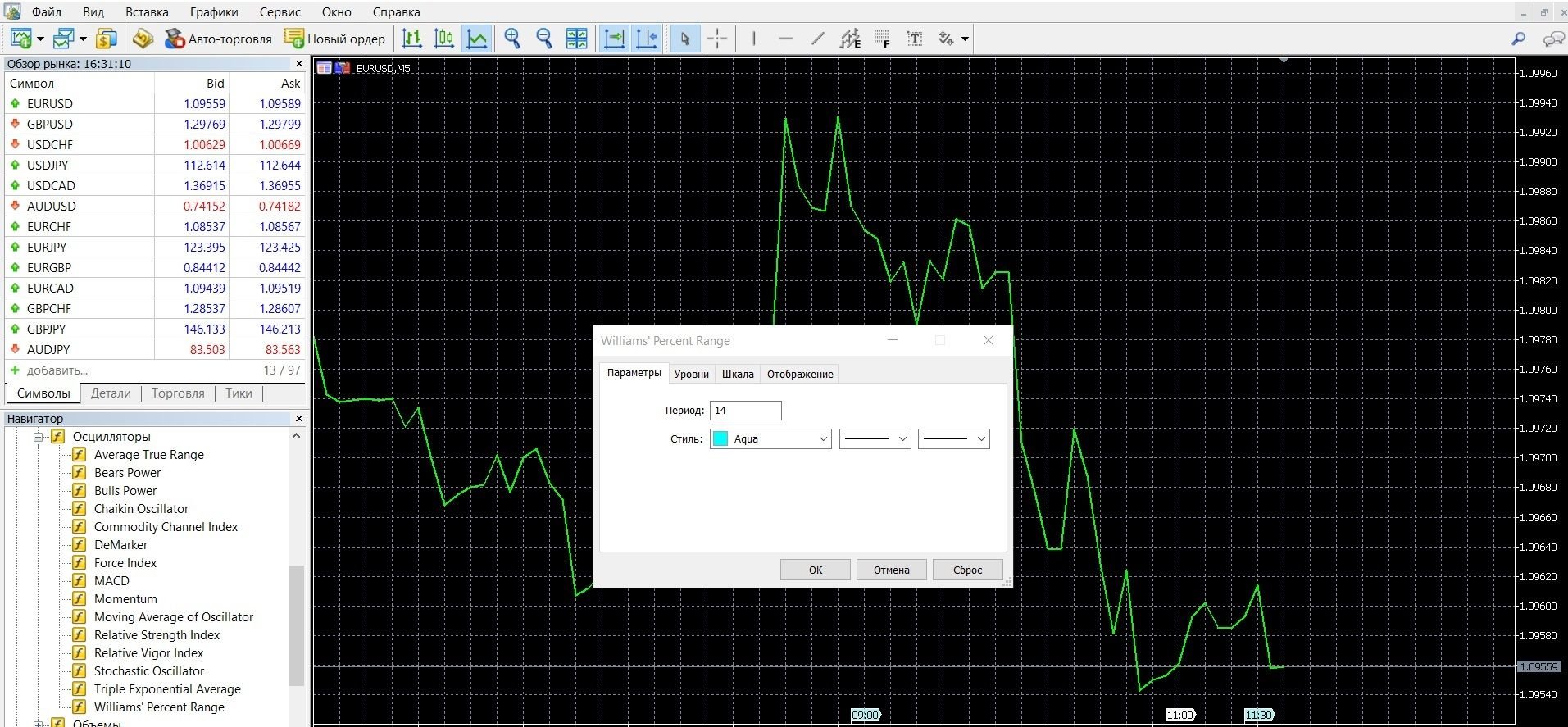

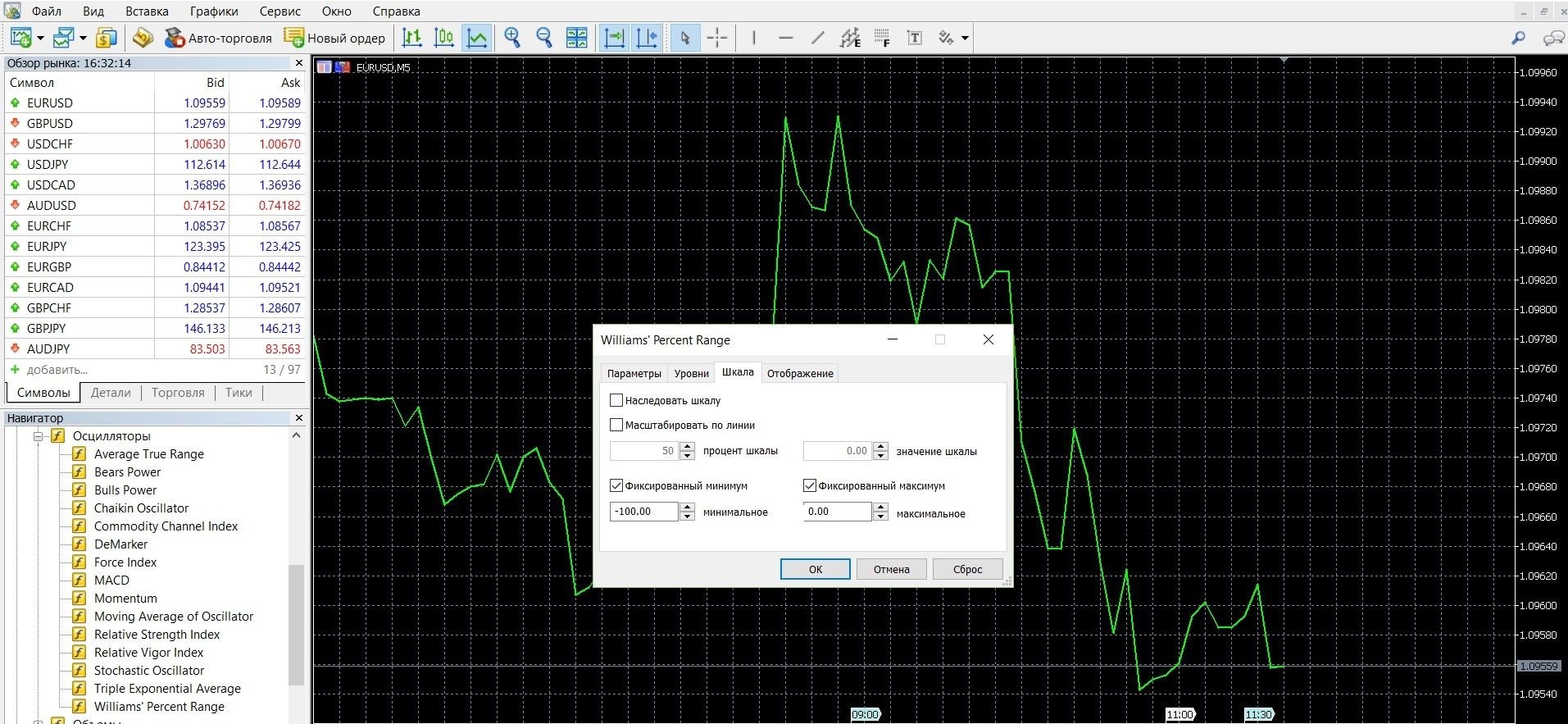

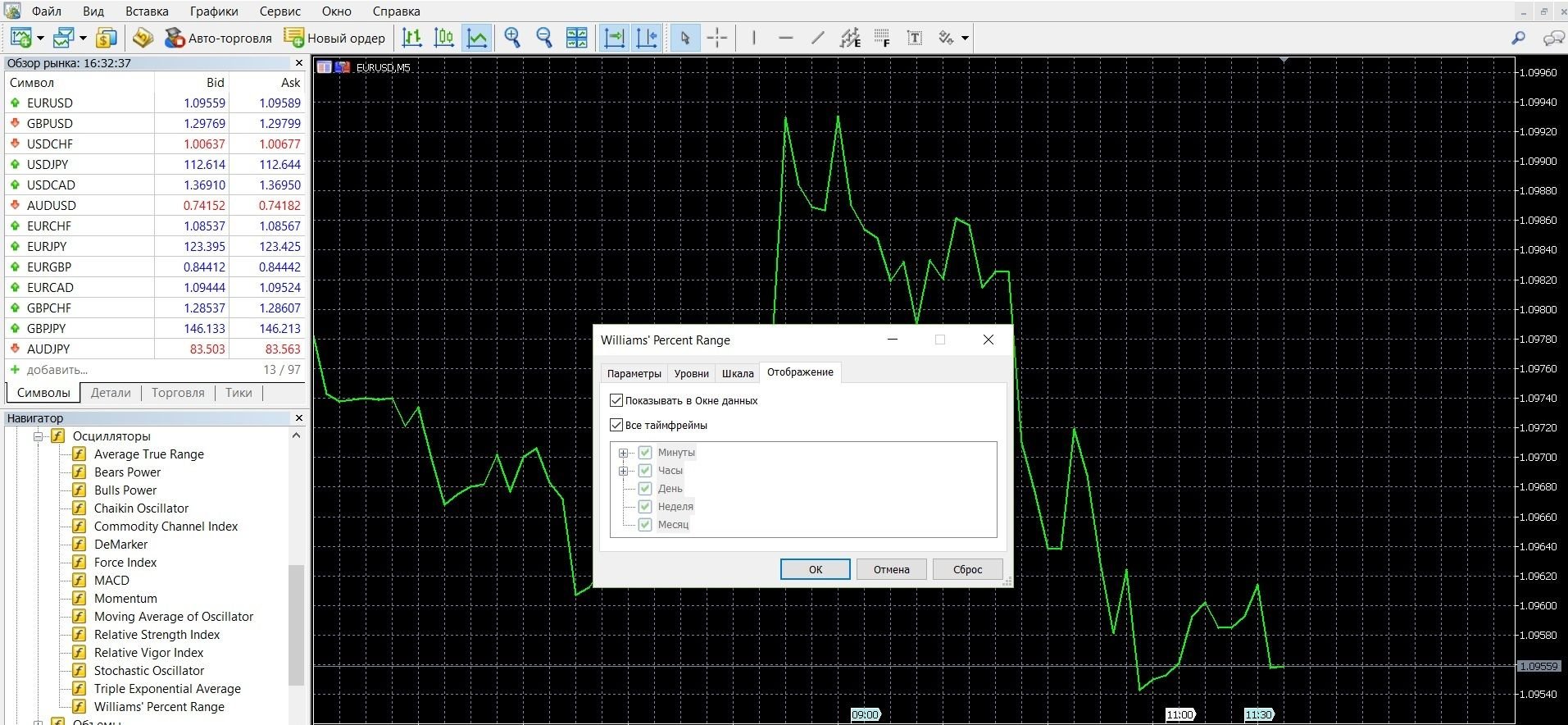

By adding an indicator to the chart, you can work and change the readings of the “period” parameter, which is usually equal to 14. According to the beliefs of the author of the tool, this is the optimal indicator, because. The oscillator is sensitive and capable of generating many profitable signals. If you increase the period, the oscillator will react less to market changes, if you reduce it, it will become highly sensitive to dynamics. Also, the trader can work with other oscillator settings (see below in the images below).

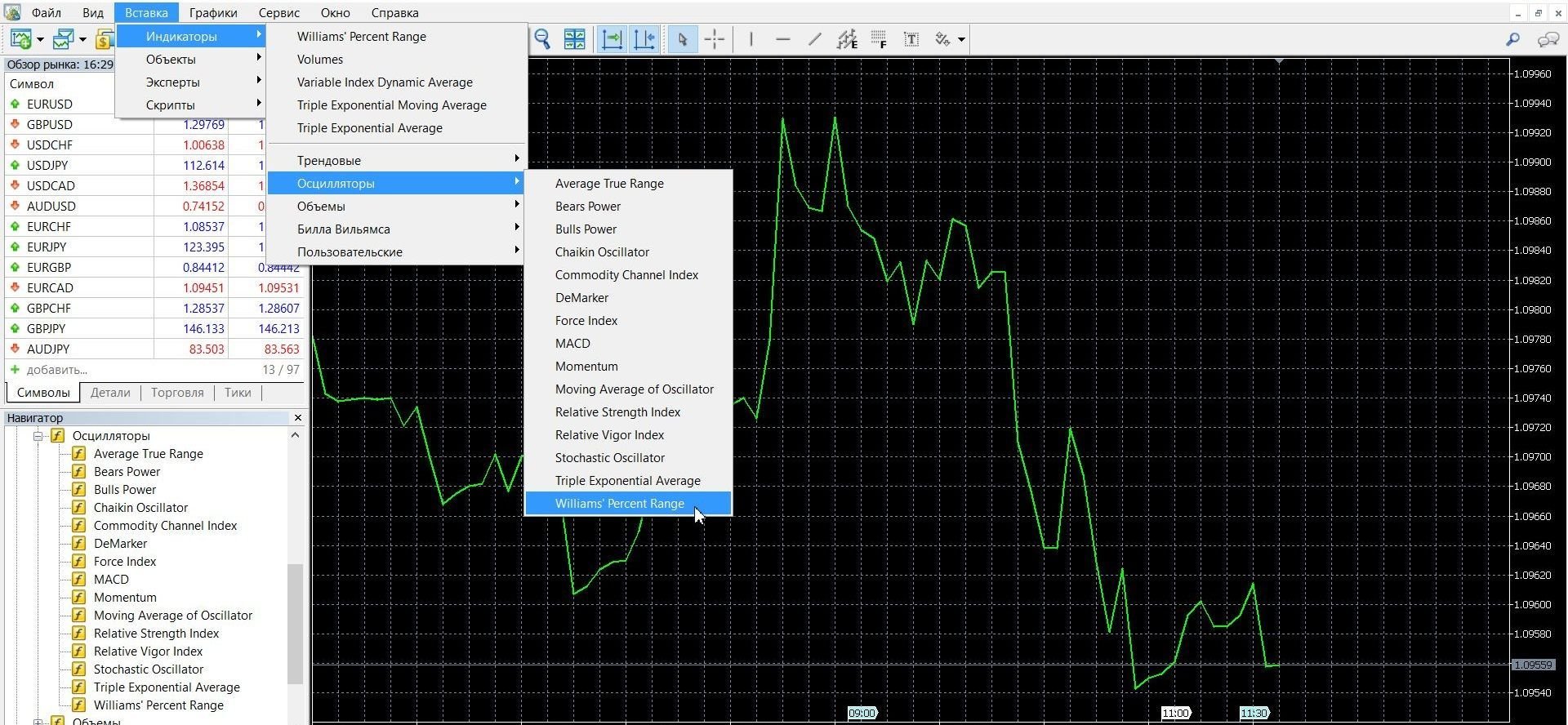

To add Williams %R to the price chart on the MetaTrader 4 platform, follow these steps:

1. Click the “Insert” tab in the top menu of the platform

2. Select the “Indicators” tab

3. In the drop-down menu that opens, select the “Oscillators” tab

4. In the drop-down menu that opens, select Williams’ Percent Range

5. So, the oscillator is added to the chart, you can start working.

If your platform does not have this indicator, you can download it here.

Application of the indicator for binary options

• The Williams Percentage Range Oscillator is a real helper for a professional trader and a beginner. This tool is indispensable for predicting changes in oversold-overbought, convergence and price divergence.

• The indicator is easy to install and operate, accurately shows trend data. And yet, for a more accurate picture of what is happening in the market, it is recommended to connect several oscillators that are convenient for you to the analysis.

• The advantage is that the Williams %R signals are ahead of the curve and are shown earlier than the information on the main chart, which will allow you to see the trend in advance and, by placing a bet, get a stable profit.

• For effective trading, it is enough to follow a simple rule: buy when the line crosses the 80 mark from below, sell when the line crosses the 20 line from above.

Rules for concluding transactions (screenshots)

Trading with an overbought-oversold signal

The Williams %R indicator accurately shows the overbought-oversold zones:

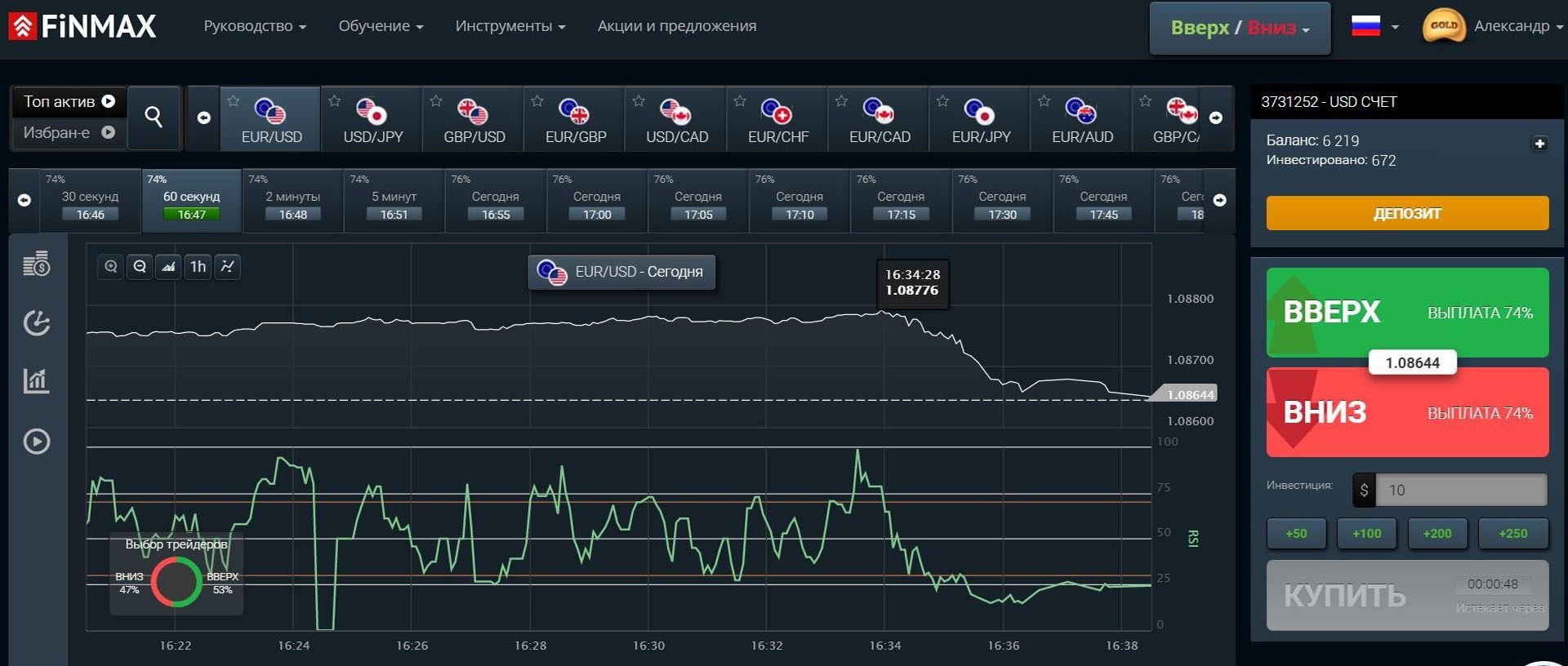

From 0 to -20 – overbought zone. If the oscillator line breaks through the -20 mark from top to bottom, you can open a PUT option:

You can take advantage of the downward trend in price and place a PUT (down) rate with the Finmax broker. To do this, you need to do the following steps:

Go to the broker’s website — finmaxbo.com. Prepare the option data, for this we indicate:

1. Type of trading asset

2. Validity of the option

3. Bet size

4. Forecast for the movement of the quote: DOWN

5. Click the “buy” button and monitor the results of the movement of currencies on the chart.

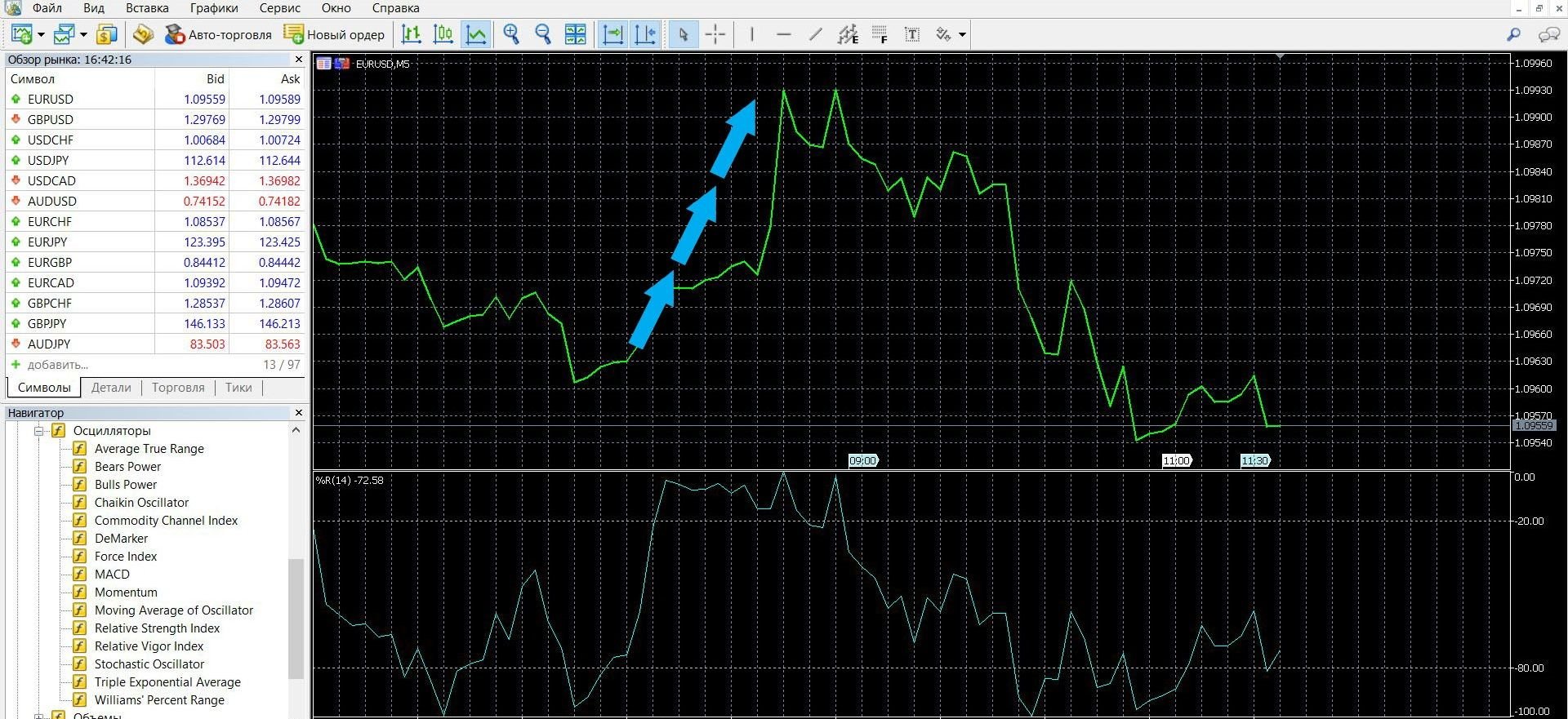

From -80 to -100 is the oversold zone. If the oscillator line breaks through the -80 mark from the bottom up, you can open a CALL option:

You can take advantage of the uptrend opportunities in price and place a CALL (up) rate with the Finmax broker. To do this, you need to do the following steps:

Go to the broker’s website — finmaxbo.com. Prepare the option data, for this we indicate:

1. Type of trading asset

2. Validity of the option

3. Bet size

4. Forecast for the movement of the quote: UP

5. Click the “buy” button and monitor the results of the movement of currencies on the chart.

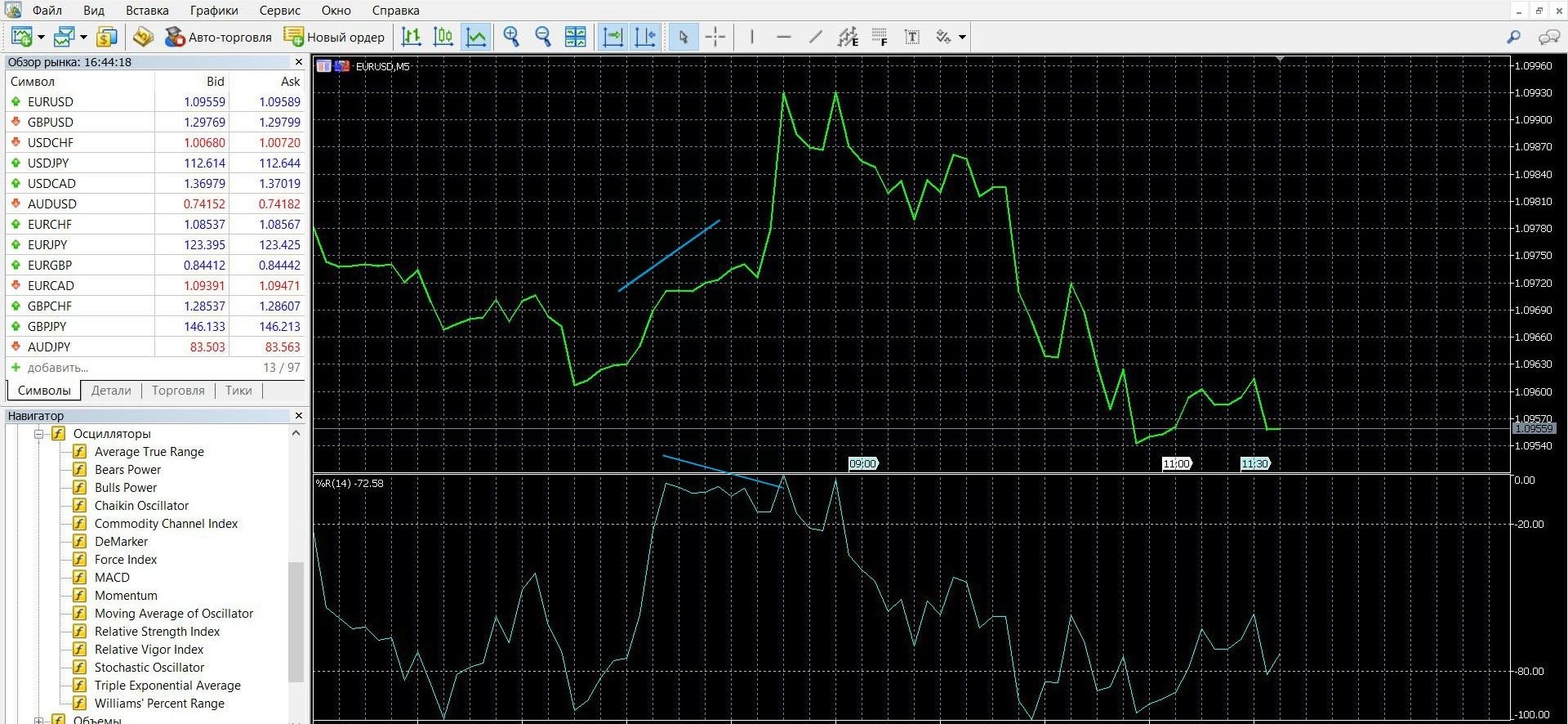

Trading with a divergence signal

Divergence, or discrepancies between the indicator readings and the price, is a reliable buy signal that will give you the most out of trading. Divergence, unlike convergence, occurs in an uptrend, when the price on the chart sets new peaks, but the indicator does not, and warns of its completion.

When the price goes one way in an uptrend, and the Williams %R line goes in the other, this is a signal that the price movement will change soon:

To take advantage of the divergence opportunities and place a bet with the Finmax broker, go to the finmaxbo.com broker’s website and follow the steps below to prepare the option data. To do this , specify:

1. Type of asset

2. Option expiration

3. Bet size

4. Forecast of quote movement

5. Next, click the “buy” button and follow the results of currency movements on the chart.

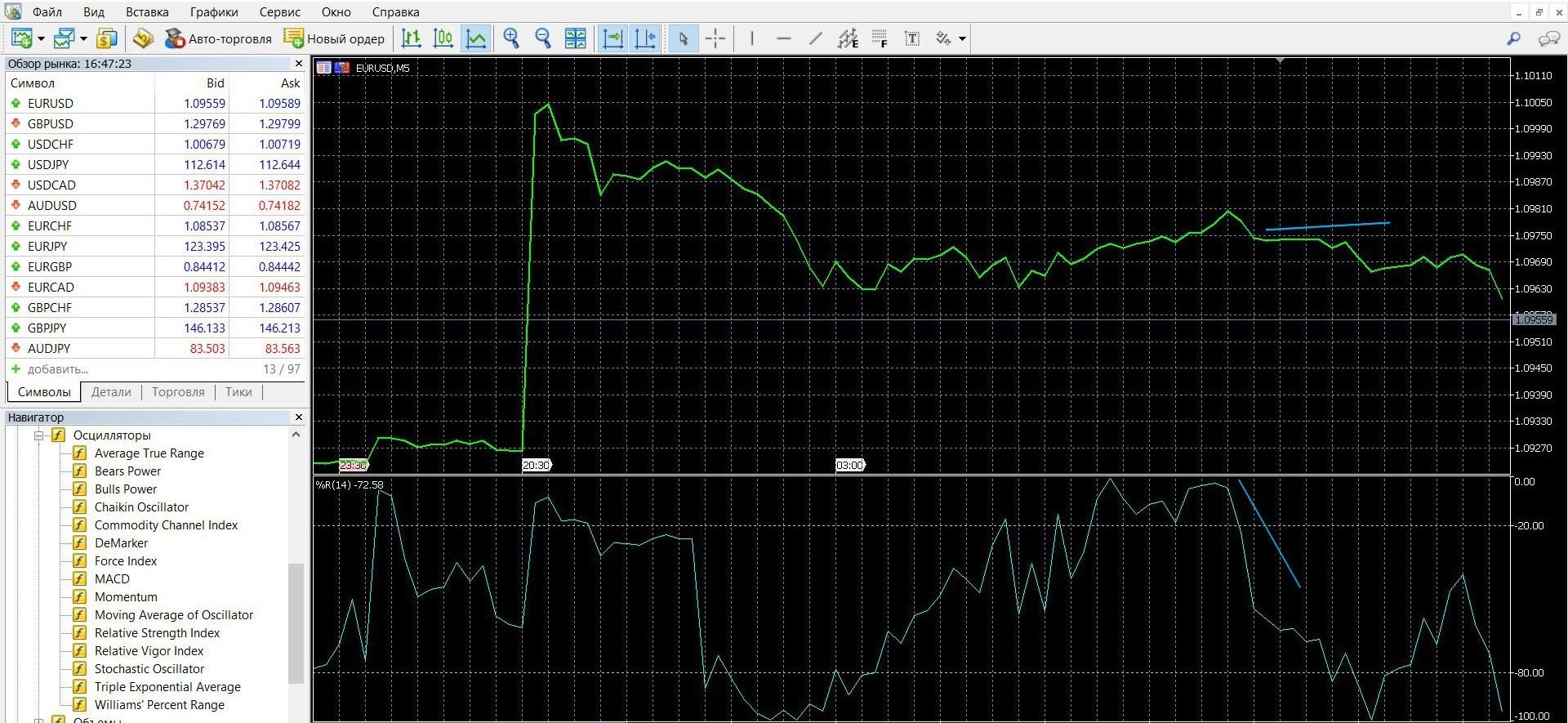

Trading with a convergence signal

Convergence – that is, the divergence between the indicator readings and the price, in contrast to divergence, appears on a downtrend, when the price on the chart sets new peaks, but the indicator does not, and warns of its completion.

When the price goes one way in a downtrend, and the Williams %R line goes in the other, this is a signal that the price movement is about to change:

To take advantage of the convergence opportunities and place a bet with the Finmax broker, go to the finmaxbo.com broker’s website and follow the steps below to prepare the option data. To do this , specify:

1. Type of asset

2. Option expiration

3. Bet size

4. Forecast of quote movement

5. Next, click the “buy” button and follow the results of currency movements on the chart.

Money management

Professional traders know that the key to success in trading is not only a reliable broker and strict self-discipline, but also conscious money management, that is, money management. If some traders believe that it is enough to have analytical skills and make correct forecasts of the state of the market, then most bidders are sure that this is not the case.

A rational approach to the disposal of capital means that the player will not lose all the money in case of failure, he will be able to make a reasonable decision. Money management in binary options trading is important, it is part of an overall strategy that will help you achieve a stable result.

How to work with your funds? Money management is the optimal management of your funds, subject to the main goal of the bidder: not to lose money on the deposit and increase their number by following the basic rules of money management:

Minimum bets. Minimum funds

When you bid, try to bet the lowest possible amount. You should bet no more than 5% of the deposit. Moreover, entrust your funds to a broker who will guarantee the best profitability in the market.

You should not transfer your entire deposit to one option, because your forecast may be incorrect, and you will be left without money and will not be able to continue trading.

Minimum deposit

When you participate in trading and work with a personal account, determine your free financial range that can be spent and only then transfer money to the deposit. You should not transfer a large amount at once, it should be a minimum of funds. Remember that your trade may end in failure and you may need more funds to continue trading.

Minimum assets

When you are just starting your journey in trading, you should not participate in all the assets offered by the market at once, although the possibilities of binary options will beckon you to do everything at once. This is not true: more transactions – more load on the deposit. In this case, there is a high probability of not noticing how you will not have any money left.

Get to know the market gradually and slowly, start with two or three assets. After you get comfortable in trading, you can think about increasing your investment portfolio and try yourself in stocks, futures, etc.

Minimum emotions

When you master the possibilities of trading, turn off your emotions, because they can interfere with your discipline. An experienced player in the market is a sober player who is aware not only of his prospects, but also of his risks. Do not succumb to your experiences, do not follow a strong desire to master everything at once. Remember that bidding is a serious job, not a lottery.

The rule of three, which came to options from Forex, will help improve your discipline: according to statistics, three failed or successful transactions, and you are immersed in emotions, the mind turns off and there is a desire to either return everything lost in case of failed transactions, or, conversely, multiply the funds won several times. This behavior will lead to the fact that you will squander all the funds on the deposit. Learn to tell yourself “stop” after three trades and leave the market, then you will always have the opportunity to continue trading and achieve a better result.

Expiration

All binary options in trading have their own term, only the time that is known to market players is valid. Working with the next contract, bidders know when it will be executed. This phenomenon is called expiration.

Expiration of binary options (from English Expiration) is the expiration date of a particular transaction, as a result of which, in case of a positive outcome of the transaction, the broker transfers funds to the trader. Expiration is of great importance in binary options trading and the fact that traders choose expiration themselves gives great flexibility to trading.

Options are divided into:

Ultra-short (turbo) – from 60 seconds to 5 minutes

Short-term – from 15 minutes to several hours

Medium-term – more than 6 hours and up to a day

Long-term – from a day to several months.

Such differences in expiration time play a big role not only in what kind of profit awaits you, but also in what the level of risk will be. For beginners, the choice of expiration is more often influenced by the possibility of quick earnings, market professionals understand trends, use technical analysis of the situation and choose longer terms of options. Often, the choice of expiration is influenced by other factors: statements by officials and high-profile events (for example, the release of a new version of Apple usually leads to an increase in the company’s shares), as well as macroeconomic indicators (for example, Nonfarm Payrolls publications usually excite the market, because strongly affect the dollar exchange rate).

Is it possible to extend the expiration of options?

It is possible, but not with all brokers. If you want to extend the expiration, it is permissible only in the direction of its increase. To do this, you need to deposit the missing amount from the value of the option.

Expiration rules:

1. Beginners in trading should try to choose a long expiration, which is characterized by less risk.

2. It is necessary to carefully approach the choice of a broker. Work, especially if you are a beginner, on the site where it is allowed to increase the expiration period, which will minimize your losses.

3. If you want to get a quick income, work with a short-term (from a minute to several hours) expiration, but remember the risks.

4. If you want a stable high income, work with a long-term expiration and, in case of a positive result, you will receive a good income.

Expiration in Williams %R strategies

Strategy for oversold-overbought signals

Short-term trading: since this type of trading is characterized by increased risk, it is not recommended to use it, the result will always be unpredictable.

Recommended expiration: from 5 minutes to several hours. So, you can analyze the situation and make the right forecast. Your earnings here will be higher than with short-term trading.

Long-term expiration: you will not only analyze the price dynamics over a similar period of time, but also be able to predict the price behavior depending on the news, economic and political situation.

Strategy for divergence and convergence signals

Short-term trading: allowed, can bring good results. It is worth remembering that such trading is characterized by increased riskiness and unpredictability.

Recommended expiration: from 5 minutes to 15 minutes. During this time period, the trend will have time to develop, which will help to achieve a positive result.

Expiration of more than an hour: also recommended, it will allow you to analyze the dynamics of the market in a calm atmosphere and predict the outcome of trading based on technical analysis (refer to other reasons affecting the price movement: news, economy, etc.)

The “4 Indicators” Strategy

The use of four tools will allow the trader to get confirmation of the trend from several instruments at once, draw the right conclusions and get a good income.

The strategy uses: Williams Percent Range; CCI (Trading Channel Index); SMMA (Smoothed Moving Average); ATR (Average True Range).

Buy signal:

1. The price has risen above the moving average

2. Signals from other oscillators:

Williams Percent Range – below the level of -85

CCI – below the level of -100

ATR is above +0.002.

Short-term trading: not recommended, because It has an increased riskiness, it is difficult to make the right choice in a short period of time.

Recommended expiration: from 5 minutes to 1 hour. During the specified time periods, you will be able to get used to the market, feel all the indicators and dynamics, and make the right forecast.

Long-term expiration: allowed, recommended for professionals with extensive experience in predicting the outcome of transactions based on technical analysis, depending on the news, economic and political situation.

Strategy “RSI + Stochastick + Williams %R”

The strategy uses three indicators for trading: RSI, Stochastick and Williams %R. Trades are opened by the movement of trends, which is confirmed by the RSI and Stochastic indicators. So, the profit will be high.

Short-term trading: not recommended in this case, because In a short period of time, it is difficult to understand the situation and make the right choice.

Recommended expiration: from 5 minutes to 4 hours. For the specified periods of time, you will get a good result and profit, because. You will work with a trend movement, which is reliably confirmed by several instruments at once.

Long-term expiration: allowed, recommended for professional traders who have positive experience in predicting the outcome of transactions based on technical analysis, allows you to achieve high results.

Strategy for novice traders “OSMA + Williams %R”

Both indicators (Moving Average and Williams Percent Range) are so clear and easy to use that, first of all, the strategy is recommended for novice traders. The strategy is based on the data of the Williams %R oscillator, which accurately shows the beginning and change of the trend, as well as the data of the moving average, which shows entry signals. Thanks to simple indicators, any expiration is allowed in the strategy, which will allow beginners to use it and achieve good results.

Entry conditions for a long position: Williams Percent Range – exits the oversold zone, crosses the -80 level from bottom to top; The candlestick opens above the moving average.

Close the position: Williams Percent – at the overbought level (between -20 and 0); The price will cross the moving average from bottom to top.

Entry conditions for a short position: Williams Percent Range – exits the overbought zone and crosses the -20 level from top to bottom; The candlestick is below the moving average.

Close the position: Williams Percent – at the oversold level (between -80 and -100); The price will cross the moving average from top to bottom.

Short-term trading: recommended, because The indicators are simple and easy to use, so that even a beginner can start working immediately after installing the charts. It is worth remembering the unpredictability of the result and increased risks in this case. Income will be lower.

Recommended expiration: from 5 minutes to several hours. Allows you to calmly analyze the situation, make the right forecast. The earning opportunity is higher than with short-term trading.

Long-term expiration: also recommended, in this case you will not only be able to analyze the dynamics of prices over a similar period of time, but also predict the correct price behavior depending on macroeconomic reasons. The yield is high.

To test all expiration options in practice, we recommend using the Finmax broker platform, just go to the finmaxbo.com website. The advantage of this platform is that you have a choice of expiration from 30 seconds to six months. Here you can not only check the strategies listed in the review, but also find your comfortable one among them and get a stable income.

Downloads

MetaTrader 4 (MT4) platform – download

Williams Oscillator %R for MT4 platform – download