McClellan Oscillator

Description

Dear professional traders and beginners! Knowledge of the basic tools of working in the market is half of your success. Knowing that it is difficult to find reliable and complete information on the Internet, we decided to collect the maximum useful on our website.

Let’s start with an overview of oscillators that will help you reach the necessary heights in currency trading.

Indicators that are based on data on rising and falling stocks are called market “width” indicators. They show the volume of shares, the dynamics of which coincide with market trends. Such indicators include the McClellan indicator. Let’s learn more about it.

The McClellan Oscillator is a technical analysis indicator that shows the width of the market by analyzing the number of rising and falling stocks of the New York Stock Exchange.

The instrument was developed in 1969 by Sherman and Marian McClellan. Since then, it has been one of the most popular market width indicators, with more and more experienced brokers using it for market research. With the help of this indicator, the McClellan summation index is constructed. The principles of operation of this oscillator were described in the book “Profitable Patterns: Oscillator and McClellan Summation Index”. Read more on Wikipedia.

The oscillator is based on working with data from exponential moving averages. The components of the indicator are:

- Rising market stocks minus falling ones

- Calculation of 19 and 39 daily exponential moving averages (EMA)

- The result of a 19-day EMA depends on a 39-day one.

What is the working principle of the McClellan oscillator

The McLellan Oscillator uses a zero mark, thanks to which you can receive trading signals and act according to the situation:

- When the McClellan Oscillator drops into the oversold area (between 70 and 100) and then turns up, a buy signal occurs.

- When the oscillator rises to the overbought area (between +70 and +100) and then turns down, a sell signal occurs.

- If the oscillator rises above +100 or falls below 100, it indicates that the market is in a state of extreme overbought or oversold. Such extreme values usually indicate a continuation of the trend.

- If the oscillator falls to 90 and turns up, this is a buy signal.

- If the oscillator falls below 100, then most likely the market will fall for another two or three weeks. In this case, you should wait until several successively increasing troughs are formed on the oscillator chart or until the market gains strength again.

How to install McClellan Oscillator

There is no chart of this oscillator on the main trading terminals, but you can easily download it and install it on the Metatrader 4 terminal.

You can read how to install the downloaded file in MetaTrader 4 here.

So that you can download the indicator and start using it right now, we will also provide a link to the McClellan oscillator at the end of the article. In this article, we provide screenshots of materials in one of the most popular Metatrader 4 terminals.

The oscillator setup is simple: you only need to specify the plot period (10 by default) and the forward shift (there is no shift by default).

Application of McClellan Oscillator for Binary Options

Oscillators are assistants to a professional trader and a beginner, they help you see and even predict the dynamics of stocks and earn good money on it. In order to own the full situation of the market in a certain period, it is important for you to be able to use and correctly interpret the indicators for yourself. These are the basics from which the trader’s training begins.

With the help of indicators for binary options, there is more information for analysis, on the basis of which you can make a decision on the conclusion of a transaction.

Experienced traders display about five or six indicators for binary options on the chart, which help to build their trading strategy. You should understand that indicator data is not a call to action, it is rather a source of data and you make the decision about the transaction yourself. Remember that indicators calculate based on information about past market conditions, and will not be able to give accurate information about the future.

Rules for concluding transactions (screenshots)

Trade from the center line

In this case, a zero mark is used. Depending on the position of the indicator, you can do this to increase your income:

- If the McClellan indicator has been above 0 for a long time, in the overbought zone, and then crossed this mark with both lines, we open for a fall. There is a signal about the upcoming market turn down and it is possible to realize the purchase of PCI contracts. PUT is a condition for a price fall, the opposite value of the CALL condition. If you think that the price of an asset will fall, then choose this condition.

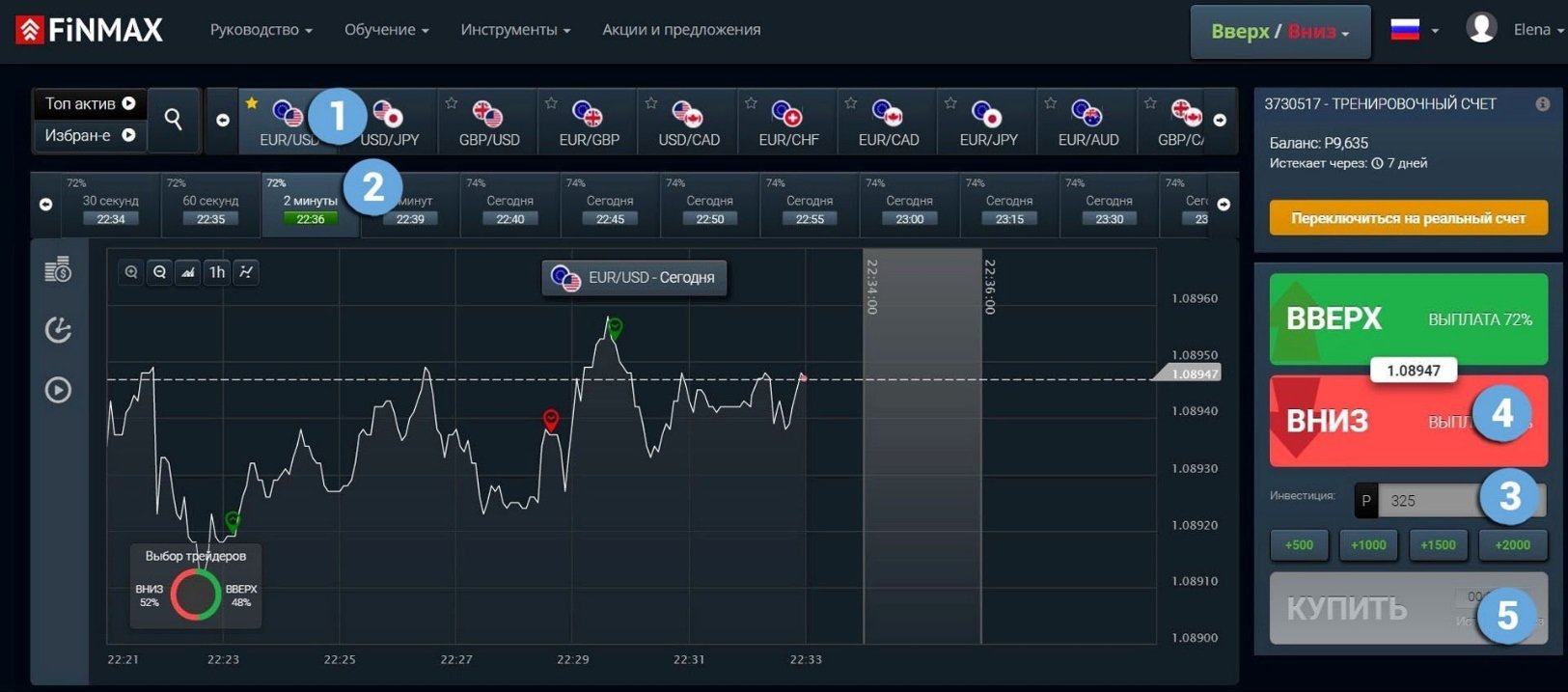

If you want to buy a down option (PCI), then on the broker’s platform Finmax – finmaxbo.com, you need to take the following steps.

In order to prepare the option data, we specify:

1. Type of trading asset

2. Validity of the option

3. Bet size

4. Forecast for the movement of the quote: DOWN

5. Click the “buy” button and monitor the results of the movement of currencies on the chart

As a result, the option closed with a profit of 559 rubles.

- If the McClellan indicator has been below 0 for a long time, in the oversold zone, and then crossed this mark with both lines, we open for an increase. There is a possibility of buying CALL agreements. This indicates the likelihood of an imminent upward turn of the market and signals the conclusion of a deal. That is, if you are sure that the price of the asset will rise at the end of the option, choose the CALL condition.

If you want to buy an option up (CALL), then on the finmaxbo.com platform, you need to take the following steps.

In order to prepare the option data, we specify:

1. Type of trading asset

2. Validity of the option

3. Bet size

4. Forecast for the movement of the quote: UP

5. Click the “buy” button and monitor the results of the movement of currencies on the chart

As a result, the option closed with a profit of 559 rubles.

Trading at the intersection of lines

A fairly powerful signal of the McClellan indicator, which occurs when both lines of the indicator intersect each other.

In this case, it is worth remembering the classic scheme:

- if the red line is lower than the blue line, you should sell the currency,

- If the red line is higher than the blue line, it is worth buying currency.

This is a simple and effective technique, the main advantage of which, unlike, for example, Stochastic, is the least sensitivity, which gives you fewer false signals.

Money management

Money management for traders is a deposit management system on which the success of the strategy depends. An experienced market player thinks in advance about minimizing risks and losses. Using the rules of money management, you can be sure of a stable income. So, let’s look at the basic rules of money management:

- The amount of the deposit must be minimal

Many beginners make the mistake of depositing a large amount of money into the account, respectively, in case of loss, you will lose the entire amount. How to proceed?

To start trading, you will only need to make a minimum deposit, and you can get down to business right away. Then, in case of failure, you have money in your account to start all over again.

- Trading in one transaction should not exceed 5%

Often, newcomers put up all their funds to participate in the auction, this is a serious risk in case of loss to be left without money. How to proceed?

Trading in one transaction should not exceed 5% of your entire deposit, as well as no more than 15% of the deposit in all transactions at the same time.

If your deposit is $200, you can invest no more than $10 in the purchase of one binary option. By distributing your funds wisely, you can continue trading if you didn’t succeed the first time.

- The number of assets should be reasonable

A large number of traded assets will not allow a novice trader to follow their movement, you simply may not have time to react to the situation in time and lose. How to proceed?

It is worth taking up to three assets for work: commodities, indices, stocks. So, you can study the price behavior without haste and make the right bets. As your experience grows, expand the number of tradable assets.

- Use the Rule of Three

Statistics show that after three failed trades, a novice trader loses control of the situation: he panics, he is seized by a keen desire to return losses. If you do not stop, it will come to the fact that there will be no money left in the account. How to proceed?

Using the rule of three, stop your participation in the auction after three consecutive transactions. It doesn’t matter if your bets were successful or not. So, you will save your money and develop discipline.

Expiration

The concept of “expiration” in binary options is one of the main terms that a novice trader will work with. Ignorance of the term will result in you not being able to trade successfully.

What is expiration?

Translated into Russian, the word means “ending”. Expiration in binary options is the expiration date of the transaction. When buying an option, you must choose the expiration time – the time after which you want to close the transaction. You have the right to choose any expiration time – from 30 seconds to several months.

Opening each of your trades, you analyze when the price will go up or down and, based on your conclusions, choose the expiration time. So, the deal will be closed at the time of your choice.

Can I change the expiration?

You can change the expiration:

If expiration is chosen, the transaction is open, but you understand that you will not achieve the desired result, brokers may allow you to close the transaction ahead of schedule and return part of the original bet.

You can also extend the expiration time of the option. For some brokers, it is permissible to extend the expiration date of the transaction from 15 minutes to 30 minutes, but you will have to pay extra.

The concept of “expiration” in binary options is the basis for successful trading of financial assets. The right expiration time is already half the success of the transaction.