Обзор

Обзор

A microfinance organization with rich functionality offers the client to receive small amounts of money in a short time.

Читать полный обзорОтзывы трейдеров

Детали

| Брокер | |

|---|---|

| Адрес сайта | |

| Демо счет | |

| Брокер с сигналами | |

| Общий балл |

Полный обзор

MFI from Novosibirsk “eCabbage” appeared in 2012 (reviews of the MFC “eCabbage” read on the website This is a divorce™). It is owned by MCC Rusinterfinance LLC. The company’s offices are open throughout the country. Loans of up to 30,000 rubles are available to customers (at the first request).

For regular borrowers, MFIs offer more favorable conditions. Before contacting the lender, we advise you to check the integrity of the “eCabbage”. You need to make sure that this is not a scam or a scam.

Why “eCabbage”?

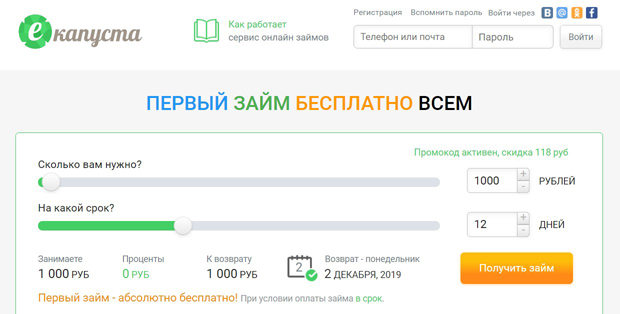

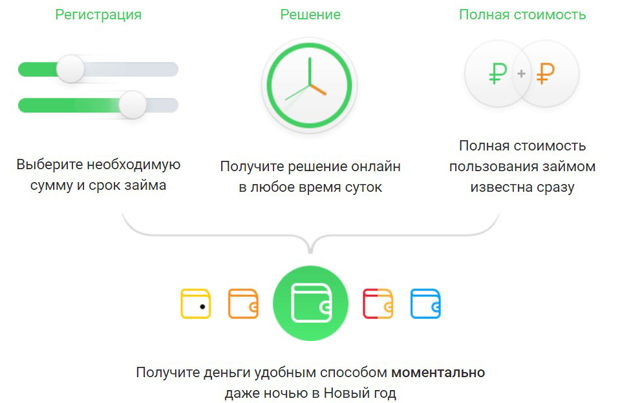

The eCabbage service is fully automated. This is a convenient platform for quick processing of loans. 10 minutes and the money is yours. The personal data of customers is processed by the system, an error due to the fault of a person is excluded. Borrowing from an MFI is easy. If you get into the number of conscientious customers, solve the financial issue and improve your credit history, then the chances of getting a bank loan will increase.

Learn more

Working with the eCabbage service is convenient and profitable. For new customers, the MFI makes a discount, just enter the promo code. On the first loan, the borrower pays 3 times less interest than on subsequent loans. In fact, it turns out that the new client takes installments. You do not need to pay interest (only with a timely return of funds in full). The service also has other advantages:

- Round-the-clock operation. The site is available 24/7, technical support answers questions around the clock. The functions of the service are always active.

- Convenient calculation methods. Borrowed funds are transferred to a bank account or card, an electronic wallet. The client independently chooses where the money will come after the approval of the application.

- Free access to services. Residents of any city in the country can receive financial support. If there is no bank in the village, the eCabbage service is happy to offer its help. There are no territorial restrictions in Russia.

- Different options for debt repayment. The client has the right to return the funds in any convenient way. The method of obtaining a loan and the option of paying the debt may not be the same.

- Available service. You can go to the ekapusta.com website and use the services of MFIs from any device: smartphone, tablet, laptop. There is an official application for working offline.

- More than 3 million borrowers used the services of MFIs. Most of the reviews are positive.

Term loans of money from ekapusta.com

Borrowed funds of MFI “eKapusta” are available to adult Russian citizens. Age restrictions: 18-70 years. You do not need to specify the purpose of receiving money. This is unnecessary information that does not affect the final result. Loans for travel and a loan for household appliances will be issued on the same terms. Requirements for customers are minimal (with the exception of a few nuances).

Conditions for granting money loans

The eKapusta service gives 1-3 weeks to repay the loan. A new client can borrow up to 30,000 rubles. With timely repayment of funds, the credit limit increases by 20%, in some cases even more.

To apply, you will need a phone number. No collateral or guarantors. Before sending the questionnaire, we advise you to familiarize yourself with the “Public Offer of Rusinterfinance”, which owns the service. There are features of microcredit:

- Only an individual can receive borrowed funds.

- The main condition for obtaining a loan is the client’s legal capacity.

- Loans are provided personally to the borrower, transfer to third parties is not provided.

- Borrowed funds must be used without violating the law.

There are few requirements, they are quite legitimate and justified. It will not be difficult to get a small loan from the service.

How to apply for a loan of money

Fill out the form to start cooperation with MFIs. Go to the website of the online service ekapusta.com. Find out the approximate cost of the loan (including interest) using the calculator, it is available on the website. If you are satisfied with the result, apply for a microloan. In the questionnaire you need to specify the following information:

- Name, passport details, place of birth, phone number and email address;

- social status (student, worker, manager), monthly income, name, and phone number with the address of the employer, your profession and length of service;

- phone number and full name of the closest friend or relative – for urgent communication with you;

- the desired terms of the loan (the option of receiving money, the amount of the loan, the method of confirmation);

- marital status, driver’s license, dependents, living conditions (to confirm reliability and stability);

- Additional information about yourself (optional) – accounts from social networks.

It takes a few seconds to review the application. Automatic analysis saves customers time. After processing the application, confirm your identity in your account on the service’s website. You will need a copy of your passport and a photo. According to statistics and user reviews, the system approves almost all applications. The most important thing is to meet the minimum requirements that MFIs impose on borrowers. After making a positive decision and confirming your identity, you can receive money. There are several ways to calculate:

- Electronic wallets Yandex.Money, QIWI.

- Payment system Golden Crown, Contact.

- Bank card (Visa, MasterCard) or current account.

- Bank transfer takes up to 3 days. In other cases, the money comes instantly.

How to return money to MFI “eKapusta”

Each client has their own payment schedule. To find out the date of repayment of the debt, go to your account on the website of the ekapusta.com service. Information is available long before the loan is issued. Use this data to make a decision and become a borrower or give up the role of a debtor. The schedule shows the dates of repayment of borrowed funds. You can pay off the debt ahead of schedule, if the family budget allows. There are several ways to pay off MFIs. A complete list of calculation methods is presented on the website in the “Redeem or extend” section. The most popular and convenient options:

- Bank transfer from an account or card.

- Through QIWI terminals.

- Through the “Contact” payment system.

When paying for a loan, pay attention to the commission of banks and the limits on a one-time transfer (usually 15,000 rubles). When you fully pay off the MFI, the loan agreement will cease to be valid. If you do not have time to pay off the debt, then extend the loan. This is possible with the advance payment of interest for delay. The daily commission is 1.49% of the loan amount.

Complaints about eKapusta

The eCabbage online platform is an honest and respectable service. Negative reviews about the work of MFIs are rare. Managers are sociable and polite (even with debtors). There is no aggression on the part of “eCabbage”, there are no threatening calls to relatives and friends of the borrower. Such actions are committed in exceptional situations.

What users complain about is the marketing of MFIs. The service offers services too intrusively, informs about current offers. When filling out the questionnaire, you indicate your phone number. It is there that informational messages will come, calls with offers will arrive. Another negative point is calls to an additional number to a loved one or relative when the borrower does not answer. But this is a common practice that is used in banking and credit organizations. In general, the reviews about the service are positive.

Regulation and licenses of MCC Rusinterfinance LLC

MFI checks clients for solvency and integrity. Meanwhile, the lender himself must be reliable and verified. The status of the company is evidenced by the availability of licenses, entries in the register and official documents on the website.

License & Regulator

The eCabbage service is the property of MCC Rusinterfinance LLC. The company is in the register of MFIs under number 5408292849. The creditor acts on legal rights. When settling with clients, he uses the law “On Consumer Credit (Loan)”.

- Read Federal Law No. 151-FZ of July 2, 2010 “On Microfinance Activities and Microfinance Organizations” as amended on the websites: consultant.ru, garant.ru;

- State Register of Microfinance Organizations (download from website cbr.ru, MCC Rusinterfinance LLC – line 183);

- Documents from the ekapusta.com website: “Public offer and general conditions for the provision of microloans” dated 01/28/2019 (see), “Tabular form of individual microloan conditions” (see), “Full cost of consumer microloans” (see), “Regulations on installment programs” (see), “Regulations for the prolongation of microloans” (see), “Rules for the provision of microloans” (see).

Support

The eCabbage service provides information support to customers. Technical support operators will help you get advice and an answer to the question, deal with the problem. They work around the clock. To quickly contact the operators, call +7 (495) 215-55-67. You can fill out the feedback form. There is another way – write a letter and send it to the email address: [email protected]. It takes a few hours to process your emails.

User Agreement ekapusta.com

The nature and features of the relationship between the lender and the borrower are defined in the user agreement. The IFI has drawn up a brief document. It reflects the basic principles of the service, the rights and obligations of the borrower. It is not allowed to publish data that violates copyrights on the online platform.

Each visitor is obliged to show respect and loyalty to the guests of the site. The service disclaims responsibility for the safety of input data. The account owner himself protects the login and password from his personal account. If the account is hacked, it is pointless to send claims to the MFI.

Another rule: spam cannot be posted on the service’s website. There are no other serious prohibitions.

![]()

Is “eCabbage” a scam?

The reputation of the eCabbage site is good, the functionality is decent. There is no reason to consider a lender a fraudster. With the help of the online service, the client can profitably and quickly become a borrower, receive a small amount for any purpose and return it within a reasonable time (with the possibility of extension). On the site you can get acquainted with the main documents of the owner of the service. The principles and rules of work are clear and understandable, there is no vague wording in the user agreement. Huge and hidden commissions were also not found.

The company that owns the service has the official status of an MFI. This is confirmed by the documents of the Central Bank of the Russian Federation. There is an extract from the state register of microfinance organizations. This circumstance once again confirms the integrity and honesty of the creditor. The online service is convenient to use. Of course, you won’t get large sums here. However, you can count on a loan of up to 50,000. The most important thing is to pay off the first loan on time in order to increase the limit. Due to the small amounts, little time is given for a refund (up to 3 weeks). The interest rate is high when compared with bank offers, but the conditions are acceptable for urgent solutions to financial problems and quick repayment of debt.

Conclusion

“eCabbage” is a functional, convenient, respectable service for quickly obtaining a loan. The site cannot be called a divorce exactly, because the data of MFIs are in the relevant state register. The lender acts with the official permission of the Central Bank of the Russian Federation, in accordance with the legislation of the country.

You can safely give a high score to the service. “eCabbage” relies on aggressive marketing, but is responsible for its words. The lender is honest and, most importantly, loyal to borrowers. He does not use “black” methods for a refund. Thanks to this, people voluntarily repay debts to MFIs. The only drawback is intrusive advertising and constant calls to customers. There are no complaints about the work of the system and the speed of processing applications. The decision is made quickly, the money comes instantly.

Брокер