Today, one of the most popular ways to make money is investing and trading in the forex market. What’s it? The Forex market provides an opportunity to trade currencies through special pairs (for example, dollar-euro, dollar-ruble, and so on) and often the most popular currency is the US dollar. As a rule, accounts or deposits can be replenished with dollars, and the system converts capital at the rate into the desired currency if you need to enter into trading in a pair where the dollar does not appear.

But the review is not at all about how the forex market works and what you can do on it. We need to talk about another problem – about brokerage companies (rating of reliable binary options brokers).

Choosing a forex broker: subtleties

The fact is that the market cannot be located on one server, since it covers a very large number of simultaneous complex operations. To do this, forex needs a kind of assistants – brokers who take on some of the clients, providing them with a platform for trading.

The system does not always work smoothly, like a Swiss watch, and sometimes fails. Forecasts may not come true, a series of unsuccessful transactions may occur, and much more. In general, it cannot be said that all brokers have an excellent system of servers and forecasts, but this is not their mistake – in this area it is quite easy not to guess how the exchange rate of a particular currency pair will behave. And that’s okay.

FTO Capital (https://www.ftocapital.com/) is one of the brokers and, as you might have guessed, the system of its work is not quite established. Sometimes technical failures can occur or forecasts do not work, and then users lose their money, take offense at the broker and may even try to argue with him.

FTO Capital: One Ambiguous Story

As a rule, each broker trader is assigned an analyst, a specialist from the company, who helps him to trade competently, makes forecasts and, in general, plays a big role in the life of a trader. What kind of duties to allow him to perform – the trader can decide for himself. In the case of beginners, the analyst becomes a kind of curator who teaches them everything, prompts everything, brings them up to date.

The client who found herself in the situation in question also had her own personal analyst who helped her work. However, something went wrong and at some point sharp leaks of transactions began to occur – that is, they became unprofitable. It is difficult to say how intentionally this happened, perhaps it is a matter of technical problems or failed forecasts. But the fact remains that the client began to rapidly lose her entire deposit and there was an urgent need for a new replenishment of the account.

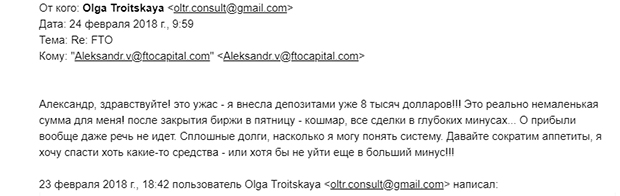

When the total amount of money deposited reached a sufficiently large figure, the client began to sound the alarm – she did not want to lose even more money and hoped to save at least some funds for withdrawal. She quickly formulated a short message and sent it to the contact mail of the specialist with whom she worked:

In the letter, the trader made it clear that she did not want to invest any more money, as she was afraid of losing an even larger amount.

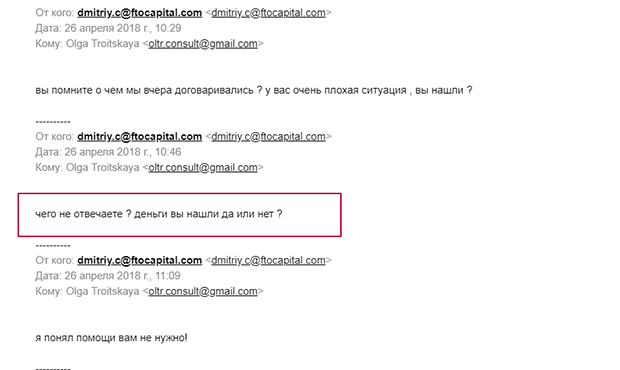

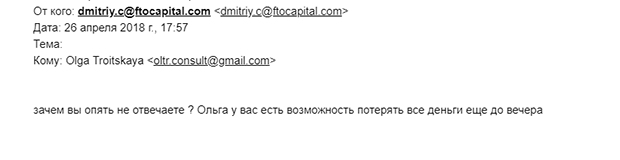

The specialist assured the client that the situation was quite deplorable and in order to return, that is, to trade back at least some money, you need to replenish the deposit again. Under certain circumstances, the client could not always respond promptly to messages, so the specialist simply “bombarded” her with letters. Analytics can also be understood, he works with a difficult client and got into a difficult situation with him, so he must somehow “get out”:

The specialist has repeatedly written that in this situation it will help to replenish the deposit once again – additional money will probably save the account and help to recoup on the exchange and return at least part of the lost amount. Of course, the client was not particularly eager to invest more money, after all, the prospect of losing a large amount did not please her.

However, the broker’s specialist continued to insist that the trader transfer more money. Perhaps he really understood how to act correctly in order to ensure a positive outcome for this situation. Yet, as mentioned earlier, no broker is immune from various system failures and often it puts a “pig” on bidders. Even the most experienced and competent analyst cannot always accurately predict what the dynamics of the foreign exchange market will be.

The client no longer has “free” money to invest. Perhaps she will ask if there is another way to solve the problem or take out a loan. It is still difficult to imagine how the story will develop, just as it is impossible to say with accuracy the reason for such behavior on the part of the broker. It remains only to observe and try to figure out what is happening.

Choosing a broker: precautions

If you are concerned about this situation and you think that you are also at risk of getting into a similar story, then before trusting the broker, it is better to study what other users write about it (traders’ complaints).

Do not be lazy to visit the relevant sites, where traders usually write about their experience with brokers. Perhaps someone has already fallen into the clutches of intruders and now does not want the same fate to their colleagues. It also does not hurt to check the availability of official registration with the company, so that later it does not turn out that you gave your money to a scammer, some “left” company that has nothing to do with the trades in which you wanted to invest (blacklist of brokers).

In addition, we strongly recommend that you familiarize yourself with such a procedure as chargeback (instructions for chargeback on the eto-ravod.ru). This is a cancellation of the transaction – that is, you can cancel the transfer of money, and it will return to your account if the organization approves your application. In some cases, this is the only and very convenient way to get your money back (is it possible to get your money back from a broker?).

However, to do this, you need to fulfill several requirements and collect a package of documents, that is, preparing for a chargeback can take a long time. That is why it is better to start learning about it right now.