Accumulation/Distribution Indicator (A/D)

Description

We continue the series of detailed reviews about binary options oscillators that will be useful to our readers. Read our materials, choose your strategy, practice trading and reach the maximum in trading in the financial market. Today we will tell you about one of the technical indicators – Accumulation / Distribution (A / D), which is common among market players. How it differs from other instruments, what is its advantage over other oscillators, as well as the rules of money management and the features of expiration with A / D – you will learn about all this in the material.

The Accumulation/Distribution (A/D) indicator is another technical indicator, the indicators of which depend on the price dynamics, as well as the volume of the asset, it connects changes in price and volume. The author of the oscillator is the well-known trader Mark Chaikin. Interestingly, the tool had to be developed due to an elementary lack of information. Daily newspapers did not publish the opening prices of trends, so the trader had to look for his own solution for this, which led to the invention of the oscillator. When A/D was invented, it became quite successfully used in binary options trading. Later, the Accumulation/Distribution indicator became the basis of the Chaikin oscillator.

For A/D, the market volume is the weighting factor for price changes. It is fair to talk about the following pattern: the higher the market volumes, which affect its dynamics, the movement is considered more significant. A larger volume transmits more weight to the price change, which is immediately reflected in the change in the indicator value. The difference between the maximum and minimum prices plays a significant role: the smaller the difference indicator, the greater the A/D value. When the volume increases dramatically, it affects the movement of the tool line.

A/D is a variation of the also popular On Balance Volume oscillator. Both of these tools confirm price changes by comparing price volumes. When A/D rises, it indicates a purchase, because. Almost all of the volume comes from rising prices. When the A/D falls, it indicates a sale, because Almost all of the volume comes from lower prices. The discrepancy between the Accumulation / Distribution and the price will tell you in advance about the upcoming price change: when the indicator rises and the price chart falls, this is a reliable signal of a price reversal and vice versa.

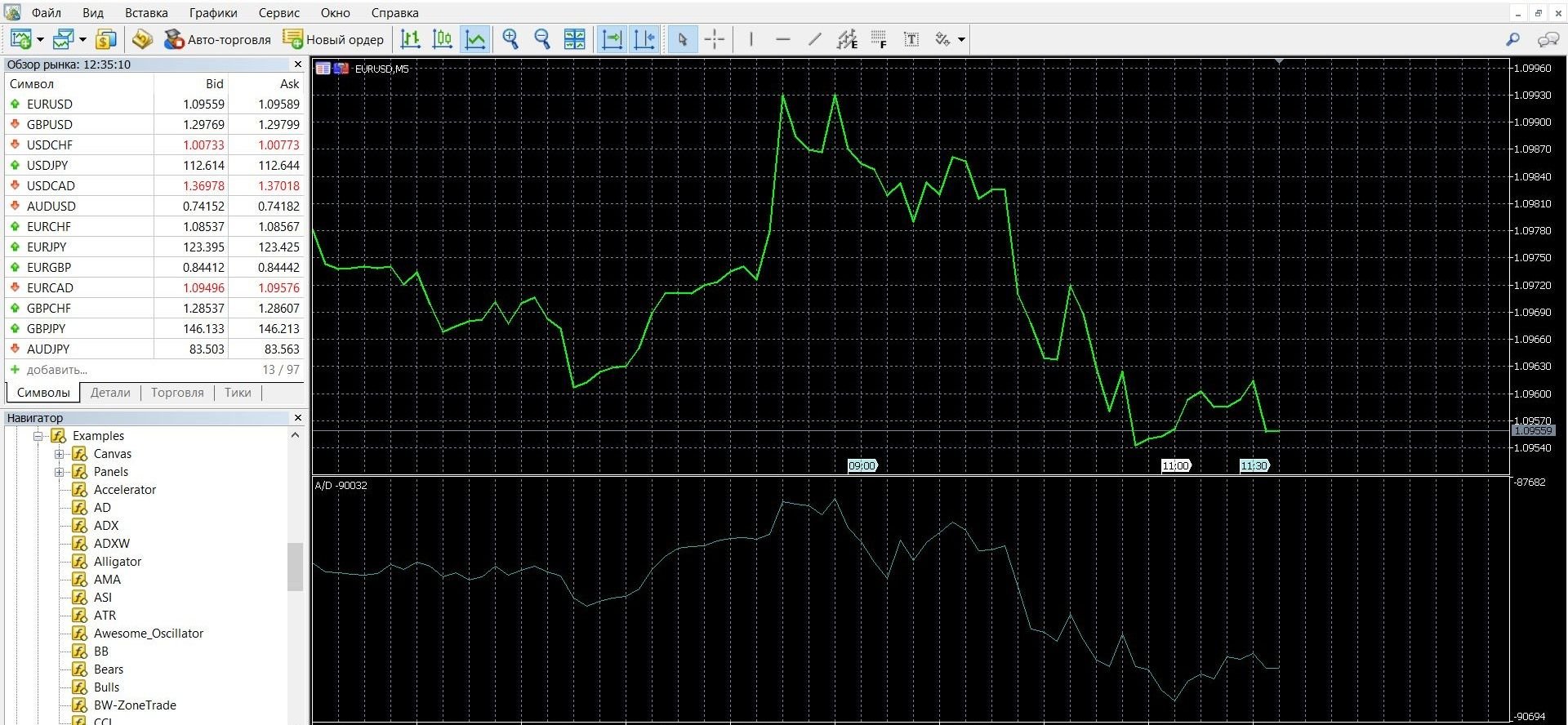

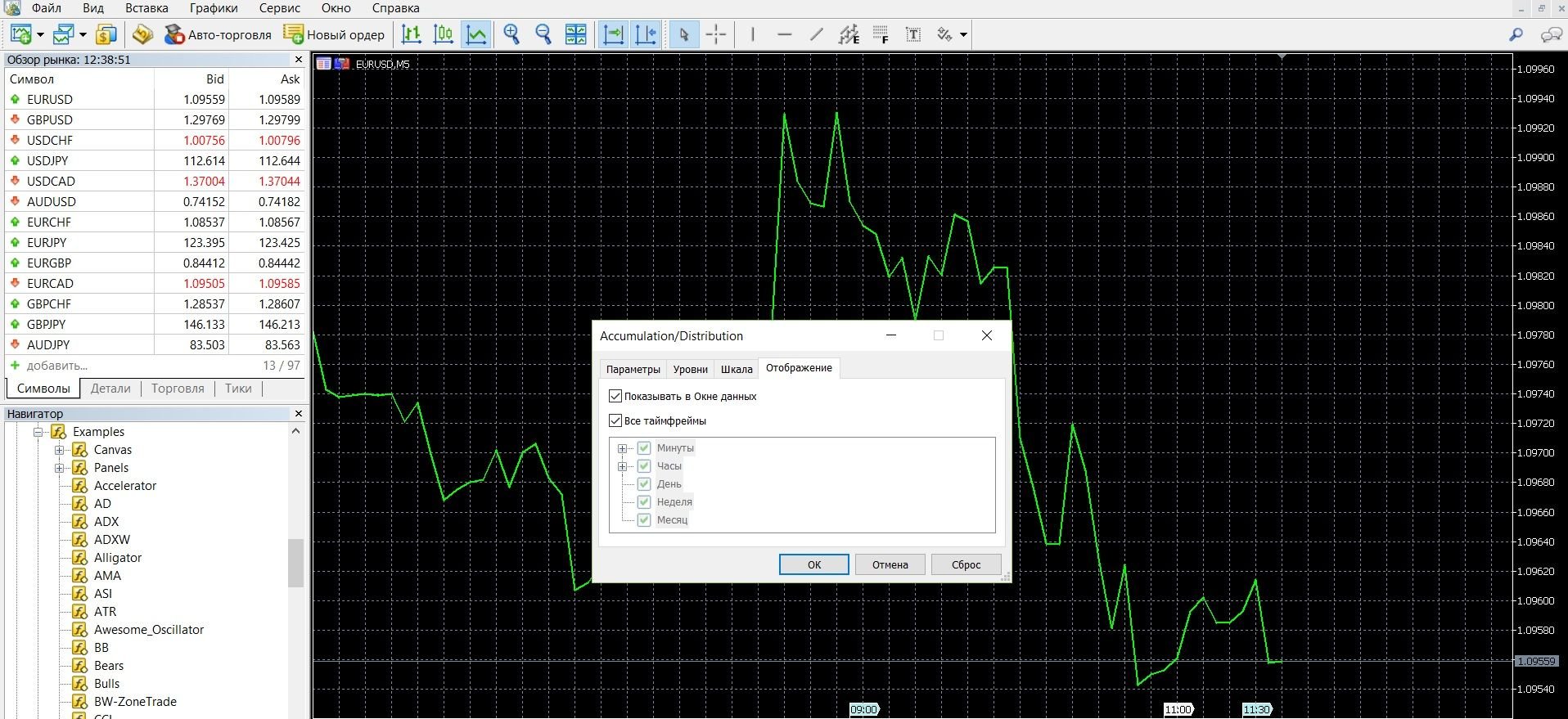

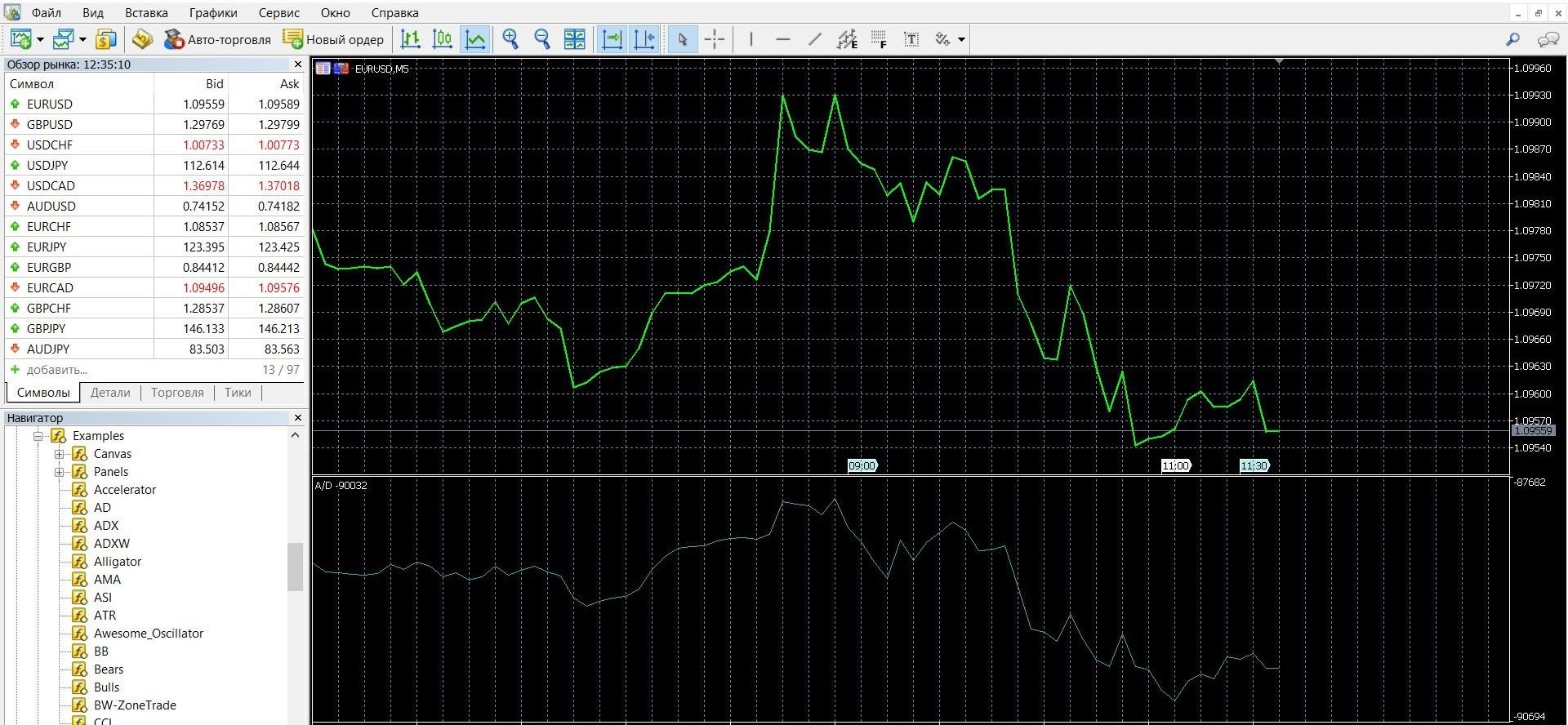

You can see what A/D looks like on the MetaTrader 4 (MT4) platform in the image below. In addition, you can download the MetaTrader 4 platform and get acquainted with this oscillator in more detail.

How does the A/D indicator work?

A/D signals the dependence of price changes on volume, and it is also a reliable tool for determining the financial forces that dominate the market at a particular moment. The larger the volume, the more significant the price dynamics; The greater the activity of participants in the financial market, the greater the price change. If the schedule grows, buyers dominate; If the chart falls, the market is dominated by sellers. The name of the oscillator also reflects the scope of its application:

“Accumulation” is a market that is controlled by buyers

“Distribution” is a market that is controlled by sellers.

As a result, if you need reliable information about the current market situation, refer to the A / D data, this is its main task.

Indicator signals:

The indicator is used to confirm current trends:

- The uptrend is confirmed by the rising values of the indicator;

- The downtrend is confirmed by the falling values of the indicator.

If AD grows and at the same time, prices rise on the chart, then there is an uptrend and you can buy call options.

If the curve tends downwards, then you can buy put options.

Signs of divergence and convergence:

- A sign of weakness in the uptrend – the price growth to a new high is not confirmed by the movement of the indicator line – is a signal of a downward reversal.

- A sign of weakness in the downtrend – the price drop to a new low is not confirmed by the movement of the indicator line – is a signal of an upward reversal.

How to calculate A/D

A/D(i) =((CLOSE(i) – LOW(i)) – (HIGH(i) – CLOSE(i)) * VOLUME(i) / (HIGH(i) – LOW(i)) + A/D(i-1), where:

A/D(i) — value of the Accumulation/Distribution Indicator for the current bar;

CLOSE(i) — bar closing price;

LOW(i) — minimum bar price;

HIGH(i) — the maximum price of the bar;

VOLUME(i) — volume;

A/D(i-1) — the value of the Accumulation/Distribution Indicator for the previous bar.

Info taken from www.metatrader5.com website

Do I need to install A/D on your platform?

The indicator is considered a classic tool for trading binary options, it is integrated into almost all modern trading platforms, and users of the MetaTrader 4 platform can also work with it without installation. A/D is a single curved line, which is located separately from the main price chart.

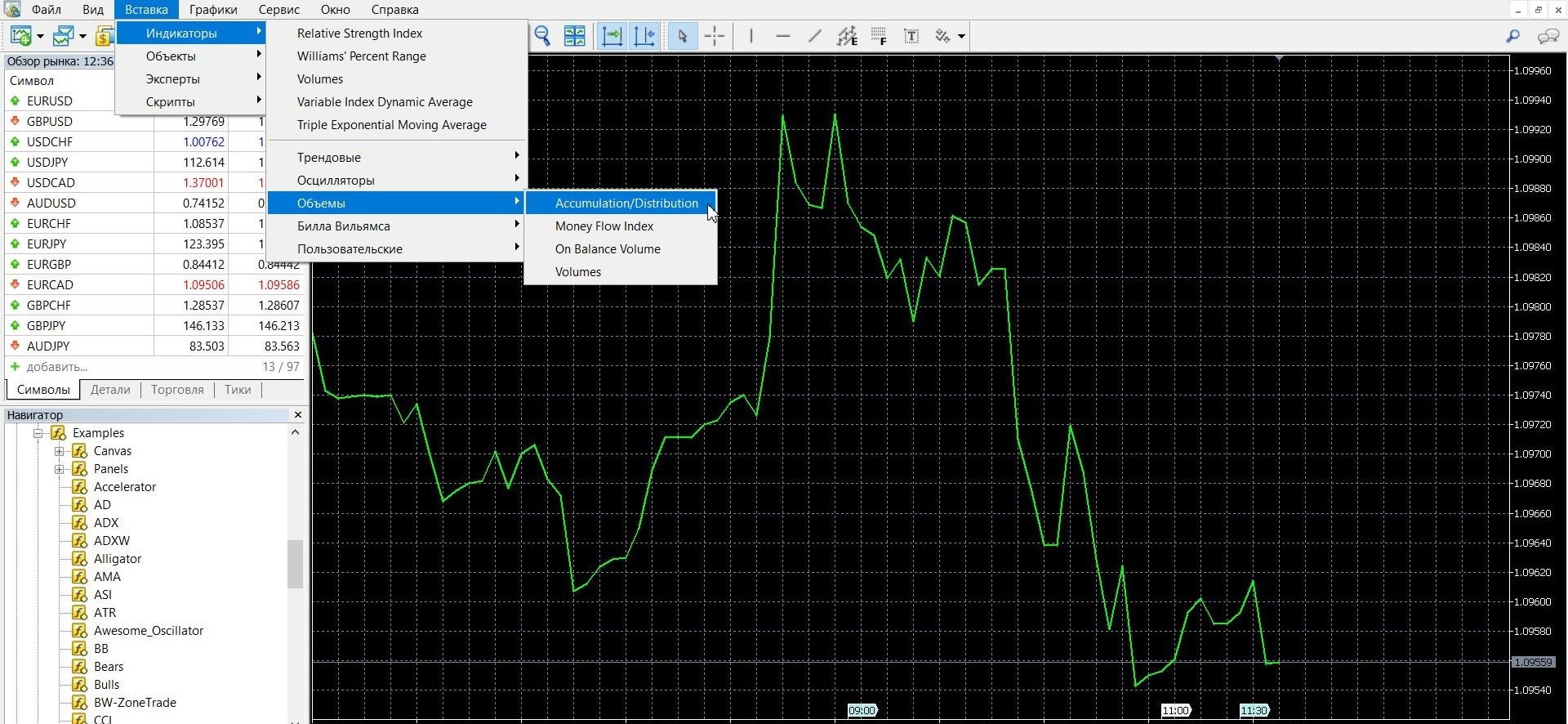

To add A/D to the price chart on the MetaTrader 4 platform, you need to perform the following steps: click the “Insert” tab – select the “Indicators” tab – then “Volumes” – Accumulation / Distribution.

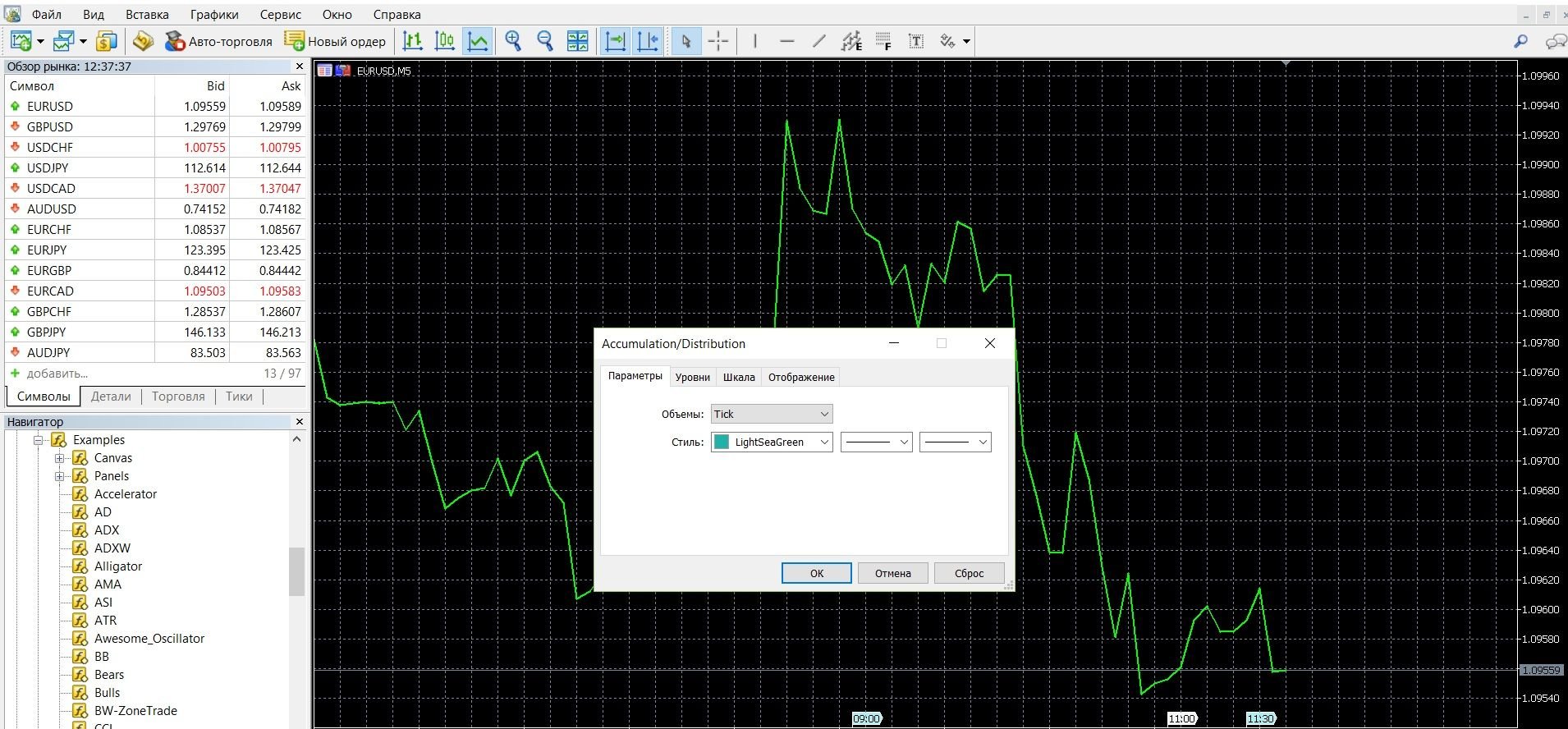

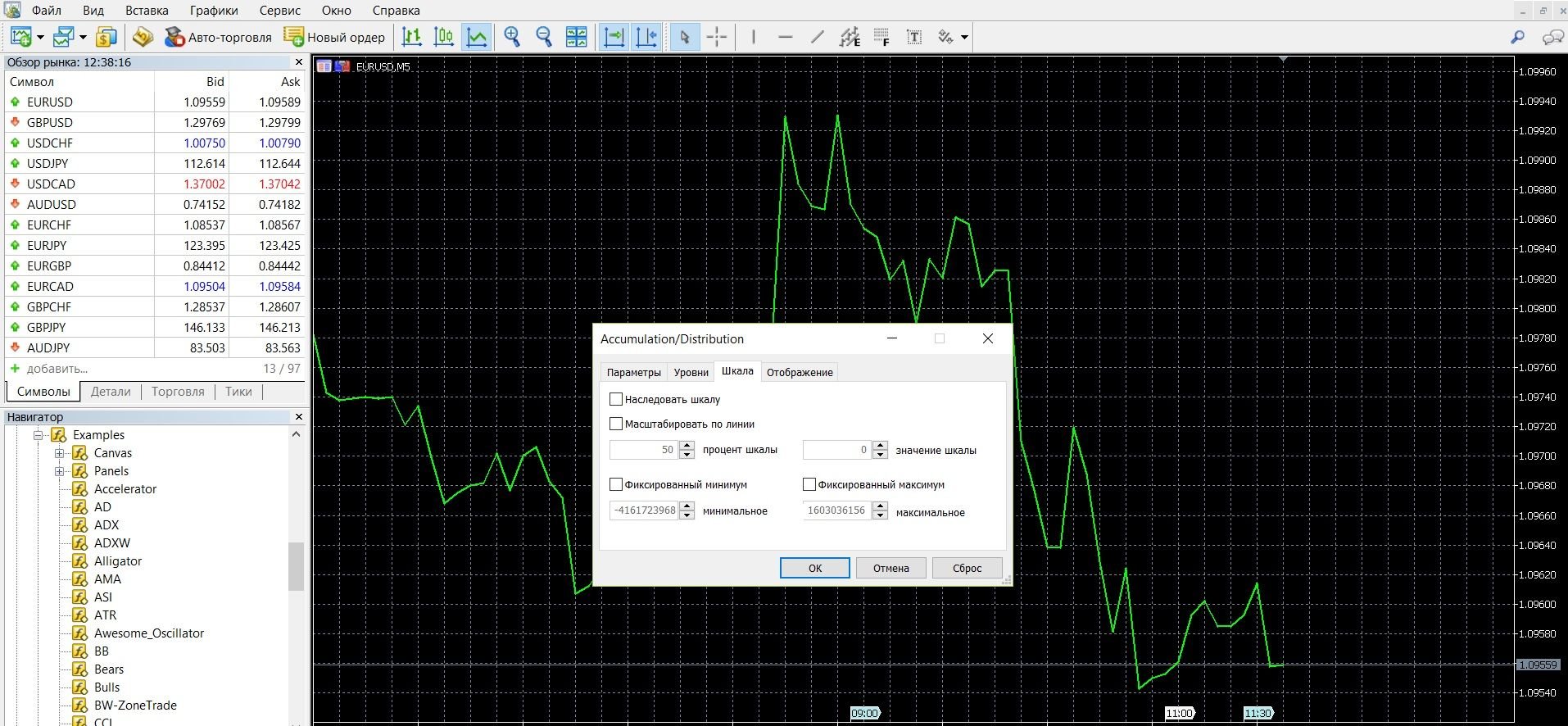

When adding to the main chart, a window will appear with a set of standard settings, click the “OK” button. A curved oscillator line will appear in a separate chart. You can get started.

If your platform doesn’t have an A/D oscillator, you can download it here.

Application of the indicator for binary options

The indicator has a lot of opportunities to use its data in trading. First of all, Accumulation Distribution is used to determine signals for trading: divergence, convergence, as well as to fix trends in a particular period. Based on this data, supported by other technical analysis tools, you can place CALL and PUT bets and get a good income.

The oscillator also indicates what the market situation is at the moment, who dominates at the moment, sellers or buyers. Based on this information, you can draw conclusions and use them in trading. Traders use Accumulation Distribution along with other oscillators as an auxiliary tool, but sometimes it can be used alone.

Professional traders work more with the indicator, because it is necessary to pay attention to details that are not taken into account by option beginners:

1. When plotting the line, the indicator does not take into account “gaps” – price gaps that are converted at the beginning of trading sessions or after the publication of economic news. This distorts the indicator data and novice players forget about it.

2. Also, the curve often completely copies price movements, not showing divergence where other instruments (RSI, MACD , etc.) talk about it. As a result, traders may miss the right moment to enter the market. In order to prevent this from happening, it is important to use A/D with other indicators.

Rules for concluding transactions (screenshots)

Trading with a signal for a rise – a decrease in prices

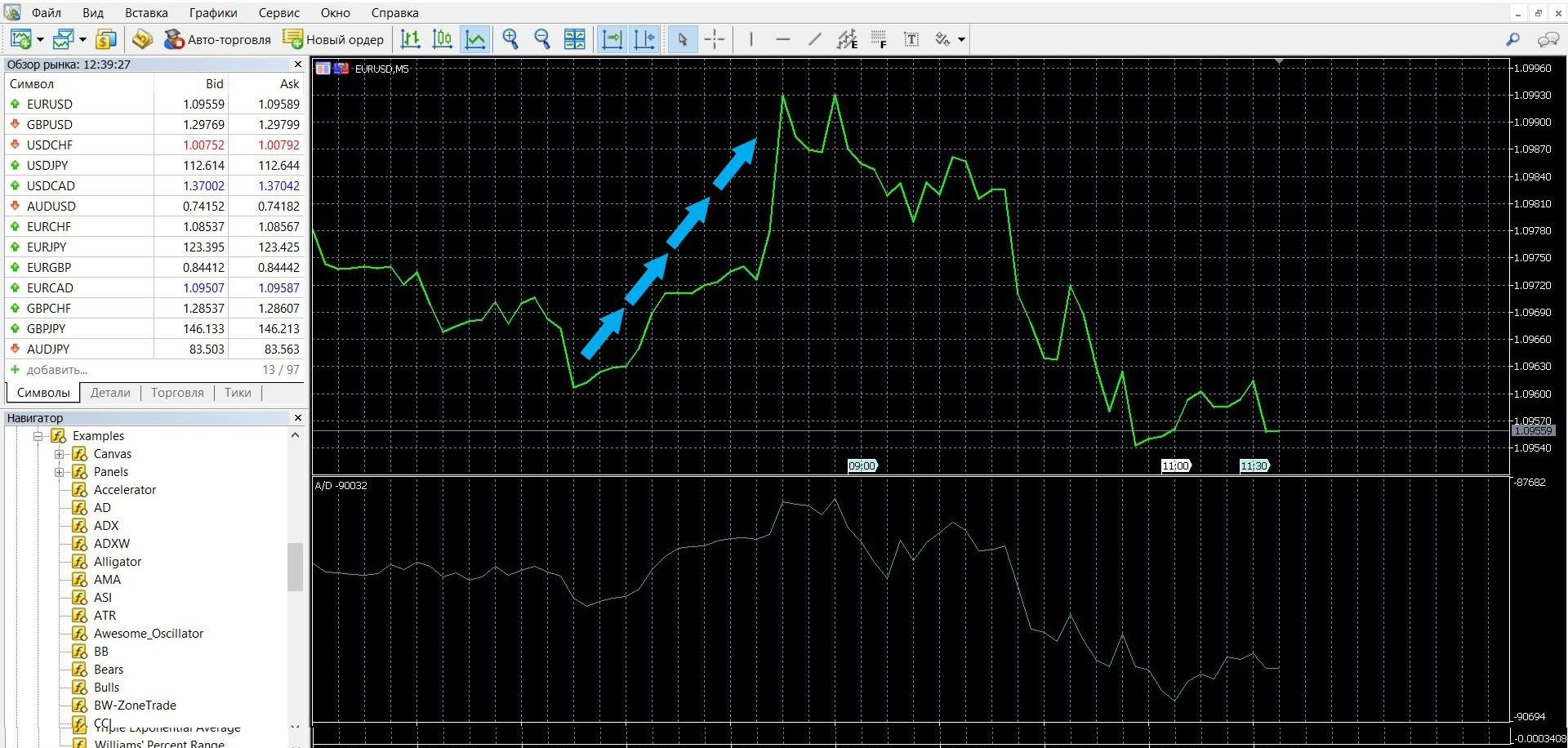

In the images below, you can see what the upward trend of the market looks like on the MetaTrader 4 platform:

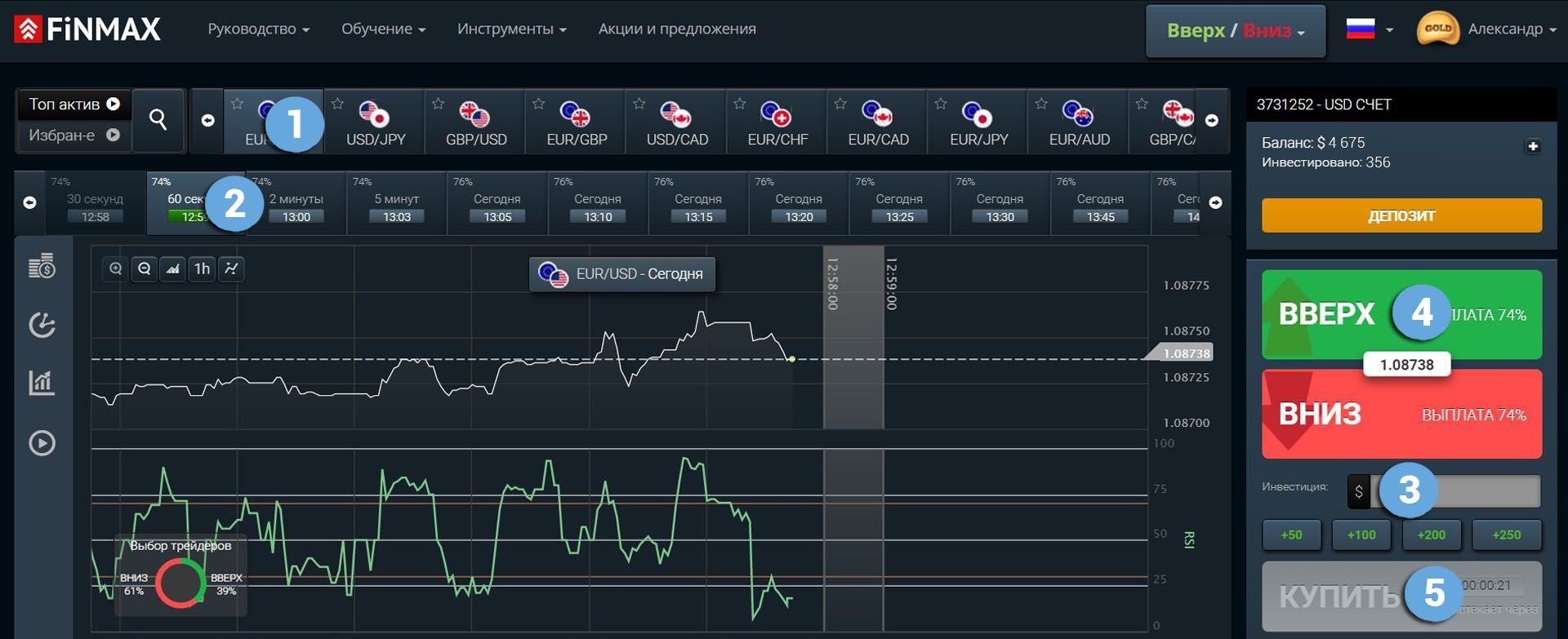

Take advantage of the opportunities of the upward trend in price and place a CALL ( up) rate with the Finmax broker. To do this, follow these steps:

Go to the broker’s website finmaxbo.com and prepare an option, to do this, specify in the system:

1. Type of asset

2. Validity of the option

3. Bet size

4. Forecast of quote movement: UP

5. Click the “buy” button and follow the results of currency movements on the chart.

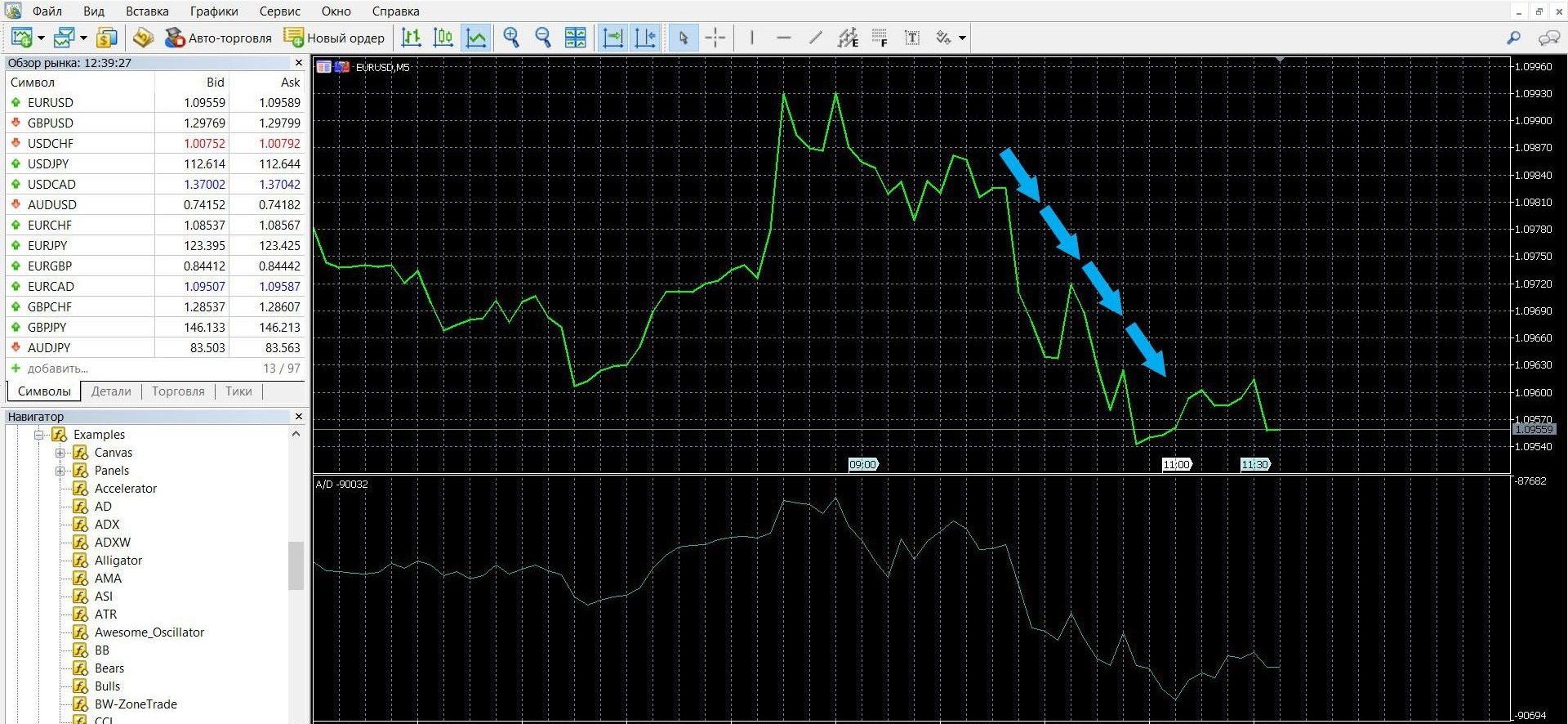

In the images below, you can see what the downward trend of the market looks like on the MetaTrader 4 platform:

Take advantage of the opportunities of the downward trend in price and make a PUT (down) rate with the Finmax broker. To do this, follow these steps:

Go to the broker’s website finmaxbo.com and prepare an option, to do this, specify in the system:

1. Type of asset

2. Validity of the option

3. Bet size

4. Forecast of quote movement: DOWN

5. Click the “buy” button and follow the results of currency movements on the chart.

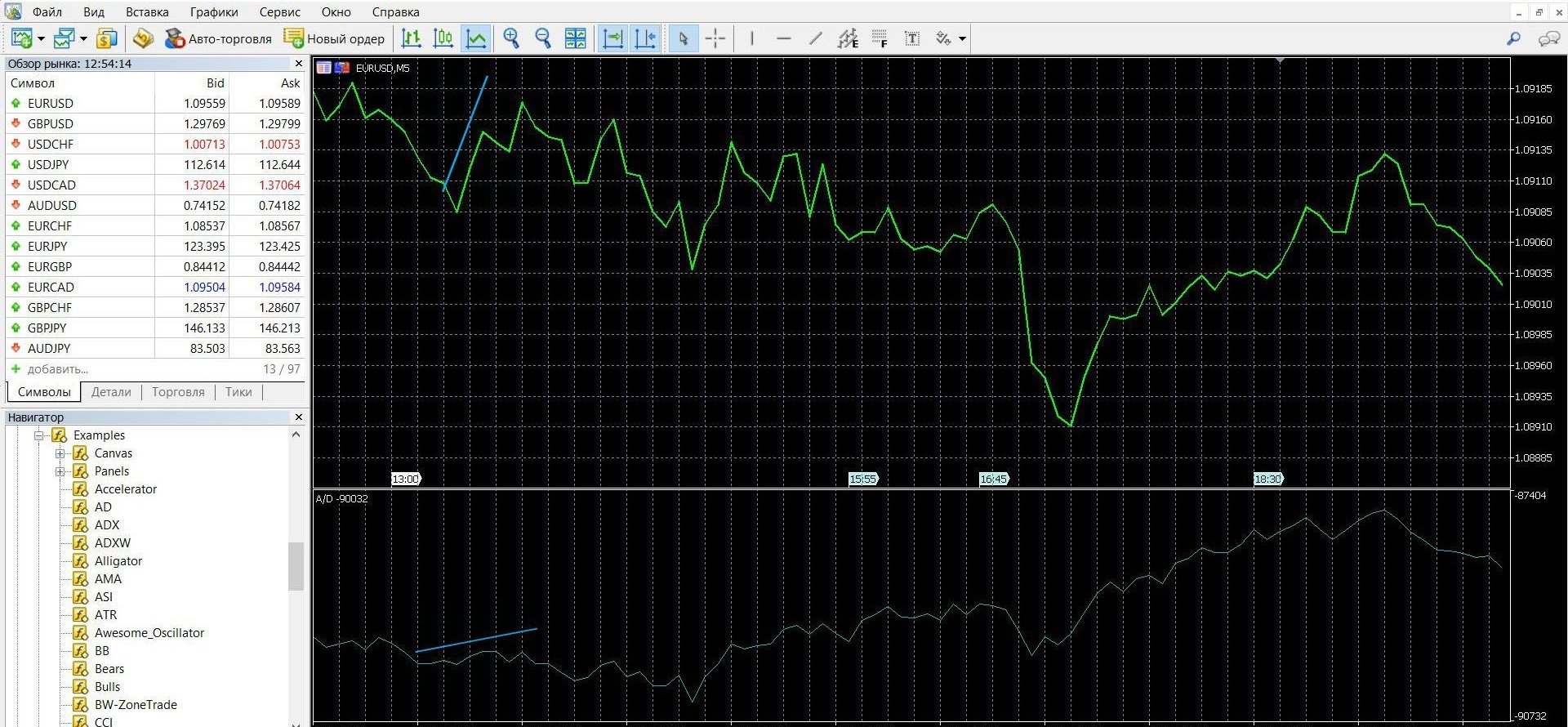

Trading with a divergence signal

Divergence is a discrepancy between the indicator readings and the price. Divergence occurs in an uptrend, when the price goes in one direction and the indicator lines in the other, this is a signal that the price movement will change soon:

Take advantage of divergence opportunities and place a bet with a trusted Finmax broker. To do this, followthese steps:

Go to the broker’s website finmaxbo.com and prepare an option, to do this, specify in the system:

1. Type of asset

2. Validity of the option

3. Bet size

4. Forecast of quote movement

5. Click the “buy” button and follow the results of currency movements on the chart.

Trading with a convergence signal

Convergence is a divergence between the indicator and price readings, which appears on a downtrend, when the price on the chart sets new peaks, but the indicator does not, and warns of its completion:

Take advantage of convergence opportunities and place a bet with a trusted Finmax broker. To do this, follow these steps:

Go to the broker’s website finmaxbo.com and prepare an option, to do this, specify in the system:

1. Type of asset

2. Validity of the option

3. Bet size

4. Forecast of quote movement

5. Click the “buy” button and follow the results of currency movements on the chart.

Money management

No computer program or robot will guarantee effective management of your money. To ensure that you always have your personal funds, you need to work with them thoughtfully and carefully. Many novice players in the options market are involved in the race to win and completely forget about their funds, not subjecting them to any rules and wasting them in the very near future. Bottom line: you are again without money and in order to continue trading, you will have to transfer funds again.

Professional traders, on the other hand, devote a lot of time to their capital and its reasonable handling, because They know that a stable good profit is possible only with a stable income. The rules of money management are a real right decision, they will become one reliable strategy that will bring positive results.

Money management is the rules of thoughtful cash capital management, which will allow you to save funds on the deposit and increase them.

Minimum bets. Minimum funds

When participating in the auction, bet a minimum amount on each specific option, but not more than 5% of your deposit. Trade lots that are lower than the funds on your deposit. Choose a consciously trusted broker and trust your funds only to the site where you will be guaranteed the best income. By using your money carefully, you will keep it in your account, and, in case of a possible loss on your part, you can continue to trade.

Minimum deposit

When bidding, start by working thoughtfully with your account. Transfer the minimum amount of money to the deposit, determining for yourself the amount that you can spend on trading. Carefully keep the funds in your account, remember the possible risks of options trading and that in case of an unsuccessful transaction, you will need to continue the game.

Minimum assets

When participating in the auction, start with the minimum, gradually master the possibilities of the market. Often, beginners in trading try their hand at all possible assets at once, which does not lead to a good outcome. It is worth remembering that a large number of trades is a large burden on the deposit and a large percentage of the probability of losing all funds at once.

Start trading with two or three assets, then, after that. As you get used to the market, make informed decisions, you can increase the number of assets. The desire to make big profits will always attract unconscious actions, and only having a money management strategy will help save your funds.

Minimum emotions

When participating in the auction, consider them serious work, in which thoughtfulness of actions, in-depth analysis and balanced decisions are important. When starting such work, turn off your emotions, do not play in a bad or excited state, this will prevent you from concentrating. Experienced market players are characterized by sobriety and clarity of action, remember not only promising transactions, but also probable risks.

Perfectly disciplines the proven rule of three. As statistics show, three successful or failed transactions are enough for a trader, and his mind is turned off, there is a strong desire to return the lost funds, in case of failure, or to multiply the won many times. So, there is a big risk of being left without funds on the deposit. Tell yourself strictly “stop” after three trades with any outcome, and you will not only save your capital and increase it, but also feel much more confident and successful.

Expiration

The concept of “expiration” in options trading is one of the most important, because mainly directly affects success in trading. Without understanding the expiration and not taking into account its role, it will be difficult for a trader to achieve a positive result in trading. Participating in the transaction, that is, setting a forecast: the price will rise or fall, market players are waiting for the expiration moment to see whether their prediction was correct, whether the funds on the deposit will be replenished.

Expiration (English Expiration, “expiration”) is the expiration date of the transaction, which, depending on the trader’s forecast, leads to a win or loss. It is worth remembering that successful trading is influenced by following a clear strategy, which includes money management, the choice of oscillators, a reliable broker, as well as the use of a specific expiration.

Types of options:

Ultra-short options – 60 seconds-5 minutes

Short-term options – 15 minutes – several hours

Medium-term options – from 6 hours – a day

Long-term options – a day – several months.

Is it possible to extend the expiration of options?

Can. Remember that this is not allowed by all brokers.

Expiration rules:

1. Beginners in options trading are advised to work with a long-term expiration. This guarantees a reduction in risks and unpredictability of trading, as in express expiration.

2. It is necessary to carefully approach the choice of a broker and work where it is allowed to increase the expiration period. This ensures that losses and risks are minimized.

3. If you need a quick income, it is worth participating in a short-term (a minute – a few hours) expiration, but you need to remember about the risks.

4. If you need a stable good income, it is worth participating in long-term expiration. With a positive outcome of the transaction, a good income is guaranteed.

Expiration in A/D strategies

Strategy for upside signals – price decline

Short-term trading: acceptable; characterized by increased risks and unpredictability of the outcome of trading; similar to a lottery; The income is minimal.

Recommended expiration: from 30 minutes to several hours; will allow you to calmly analyze the situation, use technical analysis, study indicator data and make the right bet; The income is higher than with short-term trading.

Long-term expiration: also recommended; will allow not only to make technical analysis, but also to predict the dynamics of the market depending on the news, economic and political situation; Income is higher.

Strategy for divergence and convergence signals

Short-term trading: allowed, can bring a good result; At the same time, it is important to remember that this is a lottery, that the result is unpredictable.

Recommended expiration: from 5 minutes to 15 minutes; will allow not only to develop the trend, but also to show itself in full force; you can use strategies for binary options, study the data of indicators and draw a conclusion based on them; The income is average.

Expiration of more than an hour: also recommended, it will allow you to analyze the dynamics of the market in a calm atmosphere and predict the outcome of trading based on macroeconomic analysis (news, economics, etc.); The income is high.

AD Kroll Stop Strategy

There are 3 indicators involved in the strategy: Stochastic, Chande Kroll Stop and Accumulation/Distribution. Stochastic helps to find out when the price will change direction during trading, the Accumulation / Distribution indicator reflects cash inflows and outflows, an interesting and less common Chande Kroll Stop displays the volatility of the instrument.

This strategy is suitable for traders who trade on trend and impulse movements. And yet, despite the great risks, it is considered quite profitable and reliable that it is worth trying it out.

Recommended expiration: from 60 seconds to 15 minutes; will bring a good result; It is worth remembering that short-term expirations are similar to a lottery and their result, despite the fact that the strategy works well, showing the behavior of trends, is unpredictable.

Expiration of more than an hour: also recommended, will allow you to study the data of indicators and draw a conclusion based on them; The income is average.

Long-term expiration: not recommended; because. The instruments are dynamic and it is more difficult to monitor their behavior over a long period of time, it will not be easy to predict the behavior of the market based on macroeconomic data in this case.

Elder’s Three Screen Strategy

A simple but very effective strategy of the world-famous trader Alexander Elder is popular in options and has become a classic. The strategy will need indicators: MACD, Stochastic and A/D. The first oscillator will show the trend, the second – the exact entry point, the third – the moment of buying the option.

Signals for buying a call option: MACD – in an uptrend; Stochastic – shows oversold; A/D – the trend is starting to grow.

Signals for buying a PUT option: MACD – in a downtrend; Stochastic – shows overbought; A/D – the trend is starting to fall.

Short-term trading: allowed, risky and unpredictable; The income is minimal.

Recommended expiration: from 5 minutes to several hours; will allow you to calmly analyze the situation and opportunities with an indicator; Income is several times higher than with short-term trading.

Long-term expiration: also recommended; will allow not only to analyze the dynamics of prices, but also to use macroeconomic data – news, economic and political situation, statements of companies; The income is high.

To test in practice all the expiration options in the proposed strategies, use the platform of a reliable broker Finmax, just go to the finmaxbo.com website. The advantage of the platform is that you have a choice of expiration from 30 seconds to six months. Here you can not only check the strategies listed in the review, but also find your comfortable one among them and get a good income.

Downloads

MetaTrader 4 (MT4) platform – download.

A/D oscillator for the MT4 platform – download.