ROC indicator

Description

Nowadays, the Internet plays a big role: these are social networks, Wikipedia, news and film portals, that is, everything that makes our leisure time functional. Freelancing – remote work in the network, is also not considered something surprising, today many strive for complete freedom and financial independence and are looking for new ways to earn money. Binary options are also freelancing, but, unlike other professions, it allows you to trade minimally and at the same time get a good income. So, today it should be considered the only completely legal type of work that can give the first money in 30 seconds after trading.

Having tried their hand at options, most traders build a serious strategy in order to receive a stable income from trading. To do this, market players test profitable trading systems, the best robots and new indicators, monitor broker ratings and effective signals. Even more useful material awaits you on our resource. Today we will talk about the ROC oscillator.

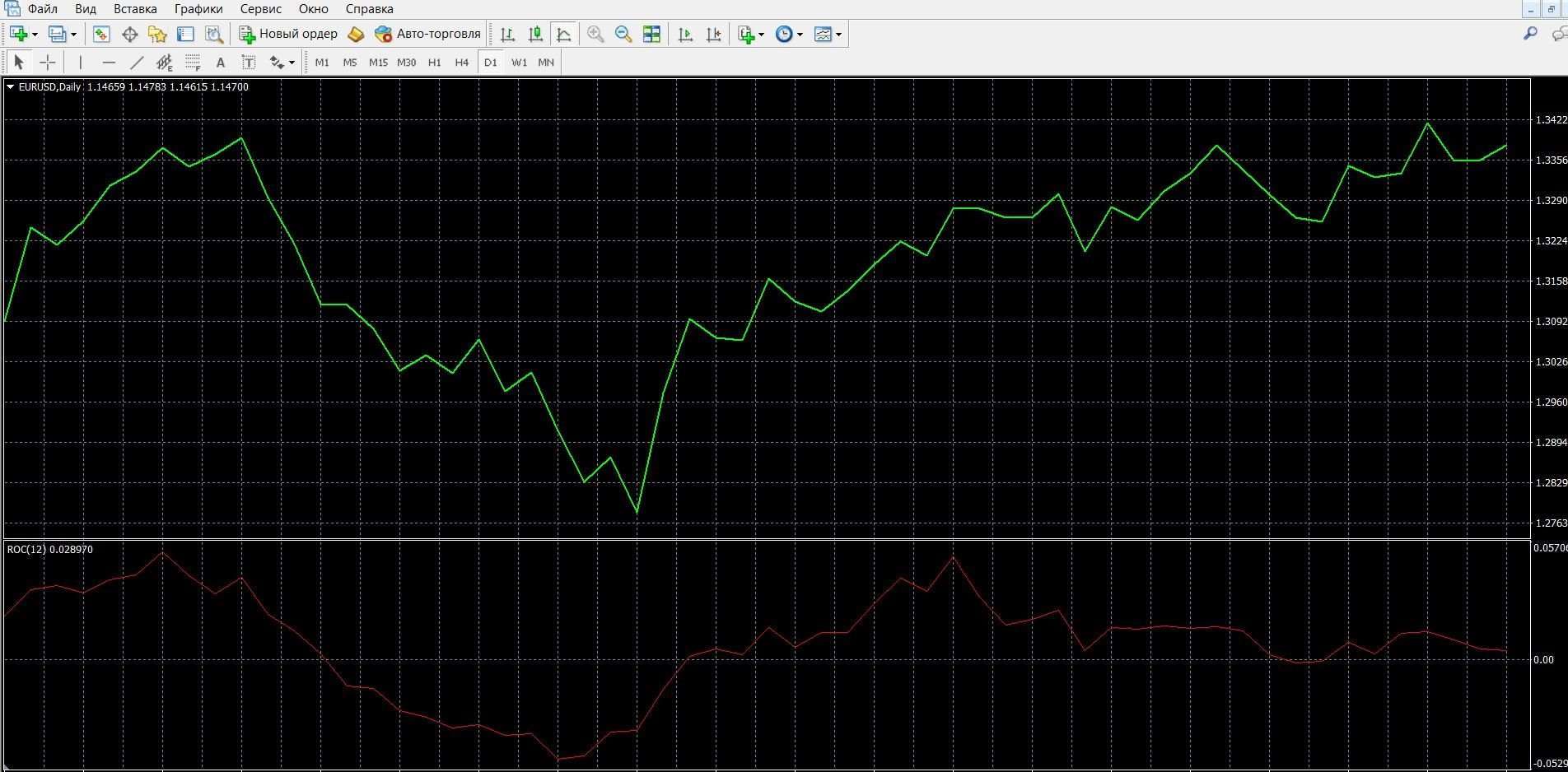

The Rate of Change (ROC) indicator is a popular, simple and effective oscillator that shows the price dynamics of several periods as a percentage. The tool makes it easy to track the smoothed rate of price change. Like other oscillators, it works ahead of time, which is very useful in trading because it allows you to see the necessary data in advance and earn a decent income on it.

By accurately determining the degree of optimism and pessimism of the crowd in relation to a particular asset, ROC demonstrates visual changes: if it grows, it indicates an uptrend and a new wave of optimism, if it falls, it indicates pessimism and a downward trend. Divergence signals with the price indicator also work, demonstrating a possible trend change. The indicator is simple and easy to use, and thanks to clear signals, even option beginners will be able to trade with it.

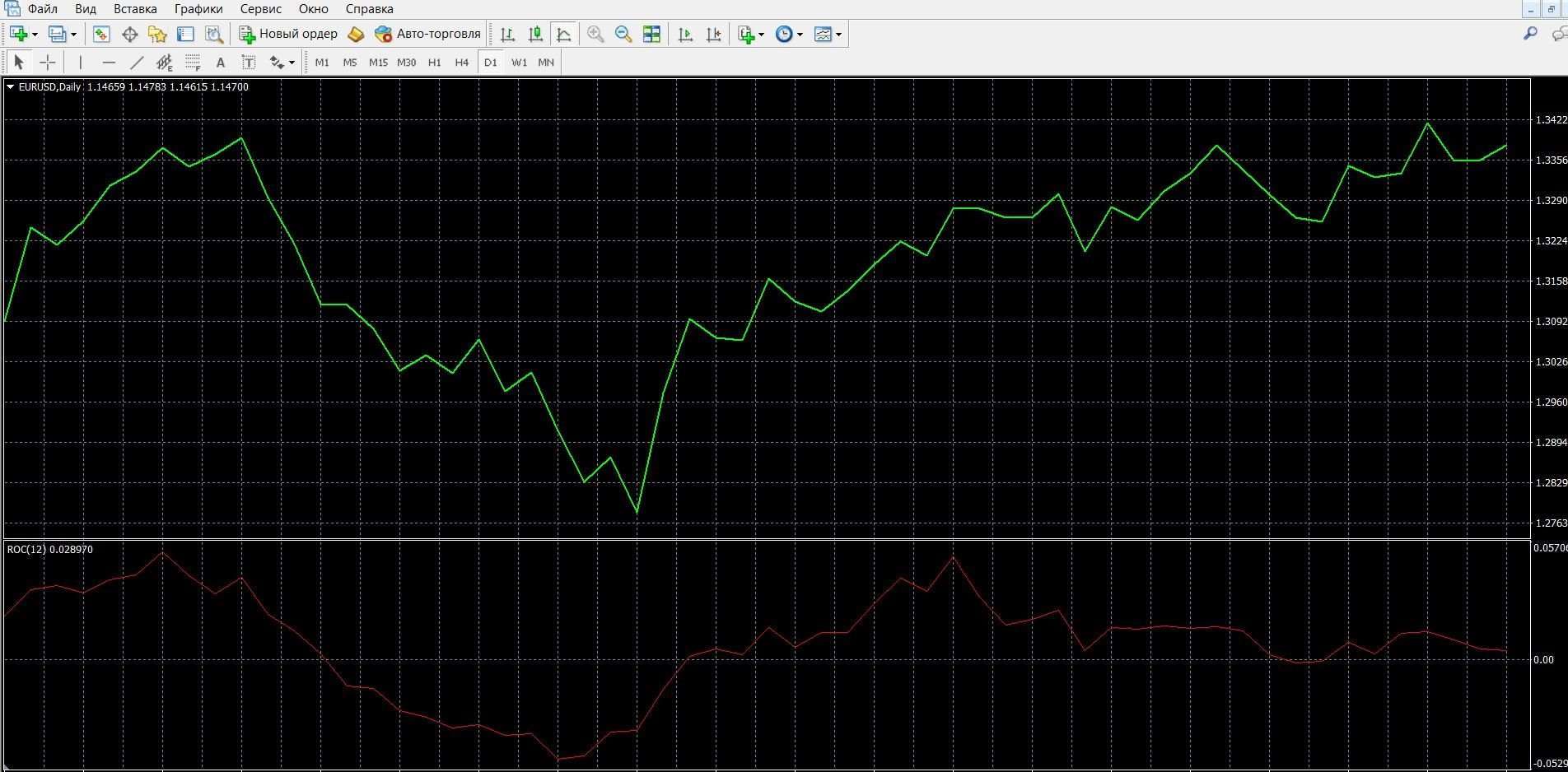

You can learn more about how ROC works on the price chart of the MetaTrader 4 platform in the image below. You can also easily and quickly download the MetaTrader 4 platform and explore its capabilities in more detail.

What is the working principle of the ROC indicator?

In trading, both in the Forex market and in trading, where the use of the tool is widespread, it is important to know about indicators that anticipate price movements, because This gives a significant advantage over the competitors of the exchange. ROC is an easy-to-use technical tool. By accurately measuring price dynamics as a percentage over several periods, this oscillator compares today’s closing price with data on how the exchange closed a few days earlier.

And although it looks like Momentum and they are interpreted almost identically, there are differences in their work. Unlike Momentum, where the values are determined by the price difference over a specific time period, the ROC data is calculated as a quotient of dividing the current day’s closing value by the previous period’s closing price.

As one of the popular indicators, ROC makes trading more efficient. It is most accurate in determining price discrepancies (the phenomenon of divergence and convergence), as well as in finding the trend, its highs and lows. It is common in both trend and countertrend (market reversals) strategies. Ahead of the price chart data, it is especially popular and effective in options trading.

The formula of the ROC indicator is:

ROC(N, i) = 100*(Close(i) – Close(i – N)) / Close(i – N), where:

N – indicator period;

i is the number of the current bar.

Info taken from website mql5.com

Indicator signals

Trend signals

When the ROC is used as a trend following indicator, it gives trend signals when the one line (or 100 line) is crossed.

- If the indicator line has crossed the 100 mark from bottom to top, you can buy call options,

- If the line has crossed the 100 mark from top to bottom, you can buy put options.

Overbought-oversold signals

- If the ROC shows the highest possible values, and then begins to turn down, this indicates a continuation of the trend, the speed of which slows down, the trend begins to “fade”, you can buy call options,

- If the ROC shows the lowest possible values, and then begins to turn upwards, the trend still continues, but begins to change, you can buy put options.

In this case, you should not buy options against the trend, as market correction is possible.

Signals of divergence between ROC and price

- With a bullish divergence taking place in an uptrend, the price highs are not confirmed by ROC data, which indicates a possible change in trend, you can buy call options,

- With a bearish convergence taking place on a downtrend, the price lows are not confirmed by ROC data, which also indicates a possible trend change, you can buy put options.

Do you need to install the ROC indicator in your platform?

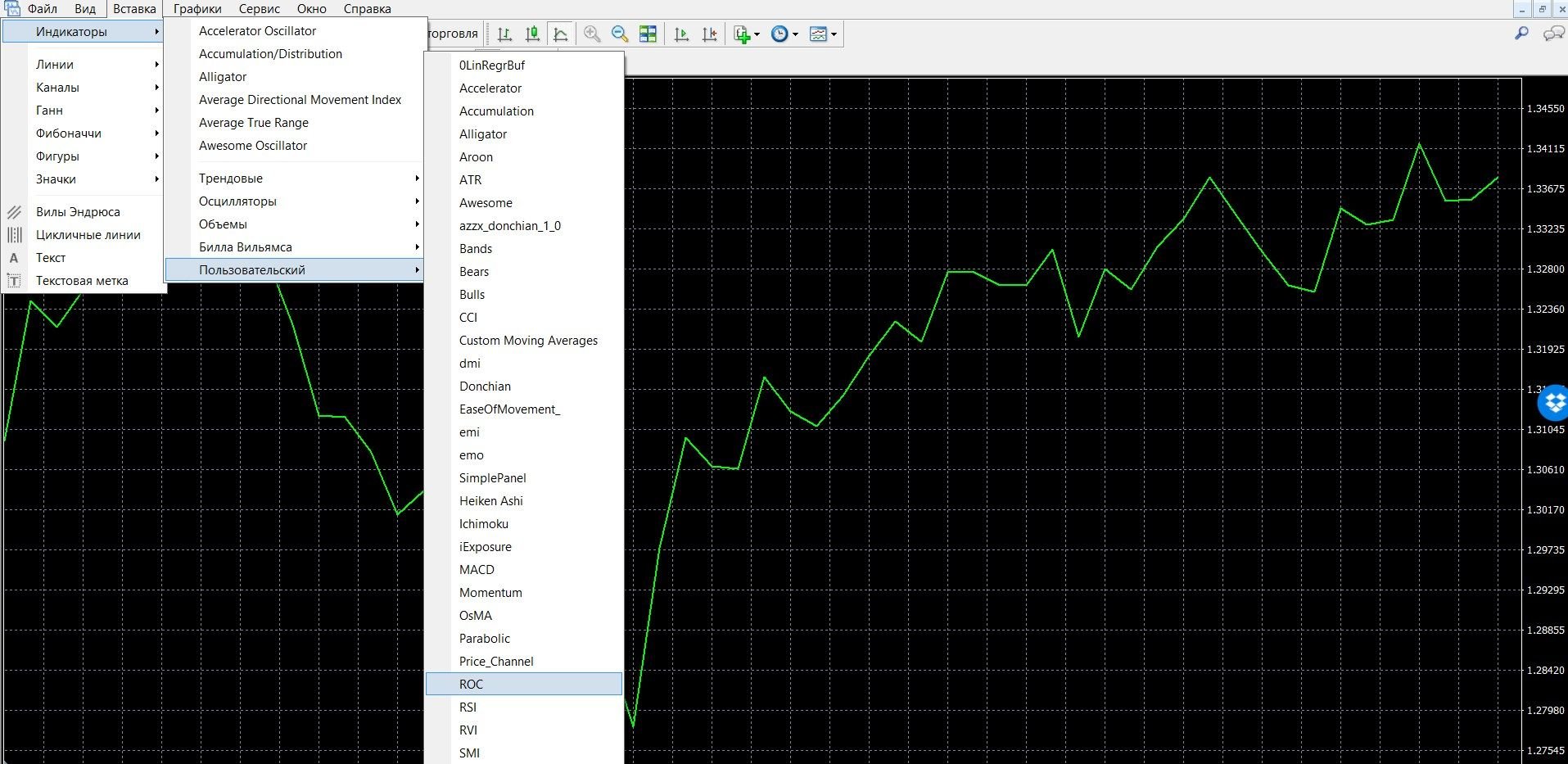

ROC is a non-standard trading tool on the stock exchange, it is not included in the basic list of MetaTrader 4 indicators. You can download it for free here. Next, you just need to install the file in the MT4 platform, following the simple clear instructions here.

After installation, add the ROC to the price chart, for this:

- Click the “Insert” tab in the top menu of the platform

- Select the “Custom” – “ROC” tab.

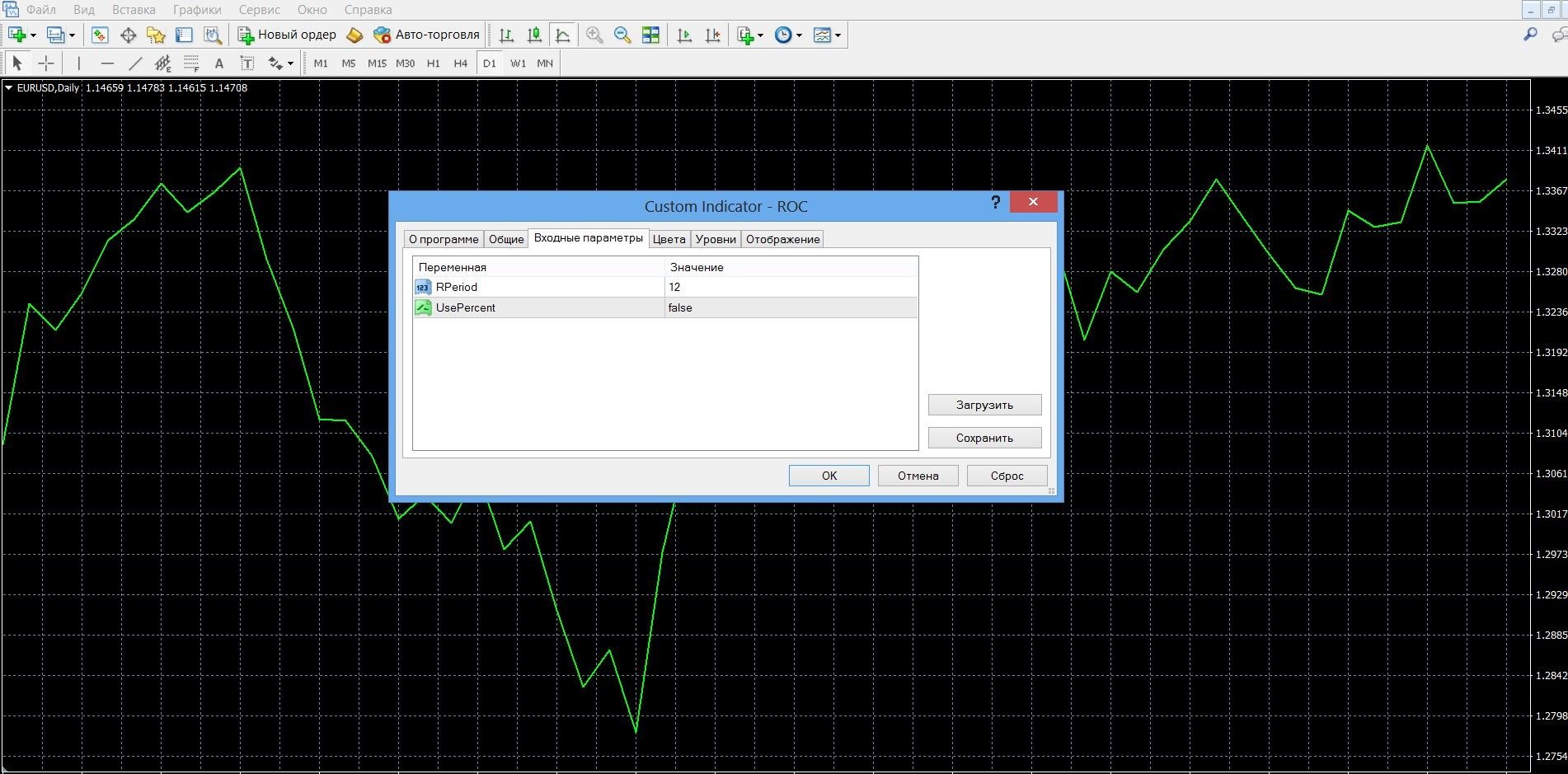

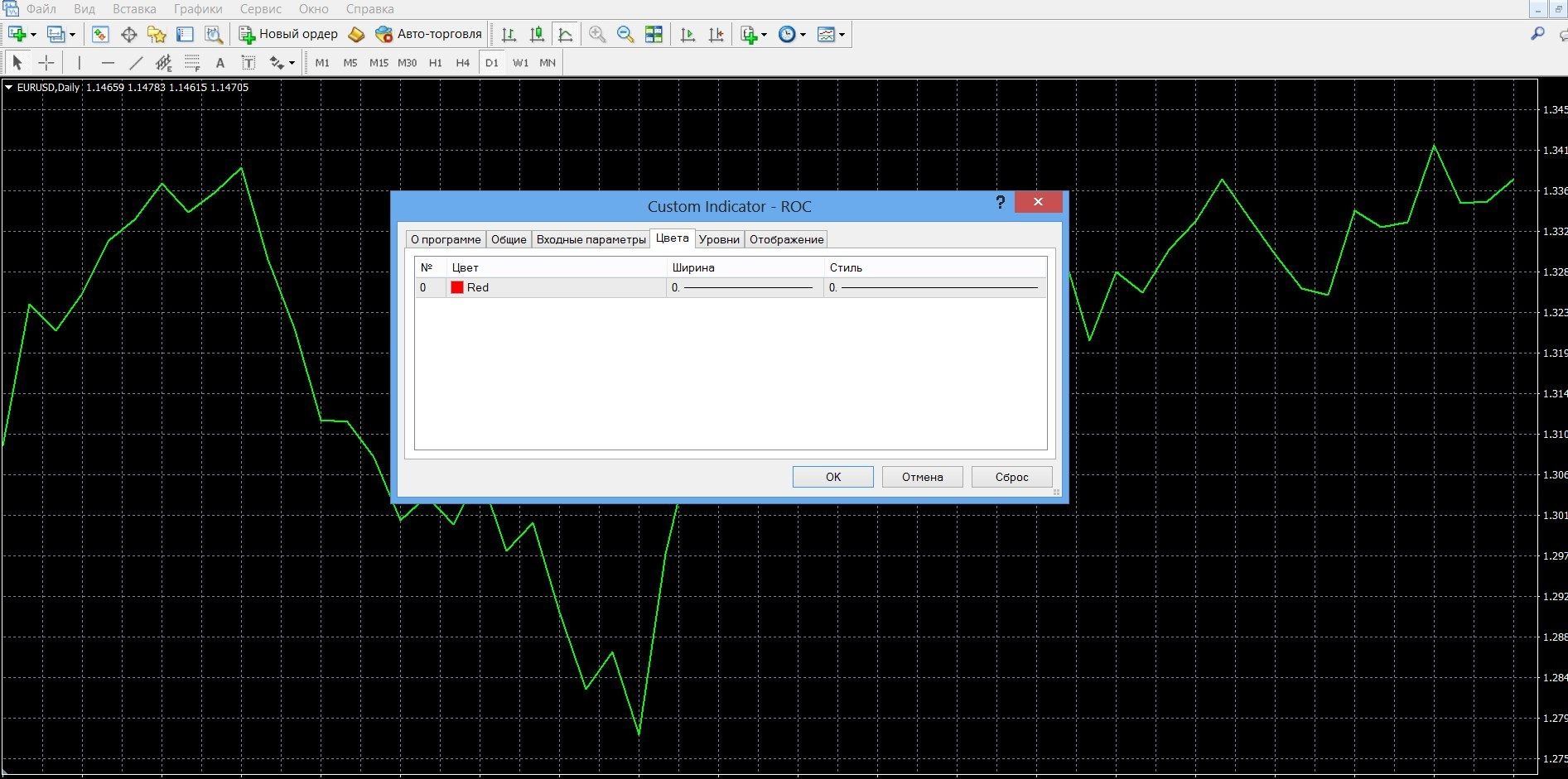

The efficiency of the instrument, the quantity and quality of its signals directly depends on the “period” parameter, which the trader can change at his discretion and according to his strategy.

Periods 12 and 25 are more common in trading, used in short-term and medium-term trading. The smaller the period indicator, the faster the ROC will react to price dynamics, giving a large number of false signals. The longer the period, the more accurate its signals will be, but the data begins to lag.

Application of the indicator for binary options

ROC is one of the simple but popular trending tools that allows you to most accurately measure the pace of the market, showing the strength of buyers and sellers. Its use is common in both the Forex market and binary options. The indicator perfectly combines the advantages of the oscillator: the accuracy of overbought-oversold signals, working ahead of the curve; It is also good at determining the direction of the market trend.

As an oscillator, it perfectly displays the wave-like dynamics of the price chart, measuring the magnitude of this dynamics for a specific period. When working with options, its data will always obey a simple rule: if the price indicator rises, the ROC also rises; if the price chart falls, the ROC also falls.

The oscillator is included in a large number of profitable strategies, there are its modifications on the network. Most often it is used in the strategy of following the trend and counter-trend trading, especially strong are reversal signals (divergence and convergence), indicating a possible change in the market trend.

It is recommended to combine ROC with other tools to confirm data, which will make trading much more productive (for example, MACD, RSI, Volume indicators, etc.). When working with the indicator, it is worth remembering its only drawback – it reacts twice to price dynamics, which increases its sensitivity to signals.

Rules for concluding transactions (screenshots)

Trading with a trend signal

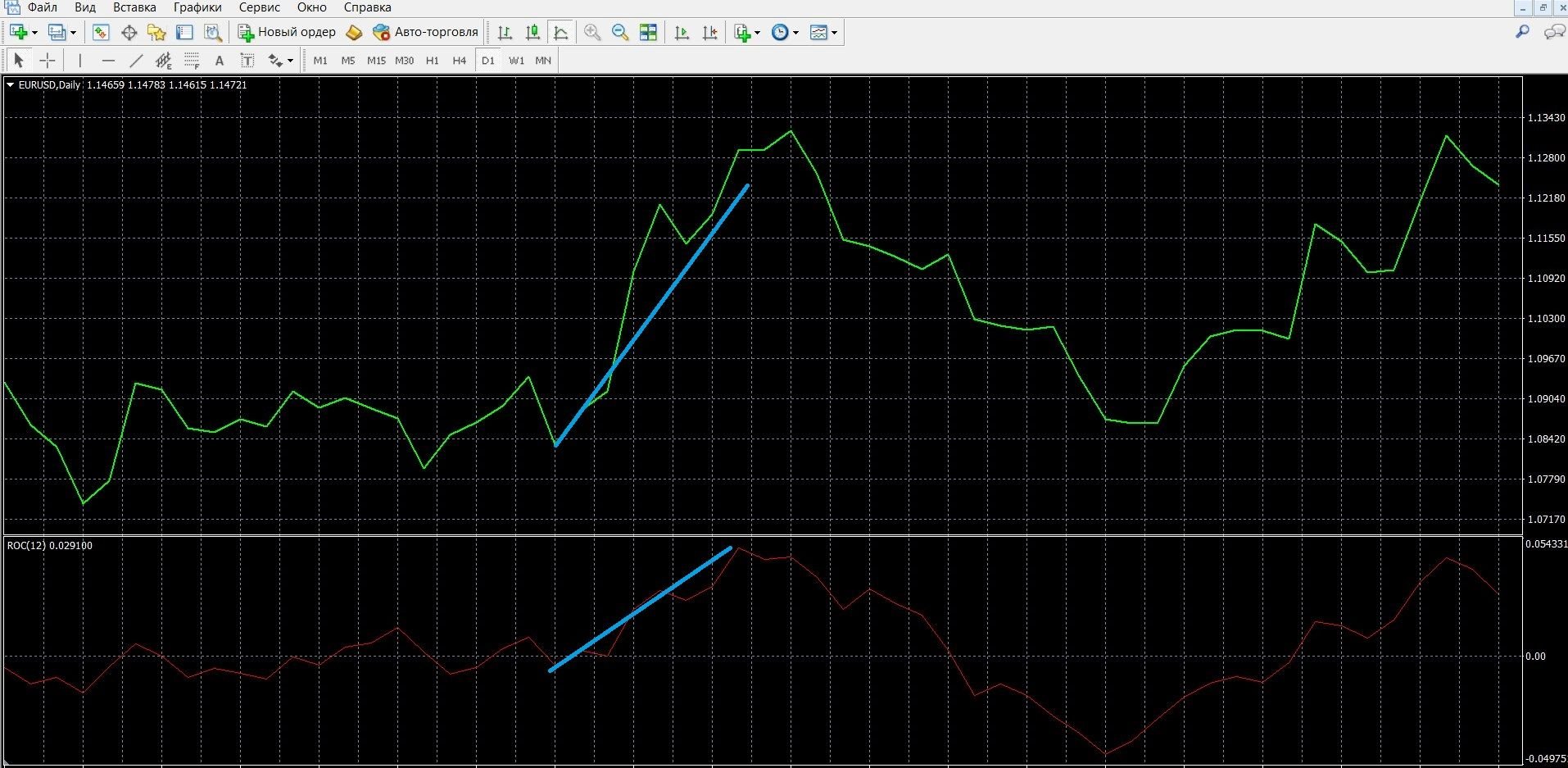

If the indicator line has crossed the 100 mark from bottom to top, you can buy call options. In the image below, you can see the upward trend on the MT4 chart:

Take advantage of the trend and place a CALL bet with the Olymp Trade broker by going to the olymptrade.com website and preparing an option, indicating:

- Type of option

- Expiration date

- Amount

- Prediction: up

- Next, click the “buy” button and wait for the results of the forecast:

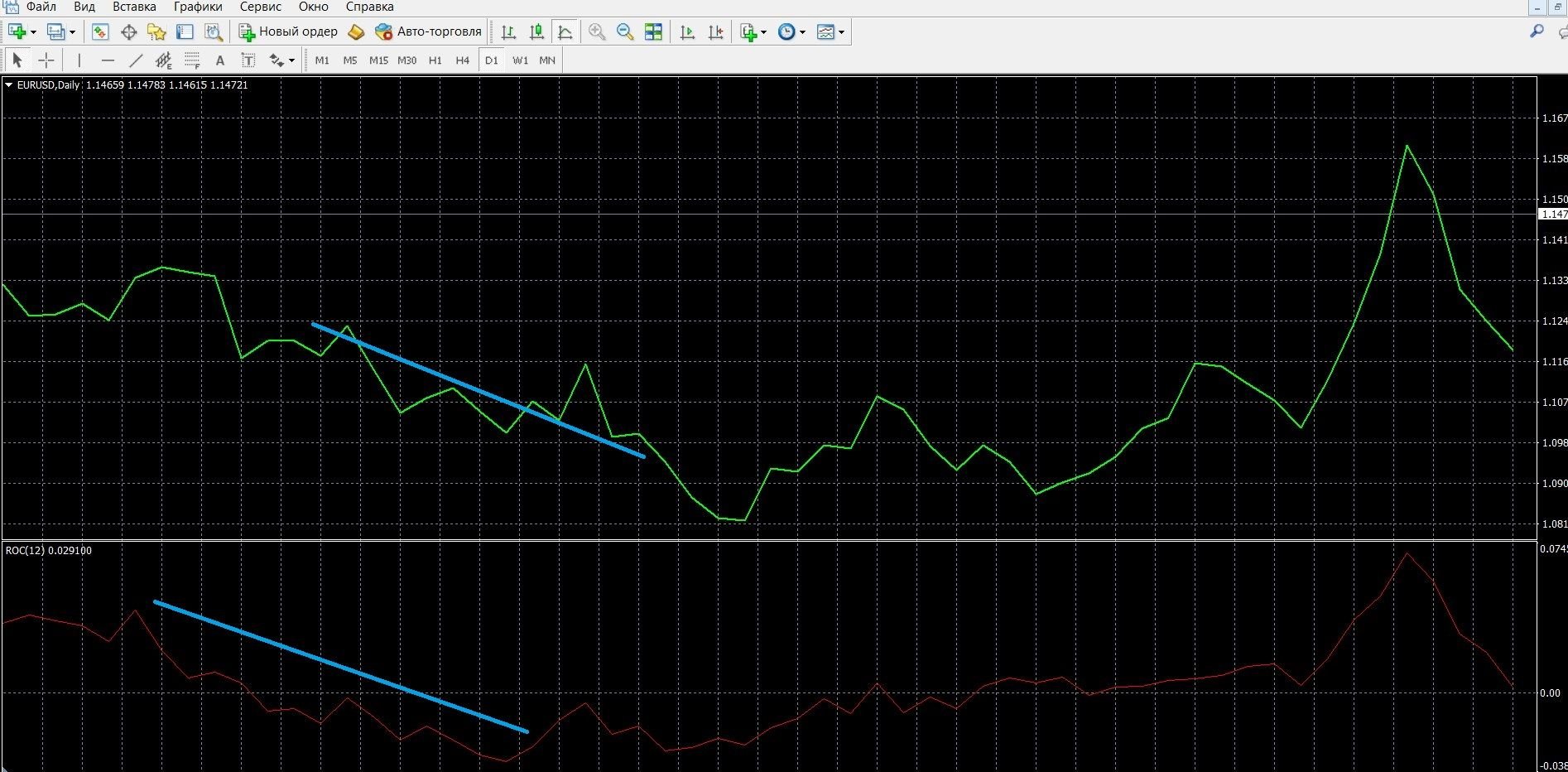

If the line has crossed the 100 mark from top to bottom, you can buy put options. In the image below, you can see the downward trend on the MT4 chart:

Take advantage of the trend and place a PCI bet with the Olymp Trade broker by going to the olymptrade.com website and preparing an option, indicating:

- Type of option

- Expiration date

- Amount

- Prediction: down

- Next, click the “buy” button and wait for the results of the forecast:

Trading with an overbought-oversold signal

If the ROC shows the highest possible values, and then begins to turn down, this indicates a continuation of the trend, the speed of which slows down, the trend begins to “fade”, you can buy call options. In the image, you can see an overbought signal in the MT4 terminal (place a CALL bet on the olymptrade.com website, the instructions are listed above):

If the ROC shows the lowest possible values, and then begins to turn upwards, the trend still continues, but begins to change, you can buy put options. In the image, you can see the oversold signal in the MT4 terminal (place a PCI bet on the olymptrade.com website, the instructions are listed above):

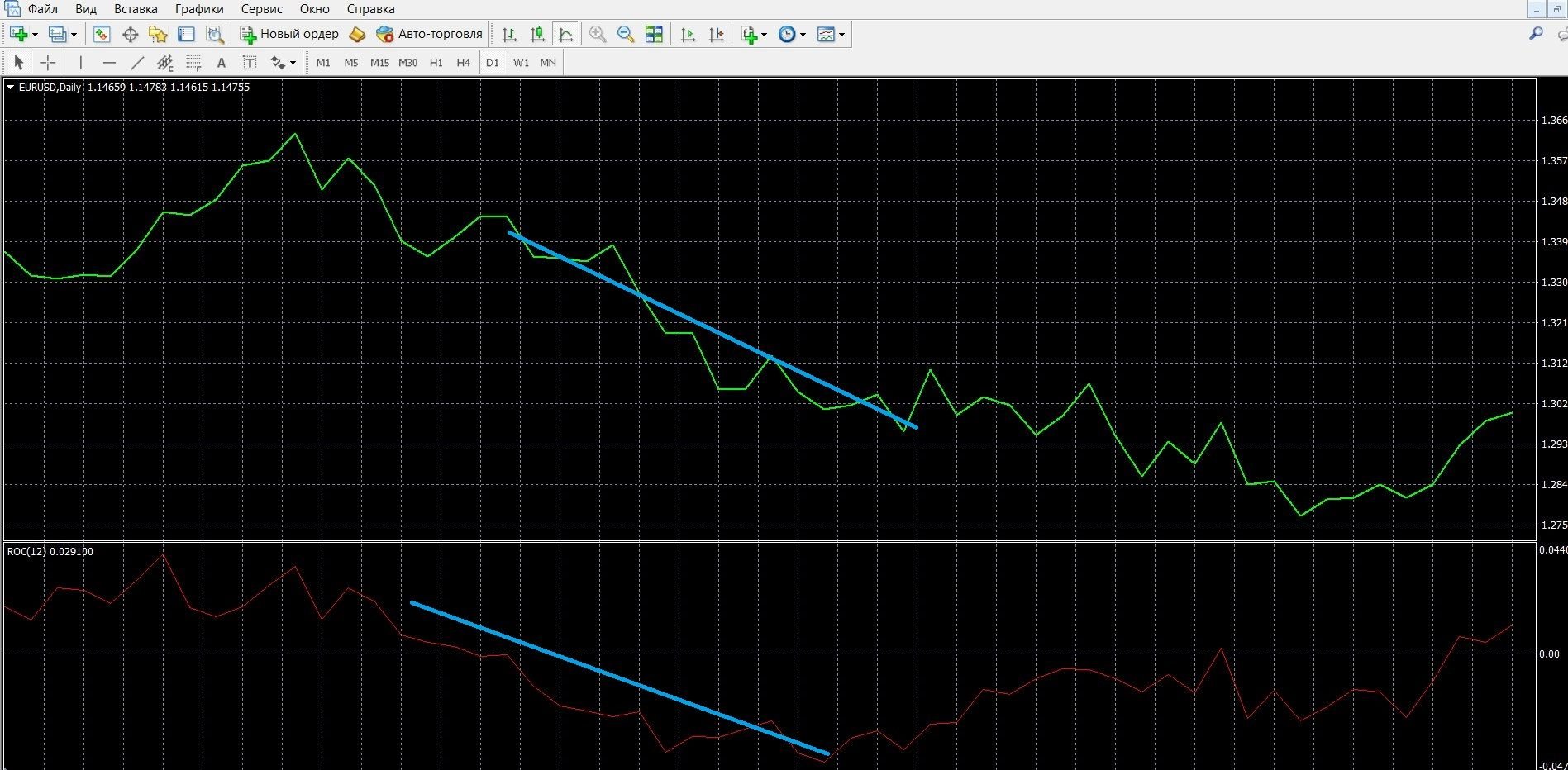

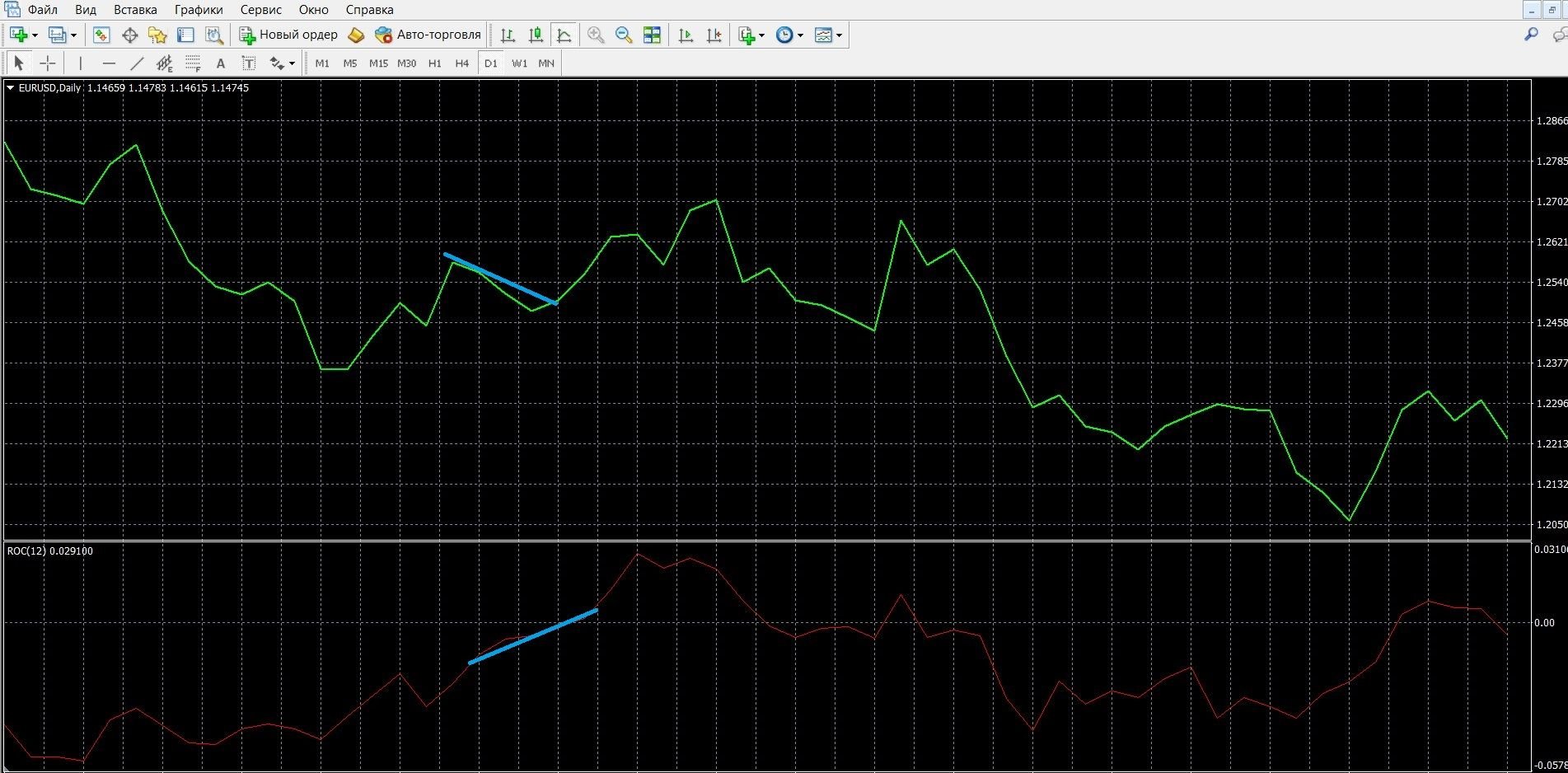

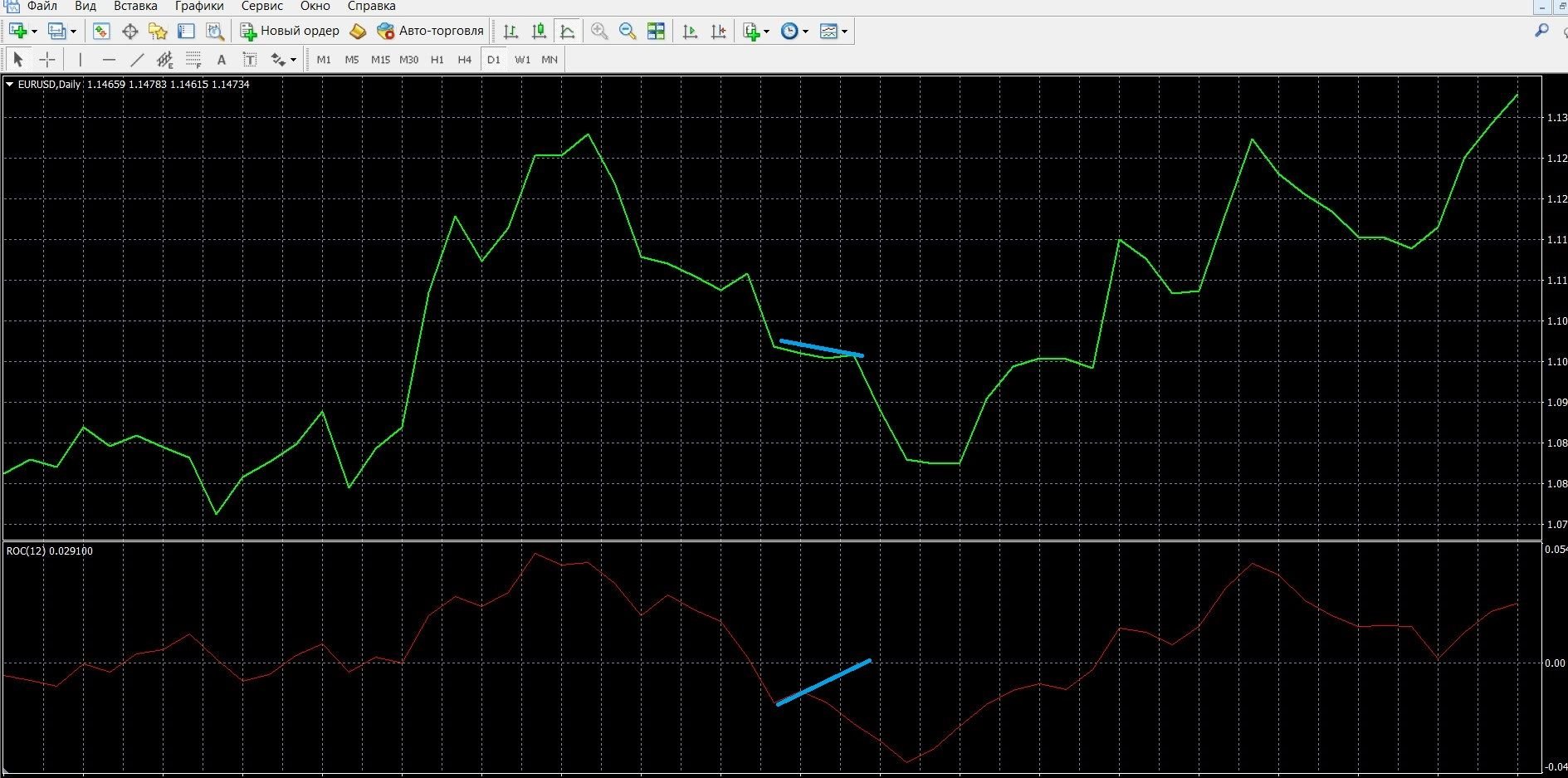

Trading when there is a signal of a divergence between the ROC and the price

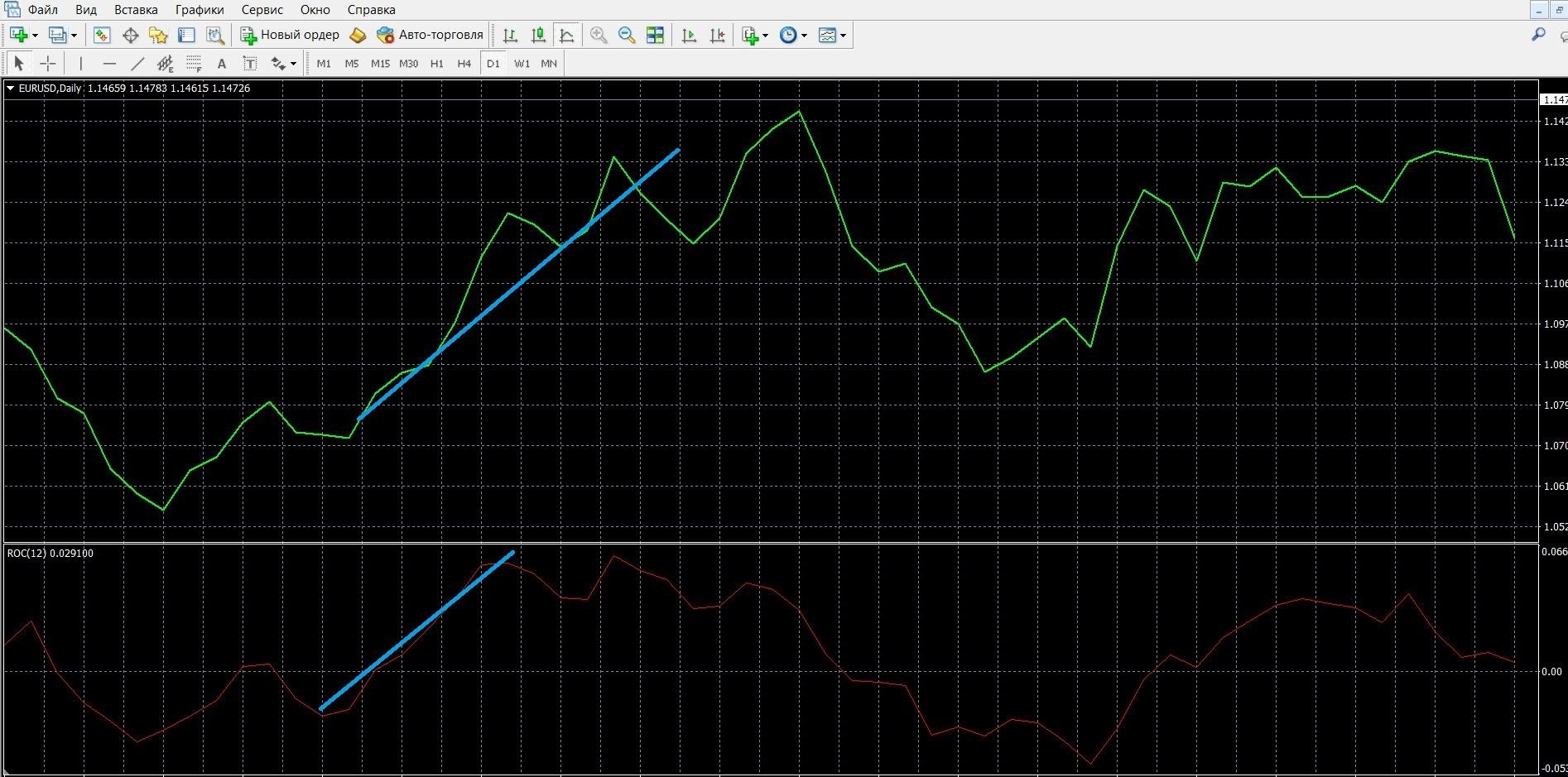

With a bullish divergence taking place on an uptrend, the price highs are not confirmed by ROC data, which indicates a possible change in trend, you can buy call options. The image shows the divergence in MT4 (place a CALL bet on the olymptrade.com website, the instructions are listed above):

With a bearish convergence taking place on a downtrend, the price lows are not confirmed by ROC data, which also indicates a possible trend change, you can buy put options. The image shows the convergence in MT4 (place a PCI bet on the olymptrade.com website, the instructions are listed above):

Money management

By determining the effectiveness of trading on the stock exchange, money management makes it easier and faster to increase earnings. These are the rules that the first thing that option beginners should familiarize themselves with. And even if a trader has reached a stable income, it is important for him to take into account the basics of money management when working with finances:

Minimum capital: when trading binary options on the stock exchange, you should bet a minimum of capital on the purchase of one bet; the price of one option should not be more than 5% of the account; It is recommended to participate in transactions with low-cost options, the acquisition of which cannot significantly change the state of the account. Working according to these simple rules, you will keep your capital in your account for a long time.

Minimum deposit: when trading binary options on the stock exchange, you should participate in such trades that will maintain the state of the account and save it; when buying a specific asset, you should not transfer all your funds to it; As long as possible, keep this action in its positive state, because They will still come in handy for work. Working according to these simple rules, you will keep your account positive for a long time.

Minimum options: when trading binary options on the stock exchange, you should initially purchase a minimum of such options, for example, 2-3 assets; Such a simple rule applies more to newcomers to the exchange; As soon as the trader becomes more experienced, you can expand the number of transactions with different assets. By working by these simple rules, you will trade effectively.

Minimum of emotions: when trading binary options on the stock exchange, you should initially tune in to serious work; always remember that trading, first of all, is analytics and your clear decisions; On the stock exchange, it is not enough to rely only on your experience, your emotionality is what makes trading more productive. By working by these simple rules, you will achieve more in binary options.

Expiration

Expiration is the moment when the trading of a particular asset ended, trading participants managed to set their forecasts based on strategies and indicator data, and at the end of the expiration they find out the results of their forecasts. This is also the basic concept of trading on the stock exchange, capable, like money management, to build trading more efficiently and get a good profit.

Types of options:

- Ultra-short options – 30 seconds – 5 minutes.

- Short-term options – 10 minutes – several hours.

- Medium-term options – a day – a few weeks.

- Long-term options – a month – six months.

Is it allowed to extend the expiration?

It is allowed, but well, for all platforms. A very convenient function that allows you to extend the expiration and reduce losses directly during trading, with an incorrect forecast.

Expiration rules:

- New binary options players should start working with long-term trades, which are the most stable with a minimum of risks.

- Professional binary options players should work with the expiration that will make trading a comfortable and productive process.

- Those binary options players who need instant income from the exchange should work with short-term transactions that will make a profit in at least 30 seconds.

- Those binary options players who need to receive a stable income from the exchange should work with long-term transactions that will bring a decent profit.

Expiration in ROC strategies

Expiration at a trend signal

Short-term trading: allowed; the ROC oscillator accurately demonstrates qualitative trend signals; It is recommended to supplement the operation of the indicator with other tools with such risky turbo trading.

Medium-term expiration: allowed; the ROC oscillator, quite accurately demonstrating high-quality signals of a trend change, allows you to conduct productive trading on such an expiration; It is recommended to supplement it with other indicators to confirm the trend.

Long-term expiration: allowed; ROC, accurately showing high-quality trend change signals, allows you to conduct productive long-term trading; It is recommended to supplement it with additional strategies, as well as use fundamental analytics when forecasting.

Expiration at an overbought-oversold signal

Short-term trading: allowed; the ROC oscillator perfectly and, most importantly, in advance, demonstrates high-quality overbought and oversold signals; It is recommended to supplement the operation of the indicator with other tools with such risky turbo trading.

Medium-term expiration: allowed; the oscillator perfectly demonstrates high-quality overbought and oversold signals; In addition, signals come earlier than on the price chart, which is very convenient and allows you to conduct productive trading on such an expiration; It is recommended to supplement it with other indicators to confirm the trend.

Long-term expiration: allowed; the oscillator accurately demonstrates high-quality overbought and oversold signals; In addition, these signals come earlier than on the price chart, which allows you to conduct productive long-term trading; It is recommended to supplement it with additional strategies, as well as use fundamental analytics when forecasting.

Expiration when there is a signal of a discrepancy between the ROC and the price

Short-term trading: allowed; the ROC oscillator perfectly shows divergence signals from the price chart; It is recommended to supplement the operation of the indicator with other tools with such risky turbo trading.

Medium-term expiration: allowed; ROC perfectly shows divergence signals from the price chart; This allows you to conduct productive trading at such an expiration; It is recommended to supplement it with other indicators to confirm the trend.

Long-term expiration: allowed; the oscillator perfectly shows divergence signals from the price chart; This allows you to conduct productive long-term trading; It is recommended to supplement it with additional strategies, as well as use fundamental analytics when forecasting.

When trading on the binary options exchange, be sure to study the possibilities of expiration, which will help you achieve the result you need. We recommend that you work in the convenient terminal of one of the most popular brokers Olympus Trade, which offers an expiration time from 1 minute to 1 hour. Go to the broker’s platform olymptrade.com right now and achieve more in trading.

Downloads

MetaTrader 4 (MT4) platform – download.

ROC indicator for the MT4 platform – download.

Tagged with: Binary Options Indicator