Strategy “Reversa”

Earnings without stress, false signals and extraneous analytics!

Imagine that two moving averages have crossed and are rising. What decision will you make:

- I will enter the purchase;

- sell the option;

- I will abstain temporarily.

Congratulate yourself if you chose the third option. It is impossible to determine where the price will go next by one intersection of the lines. Unfortunately, many people ignore this obvious rule and try to guess the trend at the very beginning of its formation. Hence there are numerous false signals, losses and other troubles.

Today we will look at a technique that can save a trader from all of the above – the strategy is called “Reversa”. Its rules are so clear and logical that even an absolute beginner can cope with them after reading the article.

Trading will be carried out on the hourly chart of any trending asset (preference should be given to those tools used by most practicing traders). In this case, transactions are carried out on the euro/dollar pair.

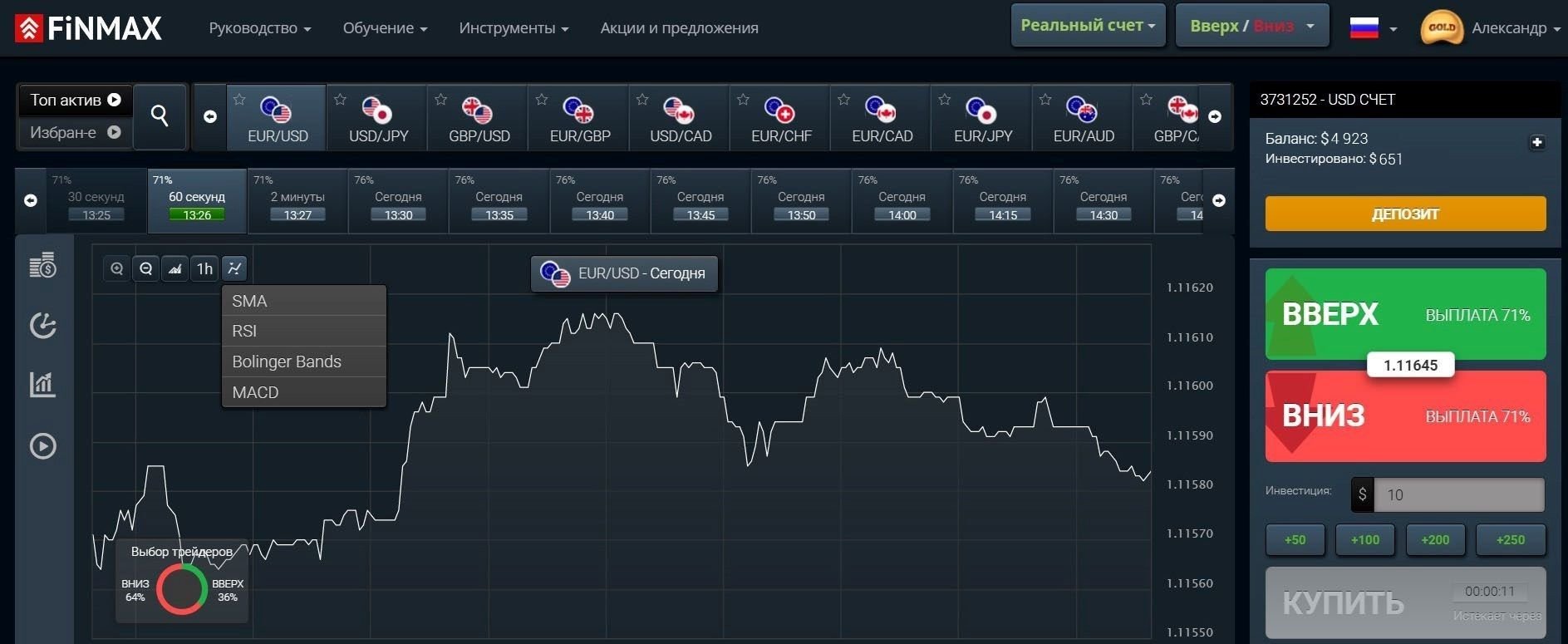

To get started, use the following indicators:

- Alligator – allows you to determine the dominant trend.

- MACD – this oscillator will identify the best moments to enter the market.

- RSI – used to confirm the generated signal.

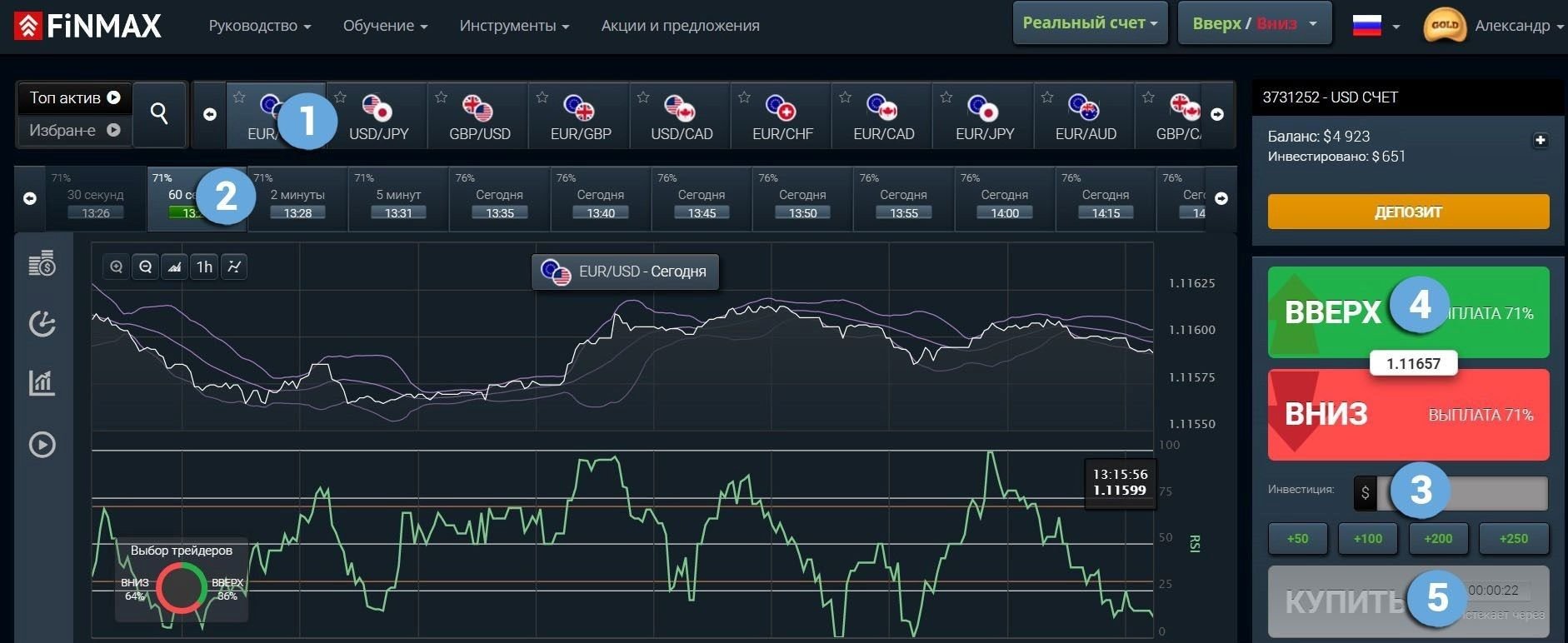

The settings of all tools are left by default. After all the steps, the graph should look like this:

The peculiarity of the Reversa TS is that the entry point will be determined not at the beginning, but in the middle of the formed trend. This is a key difference, due to which the strategy has a high percentage of spent signals.

The peculiarity of the Reversa TS is that the entry point will be determined not at the beginning, but in the middle of the formed trend. This is a key difference, due to which the strategy has a high percentage of spent signals.

This innovation is explained by the fact that many traders literally perceive any intersection of indicator lines (moving averages, alligator, etc.), and on this basis they try to trade. As a result, the position is opened at random and in the long run this approach is devoid of success.

If you plunge into the theory of technical analysis, then there is a rule according to which the current trend during its development will come into contact with the reference line (in this case, the Alligator band) from 3 to 5 times. These are averaged indicators that will be used in the “Reversa” strategy as follows:

- the trader follows the Alligator lines, waits for their intersection and further movement in one direction (growth / decline);

- after that, the market should make a correction (return to the Alligator borders) and continue to develop in the chosen direction. Here you can search for the first entry point;

- Further, the movement will continue along the specified cycle until the fracture stage comes. If the rules continue to be fulfilled at the time of the development of the trend, then another entry point is allowed.

So, for one trend impulse, you can enter a position no more than twice. Let’s take a closer look at how it works.

Buying a CALL option

- The three Alligator lines should stretch after interlacing and form an increasing angle (the greater the distance between each of the bands, the stronger the uptrend). Do not forget that until this condition is met, we do not conduct further analysis of the schedule.

- The signal candlestick should be completely placed above the increasing Alligator lines (neither the body nor the shadow is allowed).

- The MACD histogram is above the zero level. At the same time, the signal candlestick column rises above the previous one.

- The RSI line must meet two conditions: 1) it should increase; 2) it should be placed above level 70.

- If all of the above rules are followed, then at the opening of a new candlestick, we enter an increase position.

- Expiration – 6 hours.

- The chart must be monitored around the clock, since the strategy is not tied to any particular trading session.

- The permissible risk in one transaction is up to 3% of the deposit.

- Remember that no more than two entries are allowed in one trend impulse.

Example of buying a CALL option

Selling a PCI option

- The Alligator lines crossed, stretched and formed a decreasing angle. At the same time, the signal candlestick is completely fixed under this indicator.

- The MACD is below the zero level and the signal bar is below the previous one.

- The RSI line is decreasing and is below the 30 level.

- After fulfilling all the rules, open a deal for a fall.

Example of selling a PCI option

Strategy “Reversa” at the broker FiNMAX

In order to make trading on the strategy more comfortable, choose a reliable broker FiNMAX. The broker offers its traders advanced opportunities for working with binary options.

Trading in a modern terminal, you can take advantage of the expiration (from 30 seconds to six months), available indicators, types of charts, analytics and transaction history, training materials. You can see what the trading platform looks like in the image below.

A detailed review of the FiNMAX broker is here.

Go to the official website of the FiNMAX broker here.

In order to buy a

CALL

option in the FiNMAX trading terminal, follow these steps by going to the finmaxbo.com website and preparing an option, indicating:

- Type of asset

- Expiration

- The size of the bet

- Forecast of quote movement: UP

- Click the “buy” button and follow the results.

In order to buy

a PCI

option in the FiNMAX trading terminal, follow these steps by going to the finmaxbo.com website and preparing the option, indicating:

- Type of asset

- Expiration

- The size of the bet

- Forecast of quote movement: DOWN

- Click the “buy” button and follow the results.

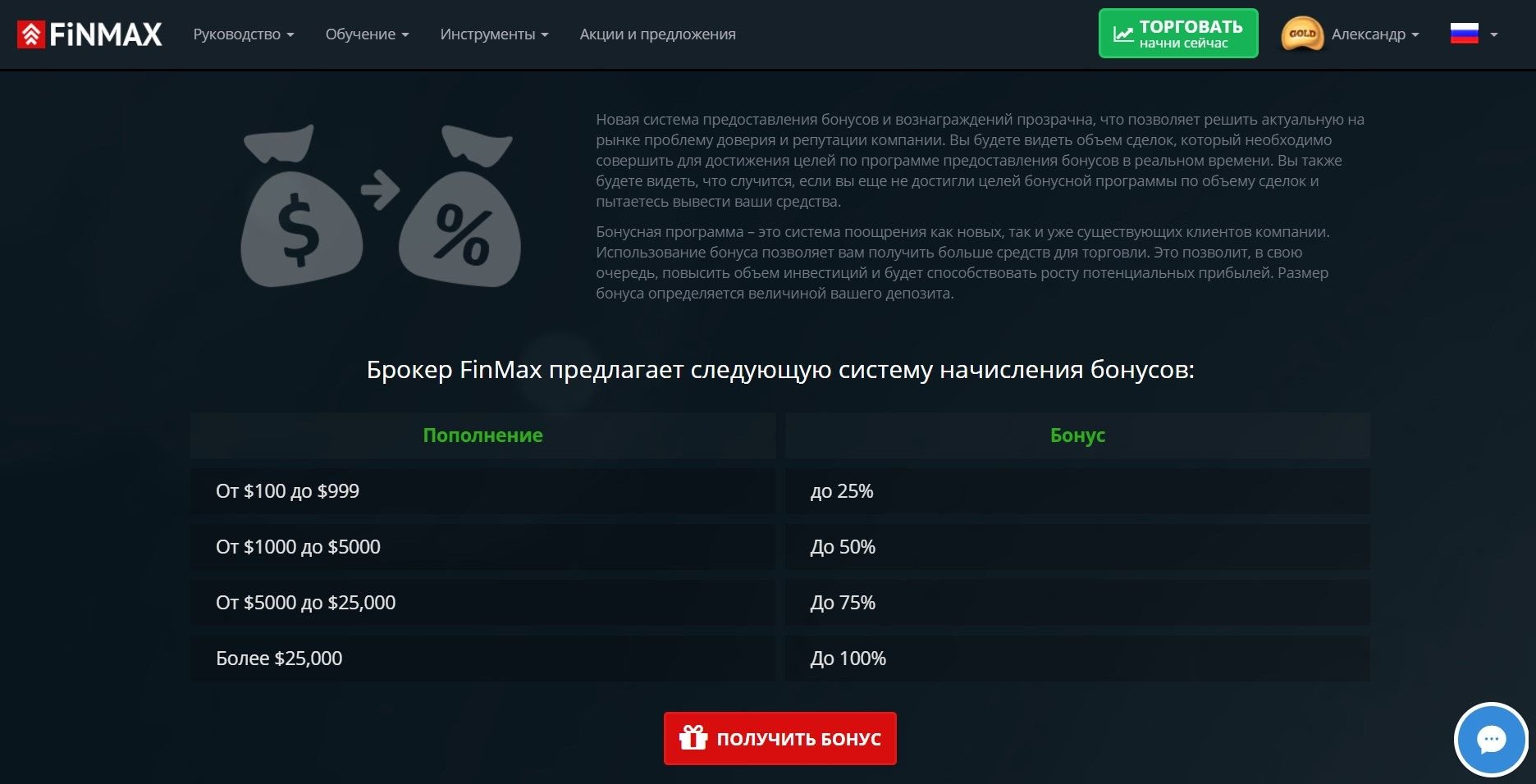

FiNMAX broker bonuses up to 100%

The official website of FiNMAX constantly offers many profitable promotions to its users, which can be found here. Promotions and bonuses allow you to save the trader’s personal funds, making trading with the broker much more effective.

Tournament on demo accounts from FiNMAX

Free tournaments of the official FiNMAX website are held for those market players who have a demo account on the broker’s platform. The tournament supports talented market players, giving them the opportunity to receive prize money for further trading without replenishing the deposit. So, the broker makes trading possible without personal investment. Both options beginners and professionals can participate in the event.

Participate in the FiNMAX tournament

Findings

The logic of the “Reversa” strategy allows you to work with an already formed impulse that has just passed its initial phase. Particular attention should be paid to this condition for beginners in the binary market, who want to make a highly accurate forecast at the first intersection of indicators.

The main difficulty of the system is due to the fact that incoming signals will need to be monitored around the clock. It is not difficult to get used to this, but first you really need to believe that the Reversa vehicle is exactly the technique with which you will work for a long time and continuously.

Tagged with: Binary Options Strategy