Adaptive Stochastic Oscillator (ASO)

Description

We bring to your attention a series of detailed reviews of binary options oscillators that will help you get acquainted with the possibilities of trading more thoroughly, use its tools so that it brings a stable income. Read our materials, think through your successful strategy and achieve better results. Today we will talk about one of the most effective technical indicators, the Adaptive Stochastic Oscillator, which is used by market players. How it differs, what are its advantages over other tools, as well as the rules of money management and features of expiration with ASO – all this is in today’s material.

The Adaptive Stochastic Oscillator (ASO) is a technical indicator that was developed by American trader Tushar Chend in 1992. During this optimization process, the indicator shows the best period for calculation based on the maximum profit for the previous period. What the trader gets in the end: more accurate than the original Stochastic, determination of overbought-oversold zones; generation of reliable buy/sell signals in oversold-overbought zones.

For the first time, this convenient indicator was learned in the article “Dynamic Momentum Index” (“Stochastic RSI and Dynamic Momentum Index”), which was published in the journal STOCKS & COMMODITIES. Like other similar tools, its purpose is to determine the strength of trends as accurately as possible and find their reversal points. The oscillator is successfully used both in options and in Forex trading.

Despite the fact that this tool is a modification of the regular Stochastic, it also combines two Stochastic (slow and fast), which gives even more benefit and reliability when trading. And although both Adaptive Stochastic and classic Stochastic have many similarities, they are completely self-sufficient and can be used independently. Like Stochastic, ASO signals the ratio of price to lows and highs for a specific period. Its main difference is that it also takes into account the dependence on the volatility of the asset. The price dynamics is accelerating – there is an increase in the sensitivity of ASO. That is, in other words, the faster the price dynamics, the smaller the ASO window, the greater its sensitivity.

Sensitivity measurement occurs at a standard price deviation with a period of 20 days. The width of the oscillator ranges from 7 to 28 days. A three-day window is often used to smooth out the results. The best option for trades is when the indicator lines are located closer to the horizon, or if they show a trend movement in the opposite direction from the price. The advantage of the tool is that it works ahead of time, giving trend signals in advance, which makes working with it even more effective.

You can see what ASO looks like on the MetaTrader 4 (MT4) platform in the image below. In addition, you can download the MetaTrader 4 platform and get acquainted with the oscillator in more detail.

What is the principle of operation of the indicator?

1. All Stochastic were created for the purpose of predicting the reversal of market points and are mainly useful in measuring the magnitude of a particular trend. In general, the indicator is in many ways similar to the classic Stochastic, being in many respects its improved model.

2. The value of the indicator in determining the strength of trends and market reversals. The oscillator accurately determines the overbought-oversold moments. When the price reaches new extremes, we can confidently talk about the continuation of the trend. The trading signals of the oscillator are ahead of the main chart, it is best to open a position at the moment of its reversal.

3. The width of the range that is used for calculations is affected by market volatility. Sensitivity is measured by deviations of closing prices in a twenty-period window.

4. When working with ASO, do not rush with the appearance of the first signal, it is worth observing the instrument for several trading sessions in order to exclude false data.

Indicator signals:

Trend confirmation:

The uptrend is confirmed by the rising values of the indicator; The downtrend is confirmed by the falling values of the indicator.

- If ASO grows and at the same time, prices rise on the chart, then there is an uptrend and you can buy call options.

- Otherwise, it is worth buying PCI options.

Overbought-oversold:

When the curves go beyond the overbought-oversold lines (20 or 80), you should buy opposite options:

- if the curves are beyond 20 – you should buy a CALL option,

- if the curves are beyond 80, you should buy a PCI option.

Do you need to install ASO in your platform?

The indicator must be installed in your trading platform. You can download the oscillator for the MetaTrader 4 platform here.

You can read how to install the downloaded file in MetaTrader 4 here.

Application of the indicator for binary options

1. The adaptive stochastic oscillator is popular among modern traders, as it accurately determines market trends. When using the Adaptive Stochastic Oscillator, it is possible to determine not only trends, but also the strength of market movement. As a stand-alone tool, it is simple and straightforward to use.

2. The indicator is the most powerful than the classic instrument, and therefore it is more used in determining oversold-overbought signals. Using a simple rule: it is worth buying put options when the market reaches the upper limits; It is worth buying call options when the market reaches the lower limits, you can achieve good results in trading. So, both professionals and beginners of binary options can work with it.

3. One of the main advantages of oscillators in trading is that they help you accurately see the price movement and make good money on it. ASO shows signals ahead of schedule, which is especially necessary during dynamic trading, when it is important to own the entire market situation.

4. Despite the fact that the oscillator combines two Stochastic (slow and fast), it is worth remembering possible false signals, so it is recommended to use it in combination with other trend indicators to confirm signals. It is not recommended to trade during the release of economic news, because It is during such periods that the market is unstable.

Rules for concluding transactions (screenshots)

Trading with a signal for the rise and fall of prices

In the image below, you can see what the upward trend of the market looks like on the MetaTrader 4 platform:

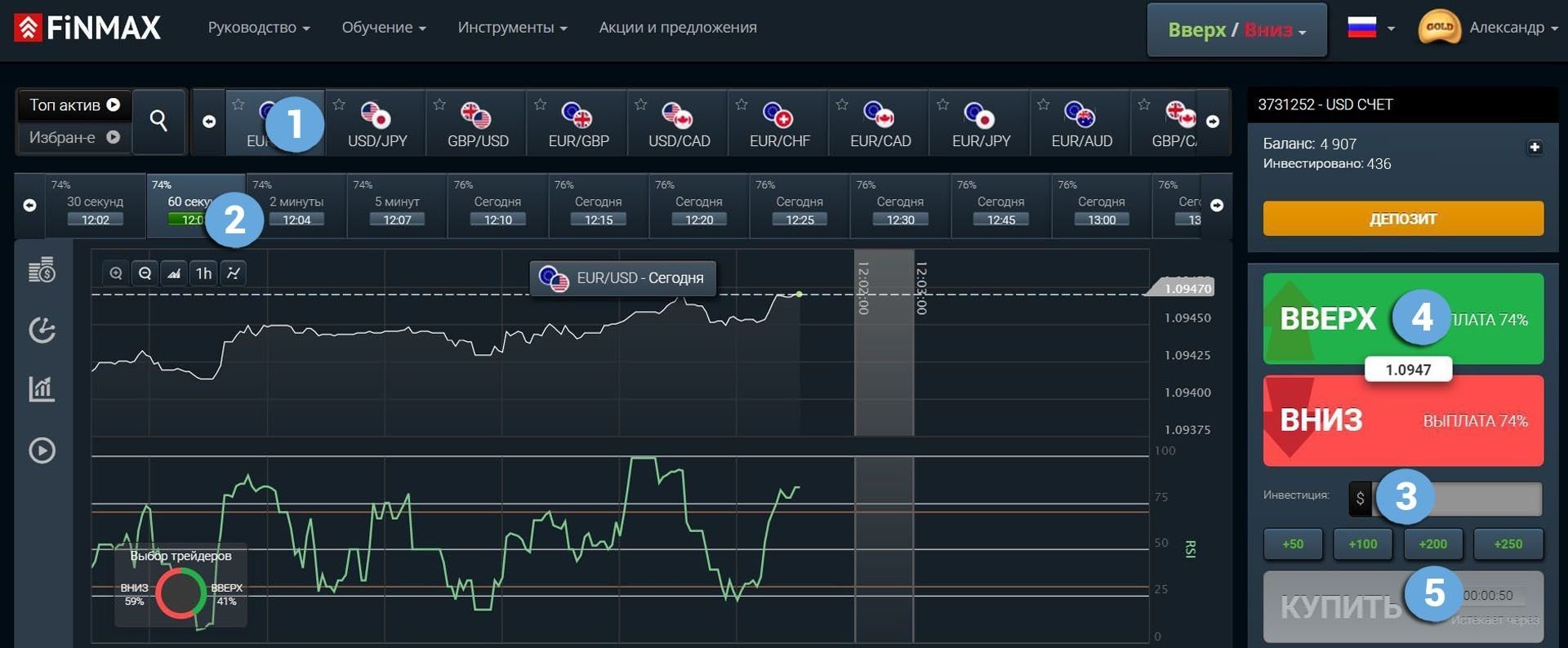

Take advantage of the upward price trend and place a CALL (up) rate with the Finmax broker. To do this, you need to go to the broker’s website finmaxbo.com and prepare an option, indicating in the system:

1. Type of asset

2. Option expiration

3. Bet size

4. Movement forecast: UP

5. Click the “buy” button and wait for the results.

In the image below, you can see what the downward trend of the market looks like on the MetaTrader 4 platform:

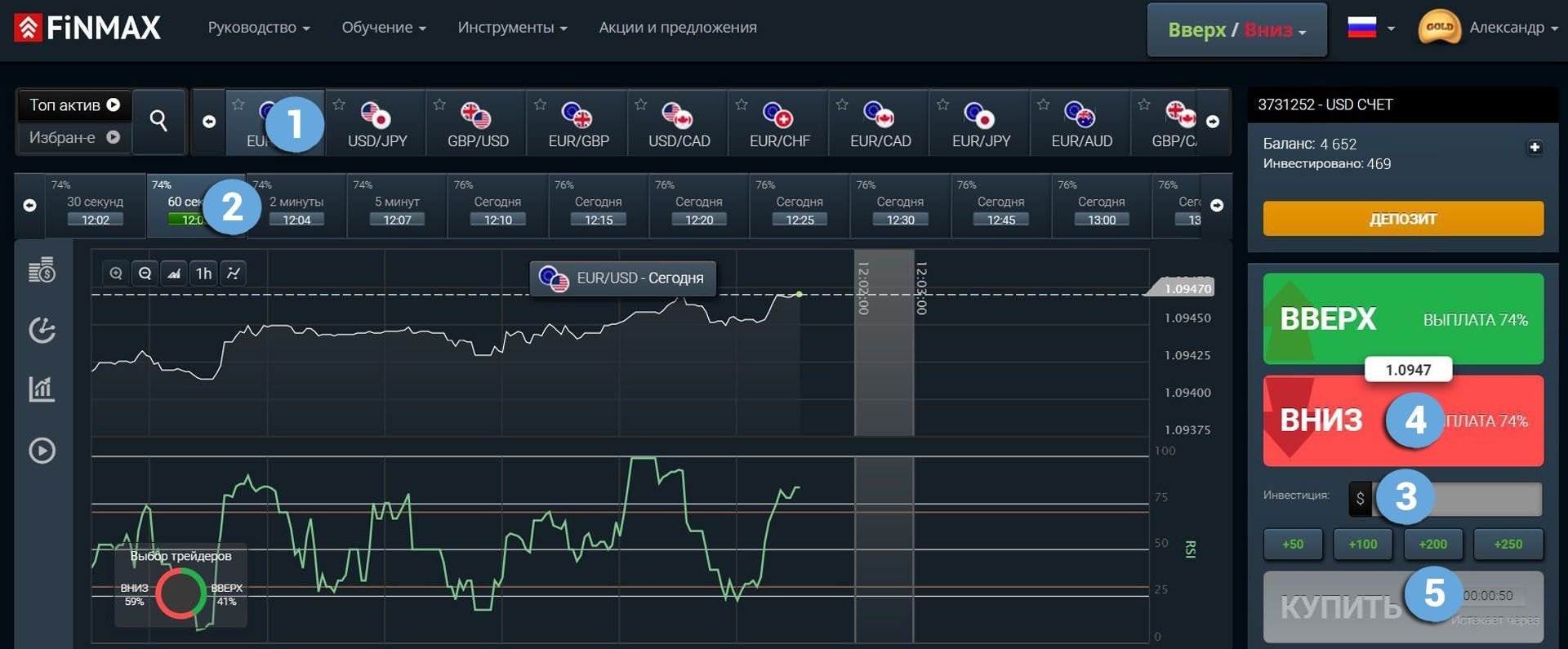

Take advantage of the downward trend in price and make a PUT (down) rate with the Finmax broker. To do this, you need to go to the broker’s website finmaxbo.com and prepare an option, indicating in the system:

1. Type of asset

2. Option expiration

3. Bet size

4. Movement forecast: DOWN

5. Click the “buy” button and wait for the results.

Trading with an overbought-oversold signal

From 0 to -20 – overbought zone. If the oscillator line breaks through the -20 mark from top to bottom, you can open a put option:

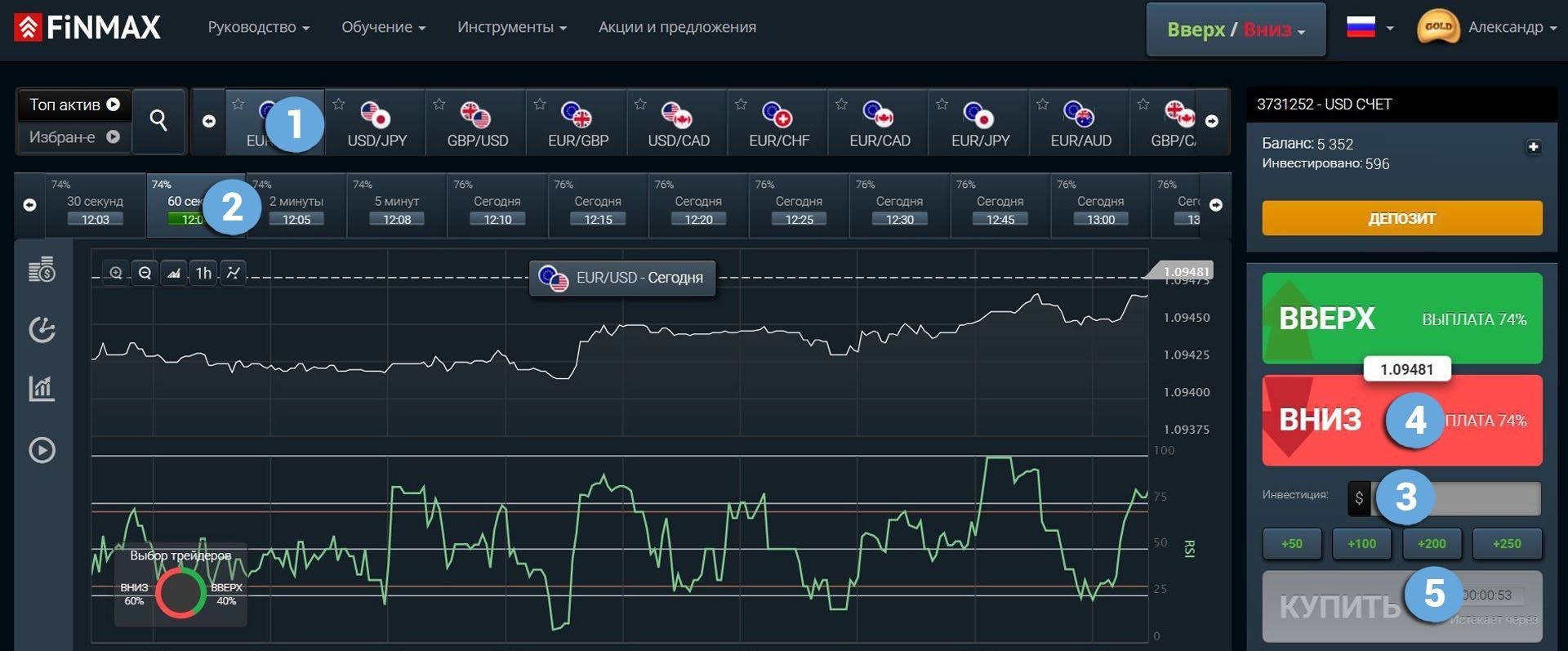

Take advantage of the downtrend opportunities of the price and make a PUT rate (down) with a reliable broker Finmax. To do this, you need to go to the broker’s website finmaxbo.com and prepare an option, indicating in the system:

1. Type of asset

2. Option expiration

3. Bet size

4. Movement forecast: DOWN

5. Click the “buy” button and wait for the results.

From -80 to -100 is the oversold zone. If the oscillator line breaks through the -80 mark from the bottom up, you can open a CALL option:

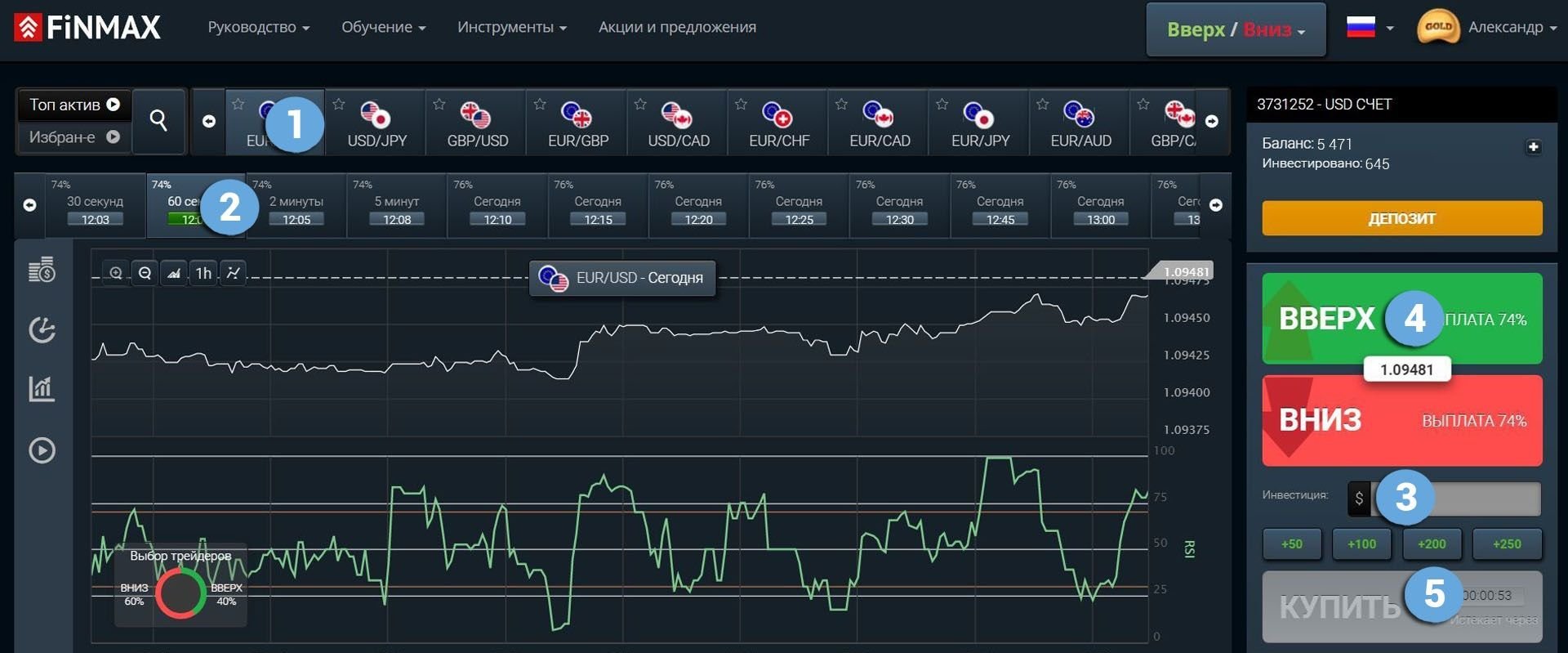

Take advantage of the uptrend opportunities of the price and make a CALL ( up) rate with a reliable broker Finmax. To do this, you need to go to the broker’s website finmaxbo.com and prepare an option, indicating in the system:

1. Type of asset

2. Option expiration

3. Bet size

4. Movement forecast: UP

5. Click the “buy” button and wait for the results.

Money management

Mastering the features of binary options trading, novice traders often underestimate the need for effective money management. They immediately join the race for profit, without thinking about the strategy of working with personal funds. As a result, the deposit is soon empty, and the player is disappointed. Professionals do things differently. They build a strategy for using their funds in order to reach a stable income with minimal losses on their personal account. In order for trading to be effective, you need to think about working with your capital, the rules of money management will help you with this:

Minimum bets. Minimum funds

When starting trading, each time put a minimum of funds on a certain option, but not more than 5% of the deposit. Participate in lots, the prices of which are lower than the funds on the deposit, otherwise there is a great opportunity to remain without funds after the first option. Also, when choosing a broker , trust the funds only to the one who guarantees you the best income. So, if you take care of your money, you will save it and, if you lose, you can continue trading.

Minimum deposit

When starting trading, separately consider working with the deposit. Transfer the minimum possible amount to the account, which will save your budget. Determine the limit that you can spend daily and stick to it in trading. Be aware of possible risks and losses that can never be avoided. So, with careful attitude to your funds, you will always have funds in your account, and you will be able to recoup in case of an unsuccessful outcome of trading.

Minimum assets

Starting trading, participate in the trading of 2-3 assets, gradually master the market opportunities and increase your load after you feel confident in your abilities and experience. More often, newcomers to trading try to participate in all possible assets, which leads to the loss of funds, because It is very difficult to keep track of the status of your account and the outcome of all transactions.

Remember that the more tradable assets, the greater the load on the deposit and the greater the probability of losing all funds at once. By starting trades with two or three assets, you can gradually increase the number of assets. And although the desire to get more profit as soon as possible will always beckon to unconscious actions, a money management strategy will save your funds.

Minimum emotions

When starting trading, consider trading a serious job, where the mood, thoughtfulness of actions and in-depth analysis are important. Try to remove your emotions, do not trade in a bad or excited mood, which will prevent you from concentrating. Experienced options players are distinguished by a sober serious approach, they always remember not only the positive outcomes of transactions, but also possible risks.

Remember the popular and already proven rule of three. As statistics show, three failed or successful transactions are enough, and the trader’s mind turns off, there is a strong desire to return what was lost, in case of failure, or to multiply what was won. So, you run the risk of being left without funds on the deposit. Learn to tell yourself “stop” after three trades with any outcome, and exit the market. So, you can save your capital and increase it.

Expiration

Expiration is one of the main concepts in binary options trading, because. Success in trading and the amount of income depend on it. Without taking into account the important role of expiration, it is not easy to achieve a good result in trading. Predicting the outcome of the transaction and setting the expiration each time, traders wait for the end of trading in order to understand whether the funds on the deposit will be replenished.

Expiration (English Expiration, “expiration”) is the end of the transaction, which leads to a win or loss. For successful trading, it is necessary not only to consciously work with expiration, but also to remember about money management, a set of oscillators, and a reliable broker.

Types of options:

- Ultra-short options – 60 seconds-5 minutes

- Short-term options – 15 minutes – several hours

- Medium-term options – from 6 hours – a day

- Long-term options – a day – several months.

Is it possible to extend the expiration of options?

Can. Remember that this is not allowed by all brokers.

Expiration rules:

- Beginners in trading are advised to work with a long expiration. This will guarantee the reduction of risks and unpredictability of trading, which distinguish express expiration.

- It is necessary to carefully choose a broker, professionals prefer to work on sites where an increase in the expiration period is allowed. This will ensure that risks are minimized.

- If you need to get income as quickly as possible, participate in a short-term (minute – several hours) expiration, but always remember the risks.

- If you need a stable income, participate in long-term expiration. In the case of your correct prediction, it will guarantee a good income.

Expiration in ASO strategies

Strategy for upside signals – lower prices

Short-term trading: possible; it is worth remembering that this is an increased degree of risk and unpredictability of the outcome; reminiscent of a lottery.

Recommended expiration: from 30 minutes to several hours; For such a time period, you can safely analyze the situation, use technical analysis, study the behavior of indicators and make the right bet.

Long-term expiration: also recommended; During the specified time period, you will be able not only to conduct technical analysis, but also to predict the dynamics of the market, depending on the news, economic and political situation.

Strategy for oversold-overbought signals

Short-term trading: not recommended, risky and unpredictable.

Recommended expiration: from 5 minutes to several hours; You will have time to analyze the situation, weigh all the data, turn to the indicators and make the right forecast.

Long-term expiration: recommended; You will be able to place a bet based on technical analysis, as well as predict the dynamics of the market depending on the news, economic and political situation.

“ASO + half candle” strategy

Candlestick analysis is very interesting, if you combine it with effective indicators, you will get good data. The strategy uses: ASO; candlestick chart.

Short-term trading: possible, in case of correct forecasting, it can bring good profits; It is necessary to remember about the unpredictability of the outcome of transactions.

Recommended expiration: from 5 minutes to 1 hour; You will be able to consider in detail the trend, the dynamics of the market.

Long-term expiration: also recommended; You will be able to connect all your experience in order to make the right forecast: it can be data from oscillators, technical analysis of the situation in a similar time period, macroeconomic data.

Strategy for beginners “EMA + ASO”

A simple strategy that will bring a good income. Two EMA moving averages are used; ASO. Ideal for beginners in trading, it is easy to understand and easy enough to generate income. The main entry signal is EMA data, ASO acts as a trend confirmation.

Short-term trading: allowed, in case of correct forecasting will bring a good result; When dealing with this expiration, always be aware of the risks.

Recommended expiration: from 5 minutes to 1 hour; You will be able to see the dynamics of the market and the trend in full force, use technical analysis.

Long-term expiration: recommended; You will be able to connect technical analysis to a specific situation in a calm atmosphere, use macroeconomic data. Remember, the greater the expiration, the clearer the signal is shown.

“MACD + ASO” Strategy

An interesting strategy that allows you to find trends. Both indicators are similar in many ways, work great together, predict price reversals, work over long periods of time, and are suitable for active traders working with large expirations. You should make a purchase in conditions when the lines of both indicators cross upwards, ASO is below the 50 mark, and the MACD line is above zero.

Short-term trading: possible, with the right forecast, it will bring good profits; It is important to remember the unpredictability of the outcome of transactions.

Recommended expiration: from 30 minutes to several hours; For a long period of time, it is easier to work, the price behaves more predictably.

Long-term expiration: also recommended; In this case, the trader can connect all his accumulated experience and make the correct forecast, which can be influenced by: oscillators and strategies, technical analysis and the use of macroeconomic data.

In order to test all expiration options in practice, we recommend using the platform of a reliable broker Finmax, for this you just need to go to the finmaxbo.com website. The advantage of the broker is that you have a choice of expiration from 30 seconds to six months. You will not only check the strategies listed in the review, find your comfortable one among them, but you will also be able to get a good income.

Downloads

MetaTrader 4 (MT4) platform – download.

ASO Oscillator for MT4 platform – download.