Commodity Channel Index (CCI) indicator

Description

The advantages of binary options trading have recently attracted an increasing number of Internet users who are in search of additional income. Only thanks to trading, you can get the first money in 30 seconds, in the case of express trading. Working remotely, independently influencing the amount of your income and receiving real money from the comfort of your home – all this has become the reason for the popularity of options.

Having successfully started trading and earning the first money, traders think about making a stable profit, study new profitable strategies, test the capabilities of indicators, and read special literature. All this, as well as many useful reviews of oscillators, broker ratings are available on our resource. Become professional traders and make all your dreams come true. Today we will tell you about the Commodity Channel Index indicator.

The Commodity Channel Index (CCI) is a binary options indicator authored by trader D. Lambert. CCI appeared in the 80s of the last century, after the publication of the book “Commodity Channel Index: Tools for Trading on Cyclical Trends”.

The tool shows the level of deviation from the average value: if the indicator indicators are high, the price is too high, if they are low, the price is underestimated. A popular area of its application is when finding entry and exit points. Being a trend indicator, it accurately determines the “bullish” and “bearish” trends, that is, the strong and weak phases of market dynamics. Initially, it was supposed to use the tool in the analysis of commodity markets, but today, due to the convenience and accuracy of signals, it has begun to be used in other markets.

CCI is a representative of oscillators, which, for example, like the popular Stochastic, when analyzing price dynamics, informs in advance about a possible change in trend. Due to such advanced properties, it is very useful in work, making trading more productive.

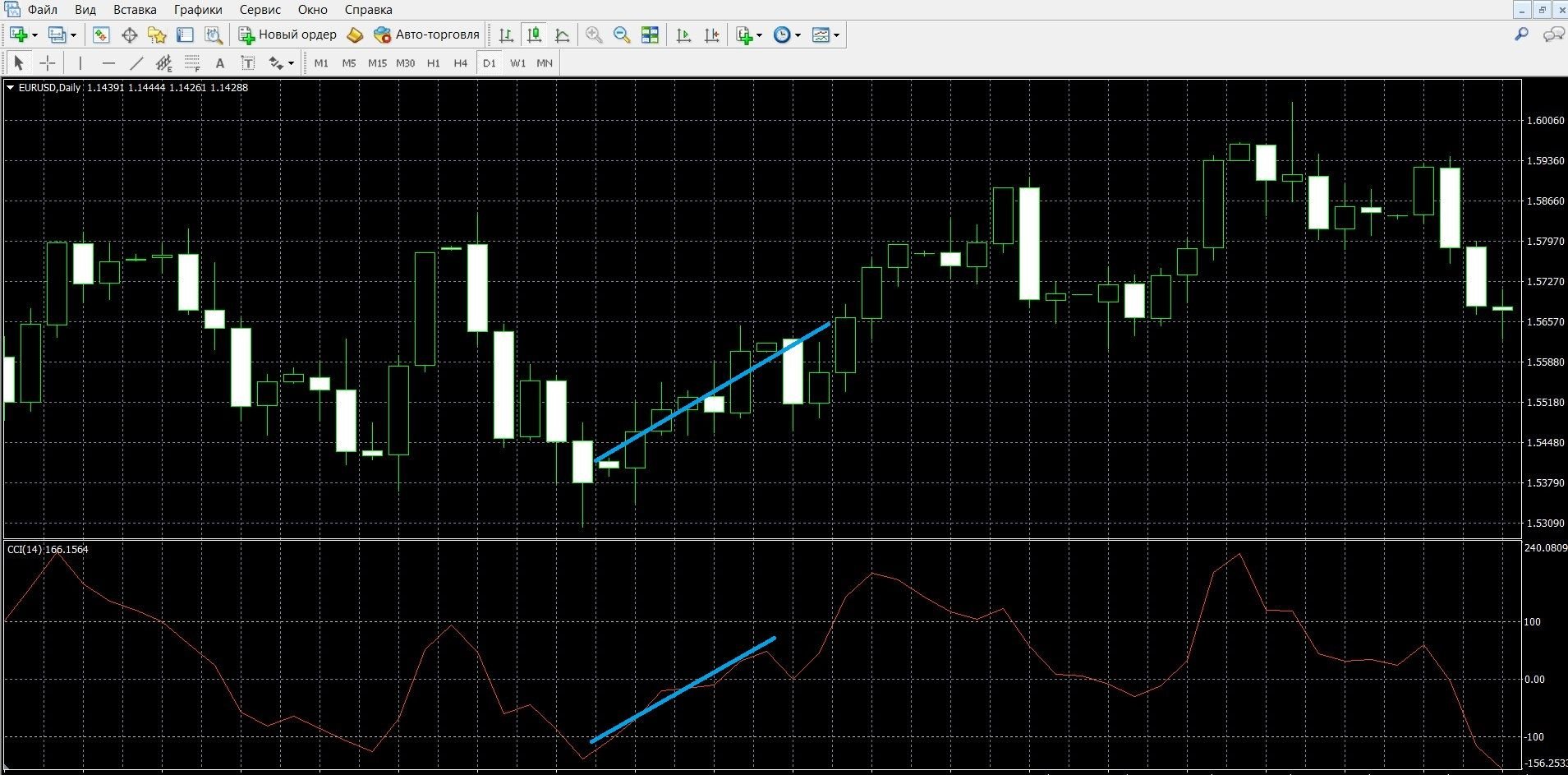

You can see how the CCI visually looks on the Metatrader 4 (MT4) price chart in the image below. You can also download the MetaTrader 4 platform and start working with the indicator.

How does the CCI indicator work?

CCI is one of the most interesting and effective tools of binary options, which is widely used in trading, allowing you to increase your income several times. The principle of its operation is based on the statement about the cyclical nature of the market, when, after a period of high prices, a phase of low indicators arises, which is reflected in the basis of the operation of many instruments, for example, the theory of Elliott Waves. By correctly identifying cycles, you can accurately see the beginning and end of the stock market trend and make money on it.

The indicator is located below the price chart and consists of two horizontal levels and a curved line that displays the indicators of the oscillator. By measuring the speed of price dynamics (i.e. momentum), this indicator applies a moving average for a specific time period. All price fluctuations most often occur around the moving average itself and range from +100% to -100%, demonstrating the following market conditions:

- If the value is above 100, it is an overbought market condition,

- If the value is below 100, there is an oversold condition in the market.

Determining volatility, CCI rarely, but grows on its own, and also shows false signals that can be avoided by combining it with indicators, for example, with a trend ADX. The difference between the oscillator and other instruments is that it has no limitations, so its signals often go beyond 300 points.

CCI Calculation Formula

Find a typical price. To do this, you need to add the maximum, low and closing price of each bar and divide the amount by 3:

TP = (HIGH + LOW + CLOSE) / 3

Calculate the n-period simple moving average of typical prices:

SMA (TP, N) = SUM (TP, N) / N

Subtract the resulting SMA(TP, N) from the typical TP prices of each of the previous n periods:

D = TP – SMA (TP, N)

Calculate the n-period simple moving average of the absolute values of D:

SMA (D, N) = SUM (D, N) / N

Multiply the resulting SMA (D, N) by 0.015:

M = SMA (D, N) * 0,015

Divide M by D:

CCI = M / D, where:

HIGH — the maximum price of the bar;

LOW — the minimum price of the bar;

CLOSE — closing price;

SMA is a simple moving average;

SUM — sum;

N is the number of periods used for the calculation.

Info taken from www.metatrader5.com website

Overbought-oversold signals

When the indicator mark goes beyond -100 and +100, it is overbought or oversold.

- When the price chart is in an overbought position, crossing the 100 line from top to bottom, which means that it is expected to decline soon, it is worth buying a PUT option.

- When the price chart is in an oversold position, crossing the -100 line from bottom to top, this means that it is expected to rise soon, it is worth buying a call option.

Trend signals

The oscillator determines market trends, which can be used when opening and closing trades:

- If the trend is upward, it means that a change in trend is expected, it is worth buying a PUT option,

- If the trend is down, it means that a change in trend is expected, it is worth buying a call option

Divergence signals

The concepts of divergence and convergence are one of the main ones in the market, arising from such discrepancies in price readings and indicators signal the correction of a weak trend:

- Divergence (bullish divergence) appears when the price maximum does not coincide with the indicator data; it is worth buying a CALL option.

- Convergence (bearish convergence) appears when the price low of the price does not coincide with the indicator data; it is worth buying a PCI option.

Do I need to install the indicator in your platform?

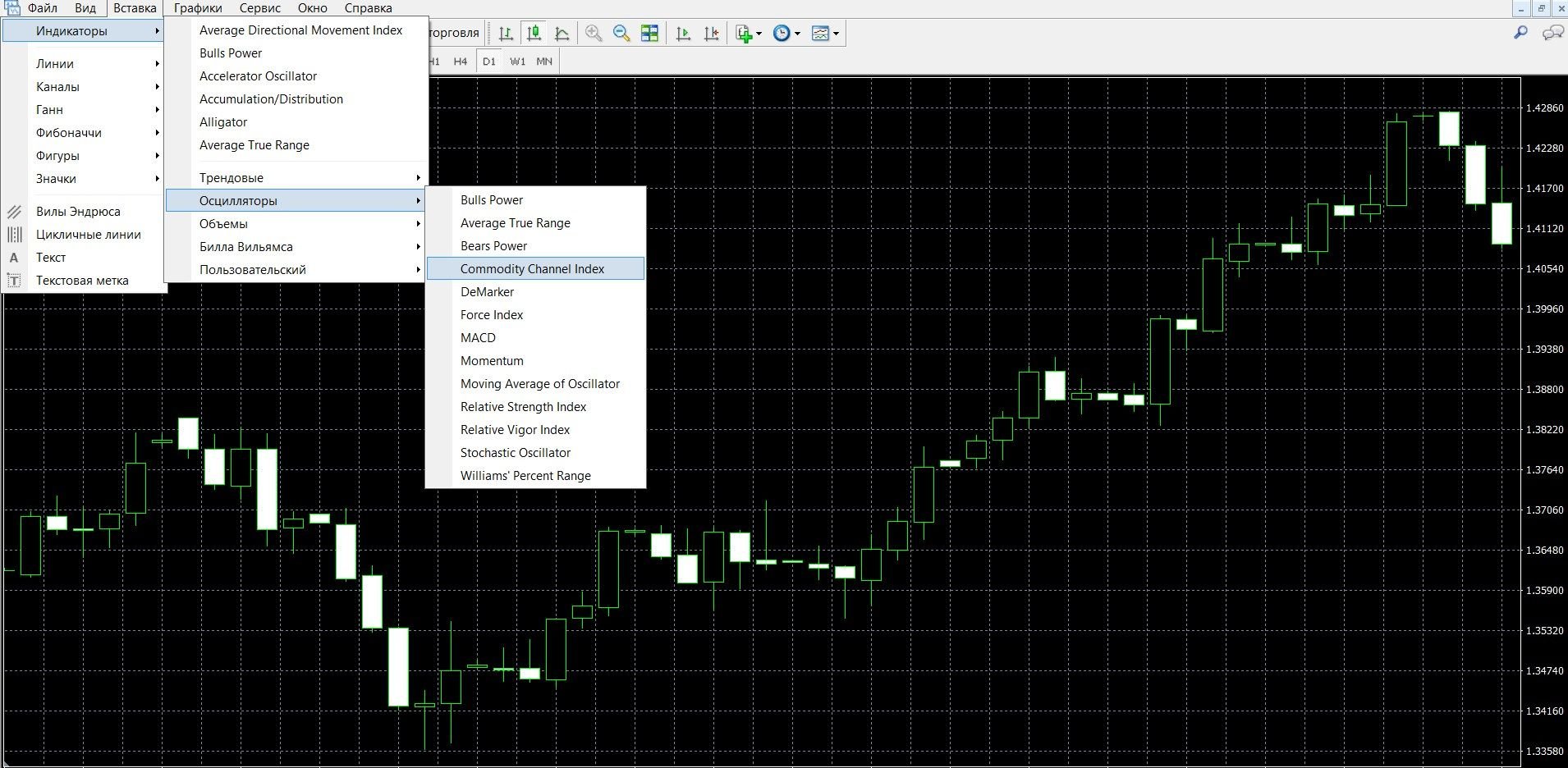

CCI is a standard binary options tool, it is included in the set of basic indicators of the MetaTrader 4 terminal. To add it to the price chart, for this:

- Click the “Insert” tab in the top menu of the platform

- Select the tab “Indicators” – “Oscillators” – “Commodity Channel Index”.

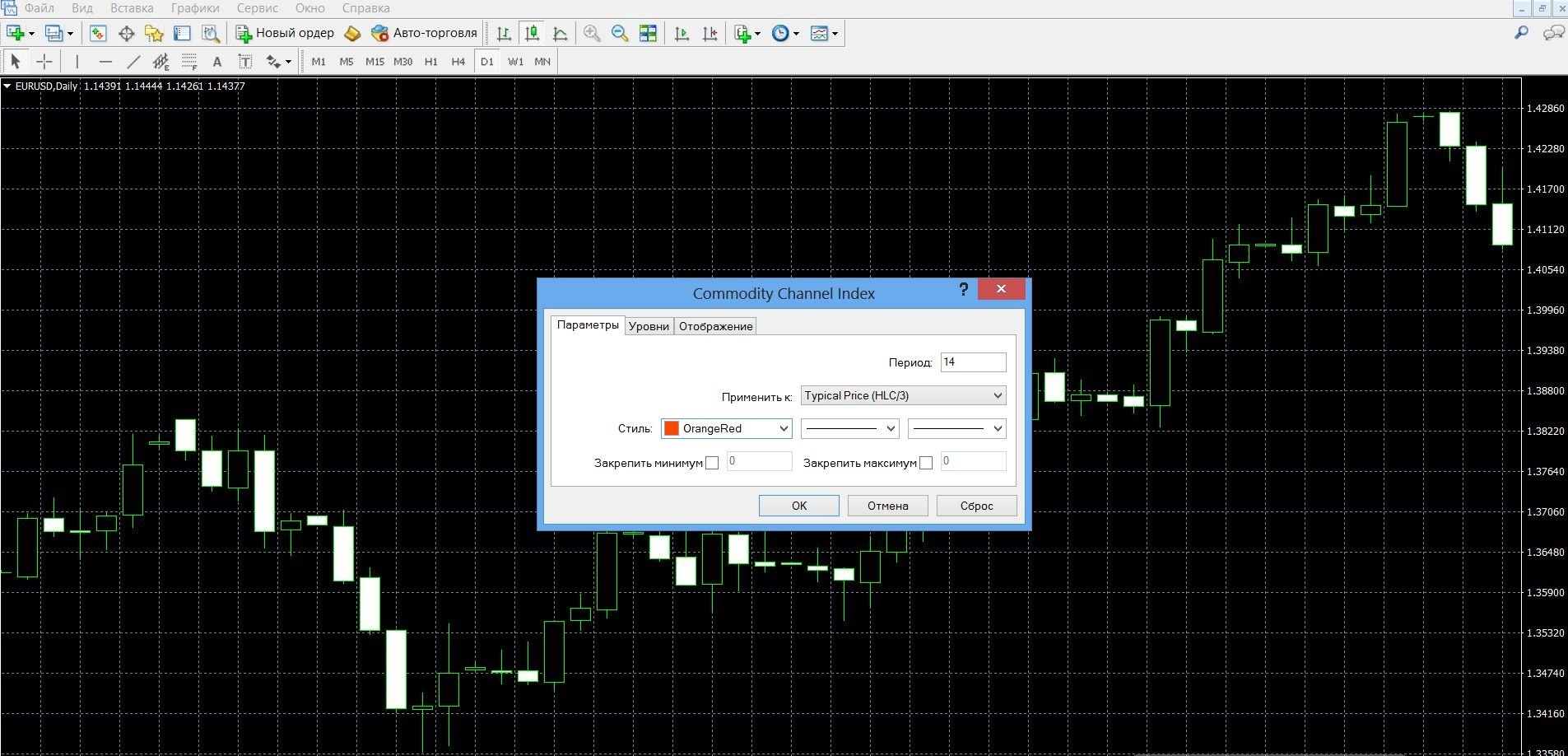

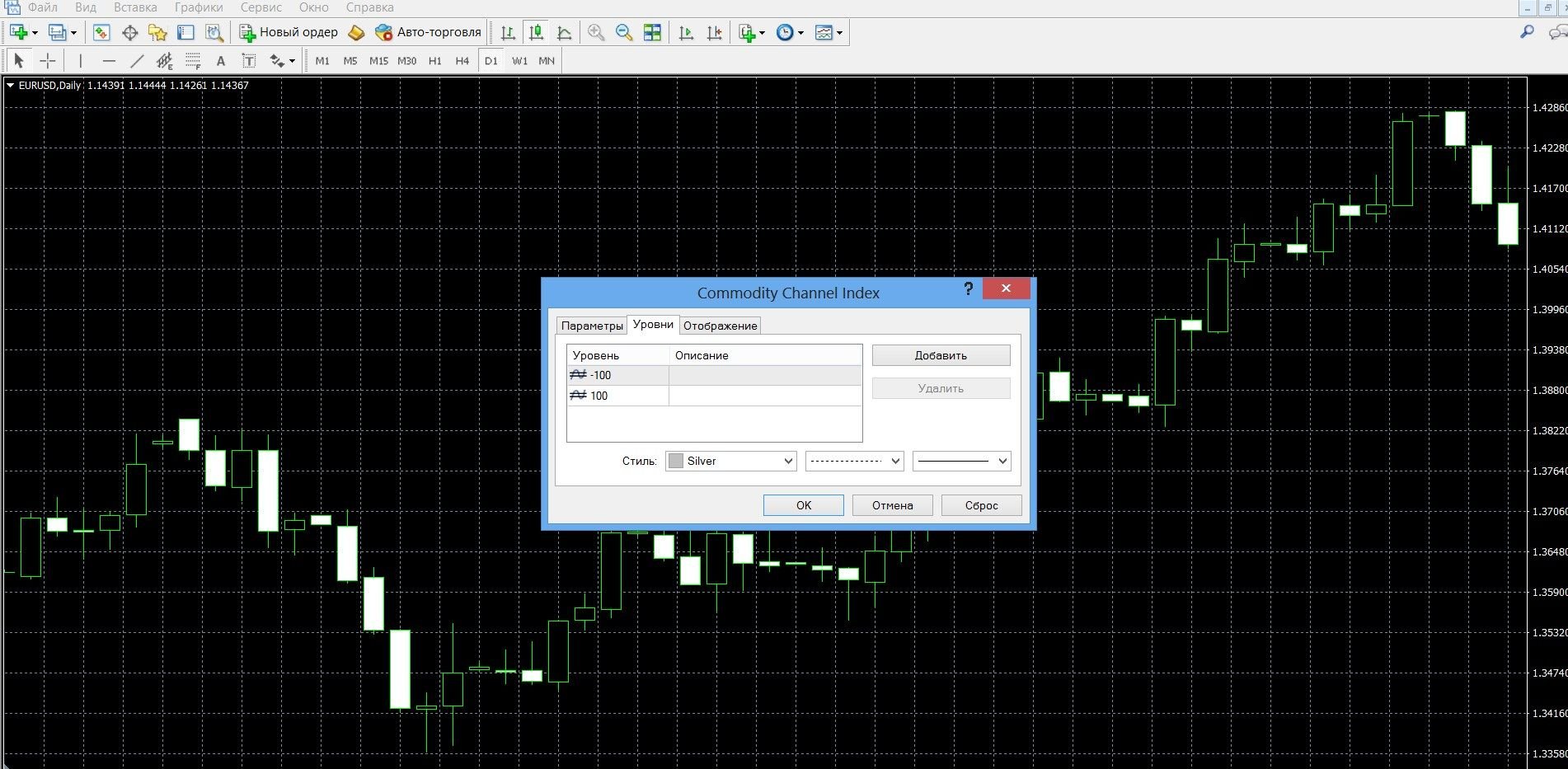

To work with the tool, the following settings are available to you:

- Period (14 candles are indicated as standard): when it decreases, the CCI becomes more sensitive, which increases the number of false signals; As the period increases, there will be fewer false signals.

- In addition, it is allowed to change the values of the overbought-oversold levels in order to reduce or increase the volatility of the oscillator.

If your platform doesn’t have CCI, download it here.

Application of the indicator for binary options

The indicator is popular in binary options. Basically, the Commodity Channel Index is used as follows:

When looking for discrepancies

Divergence signals (divergence and convergence) occur when the price shows a maximum, and the indicator, on the contrary, shows a decline. Being a classic of market behavior, the divergence warns of an imminent change in trend.

- If the divergence between the price and the CCI line occurs in an uptrend, this is a divergence, a signal to buy a call option,

- If the divergence occurs on a downtrend, it is a convergence, a signal to buy a put option.

When looking for overbought and oversold signals

Like all oscillators, it accurately detects overbought and oversold levels by measuring the ratio of price and moving average for this. High values of the instrument indicate an overprice, and low values indicate that it is greatly underpriced, which allows you to work with an overbought and oversold market:

- If the line moves to +100, this is a bullish trend (uptrend), a signal to buy a call option,

- If the line moves to the -100 indicator, it is a bearish trend (downtrend), a signal to buy a put option.

Being an oscillating indicator, it helps to determine the peaks and troughs of the price, is a signal of weakening or growth of the trend, which is in many ways similar to the Keltner Channels and Bollinger Bands. It is also very useful when looking for cyclical buy and sell points. You can work with it more efficiently by combining it with other tools, as well as when calculating the exact time interval.

CCI has become a popular tool among active traders, accurately predicting price fluctuations and offering good profits. It can be used on any timeframe – both internal and weekly.

Rules for concluding transactions (screenshots)

Trading with an overbought-oversold signal

When the price chart is in an overbought position, crossing the 100 line from top to bottom, which means that it is expected to decline soon, it is worth buying a PUT option. The image shows the downtrend in the MetaTrader 4 terminal:

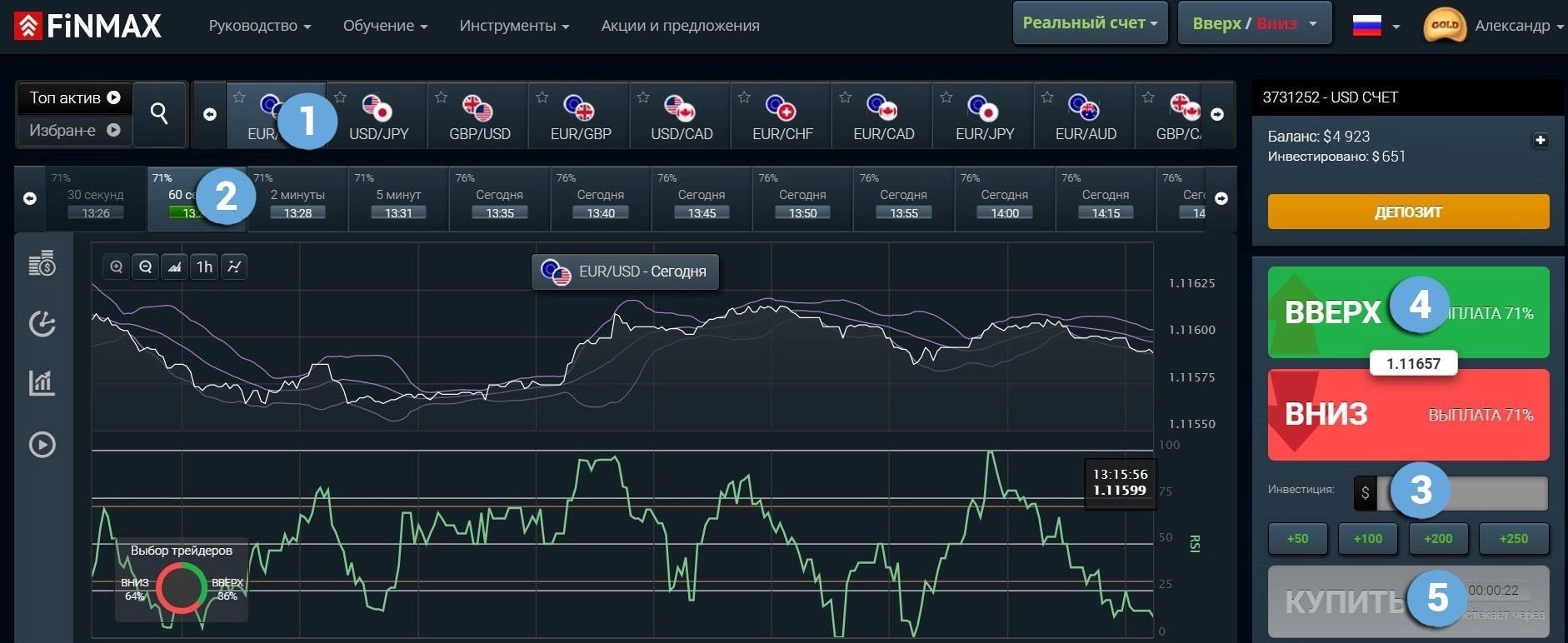

Take advantage of the trend and make a profitable PCI bet with the Finmax broker by going to the finmaxbo.com website and preparing an option, indicating:

- Type of option

- Expiration date

- Amount

- Prediction: down

- Next, it remains to click on the “buy” button and wait for the results:

When the price chart is in an oversold position, crossing the -100 line from bottom to top, this means that it is expected to rise soon, it is worth buying a call option. The image shows the uptrend in the MetaTrader 4 terminal:

Take advantage of the trend and make a profitable CALL bet with the Finmax broker by going to the finmaxbo.com website and preparing an option, indicating:

- Type of option

- Expiration date

- Amount

- Prediction: up

- Next, it remains to click on the “buy” button and wait for the results:

Trading with a trend signal

If the trend is upward, it means that a change in trend is expected, it is worth buying a PUT option. The image shows the expected downtrend after an upward trend in the MetaTrader 4 terminal (using the signal, place a PUT bet on the finmaxbo.com website, the instructions are presented above):

If the trend is downward, it means that a trend change is expected, it is worth buying a call option. The image shows the expected uptrend after a downward trend in the MetaTrader 4 terminal (using the signal, place a CALL bet on the finmaxbo.com website, instructions are presented above):

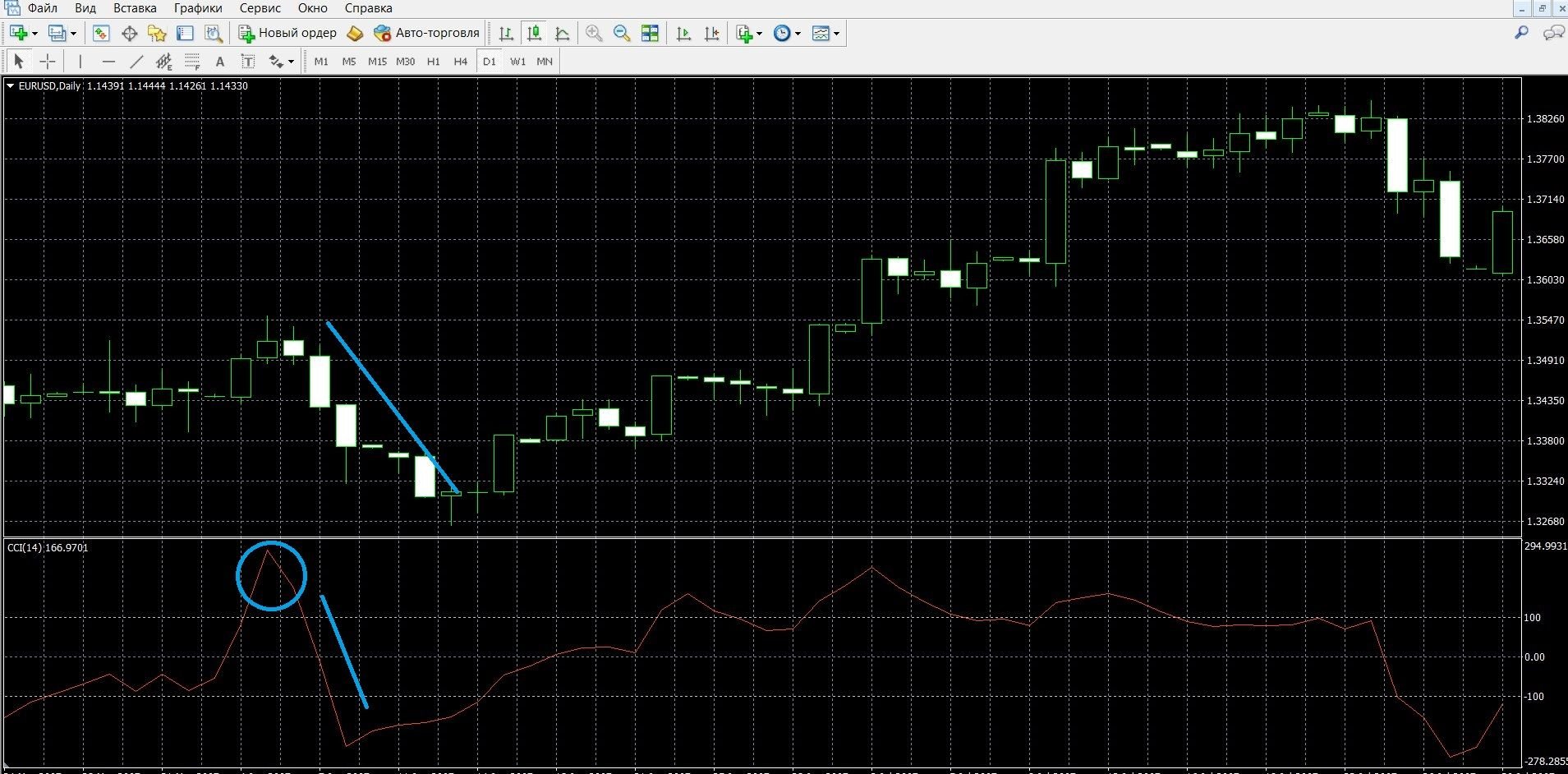

Trading with a divergence signal

Divergence occurs when the price high does not coincide with the indicator data. The image shows a divergence situation, i.e. a situation of divergence. discrepancies between the price dynamics and the CCI indicator on the MetaTrader 4 platform (you can place a CALL bet on the finmaxbo.com website, instructions are presented above):

Convergence occurs when the price low of the price does not coincide with the indicator data. The image shows the convergence situation, i.e. the convergence situation. inconsistencies between the price dynamics and the CCI indicator on the MetaTrader 4 platform (you can place a PUT bet on the finmaxbo.com website, the instructions are presented above):

Money management

Money management is a basic, basic concept in binary options, which affects the result of trading. If you want to make a stable income from trading, start your productive strategy by adjusting the possibilities of using your capital.

Minimum capital: when trading options, try to spend a minimum of funds on the purchase of an option; a transaction with the purchase of one option should not exceed more than 5% of the account amount; Choose options for trading with a minimum price that is less than the deposit. By putting these simple rules into practice, you will save your personal capital.

Minimum deposit: when trading options, try to spend the minimum deposit; when buying one asset, you should not transfer all the capital to it; When saving deposit funds, you should take into account that they will still be useful in further trading. By putting these simple rules into practice, you will save capital in your personal account.

Minimum options: when trading options, always start with a minimum of transactions, preferably with 2-3 assets; This is important for beginners in trading; As you become more experienced, you can gradually increase your trading volume and calmly buy more different assets. By putting these simple rules into practice, you will tune in to productive work.

Minimum of emotions: when trading options, try to tune in to serious analytical work; experience in options alone is not enough, emotions and your mood are what makes your performance; An excited state will interfere with concentration, and you will not be able to make a correct prediction. By putting these simple rules into practice, you can easily achieve success in trading.

Expiration

It is also one of the basic concepts in options trading, which directly determines the success of your work. Expiration (from the English Expiration, “end”) is the moment of completion of the auction, when all participants in the transaction become clear to the results of their forecasts. A conscious attitude to expiration is the most productive strategy that will bring you closer to the desired goal of becoming a professional and getting as much from trading as you want.

Types of options:

- Ultra-short options – 30 seconds – 5 minutes.

- Short-term options – 10 minutes – several hours.

- Medium-term options – a day – a few weeks.

- Long-term options – a month – six months.

Is it allowed to extend the expiration?

It is allowed, but not for all popular terminals. If during trading you suddenly realize that your forecast is wrong, simply extend the expiration, reducing possible losses.

Expiration rules:

- If you are just starting your journey in options, choose to trade long-term trades that will give the necessary stability with minimal risk of loss.

- If you are an experienced market player, choose to trade an expiration that gives you comfortable trading. When choosing a broker, consider the possibility of increasing expiration during trading, which will reduce your losses.

- If you want to make quick money, trading is your choice; To do this, choose short-term trades that can give real income in 30 seconds.

- If you want to get a stable inflow of capital, trading is also your reliable choice; To do this, choose long-term trades that are characterized by a more relaxed trading style and the opportunity to get a good income.

Expiration in strategies with CCI

Expiration at an overbought-oversold signal

Short-term trading: allowed; The indicator allows you to perfectly conduct turbo trading, in order to reduce the risks of loss, it is worth using several tools at once.

Medium-term expiration: allowed; CCI allows you to get a clear signal to action, such transactions are minimally risky and much more stable.

Long-term expiration: allowed; With calm trading, CCI also allows you to get a clear signal to action, in addition, you can make a prediction by applying knowledge of fundamental, technical analysis and profitable strategies, which will allow you to earn decent capital.

Expiration at a trend signal

Short-term trading: allowed; CCI is reliable in turbo trading, in order to reduce the risks of loss, it is worth combining several instruments at once.

Medium-term expiration: allowed; CCI allows you to get a high-quality signal for action, such transactions are minimally risky and much more stable.

Long-term expiration: allowed; With calm trading, CCI also allows you to get a clear signal to action, in addition, you can make a prediction by applying knowledge of fundamental, technical analysis and profitable strategies, which will allow you to earn decent capital.

Expiration at divergence signals

Short-term trading: allowed; CCI shows reliable signals in turbo trading, in order to reduce the risks of loss, it is worth combining several instruments at once.

Medium-term expiration: allowed; CCI generates high-quality signals, such trades are minimally risky and much more stable.

Long-term expiration: allowed; with calm trading, CCI also allows you to get a clear signal for a trade, in addition, you can make a prediction by applying knowledge of fundamental, technical analysis and profitable strategies, which will allow you to earn decent capital.

Expiration in the “CCI+MACD” strategy

Short-term trading: allowed; Both indicators work perfectly together, allowing you to get the most out of turbo trading and are able to reduce the risks of loss.

Medium-term expiration: allowed; Both tools generate high-quality signals, such trades are minimally risky and much more stable.

Long-term expiration: allowed; With calm trading, indicators will allow you to get a clear signal for a trade, in addition, you can make a forecast by applying knowledge of fundamental, technical analysis and profitable strategies, which will allow you to earn decent capital.

Actively studying your opportunities in trading, pay attention to expiration, which will help you achieve the desired performance faster. Check all possible expiration dates on the convenient platform of the Finmax broker, where there are wide options for choosing expiration (from 30 seconds to six months), etc. By going to the finmaxbo.com broker’s website, you are already starting to build a profitable strategy in options.

Downloads

MetaTrader 4 (MT4) platform – download.

CCI indicator for the MT4 platform – download.