Standard Deviation Indicator

Description

Today, freelancing is a common occurrence that more and more active network users are striving for. A freelancer, in many ways, is an image of a successful person, self-sufficient and free; He works when he wants and where it is convenient for him, while his salary level is high, and life is much more interesting than that of an ordinary office manager. Trading is considered a remote job, which is one of the most profitable and fast ways to make money. Only by trading binary options, you will receive real money in 30 seconds .

After getting acquainted with trading, market players who want to become professionals begin to draw up their successful trading strategy in order to achieve a stable income. To do this, they test profitable trading systems, reliable robots, are in constant search of productive signals, new indicators, and monitor the ratings of brokers. You can easily find all these materials on our resource. Today we will talk about the Standard Deviation indicator.

Standard Deviation (StdDev) is a technical indicator that measures market volatility, reports information about the size of price fluctuations relative to the moving average. It is simple and straightforward to work with, giving valuable information to the trader:

- if the indicator indicators are large, the market is volatile, and the bar prices are scattered relative to the moving average;

- If its value is low, the market has low volatility and the bar prices are close to the moving average.

This is one of the trader’s tools that can make the work most productive. However, on the chart, StdDev is usually used as part of other indicators and trading systems.

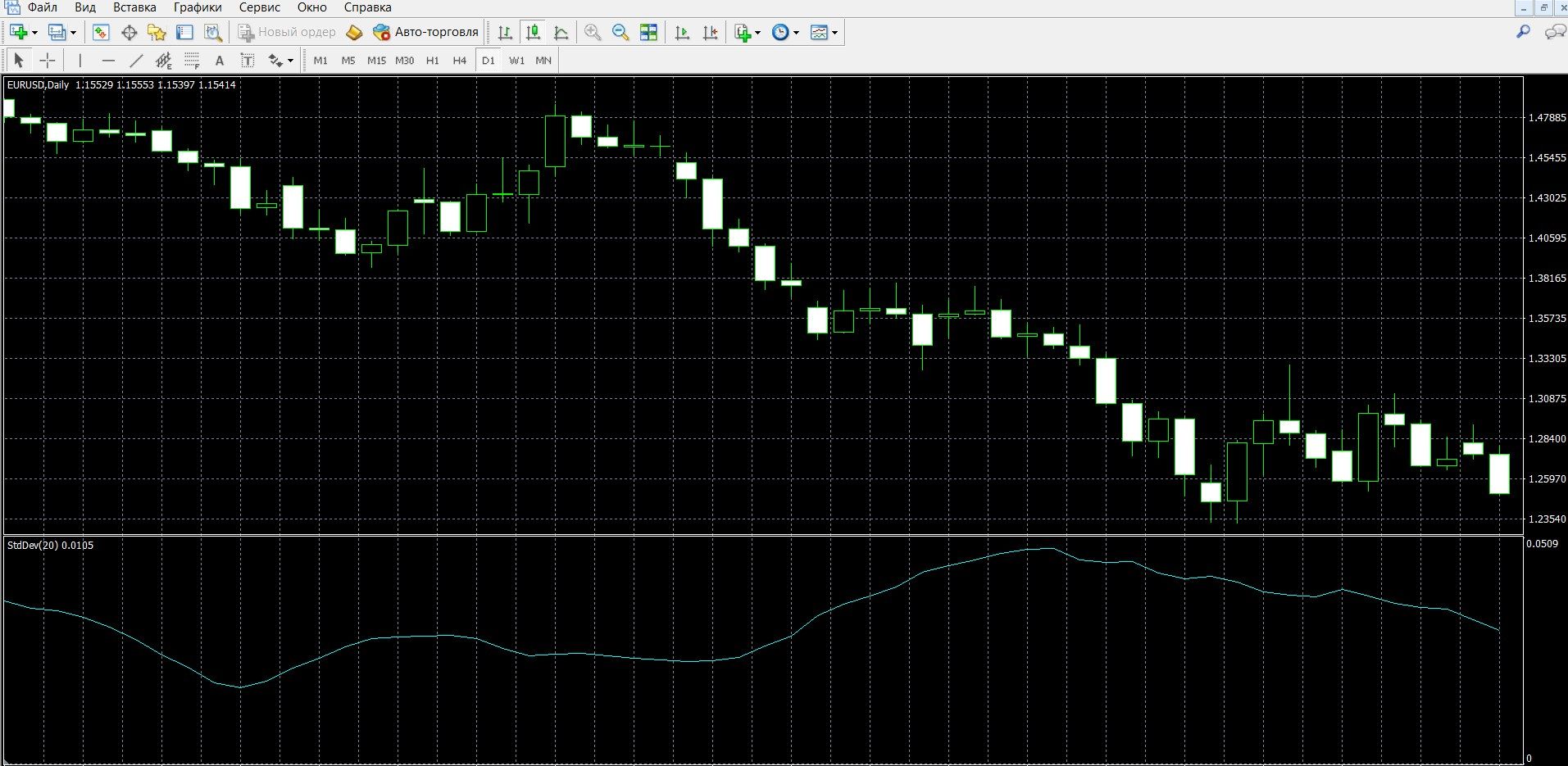

You can see how the instrument visually looks on the price chart in MetaTrader 4 in the image below. You can also download the MetaTrader 4 platform and work with the indicator in practice.

What is the principle of operation of the StdDev indicator?

As you know, market dynamics is a consistent alternation of rest and bursts of price activity, which, if used correctly, can bring you a decent income. Standard deviation measures the size of the price dynamics of a particular asset in order to show how volatile the price may be in the future. Or in another way, it will help you find out what will happen to price volatility: will it decrease or increase. To obtain this data, the tool compares the price maneuver with its historical data.

The principle of operation of StdDev is in many ways reminiscent of the famous Bollinger Bands, where the position is closed after reaching the line of the lower boundaries of the chart and vice versa. On the chart, the Standard Deviation is a blue line in a separate window that moves up or down depending on the size of the previous price dynamics compared to the current data:

- if the StdDev line is located high, this indicates serious changes in the price of the asset, which means that volatility will decrease.

- if the deviation of StdDev is very high, it suggests that there have been major price changes recently, but the volatility will decrease.

- if the deviation of StdDev, on the contrary, is very low, then the volatility will increase. This is a signal of a high probability of a flat.

Formula Calculation Standard Deviation

StdDev (i) = SQRT (AMOUNT (j = i – N, i) / N)

AMOUNT (j = i – N, i) = SUM ((ApPRICE (j) – MA (ApPRICE , N, i)) ^ 2), where:

StdDev (i) — Standard Deviation of the current bar;

SQRT is the square root;

AMOUNT(j = i – N, i) — sum of squares from j = i – N to i;

N is the smoothing period;

ApPRICE (j) — applied price of the j-th bar;

MA (ApPRICE, N, i) — the value of the moving average with a period of N on the current bar;

ApPRICE (i) — applied price of the current bar.

Info taken from metatrader5.com website

Indicator signals:

Trend signals

- If Standard Deviation shows an upward movement, buy a

CALL option

, - If Standard Deviation shows a downward movement, buy a

PAT option

.

Price divergence signals

Divergence and convergence are price divergences that are a strong signal of a change in market trend:

- Standard Deviation divergence occurs on an uptrend, it is worth buying

call options

, - Standard Deviation convergence occurs in a downtrend, it is worth buying

put options

.

Do I need to install the indicator in your platform?

Standard deviation is a classic binary options trading tool, it is presented in most popular trading platforms, including MetaTrader 4.

To add an indicator to the price chart on the MT4 platform, follow

these steps

:

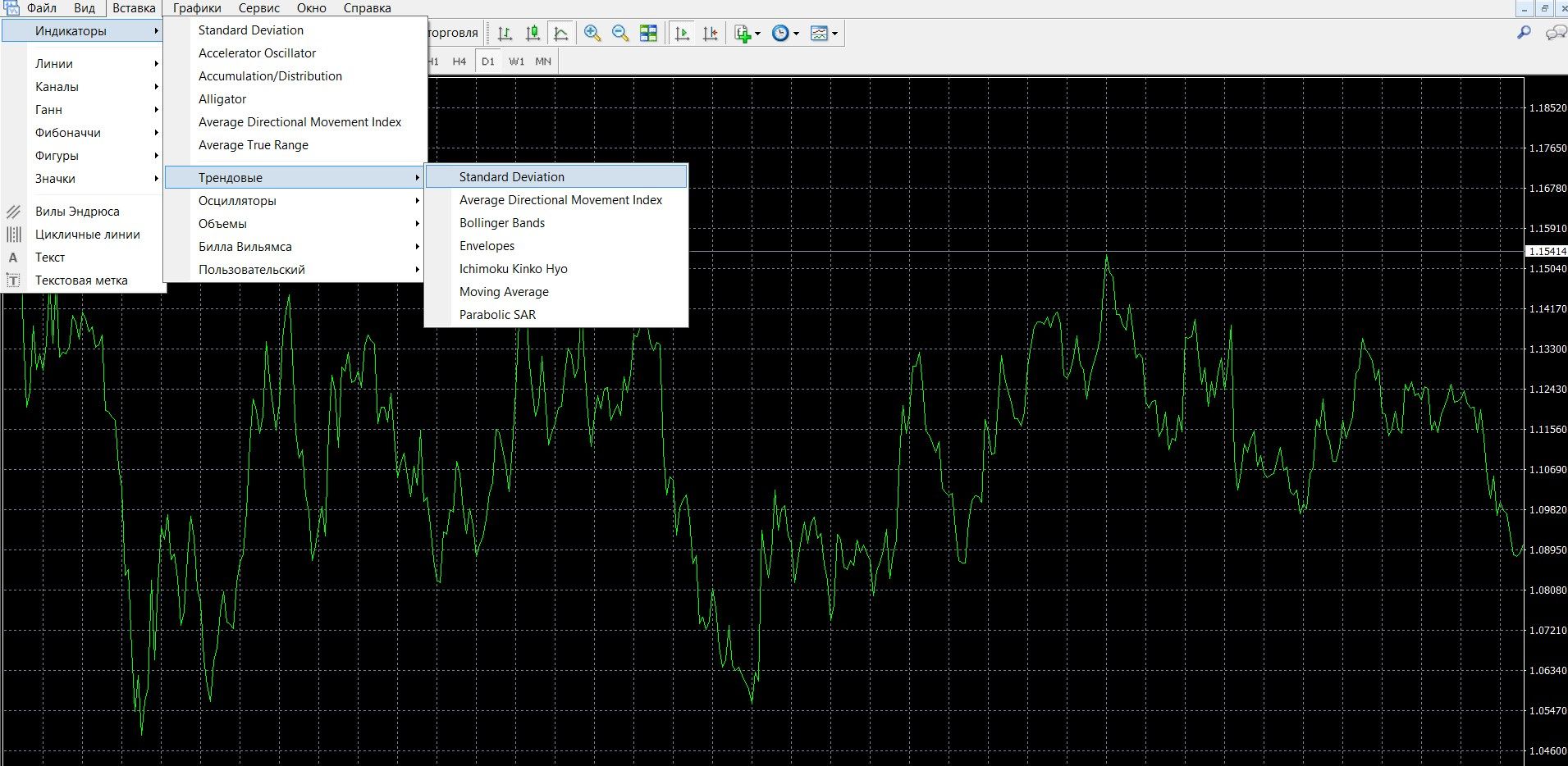

- Click the “Insert” tab in the top menu of the platform

- Select the tab “Indicators” – “Trend” – “Standard Deviation”

- The indicator has been added to the chart, start working with it.

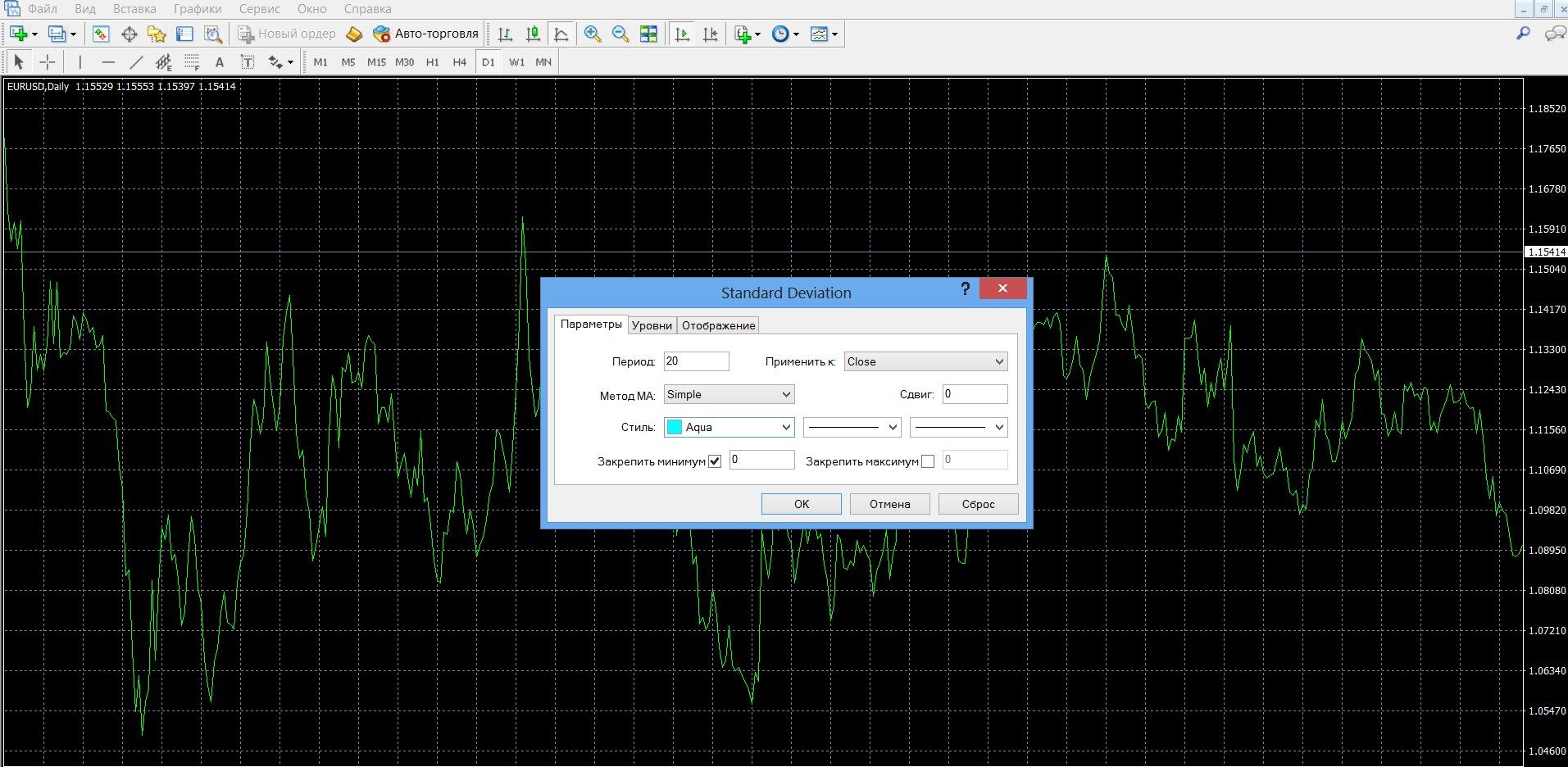

The main parameter of StdDev is a period equal to 20:

- if the period is increased, the instrument will become less sensitive (this increases the number of false signals);

- If, on the contrary, reduce it, its sensitivity will increase.

If your platform does not have this indicator, download it for free here.

Application of the indicator for binary options

Being one of the most popular tools, Standard deviation is common among traders, making work in conditions of increased market dynamics the most effective. It accurately determines the indicator of market volatility, shows the moments of convenient entry and exit from the market, is able to predict the position of the price in the future, which can be used in the work of a trader.

It is referred to as a trending instrument, because. It allows you to assess market trends (when combined with indicators). Its significant advantage will be that it is quite versatile and perfectly combined with other tools. Due to the simple principle of calculating the indicator, it is easy to learn, work with it simply and clearly.

It will also be useful for determining the moments of divergence from the price chart, which accurately signals a change in the market trend (divergence, convergence). Standard Deviation is more often used with other instruments and trading systems (for example, Bollinger Bands, RSI, MACD , etc.). As an independent tool, it is used less often, because it does not show clear signals for opening and closing positions.

Rules for concluding transactions (screenshots)

Trading with a trend signal

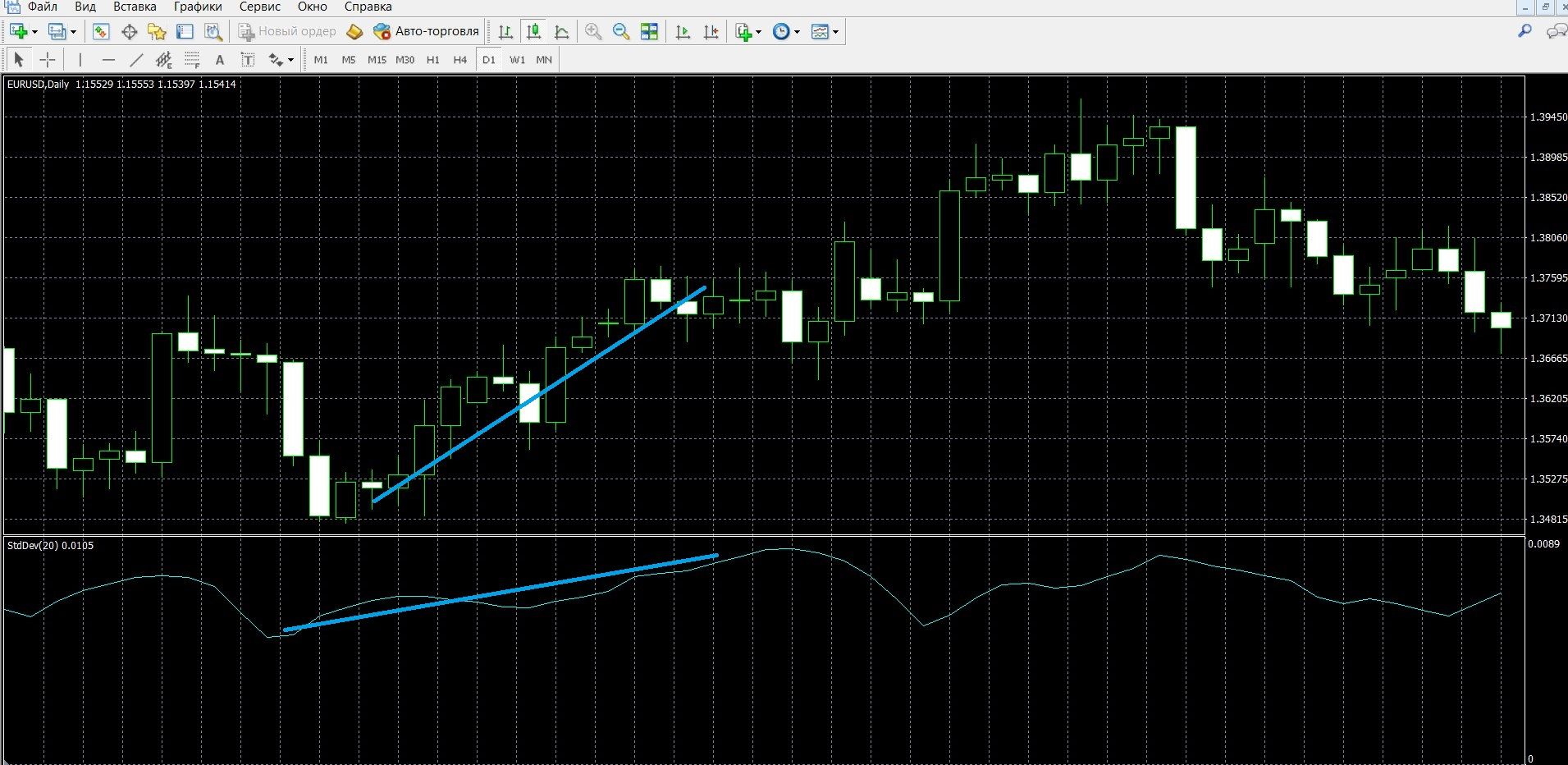

If Standard Deviation shows an upward movement, buy a call option. The image below shows the upward trend of the market in the MetaTrader 4 terminal:

Take advantage of the trend and place a CALL bet with the Olymp Trade broker by going to the olymptrade.com website and preparing an option, indicating:

- Type of option

- Expiration date

- Amount

- Prediction: up

- Next, click the “buy” button and wait for the results of the forecast:

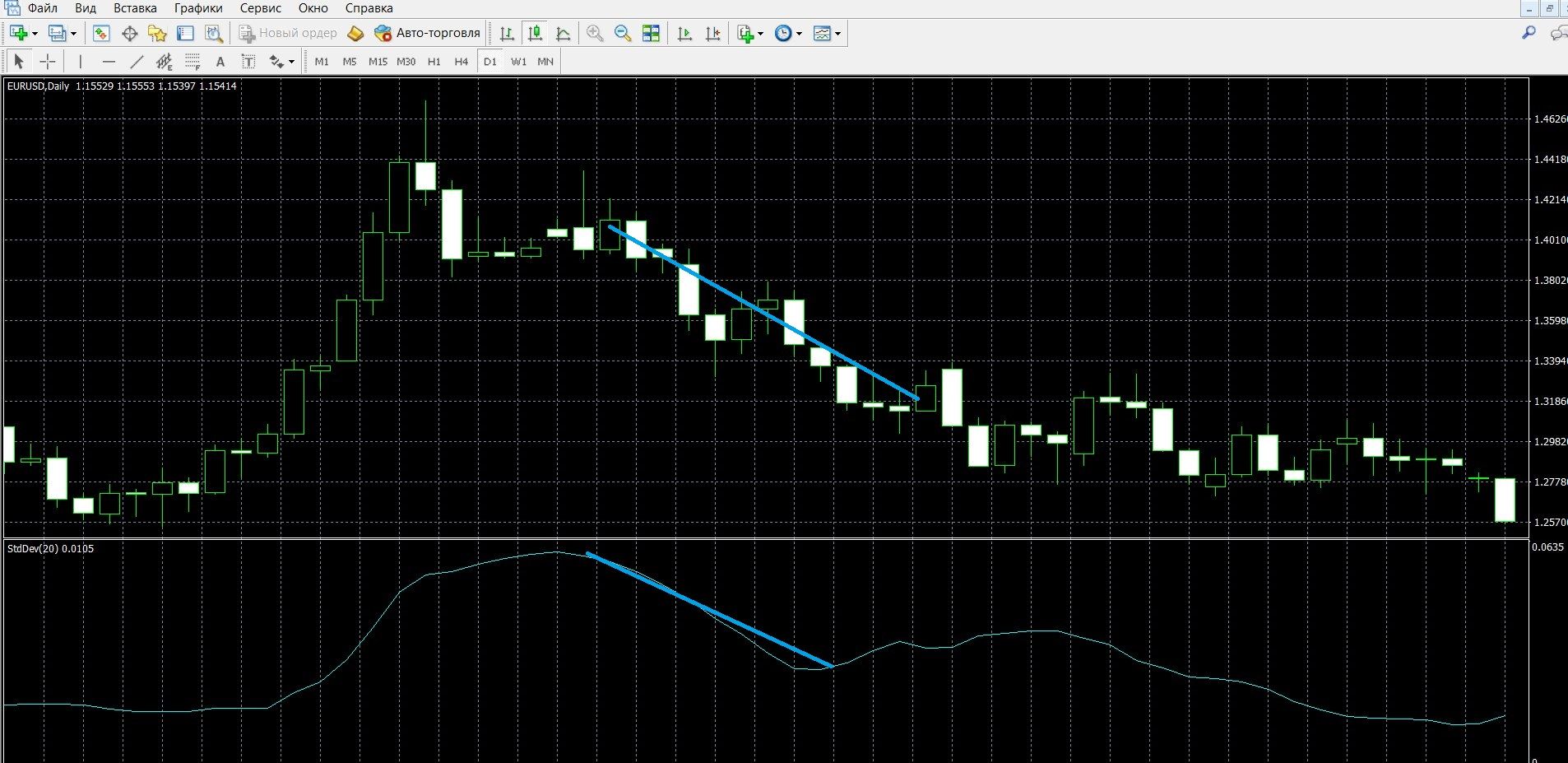

If Standard Deviation shows a downward movement, buy a

PAT option

. The image below shows the downward trend of the market in the MetaTrader 4 terminal:

Take advantage of the trend and place a put bet with the Olymp Trade broker by going to the olymptrade.com website and preparing an option, indicating:

- Type of option

- Expiration date

- Amount

- Prediction: down

- Next, click the “buy” button and wait for the results of the forecast:

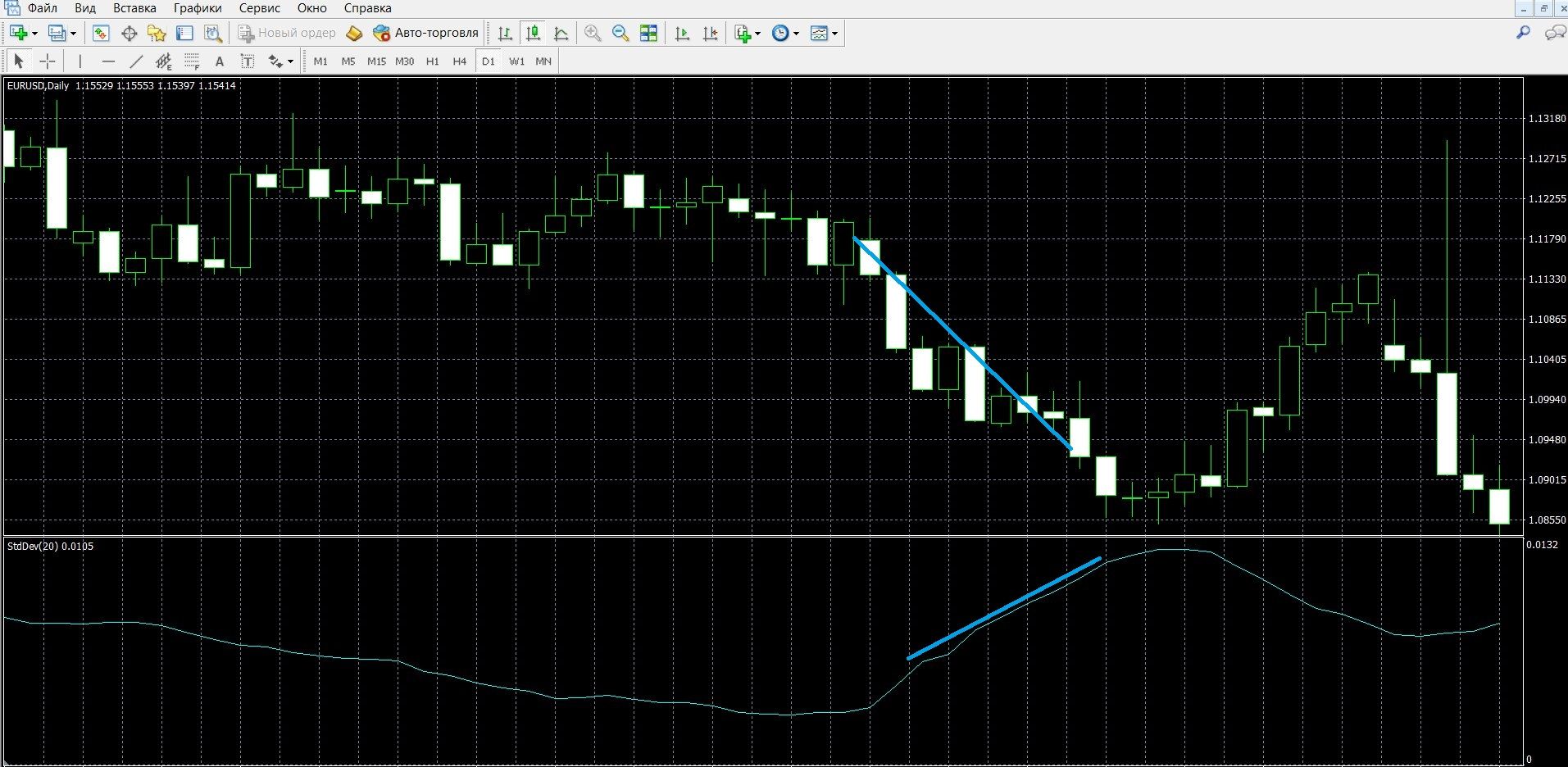

Trading with a divergence signal from the price

Standard Deviation divergence occurs on an uptrend, it is worth buying call options. In the image, you can see the expected uptrend after the fall in the MT4 terminal (taking advantage of the trend, place a CALL bet on the olymptrade.com website, the instructions are indicated above):

Standard Deviation convergence occurs in a downtrend, it is worth buying put options. In the image, you can see the expected downtrend after the fall in the MT4 terminal (taking advantage of the trend, place a PCI bet on the olymptrade.com website, the instructions are indicated above):

Money management

The concept of money management is especially important for a trader, and by using it correctly, you can positively influence the results of binary options trading. If it is important for you to receive a stable or high income, first implement the basics of money management in your strategy, which will be a quick way for you to succeed in trading.

Minimum capital

: when participating in exchange transactions, learn to put a minimum of your funds on trading; the option price cannot be more than 5% of the total deposit; Participate in the purchase of options at the lowest prices, which will not affect the capital of the account. Using these simple rules in options trading, you will save your capital.

Minimum

deposit: when participating in exchange transactions, learn to be economical with your deposit; when buying an asset, do not transfer all capital to it; Keep a positive state of the account, because It will still be useful to you in further trading. Using these simple rules in options trading, you will save your deposit.

Minimum of

options: when participating in exchange transactions, learn to buy a minimum of options, starting, for example, with 2-3 assets; This rule applies to options beginners who do not have sufficient experience in trading; As soon as you become more experienced, you can increase the number of assets. Using these simple rules in options trading, you can make the work effective.

Minimum of emotions

: by participating in the transactions of the exchange, learn to start the trading day with a serious mood, because you will find serious analytical work and balanced decisions; Always remember that there is little experience in trading, emotions and mood can make your results desirable. Using these simple rules in options trading, you will easily become a successful trader.

Expiration

One of the important concepts of trading – expiration (from the English Expiration, “end”), means the end of options trading, when the participants of these trades find out whether their forecasts of market movements will bring income. Like money management, this concept will also determine the success of trading. A conscious attitude to expiration will help build a productive strategy that will bring you closer to the desired results of work.

Types of options:

- Ultra-short options – 30 seconds – 5 minutes.

- Short-term options – 10 minutes – several hours.

- Medium-term options – a day – a few weeks.

- Long-term options – a month – six months.

Is it allowed to extend the expiration?

It is allowed, but not for all trading terminals. If during trading you realize that you have made an incorrect prediction, it is enough just to extend the expiration, this will lead to a decrease in losses.

Expiration rules:

- It is better for new market players to trade long-term options, which guarantee stability and a minimum risk of loss.

- For experienced market players, it is better to trade with the expiration that will make trading as comfortable as possible. When choosing a broker, find out whether it will be possible to extend the expiration during trading, which will reduce losses several times.

- For those who need instant income from the exchange, it is better to trade short-term options, which will give real earnings in 30 seconds.

- For those who need a stable income from the exchange, it is better to trade long-term transactions that will give calm trading and decent earnings.

Expiration in Standard Deviation Strategies

Expiration at a trend signal

Short-term trading: allowed; Standard deviation generates a variety of qualitative market trend signals, offering great opportunities for profitable trading; use additional tools to filter out false signals; When working with turbo options, remember that they are risky.

Medium-term expiration: allowed; The standard deviation generates good signals of the market trend, offering more opportunities for profitable trading; To filter out false signals, combine trading with additional instruments; With such trading, you will find a minimum of risks.

Long-term expiration

: allowed; the indicator, accurately showing high-quality signals of the market trend, makes trading effective; To search for reliable signals, use additional tools, you can apply knowledge of profitable strategies, fundamental and technical analysis, which will make long-term trading more profitable.

Expiration at a signal of divergence with the price

Short-term trading: allowed; Standard deviation generates profitable price divergence signals, which makes binary options trading productive; To avoid false signals, use additional tools; When working with turbo options, remember that they are risky.

Medium-term expiration: allowed; Standard deviation generates profitable price divergence signals, which makes binary options trading productive; To avoid false signals, use additional tools; With medium-term trading, you will find a minimum of risks.

Long-term expiration: allowed; Standard deviation generates profitable price divergence signals, which makes binary options trading productive; To avoid false signals, use additional tools; You can also apply knowledge of profitable strategies, fundamental and technical analysis, which will make long-term trading the most profitable.

Expiration in the strategy “Standard deviation + RSI”

Short-term trading

: allowed; by combining well with the RSI, the Standard Deviation generates quality trade entry signals; thanks to RSI, you can not worry about the quality of signals and work much more productively; Such express trading will bring you a decent income.

Medium-term expiration

: allowed; by combining well with the RSI, the Standard Deviation will generate quality trade entry signals; thanks to RSI, you don’t have to worry about the quality of signals, and medium-term trading will bring maximum income with a minimum of risks.

Long-term expiration

: allowed; working in a strategy with RSI, Standard Deviation will allow you to get high-quality market entry signals; Also, for the forecast, apply all the knowledge of fundamental and technical analysis, which will lead your long-term trades to the best results.

When working with binary options, pay special attention to expiration, which will allow you to quickly achieve the desired result. We advise you to start your trader’s journey by working in the convenient terminal of the Olympus Trade broker, which offers a choice of convenient expiration times from 1 minute to 1 hour. Go to the broker’s website olymptrade.com right now and make your trading profitable.

Downloads

MetaTrader 4 (MT4) platform – download.

Standard deviation indicator for the MT4 platform – download.