Average True Range indicator, ATR

Description

We all want to become financially independent, change our lives for the better and achieve more. Hence the desire to find a new job, well-paid, not difficult. Many are looking for opportunities for additional income on the network in order to then make it the main one. There are many problems on the constant path of searching: there are enough job offers on the network, but you cannot be sure that you will be paid the promised reward. And yet, there is a way out in such a situation.

Binary options trading is becoming more and more popular and is rapidly gaining momentum. This job is highly paid, uncomplicated, but legal and all licensed trading platforms fulfill their obligations by paying money. Only in trading can you get the first profit in 30 seconds, and then increase it exactly as much as you need. Options are accessible and understandable, and it doesn’t matter what experience you have, just start trading and everything will work out. For professional traders, whose number is growing, trading is becoming a favorite job, providing them with freedom, unlimited opportunities and financial well-being.

In order to make options a source of permanent income, market players improve their skills: they are looking for new auto-robots, trading strategies, profitable signals, exploring the possibilities of new indicators, taking part in promotions and bonuses, and always monitoring the ratings of brokers. All this, as well as much more useful you will find on our resource. In today’s review, we will talk about the Average True Range indicator.

The Average True Range (ATR) is a popular binary options technical indicator that most accurately reflects the state of market volatility. The author of the tool is a trader and an excellent specialist in technical analysis, Wells Wilder (who developed the equally popular ADX, RSI, Parabolic SAR), who spoke about ATR in 1978 in his work “New Concepts of Technical Trading Systems”, and since then the oscillator has only gained momentum, proving its usefulness in trading.

Working in the options market, it is important for a trader to rely on the readings of proven instruments that generate high-quality signals and are able to bring stable profits. One of these strong indicators is the Average True Range.

The Average True Range studies market volatility, its peculiar temperature: with low volatility, the market is in a sleepy state, with a higher indicator of it, the market is dynamic, trends replace one another. When trading on the stock exchange, it is important to understand the final conditions for entering and exiting the market.

It is the Average True Range that is considered the simplest option for identifying the average price range, that is, its true range. The indicators of the instrument will tell you exactly when you need to enter the market, buy or sell. It is worth remembering that the indicator does not provide information about the price reversal, it only demonstrates the volatility of the market at a particular moment.

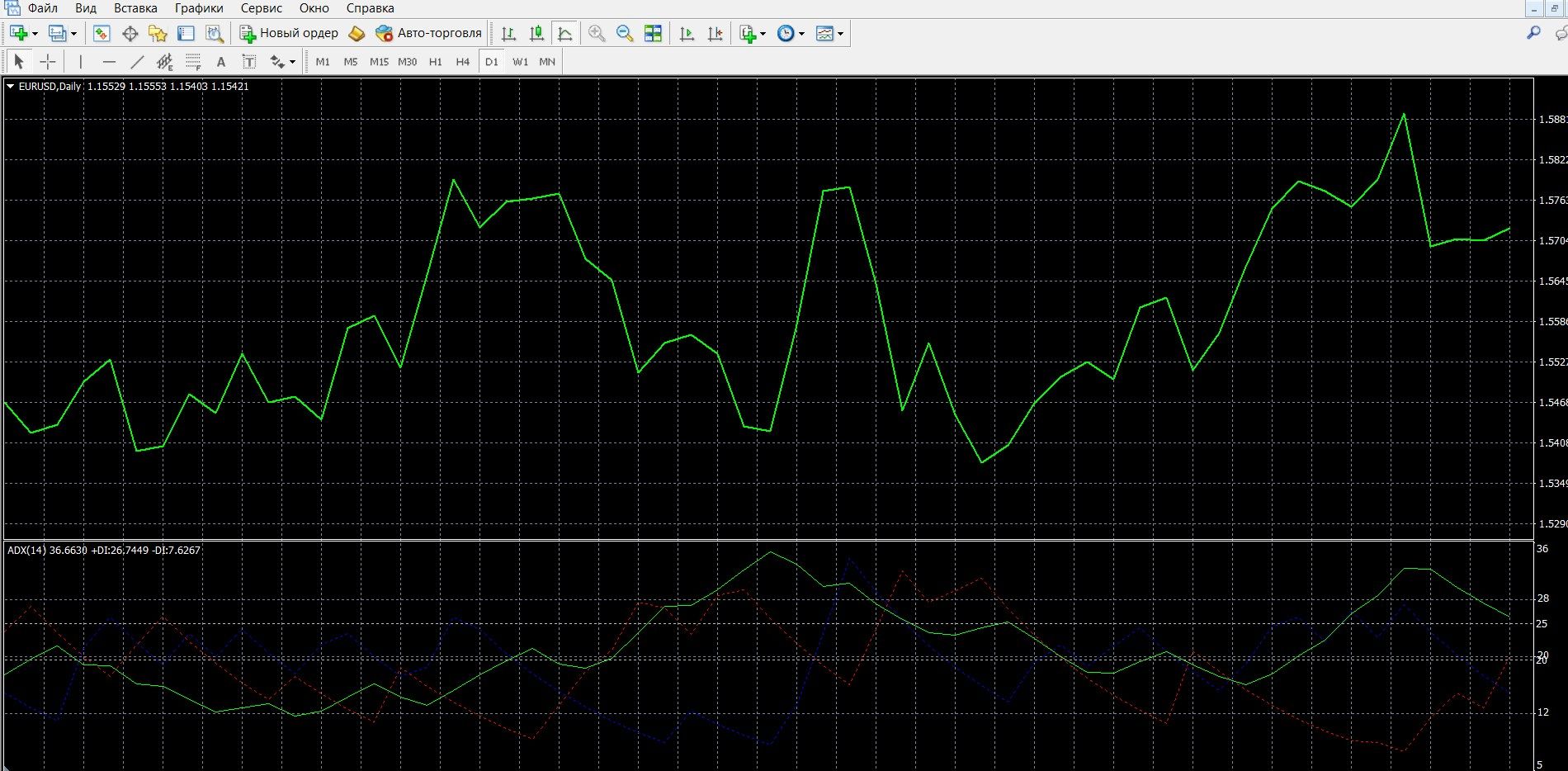

You can get acquainted with the capabilities of ATR in the MetaTrader 4 terminal in the image below. You can also easily download the MetaTrader 4 platform and learn more about its features in practice.

Download MetaTrader 4 platform

How does the Average True Range indicator work?

Average True Range is an auxiliary technical indicator, but despite this, it is considered a classic tool widely used by traders in trading strategies. It is interpreted like most volatility indicators.

ATR not only takes into account price fluctuations, but also allows you to accurately determine the range of prices used to determine market maneuvers. It shows the average value between the high and low of the price for a specific period, which makes it possible to identify market volatility.

The instrument determines the main phases of the market: the price rises and falls, rests, being in consolidation (flat). At the same time, it uses absolute, not relative, price indicators. To calculate the data, the moving average for the n-period is used, or in another way, the indicator shows the average size of the candle (that is, the price movement) for a certain period. Having the form of a moving average, it is displayed in a separate chart in the MT4 terminal.

Its peculiarity is that it is very sensitive to the dynamics of price maneuvers, so it is important to correctly adjust the indicator of its period. Initially, ATR was created for accurate technical analysis of commodity markets, which are characterized by the greatest volatility. But today, thanks to its data, it is widely used in both the currency and stock markets.

The formula for calculating the indicator:

ATR = Moving Average(TRj, n), where

TRj = the maximum of the modules of the three values

high – Low|, high – Closej-1|, | Low – Closej-1|.

Indicator signals

ATR alone cannot provide entry points to the market, it must be combined with trend instruments. ATR is able to demonstrate the strength of the trend and warn of an imminent reversal. Using auxiliary tools, you can get fairly clear signals for opening positions.

ATR Trend Strength Signals

ATR shows the “rate” of price change. The upward direction of its line indicates more active purchases:

- If the ATR line moves sharply in an upward direction, this indicates an increase in market volatility, it is worth buying options in the direction of the trend, in this case, CALL options,

- If the ATR line is gradually decreasing, this indicates that the trend is exhausted and weakening, it is worth buying options in the direction of the trend, in this case, put options,

- If the ATR line is almost straight, “jerks” in a specific direction are possible in the near future.

ATR reversal signals

- If the ATR is at the top for a long time, this indicates a possible consolidation of the market, after which a sharp reversal or continuation of the main movement is possible; based on the data of trend indicators, you can track a strong reversal signal and the appearance of a downtrend, it is worth buying put options,

- If the ATR is at the bottom for a long time, this indicates a possible consolidation of the market, after which a sharp reversal or continuation of the main movement is possible; Based on the data of trend indicators, you can track a strong signal of a reversal and growth of an uptrend, it is worth buying call options.

Do I need to install the Average True Range indicator in your platform?

ATR is a classic technical analysis tool, it is included in most of the modern trading platforms of brokers, and it is also presented in MetaTrader 4.

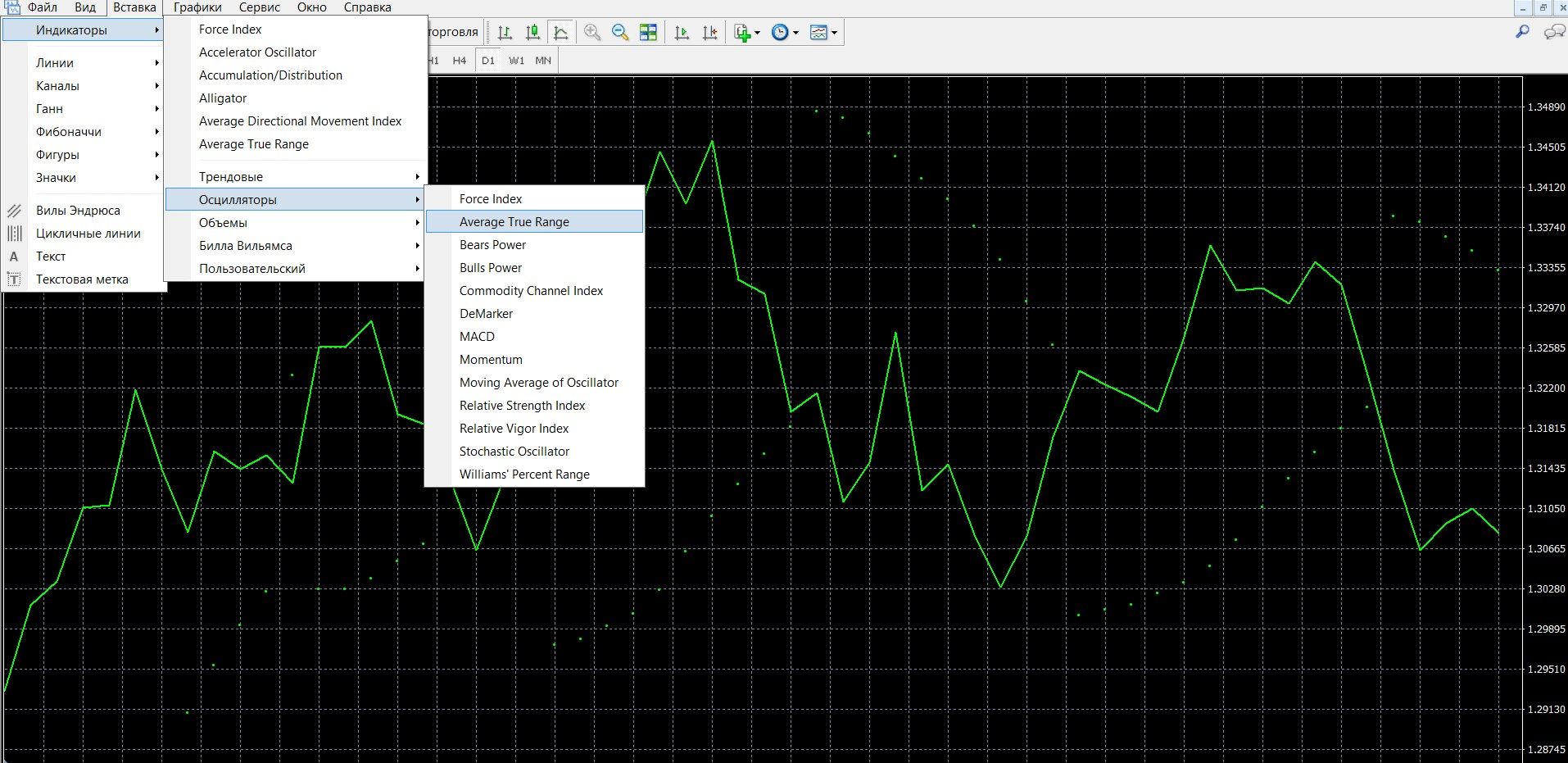

To add ATR to the price chart, do the following:

- Click the “Insert” tab in the top menu of the platform

- Select the tab “Indicators” – “Oscillators”

- In the drop-down menu that opens, select “Average True Range”. The indicator is added to the chart, you can work.

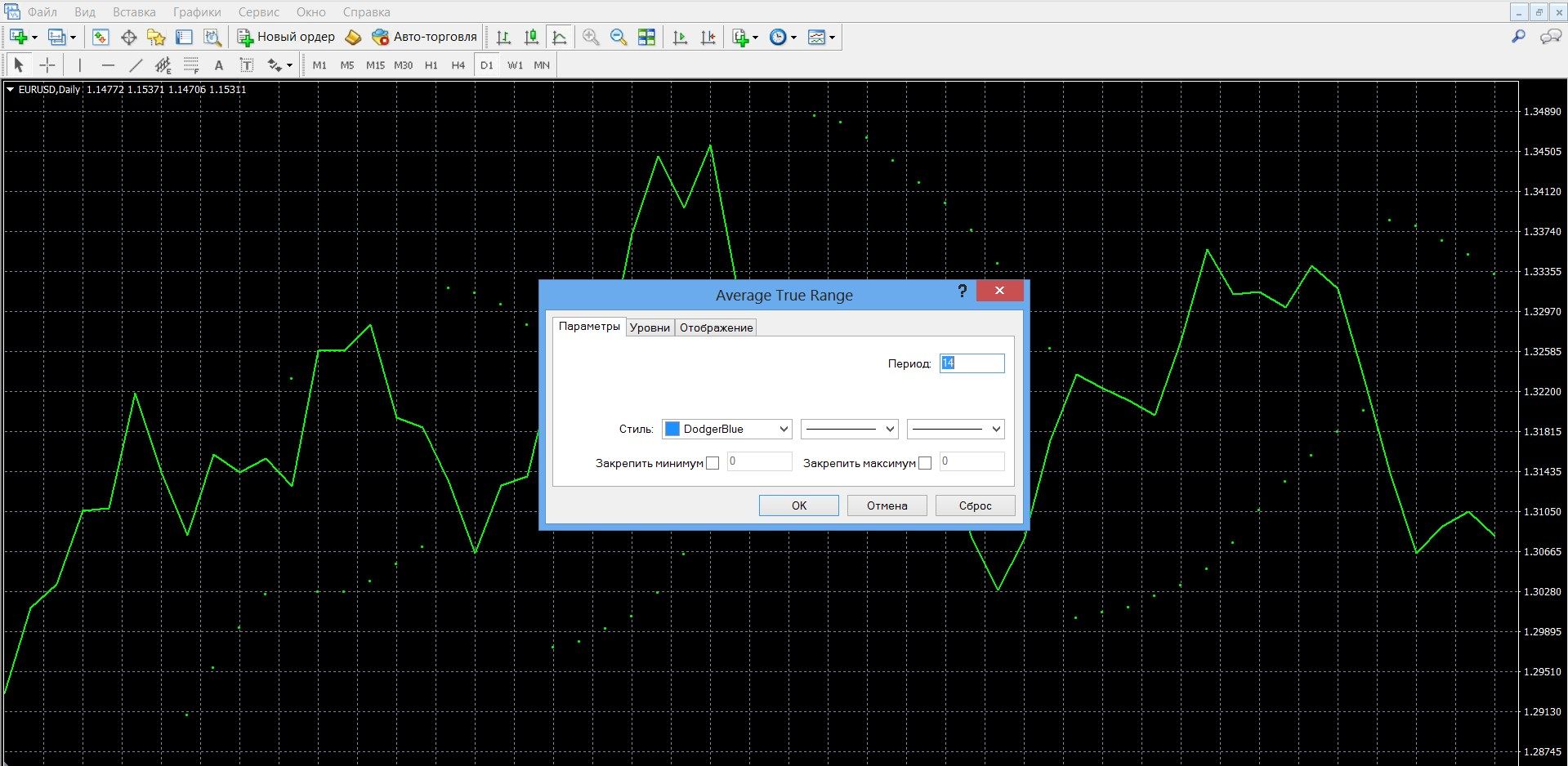

When you add an indicator, you will see a window of additional settings:

- Visual settings

- Period (the optimal value is 14; if you specify a value less than 14, the ATR will be more sensitive; if the value is greater than 14, the ATR will become less sensitive, and its signals will be smoothed).

Application of the indicator for binary options

Average True Range today is considered one of the most profitable technical trading tools, allowing you to get the most out of binary options trading. Its advantage and main application is to calculate the volatility of the market and display its volatility. At the same time, both a beginner of options and a professional can understand its signals: the higher the ATR readings, the higher the market volatility and vice versa, the lower its data, the lower the volatility.

It belongs to oscillators, but, unlike these classic instruments, it does not have overbought and oversold zones. It is worth remembering that the indicator does not calculate the direction of trends. Also, it is not customary to use ATR on long time intervals, because. Even with low volatility of the exchange over a long period of time, price changes can differ significantly, which makes its use unproductive.

It is recommended to work with it only on limited time intervals (for example, 15-minute, 4-hour, 1-day) subject to the condition that there are no global price changes on the exchange. The indicator is late with signals, so to filter a reliable signal, it is customary to duplicate it with additional tools, for example, MFI, CCI, ROC.

ATR is included in most of the Expert Advisors and profitable trading strategies, helping to avoid losses during trading. It not only determines volatility, but also allows you to competently manage risks and place stop orders: large stop losses are used at high ATR values, and small ones at low ones.

Rules for concluding transactions (screenshots)

Trading with an ATR trend strength signal

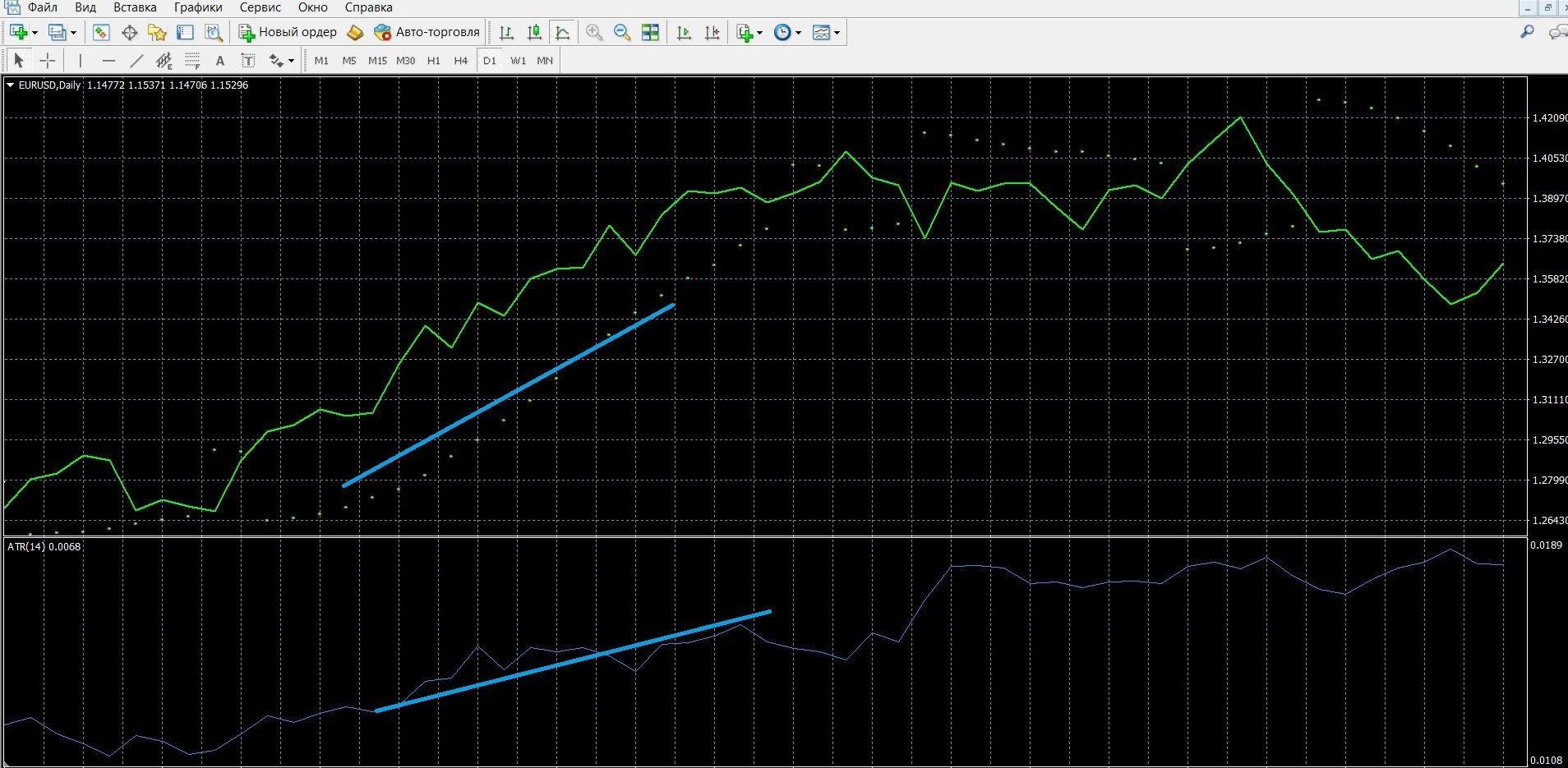

If the ATR line moves sharply in an upward direction (which is also confirmed by the additional Parabolic SAR indicator), this indicates an increase in market volatility, it is worth buying options in the direction of the trend, in this case, CALL options. In the image below, you can observe the upward trend on the MT4 chart:

You can place a CALL bet with the Olymp Trade broker by going to the olymptrade.com website and preparing an option, indicating:

- Type of option

- Expiration date

- Amount

- Prediction: up

- Next, click the “buy” button and wait for the results of the forecast:

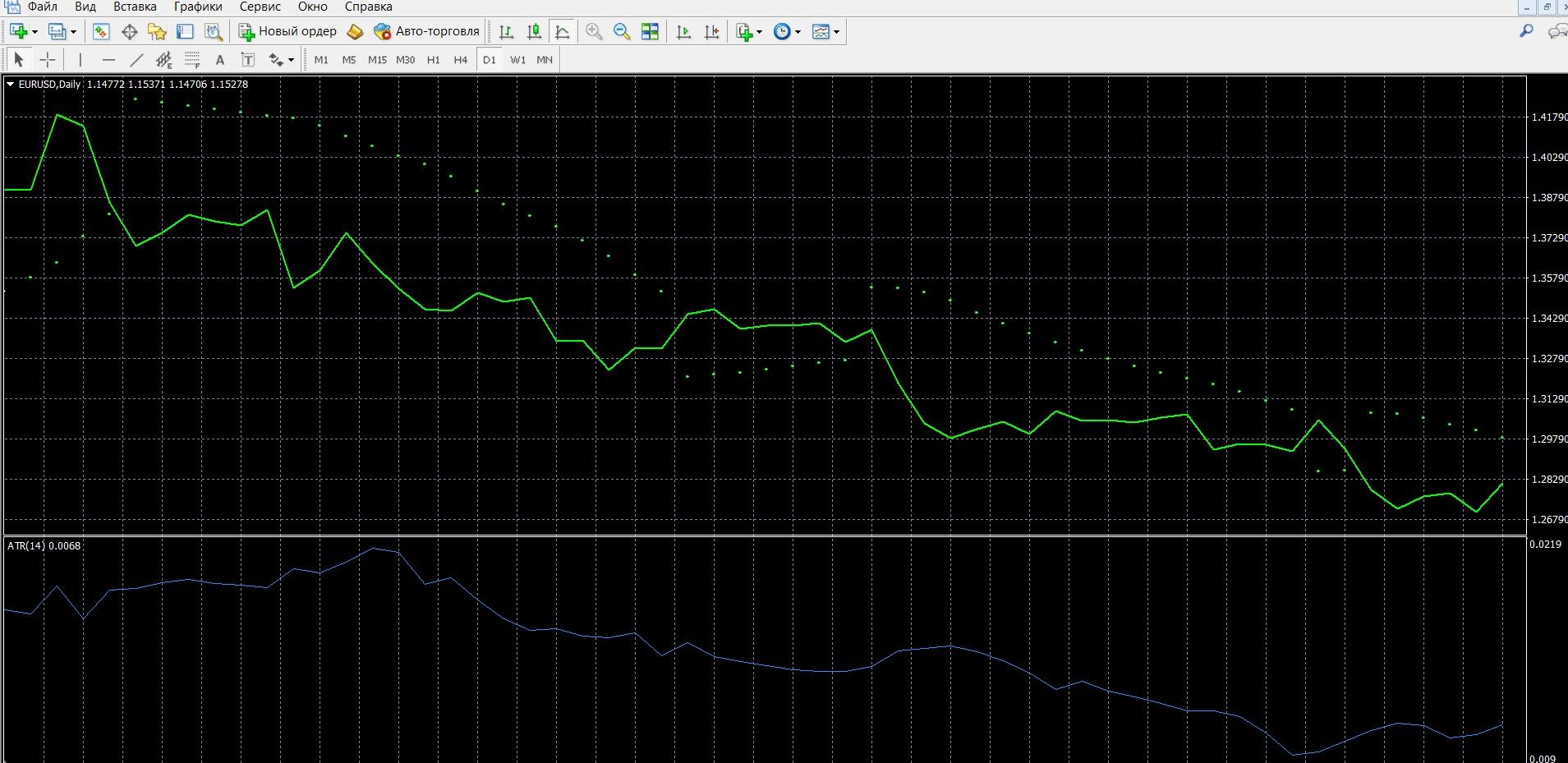

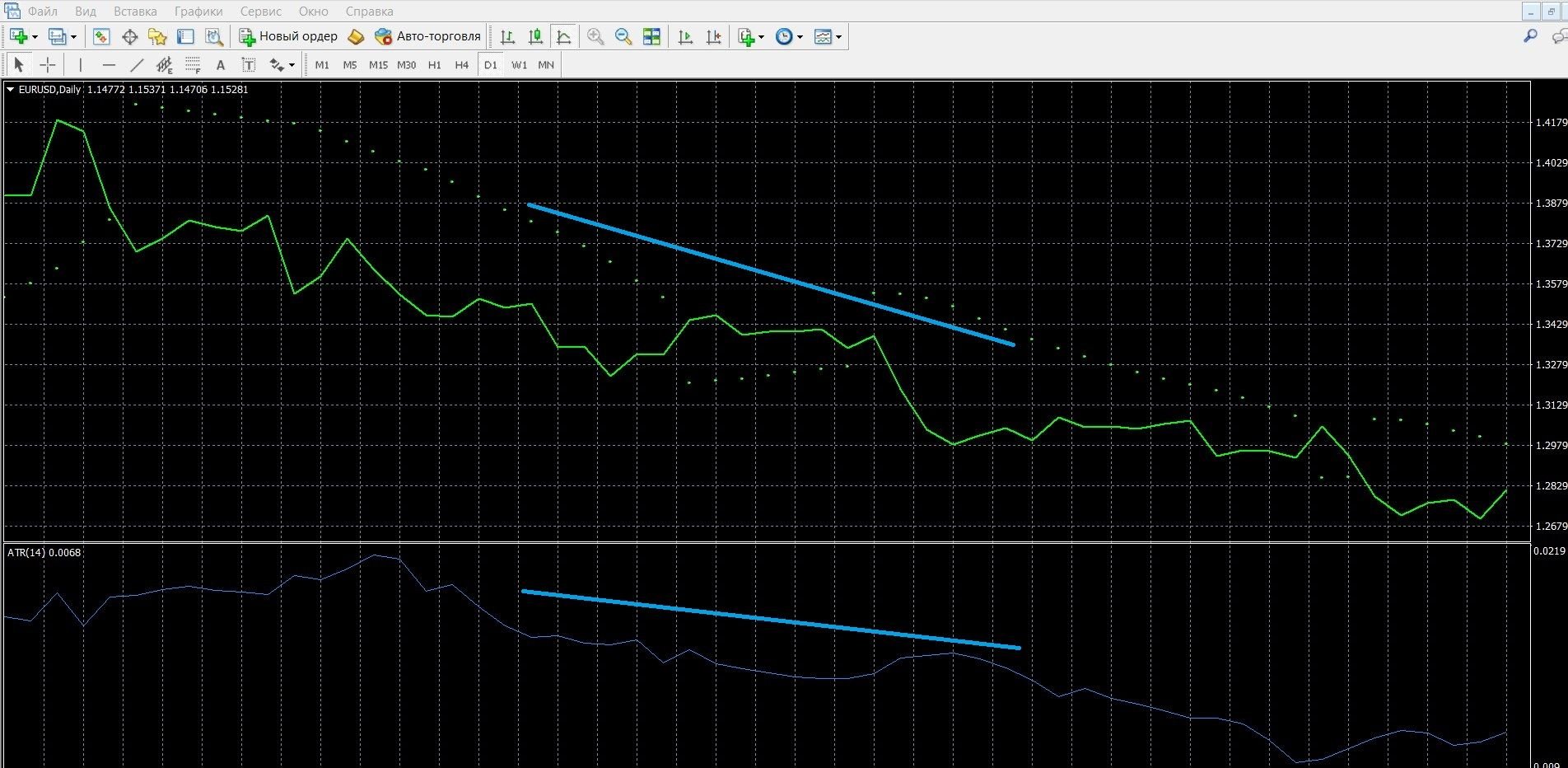

If the ATR line is gradually decreasing, this indicates that the trend has been exhausted and is weakening (which is also confirmed by the additional Parabolic SAR indicator), it is worth buying options in the direction of the trend, in this case, put options. In the image below, you can observe the downward trend on the MT4 chart:

You can place a PCI bet with the Olymp Trade broker by going to the olymptrade.com website and preparing an option, indicating:

- Type of option

- Expiration date

- Amount

- Prediction: down

- Next, click the “buy” button and wait for the results of the forecast:

Trading with an ATR reversal signal

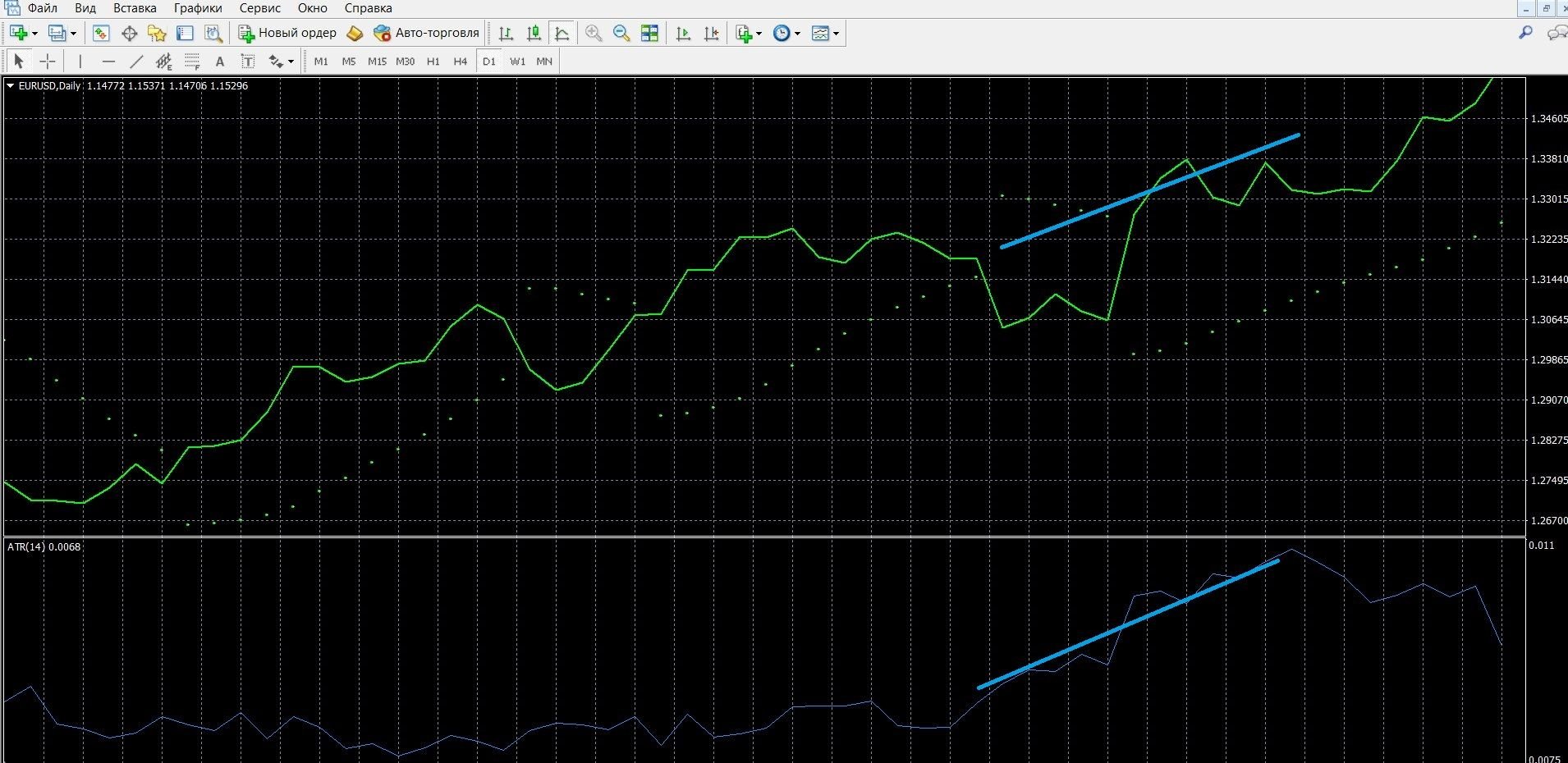

If the ATR is at the bottom for a long time, this indicates a possible consolidation of the market, after which a sharp reversal or continuation of the main movement is possible; Based on the data of trend indicators (in this case, Parabolic SAR is used), you can track a strong signal of a reversal and growth of an uptrend, it is worth buying CALL options.

The image below shows an uptrend (which arose after a long downtrend) in the MT4 terminal (you can place a CALL bet on the olymptrade.com website, the instructions are listed above):

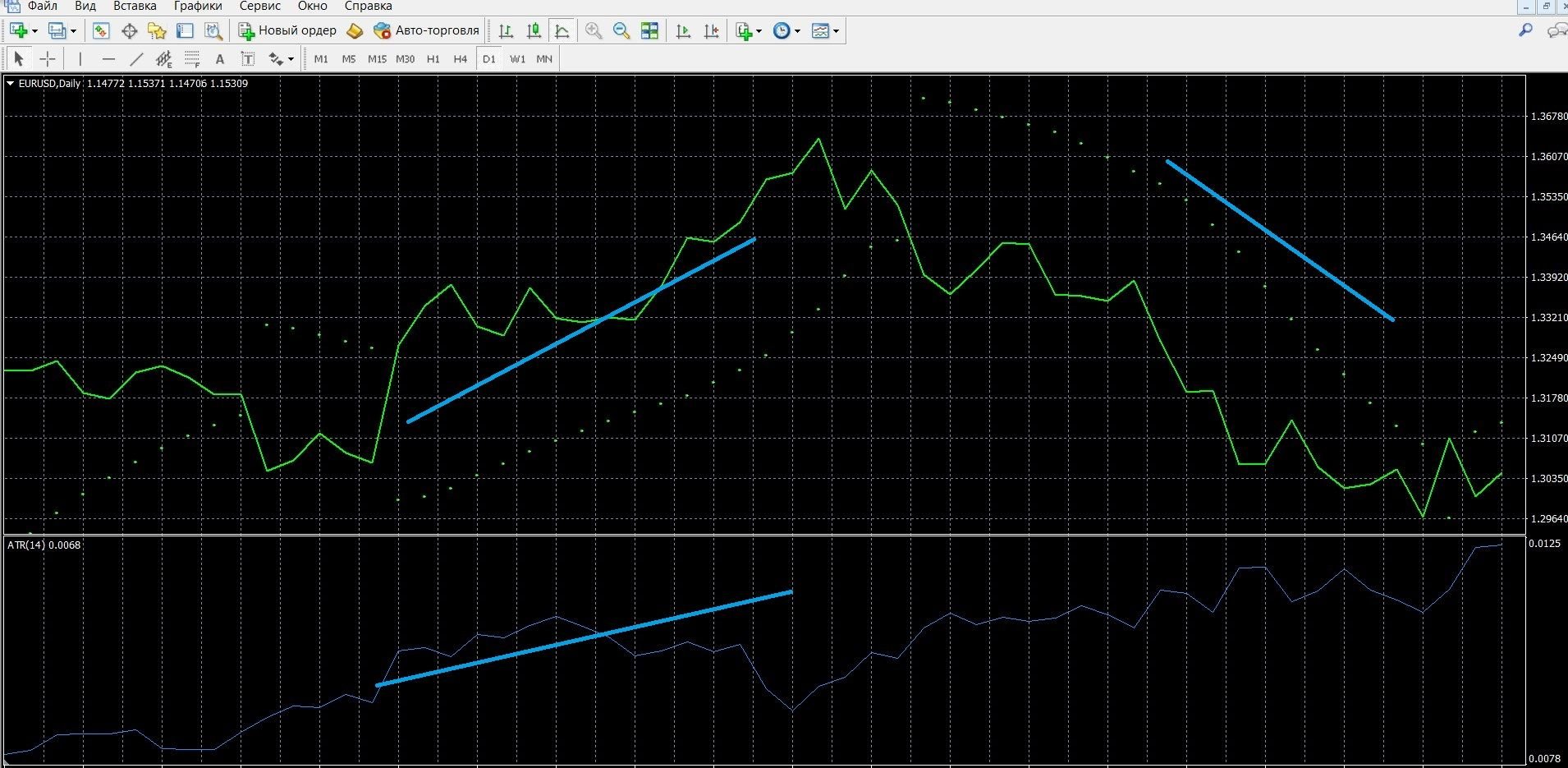

If the ATR is at the top for a long time, this indicates a possible consolidation of the market, after which a sharp reversal or continuation of the main movement is possible; Based on the data of trend indicators (in this case, Parabolic SAR is used), you can track a strong reversal signal and the appearance of a downtrend, it is worth buying put options.

The image below shows the downtrend (which arose after a long uptrend) in the MT4 terminal (you can place a PUT bet on the olymptrade.com website, the instructions are listed above):

Test ATR with Olymp Trade broker

Money management

Money management is deservedly considered one of the main tools of trading on the stock exchange, which is able to influence the success of trading and performance. This is a concept that both options beginners and professional exchange players should get acquainted with, for whom it is important to reach a stable profit.

Minimum capital: when working with binary options, we recommend using a minimum of capital when buying a specific asset; the value of the acquired asset should not exceed 5% of the size of your account; It is worth participating in the trading of inexpensive assets, the purchase of which will not be able to affect the size of the deposit in case of a losing transaction. By trading according to such rules, you will save all your capital for a long time.

Minimum deposit: working with binary options, we recommend taking part in such options that can easily support your deposit; when buying an asset, do not transfer the entire deposit to it; It is worth working with your account so that it lasts for a long time, which will give you the opportunity to earn even more. By trading according to such rules, you will not only preserve, but also increase your capital.

Minimum options: when working with binary options, we recommend participating in the purchase of a minimum of assets, for example, 2 or 3; This rule applies to newcomers to the exchange who do not have trading experience; By becoming more experienced, you can increase the number of transactions. By trading according to such rules, you will achieve the best results from trading.

Minimum of emotions: when working with binary options, we recommend that you train to build the right emotional attitude; It is worth remembering that success in trading is the clarity and balance of your decisions; Your emotions should not get the better of you, otherwise they will work against you. By trading according to these rules, you will become a successful trader.

Expiration

Expiration is the moment of the end of trading in a particular option, which occurs after all exchange participants have indicated their forecasts in the system and can finally find out about their result. Expiration should be considered one of the important concepts, without the thoughtful use of which it is unlikely to get the most out of trading.

Types of options:

- Ultra-short options – 30 seconds – 5 minutes.

- Short-term options – 10 minutes – several hours.

- Medium-term options – a day – a few weeks.

- Long-term options – a month – six months.

Is it allowed to extend the expiration?

Allowed, but not on all broker platforms. Such a convenient function gives the trader the opportunity during trading, with the specified wrong decision, to extend the expiration and reduce his losses.

Expiration rules:

- If you are still an inexperienced options exchange player, choose long-term trades for trading, the most stable, characterized by a minimum of risks.

- If you are a professional options exchange, choose to trade an expiration that will become more comfortable for you and give you a good profit.

- If instant earnings are important to you from the options exchange, work with short-term transactions that can bring capital in 30 seconds.

- If a stable income is important to you from the options exchange, work with long-term transactions that are the most reliable and can bring you decent money.

Expiration in strategies with ATR

Easpiration at ATR trend strength signal

Short-term trading: allowed; Despite the riskiness of turbo options, ATR, together with any of the trend indicators, will go well together, giving high-quality signals of the strength of market trends.

Medium-term expiration: recommended; ATR, well combined with any trend indicator, will give high-quality signals to enter a position; This expiration will allow the trend to develop quite well, and you will have time to take advantage of this and get a good profit.

Long-term expiration: not recommended; The disadvantage of such a long expiration for ATR is that it is quite difficult to predict the state of the market after a long period of time.

Expiration at ATR reversal signal

Short-term trading: allowed; Despite the riskiness of express options, the ATR, together with the trend indicator, will go well together, giving high-quality signals of market reversals.

Medium-term expiration: recommended; ATR, well combined with any trend indicator, will give high-quality signals to enter a position; This expiration will allow the trend to develop quite well, and you will have time, taking advantage of this, to get a good income.

Long-term expiration: not recommended; A significant disadvantage of such a long expiration for ATR is that it is quite difficult to predict the state of the market after a long period of time.

Expiration in the “ATR+Parabolic SAR” strategy

A simple profitable strategy. The tools used, ATR and Parabolic SAR, are perfectly combined, allowing you to get a high-quality market entry signal. So, if the ATR is growing, and the price is above the Parabolic SAR points, it is worth buying CALL options, and vice versa.

Short-term trading: allowed; despite the riskiness of express options, ATR, perfectly combined with Parabolic SAR, gives strong signals to enter a trade.

Medium-term expiration: recommended; ATR, perfectly combined with Parabolic SAR, gives quite strong signals to enter a trade; This expiration will allow trends to develop well, and you will receive a good income.

Long-term expiration: not recommended; A significant disadvantage of such a long expiration for ATR is that it is quite difficult to predict the state of the market after a long period of time.

Trying your hand at options, learn the concept of expiration, which can make your trading much more productive. We recommend testing expiration in the terminal of the popular broker Olympus Trade, which offers expiration from 1 minute to 1 hour. By going to olymptrade.com’s official website right now, you can get started right away on a free demo account.

Trade for free with Olymp Trade

Downloads

ATR for the MetaTrader 4 platform

Tagged with: Binary Options Academy • Binary Options Indicator • proximate analysis