Donchian Channel indicator

Description

Binary options trading opportunities are attracting more and more active Internet users who are looking for ways to actually make money. Trading, offering turbo trading, is almost the only option for quick income in just 30 seconds. Options are affordable, safe and reliable, so now there are more and more people who want to get real money from trading.

All beginners, having earned the first money, begin to think about how to get a stable income. To succeed, you need to try profitable strategies, indicators, and study the market in more detail. On our portal you can find reviews of oscillators, broker ratings and a lot of other useful material. Immerse yourself in trading and make your wildest dreams come true. Today we will tell you about the Donchian Channel indicator.

The Donchian Channel indicator is one of the most popular binary options trading tools, the author of which is the legendary trader Richard Donchian, the creator of the sensational Turtles system. In the 1970s, he developed a sliding channel, which was then named after him.

This indicator is one of the first created for market analysis, which is why it is so popular and widely used by different markets. The Donchian channel is a successful channel strategy, simple and easy to use, and offers a lot of opportunities to the trader. Initially, it was conceived for breakout trading, accurately shows breakout signals and guarantees a fairly good profit.

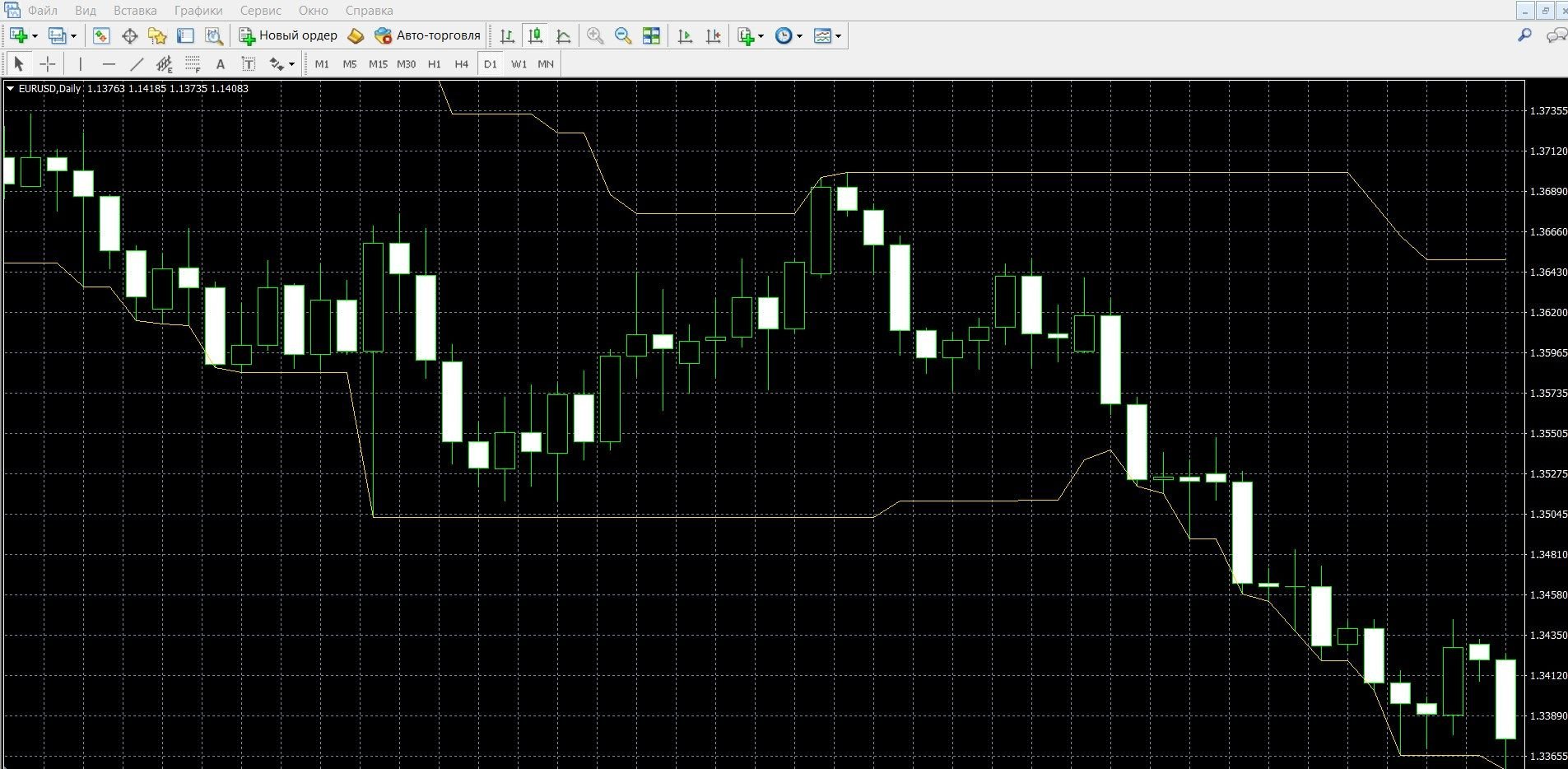

You can see how the Donchian Channel is visually displayed on the MetaTrader 4 (MT4) platform in the image below. You can also download the MetaTrader 4 platform and get acquainted with it in more detail.

What is the working principle of the Donchian Channel indicator?

Donchian Channel is another channel indicator with a number of advantages. As you know, the market is largely driven by the emotions of people who are cyclical. Donchian channels study behavior using the same type of data on the behavior of market participants.

On the price chart, it forms a corridor with upper and lower boundaries, within which market fluctuations occur:

- The upper limit shows price highs for a specific period,

- The lower limit shows price lows for a specific period.

This is a reliable volatility indicator, based on the calculations of the smallest and largest prices. This structure of the Donchian Channel resembles the Bollinger Bands in many ways. The difference between Donchian is that he uses simple calculations of the last minimums and maximums to work. So, to create a channel on the chart, you just need to find the lowest minimum and the highest maximum prices of a particular period.

Donchian Channel indicator signals:

Breakout signals:

Such signals are called trend signals.

- When the price closes above the channel, this is an uptrend signal, which will then change to the opposite, downward one, you should buy put options,

- When the price closes below the channel, this indicates an approaching uptrend, you should buy call options.

Shadow breakout signals:

Often there are situations when the price line breaks through the lower or upper border of the Channel, but the candlesticks close inside the channel. Often these candles show extremes.

- If such a situation is formed when the lower limit is broken, it is worth buying CALL options,

- If the signal is formed when the upper limit is broken, it is worth buying put options.

Rebound signals:

As a rebound, there is a situation when the price line moves inside the channel, and, after touching any of the borders of the Channel, it will in any case be pulled to the middle band, which can be used to make transactions:

- If the price line touches the lower border of the Channel, it is worth buying CALL options,

- If the price line touches the upper boundary of the Channel, it is worth buying PUT options.

Channel width signals:

Before a new dynamic, prices often shrink into a narrow channel, which is a signal of an upcoming trend. So, by the width of the Channel, you can also make a decision about the dynamics of the market:

- If the channel is narrow, it means that the market is calm.

- If the price rises or falls, the indicator changes its width and, depending on the position (ascending or descending) in which the width of the Channel changes, you can make trades:

- If the width of the indicator changes in an ascending position, a signal to buy a CALL option,

- If the change in the width of the indicator occurs in a downward position, it means that soon the market is waiting for a change in the trend, a signal to buy a put option.

Do I need to install the indicator in your platform?

The Donchian channel is a non-standard options instrument, it is not included in the set of the MetaTrader 4 terminal indicator. You can download it for free here. You can read how easy and simple it is to install a file in the MetaTrader 4 platform here.

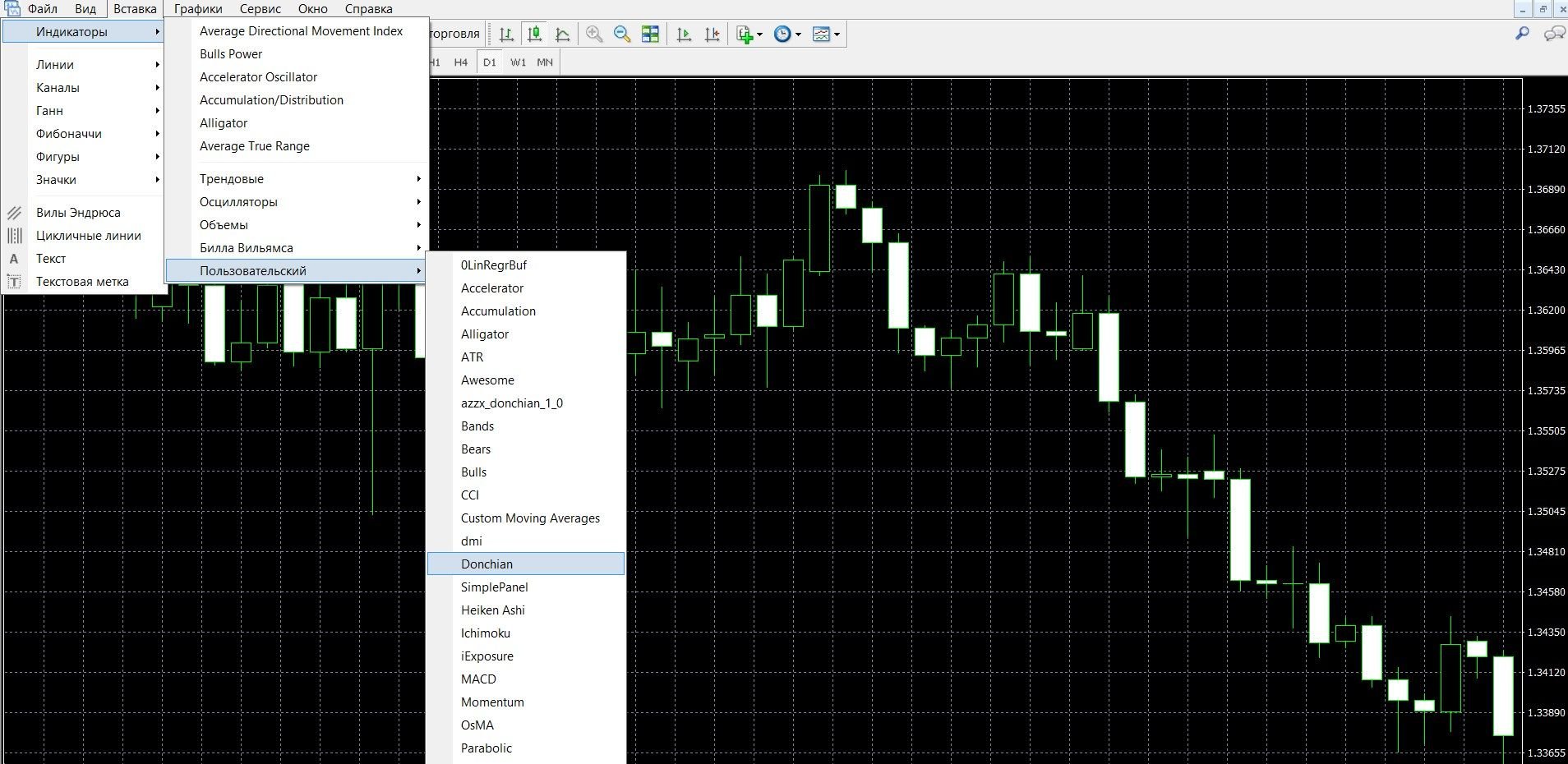

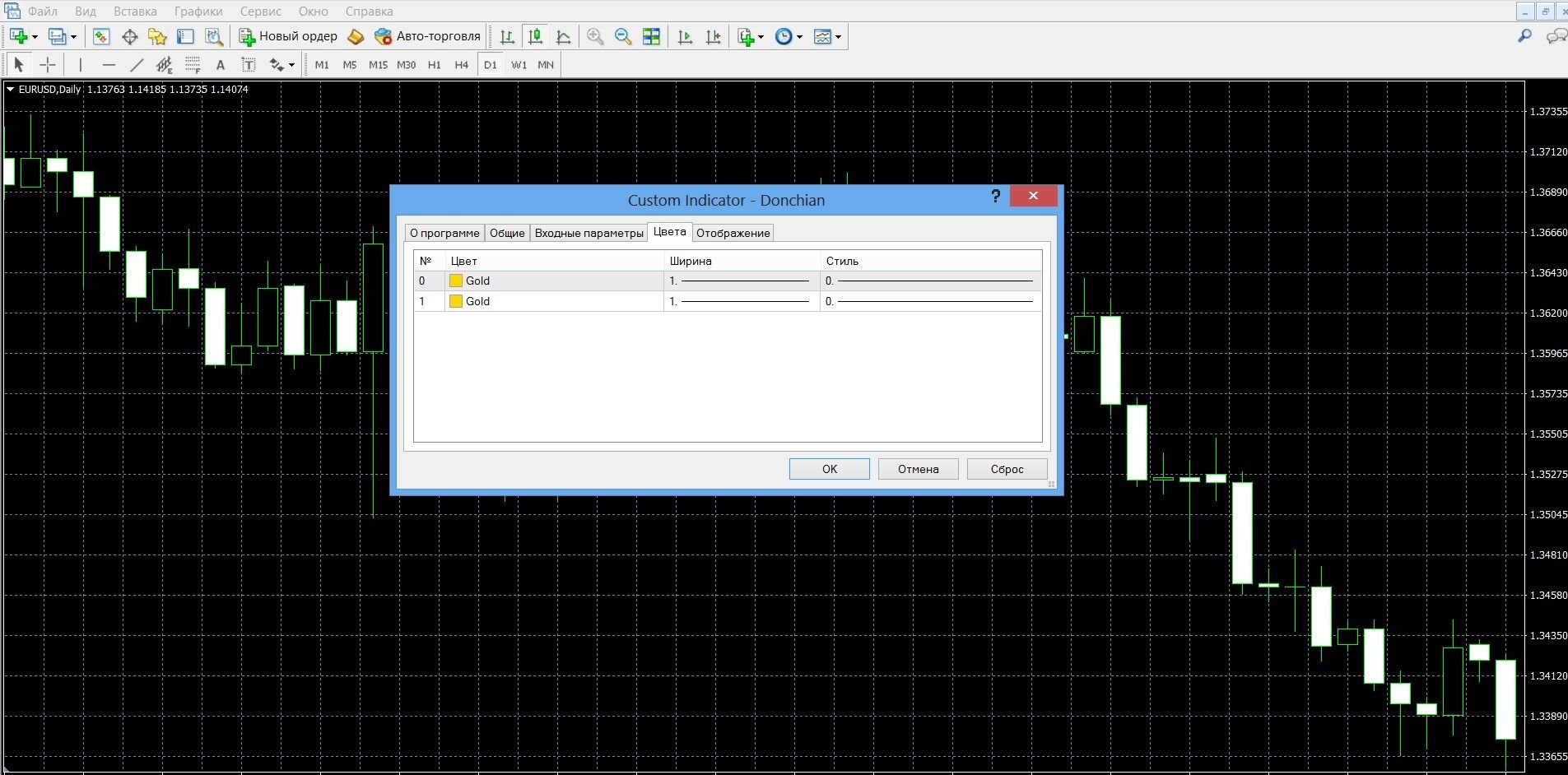

After installation, add the indicator to the price chart, for this:

- Click the “Insert” tab in the top menu of the platform

- Select the tab “Custom” – “Donchian”.

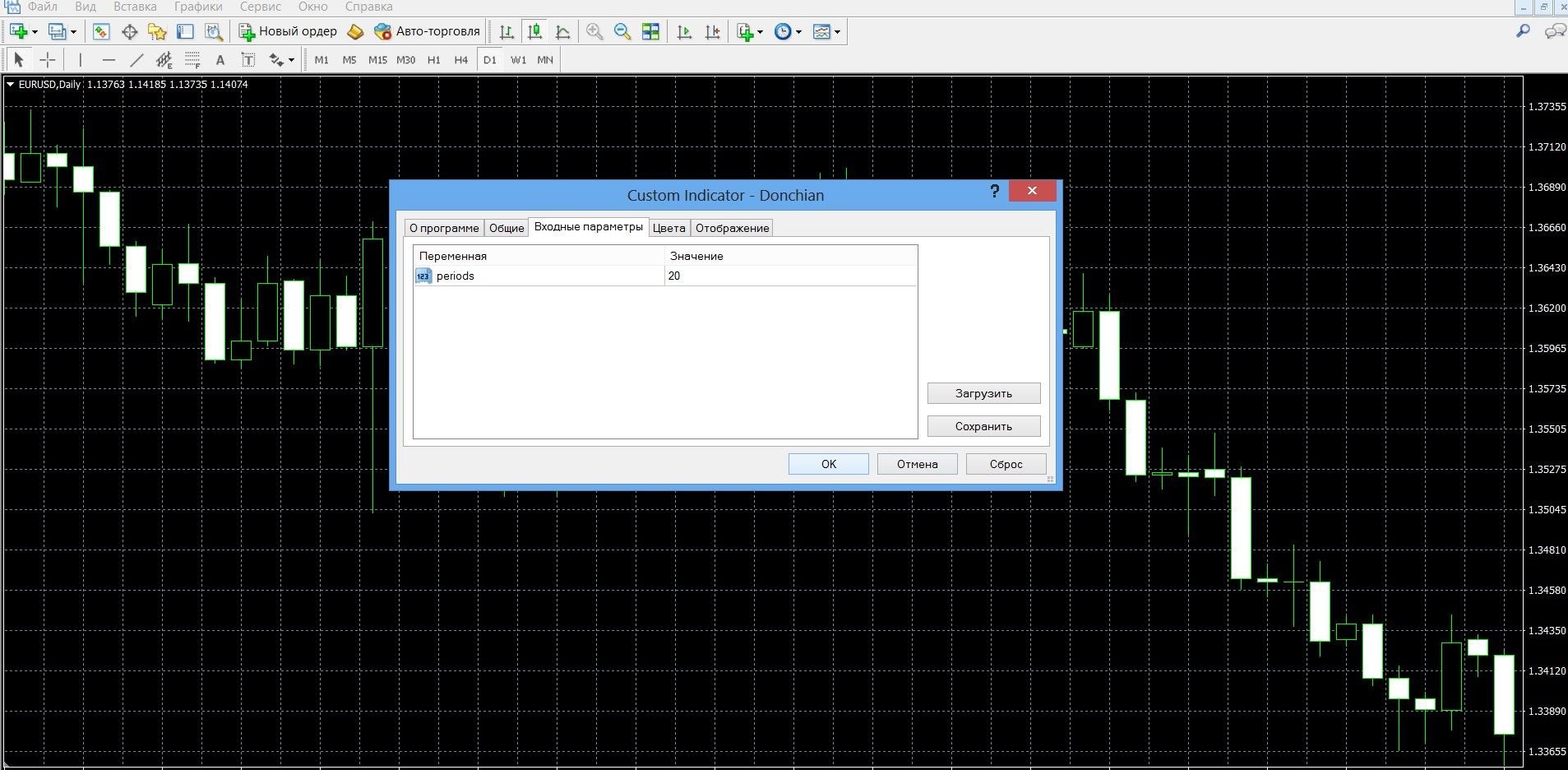

The main parameter of the instrument is the period. As a standard, it is recommended to use a period equal to 20 – this is the average number of working days per month (the tool will analyze data equal to the last 20 bars, and based on this data, calculate the minimum and maximum values).

Application of the indicator for binary options

The Donchian channel is a simple and profitable strategy, it is widely used in trading, allowing you to reach a good profitability. First of all, the indicator is used to search for high-quality trend breakouts that lead to the purchase of CALL and PUT options. Despite the fact that there are always a lot of false breakouts when trading on a breakout, if a trader has calculated a good trend, these trades will cover all unsuccessful attempts. In this case, it is recommended to combine it with ADX, which determines the strength of the trend, or with ATR, which takes into account price volatility.

The tool is also used to study market volatility:

- when the price dynamics are small and calm, the channel is narrow,

- When there are intense movements and a change in the state of the market, the channel is wide.

The width of the Donchian channel in this case acts as an independent volatility tool, reminiscent of the Envelopes , ATR or Standard Deviation instruments. Before the new dynamics, prices are compressed into a narrow channel, which is a reliable signal of an upcoming strong trend.

Working with the tool, the trader does not subjectively interpret the situation, but works with numbers, he does not analyze the data, but simply monitors the behavior of the market, which gives the following advantages:

- it is applicable for any market,

- accurate data protects against doubts and errors in case of incorrect interpretation of the situation,

- There are always unambiguous guidelines for possible risks.

The tool works great for intraday trading, as well as for long-term trading in the commodity and stock markets.

Rules for concluding transactions (screenshots)

Trading with a breakout signal

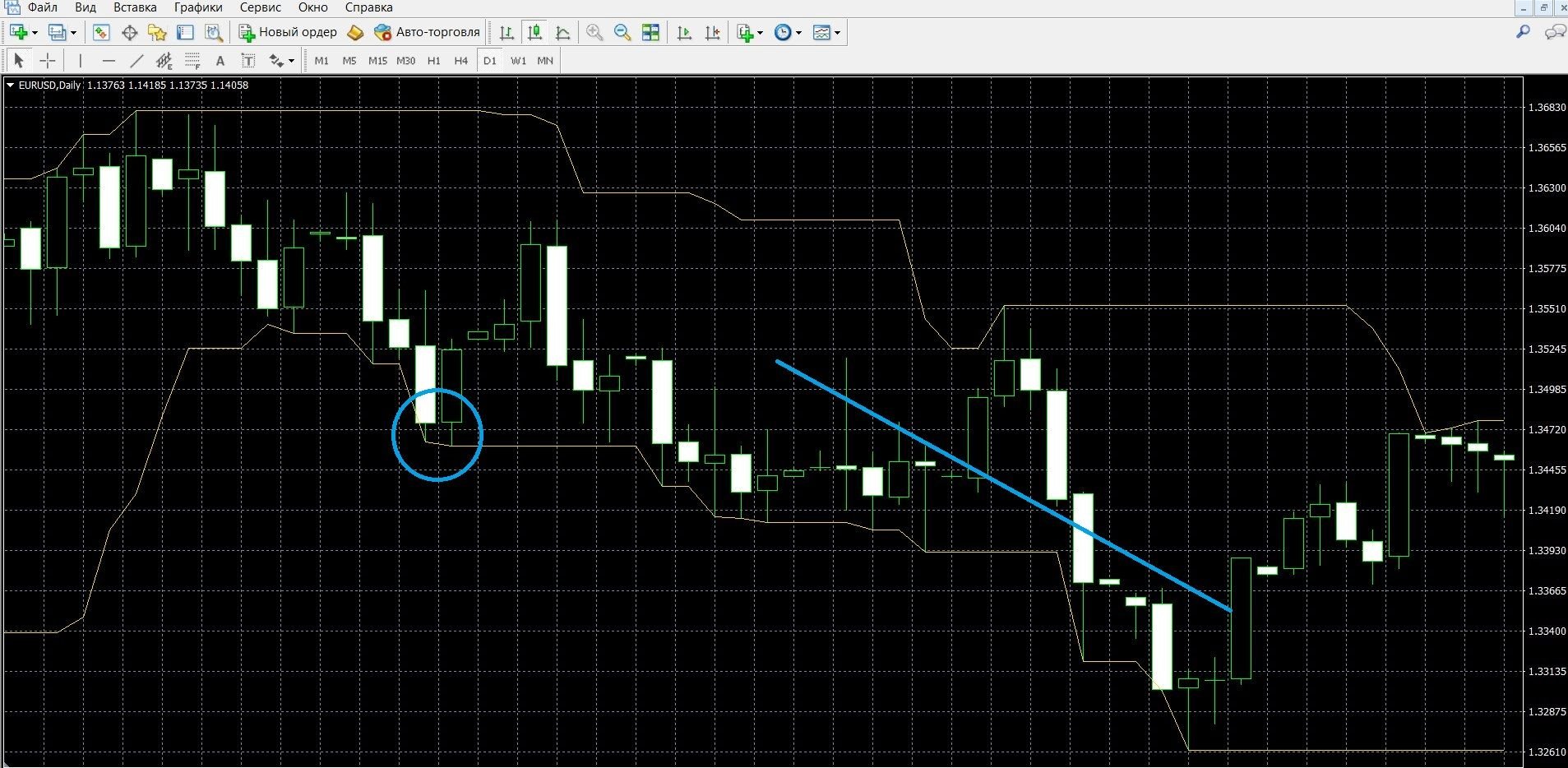

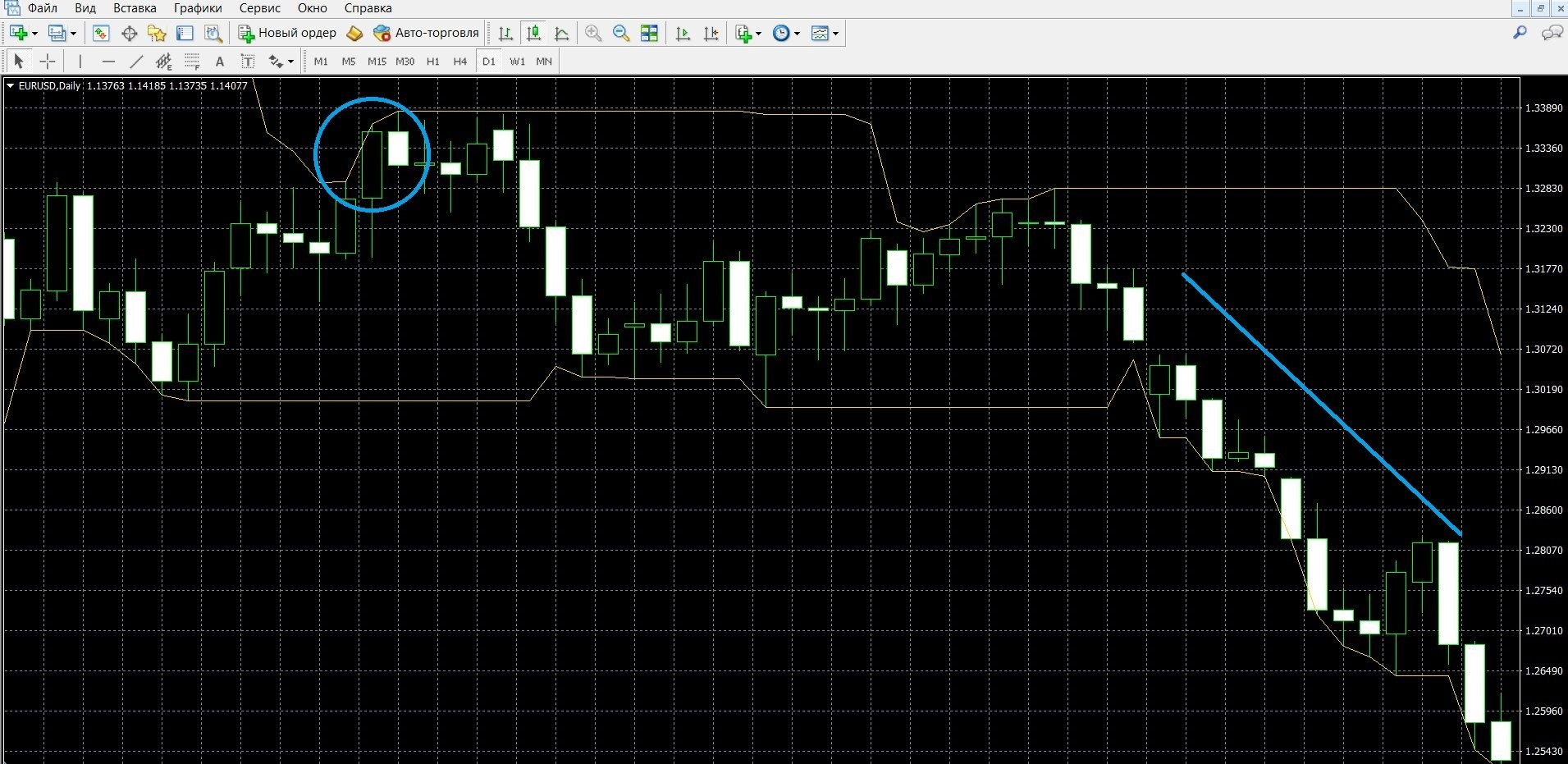

When the price closes above the Donchian Channel, this is an uptrend signal, which will then change to the opposite, downtrend, you should buy put options. The image below shows the downtrend in the MetaTrader 4 terminal:

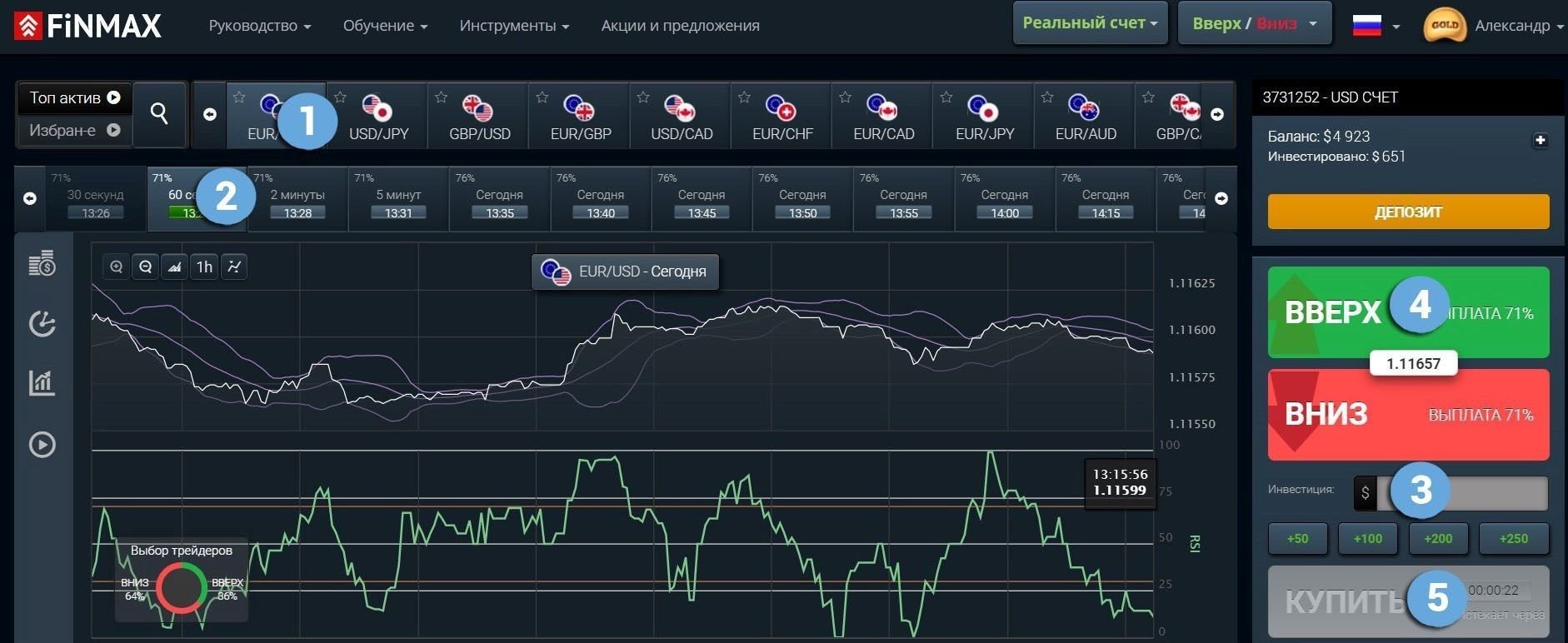

Take advantage of the trend and make a profitable PCI bet with the Finmax broker by going to the finmaxbo.com website and preparing an option, indicating:

- Type of option

- Expiration date

- Amount

- Prediction: down

- Next, it remains to click on the “buy” button and wait for the results:

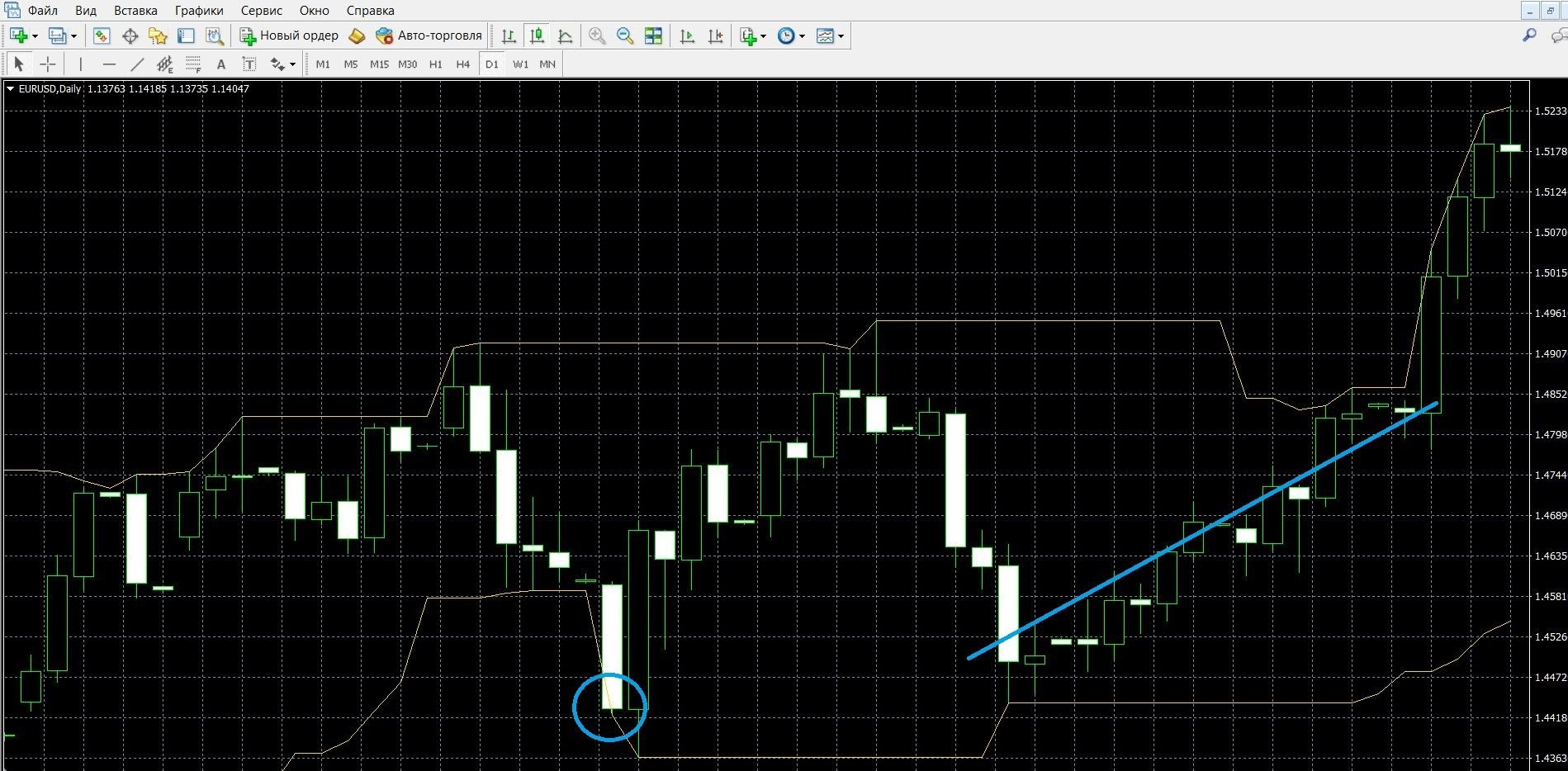

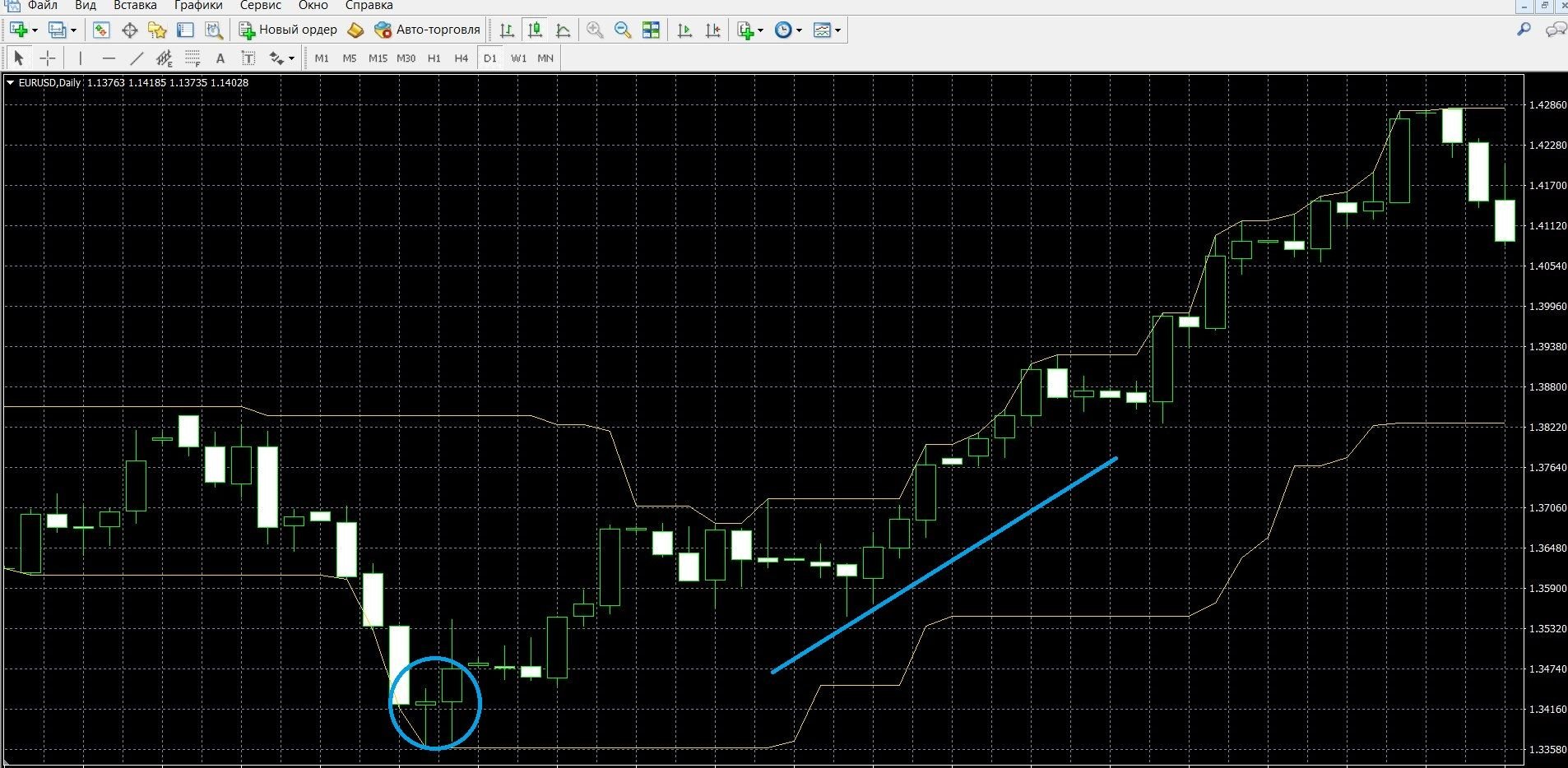

When the price closes below the channel, this indicates an approaching uptrend, you should buy call options. The image below shows the uptrend in the MetaTrader 4 terminal:

Take advantage of the trend and make a profitable CALL bet with the Finmax broker by going to the finmaxbo.com website and preparing an option, indicating:

- Type of option

- Expiration date

- Amount

- Prediction: up

- Next, it remains to click on the “buy” button and wait for the results:

Trading with a “shadow” breakout signal

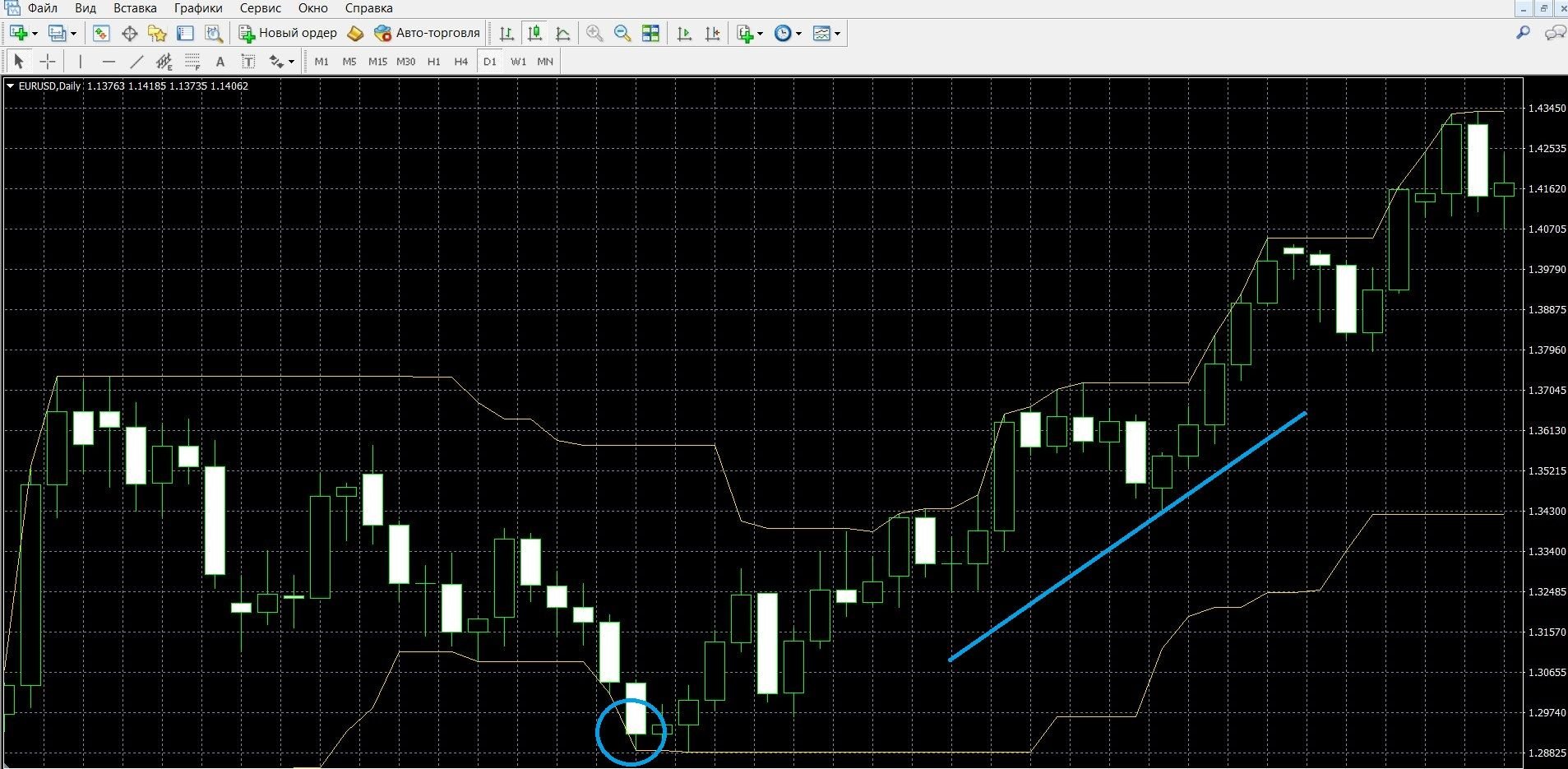

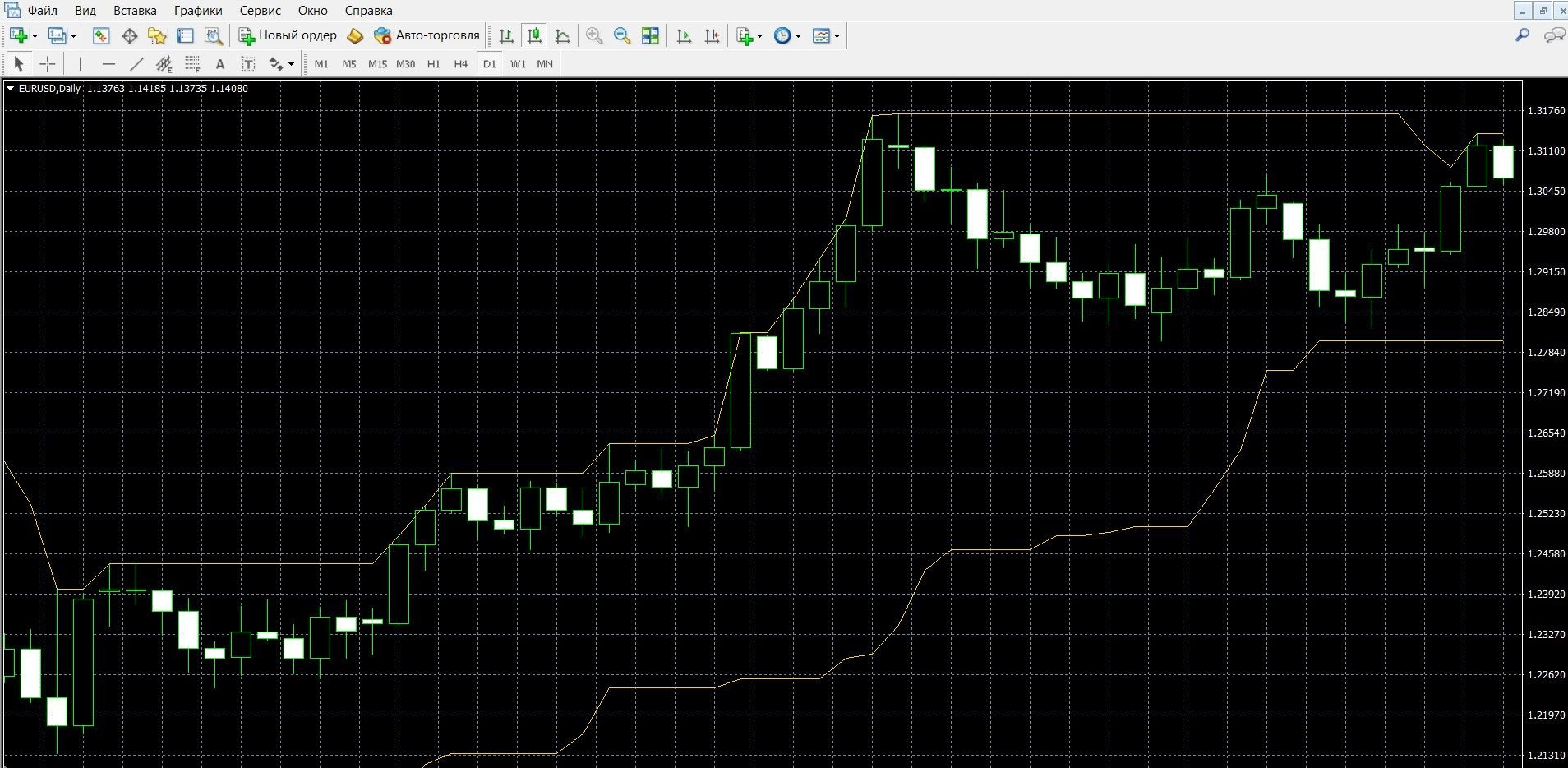

If such a signal is formed when the lower border is broken, it is worth buying CALL options. The image below shows the uptrend in the MetaTrader 4 terminal (taking advantage of the trend, place a CALL bet on the finmaxbo.com website, the instructions are presented above):

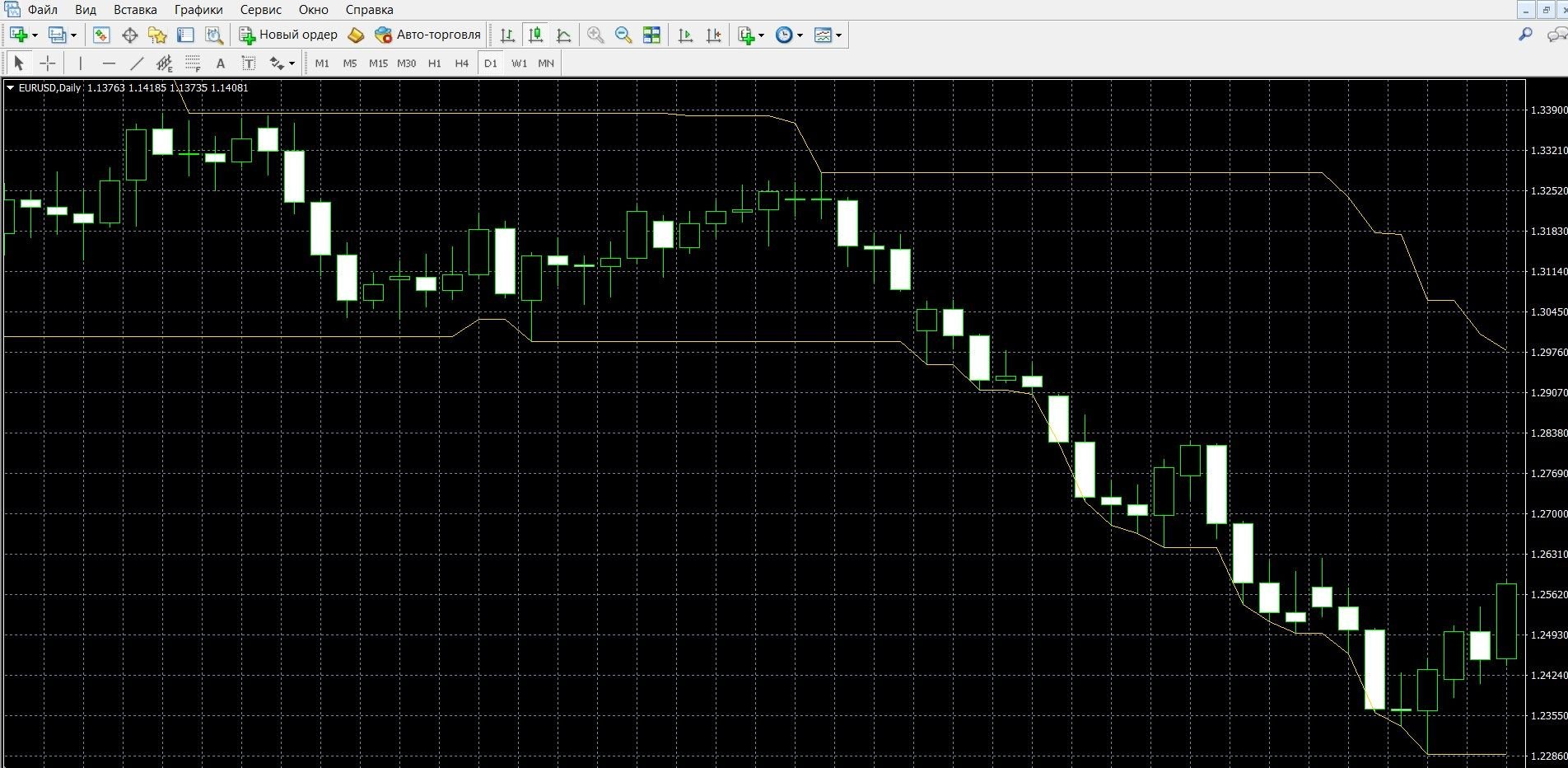

If the signal is formed when the upper limit is broken, it is worth buying put options. The image below shows the downtrend in the MetaTrader 4 terminal (taking advantage of the trend, place a PUT bet on the finmaxbo.com website, the instructions are presented above):

Trading with a rebound signal

If the price line touches the lower border of the Channel, it is worth buying CALL options. The image below shows the uptrend in the MetaTrader 4 terminal (taking advantage of the trend, place a CALL bet on the finmaxbo.com website, the instructions are presented above):

If the price line touches the upper boundary of the Channel, it is worth buying PUT options. The image below shows the downtrend in the MetaTrader 4 terminal (taking advantage of the trend, place a PUT bet on the finmaxbo.com website, the instructions are presented above):

Trading with channel width change signals

If the width of the indicator changes in an ascending position, a buy signal is a call option. The image below shows the uptrend in the MetaTrader 4 terminal (taking advantage of the trend, place a CALL bet on the finmaxbo.com website, the instructions are presented above):

If the change in the width of the indicator occurs in a downward position, it means that soon the market is waiting for a change in the trend, a signal to buy a put option. The image below shows the downtrend in the MetaTrader 4 terminal (taking advantage of the trend, place a PUT bet on the finmaxbo.com website, the instructions are presented above):

Money management

This is one of the basic concepts that affect the effectiveness of binary options trading. Money management is the first thing you should come to if you would like to make a stable income by trading in the market. The ability to put into practice the basics of money management distinguishes trading participants, no matter if you are a professional player or just starting to get acquainted with options.

Minimum money: spend a minimum of possible funds to buy an option, your expenses for one transaction should not exceed more than 5% of the deposit; Trade options that are less than the value of the deposit account. Take advantage of these rules in trading, and you will save your funds.

Minimum deposit: spend a minimum of deposit funds; do not bet all your capital on the purchase of one option; you should always remember that you will still need capital for work; After replenishing the deposit, try to think over the principle of working with it, allocating for yourself a free limit that is allowed to be used in trading. Use these rules in trading, and you will save your deposit funds.

Minimum assets: start trading with a minimum number of options, preferably with 2-3 assets, especially if you are still a beginner; Having gained some experience, you can safely expand your investment portfolio. Use these rules in trading, and you will work more productively.

Minimum emotions: when starting work in the market, always change your mood to a serious one; In addition to trading experience, your emotions and mood are the factors that give your work the desired performance; Remember that emotions interfere with working focusedly, making the right predictions. Use these rules in trading, and you will achieve success in trading.

Expiration

It is also considered a basic concept in options. Like the basics of money management, this is another extremely important factor that directly affects the success of work. Expiration is the moment when the auction ends, and all participants in a particular transaction understand the results of the forecasts. The correct attitude to the concept of expiration is, one might say, a whole productive strategy. For those traders who plan to receive stable earnings from options, expiration will help bring you closer to the goal.

Types of options:

- Ultra-short options – 30 seconds – 5 minutes.

- Short-term options – 10 minutes – several hours.

- Medium-term options – a day – a few weeks.

- Long-term options – a month – six months.

Is it allowed to extend the expiration?

It is allowed not in all trading terminals. If during trading you realize that you have indicated an incorrect forecast, you can simply extend the expiration, thereby reducing your possible losses.

Expiration rules:

- Traders who are new to options are better off working with long-term trading that ensures stable results and minimal risks.

- For traders who are professionals, it is better, when choosing an expiration, to be based on trading that is more comfortable for themselves. When choosing a broker’s site, specify whether it is possible to increase expiration during trading, which minimizes possible losses.

- For traders who came to the market to receive instant earnings, it is better to work with short-term (a minute – a few hours) transactions that will generate income in 30 seconds.

- For traders who came to the market for stable earnings, it is better to choose long-term transactions that are characterized by calm trading with the greatest predictability.

Expiration in strategies with the Donchian Channel

Expiration at breakdown signal

Short-term trading: allowed; Minimize the risks of turbo trading by using several indicators at once.

Medium-term expiration: allowed; It is characterized by minimal risks, greater stability and the opportunity to earn decent capital.

Long-term expiration: allowed; In such trading, you can, to make a decision about the forecast, apply all your knowledge of fundamental and technical analysis, use indicators and profitable strategies and earn decent capital.

Expiration at the signal of the “shadow” breakout

Short-term trading: allowed; It is distinguished by great risks, which can be minimized using several indicators at once.

Medium-term expiration: allowed; It is distinguished by minimal risks, greater stability and the opportunity to earn decent capital.

Long-term expiration: allowed; In such trading, you can, to make a decision about the forecast, apply all your knowledge of fundamental and technical analysis, use indicators and profitable strategies and earn decent capital.

Expiration at the end signal

Short-term trading: allowed; It is able to bring increased income, it is distinguished by great risks, which can be minimized using several indicators at once.

Medium-term expiration: allowed; It will bring good earnings, it is distinguished by minimal risks and stability.

Long-term expiration: allowed; In such trading, you can, to make a decision about the forecast, apply all your knowledge of fundamental and technical analysis, use indicators and profitable strategies and earn decent capital.

Expiration with channel width change signals

Short-term trading: allowed; During the session, it will bring increased profitability, it is distinguished by great risks, which can be minimized using several indicators at once.

Medium-term expiration: allowed; It will bring good earnings, has minimal risks and stability, unlike express options.

Long-term expiration: allowed; In such trading, you can, to make a decision about the forecast, apply all your knowledge of fundamental and technical analysis, use indicators and profitable strategies and earn decent capital.

Expiration in the “Donchian Channel + RSI” strategy

Short-term trading: allowed in such a profitable trading system, you will take advantage of more than one high-quality signal and will be able to get decent capital.

Medium-term expiration: allowed; Such a profitable strategy, with calmer trading, using two high-quality tools, will bring a good income.

Long-term expiration: also allowed; Such a profitable strategy, in addition to the ability to work with reliable instrument signals, will allow you to apply all your knowledge in the field of fundamental and technical analysis and earn decent capital.

Actively studying the possibilities of trading, we recommend paying special attention to the concept of expiration, which will allow you to achieve better trading results. To do this, get acquainted with the convenient platform of the Finmax broker, which offers ample opportunities for choosing expiration dates (from 30 seconds to six months), etc. Right now, start building your profitable work in options and go to the finmaxbo.com broker’s website.

Downloads

MetaTrader 4 (MT4) platform – download.

Donchian Channel indicator for the MT4 platform – download.

Tagged with: Binary Options Indicator