Binary options trading today is one of the most popular areas of online earnings. Trading is quickly spreading and developing on the network, offering more and more opportunities to get money. Thanks to turbo options, from the comfort of your home in 30 seconds, you will receive the first real income, which you can increase by trading sessions. And yet, success in this direction also depends on the knowledge that market participants have. It is important not to rest on our laurels, to study new indicators and trading strategies. Especially for the readers of our portal, we offer detailed reviews of indicators, an up-to-date rating of brokers, news and much more. Try your hand at trading, increase your skill level and reach new heights. Today we will tell you about the Envelopes indicator.

Envelopes (Envelopes) is a technical indicator of binary options, widely used in trading, which is formed by two moving averages (the first shifts up, the second down), as a result of which the so-called envelope appears on the chart. For the forex market, there is also a similar indicator: https://eto-razvod.ru/forex-indicators/envelopes/.

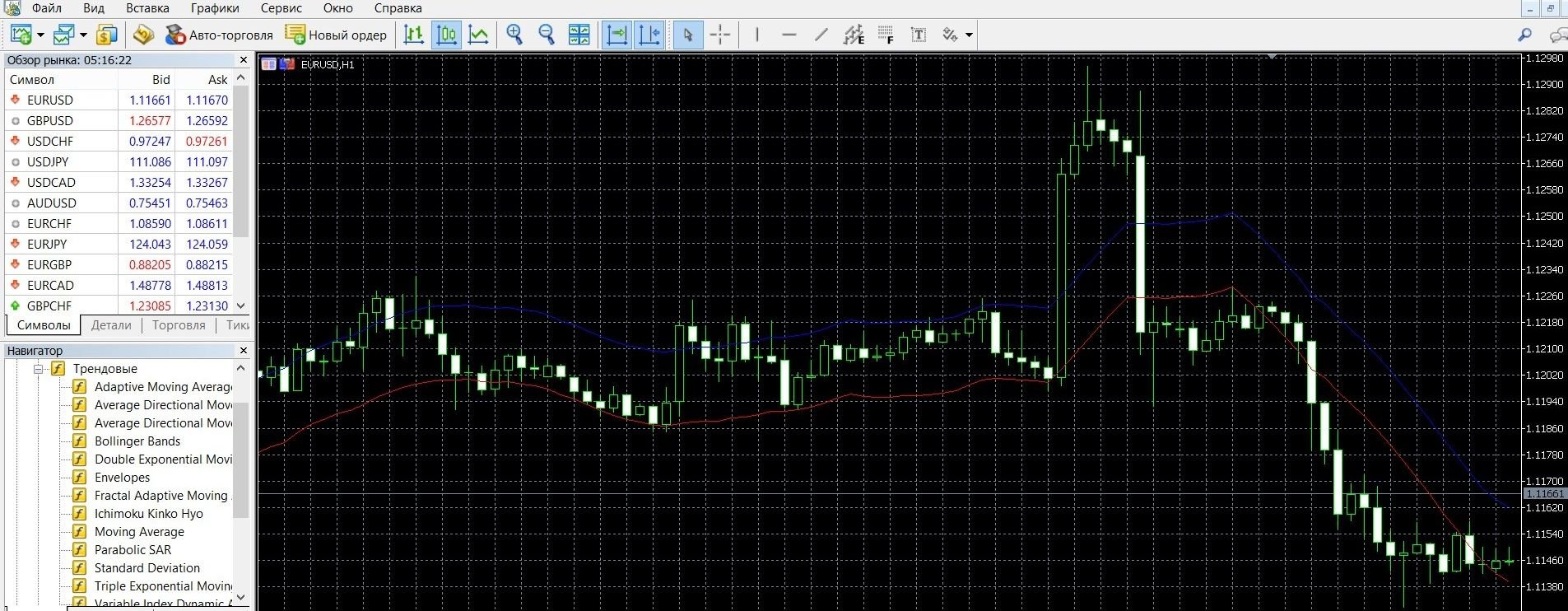

Today, many trading tools work with the help of average values, because Prices move in waves, approaching and moving away from their indicators. Envelopes shows the upper and lower boundaries of the price swing range. A sell signal will be reaching the price of the upper border of the band, a buy signal, respectively, reaching the price of the lower border of the band. The indicator determines the moments of safe entry into the market when the price chart returns to the average. Like all channel indicators, it is more effective and gives more high-quality signals when trading in a flat, and also shows itself perfectly in the role of dynamic support/resistance levels. Due to its reliable signals, Envelopes is popular among traders. You can see how the Envelopes indicator visually looks in the MetaTrader 4 (MT4) terminal in the image below. You can also download the MetaTrader 4 platform and get acquainted with this tool in your work.

How the Envelopes indicator works

Envelopes is based on the behavior of two moving averages (one is located at the top of the Envelope, the second is at the bottom). The dynamics of the shift of the boundaries of the instrument is determined by the volatility of the market: the higher the volatility, the greater the displacement. The situation of the price going beyond the envelope is a very serious signal for trading. Also, the tool accurately shows the state of the flat market when the borders occupy a horizontal position. All oscillator signals are built around a simple moving average, and two lines shifted in different directions form a kind of envelope. The main parameter here will be the deviation, which determines the width of the figure. For each asset, this value is selected manually, but traders work based on the rule that up to 95% of the time the price should be located inside the figure.

The Envelopes indicator is an excellent trend tool that is more suitable for medium and long-term trading. The use of Envelopes is based on the stabilization and return of the price chart to its normal level (this is the main central MA) after reaching the extremes. The indicator is in many ways similar to the Bollinger Bands, the difference between Envelopes is that the parameter 14 of the moving average is used for work, from which parallel lines are drawn.

The formula for calculating Envelopes:

UPPER BAND = SMA (CLOSE, N) * [1 + K / 1000]

LOWER BAND = SMA(CLOSE, N)* [1 – K / 1000], where:

UPPER BAND — upper line of the indicator;

LOWER BAND — lower line of the indicator;

SMA is a simple moving average;

CLOSE — closing price;

N is the averaging period;

K / 1000 is the magnitude of the deviation from the mean (in tenths of a percent).

Info taken from www.metatrader5.com website

Envelopes indicator signals:

Signals of rebound from the boundaries of the channel:

- If the price approaches the lower border of the channel, this is a signal to buy a CALL option (up);

- If the price chart approaches the upper limit, this is a signal to buy a PUT option (down).

Trend signals:

Trend signals are considered to be situations where the price breaks through the boundaries of the indicator

- If the price chart crosses the upper line of the indicator, it means that a downtrend is approaching, this is a signal to buy a PUT option (down);

- If the price chart crosses the lower line of the indicator, it means that an uptrend is approaching, this is a signal to buy a call option (up).

In this case, it is recommended to use trend oscillators (for example, MACD) to confirm high-quality signals.

Flat signals

During periods of market flat, all trading will be conducted inside the “envelope”:

- If the price approaches the upper line of the indicator, this is a signal to buy a PUT option (down);

- If the price touches the lower moving average, this is a signal to buy a call option (up).

To avoid false signals, we recommend opening such a position not immediately when a touch occurs, but when the price breaks through the indicator line and then returns the price inside the channel from the reverse side.

Do I need to install the indicator in your platform?

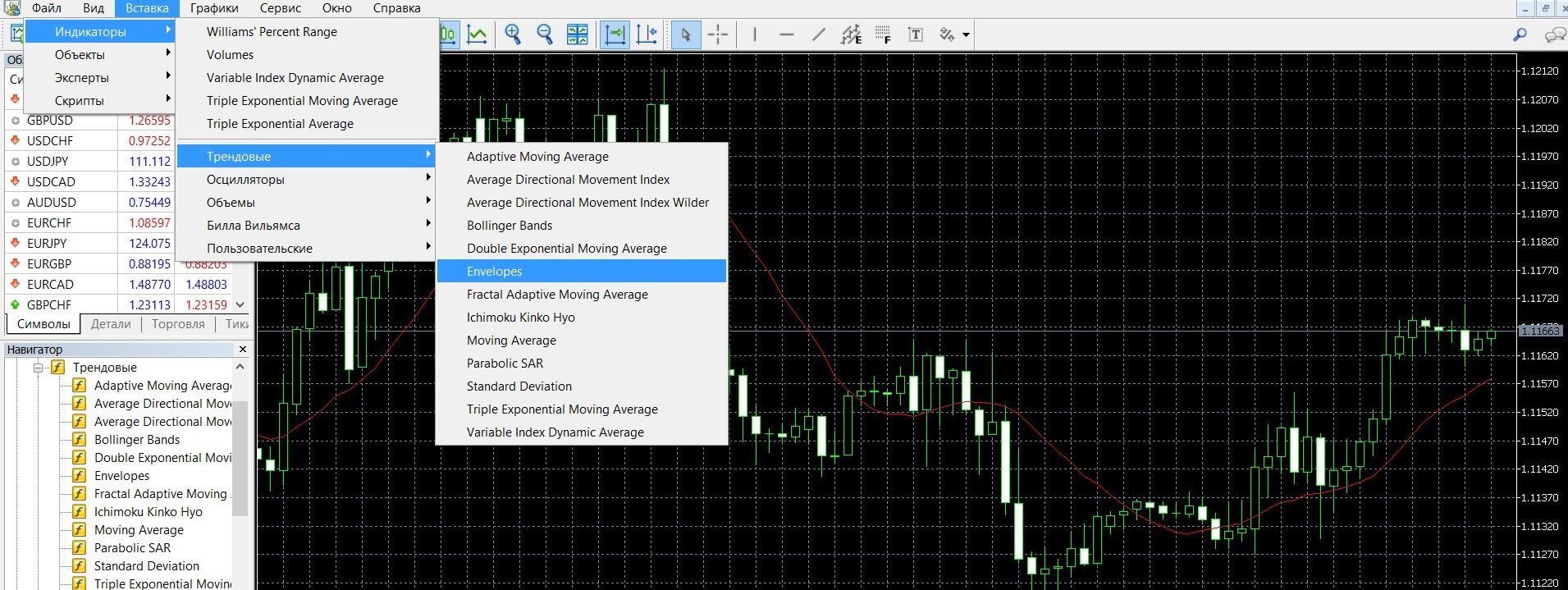

Envelopes is considered a classic technical analysis tool, it is included in most modern terminals, including MetaTrader 4. To add an oscillator to a price chart, do the following:

- Click on the “Insert” tab in the top menu of the platform.

- Select the tab “Indicators” – “Trend”.

- In the drop-down menu that opens, select “Envelopes”. The indicator is added to the chart, you can work with it.

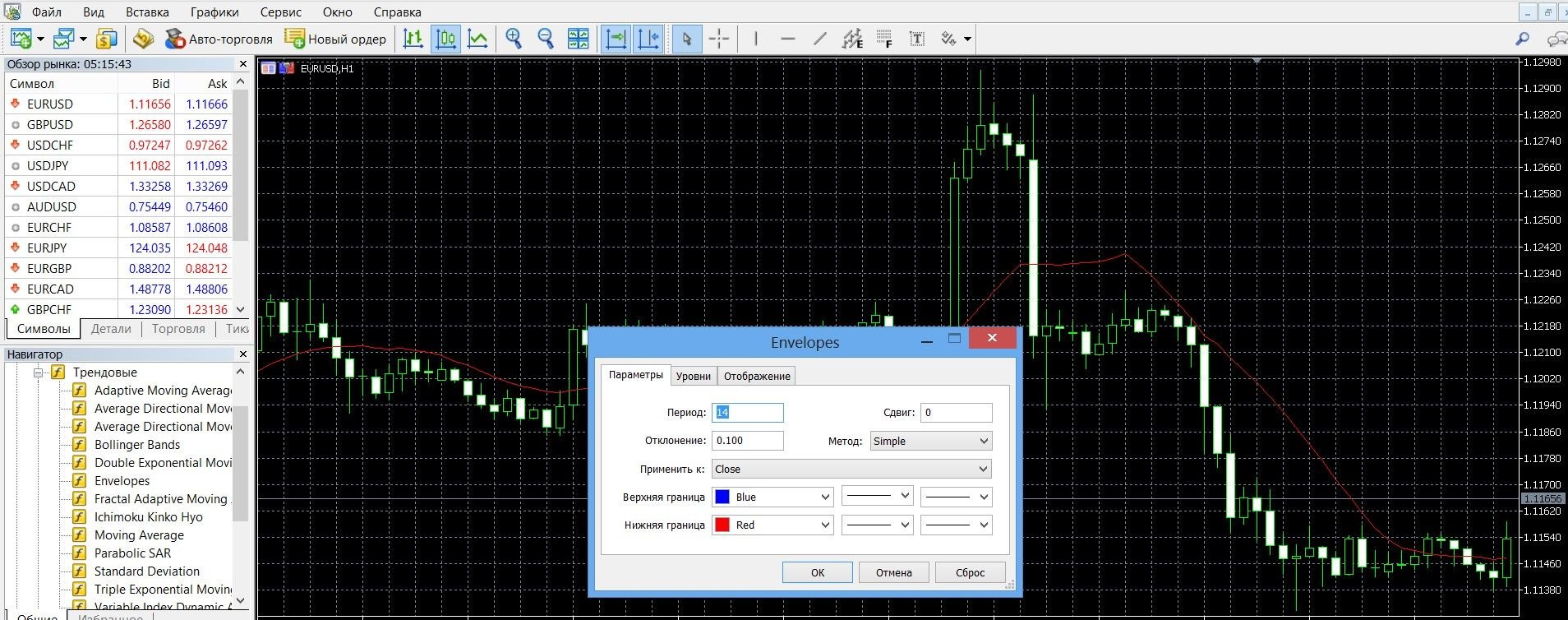

The main settings of Envelopes:

- Period (standard 14) is the number of timeframes for which the moving average is calculated.

- Deviation – the percentage of deviation of the indicator from the moving lines.

If your platform doesn’t have an indicator, download it here.

Application of the indicator for binary options

The use of Envelopes is largely based on the standard logic of the behavior of market participants: when, under pressure from buyers or sellers, the price indicator reaches extremes (upper or lower boundaries of the band), then it stabilizes, returning to realistic levels. A similar principle is used when working with Bollinger Bands, Keltner Channels and MBFX. This trend indicator is widely used in the binary options market, among its advantages:

- perfectly demonstrates the boundaries of the market, which is important when working during flat periods;

- displays the volatility of the asset, which can be used in trading strategies;

- Always shows accurate and unambiguous input and exit signals.

Envelopes allows, if used correctly, to conduct profitable trading. Like all trend tools, it lags behind showing false signals (this is especially noticeable in scalping strategies), so it is recommended to use it with additional technical analysis tools. Most often, traders use the ATR indicator to analyze the deviation parameters, which allows Envelopes to show more accurate boundaries, taking into account volatility. You can also use it in conjunction with the Awesome Oscillator, MACD, or other oscillators. Envelopes are an excellent and reliable indicator, well applicable in practice, will allow, if used correctly, to earn decent money.

Rules for concluding transactions (screenshots)

Trading with a rebound signal from the channel boundaries

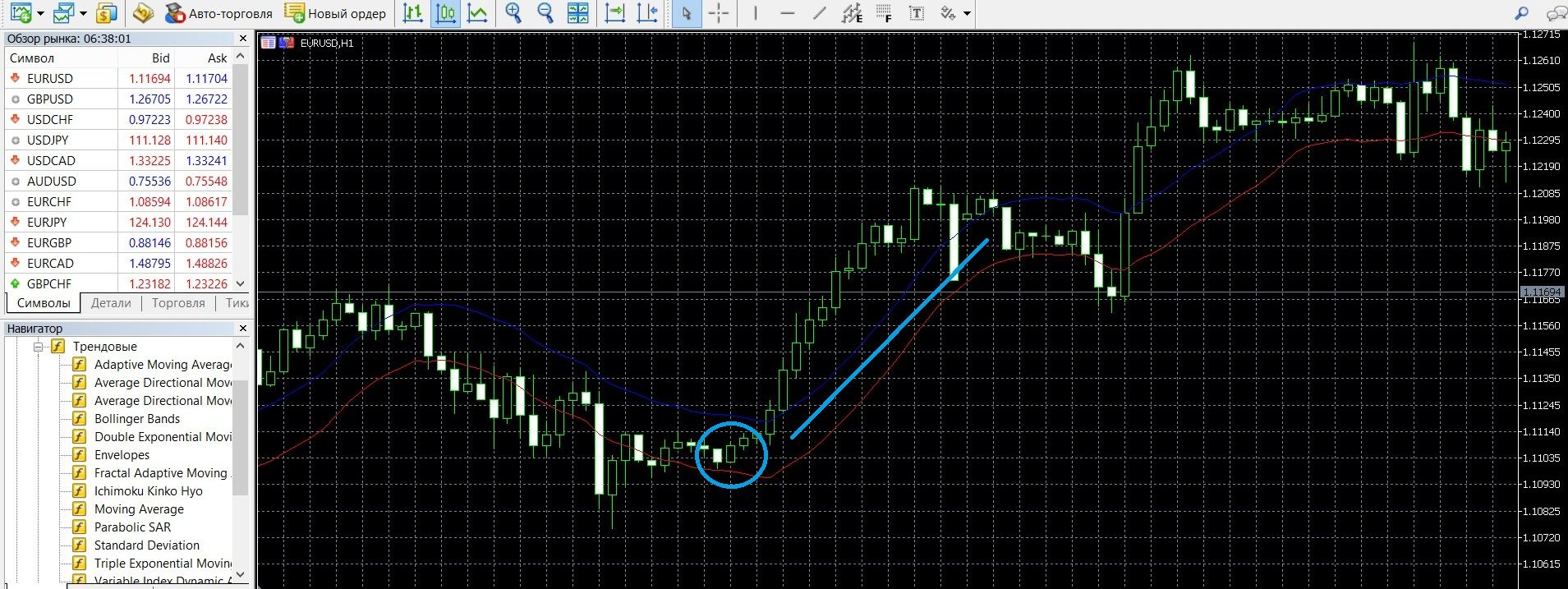

If the price approaches the lower boundary of the Envelopes indicator channel, this is a signal to buy a call option (up). The image below shows the upward trend of the market (which arose when the signal rebounds from the lower border of the indicator) on the MetaTrader 4 platform:

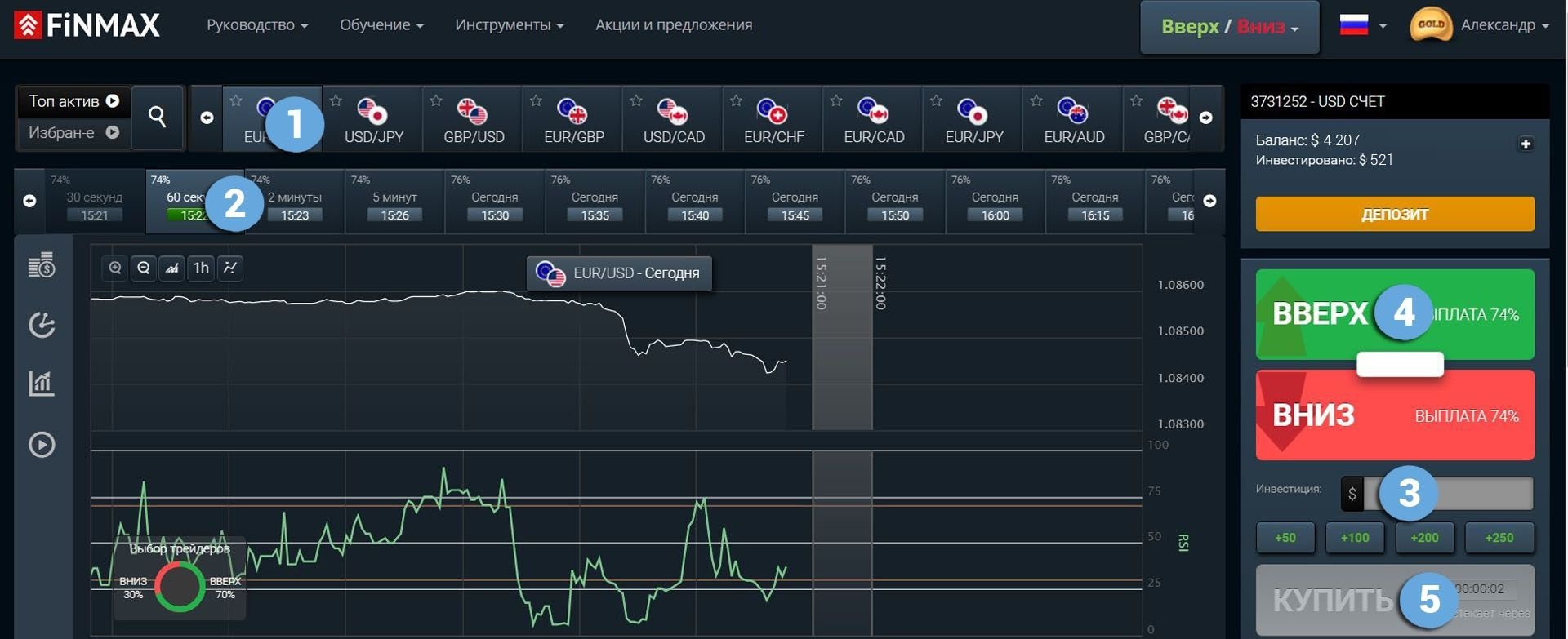

Taking advantage of the upward trend of the market, place a CALL bet with the Finmax broker. To do this, go to the broker’s website finmaxbo.com and prepare an option, indicating in the system:

- Option.

- Expiration.

- Amount.

- Movement forecast: up.

- Click the “buy” button and wait for the results:

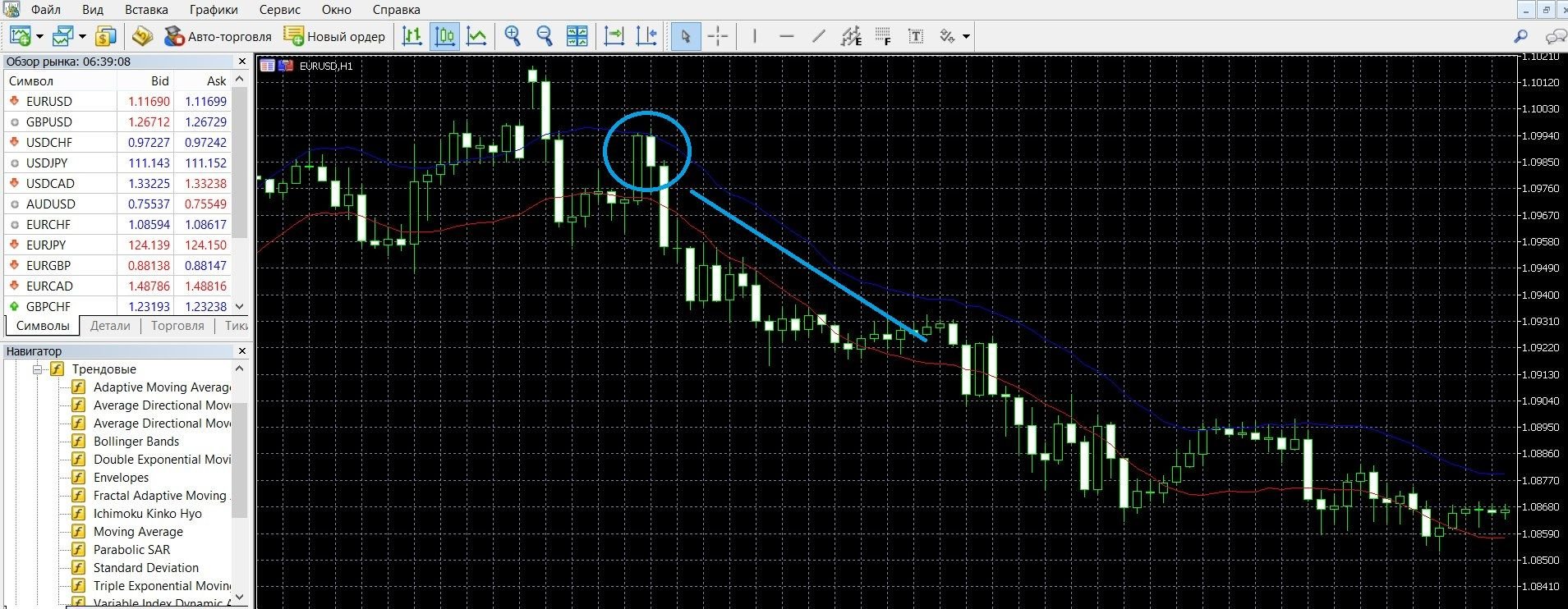

If the price chart approaches the upper limit, this is a signal to buy a PUT option (down). The image below shows the downward trend of the market (which arose when the upper border of the indicator rebounded signal) on the MetaTrader 4 platform:

Taking advantage of the downward trend of the market, place a PUT bet with the Finmax broker. To do this, go to the broker’s website finmaxbo.com and prepare an option, indicating in the system:

- Option.

- Expiration.

- Amount.

- Movement forecast: down.

- Click the “buy” button and wait for the results:

Trading with a market trend signal

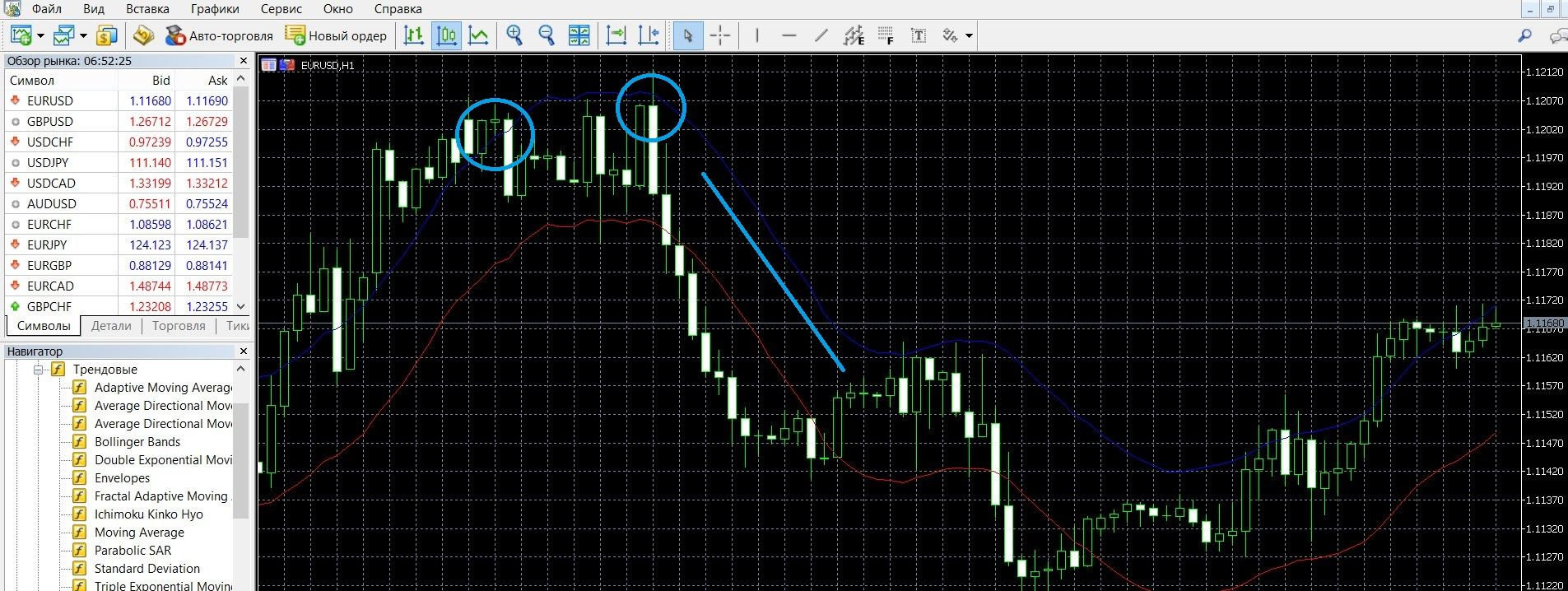

If the price chart crosses the upper line of the indicator, it means that a downtrend is approaching, this is a signal to buy a PUT option. The image below shows a downtrend signal on the MetaTrader 4 platform (you can place a PUT bet on the finmaxbo.com broker’s website, the instructions are listed above):

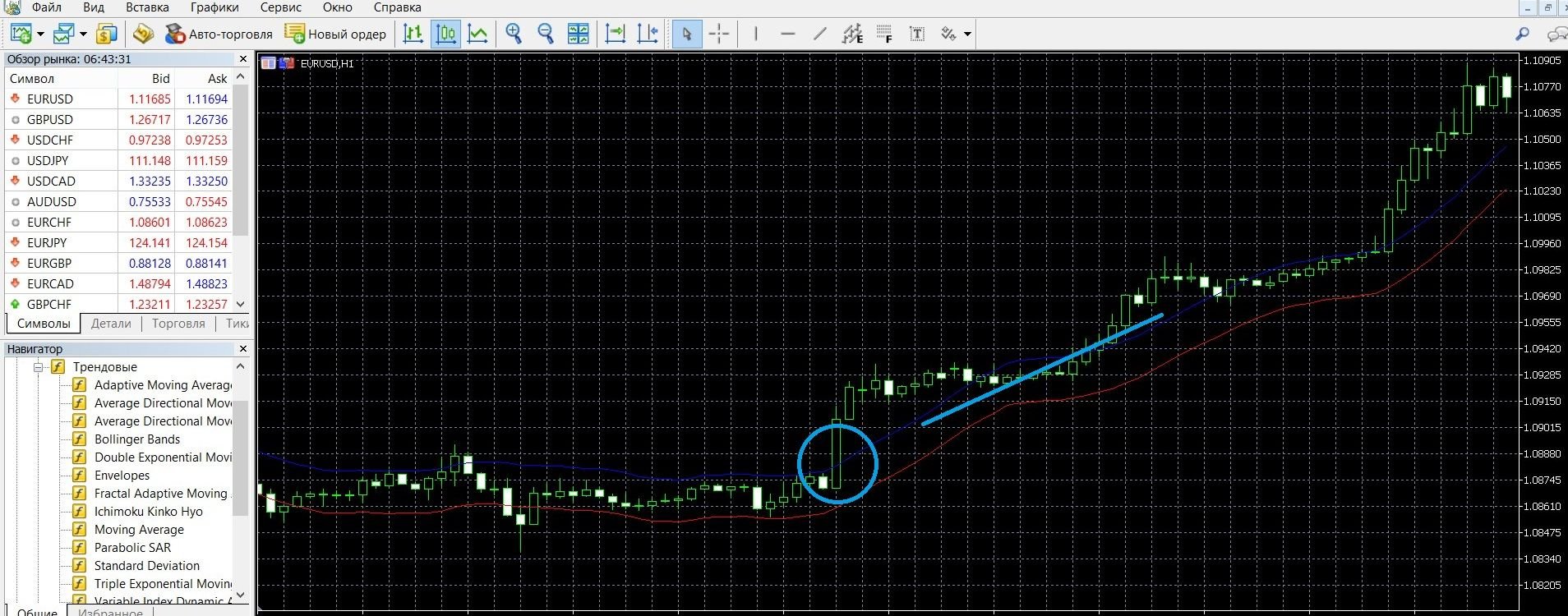

If the price chart crosses the lower line of the indicator, it means that an uptrend is approaching, this is a signal to buy a call option. The image below shows an uptrend signal on the MetaTrader 4 platform (you can place a CALL bet on the broker’s website finmaxbo.com, the instructions are listed above):

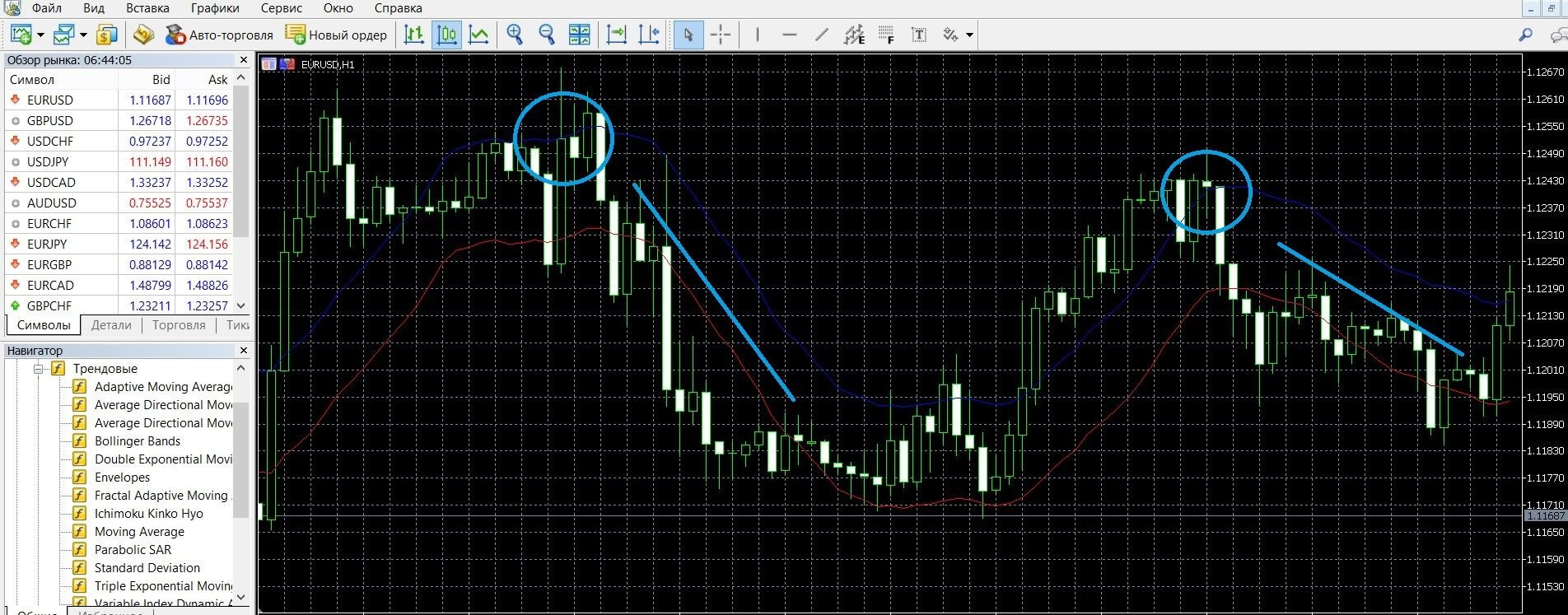

Trading with a flat market signal

If the price approaches the upper line of the indicator, this is a signal to buy a put option. The image below shows a downtrend signal on the MetaTrader 4 platform (you can place a PUT bet on the broker’s website finmaxbo.com, the instructions are listed above):

If the price touches the lower moving average, this is a signal to buy a call option. The image below shows an uptrend signal on the MetaTrader 4 platform (you can place a CALL bet on the broker’s website finmaxbo.com, the instructions are listed above):

Money management

The rules of money management are the basis for successful trading, something that an options professional should apply in his work, especially if market participants need a stable income. If you are just starting your steps in trading, get acquainted with this concept and implement it in your work as early as possible. The advantage of the basics of money management is that they build effective work on managing funds on the deposit. Thanks to money management, you will learn how to spend your deposit money sparingly, how to use it so that it is always saved in your account, guaranteeing you the opportunity to trade.

Basics of money management:

- Trading with a minimum of money: we recommend spending the lowest possible amounts on transactions; to buy options, spend no more than 5% of the deposit; Trade those options, the price of which is less than the amount of the deposit. Put these basics into practice, and you can save your capital.

- Trading with a minimum deposit: we recommend spending the minimum deposit amounts; you should not bet all the funds on the purchase of one option; you must remember that the deposit will still be useful to you; A deposit requires conscious work with it: allocate for yourself a free cash limit that you can trade, and then try not to go beyond it. Put these basics into practice, and you can save money on deposit.

- Trading with a minimum number of assets: we recommend, especially for beginners in options, to work initially with 2-3 assets; When you feel more confident in trading, you can increase your investment portfolio, participate in several transactions. Put these basics into practice, and you will be able to build your productive work with options.

- Trading without emotions: we recommend that when starting work in the market, always have the right attitude to serious work; You must remember that it is the mood that determines a lot in unpredictable trading; Emotions interfere with concentration, making the right decision about the forecast and tracking the status of the deposit. Put these basics into practice and you can achieve more in trading.

Expiration

This is another leading concept in options trading. Like the basics of money management, it determines the success of your actions in trading. Expiration is the moment of completion of trading on an option, when trading participants can find out the result of their forecasts and whether funds will appear on the deposit. A well-thought-out expiration is, one might say, your reliable strategy and, if you need a stable income, expiration is the first step to successful trading.

Types of options:

- Ultra-short options – 30 seconds – 5 minutes.

- Short-term options – 10 minutes – several hours.

- Medium-term options – a day – a few weeks.

- Long-term options – a month – six months.

Is it allowed to extend the expiration of the option?

It is allowed, but not on all trading terminals. If during trading you suddenly realize that you have indicated an incorrect forecast, you can extend the expiration, reducing your possible losses.

Expiration rules:

- Those traders who are taking their first steps in options trading should pay special attention to long-term expirations, the advantage of which is stable trading with a minimum of risks.

- Those traders who consider themselves trading professionals should, when choosing expiration, be based on the style of trading in which you are more comfortable working. When making a choice in the direction of a particular broker, find out if an increase in expiration during trading is allowed, which minimizes your losses if the forecast result is incorrect.

- Those traders who expect instant income from the market should choose a short-term (minute – several hours) expiration, thanks to which you can earn capital in 30 seconds. Be aware of the risks of turbo trading.

- Those traders who expect stable payments from the market should pay attention to the possibilities of long-term expiration, which, unlike turbo trading, has a calm trading style, is more predictable, less risky, but provides an opportunity to get a decent income.

Expiration in Envelopes Strategies

Expiration at the signal of rebound from the boundaries of the channel

Short-term trading: possible, but quite risky and less predictable, so you should be careful and use confirmatory indicators.

Medium-term expiration: also possible; because. Envelopes generates profitable signals, you can get a decent income with less capital risk than with turbo trading.

Long-term expiration: also possible; because. Envelopes generates profitable signals that can bring you a decent income.

Expiration when a market trend is signaled

Short-term trading: possible, but quite risky and less predictable, so you should be careful and use confirmatory trend indicators.

Medium-term expiration: possible; because. Envelopes generates profitable signals, you can get a decent income with less capital risk than with turbo trading.

Long-term expiration: possible; because. Envelopes generates profitable signals that can bring you a decent income.

Expiration at a flat market signal

Short-term trading: possible, but it is risky and less predictable, so be careful and use confirmatory indicators.

Medium-term expiration: possible; because. Envelopes generates profitable signals, you will get a decent income while risking less capital than with express trading.

Long-term expiration: possible; because. Envelopes generates profitable signals that can earn you decent money.

Expiration in the “Envelopes+MACD” strategy

A profitable reliable strategy using the Envelopes and MACD indicators, which allows you to work with high-quality signals and get a good income. The MACD will act as a confirmation of the signals of the Envelopes indicator. The tactics of work are simple: by combining signals, we open trades if both indicators coincide.

Short-term trading: it is possible thanks to the use of Envelopes and MACD there are fewer false signals, and, in addition, you can trade based on both instruments, giving clear signals; guarantees a good income.

Medium-term expiration: possible; because. Both indicators generate profitable signals, you will be able to trade easily and comfortably, getting a decent income.

Long-term expiration: possible; because. Both indicators generate profitable signals, you will be able to trade easily and comfortably, getting decent money.

When trading binary options, pay special attention to expiration and determine the most comfortable trading style for you. The most convenient for these purposes is a reliable broker Finmax. Among its advantages: a modern functional trading terminal with a convenient and simple personal account, a large selection of options and expiration dates (from 30 seconds to six months). Start building a profitable expiration strategy by going to the finmaxbo.com broker’s website.

Downloads

Tagged with: Binary Options Indicator