SMI Indicator

Description

Working on the Internet and getting a good income today has become commonplace and this will not surprise anyone. Freelancing is a way of life of a modern successful person who can afford more: freedom, money, comfort. Binary options trading is also freelancing, which, unlike other professions (programming, copywriting, etc.), offers you not to sit all day at the computer, but to work when you want and exactly as much as you need.

Trading has also become popular because it is perhaps the only type of legal quick money on the network – you can get real money in 30 seconds. This is especially attractive in options. Making trading your main job and getting even more is up to you. Having decided to take this step, study profitable strategies, test new indicators, and follow the ratings of brokers. More useful material is waiting for you on our portal. Today we will talk about an interesting SMI indicator.

The Stochastic Momentum Index (SMI) is an oscillator that is a modification of the usual Stochastic and is practically no different from it. Its author is William Blau, who described the instrument in his book Momentum, Directionality, and Divergence.

All modifications of the instruments appeared to identify more accurate signals for entering a trade or for high-quality work, taking into account the dynamics of the market, when such indicators perfectly adapt to the realities of the exchange. That is why SMI was created, which is a smoothed version of the Stochastic familiar to all traders, but with better signals for productive trading. Such tools are able to make work on the stock exchange simple and effective, so they are becoming more common among those market players who need to reach a new level of trading and get a stable profit at minimal cost.

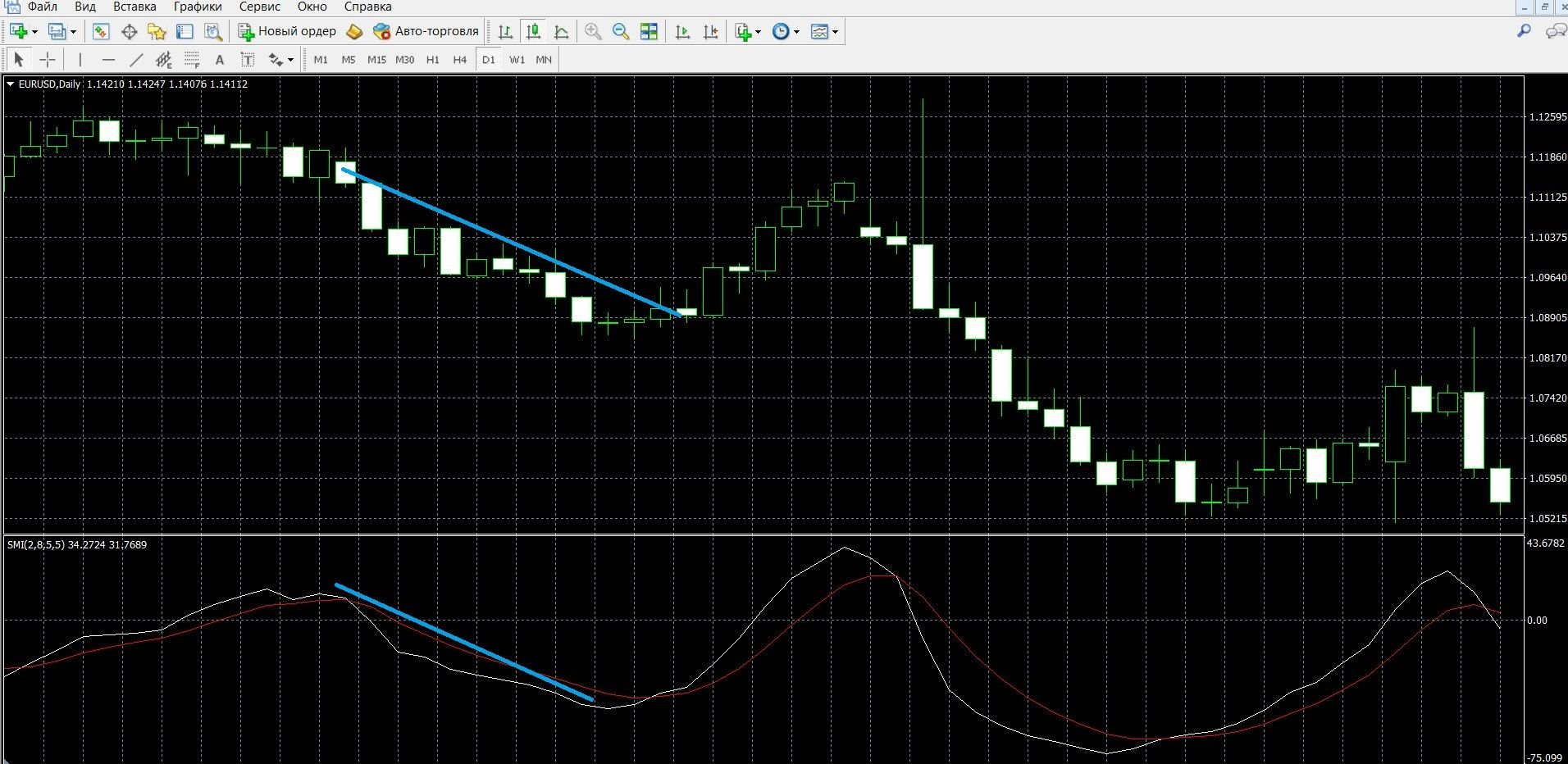

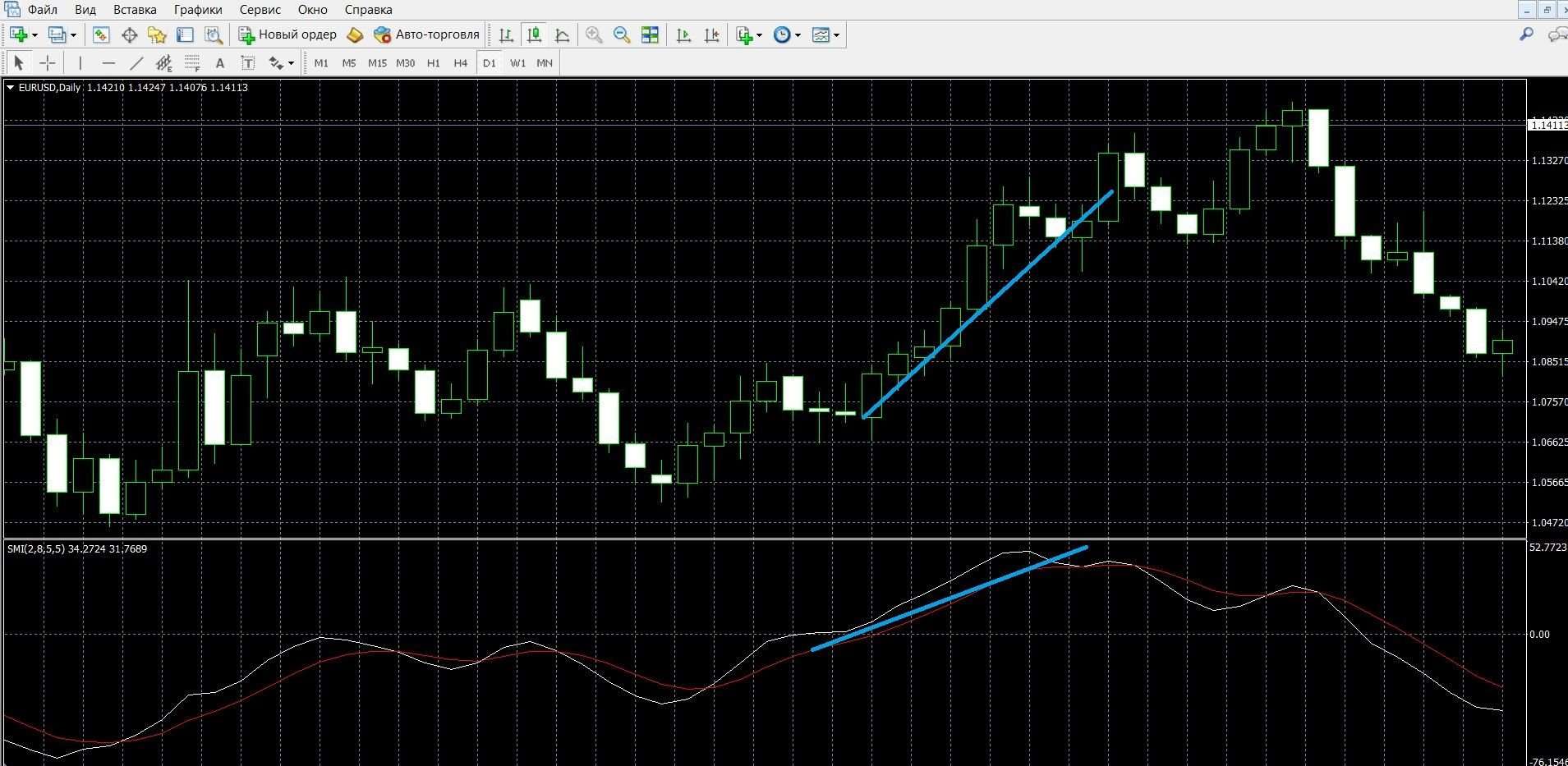

You can see what the SMI looks like on the price chart in MetaTrader 4 in the image below. You can also easily and quickly download the MetaTrader 4 platform and get acquainted with the indicator in more detail.

What is the working principle of the SMI indicator?

Like Stochastic itself, most modifications based on it quickly become popular, because they have a lot of advantages, are convenient, and generate high-quality signals. Today, many new binary options indicators arise on the basis of old tools also because the market itself does not stand still and is modified, needs modern indicators that correspond to the latest trends.

The Stochastic Momentum Index, including the Stochastic and Momentum indicators, has become popular with traders, differing in its simple principle of operation. As a result, this tool has a smoother movement that is less susceptible to market noise. As an oscillator, it works great during flat market periods, offering good market entry signals. This is its most important advantage. In the case of a clear downward or upward trend, it gives a large number of false signals.

On the chart, it is located in a separate window and includes two curves: smoothed (fast) and short-term. The instrument is built around the zero line, changing the readings either in the positive or in the negative area. For more efficient work, it is recommended to combine it with additional tools. In work, it can be used as an independent tool or as part of a trading strategy.

Calculation formula

100*EMA(EMA(EMA( price-1/2*[LL(q)+HH(q)] ,r),s),u)

100 * SMI (price,q,r,s,u)

SMI(price,q,r,s,u) = EMA(EMA(EMA( 1/2*[HH(q)-LL(q)] ,r),s),u)

EMA(EMA(EMA( 1/2*[HH(q)-LL(q)] ,r),s),u), where:

price – price [closing] – price base of the price chart;

LL(q) – the minimum value of the lowest price for the period q for the previous q periods;

HH(q) – the maximum value of the highest price for the period q for the previous q periods;

sm(price,q)=price-1/2*[LL(q)+HH(q)] – q-period stochastic momentum;

SM(price,q,r,s,u) – triple smoothed q-period stochastic momentum;

HH(q)-LL(q) – q-period range of price fluctuations;

1/2*[LL(q)+HH(q)] – the middle of the q-period range of price fluctuations;

1/2*[HH(q)-LL(q)] – half of the q-period range of price fluctuations;

EMA(…,r) – first smoothing – the exponential moving average (exponent) of the period r applied to the indicator

To Q-period stochastic momentum

to half of the q-period range of price fluctuations;

EMA(EMA(…,r),s) – the second smoothing is the exponent of period s applied to the exponent of period r;

EMA(EMA(EMA(…,r),s),u) is the third smoothing – the exponent of the period u applied to the result of the second smoothing.

Input parameters:

q is the period by which the stochastic momentum is calculated (by default, q=5);

r is the period of the 1st EMA, as applied to the stochastic momentum (default r = 20);

s is the period of the 2nd EMA, in relation to the result of the first smoothing (by default, s = 5);

u is the period of the 3rd EMA, in relation to the result of the second smoothing (by default, u=3);

AppliedPrice – price type (AppliedPrice=PRICE_CLOSE by default).

Info taken from website mql5.com

Indicator signals

SMI Trend Signals

- If the SMI curves have turned down, this is a downtrend, you need to buy put options,

- If the SMI curves have reversed upwards, this is an uptrend, it is worth buying call options.

SMI reversal signals

- If the SMI is above the zero level for a long time, and then both lines move into the negative zone, this is a downtrend, it is worth buying put options,

- If the SMI has been in the negative zone for a long time, and then both lines move into the positive zone, this indicates an uptrend, it is worth buying call options.

Do I need to install the SMI indicator in your platform?

SMI is a non-standard tool for working in the market, it is not included in the list of the main indicators of MetaTrader 4. You can download it quickly and for free from our website here. Then you need to install the downloaded file in the MT4 platform, to do this, use the simple instructions here.

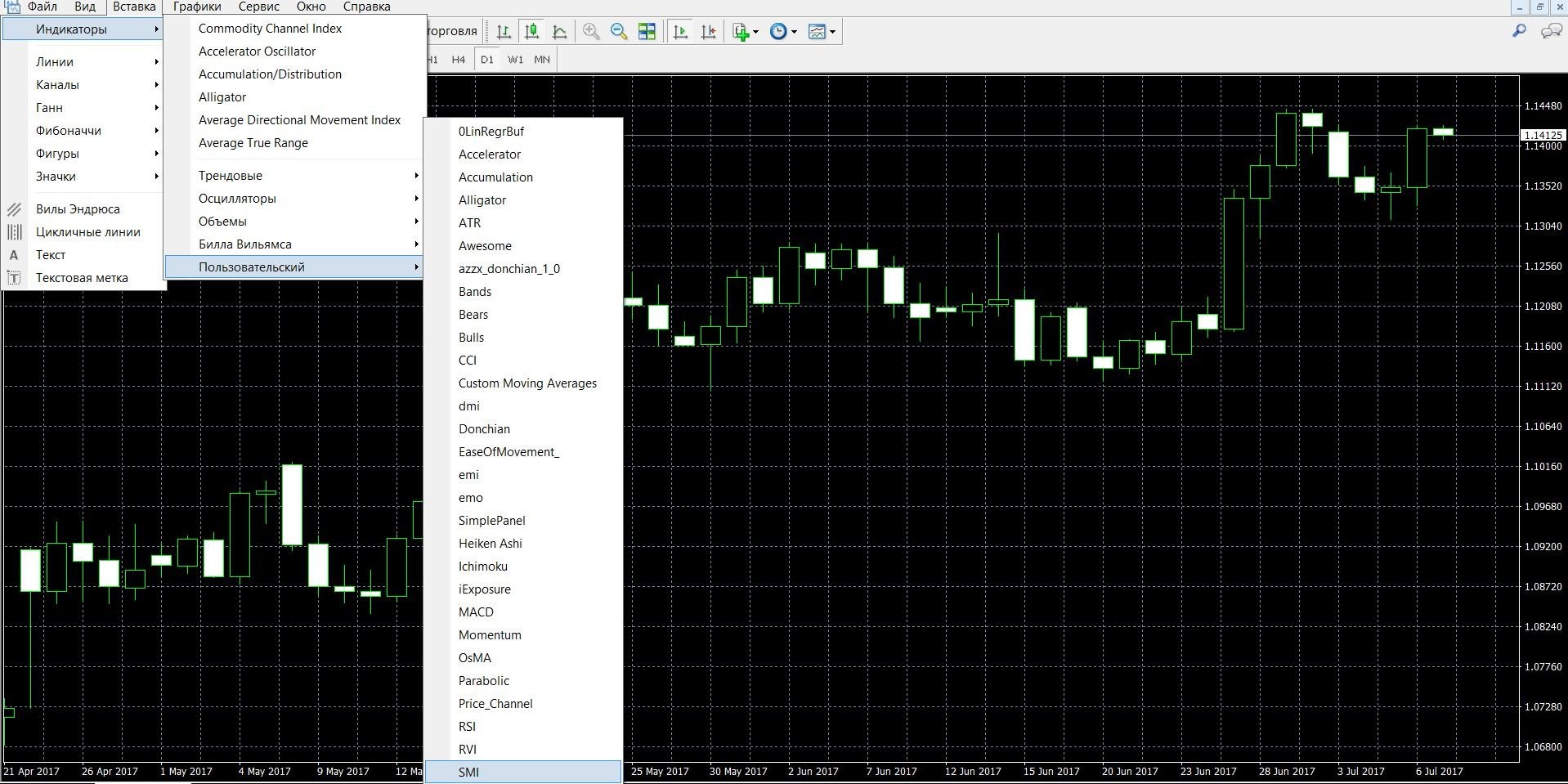

After installation, add the indicator to the price chart, for this:

- Click the “Insert” tab in the top menu of the platform

- Select the “Custom” – “SMI” tab.

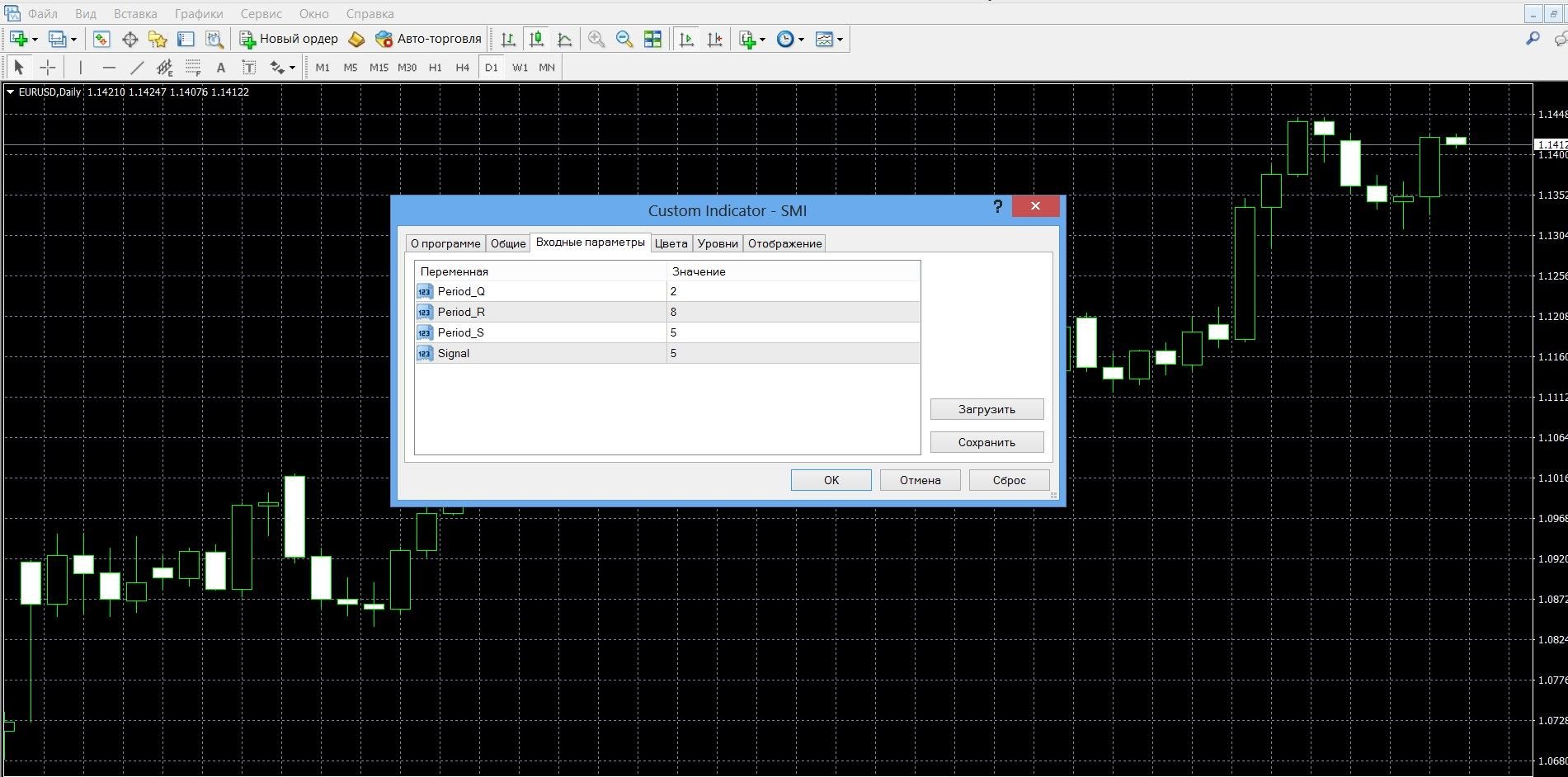

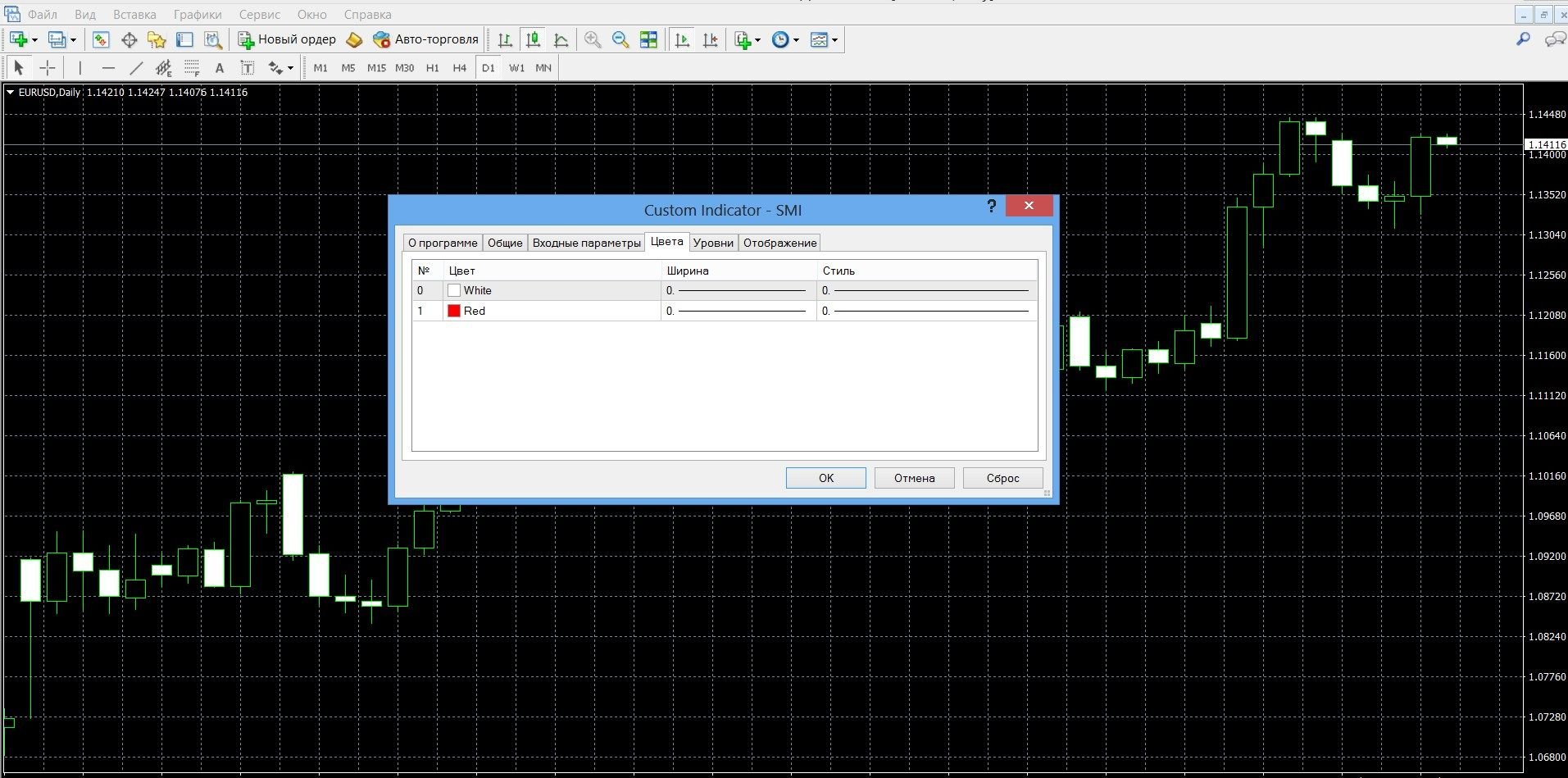

To configure the indicator, you must specify the parameters of the SMI construction period and the data for calculating the lines.

Application of the indicator for binary options

As one of the popular modifications of Stochastic, SMI is more common in binary options trading and less common in the Forex market. Its signals are powerful, but more suitable for short-term options, scalping strategies. When working with him in trading, it is worth remembering that he gives high-quality profitable signals only in a flat market state.

In other cases, the trader will be waiting for false signals. Therefore, most often the indicator is combined simultaneously with trend instruments. By combining SMI with other instruments (for example, RSI, Bollinger Bands, MACD , etc.), you can easily use it for long-term trading, but in this case you should rely on the data of trend indicators when searching for signals.

SMI is simple and convenient during trading, its signals are understandable even for a beginner of options. This is a good tool for independent use, as well as for applying it as part of trading strategies. SMI can work as a trend indicator, as well as an oscillator, showing the exact points of trend reversal.

Rules for concluding transactions (screenshots)

Trading with a trend signal

If the SMI curves have turned down, this is a downtrend, you need to buy put options. The image below shows the downward trend of the market in the MT4 terminal:

Take advantage of the trend and place a PUT bet with the Binomo broker by going to the binomo.com website and preparing an option, indicating:

- Type of option

- Expiration date

- Amount

- Prediction: down

- Next, click the “buy” button and wait for the results of the forecast:

If the SMI curves have reversed upwards, this is an uptrend, it is worth buying call options. The image below shows the upward trend of the market in the MT4 terminal:

Take advantage of the trend and place a CALL bet with the Binomo broker by going to the binomo.com website and preparing an option, indicating:

- Type of option

- Expiration date

- Amount

- Prediction: up

- Next, click the “buy” button and wait for the results of the forecast:

Trading with an SMI reversal signal

If the SMI is located above the zero level for a long time, and then both lines move into the negative zone, this is a downtrend, it is worth buying put options. In the image, you can see the downtrend in the MT4 terminal (taking advantage of the trend, place a PUT bet on the binomo.com website, the instructions are listed above):

If the SMI has been in the negative zone for a long time, and then both lines move into the positive zone, this indicates an uptrend, it is worth buying call options. In the image, you can see the uptrend in the MT4 terminal (taking advantage of the trend, place a CALL bet on the binomo.com website, the instructions are listed above):

Money management

The concept of money management today is considered the basic concept of trading, correctly building work with which, you can increase the effectiveness of work on the stock exchange much faster and easier. When it is important for a trader to receive a stable income from trading, it is faster and easier to come to this by mastering the rules of money management.

Minimum capital: starting trading on the stock exchange, it is worth putting a minimum of funds on one bet; its price should not be more than 5% of your deposit; Buy inexpensive options, and trading will not affect the size of the deposit. Using such money management rules during trading, you can save a lot of capital.

Minimum deposit: starting trading on the stock exchange, it is worth taking part in those transactions that will save the deposit; when buying a specific asset, do not transfer all capital to trading; As long as possible, try to maintain a positive state of the deposit, because You will still need these funds. Using such rules of money management during trading, you will be able to save your deposit.

Minimum options: starting trading on the stock exchange, it is worth purchasing a minimum of options, 2-3 assets; This rule is more recommended for beginners of options, becoming much more confident and experienced, you can increase the number of assets. Using such money management rules during trading, you can make trading more productive.

Minimum emotions: starting trading on the stock exchange, you should tune in to serious work, because on the stock exchange, you will need knowledge of analytics and the ability to make informed decisions; It should not be forgotten that in trading it is not enough to rely only on experience, your mood is something that will easily make the work more effective. Using such rules of money management during trading, you will be able to reach a decent income from binary options trading.

Expiration

Expiration is the moment when the trading of an asset ends, and all participants in this transaction learn about the results of forecasts. This is one of the main concepts of trading, like money management, it will make trading much more successful and profitable.

Types of options:

- Ultra-short options – 30 seconds – 5 minutes.

- Short-term options – 10 minutes – several hours.

- Medium-term options – a day – a few weeks.

- Long-term options – a month – six months.

Is it allowed to extend the expiration?

It is allowed, but not with all brokers. If during the auction you realized that you indicated the wrong forecast, simply extend the expiration, which will reduce possible losses and make a profit.

Expiration rules:

- New players in the options market should first trade long-term transactions that guarantee the stability of trading the result and a minimum of losses.

- Professional players of the exchange should trade with expiration, which will make the work and the expectation of its result much more comfortable. Be careful when choosing a broker. Find out if you will have access to the function of extending the expiration during trading, which guarantees a reduction in losses.

- Exchange players who need instant capital from trading should work with short-term transactions that will guarantee income in at least 30 seconds.

- Exchange players who need a stable income from trading should work with long-term transactions that will guarantee decent earnings.

Expiration in strategies with the SMI indicator

Expiration at a trend signal

Short-term trading: allowed; express trading is what SMI works great with, demonstrating a lot of high-quality profitable exchange trend signals ; will allow you to earn a decent income.

Medium-term expiration: allowed; It is recommended to use additional tools to filter out false signals, then you can get a decent income.

Long-term expiration: allowed; on such a long period, it is better to combine the instrument with additional indicators; Also, in this case, use fundamental and technical analysis for the effectiveness of work on the exchange.

Expiration at SMI reversal signal

Short-term trading: allowed; SMI works great with turbo trading, showcasing a variety of high-quality profitable exchange trend signals; will allow you to earn a decent income.

Medium-term expiration: allowed; it is recommended, in addition to SMI, to use additional tools to filter false signals, then you can get a decent income.

Long-term expiration: allowed; using SMI on such a long segment, it is better to combine it with additional indicators; Also, in this case, use fundamental and technical analysis for the effectiveness of work on the exchange.

Expiration in the HMA+SMI strategy

Short-term trading: allowed; Despite the fact that SMI works well with turbo options, demonstrating profitable signals, this combination of tools will not completely get rid of false signals; It is worth remembering the risks of such trading.

Medium-term expiration: allowed; recommended expiration for the strategy; Indicators generate a sufficient number of signals to enter a trade, which will allow you to get a decent income.

Long-term expiration: allowed; Using indicators on such a long period, it is better to combine it with fundamental and technical analysis for the effectiveness of work on the exchange.

Successfully mastering the profession of a trader, pay special attention to the expiration time, which will give you the opportunity to get the desired result from options trading. To do this, we recommend that you get acquainted with the convenient and functional terminal of the popular broker Binomo, which offers a choice of expiration from 30 seconds to 1 day. Go to the broker’s website binomo.com and achieve more with trading.

Downloads

MetaTrader 4 (MT4) platform – download.

SMI indicator for the MT4 platform – download.